R.R.O. 1990, Reg. 1015: GENERAL, Securities Act, R.S.O. 1990, c. S.5

Securities Act

Loi sur les valeurs mobilières

R.R.O. 1990, REGULATION 1015

GENERAL

Historical version for the period February 1, 2008 to February 20, 2008.

Last amendment: O. Reg. 589/07.

This Regulation is made in English only.

CONTENTS

|

|

|

Sections |

|

|

1 |

|

|

|

2 |

|

|

CONTINUOUS DISCLOSURE |

|

|

|

|

3-13 |

|

|

PROSPECTUS REQUIREMENTS |

14-39 |

|

|

|

40.-42-52 |

|

|

|

53-80.-82 |

|

|

MUTUAL FUNDS |

83.-86 |

|

|

|

87.-94-95 |

|

|

REGISTRATION REQUIREMENTS |

|

|

|

|

96 |

|

|

|

97 |

|

|

|

98-101 |

|

|

|

102-106 |

|

|

|

107-112 |

|

|

|

113 |

|

|

|

114-115 |

|

|

|

Conditions of Registration — Segregation of Funds and Securities |

116-122 |

|

|

Conditions of Registration — Statements of Account and Portfolio |

123 |

|

|

124-129 |

|

|

|

130-133 |

|

|

|

134-138 |

|

|

|

139-150., 151 |

|

|

OVER-THE-COUNTER TRADING |

|

|

|

|

152-153 |

|

|

|

154 |

|

|

|

155-156 |

|

|

|

157-159 |

|

|

ONTARIO SECURITIES COMMISSION PROCEDURE AND RELATED MATTERS |

|

|

|

|

160 |

|

|

|

161 |

|

|

|

162 |

|

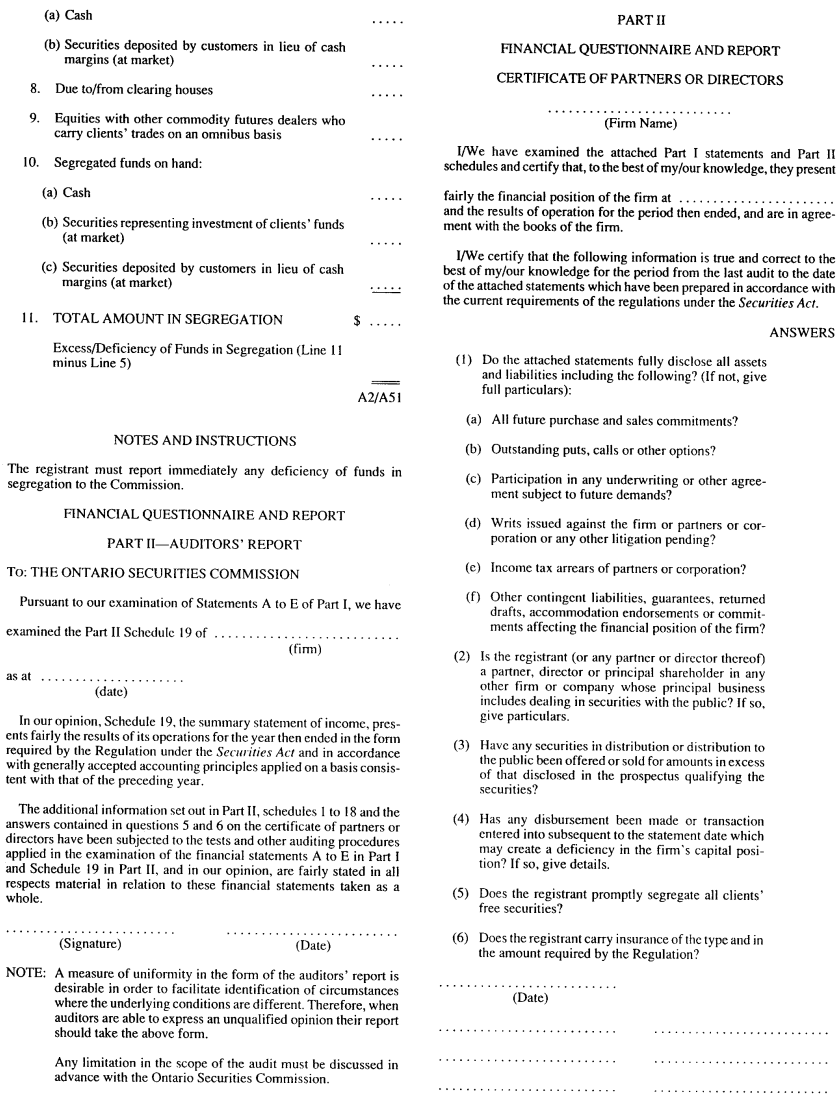

|

|

163 |

|

|

INSIDER TRADING |

|

|

|

|

164-174 |

|

|

|

175-203.2 |

|

|

UNIVERSAL REGISTRATION |

|

|

|

|

204-207 |

|

|

|

208 |

|

|

|

209 |

|

|

|

210 |

|

|

|

211 |

|

|

DEALER OWNERSHIP RESTRICTIONS |

|

|

|

|

212 |

|

|

|

213-216 |

|

|

|

217 |

|

|

|

218 |

|

|

CONFLICTS OF INTEREST |

|

|

|

|

219-221., 222 |

|

|

|

223-224 |

|

|

|

225 |

|

|

|

226 |

|

|

|

227 |

|

|

|

228-229 |

|

|

|

230 |

|

|

|

231-233 |

|

|

LABOUR SPONSORED INVESTMENT FUND CORPORATIONS |

234-245 |

|

|

ELECTRONIC FILING |

246-247 |

|

|

CIVIL LIABILITY FOR SECONDARY MARKET DISCLOSURE |

248-252 |

|

|

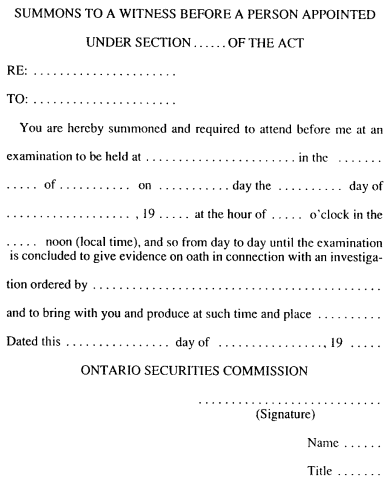

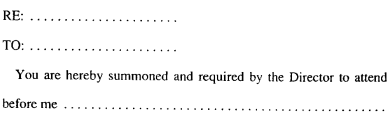

Summons to a witness before a person appointed under section ...... of the Act |

|

|

|

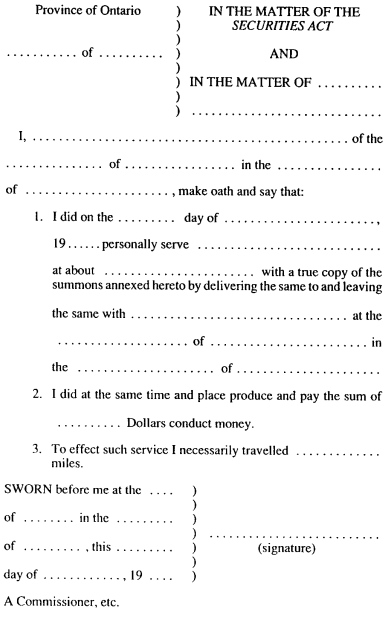

Affidavit of service |

|

|

|

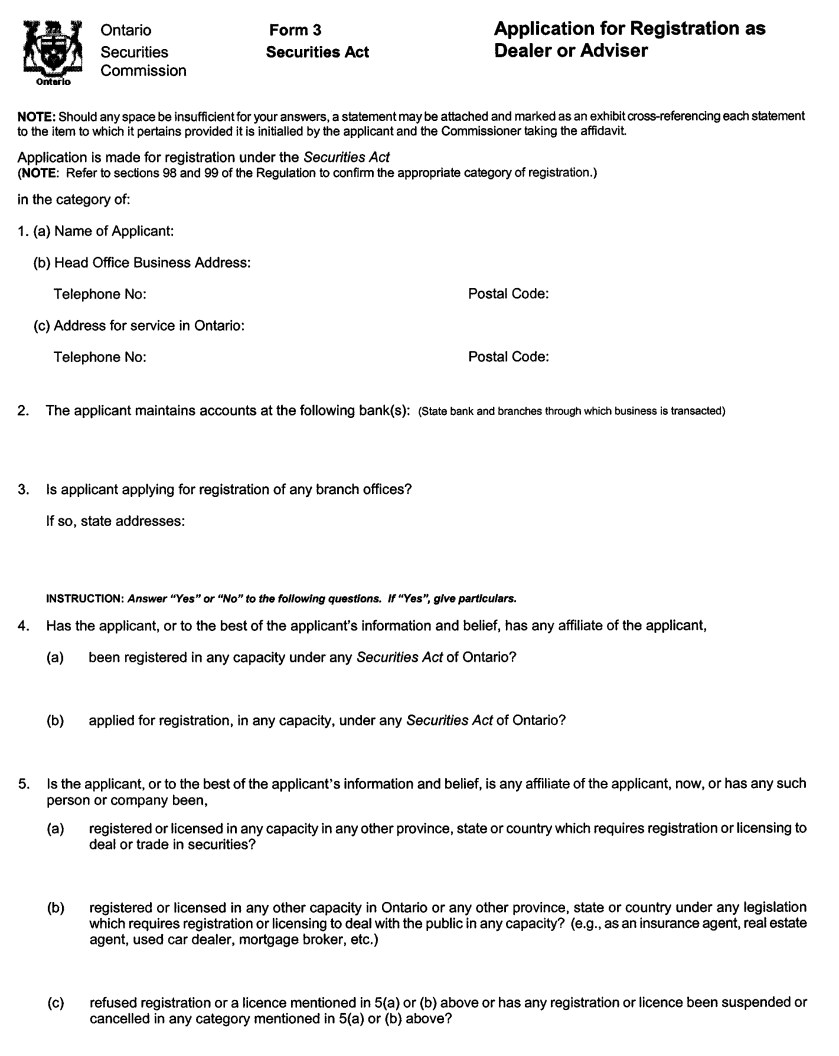

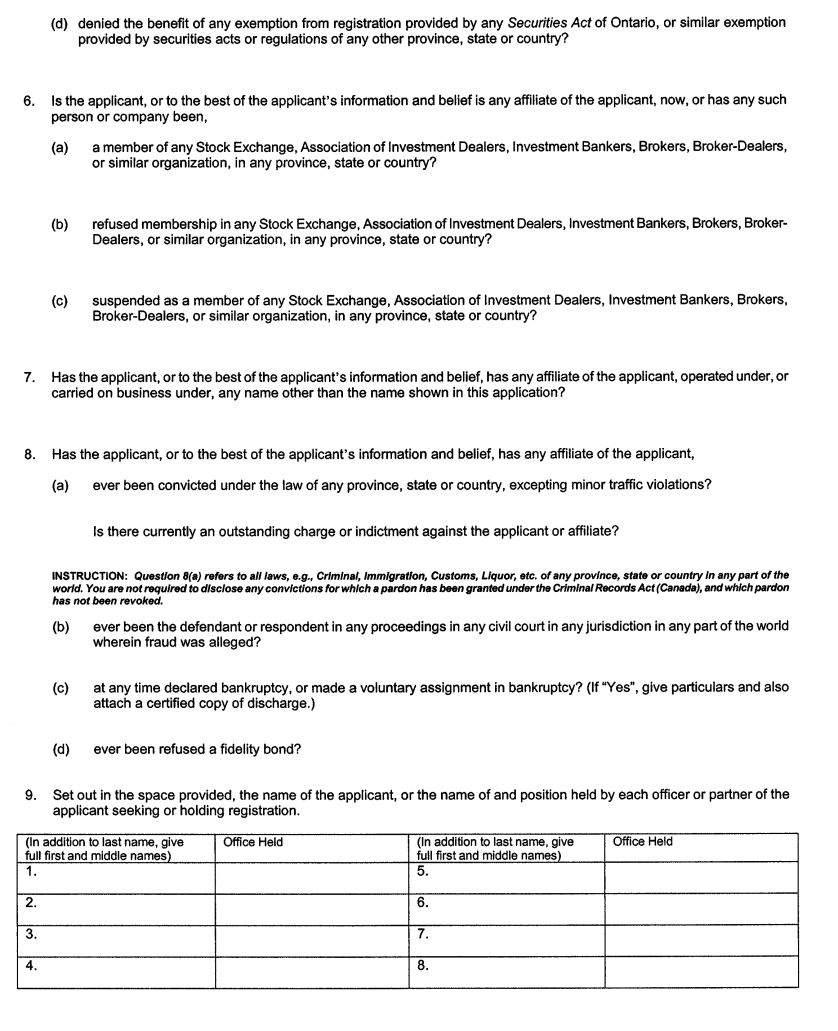

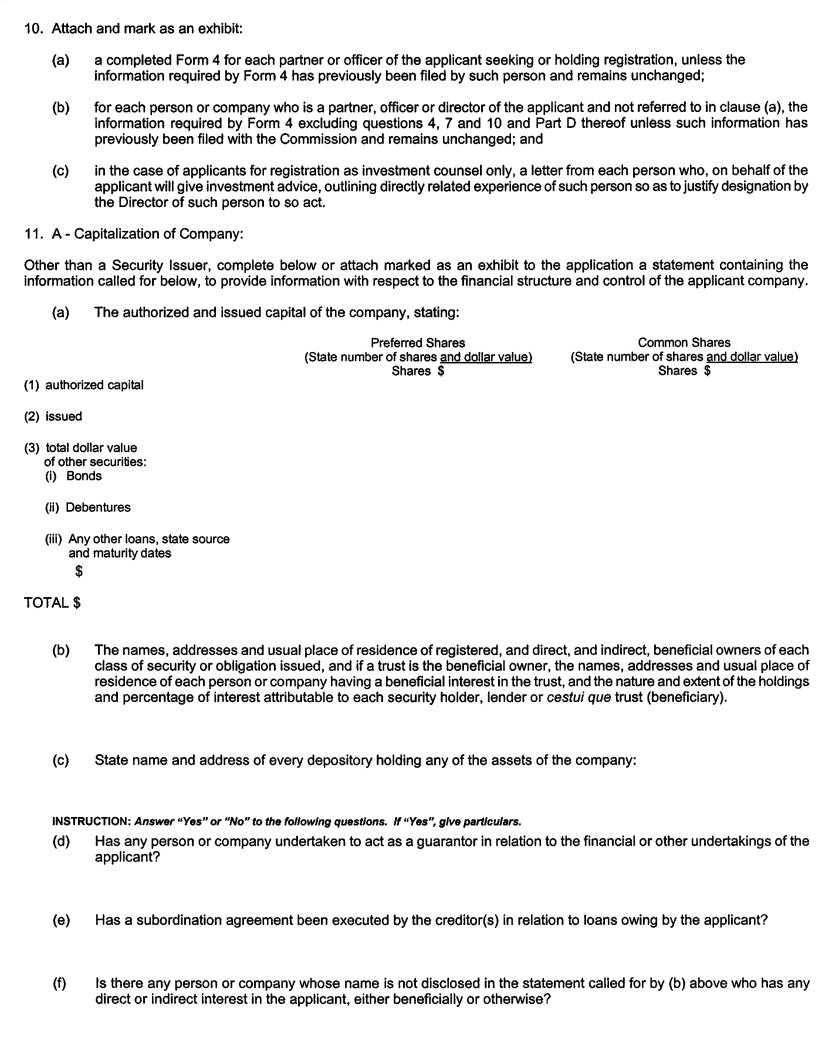

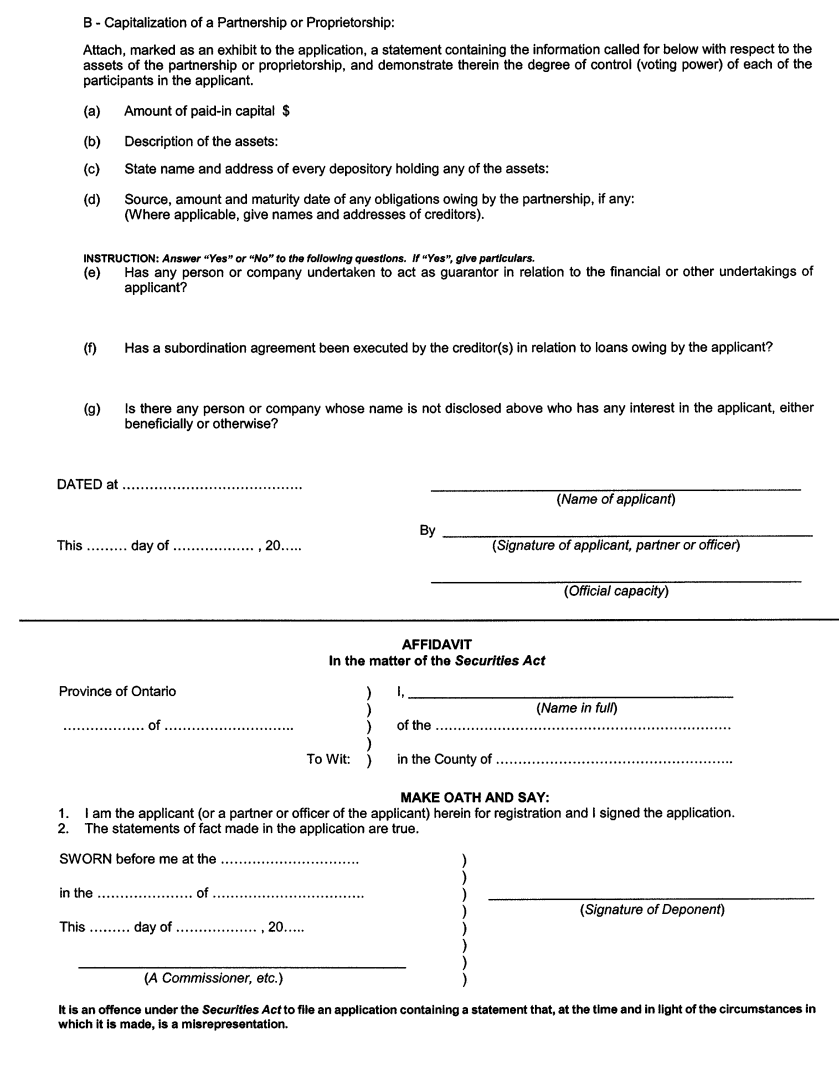

Application for registration as dealer or adviser |

|

|

|

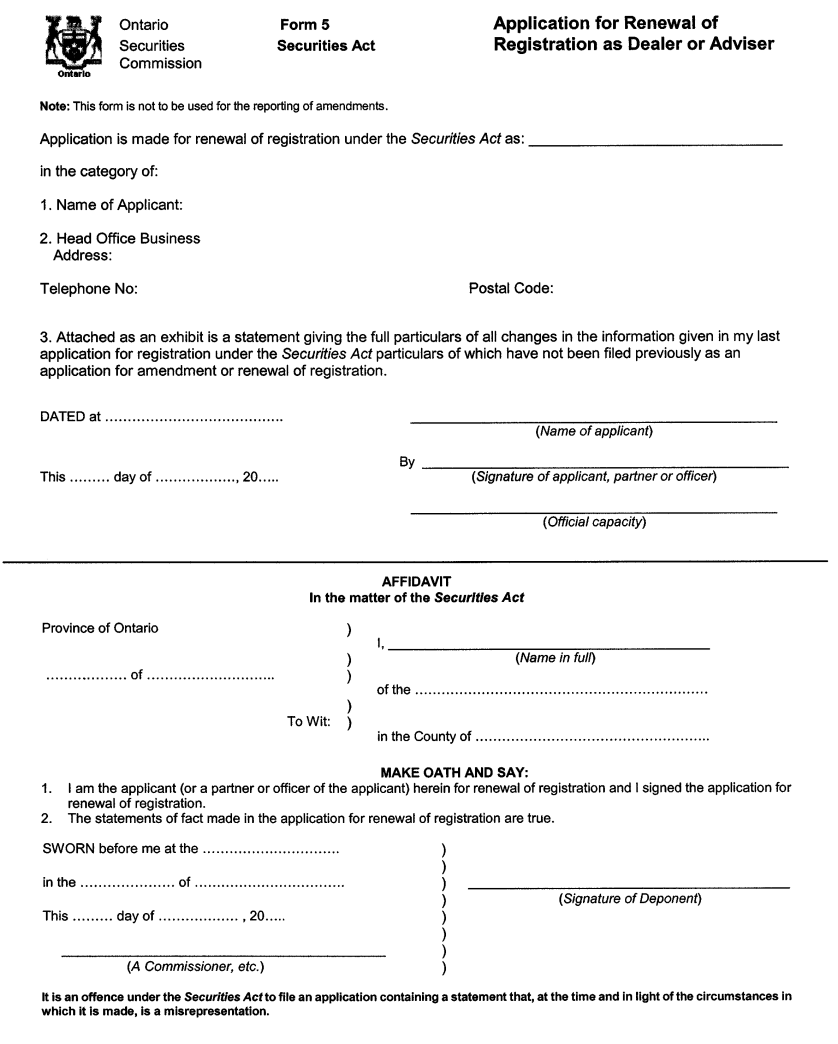

Application for renewal of registration as dealer or adviser |

|

|

|

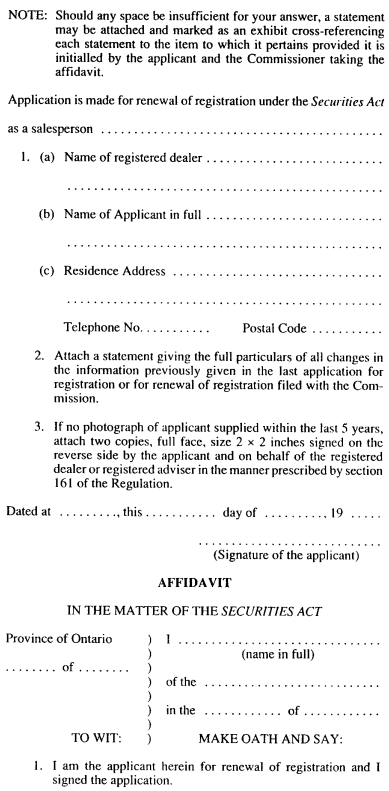

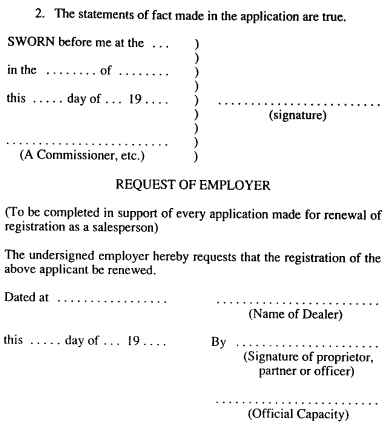

Application for renewal of registration as salesperson |

|

|

|

Summons to a witness before a person designated under section 31 of the Act |

|

|

|

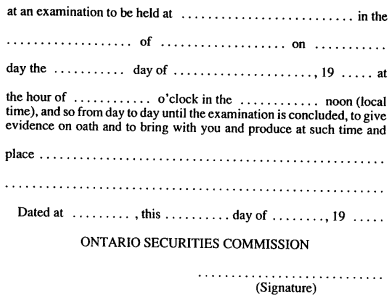

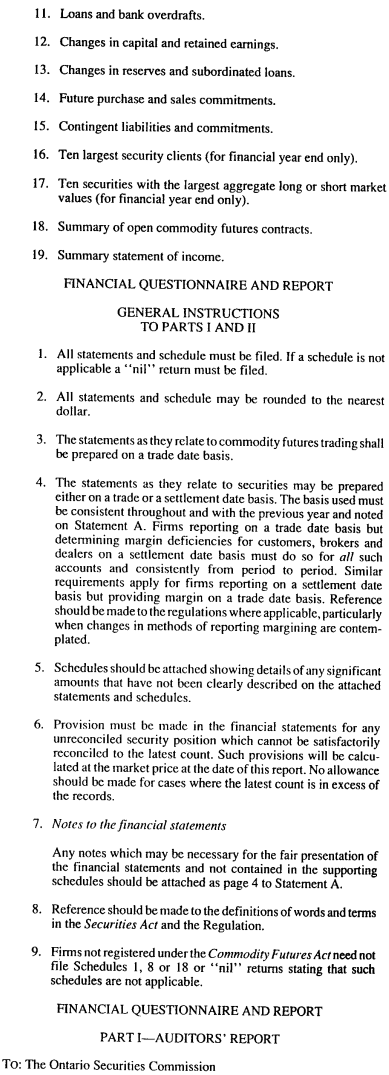

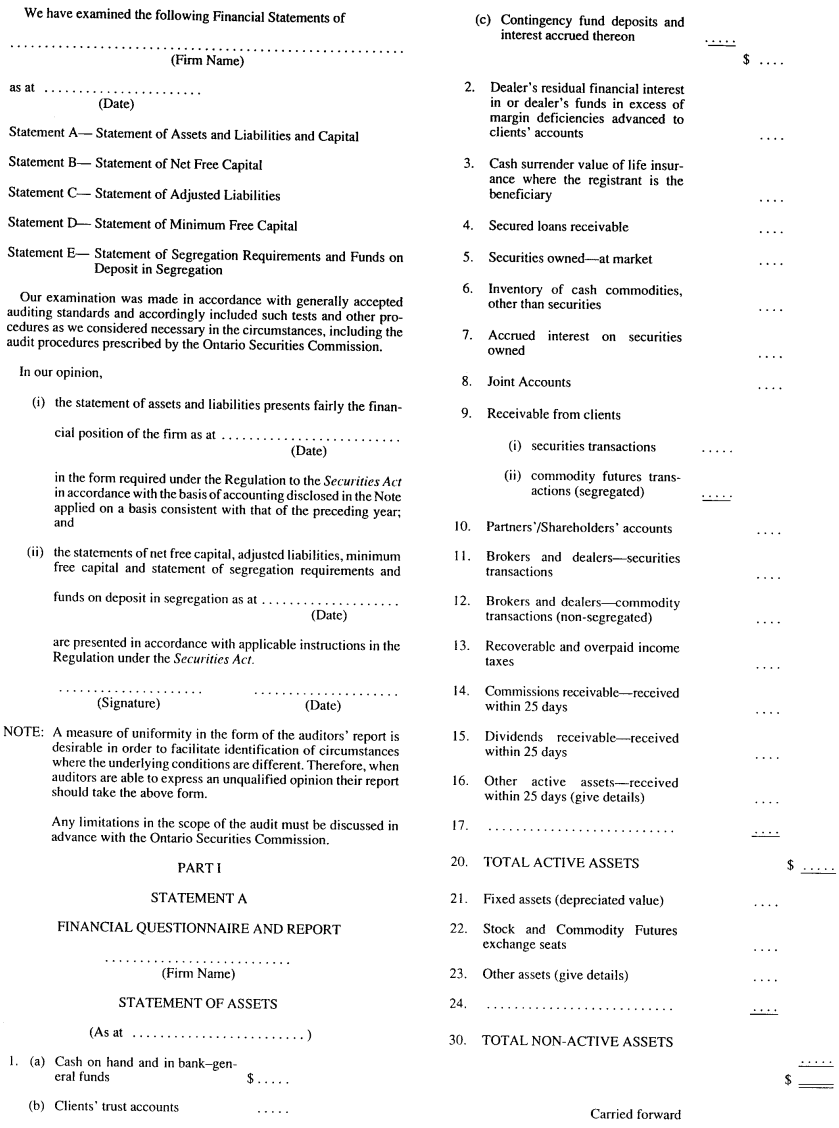

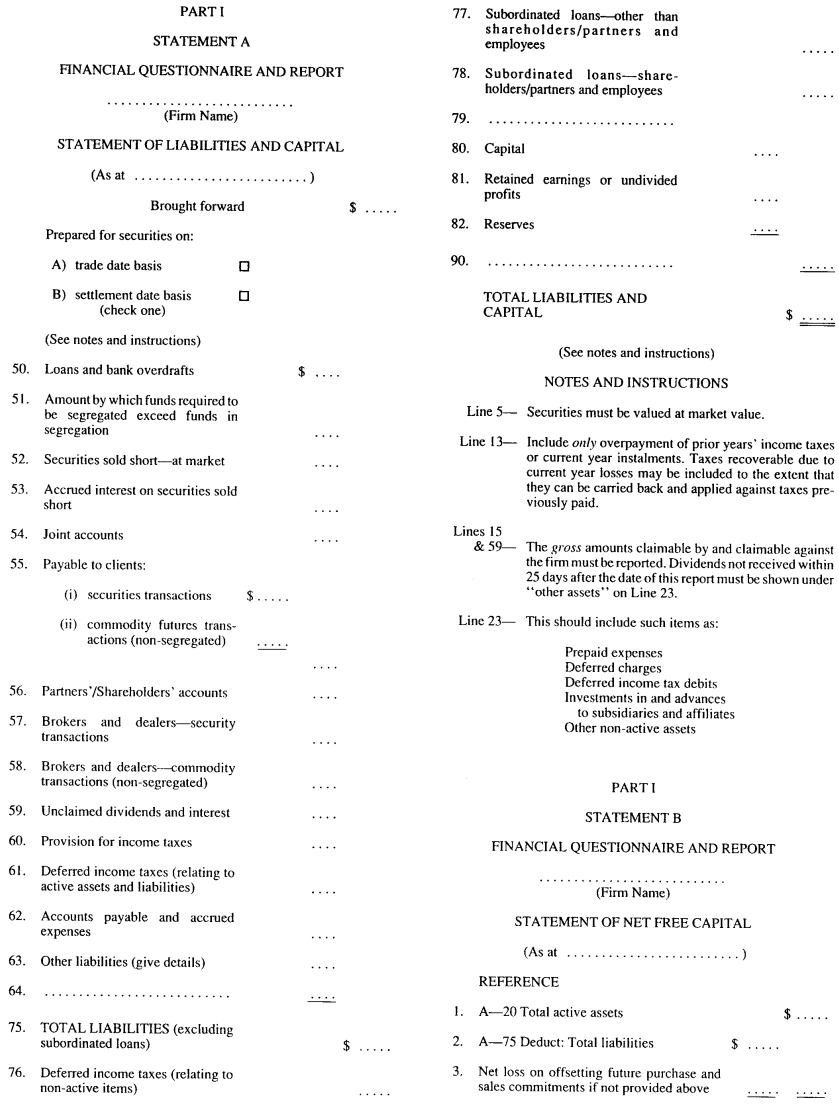

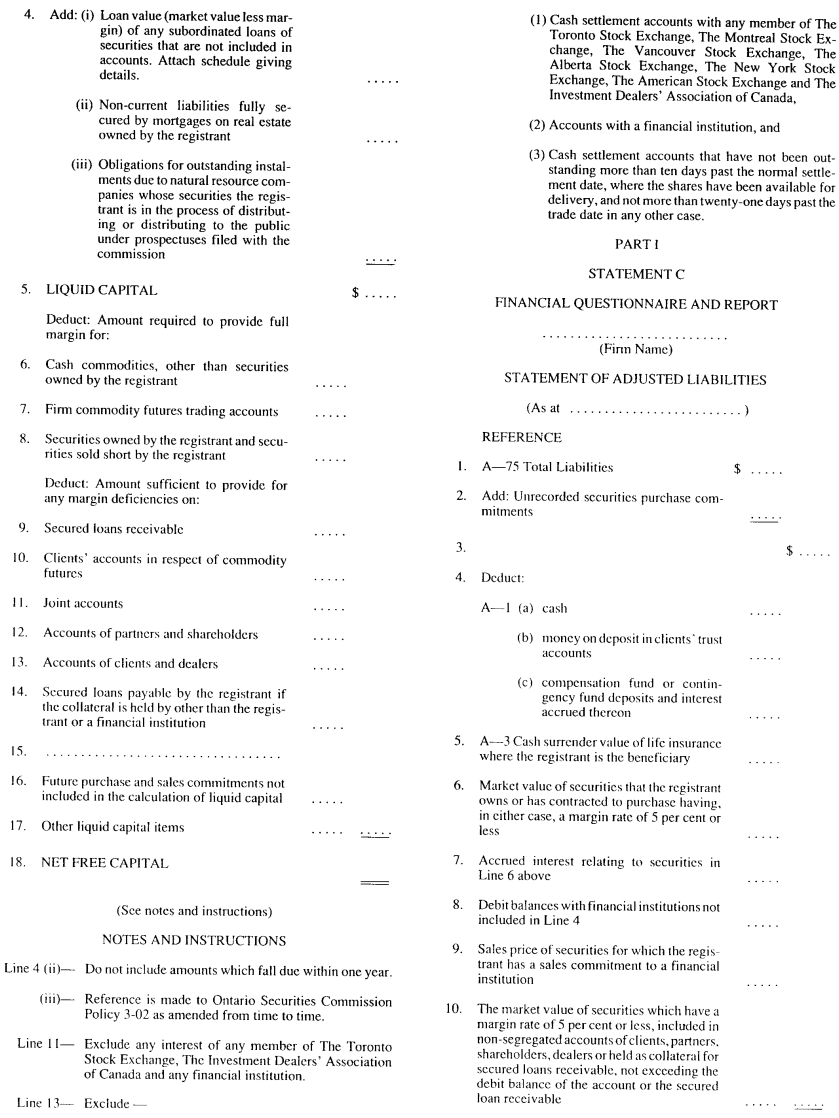

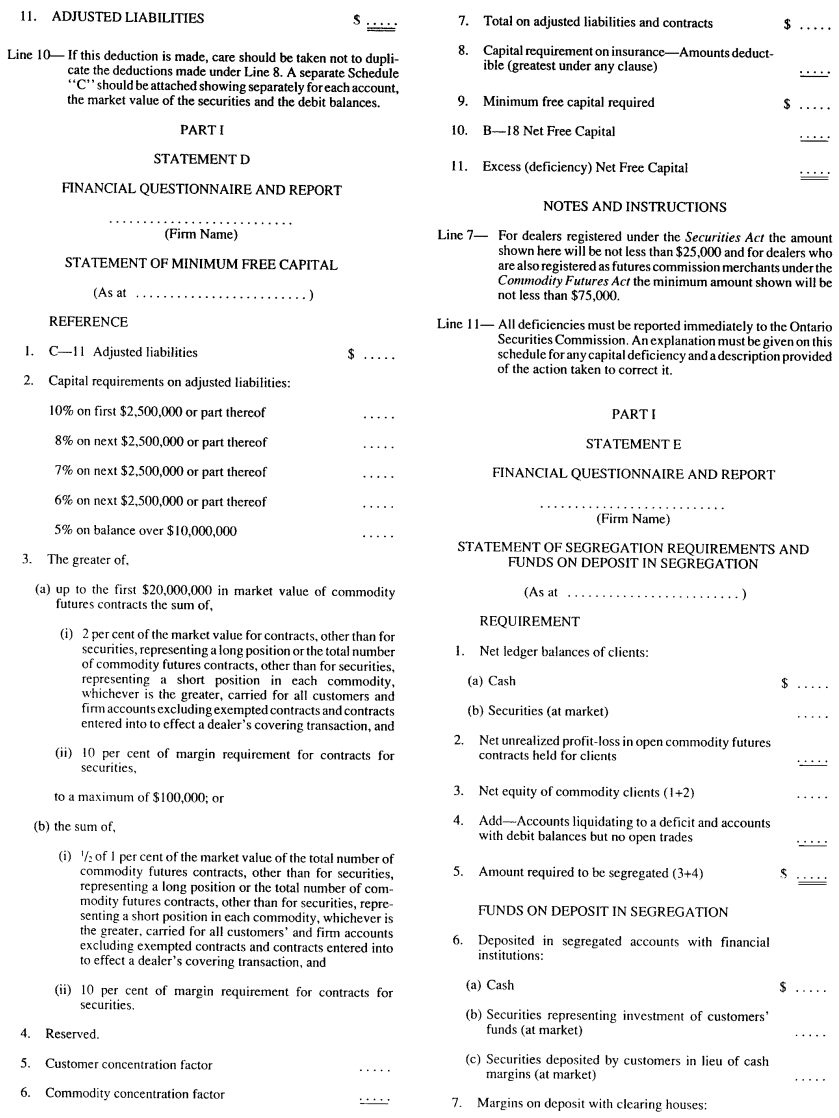

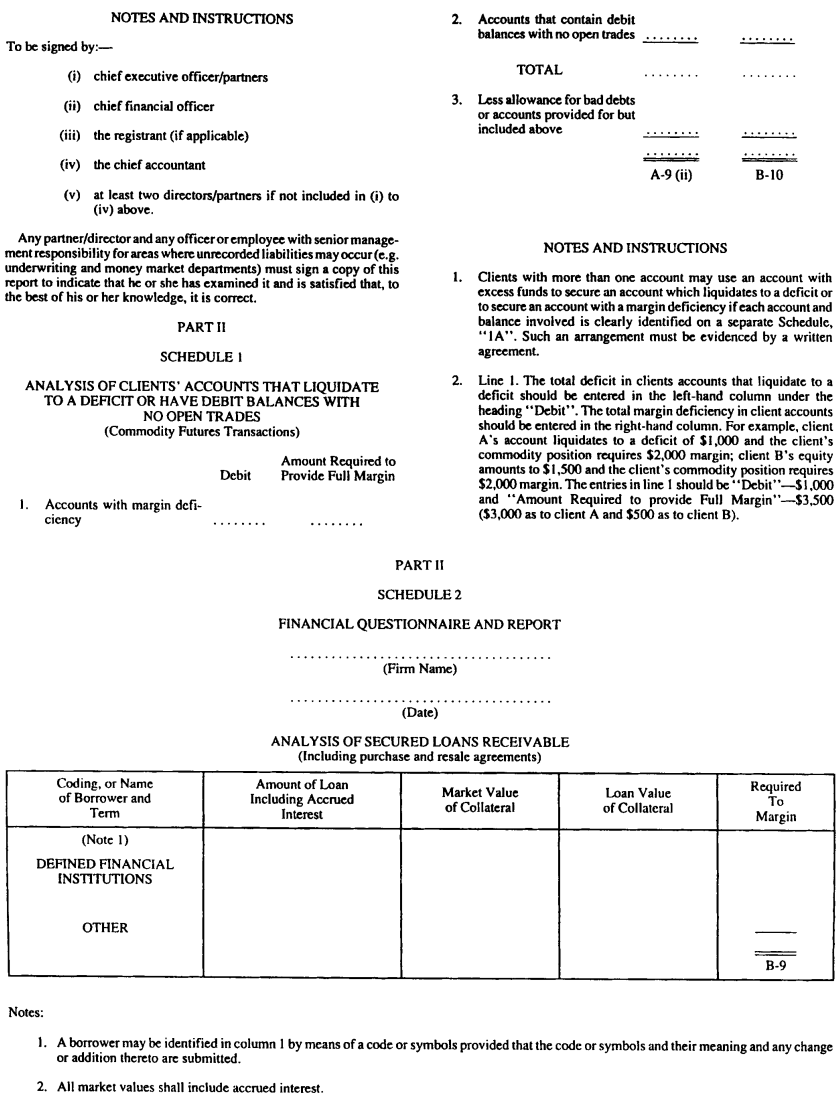

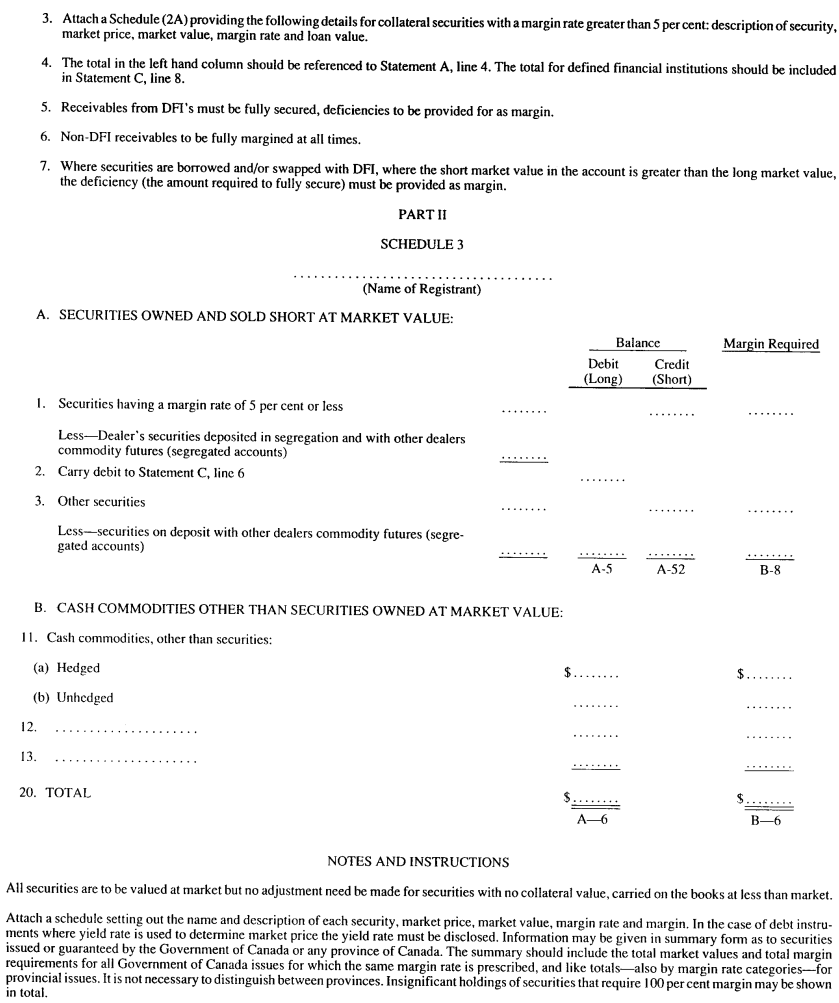

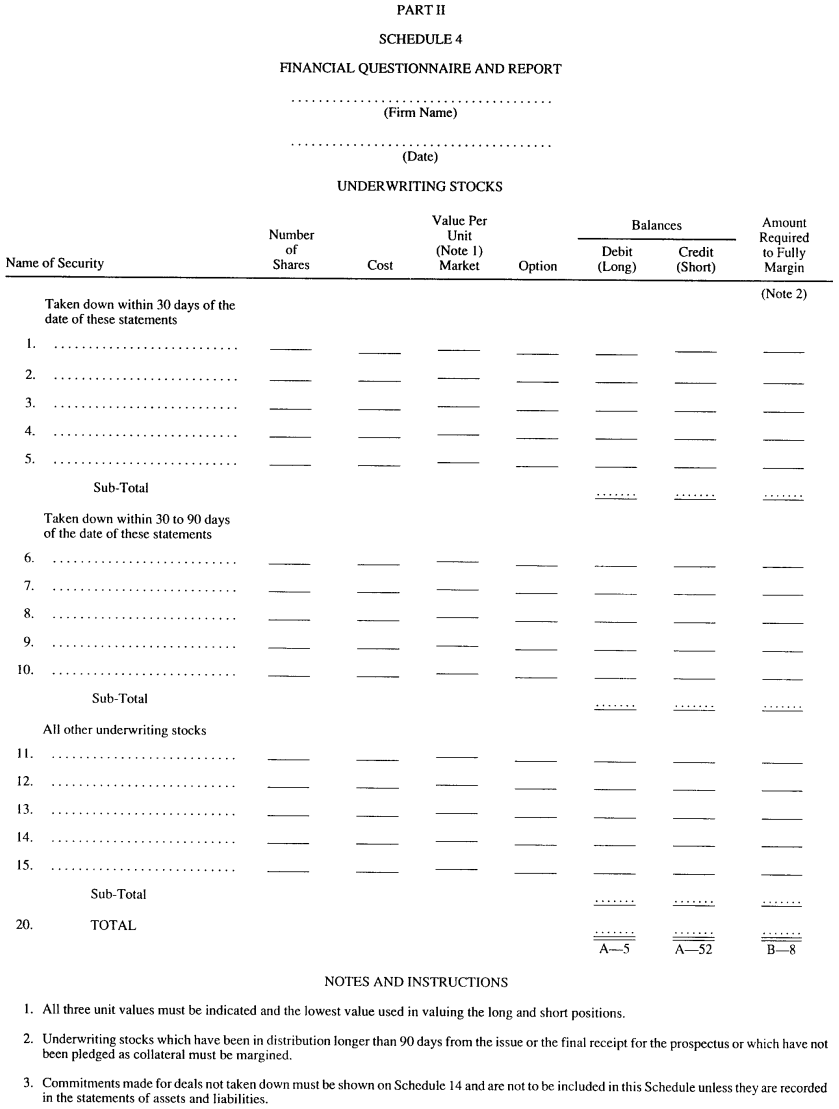

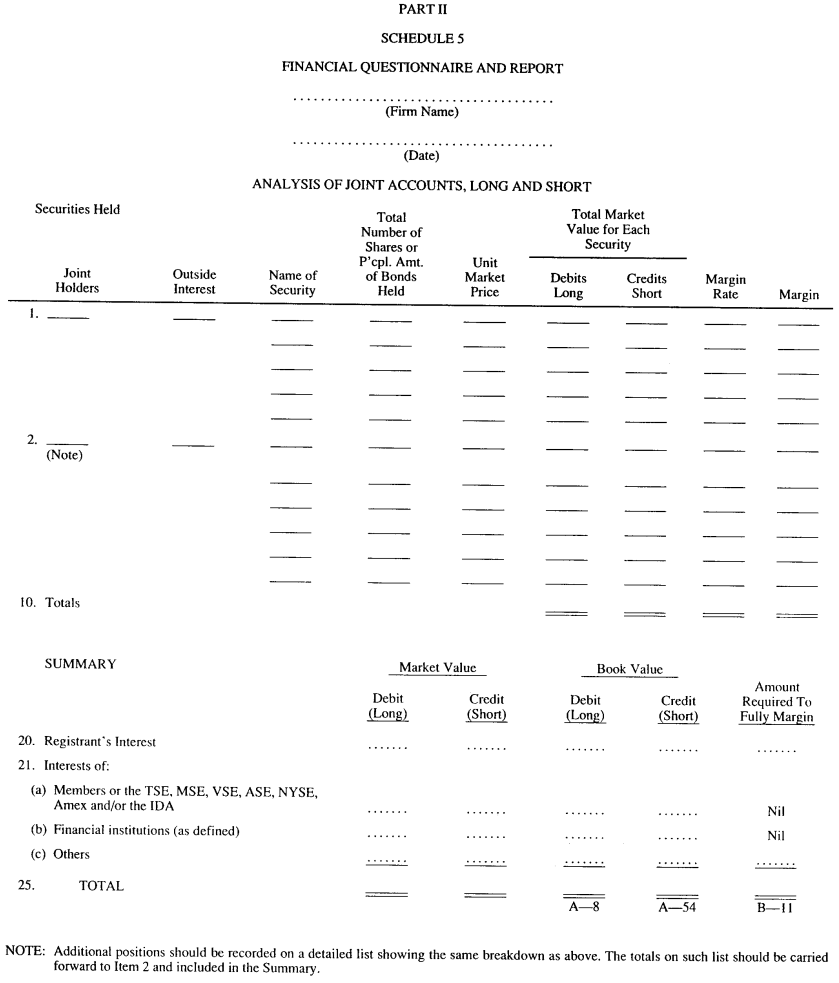

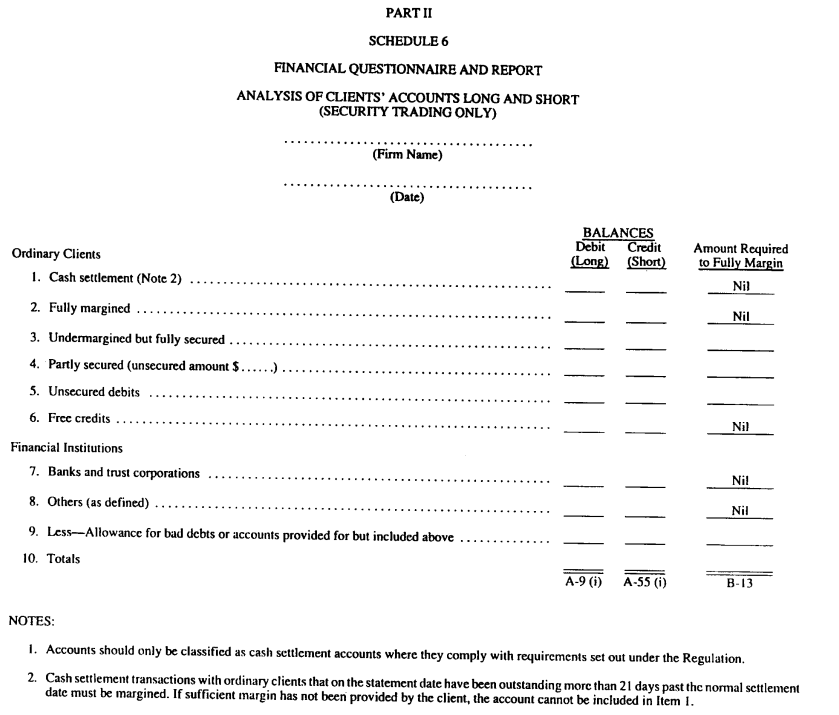

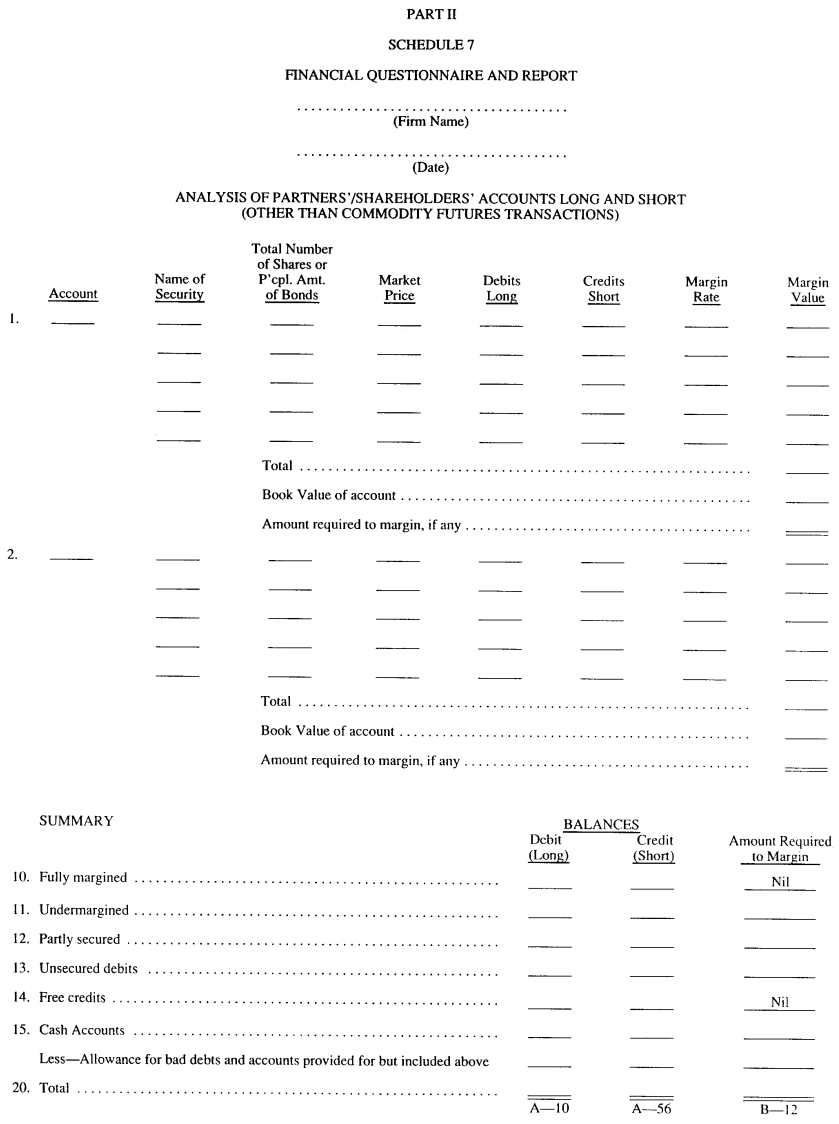

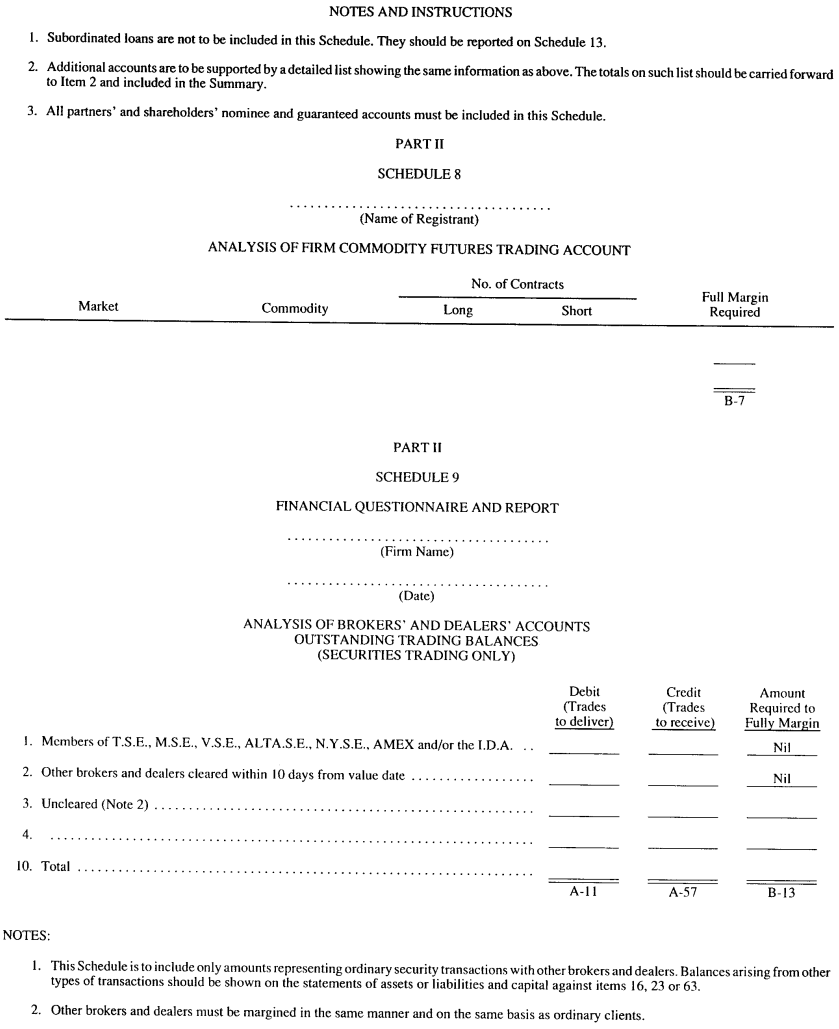

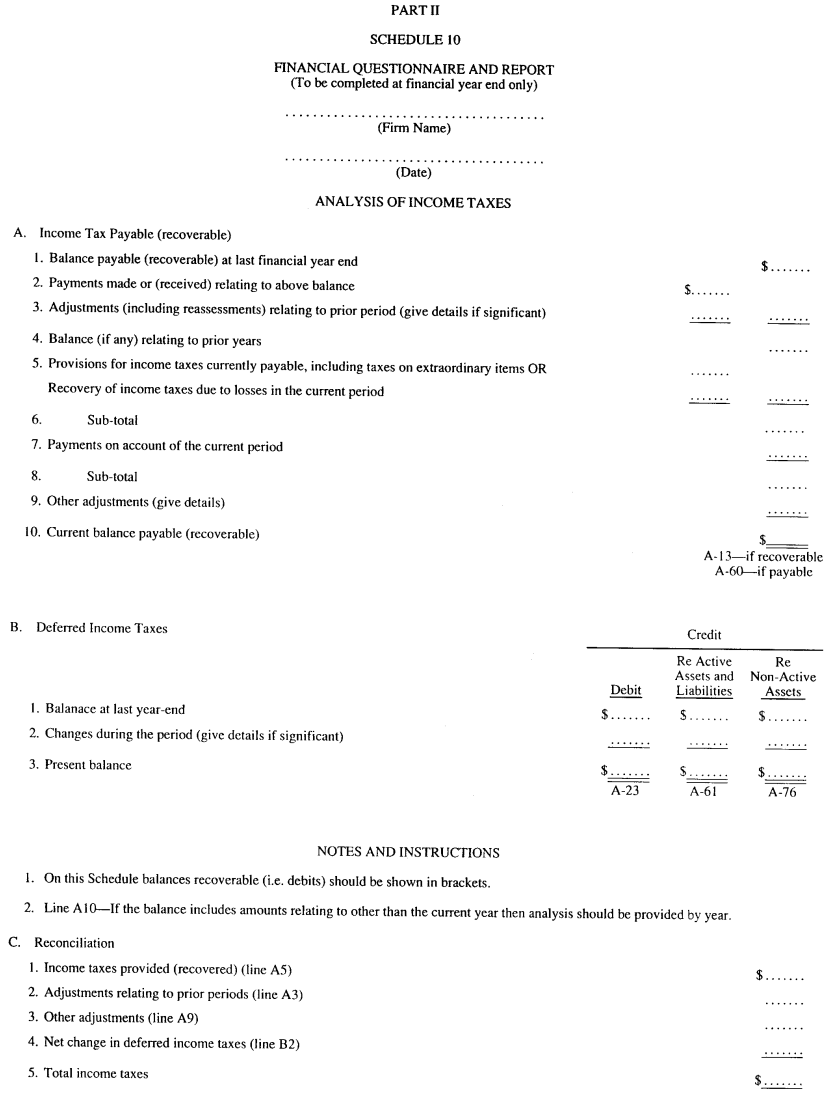

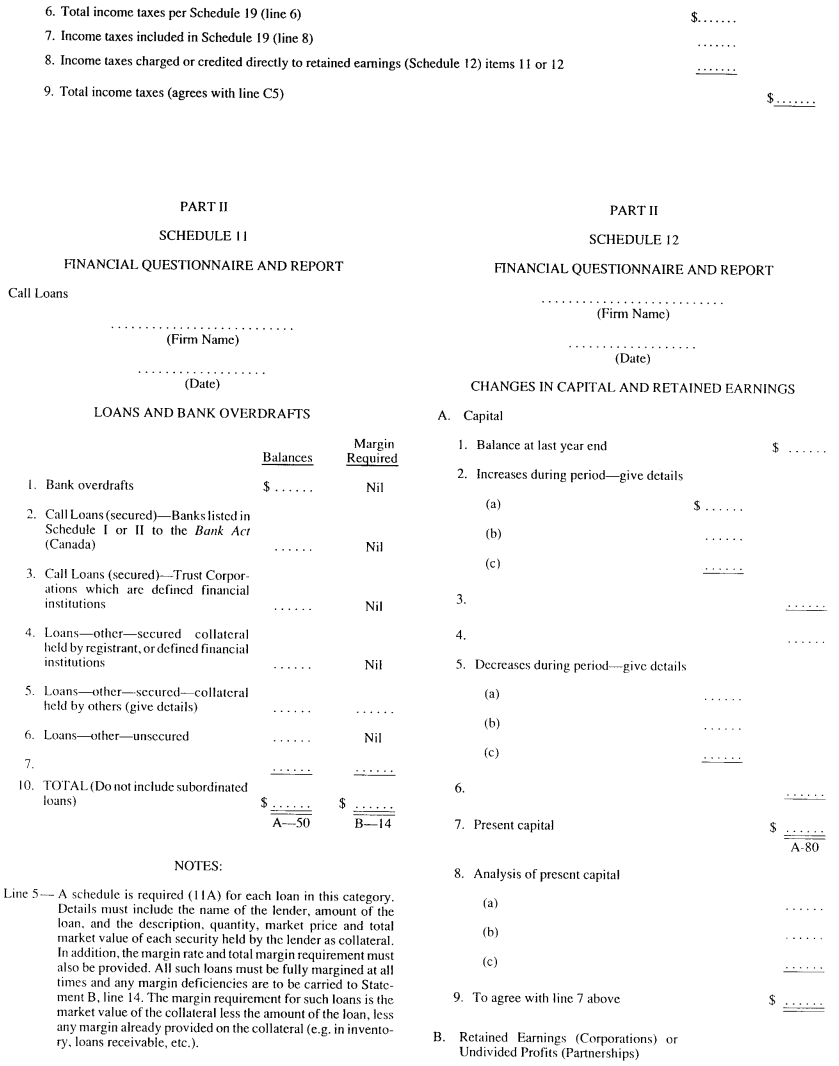

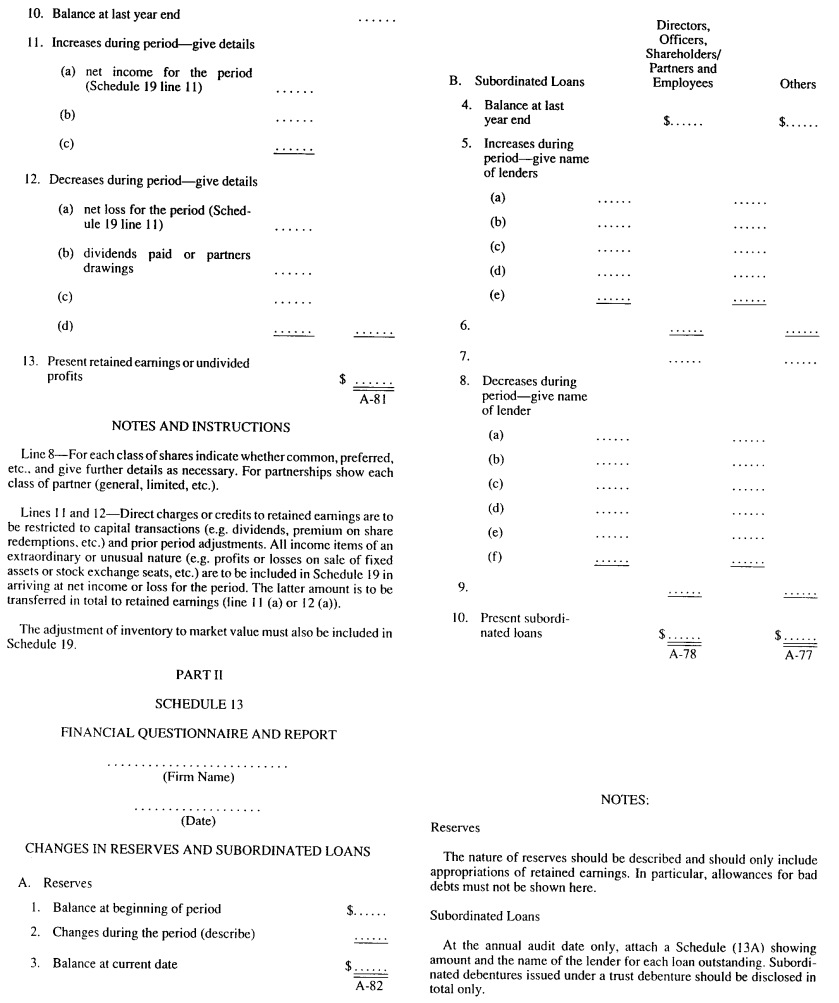

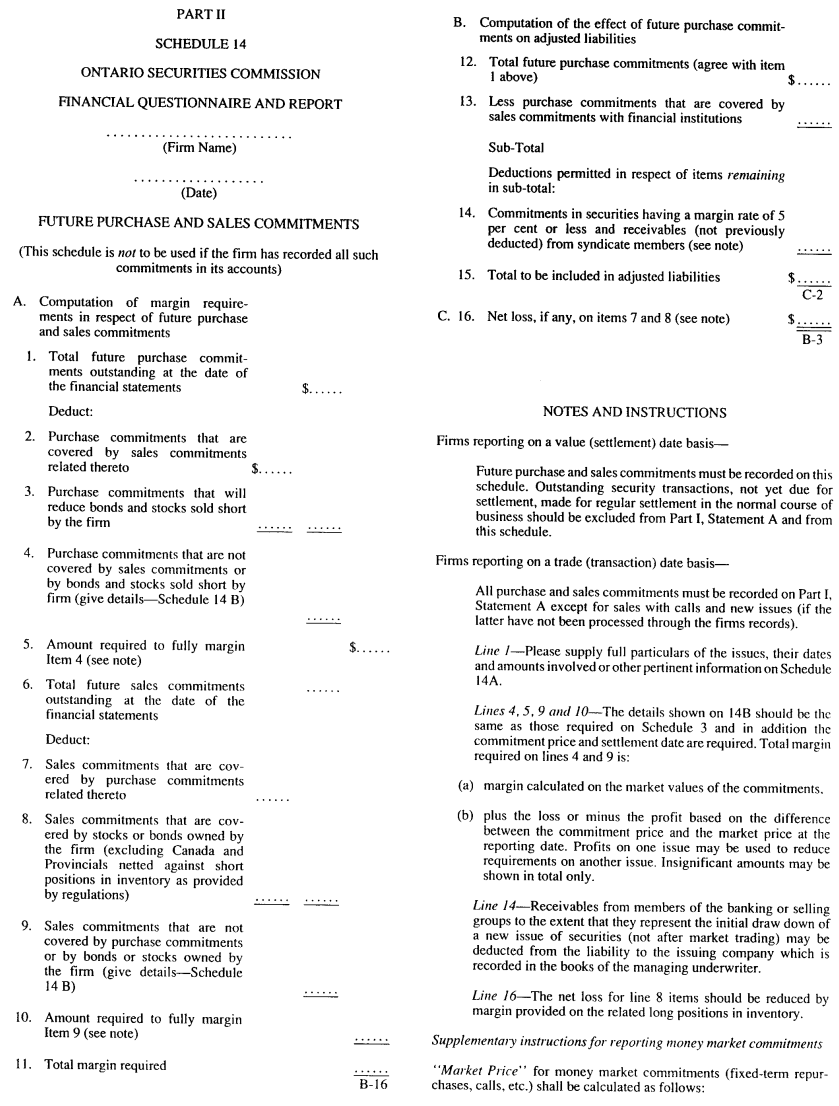

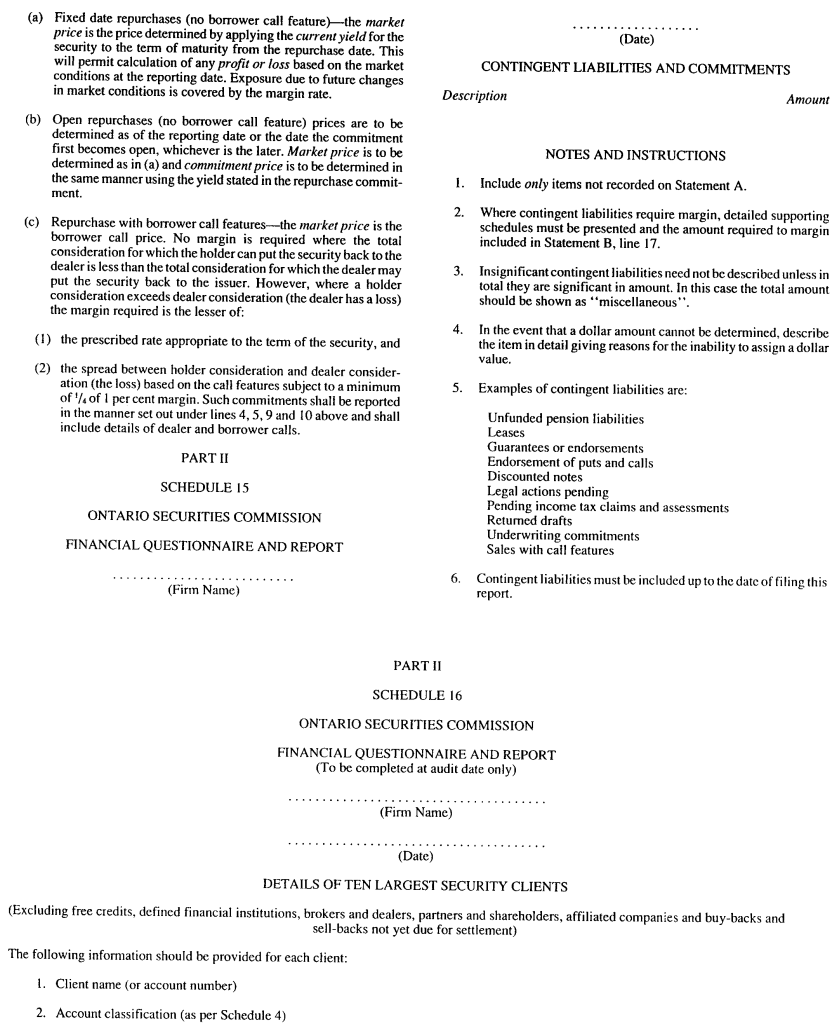

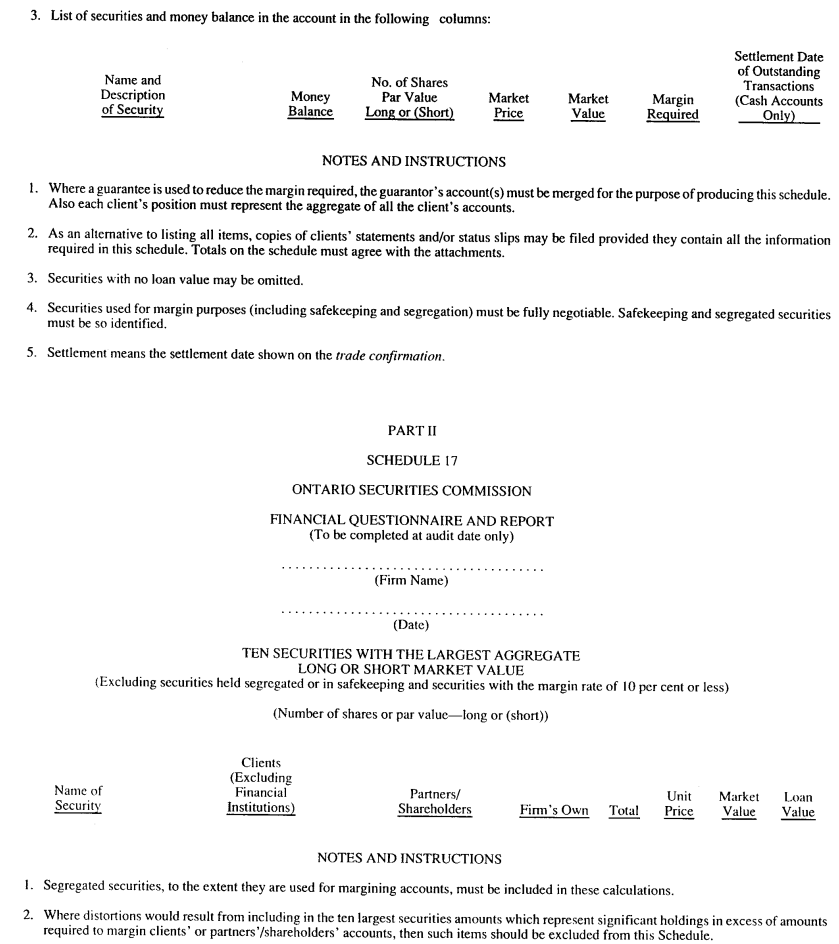

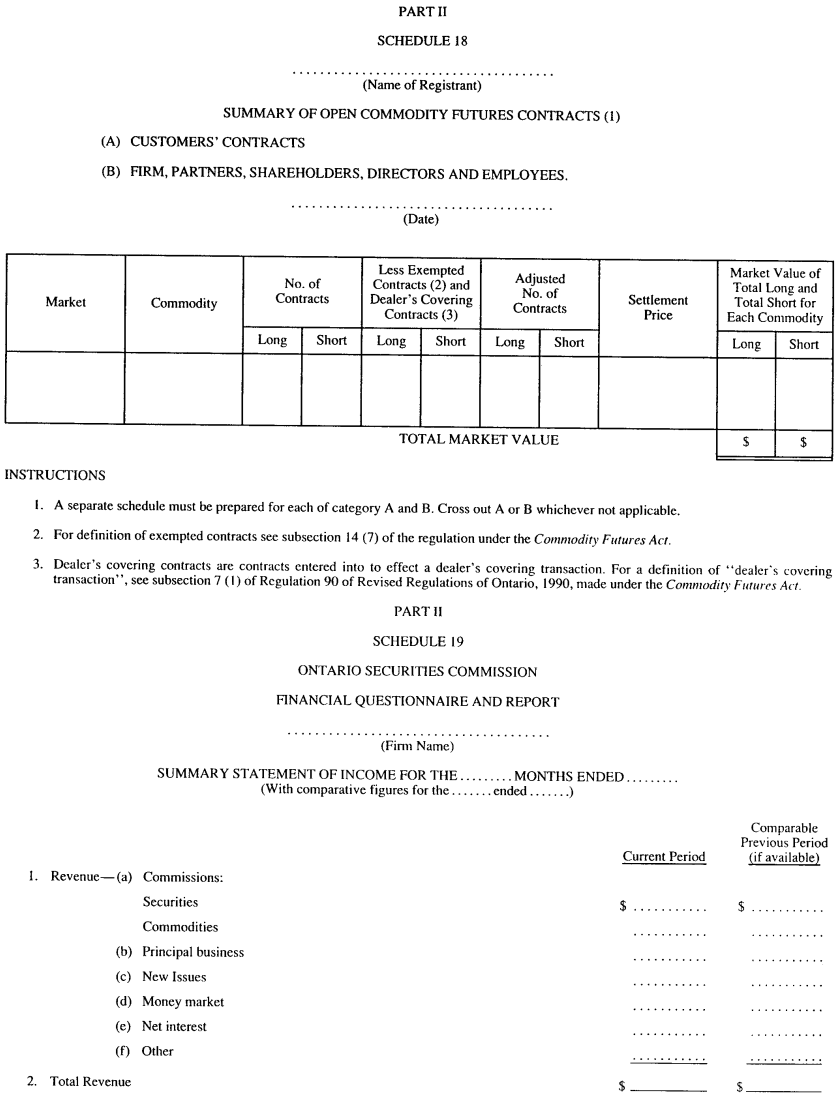

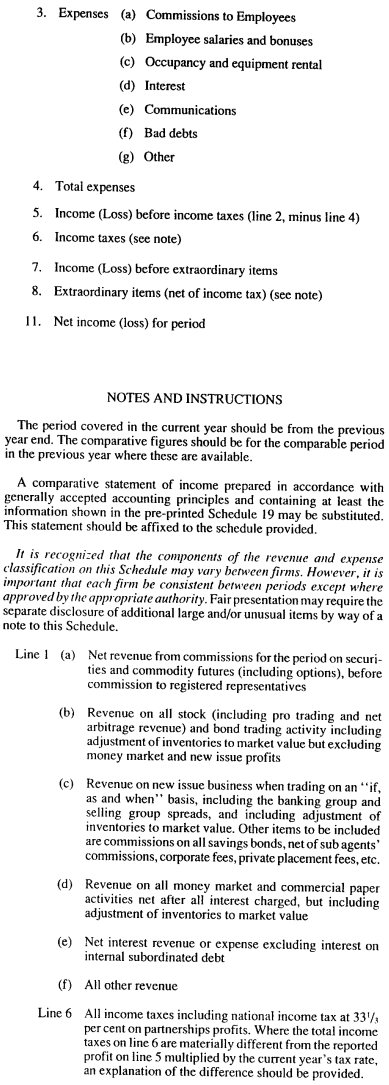

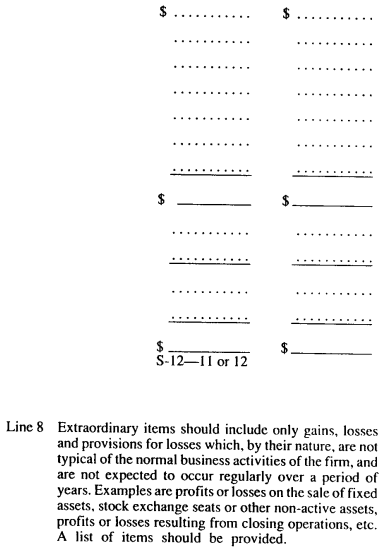

Financial questionnaire and report |

|

|

|

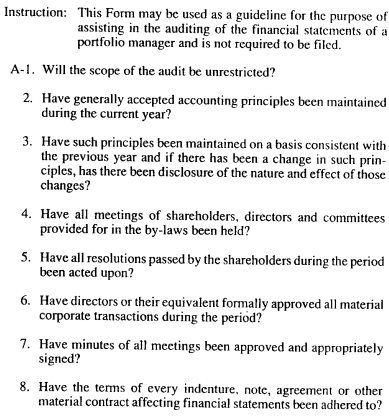

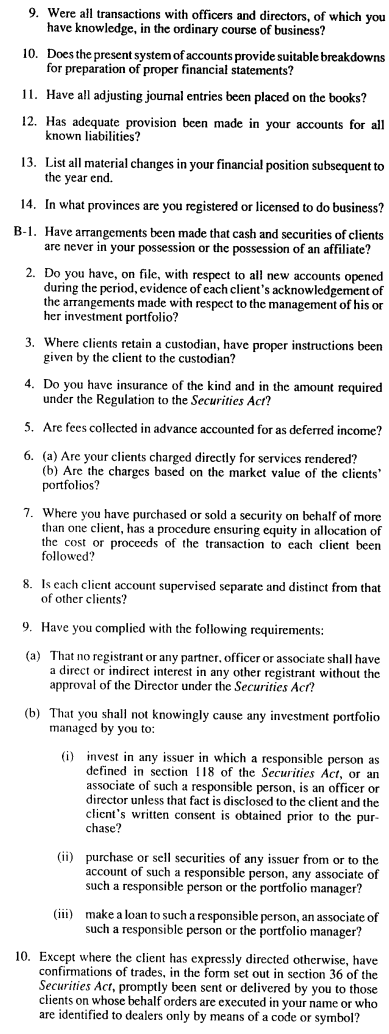

Annual questionnaire to be completed by a portfolio manager for its auditor |

|

|

|

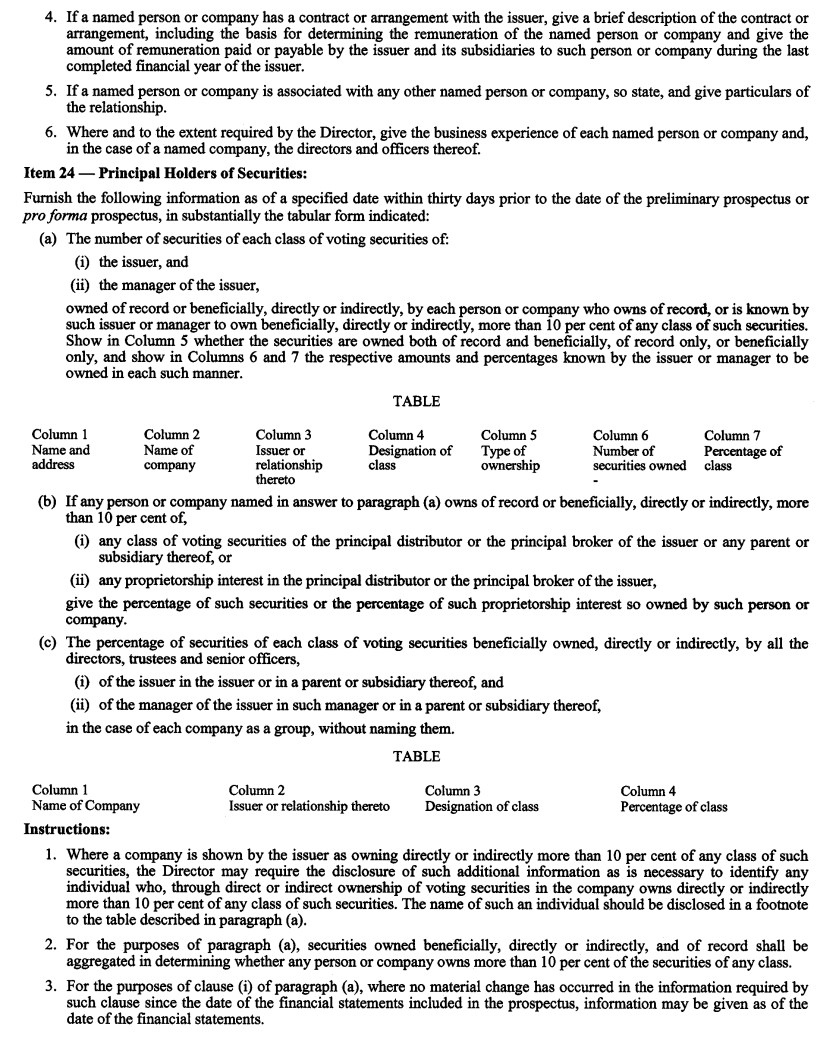

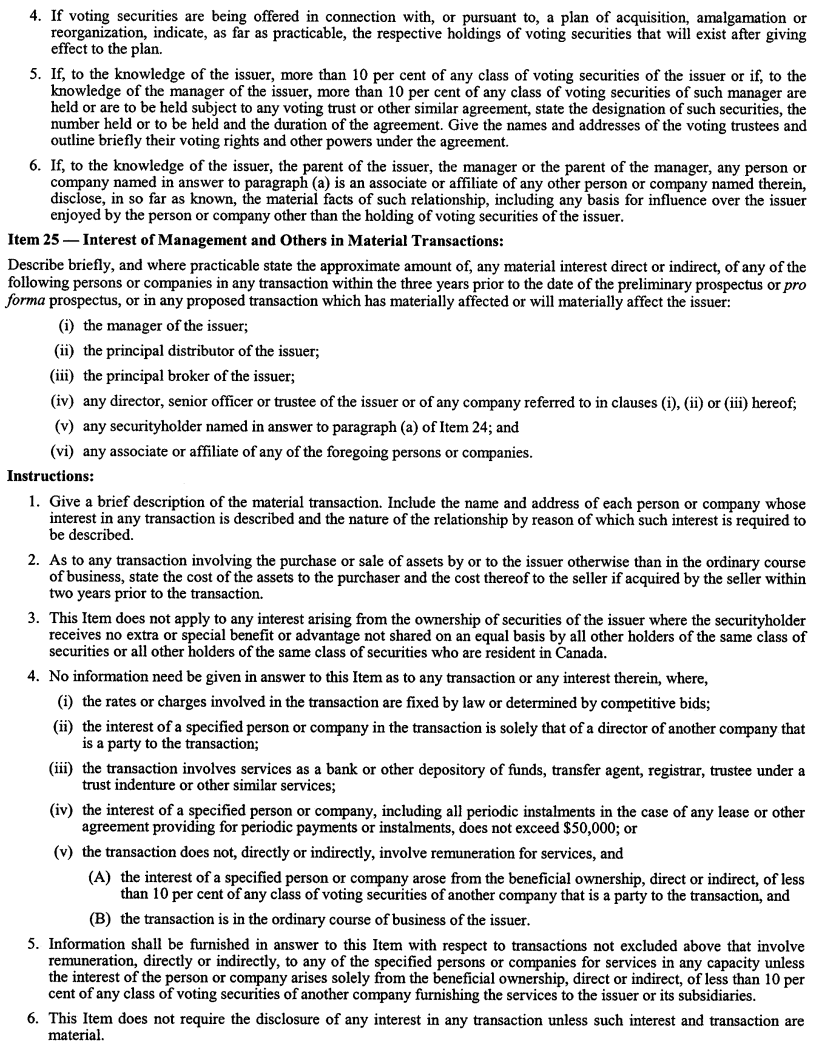

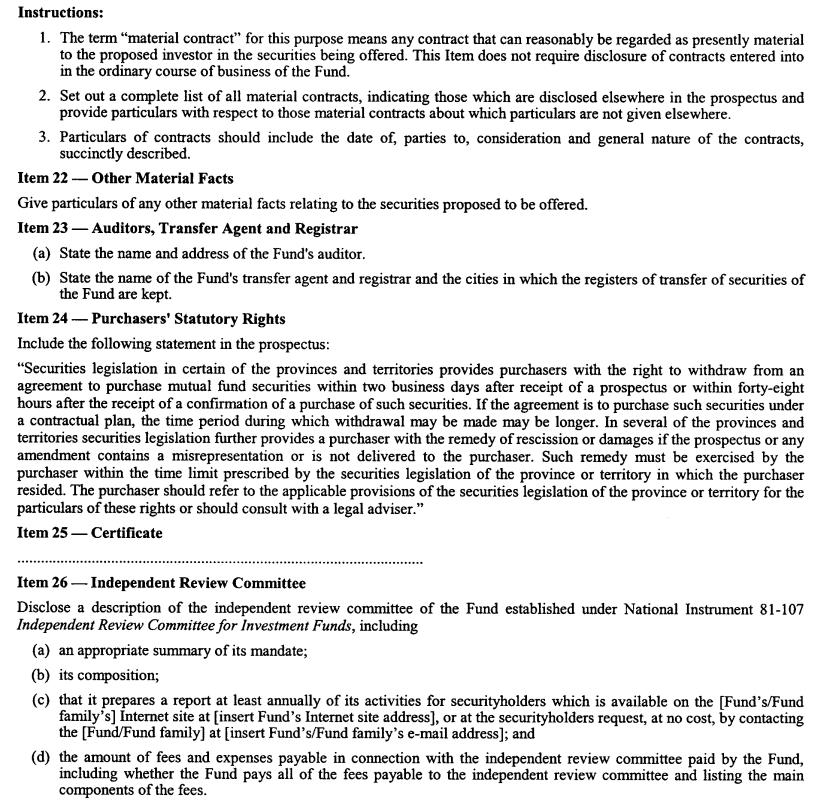

Information required in prospectus of a mutual fund |

|

|

|

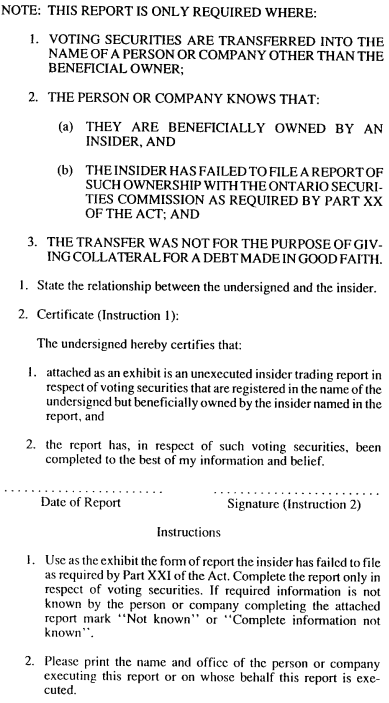

Report by a registered owner of securities beneficially owned by an insider |

|

|

|

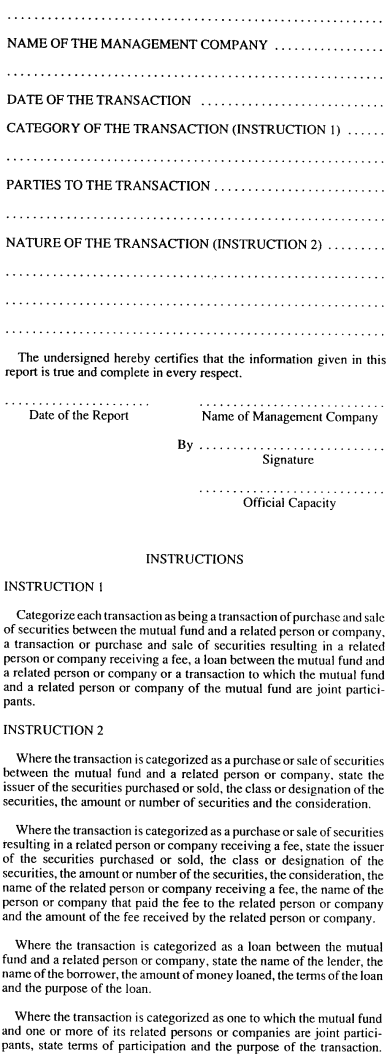

Report under section 117 of the Act |

|

|

|

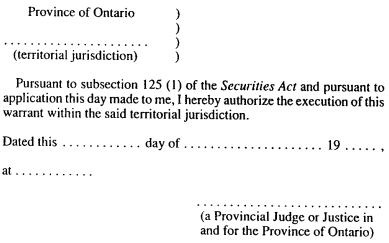

Endorsement of warrant |

|

|

|

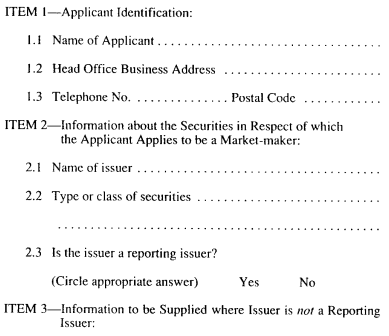

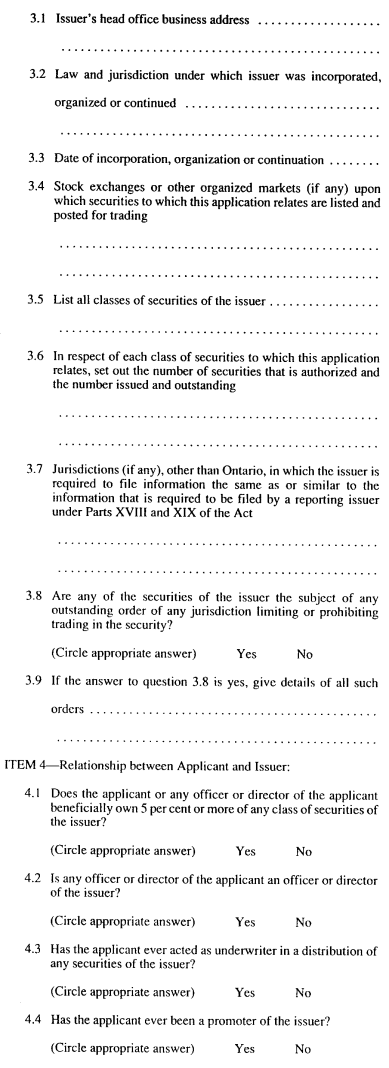

Application for approval to be a market-maker in a coats security |

|

|

|

Information required to be included in prospectus of a labour sponsored investment fund corporation |

|

PART I

GENERAL

1. (1) Every term used in this Regulation that is,

(a) defined in section 1 of the Act is used in this Regulation as so defined unless it is otherwise defined in this Regulation or the context otherwise requires;

(b) defined in a Part of the Act for purposes of that Part, is used as so defined in those sections of this Regulation that relate to the subject-matter of that Part; and

(c) defined only for a Part or section of this Regulation is, unless otherwise provided, so defined only for the purposes of such Part or section. R.R.O. 1990, Reg. 1015, s. 1 (1).

(2) In this Regulation,

“debt security” means any bond, debenture, note or similar instrument representing indebtedness, whether secured or unsecured;

“finance company” means an issuer, its subsidiaries and affiliates that,

(a) has issued securities on or after the 1st day of May, 1967, in respect of which a prospectus was filed and a receipt therefor obtained under a predecessor of this Act, or

(b) distributes its securities in Ontario, without filing a prospectus in respect thereof, in reliance on subsection 2.35 (2) of National Instrument 45-106 Prospectus and Registration Exemptions,

and is,

(c) an issuer, or a subsidiary or affiliate of an issuer, a material business activity of which involves,

(i) purchasing, discounting or otherwise acquiring promissory notes, acceptances, accounts receivable, bills of sale, chattel mortgages, conditional sales contracts, drafts and other obligations representing part or all of the sales price of merchandise, or services,

(ii) factoring or purchasing and leasing personal property as part of a hire purchase or similar business, or

(iii) making secured and unsecured loans,

but does not include,

(d) a bank listed in Schedule I or II to the Bank Act (Canada), the Federal Business Development Bank, a loan corporation or trust corporation registered under the Loan and Trust Corporations Act or an insurance company licensed under the Insurance Act,

(e) a credit union or credit union league incorporated under the Credit Unions and Caisses Populaires Act,

(f) an underwriter or dealer, or

(g) any issuer that in the opinion of the Director carries on operations making it more appropriate that such issuer be designated as an industrial company or natural resource company;

“industrial company” means an issuer designated by the Director as an industrial company;

“insurance company” means an issuer licensed under the Insurance Act;

“natural resource company” means a mining, gas, oil or exploration issuer designated by the Director as a natural resource company;

“variable insurance contract” means a contract of life insurance under which the interest of the purchaser is valued for purposes of conversion or surrender by reference to the value of a proportionate interest in a specified portfolio of assets. R.R.O. 1990, Reg. 1015, s. 1 (2); O. Reg. 491/05, s. 1.

(3) Subject to subsection (4), for the purposes of the Act and this Regulation,

(a) where the terms “generally accepted accounting principles”, “auditor’s report” and “generally accepted auditing standards” are used in reference to a financial statement to which National Instrument 52-107 Acceptable Accounting Principles, Auditing Standards and Reporting Currencies applies, those terms have the meanings provided for in that Instrument; and

(b) in all other cases, where a recommendation has been made in the Handbook of the Canadian Institute of Chartered Accountants which is applicable in the circumstances, the terms “generally accepted accounting principles”, “auditor’s report” and “generally accepted auditing standards” mean the principles, report and standards, respectively, recommended in the Handbook. O. Reg. 72/04, s. 1.

(4) Except as otherwise provided in National Instrument 52-107 Acceptable Accounting Principles, Auditing Standards and Reporting Currencies, in National Instrument 71-101 The Multijurisdictional Disclosure System and in Ontario Securities Commission Rule 71-801 The Multijurisdictional Disclosure System, where an issuer is incorporated or organized in a jurisdiction other than Canada or a province or territory of Canada, “generally accepted accounting principles” may, at the option of the issuer, mean such principles as prescribed in the incorporating jurisdiction by or pursuant to applicable legislation or where a recommendation has been made by an association in that jurisdiction equivalent to the Canadian Institute of Chartered Accountants, the principles recommended by that association, but where an option is exercised under this subsection, the notes to the financial statements shall state which option has been applied in the choice of generally accepted accounting principles. O. Reg. 72/04, s. 1.

(5) Where the Act or this Regulation requires the disclosure of the number or percentage of securities beneficially owned by a person and, by virtue of subsection 1 (5) of the Act, one or more companies will also have to be shown as beneficially owning the securities, a statement disclosing all the securities beneficially owned by the person or deemed to be beneficially owned, and indicating whether the ownership is direct or indirect and, if indirect, indicating the name of the controlled company or company affiliated with the controlled company through which the securities are indirectly owned and the number or percentage of the securities so owned by the company, shall be deemed sufficient disclosure without disclosing the name of any other company which is deemed to beneficially own the same securities. R.R.O. 1990, Reg. 1015, s. 1 (5).

(6) Where the Act or this Regulation requires the disclosure of the number or percentage of securities beneficially owned by a company and, by virtue of subsection 1 (6) of the Act, one or more other companies will also have to be shown as beneficially owning the securities, a statement disclosing all securities beneficially owned or deemed to be beneficially owned by the parent company and indicating whether the ownership is direct or indirect and, if indirect, indicating the name of the subsidiary through which the securities are indirectly owned and the number or percentage of the securities so owned, shall be deemed sufficient disclosure without disclosing the name of any other company which is deemed to beneficially own the same securities. R.R.O. 1990, Reg. 1015, s. 1 (6).

(7) A company shall be deemed to be another’s holding company or parent company if that other is its subsidiary. R.R.O. 1990, Reg. 1015, s. 1 (7).

2. (1) Subject to subsections (3) and (4), the financial statements permitted or required by the Act or this Regulation shall be prepared in accordance with generally accepted accounting principles and with any applicable provision of the Act or this Regulation. R.R.O. 1990, Reg. 1015, s. 2 (1).

(2) Revoked: O. Reg. 215/05, s. 1 (1).

(3) Revoked: O. Reg. 72/04, s. 2.

(4) Despite subsection (1), where a financial statement is not prepared in accordance with generally accepted accounting principles,

(a) the Director may accept the financial statement for the purposes for which it is to be filed,

(i) where the Director is satisfied that it is not reasonably practicable for the issuer to revise the presentation in the financial statement to conform to generally accepted accounting principles, or

(ii) where the Commission by its order under clause (b) has previously accepted a financial statement of the same issuer with a corresponding variation from generally accepted accounting principles and the Director is satisfied that there has been no material change in the circumstances upon which the decision of the Commission was based; or

(b) the Commission may, by order, accept the financial statement after giving interested parties an opportunity to be heard if the Commission is satisfied in all the circumstances of the particular case that the variation from generally accepted accounting principles is supported or justified by considerations that outweigh the desirability of uniform adherence to generally accepted accounting principles and the Commission shall publish written reasons for any acceptance of financial statements under this paragraph. R.R.O. 1990, Reg. 1015, s. 2 (4).

(5)-(7) Revoked: O. Reg. 215/05, s. 1 (2).

3. (1) Revoked: O. Reg. 215/05, s. 2 (1).

(1.1) Every report required to be filed under subsection 75 (2) of the Act by a reporting issuer shall be prepared in accordance with Form 51-102F3 of National Instrument 51-102 Continuous Disclosure Obligations except that,

(a) the reference in Item 3 of the Form to section 7.1 of National Instrument 51-102 shall be read as if it were a reference to subsection 75 (1) of the Act; and

(b) the references in Items 6 and 7 of the Form to subsection 7.1 (2) , (5) or (7) of National Instrument 51-102 shall be read as if they were references to subsection 75 (3), (4) or (5), respectively, of the Act. O. Reg. 56/04, s. 2; O. Reg. 215/05, s. 2 (2).

(1.2) Every report required to be filed under subsection 75 (2) of the Act shall, subject to section 4, be delivered to the Commission in an envelope addressed to the Commission and marked “Continuous Disclosure”. O. Reg. 56/04, s. 2.

(2) The requirements in this section apply except as otherwise provided in National Instrument 71-101 The Multijurisdictional Disclosure System and in Ontario Securities Commission Rule 71-801 The Multijurisdictional Disclosure System. O. Reg. 568/98, s. 3.

4. Where the reporting issuer files,

(a) the report required by subsection 75 (2) of the Act in reliance on,

(i) subsection 75 (3) of the Act, or

(ii) Item 7 of Form 51-102F3 of National Instrument 51-102 Continuous Disclosure Obligations; or

(iii) Revoked: O. Reg. 215/05, s. 3.

(b) the notification required by subsection 75 (4) of the Act,

everything that is required to be filed thereby shall be marked “Confidential” and placed in an envelope addressed to the Secretary marked “Confidential — s. 75”. R.R.O. 1990, Reg. 1015, s. 4; O. Reg. 56/04, s. 3; O. Reg. 215/05, s. 3.

5. Revoked: O. Reg. 56/04, s. 4.

6. Revoked: O. Reg. 215/05, s. 4.

6.1 Revoked: R.R.O. 1990, Reg. 1015, s. 6.1 (2). (See: O. Reg. 636/00, s. 1.)

7. Revoked: R.R.O. 1990, Reg. 1015, s. 7 (3). (See: O. Reg. 636/00, s. 2.)

8. Revoked: R.R.O. 1990, Reg. 1015, s. 8 (2). (See: O. Reg. 636/00, s. 3.)

9. Revoked: R.R.O. 1990, Reg. 1015, s. 9 (2). (See: O. Reg. 636/00, s. 4.)

9.1 Revoked: R.R.O. 1990, Reg. 1015, s. 9.1 (2). (See: O. Reg. 636/00, s. 5.)

10. Revoked: R.R.O. 1990, Reg. 1015, s. 10 (3). (See: O. Reg. 636/00, s. 6.)

11. Revoked: R.R.O. 1990, Reg. 1015, s. 11 (2). (See: O. Reg. 636/00, s. 7.)

12. Revoked: O. Reg. 507/97, s. 1.

13. Revoked: R.R.O. 1990, Reg. 1015, s. 13 (2). (See: O. Reg. 636/00, s. 8.)

PART III

PROSPECTUS REQUIREMENTS

14. Revoked: O. Reg. 662/98, s. 1.

15. Revoked: O. Reg. 130/98, s. 2.

16.-32. Revoked: O. Reg. 662/98, s. 1.

33. Revoked: O. Reg. 91/01, s. 1.

34.-37. Revoked: O. Reg. 632/00, s. 3.

38. Revoked: O. Reg. 453/05, s. 1.

39. Revoked: O. Reg. 632/00, s. 5.

40.-42. Revoked: O. Reg. 632/00, s. 5.

43. If a prospectus is required to be filed in respect of an issuer bid, the information required in Form 62-504F2 in Rule 62-504 Take-Over Bids and Issuer Bids, other than the certificate in Item 31 of Part 2 of the form, shall be included in the prospectus. O. Reg. 589/07, s. 1.

44. The prospectus of a commodity pool, as defined in National Instrument 81-101 Mutual Fund Prospectus Disclosure, or of a scholarship plan shall be prepared in accordance with Form 15. O. Reg. 91/01, s. 2.

45.-49. Revoked: O. Reg. 632/00, s. 6.

50., 51. Revoked: O. Reg. 631/00, s. 1.

52. Revoked: O. Reg. 632/00, s. 7.

Content of Prospectus — Financial Matters

53. Revoked: O. Reg. 632/00, s. 7.

54. (1) Every prospectus of a mutual fund shall contain,

(a) an income statement;

(b) a balance sheet;

(c) a statement of investment portfolio;

(d) a statement of portfolio transactions; and

(e) a statement of changes in net assets,

of the mutual fund, each for or as at the end of, as appropriate, its last financial year or for any period or periods permitted or required by the Director. R.R.O. 1990, Reg. 1015, s. 54 (1); O. Reg. 91/01, s. 4 (1).

(2) The financial statements described in subsection (1) may be omitted from the prospectus of the mutual fund if a copy of the financial statements that are otherwise required by subsection (1) is filed concurrently with the filing of the prospectus or if a copy of them has previously been filed under section 78 of the Act. O. Reg. 91/01, s. 4 (2).

(3) If, under subsection (2), a prospectus of a mutual fund does not contain the financial statements described in subsection (1), a prospectus that is sent or delivered to a purchaser of securities under section 71 or under subsection 63 (5) of the Act shall be accompanied by,

(a) a copy of the financial statements that are otherwise required by subsection (1); and

(b) if one or more financial statements for periods subsequent to those covered by the financial statements referred to in clause (a) have been filed under section 77 or 78 of the Act, a copy of the financial statements most recently filed before the day on which the prospectus is sent or delivered to the purchaser. O. Reg. 92/01, s. 4 (2).

(4) If, under subsection (2), a prospectus of a mutual fund does not contain the financial statements described in subsection (1), the following statement shall be printed on the outside cover page of the prospectus:

The information contained herein must be accompanied by the annual financial statements of the Fund for the last financial year completed before the date of the current prospectus of the Fund and the auditors’ report thereon, which statements and report are considered to form part of this document. As well, if subsequent financial statements, whether semi-annual or annual, have been filed with the Securities Commission, a copy of the most recent of such subsequent statements must also accompany this document.

R.R.O. 1990, Reg. 1015, s. 54 (4); O. Reg. 91/01, s. 4 (3).

55.-59. Revoked: O. Reg. 632/00, s. 7.

60. Revoked: O. Reg. 562/07, s. 1.

61.-66. Revoked: O. Reg. 632/00, s. 8.

67., 68. Revoked: O. Reg. 662/98, s. 1.

69. (1) Revoked: O. Reg. 423/01, s. 1.

(2) Revoked: O. Reg. 491/05, s. 2.

(3) Revoked: O. Reg. 662/98, s. 1.

(4), (5) Revoked: O. Reg. 657/98, s. 1.

70. Revoked: O. Reg. 423/01, s. 2.

71.-78. Revoked: O. Reg. 491/05, s. 3.

79. Revoked: O. Reg. 453/05, s. 2.

80.-82. Revoked: O. Reg. 632/00, s. 10.

83.-86. Revoked: O. Reg. 215/05, s. 5.

Statement of Portfolio Transactions

87.-94. Revoked: O. Reg. 215/05, s. 5.

95. (1) Where a trade is made in a security of a mutual fund under a contractual plan that requires that some charges be prepaid but permits other charges to be deducted from first and subsequent instalments, the confirmation of trade required by subsection 36 (3) of the Act shall contain, in addition to the requirements of subsections 36 (1) and (2) of the Act and clause 36 (3) (d) of the Act, the disclosure required by,

(a) clauses 36 (3) (a) and (b) of the Act in respect of sales, service or other charges or portions thereof that are prepaid; and

(b) clause 36 (3) (c) of the Act in respect of all sales, service or other charges or any portions thereof to be deducted from subsequent instalments. R.R.O. 1990, Reg. 1015, s. 95 (1).

(2) The confirmation of a trade made in a security of a mutual fund under a contractual plan shall not have been required to contain the information described in clause 36 (3) (d) of the Act where,

(a) the contractual plan was entered into prior to the 15th day of September, 1979;

(b) the holder of the contractual plan, in addition to the holder’s rights under section 137 of the Act and to any other rights to which the holder may have been entitled,

(i) was permitted, at any time within 365 days after the date upon which the contractual plan was entered into, to demand and to receive a refund of the net asset value of the shares or units credited to the holder prior to the date of demand, plus a refund of that portion of sales charges, exclusive of insurance premiums and fees to trustees of registered retirement savings plans, in excess of 30 per cent of an amount equal to payments under the plan scheduled and made prior to the date of demand, but not including voluntary prepayments of instalments, and

(ii) was provided with as form or letter, approved by the Director, describing rights under section 137 of the Act and under subclause (i) of this clause and setting out a table of sales charges and other information relevant to the decision of the investor as to whether to exercise such rights, which form or letter was to be sent to the investor together with each confirmation other than reinvested dividends or income during the first 365 days after the date upon which the contractual plan was entered into and was also sent to the investor not less than fifteen days and not more than forty-five days prior to the expiry of such 365-day period; or

(c) the holder of the contractual plan, in addition to rights under section 137 of the Act and to any other rights to which the holder may have been entitled,

(i) was permitted, at any time within 180 days after the date upon which the contractual plan was entered into, to have and to exercise the rights that would have arisen under section 137 of the Act if the reference to “sixty days” in subsection 137 (1) of the Act had read “180 days”, and

(ii) was provided with a form or letter, approved by the Director, describing rights under section 137 of the Act and under subclause (i) of this clause and setting out a table of sales charges and other information relevant to the decision of the investor as to whether to exercise such rights, which form or letter was to be sent to the investor together with each confirmation other than reinvested dividends or income during the first 180 days after the date upon which the contractual plan was entered into and was also sent to the investor not less than fifteen days and not more than forty-five days prior to the expiry of such 180-day period. R.R.O. 1990, Reg. 1015, s. 95 (2).

(3) Where a customer advises a registered dealer in writing before a trade in a security of a mutual fund of the customer’s participation in an automatic payment plan, automatic withdrawal plan or contractual plan that provides for systematic trading in the securities of the mutual fund no less frequently than monthly, the registered dealer shall provide the confirmation of that trade as required by section 36 of the Act, and thereafter during the continued existence of the plan and the customer’s participation in the plan, the registered dealer, in lieu of the confirmations of trade required by the said section 36, may send by prepaid mail or deliver to the customer, no less frequently than semi-annually, written summaries of trades containing the information required by the said section 36 to be disclosed to the customer, with respect to all trades of the security of the mutual fund by the customer since the last confirmation or summary of trade was prepared. R.R.O. 1990, Reg. 1015, s. 95 (3).

(4) A registered dealer who complies with subsection (3) need not comply with clause 36 (1) (d) of the Act if the confirmation or summary of trades contains a statement that the name of the person or company from or to or through whom the security of the mutual fund was bought or sold will be furnished to the customer upon request. R.R.O. 1990, Reg. 1015, s. 95 (4).

PART V

REGISTRATION REQUIREMENTS

96. In this Part,

“active assets” means money and the market value of assets readily convertible into money;

“adjusted liabilities” means total liabilities plus, where the securities accounts of the registrant are kept on a settlement date basis, any unrecorded securities purchase commitments, minus, without duplication, the sum of,

(a) cash,

(b) money on deposit in a client’s trust account,

(c) any amounts deposited by the registrant pursuant to a compensation fund or contingency trust fund established under section 110,

(d) the cash surrender value of life insurance where the registrant is the beneficiary,

(e) the market value of any securities that the registrant owns or has contracted to purchase, and that, in either case, have a margin rate of 5 per cent or less,

(f) interest accrued to the registrant in respect of the securities referred to in clause (e),

(g) the sales price of securities for which the registrant has a sales commitment to a financial institution,

(h) any debit balances with any financial institution, and

(i) the market value of securities that have a margin rate of 5 per cent or less included in,

(i) non-segregated accounts of clients, partners, shareholders, dealers, or

(ii) held as collateral for secured loans receivable,

not exceeding the debit balance of the account or the secured loan receivable;

“anniversary date” means the day and month on which the current registration or renewal of registration was granted, but where any doubt exists, such date shall be determined by the Director;

“capital” means money raised through the issuance of shares, certificates, bonds, debentures, long-term notes or any other long-term obligation, contributed or earned surplus and reserves;

“client’s trust account” means a trust account maintained by a registrant with a bank listed in Schedule I or II to the Bank Act (Canada) or a trust corporation registered under the Loan and Trust Corporations Act or substantially similar laws of Canada or one of its provinces or territories and designated as a client’s trust account;

“financial institution” means,

(a) the Government of Canada, the government of any province or territory of Canada, any municipal corporation, Crown corporation or public board or commission in Canada,

(b) the Bank of Canada, a bank listed in Schedule I or II to the Bank Act (Canada), any Quebec savings bank, and the pension funds of such banks,

(c) a trust corporation or insurance company if the company is licensed to do business in Canada and has a minimum paid up capital and surplus of $5,000,000, and the pension funds of such companies,

(d) a credit union or credit union league with a minimum paid up capital and surplus of $5,000,000,

(e) a mutual fund with net assets of $5,000,000, and

(f) a company, other than a dealer, having a minimum net worth of $25,000,000 on the last audited balance sheet, where the balance sheet is available for inspection by the Commission and any trusteed pension plan of such a company;

“free credit balances” includes money received from, or held for the account of, clients by a registrant,

(a) for investment pending the investment and payment for securities purchased by the clients from or through the registrant where the registrant does not own such securities at the time of purchase or has not purchased them on behalf of the client, pending the purchase thereof by the registrant, and

(b) as proceeds of securities purchased from clients or sold by the registrant for the account of clients where securities have been delivered to the registrant but payment has not been made pending payment of such proceeds to the clients;

“liquid capital” means the amount by which active assets exceed the sum of,

(a) total liabilities, and

(b) where the securities accounts of the registrant are recorded on a settlement date basis, any net loss on offsetting future purchase and sales commitments of securities,

and the amount of liquid capital may be increased by adding,

(c) the loan value of any securities delivered pursuant to a subordinated loan agreement in the form prescribed by the Commission that are not included in the accounts,

(d) non-current liabilities fully secured by mortgages on real estate owned by the registrant, and

(e) obligations for outstanding instalments due to natural resource companies whose securities the registrant is in the process of distributing or distributing to the public under prospectus filed with the Commission;

“loan value” means the market value of securities less the applicable margin requirements;

“margin”, “margin agreement”, “margin deficiency”, “margin rate” and “margin requirements” mean,

(a) subject to clause (b), the provisions in that regard determined pursuant to the by-laws of The Toronto Stock Exchange, or

(b) where used with respect to commodity futures contracts or cash commodities, the provisions in that regard prescribed under the Commodity Futures Act;

“market value” where used with respect to,

(a) a commodity futures contract means the settlement price on the relevant date or last trading day prior to the relevant date,

(b) a security means,

(i) where the security is listed and posted for trading on a stock exchange,

(A) the bid price, or

(B) if the security is sold short, the ask price,

as shown on the exchange quotation sheets as of the close of business on the relevant date or last trading date prior to the relevant date, as the case may be, subject to an appropriate adjustment where an unusually large or unusually small quantity of securities is being valued, or

(ii) where the security is not listed and posted for trading on a stock exchange, a value determined in accordance with section 97;

“minimum free capital” means the applicable amount determined in accordance with section 107;

“net free capital” means liquid capital after deducting,

(a) the amount required to provide full margin for,

(i) cash commodities, other than in respect of securities, owned by the registrant,

(ii) firm commodity futures trading accounts, and

(iii) securities owned by the registrant and securities sold short by the registrant,

(b) the amount sufficient to provide for any margin deficiencies on,

(i) secured loans receivable,

(ii) clients’ accounts in respect of commodity futures,

(iii) joint accounts after excluding any interest of any member of The Toronto Stock Exchange, the Investment Dealers’ Association of Canada and any financial institution,

(iv) accounts of partners and shareholders,

(v) accounts of clients and dealers, except,

(A) cash settlement accounts with any member of The Toronto Stock Exchange, The Montreal Stock Exchange, The Vancouver Stock Exchange, The Alberta Stock Exchange, The New York Stock Exchange, The American Stock Exchange and the Investment Dealers’ Association of Canada,

(B) accounts with a financial institution, and

(C) cash settlement accounts that have not been outstanding more than ten days past the normal settlement date, where the shares have been available for delivery, and not more than twenty-one days past the normal settlement date in any other case,

(vi) secured loans payable by the registrant if the collateral is held by other than the registrant or a financial institution,

(vii) where the securities accounts of the registrant are kept on a settlement date basis, future purchase and sales commitments not included in the calculation of liquid capital, and

(viii) any other liquid capital items;

“total liabilities” means all liabilities including,

(a) adequate provision for income taxes, and

(b) other accruals,

but excluding,

(c) debts the payment of which is postponed in favour of other creditors pursuant to a subordination agreement in a form approved by the Commission, and

(d) deferred income taxes relating to nonactive assets;

“working capital” means the excess of current assets over current liabilities. R.R.O. 1990, Reg. 1015, s. 96; O. Reg. 468/00, s. 1.

97. (1) Subject to subsections (2), (3) and (4), the market value of a security not listed and posted for trading on a stock exchange shall be determined by assigning a reasonable value on the basis of values shown on published market reports or inter-dealer quotation sheets on the relevant date or last trading day prior to the relevant date. R.R.O. 1990, Reg. 1015, s. 97 (1).

(2) The registrant may vary a value from that shown on published market reports or inter-dealer quotation sheets where, in light of all the circumstances, some other value would be more appropriate. R.R.O. 1990, Reg. 1015, s. 97 (2).

(3) The Director may require that a different value from that determined under subsection (1) or (2) be assigned, where in light of all the circumstances, some other value would be more appropriate. R.R.O. 1990, Reg. 1015, s. 97 (3).

(4) Where no published market report or inter-dealer quotation sheet exists with respect to the security, the security shall be assigned a market value of zero unless the Director agrees otherwise. R.R.O. 1990, Reg. 1015, s. 97 (4).

98. Every person or company that is required to register as a dealer shall be registered and classified into one or more of the following categories:

1. Broker, being a person or company that is registered to trade in securities in the capacity of an agent or principal, which person or company is a member of a stock exchange in Ontario recognized by the Commission.

2. Financial intermediary dealer, being a financial intermediary that is registered solely for the purpose of trading in securities in accordance with section 209.

3. Foreign dealer, being a person or a company that is registered solely for the purpose of trading in securities in accordance with section 210.

4. International dealer, being a person or company that is registered solely for the purpose of trading in securities in accordance with section 208.

5. Investment dealer, being a person or company that is a member, branch office member or associate member of the Ontario District of the Investment Dealers’ Association of Canada, which person or company engages in the business of trading in securities in the capacity of an agent or principal.

6. Limited market dealer, being a person or company that is registered solely for the purpose of trading in securities in accordance with Ontario Securities Commission Rule 31-503 Limited Market Dealers.

7. Mutual fund dealer, being a person or company that is registered solely for the purpose of trading in the shares or units of mutual funds.

8. Scholarship plan dealer, being a person or company that is registered solely for the purpose of trading in securities of a scholarship or educational plan or trust.

9. Securities dealer, being a person or company that is registered for trading in securities and engages in the business of trading in securities in the capacity of an agent or principal.

10. Security issuer, being an issuer that is registered for trading in securities for the purpose of distributing securities of its own issue solely for its own account. R.R.O. 1990, Reg. 1015, s. 98; O. Reg. 149/98, s. 1.

99. Every person or company that is required to register as an adviser shall be registered and classified into one or more of the following categories:

1. Financial advisers, being persons or companies that engage in or hold themselves out as engaging in the business of advising others as to investing in or the buying or selling of securities on a basis that does not require their classification in another category of adviser.

2. Investment counsel, being persons or companies that engage in or hold themselves out as engaging in the business of advising others as to the investing in or the buying or selling of specific securities or that are primarily engaged in giving continuous advice as to the investment of funds on the basis of the particular objectives of each client.

3. Portfolio managers, being persons or companies that are registered for the purpose of managing the investment portfolio of clients through discretionary authority granted by one or more clients.

4. Securities advisers, being persons or companies that hold themselves out as engaging in the business of advising others either through direct advice or through publications or writings, as to the investing in or the buying or selling of specific securities, not purporting to be tailored to the needs of specific clients.

5. International advisers (investment counsel, portfolio managers or securities advisers), being persons or companies that have registered under the Act in reliance on Ontario Securities Commission Rule 35-502 Non-Resident Advisers and that are,

i. investment counsel,

ii. investment counsel and portfolio managers, or

iii. securities advisers. R.R.O. 1990, Reg. 1015, s. 99; O. Reg. 601/00, s. 1.

100. (1) The registration of a mutual fund dealer, scholarship plan dealer or securities issuer authorizes the dealer or issuer to act as an underwriter for the sole purpose of distributing the securities that the dealer or issuer is registered to trade but not for any other purpose. O. Reg. 453/05, s. 3.

(2) The registration of a limited market dealer, international dealer or financial intermediary dealer authorizes the dealer to act as an underwriter for the sole purpose of making a distribution that the dealer is authorized to make by section 208 or 209 or Ontario Securities Commission Rule 31-503 Limited Market Dealers, as the case may be, but not for any other purpose. O. Reg. 453/05, s. 3.

101. (1) Where section 3.8 of National Instrument 45-106 Prospectus and Registration Exemptions applies and has been complied with, this Part as it relates to a portfolio manager does not apply to a broker or investment dealer acting as a portfolio manager. R.R.O. 1990, Reg. 1015, s. 101 (1); O. Reg. 491/05, s. 4.

(2) This Part applies to portfolio managers where they act as investment counsel. R.R.O. 1990, Reg. 1015, s. 101 (2).

(3) Subject to subsection (4), this Part does not apply to an international adviser (investment counsel, portfolio manager or securities adviser) except as provided in Ontario Securities Commission Rule 35-502 Non-Resident Advisers. O. Reg. 601/00, s. 2.

(4) Section 99 applies to an international adviser (investment counsel, portfolio manager or securities adviser). O. Reg. 601/00, s. 2.

Conditions of Registration — General

102. No registration or renewal of registration shall be granted unless the applicant has complied with the applicable requirements of this Regulation at the time of the granting of the registration or renewal of registration. R.R.O. 1990, Reg. 1015, s. 102.

103. Each registrant shall comply with the applicable requirements of this Regulation. R.R.O. 1990, Reg. 1015, s. 103.

104. (1) A registrant who is a registered dealer or adviser or a partner or officer of a registered dealer or adviser and who proposes to acquire, directly or indirectly, beneficial ownership of or control or direction over any security of another registered dealer or adviser shall give written notice of the proposed acquisition to the Director at least 30 days before the acquisition and shall provide with the notice all relevant facts to permit the Director to determine if the acquisition,

(a) is likely to give rise to conflicts of interest;

(b) is likely to hinder a registrant in complying with the conditions of registration applicable to it;

(c) is inconsistent with an adequate level of investor protection; or

(d) is otherwise prejudicial to the public interest. R.R.O. 1990, Reg. 1015, s. 104 (1); O. Reg. 453/05, s. 4 (1).

(2) If, within thirty days of the receipt of a notice under subsection (1), the Director gives a written notice of objection to the registrant, the registrant shall not make the acquisition until the Director approves it. R.R.O. 1990, Reg. 1015, s. 104 (2).

(3) The registrant, following receipt of a notice of objection under subsection (2), may request the Director to hold a hearing on the matter. R.R.O. 1990, Reg. 1015, s. 104 (3).

(4) Subsection (1) does not apply to,

(a) a partner or officer of a registered dealer or adviser who, alone or in combination with any other person or company, proposes to acquire securities that, together with the securities already beneficially owned or over which control or direction is already exercised, do not exceed more than 5 per cent of any class or series of securities of any other registered dealer or adviser that are listed and posted for trading on a stock exchange anywhere in the world;

(b) an acquisition by a financial intermediary dealer or its officers or an acquisition of securities of a financial intermediary dealer;

(c) an acquisition by an international dealer of securities of a dealer that is its only registered subsidiary; or

(d) an acquisition by a registered dealer in the ordinary course of its business of trading in securities. R.R.O. 1990, Reg. 1015, s. 104 (4); O. Reg. 453/05, s. 4 (2, 3).

105. The Commission may prescribe conditions of registration for a registrant or group of registrants that are in lieu of some or all of the conditions of registration prescribed in sections 108 to 123, sections 125 to 127 and sections 139 to 147, where it gives prior notice of the proposed conditions to registrants affected and affords the registrant an opportunity to be heard and the Commission publishes notice in a publication published by the Commission of each instance when it so prescribes. R.R.O. 1990, Reg. 1015, s. 105.

106. Every registered dealer that is a reporting issuer shall comply with the applicable conditions of registration under the Act and this Regulation. R.R.O. 1990, Reg. 1015, s. 106.

Conditions of Registration — Capital Requirements

107. (1) Subject to subsection (2), every dealer, other than a securities issuer, shall maintain a minimum free capital of the maximum amount, if any, that is deductible under any clause of the bonding or insurance policy required under section 108, plus the greater of,

(a) $25,000; and

(b) an amount equal to the sum of 10 per cent of the first $2,500,000 of adjusted liabilities, 8 per cent of the next $2,500,000 of adjusted liabilities, 7 per cent of the next $2,500,000 of adjusted liabilities, 6 per cent of the next $2,500,000 of adjusted liabilities and 5 per cent of adjusted liabilities in excess of $10,000,000. R.R.O. 1990, Reg. 1015, s. 107 (1).

(2) Every dealer, other than a securities issuer, who is also registered as a futures commission merchant under the Commodity Futures Act, shall maintain a minimum free capital of the maximum amount, if any, that is deductible under any clause of the bonding or insurance policy required under section 108 and under the corresponding provision under the Commodity Futures Act, plus the greater of,

(a) $75,000 of net free capital calculated in accordance with Form 9; and

(b) the amount calculated in accordance with clause 14 (1) (b) of Regulation 90 of the Revised Regulations of Ontario, 1990, subject to subsection 14 (2) thereof. R.R.O. 1990, Reg. 1015, s. 107 (2).

(3) Every adviser shall maintain a minimum free capital of the maximum amount, if any, that is deductible under any clause of the bonding or insurance policy required under section 108 plus $5,000 of working capital calculated in accordance with generally accepted accounting principles or such greater amount as the Director considers necessary where the adviser exercises control over clients’ funds or securities. R.R.O. 1990, Reg. 1015, s. 107 (3).

(4) Subsection (3) does not apply to an adviser who provides written or published advice if the adviser exercises no control over clients’ funds or securities and if no investment advice is or purports to be tailored to the needs of specific clients. R.R.O. 1990, Reg. 1015, s. 107 (4).

(5) Revoked: O. Reg. 453/05, s. 5.

(6) In clause (1) (a), $25,000 means,

(a) where it applies to a mutual fund dealer or a scholarship plan dealer, $25,000 of working capital calculated in accordance with generally accepted accounting principles; and

(b) where it applies to any other category of dealer other than a securities issuer, $25,000 of net free capital calculated in accordance with Form 9. R.R.O. 1990, Reg. 1015, s. 107 (6).

108. (1) Except where the Director is satisfied in a particular case that reduced or no coverage would not be prejudicial to the public interest, every dealer, other than a mutual fund dealer and a security issuer, shall maintain bonding or insurance, by means of a broker’s blanket bond on terms acceptable to the Director, in an amount of not less than $200,000, or such larger amount as is indicated to be necessary by the resolution referred to in subsection (4). R.R.O. 1990, Reg. 1015, s. 108 (1).

(2) Every mutual fund dealer shall maintain bonding or insurance, on terms acceptable to the Director,

(a) for employees in an amount not less than $50,000 for each employee, or such larger amount as is indicated to be necessary by the resolution referred to in subsection (4);

(b) for itself in an amount to be determined by the Director. R.R.O. 1990, Reg. 1015, s. 108 (2).

(3) Except where the Director is satisfied in a particular case that reduced or no coverage would not be prejudicial to the public interest, every security issuer and every adviser shall maintain bonding or insurance, on terms acceptable to the Director, in an amount of not less than $10,000, or such larger amount as is indicated to be necessary by the resolution referred to in subsection (4). R.R.O. 1990, Reg. 1015, s. 108 (3); O. Reg. 453/05, s. 6 (1).

(4) Every person or company applying for registration or renewal of registration as a dealer or adviser shall deliver to the Director, with the application, a certified copy of a resolution of its directors stating that full consideration has been given to the amount of bonding or insurance necessary to cover insurable risks in the business of the applicant and that either,

(a) the minimum amount of coverage required by this Regulation is sufficient; or

(b) the minimum amount of coverage required by this Regulation is not sufficient but that an indicated amount of coverage would be sufficient. R.R.O. 1990, Reg. 1015, s. 108 (4); O. Reg. 453/05, s. 6 (2).

(5) No registration or renewal of registration shall be granted where in the opinion of the Director the minimum amount of bonding or insurance required by this Regulation or, where a larger amount is indicated in a certified copy of a resolution referred to in subsection (4), the amount stated in the resolution, is not sufficient. R.R.O. 1990, Reg. 1015, s. 108 (5).

(6) The Director may exempt registrants who are members of a recognized self-regulatory organization referred to in section 21.1 of the Act or a recognized stock exchange from compliance with subsection (4) if the Director is satisfied that the registrant is subject to requirements imposed by that organization or exchange that provide at least equal protection for clients to the protection provided under subsection (4). O. Reg. 453/05, s. 6 (3).

109. Every registrant shall forthwith notify the Commission in writing of any change in, or claim made under, the provisions of any bond or insurance policy maintained pursuant to the requirements of this Part. R.R.O. 1990, Reg. 1015, s. 109.

110. (1) Every dealer, other than a security issuer, shall participate in a compensation fund or contingency trust fund approved by the Commission and established by,

(a) a recognized self-regulatory organization referred to in section 21.1 of the Act;

(b) a recognized stock exchange; or

(c) a trust corporation registered under the Loan and Trust Corporations Act. O. Reg. 453/05, s. 7.

(2) The Commission may vary the amount required to be contributed by any participant where in its opinion it would not be prejudicial to the public interest to do so, provided that the variation is published by the Commission in a publication published by it prior to the variation taking effect. R.R.O. 1990, Reg. 1015, s. 110 (2).

111. At the request of the Commission, a registrant shall enter into a subordination agreement in the form prescribed by the Commission. R.R.O. 1990, Reg. 1015, s. 111.

112. The financial statements and reports required under sections 139 to 142 shall be reported upon by a person, acceptable to the Commission, who is the auditor of the registrant or is an accountant eligible for appointment as the auditor. R.R.O. 1990, Reg. 1015, s. 112.

Conditions of Registration — Record Keeping

113. (1) Every registrant shall maintain books and records necessary to record properly its business transactions and financial affairs. R.R.O. 1990, Reg. 1015, s. 113 (1).

(2) All records may be kept by means of mechanical, electronic or other devices where such method of record keeping is not prohibited under other applicable legislation and the registrant,

(a) takes adequate precautions, appropriate to the means used, to guard against the risk of falsification of the information recorded; and

(b) provides a means for making the information available in an accurate and intelligible form within a reasonable time to any person lawfully entitled to examine the records. R.R.O. 1990, Reg. 1015, s. 113 (2).

(3) Without restricting the generality of subsection (1), a registrant shall maintain each of the following books and records that, in the opinion of the Director, are appropriate to its business:

1. Blotters, or other records of original entry, containing an itemized daily record of all purchases and sales of securities, all receipts and deliveries of securities, including certificate numbers, all receipts and disbursements of cash, all other debits and credits, the account for which each transaction was effected, the name of the securities, the class or designation of the securities, the number or value of the securities, the unit and aggregate purchase or sale price, if any, the trade date and the name or other designation of the person from whom the securities were purchased or received or to whom they were sold or delivered.

2. Ledgers or other records maintained in detail reflecting all the assets and liabilities, income and expense and capital accounts.

3. Ledger accounts or other records itemizing separately for each cash and margin account of every client, all purchases, sales, receipts, and deliveries of securities and commodities for the account and all other debits and credits to the account.

4. Ledgers or other records reflecting,

i. securities in transfer,

ii. dividends and interest received,

iii. securities borrowed and securities loaned,

iv. money borrowed and money loaned, together with a record of the collateral therefor and any substitutions in the collateral, and

v. securities which the registrant has failed to receive and failed to deliver.

5. A securities record or ledger showing separately for each security as of the trade date or settlement date all long and short positions, including securities in safekeeping, carried for the registrant’s account or for the account of clients, the location of all securities long and the position offsetting securities sold short and, in all cases, the name or designation of the account in which each position is carried.

6. An adequate record of each order and of any other instruction, which may be a copy of the order or instruction, given or received for the purchase or sale of securities, whether executed or unexecuted, showing,

i. the terms and conditions of the order or instruction and of any modification or cancellation of the order or instruction,

ii. the account to which the order or instruction relates,

iii. where the order or instruction is placed by an individual other than,

A. the person in whose name the account is operated, or

B. an individual duly authorized to place orders or instructions on behalf of a customer that is a company,

the name, sales number or designation of the individual placing the order or instruction,

iv. the time of the entry of the order or instruction, and, where the order is entered pursuant to the exercise of discretionary power of a registrant or any employee of a registrant, a statement to that effect,

v. the price at which the order or instruction was executed, and

vi. to the extent feasible, the time of execution or cancellation.

7. Copies of confirmations or other records of all purchases and sales of securities required by section 36 of the Act and copies of notices of all other debits and credits of securities, cash and other items for the accounts of clients.

8. Subject to section 1.5 of Ontario Securities Commission Rule 31-505 Conditions of Registration, a client record in respect of each cash and margin account containing,

i. the name and address of the beneficial owner and the guarantor, if any, of the account,

ii. where trading instructions are accepted from a person or company other than the client, written authorization or ratification from the client naming the person or company, and

iii. in the case of a margin account, a properly executed margin agreement containing the signature of the owner and the guarantor, if any, and the additional information obtained under section 115 of this Regulation and sections 1.2, 1.5 and 1.6 of Ontario Securities Commission Rule 31-505 Conditions of Registration,

but, in the case of a joint account or an account of a corporation, such records are required only in respect of the person or persons authorized to transact business for the account.

9. A record of all puts, calls, spreads, straddles and other options in which the registrant has any direct or indirect interest or which the registrant has granted or guaranteed, containing at least an identification of the security and the underlying security and the number of underlying securities to which the put, call, spread, straddle or other option relates.

10. A record of the proof of money balances of all ledger accounts in the form of trial balances and a record of a reasonable calculation of minimum free capital, adjusted liabilities and capital required, prepared for each month within a reasonable time after the month. R.R.O. 1990, Reg. 1015, s. 113 (3); O. Reg. 453/05, s. 8.

(4) Unless otherwise required by applicable legislation to be maintained for a longer period of time,

(a) records relating to unexecuted orders or instructions as prescribed in paragraph 6 of subsection (3) and confirmations prescribed in paragraph 7 of the said subsection (3), shall be maintained for a period of at least two years; and

(b) documents relating to executed orders or instructions as prescribed in paragraph 6 of subsection (3), shall be maintained for a period of at least five years and shall be retained in a readily accessible location for the first two years of that five-year period. R.R.O. 1990, Reg. 1015, s. 113 (4).

(5) Subject to subsection (6), every registrant shall maintain the situs of its books and records in Ontario. R.R.O. 1990, Reg. 1015, s. 113 (5).

(6) Where the head office of the registrant is not in Ontario, the registrant shall maintain in Ontario such books and records as are necessary to record properly its business transactions and financial affairs in Ontario. R.R.O. 1990, Reg. 1015, s. 113 (6).

Conditions of Registration — New Accounts and Supervision

114. Revoked: O. Reg. 1/99, s. 1.

115. (1) Every investment counsel shall maintain standards directed to ensuring fairness in the allocation of investment opportunities among the investment counsel’s clients and a copy of the policies established shall be furnished to each client and filed with the Commission. R.R.O. 1990, Reg. 1015, s. 115 (1).

(2) Every investment counsel shall charge clients directly for the investment counsel’s services and such charge may be based upon the dollar value of the client’s portfolio, but not on the value or volume of the transactions initiated for the client and, except with the written agreement of the client, shall not be contingent upon profits or performance. R.R.O. 1990, Reg. 1015, s. 115 (2).

(3) Subject to subsection (4), every investment counsel shall ensure that,

(a) the account of each client is supervised separate and distinct from other clients; and

(b) except in the case of mutual funds or pension funds, an order placed on behalf of one account is not pooled with that of another account. R.R.O. 1990, Reg. 1015, s. 115 (3).

(4) A portfolio manager shall ensure that the account of each client is supervised, separate and distinct from other clients but, subject to the by-laws of The Toronto Stock Exchange with respect to commission rate structure, an order placed on behalf of one account may be pooled with that of another account. R.R.O. 1990, Reg. 1015, s. 115 (4).

(5) Where there has been a material change in the ownership or control of the investment counsel or where it is proposed that an investment counsel sell or assign the account of a client in whole or in part to another registrant, the investment counsel shall, prior to such sale or assignment and immediately after such material change, give a written explanation to the client of the proposal or change and shall inform the client of the client’s right to withdraw the client’s account. R.R.O. 1990, Reg. 1015, s. 115 (5).

(6) No purchase or sale of any security in which an investment counsel or any partner, officer or associate of an investment counsel has a direct or indirect beneficial interest shall be made from or to any portfolio managed or supervised by the investment counsel. R.R.O. 1990, Reg. 1015, s. 115 (6).

(7) Subsection (6) does not apply in the case of an investment counsel who is acting as a portfolio manager of an investment fund, with respect to a purchase or sale of a security referred to in subsection 6.1 (2) of National Instrument 81-107 Independent Review Committee for Investment Funds if the purchase or sale is made in accordance with that subsection. O. Reg. 500/06, s. 1.

Conditions of Registration — Segregation of Funds and Securities

116. (1) Securities that are held by a registrant for a client pursuant to a written safekeeping agreement and that are unencumbered shall be kept apart from all other securities and be identified as being held in safekeeping for a client in the registrant’s security position record, client’s ledger and statement of account. R.R.O. 1990, Reg. 1015, s. 116 (1).

(2) Securities held under subsection (1) may be released only on an instruction from the client and not solely because the client has become indebted to the registrant. R.R.O. 1990, Reg. 1015, s. 116 (2).

117. (1) Securities held by a registrant for a client that are unencumbered and that are either fully paid for or are excess margin securities but that are not held pursuant to a written safekeeping agreement shall be,

(a) segregated and identified as being held in trust for the client; and

(b) described as being held in segregation on the registrant’s security position record, client’s ledger and statement of account. R.R.O. 1990, Reg. 1015, s. 117 (1).

(2) Segregated securities may be used by the registrant, by sale or loan, whenever a client becomes indebted to a registrant but only to the extent reasonably necessary to cover the indebtedness. R.R.O. 1990, Reg. 1015, s. 117 (2).

(3) Bulk segregation of securities described in subsection (1) is permissible. R.R.O. 1990, Reg. 1015, s. 117 (3).

118. Clients’ free credit balances, where satisfactory arrangements concerning bonding or insurance have not been made and approved by the Commission, shall be deposited in a client’s trust account and properly identified forthwith upon their receipt by the registrant. R.R.O. 1990, Reg. 1015, s. 118.

119. Subscriptions or prepayments held pending investment by mutual fund dealers, securities advisers or investment counsel shall be segregated in a trust account and not commingled with the assets of the dealer, adviser or counsel. R.R.O. 1990, Reg. 1015, s. 119.

120. (1) Where a registrant maintains a securities account and a commodity futures account for the same client and where the securities account contains a free credit balance and the commodity futures account contains a debit balance of $5,000 or more, the registrant shall transfer to the commodity futures account as much of the free credit balance in the securities account as is necessary to eliminate or, if the free credit balance is less than the debit balance, to reduce to the greatest extent possible the debit balance in the commodity futures account. R.R.O. 1990, Reg. 1015, s. 120 (1).

(2) Subsection (1) does not apply to a registrant in respect of a client’s securities and commodity futures accounts where the client has directed the registrant, in writing or orally, if subsequently confirmed in writing,

(a) to transfer an amount that is less than the amount otherwise required to be transferred under that subsection; or

(b) not to transfer any amount,

from the securities account to the commodity futures account. R.R.O. 1990, Reg. 1015, s. 120 (2).

(3) For the purposes of this section, “free credit balance” does not include money in a client’s securities account that is committed to be used on a specific settlement date as payment for securities where the registrant who maintains the securities account prepares financial statements on a settlement date basis. R.R.O. 1990, Reg. 1015, s. 120 (3).

121. A registrant who maintains a securities account and a commodity futures account for the same client may make a transfer of any amount of a free credit balance from the securities account to the commodity futures account of the client if,

(a) the transfer is made in accordance with a written agreement between the registrant and the client; and

(b) the transfer is not a transfer referred to in section 120. R.R.O. 1990, Reg. 1015, s. 121.

122. The Director may exempt registrants who are members of the Ontario District of the Investment Dealers’ Association of Canada or The Toronto Stock Exchange from compliance with sections 115 to 121 where the Director is satisfied that the registrant is subject to requirements imposed by one or both of those organizations that provide protection for clients at least equal to that under the said sections 116 to 121. R.R.O. 1990, Reg. 1015, s. 122.

Conditions of Registration — Statements of Account and Portfolio

123. (1) Subject to subsection (5), a dealer shall send a statement of account to each client at the end of each month in which the client has effected a transaction, where there is a debit or credit balance or securities held. R.R.O. 1990, Reg. 1015, s. 123 (1).

(2) Subject to subsection (5), where a client has not effected a transaction but there are either funds or securities held by the dealer on a continuing basis, the dealer shall forward a statement of account to the client showing any debit or credit balance and the details of any securities held or owned not less than once every three months. R.R.O. 1990, Reg. 1015, s. 123 (2).

(3) The Director may vary subsections (1) and (2) as they apply to any dealer. R.R.O. 1990, Reg. 1015, s. 123 (3).

(4) The statements required by subsections (1) and (2) must list the securities held for the client and indicate clearly which securities are held for safekeeping or in segregation. R.R.O. 1990, Reg. 1015, s. 123 (4).

(5) A mutual fund dealer is not required to comply with subsections (1) and (2) where a statement of account is sent to each client not less frequently than once every twelve months, showing the number and market value at the date of purchase or redemption of securities purchased or redeemed during the period since the date of the last statement sent under this subsection and showing the total market value of all securities of the mutual fund held by the client at the date of the statement. R.R.O. 1990, Reg. 1015, s. 123 (5).

(6) Except where the client has expressly directed otherwise, every portfolio manager shall send to each client not less than once every three months, a statement of the portfolio of such client under the portfolio manager’s management. R.R.O. 1990, Reg. 1015, s. 123 (6).

Conditions of Registration — Proficiency Requirements

124. Revoked: O. Reg. 468/00, s. 2.

125. Revoked: O. Reg. 1/99, s. 1.

126. Revoked: O. Reg. 468/00, s. 3.

127. (1) Subject to subsection (2), no individual shall be granted registration or renewal of registration as a salesperson unless the individual is employed full-time as a salesperson. R.R.O. 1990, Reg. 1015, s. 127 (1).

(2) Subsection (1) does not apply to an individual granted registration or renewal of registration where,

(a) the individual is a part-time student enrolled in a business, commercial or financial course;

(b) the individual is a full-time student enrolled in a business, commercial or financial course and satisfies the Director that he or she has a present intention of continuing a career in the investment business;

(c) the individual is otherwise employed for six months or less during the calendar year and while so employed is not employed as a salesperson;

(d) the individual is carrying on a hobby, recreational or cultural activity which in the opinion of the Director will not interfere with the individual’s duties and responsibilities as a salesperson;

(e) in the case of a salesperson employed by a mutual fund dealer, the area in which the individual is to be employed is in the opinion of the Director so remote and sparsely populated that full-time employment as a salesperson is not economically feasible;

(f) the individual holds a licence as an insurance agent under the Insurance Act or a licence as an investment contract sales agent under the Investment Contracts Act and is in the employ or under the sponsorship of the dealer who proposes to employ the individual;

(g) with the written consent of the dealer employing the individual and the Director, the individual is employed outside normal working hours and there is no conflict of interest arising from the individual’s duties as a salesperson and the individual’s outside employment;

(h) the individual is carrying on an activity which in the opinion of the Director and the employer will not in the circumstances interfere with his or her duties and responsibility as a salesperson and there is no conflict of interest arising from the individual’s duties as a salesperson and his or her outside activity; or

(i) the individual is registered under the Commodity Futures Act. R.R.O. 1990, Reg. 1015, s. 127 (2).

128. Revoked: O. Reg. 393/01, s. 1.

129. Revoked: O. Reg. 16/03, s. 1.

130. (1) Subject to subsections (2) and (2.1) and except as otherwise provided in Ontario Securities Commission Rule 31-502 Proficiency Requirements for Registrants, every registration and renewal of registration is suspended at the end of the day preceding the first anniversary of the granting of the registration or renewal of registration, as the case may be. R.R.O. 1990, Reg. 1015, s. 130 (1); O. Reg. 249/92, s. 3 (1); O. Reg. 468/00, s. 4.

(2) The registration or renewal of registration of every salesperson, partner and officer of a registered dealer is suspended at the same time as the registration or renewal of registration of the registered dealer is suspended. R.R.O. 1990, Reg. 1015, s. 130 (2).

(2.1) In the event of an amalgamation or merger of two or more registrants, the registration or renewal of registration of the successor registrant is suspended at the end of the day preceding the first anniversary of the latest of the dates on which registration or renewal of registration was granted to each of the predecessor registrants. O. Reg. 249/92, s. 3 (2).

(3) Every application for renewal of registration shall be filed no later than thirty days before the date on which the registration or renewal of registration is suspended. R.R.O. 1990, Reg. 1015, s. 130 (3).

131. (1) Subject to subsection (2), the registration of a registered dealer, salesperson, partner or officer that is suspended under section 130 expires on the second anniversary of the suspension unless, in the interim, an application for renewal satisfactory to the Director is filed. R.R.O. 1990, Reg. 1015, s. 131 (1).

(2) Where a hearing is commenced under section 27 of the Act, the registration of the registered dealer, salesperson, partner or officer that has been suspended under section 130 continues in suspension until a decision has been made by the Commission. R.R.O. 1990, Reg. 1015, s. 131 (2).

132. (1) Unless the Director permits or requires otherwise, and, subject to subsection (2), every application for renewal of registration as a dealer or adviser shall be by way of a letter filed with the Director requesting renewal of registration. R.R.O. 1990, Reg. 1015, s. 132 (1); O. Reg. 453/05, s. 9.

(2) Subject to subsection (3), where the information filed by the applicant in the last application for registration has changed and particulars of such change have not been filed with the Commission as an application for amendment or renewal of registration, an application for renewal of registration shall be prepared in accordance with Form 5. R.R.O. 1990, Reg. 1015, s. 132 (2).

(3) Where the information that has changed is that required in an exhibit required by clause (b) of Item 10 of Form 3 and is for a person in respect of whom a similar exhibit has been filed by the applicant with a Securities Commission or Administrator in a province or territory of Canada in which the principal office of the applicant is situate, the exhibit is not required for the person, where the full name of the person and the place that the exhibit has been so filed are stated. R.R.O. 1990, Reg. 1015, s. 132 (3).

133. (1) Unless the Director permits or requires otherwise, and subject to subsection (2), an application for renewal of registration as a salesperson shall be by way of letter filed with the Director requesting renewal of registration. R.R.O. 1990, Reg. 1015, s. 133 (1).

(2) Where the information filed by the applicant in the last application for registration has changed and particulars of such change have not been filed with the Commission as an application for amendment or renewal of registration, an application for renewal of registration shall be prepared in accordance with Form 6. R.R.O. 1990, Reg. 1015, s. 133 (2).

134. A summons for an examination under section 31 of the Act shall be in Form 8. R.R.O. 1990, Reg. 1015, s. 134.

135. Revoked: O. Reg. 453/05, s. 10.

136. Revoked: O. Reg. 16/03, s. 3.

137., 138. Revoked: O. Reg. 453/05, s. 10.

Reporting to Ontario Securities Commission

139. Every mutual fund dealer who is not a member in good standing of a self-regulatory organization that is recognized by the Commission under section 21.1 of the Act, every adviser and every scholarship plan dealer shall deliver to the Commission, not more than 90 days after the end of each financial year of the dealer or adviser, a copy of its financial statements for the year. O. Reg. 453/05, s. 11.

140. The financial statements required to be delivered under section 139 shall include,

(a) an income statement, a statement of surplus and a statement of changes in financial position, each for the financial year; and

(b) a balance sheet as at the end of the financial year, signed by one director of the registrant. R.R.O. 1990, Reg. 1015, s. 140.

141. Every mutual fund dealer who is not a member in good standing of a self-regulatory organization that is recognized by the Commission under section 21.1 of the Act and every scholarship plan dealer shall deliver a report prepared in accordance with Statement C of Form 9 to the Commission not more than 90 days after the end of each financial year of the dealer. O. Reg. 453/05, s. 12.

142. Every securities dealer who is not a member in good standing of a self-regulatory organization that is recognized by the Commission under section 21.1 of the Act shall deliver a report prepared in accordance with Form 9 to the Commission not more than 90 days after the end of each financial year of the dealer. O. Reg. 453/05, s. 12.

143. Form 10 may be used as a guideline for the purpose of assisting in the auditing of the financial statements of a portfolio manager. R.R.O. 1990, Reg. 1015, s. 143.

144. The report required by section 142 shall be audited in accordance with generally accepted auditing standards and the audit requirements published by the Commission. R.R.O. 1990, Reg. 1015, s. 144.

145. (1) Every registrant that is not a member in good standing of a self-regulatory organization that is recognized by the Commission under section 21.1 of the Act or a recognized stock exchange shall issue a direction to its auditor instructing the auditor to conduct any audit requested by the Commission or the Director during its registration and shall deliver a copy of the direction to the Commission,

(a) with its application for registration; and

(b) immediately after the registrant changes its auditor. R.R.O. 1990, Reg. 1015, s. 145 (1); O. Reg. 453/05, s. 13.

(2) Where the Commission or the Director requests an auditor to conduct an audit of the financial affairs of a registrant in accordance with a direction referred to in subsection (1), all fees related to the audit shall be paid by the registrant. R.R.O. 1990, Reg. 1015, s. 145 (2).

146. Every audit under section 21.10 of the Act shall satisfy the audit requirements published by the Commission, in addition to the requirements in that section, and in the event of a conflict, the requirements of section 21.10 prevail. O. Reg. 453/05, s. 14.

147. (1) Revoked: O. Reg. 453/05, s. 15 (1).

(2) No registrant shall withhold, destroy or conceal any information or documents or otherwise fail to cooperate with a reasonable request made by an auditor of a registrant in the course of an audit under section 21.10 of the Act. R.R.O. 1990, Reg. 1015, s. 147 (2); O. Reg. 453/05, s. 15 (2).

148. Revoked: O. Reg. 491/05, s. 6.

149. Revoked: O. Reg. 424/01, s. 1.

150., 151. Revoked: O. Reg. 491/05, s. 7.

PART VI

OVER-THE-COUNTER TRADING

152. In this Part,

“approved market-maker” means a registered dealer who is approved under this Regulation to act as a market-maker in a security;

“COATS security” means,

(a) a share of a company,

(b) a right or warrant, but not an option, to purchase a share of a company, or

(c) any combination of a share of a company and a right or warrant, but not an option, to purchase a share of a company,

but does not include,

(d) a security of a private issuer as defined in subsection 2.4 (1) of National Instrument 45-106 Prospectus and Registration Exemptions,

(d.1) a security that, under subsection 2.13 (1), 2.20 (1), 2.21 (1), 2.34 (2), 2.35 (1), 2.36 (2), 2.37 (1) or 2.38 (1) of National Instrument 45-106 Prospectus and Registration Exemptions, is exempt from registration,

(d.2) a security that, under subsection 2.4 (1), 2.5 (1) or 2.6 (1) or (2) of Ontario Securities Commission Rule 45-501 Ontario Prospectus and Registration Exemptions, is exempt from registration, or

(d.3) Revoked: O. Reg. 491/05, s. 8 (3).

(e) a security that is traded on a marketplace as defined in National Instrument 21-101 Marketplace Operation;

“COAT System” means the system developed for trading in the over-the-counter market and known as the Canadian Over-the-Counter Automated Trading System. R.R.O. 1990, Reg. 1015, s. 152; O. Reg. 393/01, s. 2; O. Reg. 424/01, s. 2; O. Reg. 491/05, s. 8.

153. The Commission, itself or through an agent, shall operate the COAT System and for such purpose it shall develop computer software and provide and operate computer facilities. R.R.O. 1990, Reg. 1015, s. 153.

154. (1) Every purchase or sale in Ontario of a COATS security made by a registered dealer, as principal or agent, shall be reported on the COAT System except a trade that is,

(a) made through the facilities of a stock exchange or other organized market recognized by the Commission for the purpose of this Part;

(b) a distribution by or on behalf of an issuer; or

(c) a trade made in reliance on an exemption set out in section 2.3, 2.7, 2.8, 2.10 or 2.15 of National Instrument 45-106 Prospectus and Registration Exemptions. R.R.O. 1990, Reg. 1015, s. 154 (1); O. Reg. 424/01, s. 3; O. Reg. 491/05, s. 9.

(2) Every purchase or sale in a COATS security that is required to be reported under subsection (1) shall be reported on the COAT System in accordance with the following provisions:

1. The registered dealer, if any, through or by whom the sale is made shall report the trade.

2. Where the sale is not made by or through a registered dealer, the registered dealer by or through whom the purchase is made shall report the trade.

3. The report shall be made in accordance with the requirements of the COAT System. R.R.O. 1990, Reg. 1015, s. 154 (2).

155. (1) A registered dealer, other than a security issuer, mutual fund dealer or scholarship plan dealer, may apply to the Director for approval to act as a market-maker in a COATS security of a class that trades in Ontario. R.R.O. 1990, Reg. 1015, s. 155 (1).

(2) An application for approval to act as a market-maker in a security shall be in Form 41 and shall be filed with the Director. R.R.O. 1990, Reg. 1015, s. 155 (2).

156. (1) A registered dealer shall not post quotations for a security on the COAT System,

(a) unless the dealer has been approved by the Director to act as a market-maker in the security;

(b) until the day and time set out in the Director’s approval; and