Private gas wells: qualified person’s manual

Manual designed for qualified persons for evaluating private gas wells under the Ontario government private gas well incentive program.

September 2012

Overview

Oil and natural gas exploration and production in Ontario are regulated by the Oil, Gas, and Salt Resources Act (OGSRA). Changes to the Act in 1997 require that all oil and gas wells be licensed by the Ministry of Natural Resources (MNR). In addition to commercially owned and operated oil and gas wells, this licensing requirement applies to privately owned natural gas wells (hereinafter referred to as “private gas wells”).

Under Ontario Regulation 245/97, “private well” means,

- an unplugged well drilled for the purpose of oil or gas exploration or production on land of which the operator owns both the surface and mineral rights, and

- oil or gas is produced from the well, the oil or gas,

- is for the operator’s private use,

- is not used in relation to a business or commercial enterprise, and

- is not sold by the operator.

The ministry has adopted a policy for the licensing of existing private gas wells. To view the policy, go to the Environmental Registry website (Registry #011-2981) or Oil, Gas and Salt Resources Act.

The requirements established by this policy recognize that private gas wells generally present lower risks than do commercial wells because they produce a low volume of gas and operate at much lower pressures. The policy establishes requirements that reflect the nature of these risks.

In support of the new policy, the ministry is implementing a five-year incentive program. The program will provide financial assistance to private well operators for well evaluation and wellhead improvements or well plugging.

To be eligible for incentives, the well operator must first have the wellhead and well location evaluated by a Qualified Person (QP). A QP is anyone meeting the definition provided in the policy, and as described in this guide. The QP’s well evaluation will establish whether the private gas well conforms to the requirements established by the policy.

If the well does not conform, it will need to be retrofitted or plugged, depending on the circumstances. The QP will help the well operator identify a potential course of action. The QP may also assist the well operator in completing the necessary application forms and compiling the relevant information.

The Private Gas Well Incentive Program

Eligibility

The Private Gas Well Incentive Program is open to any operator of an unlicensed or a licensed private gas well drilled prior to June 27, 1997, provided that gas produced from the well:

- is for the operator’s private use

- is not used in relation to a business or commercial enterprise that sells, supplies, or distributes gas

- is not sold by the operator.

Incentives

The Private Gas Well Incentive Program will provide grants to well operators to assist with costs associated with well evaluations, wellhead retrofitting and well plugging.

Well evaluation grant

This grant will assist well operators with the cost of the well evaluation carried out by a Qualified Person. The grant will cover 100 per cent of the well evaluation costs up to $500 (including HST). Should the costs of the total evaluation exceed $500, the well operator will be responsible for the amount in excess of $500. All eligible private gas wells qualify for this grant provided that the application for the grant is accompanied by the required documents listed under Submitting the Grant Application Package. An operator with more than one well may wish to have all of the wells evaluated. A separate evaluation must be done for each well; each well will require a separate grant and licence application.

How will the well evaluation be paid?

The well operator is responsible for paying the Qualified Person for services and submitting an application to MNR for reimbursement of the eligible portion of the evaluation cost. In order to seek reimbursement for the evaluation, the operator must include proof of payment with the completed grant application. As a result, Qualified Persons must provide receipts on payment of evaluation services.

Wellhead retrofit grant

The wellhead retrofit grant is only available to a well operator whose well is located outside the setback distances and restricted areas as defined in the policy. This grant will help the well operator bring the wellhead up to the minimum requirements established by the policy. The grant will cover half of the wellhead retrofit costs, to a maximum grant of $500 (including HST). To qualify, the application for the grant must be accompanied by the required documents listed under Submitting the Grant Application Package.

Since no work can be conducted legally on an unlicensed well, the operator must obtain a private gas well licence before proceeding with a wellhead retrofit. Ministry of Natural Resources staff will contact the operator regarding approval to proceed with the wellhead retrofit.

Well plugging grant

While all eligible private gas wells qualify for a well plugging grant, the amount will vary depending on the well location. There are two grant levels.

- 100% Plugging Grant

If a well is located within the setback distances outlined in the policy or the source water protection areas, 100 per cent of the cost to plug the well will be paid by the Ontario government. The contracting for well plugging will be managed by the ministry and staff will communicate with the operator to advise when the well will be plugged. The operator is not required to obtain a quote and will not contract for the work to be done. The contracting for plugging will be managed by MNR staff will work with the applicant to ensure ample notice of when the well will be plugged.

- 50% Plugging Grant

If a well is not located within the setback distances defined in the policy and is not in a source water protection area, 50 per cent of the cost to plug the well will be paid by the government to a maximum grant of $10,000 (including HST). In this case, the operator is required to obtain written quotes supplied by two companies that have proof of Workplace Safety and Insurance Board and Liability Insurance coverage and submit this information with the grant application. The operator will be managing the plugging contract and will be contacted by ministry staff regarding approval to proceed with the well plugging. The operator must pay for plugging the well and submit receipts to MNR to seek reimbursement to a maximum of $10,000.

Since no work can be conducted legally on an unlicensed well, the operator must obtain a private gas well licence (for plugging purposes only) before proceeding with well plugging. Ministry of Natural Resources staff will contact the operator regarding approval to proceed with the plugging, which must conform to ministry standards.

Role of the Qualified Person

Well operators will initially contact a QP to conduct a wellhead and well location evaluation. The QP will complete the Well Evaluation Form and recommend to the operator which incentives they may be eligible for. Please note that the ultimate decision regarding well licensing and grant approval rests with the ministry.

The QP must complete a Well Evaluation Form documenting the findings of the wellhead and well location evaluation, including a well location sketch and photographs of the well. This is required for processing both the grant and the licensing application forms.

Please ensure that all forms are completely filled out. Incomplete applications or well evaluations will be returned to the applicant for more information. The ministry will not reimburse applicants for any additional QP costs that may be associated with completing returned applications.

Who is considered a Qualified Person?

A Qualified Person must be one of the following:

- A person who holds a licence, limited licence or temporary licence under the Professional Engineers Act, 1990;

- A person who holds a certificate of registration under the Professional Geoscientists Act, 2000, and is a practising member, temporary member or limited member of the Association of Professional Geoscientists of Ontario (O. Reg. 66/08, s. 2); or

- A person who is certified as a Class II Examiner under the MNR Examiners’ Program for examining petroleum operations.

Note: Persons not already certified as a Class II Examiner may seek to receive this designation and thereby become a Qualified Person. Contact information for the Class II Examiner certification process is found on the Oil, Gas & Salt Resources Library.

Submitting the Grant Application Package

The Qualified Person is responsible for completing the Well Evaluation Form, taking the well photographs, creating the well location sketch and signing off on the grant application once they have received payment for their services.

The operator is responsible for submitting the following documentation to the ministry:

- A completed Incentive Application Form (Form 0234);

- A completed Private Gas Well Licence Application Form (Form 0233E), if applicable;

- A completed Well Evaluation Form (Form 0235);

- A well location sketch;

- Four photographs/images of the well in its current state from all four sides;

- Proof of payment to the QP for services provided;

- Quotes for wellhead retrofit or well plugging, if applicable;

- Proof of legal interest in the well (copy of deed, tax bill or other legal document);

- An engineer’s report, if applicable; and

- Other documents as required to complete the applications.

All incentive program applications for unlicensed wells must be accompanied by a Private Gas Well Licence Application (unless the well is already licensed).

MNR inspections

The ministry will conduct inspections of well sites for compliance with the Oil, Gas and Salt Resources Act. MNR Petroleum Inspectors may enter upon private property in carrying out their duties. An inspector may contact the operator before conducting an inspection.

Work to be completed by December 31

All work must be completed by December 31 of the calendar year in which the approval for a grant is received by the applicant.

Quality assurance

The ministry will conduct quality assurance checks on grant applications. Overpayment or unauthorized use of any part of the funding will be deemed a debt to the Crown and must be repaid to the ministry by the applicant.

Well Evaluation Form (Form 0235)

The Well Evaluation Form is a two-page document that has been designed to record all of the relevant licensing and/or granting information regarding the evaluated wellhead and well location.

Download the Well Evaluation Form

The following is a section-by-section overview of the Well Evaluation Form and the information required for each section.

Qualified Person

Enter your name, contact information, technical designation and company name, if applicable.

Well operator

Enter name, address and contact information.

Well location

Enter the well ID, if known, and location coordinates.

Note: Many private wells were previously licensed or may still hold an active licence. If the well operator is not aware of an assigned well ID, please contact the Oil, Gas and Salt Resources Library to search for a well record. If there is no record of a well ID in the Library, please enter “N/A” in the box.

Ownership

This section has been designed to confirm that the applicant has a legal right to license, retrofit or plug the well. MNR is requesting proof of land ownership (copy of deed or tax assessment) or legal interest in the well (notarized document, easement). This must be submitted with the Well Evaluation Form.

Location

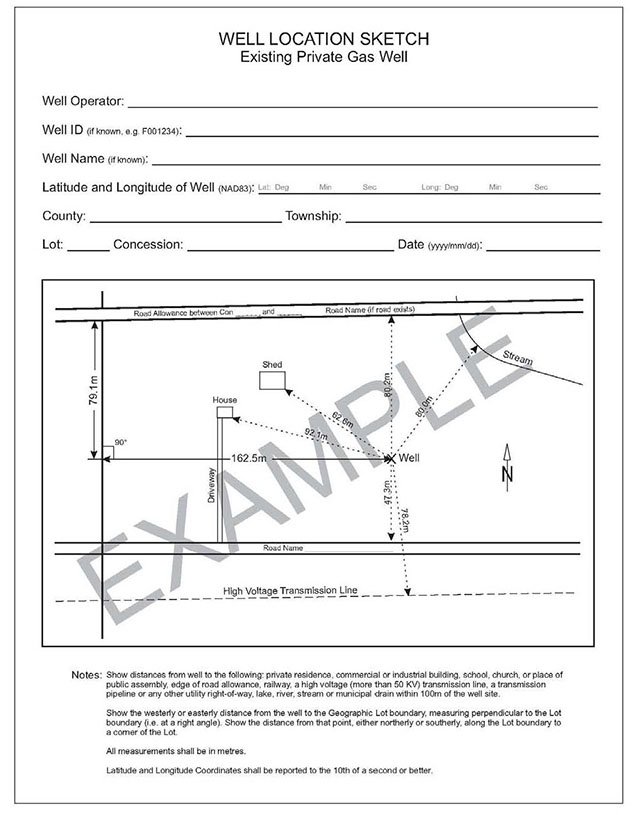

In accordance with Section 5.3 of the Policy, all setbacks must be measured and recorded on the well location sketch. See the sample sketch included in this guide.

If the well location falls within the setback distances established in the policy, the well operator may elect to have a well integrity test or engineer’s report completed at their own expense. As per Section 5.4 of the Policy, an engineer’s report must be included with the Well Evaluation Form.

To obtain information about source water protection areas, please contact your local Conservation Authority.

For further information visit the Conservation Ontario website at www.conservation- ontario.on.ca. The website provides a map of source water protection areas and provides links to the Assessment Reports for each area. The Assessment Reports contain maps showing the locations of the protection zones.

Wellhead condition

Section 5.2 of the Policy sets out the minimum wellhead requirements. This section of the Evaluation Form is to confirm that the well being evaluated meets the minimum wellhead requirements. Where minimum wellhead requirements are not met, a wellhead retrofit will be required.

Wellhead photos/images

Photos/images of the well are required and should be taken from all four sides at the time of the well evaluation. The photos/images must accompany the submission package.

Comments

Enter any additional comments that will assist MNR in processing the grant and licensing applications.

Qualified Person’s Statement

By dating and signing the Well Evaluation Form for each well evaluated, the QP confirms that all of the information is true and correct to the best of his/her knowledge as of the date of evaluation.

Well location sketch

A well location sketch is required to document the physical location of the well.

The sketch does not have to be a surveyed plan but should contain the location coordinates, date prepared and author’s name, and identify any of the following that occur within 100 m of the well:

- Water bodies and streams

- Places of public assembly (church, school, hospital, etc.)

- Commercial or industrial buildings

- Private residences

- All other structures

- Railway lines

- High voltage transmission lines

- Pipelines

- Utility right of way, and

- Road allowances.

Please record all distances that are relevant to the setback requirements. Location coordinates should be in NAD 83.

An example of a Well Location Sketch is illustrated below.

The Private Gas Well Licence Application Form is a one-page document designed to record all relevant information regarding the well.

The Private Gas Well Incentive Program Application Form is a two-page document designed to record all relevant information regarding the evaluated wellhead in relation to its eligibility for a grant. Page 2 of the application form contains the terms and conditions under which grants will be awarded. The applicant should read the terms and conditions carefully before signing and submitting the application form.

Resources

Ministry of Natural Resources

Petroleum Operations Section

659 Exeter Road

London, Ontario N6E 1L3

Telephone:

Toll Free:

Facsimile:

Email: pgwincentives@ontario.ca

Web page: /page/oil-gas-and-salt-resources-act-reasoned-decisions

The Ministry of Natural Resources is responsible for the management of oil, natural gas, salt-solution mining and underground storage resources in the province. The ministry regulates both onshore and offshore exploration, development and production of these resources, as well as abandonment and reclamation, ensuring activities are conducted in a safe, efficient and orderly manner. The ministry also manages Crown land tenure for these resources. The ministry’s Petroleum Operations Section is responsible for licensing and compliance, as well as supporting information management functions.

Ontario Oil, Gas and Salt Resources Library

669 Exeter Road

London, Ontario

N6E 1L3

Telephone:

The Ontario Oil, Gas and Salt Resources Library is a resource centre for the study of the subsurface geology, petroleum, salt and underground hydrocarbon storage resources of Ontario. The Library specializes in the collection, generation, and distribution of information on the subsurface geology, petroleum and salt resources of Ontario. This includes information on:

- Paleozoic geology of Ontario

- Oil and gas exploration, drilling, production, and disposal of oil-field fluids

- Natural gas storage reservoirs

- Solution mining of salt

- Subsurface storage of hydrocarbons in solution mined caverns.

The library houses cutting samples from over 13,000 wells, core from nearly 1000 wells, and file information on over 27,000 wells. The files include details on well history, construction, location, stratigraphy, oil, gas and water-bearing intervals.

Some of this information is available to the public free of charge on the library’s website. The Library is open to the public from 8:15 a.m. until 4:30 p.m., Monday through Friday.

Ontario Petroleum Institute

555 Southdale Road East, Suite 104

London, Ontario

N6E 1A2

Telephone:

Facsimile:

http://www.ontariopetroleuminstitute.com/

The Ontario Petroleum Institute is a non-profit industry association which represents explorationists, producers, contractors, geologists, petroleum engineers and other professionals, individuals or companies directly related to the oil and gas, hydrocarbon storage and solution mining industries of Ontario. The fundamental objectives of the Institute are:

- To encourage responsible exploration and development of the oil, gas, hydrocarbon storage and solution-mining industries in Ontario;

- To maintain close liaison with government agencies which regulate the industry;

- To disseminate information relevant to member needs;

- To promote the legislative goals of the membership, and

- To inform and educate the general public on the significance of the industry to the province of Ontario.

More Information

For more information, including Frequently Asked Questions, please refer to the Ministry’s website. The relevant forms and the policy are available at this website and are included in this guide for your reference You can also call the Ministry of Natural Resources Petroleum Operations Section from Monday to Friday, 8:30 a.m. to 5:00 p.m. at

Private Gas Well Licence Application Form

Click here for the Private Gas Well Licence Application

Private Gas Well Incentive Program Application Form

Click here for the Privage Gas Well Incentive Program Application Form

MNR 52698

ISBN 978-1-4606-0302-4 (Print) ISBN 978-1-4606-0303-1 (PDF)

© 2012