O. Reg. 181/03: MUNICIPAL TAX SALES RULES, Municipal Act, 2001, S.O. 2001, c. 25

Municipal Act, 2001

municipal tax sales rules

Historical version for the period December 21, 2017 to December 31, 2017.

Last amendment: 571/17.

Legislative History: 580/06, 571/17.

This is the English version of a bilingual regulation.

CONTENTS

|

PART I |

|

|

Definitions |

|

|

Public sale of land |

|

|

Required information on documents |

|

|

Matters prescribed for purposes of s. 381 (3) of the Act |

|

|

Forms |

|

|

Forms |

|

|

PART II |

|

|

Advertisement |

|

|

Advertisement |

|

|

Tender |

|

|

Receipt of tender |

|

|

Withdrawn tender |

|

|

Opening of tenders |

|

|

Notice of vesting |

|

|

Two remaining tenders |

|

|

One remaining tender |

|

|

PART III |

|

|

Advertisement |

|

|

Advertisement |

|

|

Auctioneer |

|

|

Duties of auctioneer |

|

|

Highest bidder is purchaser |

|

|

Failure to pay |

|

|

No bids |

|

|

Receipt |

|

|

Auction closed |

|

|

List |

|

|

PART IV |

|

|

Postponement of sale |

|

|

Returning tenders |

|

|

Registration |

|

|

Condition |

|

|

Method of payment |

|

|

Forfeited funds |

|

|

Transition |

|

|

Transition, certificate registered before January 1, 2018 |

|

|

Tax arrears certificate |

|

|

Tax arrears cancellation certificate |

|

|

Tax arrears cancellation certificate |

|

|

Tax deed |

|

|

Notice of vesting |

|

|

Forms |

|

|

Notice of registration of tax arrears certificate |

|

|

Statutory declaration regarding sending of notice |

|

|

Final notice |

|

|

Statutory declaration regarding the sending of final notice |

|

|

Payment into court — statement of facts |

|

|

Sale of land by public tender |

|

|

Tender to purchase |

|

|

Sale of land by public auction |

|

|

Mining act information |

|

|

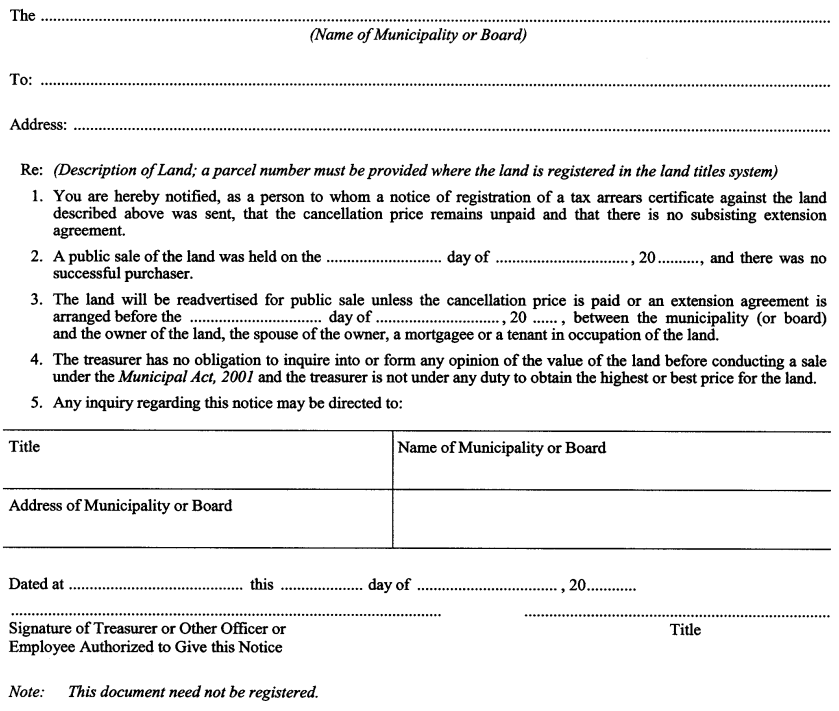

Final notice of readvertisement |

|

PART I

Interpretation and FORMS

Definitions

“accumulated taxes” means real property taxes that have accumulated with respect to a parcel of land from the first day of advertising of the parcel for sale by public sale until the day a successful purchaser is declared; (“impôts accumulés”)

“board” means a board described in subsection 371 (2) of the Act. (“conseil”) O. Reg. 181/03, s. 1.

Public sale of land

2. A public sale of land under the Act shall be conducted in accordance with this Regulation. O. Reg. 181/03, s. 2.

Required information on documents

3. (1) A tax arrears certificate shall contain the information set out in Schedule 1. O. Reg. 181/03, s. 3 (1).

Note: On January 1, 2018, subsection 3 (1) of the Regulation is amended by adding “referred to in subsection 373 (1) or 373.1 (1) of the Act” after “tax arrears certificate”. (See: O. Reg. 571/17, s. 1 (1))

(2) A tax arrears cancellation certificate referred to in subsection 375 (2), 378 (6) or 382 (3) or (6) of the Act or subsection 22 (2) of this Regulation shall contain the information set out in Schedule 2. O. Reg. 181/03, s. 3 (2); O. Reg. 580/06, s. 1.

(3) A tax deed and the statement of compliance related to it, as required by clause 379 (5) (a) and subsection 379 (6) of the Act, shall contain the information set out in Schedule 3. O. Reg. 181/03, s. 3 (3).

(4) A notice of vesting and the statement of compliance related to it, as required by clause 379 (5) (b) and subsection 379 (6) of the Act, shall contain the information set out in Schedule 4. O. Reg. 181/03, s. 3 (4).

Note: On January 1, 2018, subsections 3 (3) and (4) of the Regulation are amended by striking out “of compliance” wherever it appears. (See: O. Reg. 571/17, s. 1 (2))

Note: On January 1, 2018, the Regulation is amended by adding the following section: (See: O. Reg. 571/17, s. 2)

Matters prescribed for purposes of s. 381 (3) of the Act

3.1 The matters described in subparagraphs 5 (i), (ii), (iii) and (v) of Schedule 3 and subparagraphs 6 (i), (ii), (iii) and (v) of Schedule 4 are prescribed for the purposes of subsection 381 (3) of the Act. O. Reg. 571/17, s. 2.

Forms

4. (1) A notice required by section 374 of the Act shall be in Form 1. O. Reg. 181/03, s. 4 (1).

(2) A statutory declaration required by subsection 374 (3) of the Act shall be in Form 2. O. Reg. 181/03, s. 4 (2).

(3) A final notice required by subsection 379 (1) of the Act shall be in Form 3. O. Reg. 181/03, s. 4 (3).

(4) A statutory declaration required by subsection 379 (2) of the Act shall be in Form 4. O. Reg. 181/03, s. 4 (4).

(5) The statement required by subsection 380 (2) of the Act shall be in Form 5. O. Reg. 181/03, s. 4 (5).

(6) A notice required by subsection 380.1 (2) of the Act shall be in Form 10. O. Reg. 580/06, s. 2.

Note: On January 1, 2018, section 4 of the Regulation is revoked and the following substituted: (See: O. Reg. 571/17, s. 3)

Forms

4. (1) The forms set out in the Table to Schedule 5 are prescribed as required forms for the purposes indicated in the Table. O. Reg. 571/17, s. 3.

(2) The forms prescribed by subsection (1) are the forms that are available on the website of the Government of Ontario Central Forms Repository under the listing for the Ministry of Municipal Affairs. O. Reg. 571/17, s. 3.

Advertisement

5. (1) If the treasurer conducts a sale by public tender, the advertisement required by clause 379 (2) (b) of the Act shall be in Form 6 and the treasurer shall allow at least seven days after the publication of the last advertisement in The Ontario Gazette or newspaper or, where there is no newspaper, the posting of the notice, for the submission of tenders. O. Reg. 181/03, s. 5 (1).

(2) An advertisement may relate to the sale of any number of parcels of land. O. Reg. 181/03, s. 5 (2).

Note: On January 1, 2018, section 5 of the Regulation is revoked and the following substituted: (See: O. Reg. 571/17, s. 4)

Advertisement

5. (1) If the treasurer conducts a sale by public tender, the advertisement required by clause 379 (2) (b) or clause 379 (2.0.1) (b) of the Act, as the case may be, shall comply with this section. O. Reg. 571/17, s. 4.

(2) The treasurer shall advertise the land for sale once in The Ontario Gazette and once a week for four weeks in a newspaper that, in the opinion of the treasurer, has such circulation within the municipality as to provide reasonable notice of the sale or, if there is no such newspaper, post a notice in the municipal office and one other prominent place in the municipality. O. Reg. 571/17, s. 4.

(3) The following rules apply to advertisements under subsection (2):

1. The advertisement in The Ontario Gazette shall be in Form 6.

2. If the land is advertised for sale in a newspaper,

i. during the first week, the advertisement in the newspaper shall be in Form 6,

ii. during the second, third and fourth weeks, the advertisement shall either be in Form 6 or shall contain the information set out in subsection (4), and

iii. if the advertisement is not in Form 6 during one or more of the weeks described in subparagraph ii, the treasurer shall make a copy of the advertisement in Form 6 available on a website of the treasurer’s choosing during those weeks that the advertisement is not in Form 6.

3. If the land is advertised for sale by the posting of a notice, the notice shall be in Form 6. O. Reg. 571/17, s. 4.

(4) If Form 6 is not used for a newspaper advertisement in one or more of the weeks described in subparagraph 2 ii of subsection (3), the advertisement shall contain the following information during those weeks that the advertisement is not in Form 6:

1. The name of the municipality or board.

2. The street address and municipality in which the land is located or, if there is no street address, the location of the land.

3. The deadline for receiving tenders.

4. The minimum tender amount (set out the cancellation price as of the first day of advertising).

5. The following statements:

i. This sale is governed by the Municipal Act, 2001 and the Municipal Tax Sales Rules made under that Act.

ii. Further information about this matter is available online at (website address), or you may contact (contact information for the municipality or board, such as address, email address, telephone number, and one or more contact names). O. Reg. 571/17, s. 4.

(5) An advertisement may relate to the sale of any number of parcels of land. O. Reg. 571/17, s. 4.

(6) The treasurer shall allow at least seven days after the publication of the last advertisement in The Ontario Gazette or a newspaper, or where there is no newspaper, the posting of the notice, for the submission of tenders. O. Reg. 571/17, s. 4.

Tender

6. (1) A tender shall be in Form 7 and shall be,

(a) typewritten or legibly handwritten in ink;

(b) accompanied by a deposit of at least 20 per cent of the tender amount, which deposit shall be made by way of money order or by way of bank draft or cheque certified by a bank or trust corporation;

Note: On January 1, 2018, clause 6 (1) (b) of the Regulation is amended by striking out “bank or trust corporation” at the end and substituting “bank or authorized foreign bank within the meaning of section 2 of the Bank Act (Canada), a trust corporation registered under the Loan and Trust Corporations Act or a credit union within the meaning of the Credit Unions and Caisses Populaires Act, 1994”. (See: O. Reg. 571/17, s. 5)

(c) submitted in a sealed envelope which indicates on it that it is a tax sale and provides a short description or municipal address of the land sufficient to permit the treasurer to identify the parcel of land to which the tender relates; and

(d) addressed to the treasurer. O. Reg. 181/03, s. 6 (1).

(2) A tender shall relate to only one parcel of land. O. Reg. 181/03, s. 6 (2).

Receipt of tender

7. (1) On receiving an envelope identified as containing a tender, the treasurer shall mark on it the time and date on which it was received and shall retain it unopened in a safe place. O. Reg. 181/03, s. 7 (1).

(2) For the purposes of this Part, where two or more tenders are equal, the tender that was received earlier shall be deemed to be the higher. O. Reg. 181/03, s. 7 (2).

Withdrawn tender

8. (1) A tender is withdrawn if the tenderer’s written request to have the tender withdrawn is received by the treasurer before 3 p.m. local time on the last date for receiving tenders. O. Reg. 181/03, s. 8 (1).

(2) The envelope containing a withdrawn tender shall be opened at the time of the opening of the sealed envelopes. O. Reg. 181/03, s. 8 (2).

Opening of tenders

9. (1) The treasurer, at a place in the municipality that is open to the public, shall open the sealed envelopes containing the tenders as soon as possible after 3 p.m. local time on the last date for receiving tenders. O. Reg. 181/03, s. 9 (1).

(2) The sealed envelopes shall be opened in the presence of at least one person who did not submit a tender, which person may be a municipal employee. O. Reg. 181/03, s. 9 (2).

(3) After opening the sealed envelopes, the treasurer shall examine their contents and shall reject every tender that,

(a) is not equal to or greater than the minimum tender amount as shown in the advertisement;

(b) does not comply with section 6;

(c) includes any term or condition not provided for in this Regulation; or

(d) has been withdrawn as set out in subsection 8 (1). O. Reg. 181/03, s. 9 (3).

(4) After complying with subsection (3), the treasurer shall reject all but the two highest of the remaining tenders. O. Reg. 181/03, s. 9 (4).

(5) Every rejected tender shall be returned to the tenderer together with the tenderer’s deposit, if any, and a statement of the reason for rejection. O. Reg. 181/03, s. 9 (5).

Notice of vesting

10. If, after complying with section 9, no tenders remain, the treasurer shall declare that there is no successful purchaser. O. Reg. 181/03, s. 10.

Two remaining tenders

11. (1) If, after complying with section 9, two tenders remain, the treasurer shall immediately notify the higher tenderer, by ordinary mail sent to the address shown in the tender, that the tenderer will be declared to be the successful purchaser if, within 14 days of the mailing of the notice, the balance of the amount tendered, the applicable land transfer tax and the accumulated taxes are paid, in cash, to the treasurer. O. Reg. 181/03, s. 11 (1).

Note: On January 1, 2018, subsection 11 (1) of the Regulation is amended by striking out “the applicable land transfer tax” and substituting “any taxes that may be applicable, such as a land transfer tax,”. (See: O. Reg. 571/17, s. 6)

(2) If the higher tenderer makes the payment as set out in subsection (1), the treasurer shall declare the tenderer to be the successful purchaser. O. Reg. 181/03, s. 11 (2).

(3) If the higher tenderer does not make the payment as set out in subsection (1), the tenderer’s deposit shall be immediately forfeited to the municipality and the treasurer shall offer the parcel of land to the lower tenderer in accordance with section 12. O. Reg. 181/03, s. 11 (3).

One remaining tender

12. (1) If, after complying with section 9, only one tender remains or if, in accordance with subsection 11 (3), the treasurer is required to offer the parcel of land to the lower tenderer, the treasurer shall immediately notify the tenderer, by ordinary mail sent to the address shown in the tender, that the tenderer will be declared to be the successful purchaser if, within 14 days of the mailing of the notice, the balance of the amount tendered, the applicable land transfer tax and the accumulated taxes are paid, in cash, to the treasurer. O. Reg. 181/03, s. 12 (1).

Note: On January 1, 2018, subsection 12 (1) of the Regulation is amended by striking out “the applicable land transfer tax” and substituting “any taxes that may be applicable, such as a land transfer tax,”. (See: O. Reg. 571/17, s. 7)

(2) If the tenderer makes the payment as set out in subsection (1), the treasurer shall declare the tenderer to be the successful purchaser. O. Reg. 181/03, s. 12 (2).

(3) If the tenderer does not make the payment as set out in subsection (1),

(a) the treasurer shall declare that there is no successful purchaser and may register a notice of vesting in the name of the municipality; and

(b) the tenderer’s deposit shall be immediately forfeited to the municipality. O. Reg. 181/03, s. 12 (3).

PART III

SALE BY PUBLIC AUCTION

Advertisement

13. (1) If the treasurer conducts a sale by public auction, the advertisement required by clause 379 (2) (b) of the Act shall be in Form 8 and the treasurer shall allow at least seven days after the publication of the last advertisement in The Ontario Gazette or newspaper or, where there is no newspaper, the posting of the notice, before holding the auction. O. Reg. 181/03, s. 13 (1).

(2) The auction shall be held at such place in the upper-tier municipality or single-tier municipality or, in the case of unorganized territory, in the territorial district in which the land is located as the treasurer may name in the advertisement. O. Reg. 181/03, s. 13 (2).

(3) An advertisement may relate to the sale of any number of parcels of land. O. Reg. 181/03, s. 13 (3).

Note: On January 1, 2018, section 13 of the Regulation is revoked and the following substituted: (See: O. Reg. 571/17, s. 8)

Advertisement

13. (1) If the treasurer conducts a sale by public auction, the advertisement required by clause 379 (2) (b) or clause 379 (2.0.1) (b) of the Act, as the case may be, shall comply with this section. O. Reg. 571/17, s. 8.

(2) The treasurer shall advertise the land for sale once in The Ontario Gazette and once a week for four weeks in a newspaper that, in the opinion of the treasurer, has such circulation within the municipality as to provide reasonable notice of the sale or, if there is no such newspaper, post a notice in the municipal office and one other prominent place in the municipality. O. Reg. 571/17, s. 8.

(3) The following rules apply to advertisements under subsection (2):

1. The advertisement in The Ontario Gazette shall be in Form 8.

2. If the land is advertised for sale in a newspaper,

i. during the first week, the advertisement in the newspaper shall be in Form 8,

ii. during the second, third and fourth weeks, the advertisement shall either be in Form 8 or shall contain the information set out in subsection (4), and

iii. if the advertisement is not in Form 8 during one or more of the weeks described in subparagraph ii, the treasurer shall make a copy of the advertisement in Form 8 available on a website of the treasurer’s choosing during those weeks that the advertisement is not in Form 8.

3. If the land is advertised for sale by the posting of a notice, the notice shall be in Form 8. O. Reg. 571/17, s. 8.

(4) If Form 8 is not used for a newspaper advertisement in one or more of the weeks described in subparagraph 2 ii of subsection (3), the advertisement shall contain the following information during those weeks that the advertisement is not in Form 8:

1. The name of the municipality or board.

2. The street address and municipality in which the land is located or, if there is no street address, the location of the land.

3. The time and place of the auction.

4. The minimum bid amount (set out the cancellation price as of the first day of advertising).

5. The following statements:

i. This sale is governed by the Municipal Act, 2001 and the Municipal Tax Sales Rules made under that Act.

ii. Further information about this matter is available online at (website address), or you may contact (contact information for the municipality or board, such as address, email address, telephone number, and one or more contact names). O. Reg. 571/17, s. 8.

(5) An advertisement may relate to the sale of any number of parcels of land. O. Reg. 571/17, s. 8.

(6) The treasurer shall allow at least seven days after the publication of the last advertisement in The Ontario Gazette or a newspaper, or where there is no newspaper, the posting of the notice, before holding the auction. O. Reg. 571/17, s. 8.

(7) The auction shall be held at such place in the upper-tier municipality or single-tier municipality or, in the case of unorganized territory, in the territorial district in which the land is located as the treasurer may name in the advertisement. O. Reg. 571/17, s. 8.

Auctioneer

14. (1) The treasurer or such other person as the treasurer may name shall act as auctioneer. O. Reg. 181/03, s. 14 (1).

(2) The auctioneer shall open the auction by declaring the tax sale officially open and by reading out sections 15, 16, 17 and 18. O. Reg. 181/03, s. 14 (2).

Duties of auctioneer

15. For each parcel of land to be sold during the auction, the auctioneer shall,

(a) in opening or reopening the bidding on the parcel, state the minimum bid as set out in the advertisement;

(b) acknowledge each bidder, repeat each bid made and call for higher bids; and

(c) if no higher bid is made, repeat the last bid three times and if there is still no higher bid, acknowledge the highest bidder. O. Reg. 181/03, s. 15.

Highest bidder is purchaser

16. The highest bidder shall be declared to be the successful purchaser if the bidder immediately pays the amount bid, the applicable land transfer tax and the accumulated taxes, in cash, to the auctioneer. O. Reg. 181/03, s. 16.

Note: On January 1, 2018, section 16 of the Regulation is amended by striking out “the applicable land transfer tax” and substituting “any taxes that may be applicable, such as a land transfer tax,”. (See: O. Reg. 571/17, s. 9)

Failure to pay

17. If the highest bidder fails to make the payment as set out in section 16 and the bidding has not been previously reopened under this Regulation, the auctioneer shall immediately reopen the bidding. O. Reg. 181/03, s. 17.

No bids

18. If no bid is made for a parcel of land after the opening of the bidding or if, after the reopening of the bidding under section 17, no bid is made or there is no successful purchaser, the auctioneer shall declare that there is no successful purchaser. O. Reg. 181/03, s. 18.

Receipt

19. The auctioneer shall issue a receipt to the successful purchaser for the amounts received under section 16 and the receipt shall include a legal description of the parcel of land and the name of the purchaser and the name in which the tax deed will be registered. O. Reg. 181/03, s. 19.

Auction closed

20. The auctioneer shall declare the auction closed upon completion of the bidding on all the parcels of land offered for sale in the auction. O. Reg. 181/03, s. 20.

List

21. The auctioneer shall prepare and keep a list showing each parcel of land offered for sale in the auction and the name and address of the successful purchaser or, where there is no successful purchaser, that there is no successful purchaser. O. Reg. 181/03, s. 21.

Postponement of sale

22. (1) If, after a public sale under the Act is advertised in accordance with clause 379 (2) (b) of the Act, the treasurer is of the opinion that completing the sale would be impractical or would be unfair to the bidders or tenderers, the treasurer may postpone the sale and conduct it on a later date after readvertising it in accordance with clause 379 (2) (b) of the Act. O. Reg. 580/06, s. 3.

Note: On January 1, 2018, subsection 22 (1) of the Regulation is amended by striking out “clause 379 (2) (b) of the Act” wherever it appears and substituting in each case “section 5 or 13, as the case may be”. (See: O. Reg. 571/17, s. 10)

(2) If a public sale is postponed under subsection (1) and the rescheduled sale does not occur within 90 days after the date that was originally advertised for the sale, the treasurer shall immediately register a tax arrears cancellation certificate. O. Reg. 580/06, s. 3.

(3) Subsection (2) does not prevent the treasurer from registering a new tax arrears certificate and proceeding under Part XI of the Act. O. Reg. 580/06, s. 3.

Returning tenders

22.1 If the treasurer postpones or cancels a sale by public tender, the treasurer shall,

(a) open the sealed envelopes, if he or she has not already done so; and

(b) return to the tenderers any tenders that he or she retains together with the appropriate deposits, if any, and a statement setting out the reason for the return. O. Reg. 580/06, s. 3.

Registration

23. As soon as possible after a successful purchaser is declared in a sale under the Act, the treasurer shall prepare and register the necessary documents in accordance with the Act. O. Reg. 181/03, s. 23.

Condition

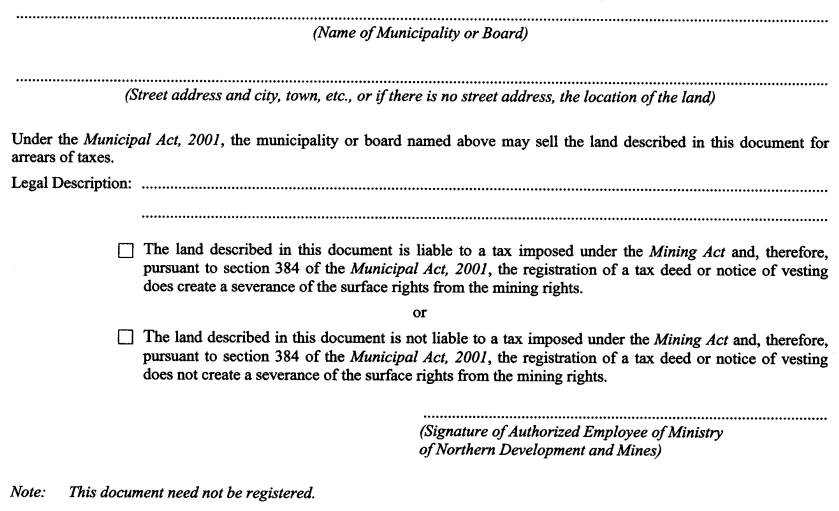

24. Before registering a tax deed or a notice of vesting in respect of land that is in a local municipality referred to in Schedule 2 to Regulation 995 of the Revised Regulations of Ontario, 1990 (Forms and Records) made under the Registry Act, the treasurer shall obtain a statement in Form 9 signed by an authorized employee of the Ministry of Northern Development and Mines. O. Reg. 181/03, s. 24; O. Reg. 580/06, s. 4.

Method of payment

25. Subject to clause 6 (1) (b), any payment required by this Regulation to be made in cash may be made by way of cash or money order or by way of bank draft or cheque certified by a bank or trust corporation. O. Reg. 181/03, s. 25.

Note: On January 1, 2018, section 25 of the Regulation is amended by striking out “bank or trust corporation” at the end and substituting “bank or authorized foreign bank within the meaning of section 2 of the Bank Act (Canada), a trust corporation registered under the Loan and Trust Corporations Act or a credit union within the meaning of the Credit Unions and Caisses Populaires Act, 1994”. (See: O. Reg. 571/17, s. 11)

Forfeited funds

26. All deposits forfeited under this Regulation to a municipality shall form part of the general funds of the municipality. O. Reg. 181/03, s. 26.

Transition

27. (1) If a tax arrears certificate in respect of vacant land has been registered before January 1, 2003 in accordance with clause 3 (1) (b) of the Municipal Tax Sales Act, as it read before January 1, 2003, the proceedings in respect of the sale of that land may continue even though the period in which the tax arrears were owing before the registration of the certificate may be less than the period specified in subsection 373 (1) of the Municipal Act, 2001. O. Reg. 580/06, s. 5.

(2) If a tax arrears certificate in respect of land has been registered before January 1, 2007, the proceedings in respect of the sale of that land may continue as if the certificate had been registered under the Act as amended by the Municipal Statute Law Amendment Act, 2006. O. Reg. 580/06, s. 5.

Note: On January 1, 2018, section 27 of the Regulation is revoked and the following substituted: (See: O. Reg. 571/17, s. 12)

Transition, certificate registered before January 1, 2018

27. If, before January 1, 2018, a tax arrears certificate is registered in respect of land, this Regulation as it read on December 31, 2017 applies in respect of the proceedings or other steps that may be taken as a result of the registration of that certificate. O. Reg. 571/17, s. 12.

28. Omitted (revokes other Regulations). O. Reg. 181/03, s. 28.

Schedule 1

tax arrears certificate

A tax arrears certificate shall contain the following information:

1. The name of the municipality or board.

2. The street address and municipality in which the land is located or, if there is no street address, the location of the land.

3. A statement by the treasurer of the municipality verifying,

(i) the amount of tax arrears owing on December 31 of the relevant year and that at least part of the amount plus any additional real property taxes and costs are still owing to the municipality or board, and

(ii) that the land described in the certificate will be sold by public sale if the cancellation price is not paid within one year following the date of registration of the certificate.

Note: On January 1, 2018, subparagraph 3 (ii) of Schedule 1 to the Regulation is revoked and the following substituted: (See: O. Reg. 571/17, s. 13 (1))

(ii) that the land described in the certificate will be sold by public sale if the cancellation price is not paid within (choose one year or 90 days, as appropriate) following the date of the registration of the certificate.

4. The name of the treasurer and the date of the statement.

5. A notice setting out,

(i) that the time period for paying the cancellation price may be extended if the municipality or board authorizes an extension agreement with the owner of the land before the expiry of the one-year period,

Note: On January 1, 2018, subparagraph 5 (i) of Schedule 1 to the Regulation is revoked and the following substituted: (See: O. Reg. 571/17, s. 13 (2))

(i) that the time period for paying the cancellation price may be extended if, before the expiry of the (choose one-year or 90-day, as appropriate) period, the municipality or board enters into an extension agreement with any owner of the land, the spouse of any owner, any mortgagee, any tenant in occupation of the land or any person the treasurer is satisfied has an interest in the land,

(ii) that the cancellation price will be calculated as of the date that the amount of the tax arrears is paid to the municipality or board and may be higher than the amount set out in the certificate,

(iii) that, if there is no successful purchaser at the public sale, the land, upon registration of a notice of vesting, will vest in the municipality or board, and

(iv) the name and address of the municipality or board to which any enquiries may be directed, including an address for service.

Note: On January 1, 2018, the English version of subparagraph 5 (iv) of Schedule 1 to the Regulation is amended by striking out “enquiries” and substituting “inquiries”. (See: O. Reg. 571/17, s. 13 (3))

6. A legal description of the land.

O. Reg. 181/03, Sched. 1; O. Reg. 580/06, s. 6.

Schedule 2

tax arrears cancellation certificate

A tax arrears cancellation certificate referred to in subsection 375 (2), 378 (6) or 382 (3) or (6) of the Act or subsection 22 (2) of the regulation shall contain the following information:

1. The name of the municipality or board.

2. The street address and municipality in which the land is located or, if there is no street address, the location of the land.

3. A statement by the treasurer verifying that,

(i) the tax arrears certificate registered on (date of registration) as (instrument number) is cancelled in respect of the land described in the tax arrears cancellation certificate,

(ii) the cancellation price (choose (A) or (B) as appropriate),

(A) remains unpaid and a new tax arrears certificate may be registered in this matter, or

(B) was paid on (date of payment),

(iii) if the cancellation price was paid, it was paid by or on behalf of (choose (A) or (B) as appropriate),

(A) the owner or the spouse of the owner of the land or a person who was not entitled to receive notice under subsection 374 (1) of the Municipal Act, 2001 and accordingly there is no lien on the land described in this document in respect of the payment, or

(B) a person, other than the owner or spouse of the owner of the land, who was entitled to receive notice under subsection 374 (1) of the Municipal Act, 2001 or an assignee of such person and, as a result of the payment, (name and address of person) has a lien on the land for (amount of lien) and the lien has priority over the interest of any person to whom notice was sent under section 374 of that Act.

4. The name of the treasurer and the date of the statement.

5. The name and address of the municipality or board to which any enquiries may be directed, including an address for service.

6. A legal description of the land.

O. Reg. 181/03, Sched. 2; O. Reg. 580/06, s. 7.

Note: On January 1, 2018, Schedule 2 to the Regulation is revoked and the following substituted: (See: O. Reg. 571/17, s. 14)

SCHEDULE 2

TAX ARREARS CANCELLATION CERTIFICATE

1. A tax arrears cancellation certificate referred to in subsection 375 (2), 378 (6) or 382 (3) or (6) of the Act or subsection 22 (2) of this Regulation shall, in relation to a tax arrears certificate that was registered under section 373 or 373.1 of the Act, contain the following information:

1. The name of the municipality or board.

2. The street address and municipality in which the land is located or, if there is no street address, the location of the land.

3. A statement by the treasurer verifying that the tax arrears certificate registered on (date of registration) as (instrument number) is cancelled in respect of the land described in the tax arrears cancellation certificate.

4. If applicable, a statement by the treasurer verifying that the cancellation price was paid on (date of payment).

5. If applicable, a statement by the treasurer verifying that the cancellation price remains unpaid and a new tax arrears certificate may be registered in this matter.

6. The name of the treasurer and the date of the statement.

7. The name and address of the municipality or board to which any inquiries may be directed, including an address for service.

8. A legal description of the land.

2. In addition to the information set out in section 1 of this Schedule, a tax arrears cancellation certificate shall, in relation to a tax arrears certificate that was registered under section 373 of the Act, contain a statement by the treasurer stating, if applicable, that,

(a) the cancellation price was paid by a person, other than the owner or spouse of the owner of the land, who was entitled to receive notice under subsection 374 (1) of the Municipal Act, 2001 or an assignee of such person; and

(b) as a result of the payment of the cancellation price, (name and address of person) has a lien on the land for (amount of lien), except in the circumstances where subsection 375 (3.1) of the Municipal Act, 2001 applies to the land.

O. Reg. 571/17, s. 14.

A tax deed and the statement of compliance related to it, as required by clause 379 (5) (a) and subsection 379 (6) of the Act, shall contain the following information:

Note: On January 1, 2018, Schedule 3 to the Regulation is amended by striking out “of compliance” in the portion before paragraph 1. (See: O. Reg. 571/17, s. 15 (1))

1. The name of the municipality or board.

2. The street address and municipality in which the land is located or, if there is no street address, the location of the land.

3. A statement that, by virtue of the Municipal Act, 2001, the registration of the tax deed vests in the transferee an estate in fee simple in the land together with all rights, privileges and appurtenances and free from all estates and interests except,

(i) easements and restrictive covenants that run with the land,

(ii) any estates and interests of the Crown in right of Canada or Ontario, other than an estate or interest acquired by the Crown in right of Ontario due to an escheat or forfeiture under the Business Corporations Act or the Corporations Act, and

Note: On January 1, 2018, subparagraph 3 (ii) of Schedule 3 to the Regulation is revoked and the following substituted: (See: O. Reg. 571/17, s. 15 (2))

(ii) any estates and interests of the Crown in right of Canada or in right of Ontario, other than an estate or interest in the land that,

(A) is vested in the Crown in right of Ontario because of an escheat or forfeiture as a result of the dissolution of a corporation, or

(B) belongs to the Crown in right of Ontario as a result of the death of an individual who did not have any lawful heirs, and

(iii) any interest or title acquired by adverse possession by abutting landowners before registration of the tax deed.

4. A statement that the registration of the tax deed vests in the transferee any interest in or title to adjoining land acquired by adverse possession before the registration of the tax deed if the person originally acquiring the interest or title did so as a consequence of possession of the land described in the tax deed.

5. A statement by the treasurer verifying that,

(i) a tax arrears certificate was registered as (instrument number) with respect to the land at least one year before the land was advertised for sale,

(ii) notices were sent and statutory declarations were made in substantial compliance with the applicable provisions of the Municipal Act, 2001, the Municipal Tax Sales Act, as it read before January 1, 2003, and the regulations under those Acts,

(iii) the cancellation price was not paid within one year following the date of the registration of the tax arrears certificate,

Note: On January 1, 2018, subparagraphs 5 (i), (ii) and (iii) of Schedule 3 to the Regulation are revoked and the following substituted: (See: O. Reg. 571/17, s. 15 (3))

(i) a tax arrears certificate was registered under (choose section 373 or section 373.1, as appropriate) of the Municipal Act, 2001 as (instrument number) with respect to the land at least (choose one year or 90 days, as appropriate) before the land was advertised for sale,

(ii) notices were sent and statutory declarations were made in substantial compliance with the Municipal Act, 2001 and the regulations under that Act,

(iii) the cancellation price was not paid within (choose one year or 90 days, as appropriate) following the date of the registration of the tax arrears certificate,

(iv) there was no subsisting extension agreement when the land was advertised for sale,

(v) the land was advertised for sale in substantial compliance with the Municipal Act, 2001 and the regulations under that Act, and

(vi) if applicable, the (name of municipality) passed a by-law under subsection 379 (3) of the Municipal Act, 2001 excluding mobile homes from the sale of the land.

6. If applicable, a statement by the treasurer verifying that the Ministry of Northern Development and Mines has advised the municipality that the land described in this tax deed (choose (i) or (ii) as appropriate),

(i) is liable to a tax imposed under the Mining Act and accordingly, under section 384 of the Municipal Act, 2001, the registration of this document creates a severance of the surface rights from the mining rights, or

(ii) is not liable to a tax imposed under the Mining Act and accordingly, under section 384 of the Municipal Act, 2001, the registration of this document does not create a severance of the surface rights from the mining rights.

7. The name and address of the municipality or board to which any enquiries may be directed, including an address for service.

Note: On January 1, 2018, the English version of paragraph 7 of Schedule 3 to the Regulation is amended by striking out “enquiries” and substituting “inquiries”. (See: O. Reg. 571/17, s. 15 (4))

8. A legal description of the land.

O. Reg. 181/03, Sched. 3; O. Reg. 580/06, s. 8.

A notice of vesting and the statement of compliance related to it, as required by clause 379 (5) (b) and subsection 379 (6) of the Act, shall contain the following information:

Note: On January 1, 2018, Schedule 4 to the Regulation is amended by striking out “of compliance” in the portion before paragraph 1. (See: O. Reg. 571/17, s. 16 (1))

1. The name of the municipality or board.

2. The street address and municipality in which the land is located or, if there is no street address, the location of the land.

3. A statement that registration is made under the Municipal Act, 2001 and, under that Act, the municipality or board attempted to sell the land described in the notice of vesting for arrears of taxes but could not find a successful purchaser and, accordingly, the registration of the notice vests the land described in the notice of vesting in the municipality or board.

4. A statement that, by virtue of the Municipal Act, 2001, the registration of the notice of vesting vests in the municipality or board an estate in fee simple in the land together with all rights, privileges and appurtenances and free from all estates and interests, including all estates and interests of the Crown in right of Ontario, except,

(i) easements and restrictive covenants that run with the land, including those for the benefit of the Crown in right of Ontario,

(ii) any estates and interests of the Crown in right of Canada, and

(iii) any interest or title acquired by adverse possession by abutting landowners, including the Crown in right of Ontario, before registration of the notice of vesting.

5. A statement that the registration of the notice of vesting vests in the municipality or board any interest in or title to adjoining land acquired by adverse possession before the registration of the notice if the person originally acquiring the interest or title did so as a consequence of possession of the land described in the notice.

6. A statement by the treasurer verifying that,

(i) a tax arrears certificate was registered as (instrument number) with respect to the land at least one year before the land was advertised for sale,

(ii) notices were sent and statutory declarations were made in substantial compliance with the applicable provisions of the Municipal Act, 2001, the Municipal Tax Sales Act, as it read before January 1, 2003, and the regulations under those Acts,

(iii) the cancellation price was not paid within one year following the date of the registration of the tax arrears certificate,

Note: On January 1, 2018, subparagraphs 6 (i), (ii) and (iii) of Schedule 4 to the Regulation are revoked and the following substituted: (See: O. Reg. 571/17, s. 16 (2))

(i) a tax arrears certificate was registered under (choose section 373 or section 373.1, as appropriate) of the Municipal Act, 2001 as (instrument number) with respect to the land at least (choose one year or 90 days, as appropriate) before the land was advertised for sale,

(ii) notices were sent and statutory declarations were made in substantial compliance with the Municipal Act, 2001 and the regulations under that Act,

(iii) the cancellation price was not paid within (choose one year or 90 days, as appropriate) following the date of the registration of the tax arrears certificate,

(iv) there was no subsisting extension agreement when the land was advertised for sale,

(v) the land was advertised for sale in substantial compliance with the Municipal Act, 2001 and the regulations under that Act, and

(vi) if applicable, (name of municipality) passed a by-law under subsection 379 (3) of the Municipal Act, 2001 excluding mobile homes from the sale of the land.

7. If applicable, a statement by the treasurer verifying that the Ministry of Northern Development and Mines has advised the municipality that the land described in this notice (choose (i) or (ii) as appropriate),

(i) is liable to a tax imposed under the Mining Act and accordingly, under section 384 of the Municipal Act, 2001, the registration of this notice creates a severance of the surface rights from the mining rights, or

(ii) is not liable to a tax imposed under the Mining Act and accordingly, under section 384 of the Municipal Act, 2001, the registration of this notice does not create a severance of the surface rights from the mining rights.

8. The name and address of the municipality or board to which any enquiries may be directed, including an address for service.

Note: On January 1, 2018, the English version of paragraph 8 of Schedule 4 to the Regulation is amended by striking out “enquiries” and substituting “inquiries”. (See: O. Reg. 571/17, s. 16 (3))

9. A legal description of the land.

O. Reg. 181/03, Sched. 4; O. Reg. 580/06, s. 9.

Note: On January 1, 2018, the Regulation is amended by adding the following Schedule: (See: O. Reg. 571/17, s. 17)

|

Column 1 Form |

Column 2 Title |

Column 3 Date |

Column 4 Purpose for which form is used |

|

1 |

Notice of Registration of Tax Arrears Certificate |

January 2018 |

a notice required by section 374 of the Act |

|

2 |

Statutory Declaration Regarding Sending of Notice of Registration of Tax Arrears Certificate |

January 2018 |

a statutory declaration required by subsection 374 (3) of the Act |

|

3 |

Final Notice of Registration of Tax Arrears Certificate Under Section 373 of the Act |

January 2018 |

a final notice required by subsection 379 (1) of the Act |

|

4 |

Statutory Declaration Regarding Sending of Final Notice |

January 2018 |

a statutory declaration required by subsection 379 (2) of the Act |

|

5 |

Payment into Court – Statement of Facts |

January 2018 |

the statement required by subsection 380 (2) of the Act |

|

6 |

Sale of Land by Public Tender |

January 2018 |

form of advertisement required by paragraphs 1, 2 and 3 of subsection 5 (3) of this Regulation |

|

7 |

Tender to Purchase |

January 2018 |

form of tender required by subsection 6 (1) of this Regulation |

|

8 |

Sale of Land by Public Auction |

January 2018 |

form of advertisement required by paragraphs 1, 2 and 3 of subsection 13 (3) of this Regulation |

|

9 |

Mining Act Information |

January 2018 |

a statement required by section 24 of this Regulation |

|

10 |

Notice of Readvertisement |

January 2018 |

a notice required by subsection 380.1 (2) of the Act |

O. Reg. 571/17, s. 17.

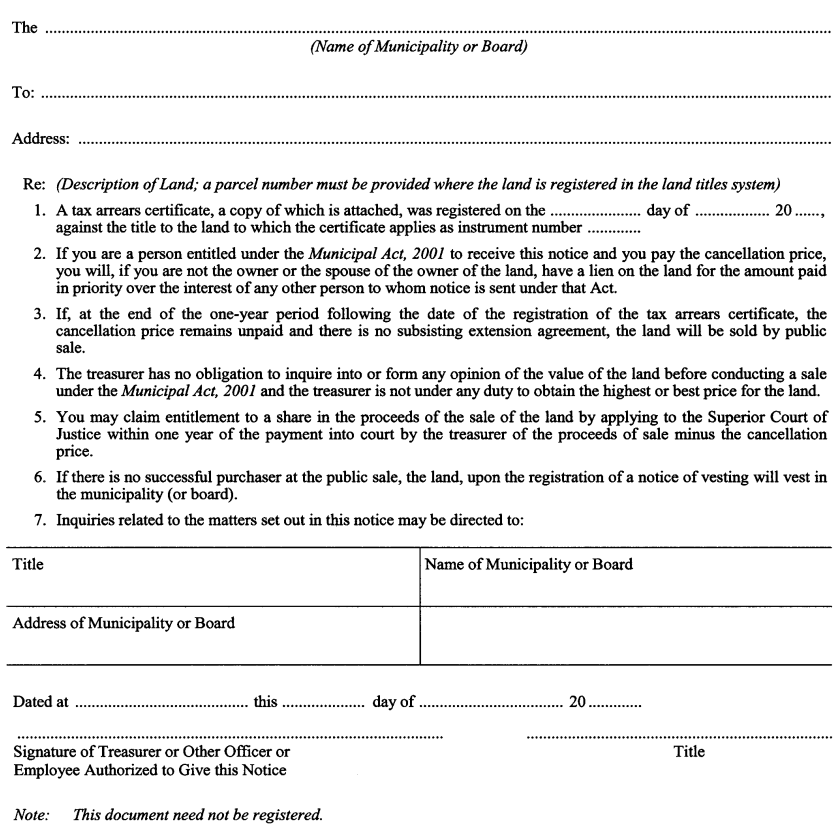

Form 1

NOTICE OF REGISTRATION OF TAX ARREARS CERTIFICATE

Municipal Act, 2001

Insert regs\graphics\2003\181\181001ae.tif

O. Reg. 181/03, Form 1.

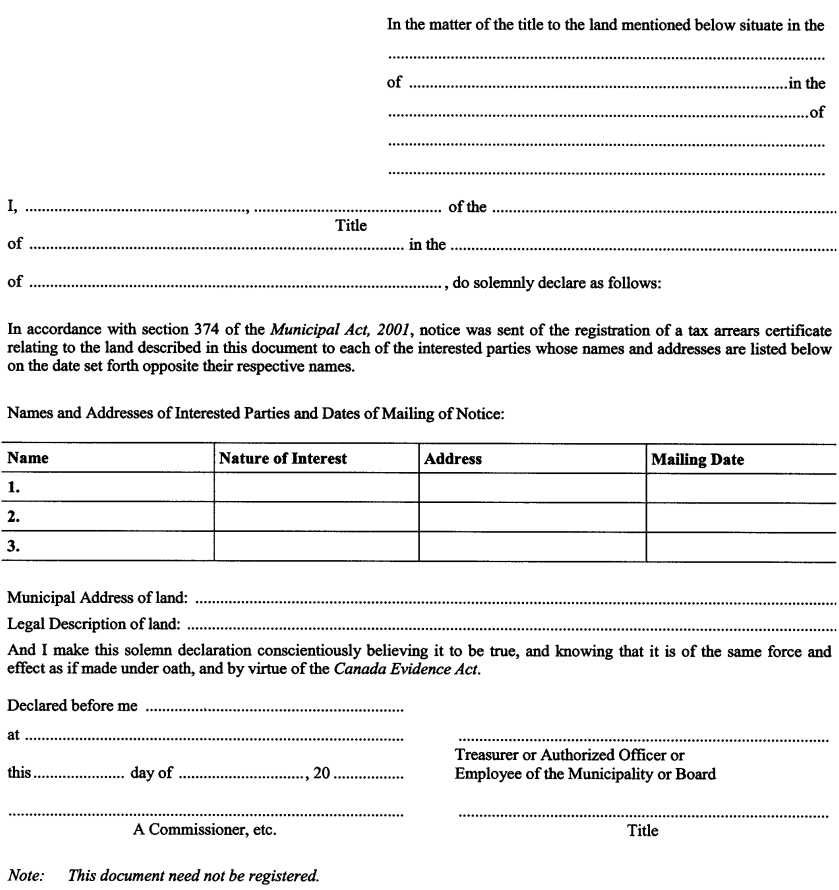

Form 2

STATUTORY DECLARATION REGARDING SENDING OF NOTICE

Municipal Act, 2001

Insert regs\graphics\2003\181\181002ae.tif

O. Reg. 181/03, Form 2.

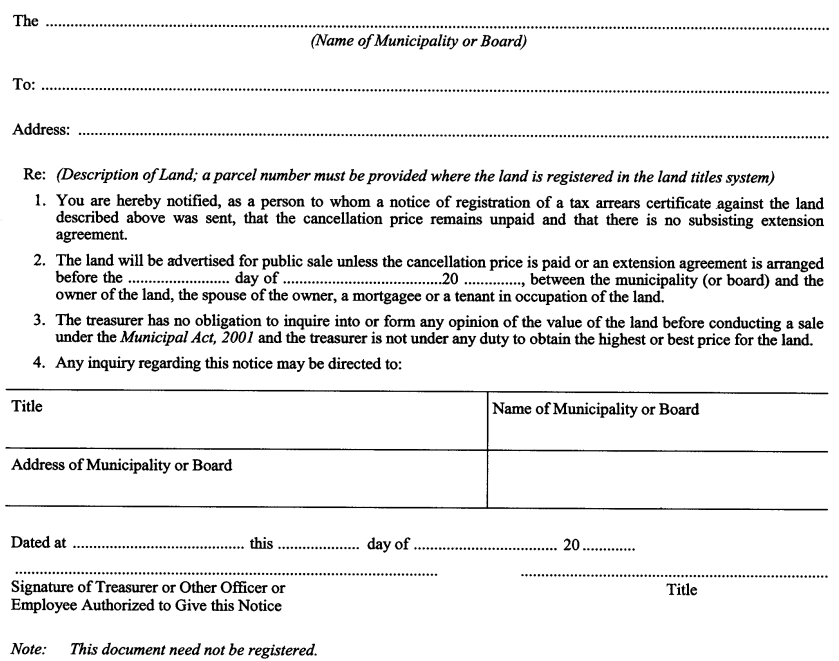

Municipal Act, 2001

Insert regs\graphics\2003\181\181003ae.tif

O. Reg. 181/03, Form 3.

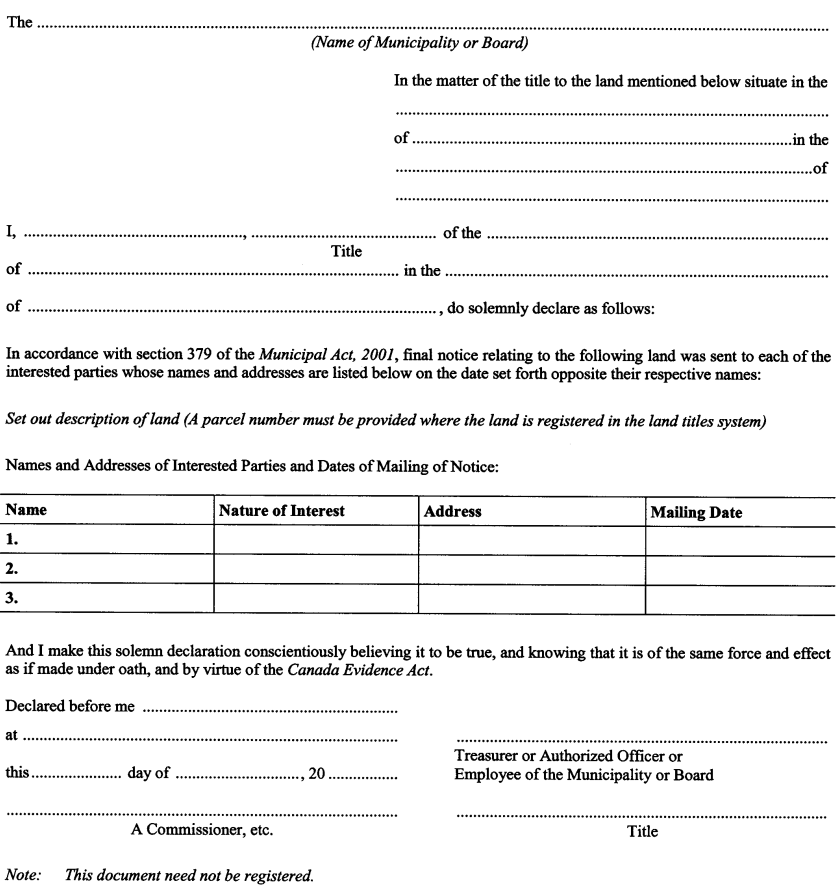

Form 4

STATUTORY DECLARATION REGARDING THE SENDING OF FINAL NOTICE

Municipal Act, 2001

Insert regs\graphics\2003\181\181004ae.tif

O. Reg. 181/03, Form 4.

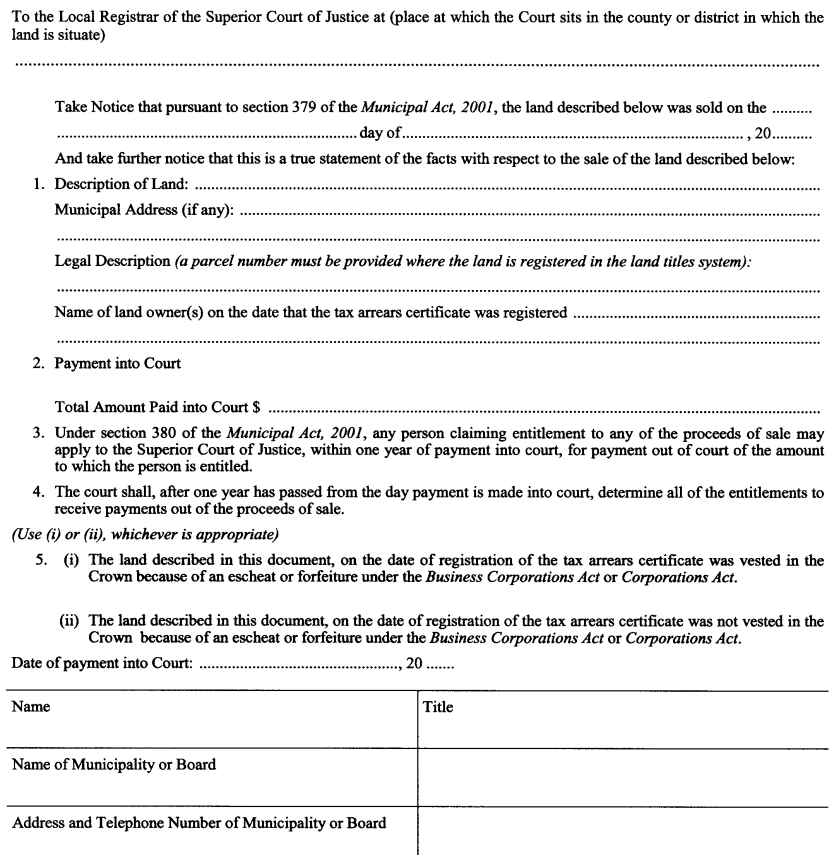

FORM 5

PAYMENT INTO COURT — STATEMENT OF FACTS

Municipal Act, 2001

Insert regs\Graphics\Source Law\2006\580\580005ae.tif

O. Reg. 580/06, s. 10.

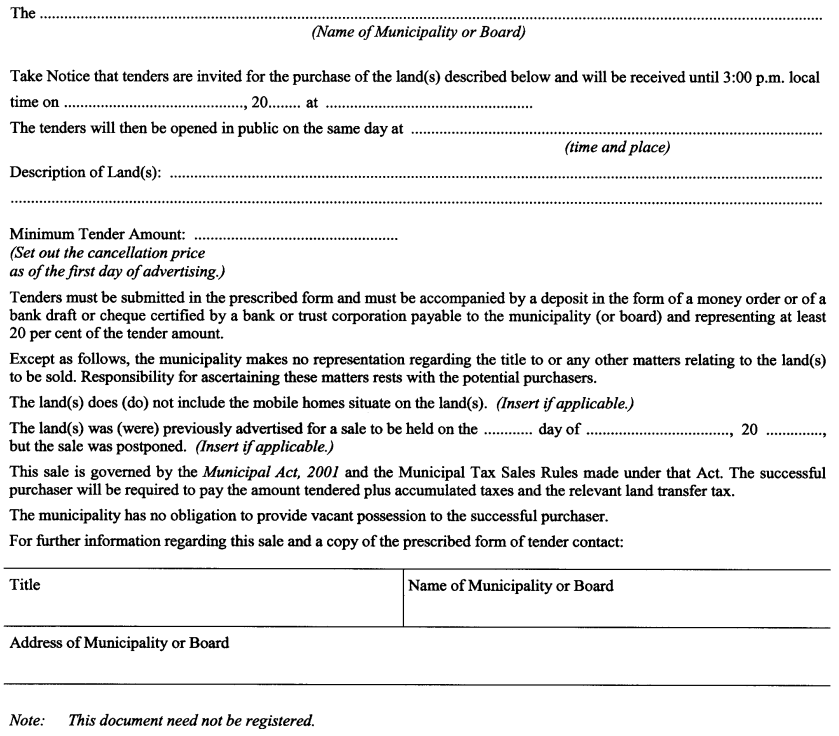

FORM 6

SALE OF LAND BY PUBLIC TENDER

Municipal Act, 2001

Insert regs\Graphics\Source Law\2006\580\580006ae.tif

O. Reg. 580/06, s. 11.

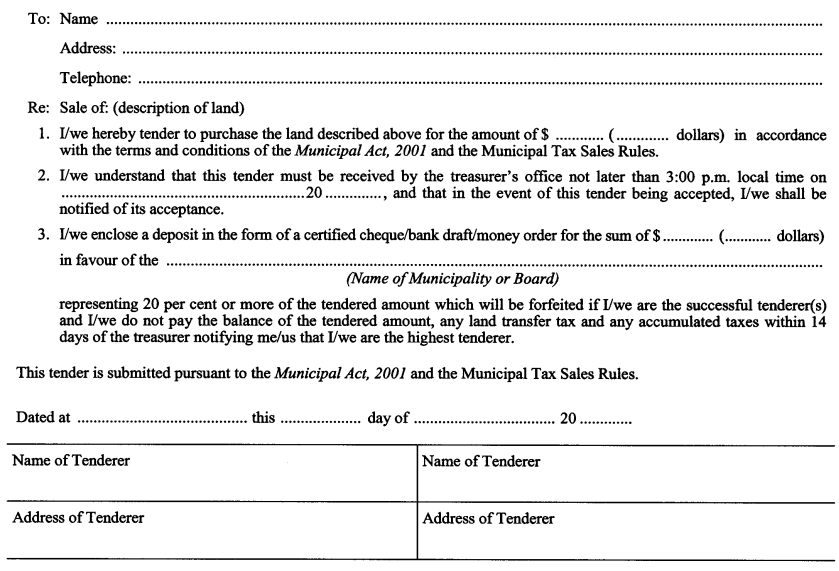

Municipal Act, 2001

Insert regs\graphics\2003\181\181007ae.tif

O. Reg. 181/03, Form 7.

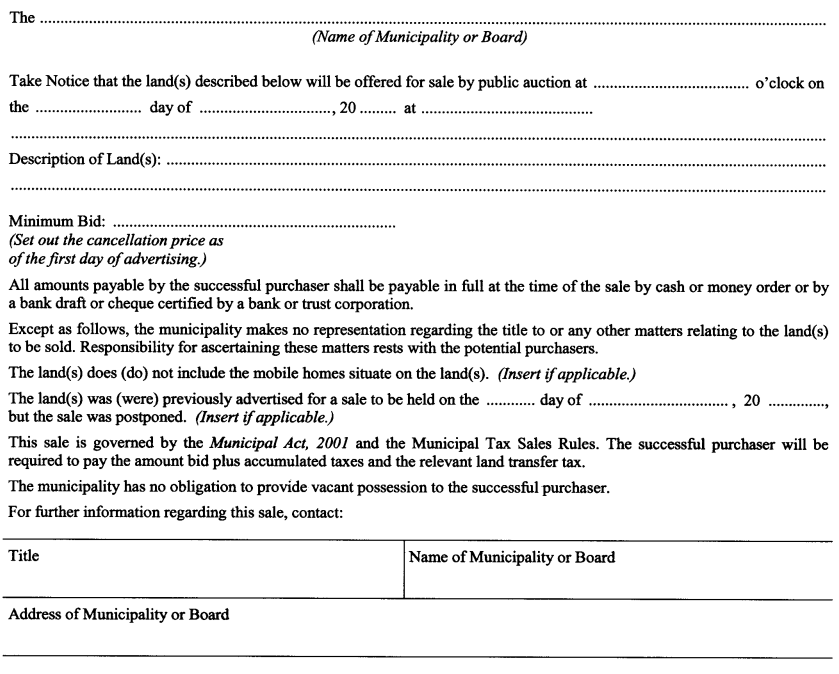

FORM 8

SALE OF LAND BY PUBLIC AUCTION

Municipal Act, 2001

Insert regs\Graphics\Source Law\2006\580\580008ae.tif

O. Reg. 580/06, s. 12.

Municipal Act, 2001

Insert regs\graphics\2003\181\181009ae.tif

O. Reg. 181/03, Form 9.

FORM 10

FINAL NOTICE OF READVERTISEMENT

Municipal Act, 2001

Insert regs\Graphics\Source Law\2006\580\580010ae.tif

O. Reg. 580/06, s. 13.

Note: On January 1, 2018, Forms 1 to 10 of the Regulation are revoked. (See: O. Reg. 571/17, s. 18)