Improving performance and unlocking value in the electricity sector

Read the final recommendations from the Premier’s Advisory Council on Government Assets on how Ontario can maximize the value of Hydro.

Executive summary

In November 2014, the Advisory Council on Government Assets presented our Initial Report to government entitled "Retain and Gain: Making Ontario’s Assets Work Better for Taxpayers and Consumers". The Report contained our overall assessment of the entities we examined, and our thinking on the future direction for these entities. In the Report, the Council indicated that we were open to looking at additional options on how best to proceed.

Following submission of that Report, the government expanded the Council’s mandate and authorized us to move into the second phase of our review.

In Phase 2 of our review, we conducted detailed valuation and due diligence including regulatory and policy considerations as well as careful consideration of input and reactions from stakeholders, policy and financial experts, labour leaders, and others.

Throughout Phase 2 of our work, we maintained our commitment to a collaborative and confidential process in order to further our goal of reaching agreement among key stakeholders on specific proposals for the future divestiture of Hydro One and Hydro One Brampton.

This report represents our final report to government on the future direction for Hydro One Networks and Hydro One Brampton.

Conclusion

We are satisfied that the recommendations in our Initial Report were soundly based. In that Report, the Council also committed to exploring all viable options and to listening to market and stakeholders' input. We did listen, and we have evolved our thinking significantly as a result.

First of all, we have done that with respect to Hydro One Brampton. In our continuing consultations and diligence, we were impressed by alternative arguments that stressed the potential for accelerated local distribution company (LDC) consolidation from merging Hydro One Brampton with three local distribution companies. The Council envisages Hydro One Brampton becoming part of a large-scale merged Greater Toronto and Hamilton Area (GTHA) distribution company, comparable in scale to Toronto Hydro and Hydro One Networks, which would improve industry competition for regional consolidation by increasing the number of LDCs with the capacity to drive further consolidation and thereby act as a catalyst for further consolidation. We have concluded, as did the 2012 report from the Ontario Distribution Sector Review Panel, that economies of scale enabled by further consolidation would lead to a favourable impact on rates.

Our consultations also led us to significantly revise our conclusion as to what to do with Hydro One. We concluded that the Province should sell, over time, a majority interest in Hydro One through share sales to the public. Selling a portion of Hydro One as a combined entity, compared to separating and selling the distribution business, is faster and achieves higher value.

We looked again at the issues raised about selling public assets – tax leakage and lost net income to the Province. We found that the tax leakage issue was a theoretical loss but not a real one because of the effect on the tax base of the company of going public. A new publicly-held Hydro One is not likely to pay provincial or federal taxes for some time, and at least some of the value of this tax shield should be reflected in the valuation.

The issue of lost income to the Province hasn't changed from our Initial Report – there will indeed be some lost income. However, there is, of course, the broader question: if governments have a lower cost of borrowing than business enterprises earn, should they own many of them to earn revenue for the province? A conclusion to do so assumes that governments have no debt limits and unlimited capacity to effectively manage large and complex business operations. Whatever one’s view is on the latter issue, it is clear that Ontario does have a limit on how much it can borrow; therefore, not selling assets has an opportunity cost: the investments that are not made.

So the critical issue is the return to the economy of the infrastructure investments made in transit and transportation. The government’s view, and one which we accept, is that the return on well-conceived projects will be higher than the return that the government would forego by selling Hydro One today, in the context of today’s market and interest rates. Investors today are demanding a very small premium to the government’s borrowing rate; never before have the returns that the market demands been as close to the Province’s borrowing rate as they are now. However, there will be a loss to the provincial government’s revenue even if the province is better off. Some of this may be offset by improved economic performance as a result of the infrastructure investments and therefore improved provincial government revenue performance. Another offset may well be improved company performance as a result of private sector discipline.

The loss can also be affected by how you sell down your interest. We considered carefully the lessons of previous unsuccessful divestiture efforts of Hydro One and other assets. Unlike those efforts, we are proposing that divestiture be staged over time with measures to protect the public interest as a responsible shareholder. This staged approach better matches the offerings to the capacity of the market to absorb them and reduces pricing risk. The mistake often made is to try to sell too much at one time. Value is destroyed in doing so. By staging a sale, it will also allow the Province to retain a substantial interest in Hydro One over an extended period of time, thereby continuing to enjoy the benefit of continued income from a growth company, rather than simply trading a one-time gain for a long-term income loss.

The heart of the issue remains the public policy issues involved in selling Hydro One. For the distribution business, our views on the importance of spurring consolidation in the electricity distribution sector have not changed. We said in our Initial Report that we would favour selling the distribution business of Hydro One Networks whether or not the government needed the revenue to finance infrastructure investments. It just made good energy policy sense. Indeed these views have been strengthened by our consultation process, as almost all stakeholders urged us to find a way to spur further consolidation. The key is finding a catalyst. We believe our recommendations today will be that catalyst. We will have created a real urban consolidator through our proposal involving Hydro One Brampton. We will have a competing strong consolidator by giving the distribution arm of Hydro One the backing of a strong company whose shares are valued at a high multiple. And by addressing some of the cost issues coming out of the labour contracts in Hydro One, we will have reduced another barrier to consolidation.

There remains however the policy issues surrounding the transmission business. We put the question squarely back to government – can the public policy objectives of providing electricity transmission services to the province only be met by having the government own 100% of them? In re-examining this issue, in looking at jurisdictions where transmission lines are not owned by the government and in examining the options of expanding the powers and capabilities of the regulatory agencies, the government came to the view that the public policy needs could be met without 100% ownership. That view allowed us to conclude that we should recommend the proposal that would maximize the value to taxpayers: keep Hydro One together and sell down the government’s interest in a staged approach. We would therefore not break the company up into separate transmission and distribution companies.

We also believe that taking Hydro One public creates an opportunity: to create a new, growing company that can in turn create jobs, something that realistically it could not do – and did not do – as a 100% government-owned company. We see the new Hydro One as a strongly growth-oriented company, centred in Ontario and widely-held with measures to protect the public interest. The entity will be primarily Canadian-owned, rank among the larger public companies in the country by market capitalization, and be positioned to drive revenue and to generate jobs across Ontario. By unfettering Hydro One and allowing it to expand its business opportunities, the company could also return an increasingly profitable dividend to all Ontarians.

We believe strongly that bringing in new capital in this way will benefit the government, ratepayers, and taxpayers. It will facilitate improvements in the efficiency of the electricity system in Ontario, which in turn would lead to a favourable impact on rates and support funding of much-needed public transit and transportation infrastructure that otherwise would not be possible.

Final recommendations

The Council has now completed its review of Hydro One and Hydro One Brampton, and we are pleased to present our final recommendations in support of the Province’s 2015 Budget.

- The Province should proceed immediately with a sale or merger of its interest in Hydro One Brampton Networks Inc. to or with Enersource Corporation, PowerStream Holdings Inc. and Horizon Holdings Inc., intended to catalyze consolidation in the Greater Toronto and Hamilton Area and to strengthen competition in the electricity distribution sector by increasing the number of LDCs with the capacity to drive further consolidation.

- The Province should amend the transfer tax rules and departure tax rules that apply when municipal electricity utilities leave the payment-in-lieu of taxes regime both on a time-limited basis and implement these changes as quickly as possible.

- The Province should proceed with a partial sale of a portion of its interest in Hydro One as an integrated entity, including both the transmission and distribution businesses, to create a growth-oriented company centred in Ontario.

- The partial sale of the Province’s interest in Hydro One should be by way of an Initial Public Offering (IPO) so that the company will be widely held, predominantly by Canadians.

- The government should indicate its intention to retain its remaining shares after selling down to 40%, and the balance should be widely held with no other individual shareholder having more than a 10% holding.

- Hydro One should be required to maintain its head office and substantially all of its strategic management functions in Ontario.

- The mandate and powers of the Ontario Energy Board should be strengthened to ensure that changes in industry structure do not put upward pressure on rates.

- Governance of Hydro One should be adjusted to meet the requirements for a widely-held public company, and certain legislative and government regulatory and policy requirements that are applicable to government entities should be removed.

- Governance of the company should be vested in its Board of Directors; all directors would be independent with the requisite skills and board experience for an operation of the company’s size and owe a fiduciary duty to the company.

- In order to ensure the Province has additional powers to protect both the public interest and its investment through the company in Ontario’s transmission and distribution systems, Hydro One should not be allowed to do any of the following:

- sell all or substantially all of the Ontario-based transmission assets of the company;

- sell all or substantially all of the Ontario-based distribution assets of the company; or

- change the jurisdiction of incorporation of the company.

- The Province, Hydro One management, and unions should finalize agreements on pensions and labour costs in advance of the Hydro One IPO to address issues raised by the Leech Report and the Ontario Energy Board with respect to pensions and compensation.

Introduction

Background

In November 2014, the Advisory Council on Government Assets presented to the government our Initial Report entitled "Retain and Gain: Making Ontario’s Assets Work Better for Taxpayers and Consumers". The Initial Report included our overall assessment of the government-owned electricity sector companies in Ontario based on detailed reviews of Hydro One and Ontario Power Generation, input from stakeholder consultations, and our thinking on the future direction of the two companies.

The report provided suggestions as to how best to achieve the government’s objectives, and indicated that we were open to looking at additional options on how best to proceed.

In response to the Council’s Initial Report, the government issued a statement indicating its support for the direction of the proposals contained in the report and authorizing the Council to move to the second phase of its review.

The government expanded the Council’s mandate for Phase 2 of its review. The amended mandate authorized the Council to conduct further due diligence on the proposals presented in the Initial Report relative to Hydro One and Hydro One Brampton and to develop an implementation plan. The Council was also mandated to provide final recommendations to the government in support of its 2015 Budget process.

The amended mandate recognized that the Council is both an advisory body and a representative of the Crown. This has necessitated that the Council work very closely with the government at all times in Phase 2 of our review, and we have been guided by the government’s stated public policy objectives in framing our recommendations.

Restructuring Secretariat

To support the expanded mandate of the Council relative to Hydro One, a Restructuring Secretariat was announced in December 2014. The Restructuring Secretariat provided the Council with a structure to engage various stakeholders from the electricity sector, the financial community, and labour groups. The Restructuring Secretariat’s analytical and financial expertise allowed interested stakeholders to provide input into the second phase of the Council’s work in a collaborative and confidential manner, ensuring that the Council could review all of the suggestions and input that it received in a meaningful way.

The Restructuring Secretariat received input and submissions from a large cross-section of stakeholders. These were invaluable in informing the Council’s final recommendations. We would like to thank each of these groups for their contributions to the Council’s deliberations and final recommendations.

Approach

Our Initial Report provided the basis for the due diligence we conducted on Hydro One in Phase 2. It envisaged:

- Development of options and implementation planning for final recommendations on Hydro One Brampton Networks Inc. (Hydro One Brampton); and

- Development of options and implementation planning for a separation of the transmission and distribution businesses that are currently integrated in Hydro One Networks.

In Phase 2, the Council conducted detailed valuations and due diligence, including regulatory and policy considerations, assessment of synergies and dis-synergies, as well as analysis of various accounting, labour, company debt, pension, and tax issues.

Throughout Phase 2 of our work, the Council continued our commitment to a collaborative and confidential process in order to develop specific proposals for the future direction of Hydro One.

To this end, the Council carefully considered reaction from key stakeholders, policy and financial experts, as well as labour leaders and others. The input from these consultations, together with our detailed analysis, has enabled us to refine our thinking. In some cases, the evolution has been modest; in others it has been significant. In all cases, it has been developed, first and foremost, with a view to serving the public interest and securing the best outcomes for the people of Ontario.

As noted in our Initial Report, our bias has clearly been towards what is do-able and towards framing proposals and recommendations that are pragmatic and implementable.

Our report

This report represents our final report to government on the future direction for Hydro One Networks and Hydro One Brampton. The report outlines the major issues that the Council considered in coming to a view on these issues in light of the detailed due diligence, market soundings, and analysis that we undertook in Phase 2 of our review, and it provides our final recommendations to government.

The council’s perspective

Guiding principles

As the Council considered the future direction for Hydro One and Hydro One Brampton, we developed principles to guide our thinking on how best to approach unlocking value from the two companies and improving the efficiency of the distribution system in Ontario through consolidation. Our principles were:

- Efficiency and Consolidation. Divestiture should be designed to promote consolidation in the electricity distribution sector and improve the overall efficiency of the distribution system.

- Public Ownership. The Government of Ontario should remain the largest shareholder in any publicly-traded company created by divestiture.

- Financial Benefit. Divestiture should unlock value from the Province’s interest in Hydro One and deliver substantial financial gains that can be applied to public transit and transportation infrastructure all across Ontario.

- Ratepayer Protection. Existing regulatory controls should be strengthened to ensure that Ontario ratepayers are not disadvantaged in terms of rates and service levels following any divestiture.

- Service Quality. Regulatory oversight should continue to ensure that service and reliability standards are maintained for customers in communities of every size.

Unlocking the value of Hydro One would be a key step towards the government’s 2014 Budget goal of allowing Ontarians to share in the value of a core asset like Hydro One while providing funds for new public transit and transportation infrastructure, all while ensuring that a core government asset remains broadly held and creating a growth-oriented and Ontario-based company.

Finally, it is important to emphasize that the Council’s mandate operated at all times in the context of the government’s desire to build for the future in the context of the government’s limited borrowing capacity. Unlocking economic value and realizing financial benefit from major assets is directed by the government’s commitment to make investments in equally vital and sustaining public transit and transportation infrastructure projects. In this way, the economic value built up over generations in existing assets can be utilized to help create new assets that will accrue to the benefit of the people of Ontario in the future. These investments pay a return to the citizens of Ontario either directly by improving transit and transportation services or indirectly by unlocking growth potential in the economy.

Key considerations

Flowing from the principles section outlined above, the Council identified seven major issues requiring detailed consideration. Our work in Phase 2 was directed to undertaking the necessary due diligence and analysis to allow us to formulate carefully considered conclusions and recommendations on each issue. The issues were:

- How best to catalyze LDC consolidation including addressing current barriers and incentives, such as taxes, that impede consolidation.

- How to unlock maximum financial value from the Province’s interest in Hydro One and Hydro One Brampton.

- The most effective ways to separate the distribution arm of Hydro One, the issues involved in splitting the company and whether splitting the company is the most effective way to realize value or whether there are other options that could better realize value and still meet public policy objectives.

- Ensuring that electricity rates are not adversely affected by any transaction.

- Ensuring that regulatory oversight is in place to maintain service and reliability standards for customers in Ontario communities of every size.

- How best to structure the governance of the new company to protect the interests of the government as a responsible shareholder and maximize value for Ontario taxpayers without discouraging potential investors.

- Addressing Hydro One’s compensation and pension cost challenges.

This section provides the Council’s perspective on each of these issues.

Hydro One Brampton as a catalyst for LDC consolidation

In our Initial Report, the Council strongly endorsed the need for faster consolidation among LDCs in Ontario. We also noted that the system needs private sector capital and a level of competition that will encourage innovation among companies that can adjust nimbly to the changing energy world. We identified Hydro One Brampton as key to breaking the deadlock on this issue and as a potential catalyst for consolidation.

The Council’s consultations with numerous market participants and our supporting due diligence have confirmed that there is a compelling case to support our initial proposal that Hydro One Brampton should be used as a catalyst for consolidation.

Hydro One Brampton occupies a strategic area between multiple large urban distribution companies and presents an attractive sale or merger opportunity in a region where the industry has been reluctant to pursue further mergers or cooperate on efficiencies to benefit ratepayers.

We examined potential options for such a transaction – an Initial Public Offering (IPO) or a sale to a strategic buyer or buyers. On an IPO, the Council received advice that although there may be some interest in the public capital market, the offering would likely be too small to be viable and sacrifice significant value to provincial taxpayers.

This indicated that a sale or merger with a strategic buyer would be the most effective route. Based on our due diligence, it is clear that Hydro One Brampton is an efficient, stand-alone urban electricity distribution business with strong growth potential. These qualities make it a rarity in Ontario that would likely attract a value premium for that scarcity. In considering what form of strategic sale or merger to pursue, the Council was influenced strongly by the importance of creating a strong, standalone industry consolidator. The Council remains of the view that Ontario would be best served by having at least three or four financially strong distribution players that are able to adapt to changing circumstances and provide the OEB with true comparators to review relative performance in the sector.

In our Initial Report, we expressed the view that Hydro One Brampton could be used as a catalyst for LDC consolidation by merging it with one or more GTA distribution companies and then divesting some of the government’s interest in Hydro One Brampton. We indicated our belief that Hydro One Brampton should be a natural merger partner for neighbouring utilities.

The resulting company would create a large urban entity that is well-positioned to pursue consolidation and modernization of Ontario’s electricity distribution system – particularly in the Greater Toronto and Hamilton Area (GTHA) and surrounding environment where multiple local distribution companies present significant opportunities for savings from economies of scale. As well, such a merger would create a distribution utility of comparable scale to Hydro One Networks and to Toronto Hydro. By creating a utility of this size, municipalities will have a choice of business partners to encourage efficiency and local development. This choice should strengthen competition for mergers in the region and attract additional capital; it would no longer be a binary choice to merge with Hydro One or not.

The Council favours competition in cost efficiencies whenever possible as a natural impetus for innovation and cost reduction, both of which should have long-term benefits to ratepayers. Providing additional cost comparisons for benchmarks in large distribution companies other than just Hydro One and Toronto Hydro would also provide the Ontario Energy Board with additional information to better evaluate fair costs for ratepayers.

In the course of our Phase 2 consultations, the Restructuring Secretariat received a strong pre-emptive bid from a consortium of GTHA-area LDCs that envisages a merger of Hydro One Brampton with Enersource (Enersource Corporation), PowerStream (PowerStream Holdings Inc.), and Horizon (Horizon Holdings Inc.). Following intensive negotiations between these companies and the Province, the consortium would have the option under the terms of this bid of acquiring Hydro One’s interest in Hydro One Brampton for either a 17% interest in the new consolidated entity or for an enterprise value of $607 million in cash.

We wish to emphasize that the quantum of the cash option is clearly at the higher end of the indicative values identified in our market soundings, and the equity option appears to be equally attractive. This option results in a strong consolidator in the GTHA at a value that was as high as could otherwise be achieved. Accordingly it is the option that the Council believes the government should pursue.

The public interest benefits of such a merger are many, including the potential to improve efficiency, to strengthen service and reliability, to open the door to new capital investment from the private sector, to encourage modernization of the distribution system and to help to catalyze further consolidation in the sector by demonstrating the merits of such an approach. By proceeding with merger partners that are already in place and operating established distribution businesses, ratepayers in these areas should start to see the benefits of consolidation sooner, as opposed to introducing a strategic operator or trying to carve up Hydro One’s service areas through complicated regulatory proceedings.

In light of this, the Council believes that the Province should not conduct an open auction or procurement process for Hydro One Brampton, but instead should immediately proceed to negotiate a sale or merger of Hydro One Brampton to Enersource, PowerStream, and Horizon on the basis noted above. This should be completed during the province’s 2015-16 fiscal year.

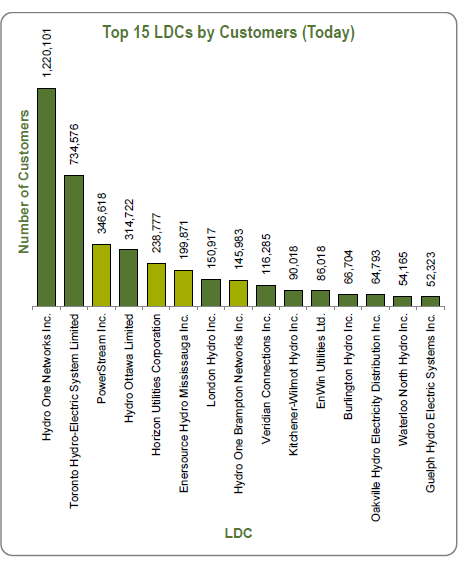

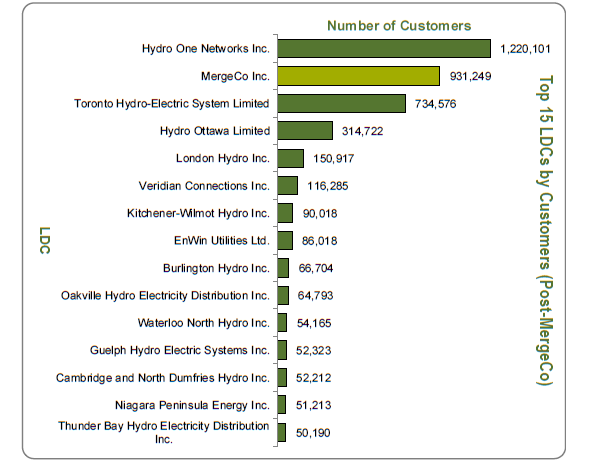

These two tables illustrate the dramatic impact that such a merger would have on the LDC landscape in Ontario, particularly in the GTHA.

Chart 1 - Source Data from 2013 Yearbook of Electricity Distributors

Chart 2 - Source Data from 2013 Yearbook of Electricity Distributors

Through this proposed transaction, not only would the Province protect its interest by either maintaining a foothold in a high growth, urban LDC in the case of a merger or receiving significant value in a sale, but would also protect the interests of electricity ratepayers by facilitating consolidation of local distribution companies as originally recommended in the 2012 report from the Ontario Distribution Sector Review Panel.

Encouraging further LDC consolidation

The proposed Hydro One Brampton transaction represents a major step forward in catalyzing LDC consolidation in Ontario. However, it is only one step and the Council remains strongly supportive of using the momentum of that transaction to provide for further consolidation.

In the course of our consultations, a number of transition proposals have been presented to the Council that envisage consolidation of LDCs. Most of these are proposals for individual LDCs to negotiate the acquisition of contiguous parts of Hydro One’s distribution business and merging it with their own operations. Arguments in favour of this approach versus the Council’s approach include:

- maintaining electricity delivery under local control;

- providing a sound basis for overall restructuring of the distribution sector by voluntary consolidation; and

- offering value to the Province for any acquisition and supporting tax efficiency.

Although the Council is supportive of these kinds of transactions in principle, our assessment of the proposals indicated that they have had a number of shortcomings. Specifically:

- they generally seek to "cherry-pick" assets from Hydro One distribution that could leave Hydro One with stranded, rural assets that would increase its average per customer cost base;

- the proposals seem to significantly under-value the Province’s interest in these regions, meaning that transactions at these proposed levels would transfer substantial value away from the Province to the owner municipalities; and

- the process is likely to be relatively slow-moving because of the regulatory process, and while it may indeed foster consolidation, it is unlikely to do so in the near term forgoing significant opportunities to benefit ratepayers. Further, it would not create another large distribution utility that could act as another strong, standalone industry consolidator.

For these reasons, we believe that the approach the Council is recommending for Hydro One Brampton and Hydro One itself offers significantly greater benefits. However, we do support continuing efforts by Ontario’s LDCs to consolidate, and we believe that with the catalyst offered by the package of the Council’s recommendations, including time-limited changes to transfer tax rules and departure tax rules, it may be possible to accelerate the consolidation process, thereby supporting the goal of greater efficiencies in the overall system, and therefore lower costs for ratepayers than would have occurred without these changes.

Mitigating the costs of departure from government ownership

Under the Electricity Act, 1998, municipal electricity utilities (MEUs) are subject to a transfer tax of 33% on the fair market value of electricity assets sold to the private sector, less the total amount of payments-in-lieu (PILs) of taxes paid up to the time of the transfer. The Province’s transfer tax is designed to ensure that the MEU contributes its fair share to the pay down of stranded debt since ownership of the MEU was provided at no cost and essentially debt-free to municipalities as part of the 1998 restructuring of the sector. The tax also compensates the Ontario Electricity Financial Corporation (OEFC) for the loss of the federal portion of PILs when an MEU is sold to the private sector. PILs are paid to OEFC to help service and pay down electricity sector stranded debt.

Stakeholders have long argued for proposed modifications to this tax regime, including elimination of the transfer tax, in order to encourage voluntary consolidation in the distribution sector. Stakeholders suggested to the Ontario Distribution Sector Review Panel in 2012 and to the Council during our consultations that the tax over-captures value to the Province and impedes rational business decisions by the municipal stakeholders of local distribution companies.

Providing relief on the transfer tax represents a trade-off between the fiscal risk of on-going revenue loss from MEU PILs needed to continue reducing electricity sector stranded debt and the incentives for MEUs to potentially consolidate for the benefit of municipalities and ratepayers.

The Council examined this issue carefully and considered the original purpose of the transfer tax, which was to help pay down stranded debt in the electricity sector. In light of this, we are not supportive of stakeholder calls for the tax to be permanently eliminated. We do, however, support a temporary three-year reduction starting in 2016 in the rate of transfer tax from the current 33%. This reduction would provide an incentive for consolidation, while not unduly impacting ratepayers and taxpayers.

We believe that the government should offer a time-limited exemption for small MEUs (where "small" is defined as an MEU with less than 30,000 customers), in order to provide them with an incentive to consolidate with larger entities without resulting in material loss of on-going revenue to the OEFC and the Province.

We would also support a time-limited exemption from the capital gains component under the departure tax rules described in the Electricity Act, 1998 (with the exception of goodwill). The Council recognizes that, although the MEUs were provided to municipalities at no cost, municipal ownership since that time has, in some cases, added value. Accordingly, the Council believes that the Province should realize value for what was transferred, but that it is unfair to capitalize on the results of stewardship by MEUs over the last 15 years.

A time-limited capital gains exemption would strike a reasonable balance among the interests of the government, municipal stakeholders, and policy objectives. These assets were gifted to the municipalities by the Province under the Electricity Act, 1998 for no consideration leaving the electricity sector stranded debt with the OEFC, a provincial agency. We believe it is therefore reasonable for the Province to recapture some value on sale of these assets.

Departure taxes have frequently been cited as a major barrier to consolidation, but our consultations revealed that in many situations, even were the tax to be removed, many municipalities, for a variety of reasons, would prefer to continue to own their local distribution companies. However, the Council’s strong view remains that it is not in the long-term interests of ratepayers in these municipalities to have such a large number of small distribution companies.

Accordingly we propose that the MEU tax regime should be modified. We believe that these time-limited tax incentives to promote consolidation should be offered from January 1, 2016 for a period of three years, and that for any local distribution company appearing before the OEB prior to December 31, 2018, the tax on the transaction should be similarly reduced or eliminated when the transaction closes.

We do not believe that these tax measures should be put in place permanently. This would unfairly benefit municipalities at the cost of all provincial ratepayers and taxpayers. Our view is that tax policy measures intended to encourage consolidation should only provide incentives to consolidation, not fund them entirely.

Unlocking value from Hydro One

The Council’s main preoccupation relative to unlocking value from its interest in Hydro One is how best to obtain maximum financial value from a transaction while also maximizing protection for taxpayers and ratepayers.

In our Initial Report, the Council recommended that Hydro One’s transmission and distribution businesses be separated. At that time, the Council recommended that the Province retain its ownership of the transmission business given our understanding of its current role in meeting public policy objectives. We indicated that retaining the transmission business of Hydro One in public ownership would be advantageous in several areas of electricity policy including ongoing energy-sharing discussions with Quebec. This view was based on the Province of Ontario and the former Ontario Power Authority (OPA) – now part of the Independent Electricity System Operator (IESO) – being engaged in negotiations with Hydro Quebec for possible purchases of hydroelectric power.

However, in the course of Phase 2 of our review, the Council has worked closely with the government (including various ministries), regulatory authorities, and industry stakeholders to better understand the Province’s position in these discussions. The government is satisfied that retaining 100% ownership of Hydro One’s transmission assets is not a pre-requisite in order to achieve equally good energy policy outcomes. And as we further examined the public policy rationale for retaining Hydro One’s transmission assets in public ownership, we did not find the case compelling.

After examining the issues, there appeared to be no reason that a publicly-held Hydro One would not be able to carry out what would be required. Hydro One does not have an exclusivity on transmission projects in Ontario. Indeed, the last major competitive designation process for a transmission line in Ontario was won by a private sector company. Further, the OPA and IESO have now been combined to form a powerful agency whose mandate is to ensure that Ontarians are supplied with sufficient reliable energy at the lowest cost.

Furthermore, on the issue of maximizing value to the Province, it became clear in the course of our due diligence and market consultations that Hydro One as an integrated entity is worth more than the sum of its constituent parts as stand-alone businesses. The value premium in the market for a partial sale of a combined transmission and distribution company is likely to be significant. As a result, divesting a portion of the integrated entity would yield significantly greater economic value to the taxpayers of Ontario, while still allowing the government to protect ratepayers and the wider public interest.

In practical terms, a partial divestiture of the Province’s share in the integrated business of Hydro One would be a much simpler and less challenging process since it would not require splitting the company into two separate businesses ahead of the transaction. It would also avoid potentially material dis-synergies and separation costs that would arise from splitting the company. Labour and pension arrangements at Hydro One could continue to be negotiated with a single employer, as opposed to splitting the company into two separate business units that would each require a split pension plan.

Moving more quickly would allow the Province to take advantage of the uniquely attractive market conditions that currently prevail. Never before have the returns that the market demands been as close to the Province’s borrowing rate as they are today.

A sale of part of the Province’s interest in the integrated business would allow for the introduction of private sector discipline in governance, operating efficiency and spending, while maintaining public ownership and regulatory oversight to protect ratepayers and taxpayers. Regardless of ownership, regulatory oversight of both the distribution and transmission infrastructure will be maintained through the Ontario Energy Board (OEB), ensuring that Hydro One customers and Ontario ratepayers are not only protected but are efficiently served by an independent Hydro One.

The same OEB regulatory protection would also ensure that rates would not be affected and would certainly not increase as a consequence of the partial divestiture.

Concern has been expressed to the Council that the partial divestiture of Hydro One will result in front-end gains to the Province but a long-term income loss. It is argued that this will occur because the government would be selling assets that earn a 10% return on their book value and getting no material long-term income stream in return.

While it is true that there will be some loss of income as a result of the transaction, the government believes strongly that this will be mitigated by at least three factors. Firstly, it is the government’s intention to apply the proceeds of the partial divestiture up to the book value of the proportionate share of Hydro One divested in order to pay down debt. This will have the effect of reducing interest payments on that debt that would otherwise have been payable. Secondly, the government takes the view that it is investing the net proceeds of the partial divestiture in economically productive public transit and transportation infrastructure – investments that would not have otherwise been possible. These investments are specifically directed to producing long-term economic benefit to Ontarians by stimulating economic growth in the province. Over time, the government expects the return to the economy on these investments to be strongly positive. Thirdly, we believe that this will create a large, publicly-held Ontario company that will be strongly growth-oriented, with an infusion of new capital and management that will enable it to deliver stronger performance, better returns to the Province for its interest, and be well-positioned to support economic growth in Ontario. The Council has accepted this position.

Based on all these factors, the Council has concluded that the interests of the government and taxpayers of Ontario are best served by a partial sale of the Province’s interest in Hydro One as an integrated company, including both its transmission and distribution businesses.

Structuring a Hydro One transaction

As noted above, our market soundings confirmed strong interest in Hydro One. This was evident for both strategic buyers as well as on the public market.

The Council considered the option of a partial sale to or partnership with strategic investors but rejected it as contrary to the public interest and inconsistent with the government’s public policy objectives.

Unlike in the case of Hydro One Brampton, our analysis indicated that the return to the government of a sale to a strategic buyer could actually be lower than in an IPO. This is because the size of the transaction would severely limit the number of qualified bidders for Hydro One and would reduce the government’s ability to negotiate price. Moreover, the Council believes that it would be contrary to the public interest to permit any single external bidder to own a sizeable part of the company. Finally, in the Council’s view, a sale to an external strategic buyer would mean missing the opportunity to create a widely-held Ontario growth company.

The Council’s analysis indicates that, in today’s markets, the integrated Hydro One transmission and distribution business would likely command a fully distributed equity valuation of between $13.5 billion and $15 billion in a public offering, excluding Hydro One Brampton. We believe this valuation is a conservative range in the context of today’s market: the actual value may well exceed this amount. Of course, the Council recognizes that markets are volatile and market value could deteriorate.

This offering would be highly-attractive to the market as a dividend paying investment in a low-yield economic environment and would generate a substantial return that would support the government’s plans to invest in new public transit and transportation infrastructure all across Ontario.

An IPO offers the opportunity to provide ownership in a growing company to a wide spectrum of Ontarians and to maintain Canadian ownership of the company.

An IPO was proposed for Hydro One in 2002. However, the proposal at that time was to take 100% of the company public in one transaction. In considering the IPO option, the Council is proposing an alternative that would generate better returns to the Province while providing for protection of the public interest. The Council reviewed a number of past divestments, both in Canada and internationally, focusing on what worked and what did not. A common theme emerged – often governments rush to sell too much at once or without measures to protect the public interest. Initial offerings usually require a discount value to what will be the long-run value of the asset. Clearly therefore, the best approach is to sell as little as possible in the first round, both to let the market establish value and to see the potentially improved performance of the business.

Our analysis also indicated that the Canadian market could not accommodate such a large offering and that proceeding with such a large IPO in a single stage could significantly compromise value to the Province.

Proceeding in stages would allow the Province to continue receiving on-going income from the company rather than trading that income for a one-time revenue gain as would have been the case had the 2002 IPO proceeded. Finally, this approach allows the government to carefully monitor each stage of the sale and exercise discretion to suit market conditions prevailing at the time of each share sale.

The Council believes strongly that a staged divestiture would be the most effective way to unlock value from a partial sale of Hydro One. There will be those who will argue that there could be lost value to shareholders because the market will be concerned that the government has excessive control during the staged sale. We believe that there is a balanced approach that can meet the market’s concern, allow taxpayers to realize better economic value in a staged divestiture, while still meeting legitimate public policy concerns about the government’s investment in Hydro One.

Our analysis suggests that the IPO market could accommodate at least $3 billion of Hydro One shares at any one time. We propose that the initial tranche should offer approximately 15% of the company to the market. Future sales could be offered at opportune times in the market.

We believe that it is important for the Province to signal clearly to the market that it wants the new Hydro One to operate independently of the government. This can be achieved by the Province declaring its eventual intention to sell down its position to 40% of the shares outstanding on the IPO. While this will not occur for some time, the markets will want to know the government’s intention with respect to what it wants to do when it sells down its position to 40%. The government has indicated to the Council that it is their intention to hold their remaining shares. Retaining a long-term interest in the new Hydro One makes good economic sense and maintains the Province’s standing as a significant and responsible shareholder. It will also ensure that Ontarians as citizens, not just as investors, will have a continuing interest in this important company. The government could enshrine this intention in legislation. Obviously, future governments will still have the right to amend the legislation to permit future sales should they choose to do so.

The Council believes that this approach strikes the best possible balance. It offers the people of Ontario maximum financial return, providing funds for investment in strategic transit and transportation infrastructure all across Ontario. It preserves the Province as the largest shareholder, ensuring the long- term preservation of the public interest. It provides for a strong new governance structure, and it allows the government to share in the future of this large, growth-oriented company thereby retaining a growing income stream for the lasting benefit of the people of Ontario. By unfettering Hydro One and allowing it to expand its business opportunities, the company could also return an increasingly profitable dividend to all Ontarians.

Initiating a divestiture of the government’s interest in the integrated company by way of an IPO could commence during the Province’s 2015-16 fiscal year, subject to necessary legislative approvals.

We believe it would be in the public’s best interest for Hydro One to be widely-held. Accordingly, we would propose that there be a share ownership restriction that would not allow any one shareholder or consortium of shareholders (other than the Province) to hold more than 10% of Hydro One. This restriction further mitigates the risks of any one investor becoming too influential and helps protect the long-term interests of all Ontarians.

In the Council’s view, the IPO should be structured in such a way that it provides retail investor residents of Canada an allocation of 25-30% of the shares offered to the public under the IPO. This will allow Canadian investors to participate in the creation and growth of a large, growth-oriented, Canadian company. The creation of such a new company free to grow and expand will generate returns, not only for the shareholders but for all Ontarians.

Service quality at Hydro One has long been a concern of ratepayers. The Council finds it disappointing that a major service company such as Hydro One should have difficulty meeting modern service standards. We know that the company has worked hard to rectify these service issues. We would urge the new Board, even before the launch of Hydro One as a publicly-held company, to make "customer first" one of its core principles and to ensure that it has an execution plan to deliver on that commitment. We are also proposing that, although the company, like other publicly-traded companies, will no longer fall under the scrutiny of the Ontario Ombudsman, the company should appoint an independent ombudsman reporting directly to the Board to ensure that customers have an independent oversight and that the Board is made aware of any service shortcomings.

Finally, the Council is of the view that under the terms of the IPO, the government should ensure that there are requirements for Hydro One to maintain its head office and substantially all of its strategic management functions in Ontario. Given the province’s interest as a responsible shareholder, the government should ensure that the commitments are enshrined in legislation.

Controlling upward pressure on electricity rates

The Council believes strongly that transforming Hydro One from a locked legacy asset into a new, widely-held growth business will offer significant benefits to ratepayers as well as shareholders. More efficient operations will reduce costs and improve competitiveness. This will reduce upward pressure on rates even in the absence of other actions. Changes being proposed set the stage for improved operational performance and benefits to ratepayers.

The Council recognizes that there is public concern over the upward trend of electricity rates in Ontario. This is understandable. However, we believe that a shift from a government-owned entity to a widely-held and publicly-regulated company would ultimately decrease costs and therefore reduce upward pressure on rates. The new publicly-traded company will strive to improve its returns by finding efficiencies which, under Ontario’s regulatory regime, accrue only initially to the shareholders, but ultimately go to reducing rates from what they otherwise would have been – all of which is a benefit to ratepayers.

The government has stated clearly that no proposal for the future of Hydro One should result in additional upward pressure on rates. Proceeding with an IPO does not conflict with this principle. Indeed, the Council’s proposal would confirm the key role of the Ontario Energy Board (OEB) as a regulator and thereby ensure that rates would not be raised as a consequence of the partial divestiture. We are confident that the Council’s recommendations will reduce the level of rate increases that would otherwise have occurred. This will be achieved partly through improved efficiency of the company and partly by way of, and under the supervision of, regulatory oversight.

All rate-regulated gas and electric utilities in Ontario are overseen by the Ontario Energy Board. This encompasses oversight of the distribution and transmission utilities in Ontario, including Hydro One. The new company would continue to be regulated by the OEB.

The OEB is a quasi-judicial administrative tribunal that monitors the performance of all regulated electricity and gas utilities, both public and private, through transparent reporting requirements. The OEB also directly enforces service quality standards and approves rates. In the case of Hydro One, current rate filings are in place for both transmission (which apply for the next two years) and distribution (applying for the next three years). Following these rate filings, the more efficient and publicly held Hydro One would again justify its costs and revenue requirements, passing on any savings to ratepayers – and the OEB would continue to ensure that consumers and industry pay fair and reasonable rates for the electricity they use.

The OEB's mandate is to protect consumers through the setting of fair prices and ensuring appropriate service quality and reliability. Additionally, the OEB has compliance and enforcement powers, including the ability to revoke an electricity distributor’s or transmitter’s (or marketer’s) licence and to levy fines and penalties.

All rate-regulated utilities, including Hydro One and Hydro One Brampton, are required to submit comprehensive rate applications to the OEB for review. Rate applications undergo a review process and receive approval from the OEB, which ensures only fair and reasonable costs are recovered through rates. This regulatory oversight will ensure that a publicly-traded Hydro One will not be able to unreasonably increase rates.

Rate applications to the OEB are also public, so consumer and industrial groups have an opportunity to review costs and question rates being requested by regulated distribution and transmission companies.

The OEB has experience in regulating transmission companies that are in the private sector. There are currently five rate-regulated transmission companies, two of which are 100% investor-owned, as well as several distribution companies with private sector involvement. Rate filing requirements are the same for companies of the same type, regardless of a public or private owner – each is required to justify its costs and rates, which protects the public interest. Further, natural gas service is provided by private utilities in Ontario today, and there is no evidence that they underserve the public.

We are convinced that, because Hydro One will continue to be regulated with respect to the rates that it can charge, and because the Council also heard from the government that broader public policy objectives can continue to be met without 100% ownership, continued 100% public ownership of Hydro One adds no additional value.

The Council recognizes the OEB as an effective regulator, but we have recommended to the government that it consider further enhancements to strengthen the OEB's mandate and powers to ensure that all ratepayers continue to be effectively protected.

Putting in place appropriate governance for the new company

As Hydro One transitions from being a government business enterprise to a widely-held Ontario public company, its governance structures and processes will need to be amended significantly.

In this regard, it will be necessary to strike a balance between protecting the interests of the Province as a responsible shareholder and by extension, Ontario taxpayers, while at the same time providing assurance to investors that the new company will have sufficient autonomy and flexibility to operate effectively in the private sector. This will be achieved primarily by establishing an independent relationship between the Province and the company as well as addressing the establishment and operation of the company’s Board and removing some statutory restrictions on the company. It will also be necessary to eliminate some of Hydro One’s current obligations under existing government directives and requirements.

The Council has examined this issue in detail, and we have developed a framework for the governance of the new company.

We believe the new governance framework should have the following attributes:

- The Province, in its capacity as a shareholder, should engage in the business and affairs of the company only as an investor and not as a manager.

- The Province should approve the initial governance standards of the company. These should be consistent with "best practices" in Canada for public companies having regard to the company’s ownership structure.

- Governance of the company should be vested in its Board of Directors. The Board should have full authority to approve the strategy and the annual business plan and budget for the company and to hire, direct, and oversee the company’s management.

- All members of the Board should be high-quality, reputable business leaders with the requisite skills, board experience, time, and motivation for an operation of the company’s size and scope and having regard to the company’s core operating principles.

- All directors would be independent and owe a fiduciary duty to the company.

- The Province should identify the initial members of the Board as at the date of the IPO. The initial members of the Board should be appointed by the Minister of Energy based on the recommendation of the Chair of the Board and, at the request of the government, the Chair of the Premier’s Advisory Council on Government Assets. After that point, the Chair should be elected by the independent Board.

- The Province should be entitled to nominate a number of directors equal to its proportionate share of the outstanding votes, subject to a maximum of 40%, with the remaining directors independently nominated to bring a balance of expertise, skills, and experience.

- The government can vote to remove the entire Board but only if in doing so it removes the whole Board or all the Board except the Chair and replaces its nominees with new directors.

- The Chair and the CEO should be confirmed annually by two-thirds of the Board. This confirmation gives the government nominees and the independent directors effective veto rights over the Chair and CEO. This confirmation also ensures that both the Chair and the CEO, who are critical to the direction and management of the company, must be satisfactory to the Province’s nominees.

- As noted earlier, the company’s head office, CEO, and substantially all strategic decision-making management and functions must be maintained in Ontario. As well, the Grid Control Centre for Ontario operations must be maintained in Ontario.

- In order to ensure the Province has additional powers to protect both the public interest and its investment through the company in Ontario’s transmission and distribution systems, the company should not be allowed to do any of the following:

- sell all or substantially all of the Ontario-licensed transmission business of the company

- sell all or substantially all of the Ontario-based distribution assets of the company

- change the jurisdiction of incorporation of the company

Addressing the challenge of labour and pension costs

In our Initial Report, we noted that both Hydro One’s and Ontario Power Generation’s various labour agreements have resulted in a very high burden of compensation costs. The Report on the Sustainability of Electricity Sector Pension Plans (the Leech Report) raised a number of issues with the pension plans in the electricity sector. The Council’s view was that, while the compensation arrangements were won at the bargaining table, it is becoming increasingly unsustainable that this sector has pension arrangements that do not align with the public sector as a whole and overall compensation arrangements that place a burden on ratepayers.

This position has been reinforced by recent decisions of the OEB. The OEB has disallowed proposed compensation for both Hydro One and OPG because they deem such compensation to be excessive. As a result, these costs are not being recovered from ratepayers. Ultimately, the taxpayer is paying for what the OEB deems to be "excessive compensation".

The Council recognizes that the agreements in place were negotiated at the bargaining table and that any changes should also be reached through the collective bargaining process. We believe that it is clearly in the interests of both management and the unions to seek negotiated solutions. Both parties have an interest in arriving at a sufficiently robust solution to the issues raised by the Leech Report that will enable both sides to agree that the fundamental issues raised by Mr. Leech have been dealt with. It is also important to be able to show the OEB that real progress has been made on compensation costs.

In parallel with Phase 2 of our review, discussions have been underway with the Power Workers' Union and Hydro One and OPG with respect to their labour contracts. Tentative agreements have been announced. The Council has reviewed the proposed agreements, and we believe that, if endorsed, they offer a basis over time for meeting the concerns that Mr. Leech raised in his report and for closing the gap between the current situation and the more sustainable and affordable long-term answers required by the OEB. They also adhere to the government’s insistence that all wage increases be at least offset by cost savings – the concept of net zero.

Agreements have yet to be ratified. Obviously, the terms will have to be such that the average worker believes they are fair. If the agreements are ratified, not only will they have significantly addressed long-term issues, but they will reduce electricity rates from what they would have otherwise been.

Conclusion

We are satisfied that the recommendations in our Initial Report were soundly based. In that Report, the Council also committed to exploring all viable options and to listening to market and stakeholders' input. We did listen, and we have evolved our thinking significantly as a result.

First of all, we have done that with respect to Hydro One Brampton. In our continuing consultations and diligence, we were impressed by alternative arguments that stressed the potential for accelerated LDC consolidation from merging Hydro One Brampton with three local distribution companies. The Council envisages Hydro One Brampton becoming part of a large-scale merged Greater Toronto and Hamilton Area (GTHA) distribution company, comparable in scale to Toronto Hydro and Hydro One Networks, which would improve industry competition for regional consolidation by increasing the number of LDCs with the capacity to drive further consolidation and thereby act as a catalyst for further consolidation. We have concluded, as did the 2012 report from the Ontario Distribution Sector Review Panel, that economies of scale enabled by further consolidation would lead to a favourable impact on rates.

Our consultations also led us to significantly revise our conclusion as to what to do with Hydro One. We concluded that the Province should sell, over time, a majority interest in Hydro One through share sales to the public. Selling a portion of Hydro One as a combined entity, compared to separating and selling the distribution business, is faster and achieves higher value.

We looked again at the issues raised about selling public assets – tax leakage and lost net income to the Province. We found that the tax leakage issue was a theoretical loss but not a real one because of the effect on the tax base of the company of going public. A new publicly-held Hydro One is not likely to pay provincial or federal taxes for some time, and at least some of the value of this tax shield should be reflected in the valuation.

The issue of lost income to the Province hasn't changed from our Initial Report – there will indeed be some lost income. However, there is, of course, the broader question: if governments have a lower cost of borrowing than business enterprises earn, should they own many of them to earn revenue for the province? A conclusion to do so assumes that governments have no debt limits and unlimited capacity to effectively manage large and complex business operations. Whatever one’s view is on the latter issue, it is clear that Ontario does have a limit on how much it can borrow; therefore, not selling assets has an opportunity cost: the investments that are not made.

So the critical issue is the return to the economy of the infrastructure investments made in transit and transportation. The government’s view, and one which we accept, is that the return on well-conceived projects will be higher than the return that the government would forego by selling Hydro One today, in the context of today’s market and interest rates. Investors today are demanding a very small premium to the government’s borrowing rate; never before have the returns that the market demands been as close to the Province’s borrowing rate as they are now. However, there will be a loss to the provincial government’s revenue even if the province is better off. Some of this may be offset by improved economic performance as a result of the infrastructure investments and therefore improved provincial government revenue performance. Another offset may well be improved company performance as a result of private sector discipline.

The loss can also be affected by how you sell down your interest. We considered carefully the lessons of previous unsuccessful divestiture efforts of Hydro One and other assets. Unlike those efforts, we are proposing that divestiture be staged over time with measures to protect the public interest as a responsible shareholder. This staged approach better matches the offerings to the capacity of the market to absorb them and reduces pricing risk. The mistake often made is to try to sell too much at one time. Value is destroyed in doing so. By staging a sale, it will also allow the Province to retain a substantial interest in Hydro One over an extended period of time, thereby continuing to enjoy the benefit of continued income from a growth company, rather than simply trading a one-time gain for a long-term income loss.

The heart of the issue remains the public policy issues involved in selling Hydro One. For the distribution business, our views on the importance of spurring consolidation in the electricity distribution sector have not changed. We said in our Initial Report that we would favour selling the distribution business of Hydro One Networks whether or not the government needed the revenue to finance infrastructure investments. It just made good energy policy sense. Indeed these views have been strengthened by our consultation process, as almost all stakeholders urged us to find a way to spur further consolidation. The key is finding a catalyst. We believe our recommendations today will be that catalyst. We will have created a real urban consolidator through our proposal involving Hydro One Brampton. We will have a competing strong consolidator by giving the distribution arm of Hydro One the backing of a strong company whose shares are valued at a high multiple. And by addressing some of the cost issues coming out of the labour contracts in Hydro One, we will have reduced another barrier to consolidation.

There remains however the policy issues surrounding the transmission business. We put the question squarely back to government – can the public policy objectives of providing electricity transmission services to the province only be met by having the government own 100% of them? In re-examining this issue, in looking at jurisdictions where transmission lines are not owned by the government and in examining the options of expanding the powers and capabilities of the regulatory agencies, the government came to the view that the public policy needs could be met without 100% ownership. That view allowed us to conclude that we should recommend the proposal that would maximize the value to taxpayers: keep Hydro One together and sell down the government’s interest in a staged approach. We would therefore not break the company up into separate transmission and distribution companies.

We also believe that taking Hydro One public creates an opportunity: to create a new, growing company that can in turn create jobs, something that realistically it could not do – and did not do – as a 100% government-owned company. We see the new Hydro One as a strongly growth-oriented company, centred in Ontario and widely-held with measures to protect the public interest. The entity will be primarily Canadian-owned, rank among the larger public companies in the country by market capitalization, and be positioned to drive revenue and to generate jobs across Ontario. By unfettering Hydro One and allowing it to expand its business opportunities, the company could also return an increasingly profitable dividend to all Ontarians.

We believe strongly that bringing in new capital in this way will benefit the government, ratepayers, and taxpayers. It will facilitate improvements in the efficiency of the electricity system in Ontario, which in turn would lead to a favourable impact on rates and support funding of much-needed public transit and transportation infrastructure that otherwise would not be possible.

Final recommendations

The Council has now completed its review of Hydro One and Hydro One Brampton, and we are pleased to present our final recommendations in support of the Province’s 2015 Budget.

- The Province should proceed immediately with a sale or merger of its interest in Hydro One Brampton Networks Inc. to or with Enersource Corporation, PowerStream Holdings Inc. and Horizon Holdings Inc., intended to catalyze consolidation in the Greater Toronto and Hamilton Area and to strengthen competition in the electricity distribution sector by increasing the number of LDCs with the capacity to drive further consolidation.

- The Province should amend the transfer tax rules and departure tax rules that apply when municipal electricity utilities leave the payment-in-lieu of taxes regime both on a time-limited basis and implement these changes as quickly as possible.

- The Province should proceed with a partial sale of a portion of its interest in Hydro One as an integrated entity, including both the transmission and distribution businesses, to create a growth-oriented company centred in Ontario.

- The partial sale of the Province’s interest in Hydro One should be by way of an Initial Public Offering (IPO) so that the company will be widely held, predominantly by Canadians.

- The government should indicate its intention to retain its remaining shares after selling down to 40%, and the balance should be widely held with no other individual shareholder having more than a 10% holding.

- Hydro One should be required to maintain its head office and substantially all of its strategic management functions in Ontario.

- The mandate and powers of the Ontario Energy Board should be strengthened to ensure that changes in industry structure do not put upward pressure on rates.

- Governance of Hydro One should be adjusted to meet the requirements for a widely-held public company, and certain legislative and government regulatory and policy requirements that are applicable to government entities should be removed.

- Governance of the company should be vested in its Board of Directors; all directors would be independent with the requisite skills and board experience for an operation of the company’s size and owe a fiduciary duty to the company.

- In order to ensure the Province has additional powers to protect both the public interest and its investment through the company in Ontario’s transmission and distribution systems, Hydro One should not be allowed to do any of the following:

- sell all or substantially all of the Ontario-based transmission assets of the company;

- sell all or substantially all of the Ontario-based distribution assets of the company; or

- change the jurisdiction of incorporation of the company.

- The Province, Hydro One management, and unions should finalize agreements on pensions and labour costs in advance of the Hydro One IPO to address issues raised by the Leech Report and the Ontario Energy Board with respect to pensions and compensation.