O. Reg. 33/98: PRESCRIBED TAX - INTERNATIONAL BRIDGES, Under: Municipal Act, 2001, S.O. 2001, c. 25

Municipal Act, 2001

Loi de 2001 sur les municipalités

ontario REGULATION 33/98

formerly under Municipal Act

PRESCRIBED TAX — INTERNATIONAL BRIDGES

Consolidation Period: From December 19, 2002 to the e-Laws currency date.

Last amendment: 386/02.

Legislative History: 248/98, 386/02.

This Regulation is made in English only.

1. The prescribed amount for a taxation year for the purposes of subsection 320 (2) of the Act is 0.5 per cent times the assessment made under the Assessment Act in the year for the land used for the purposes of the bridge or tunnel. O. Reg. 33/98, s. 1; O. Reg. 248/98, s. 1; O. Reg. 386/02, s. 1.

2. Despite section 1, the maximum prescribed amount payable under that section with respect to a bridge or tunnel in a taxation year is $40,000. O. Reg. 33/98, s. 2.

3. The following bridges are prescribed for the purposes of subsection 320 (3) of the Act:

1. The Ambassador bridge having an Ontario portion located in the City of Windsor.

2. The Fort Frances-International Falls bridge having an Ontario portion located in the Town of Fort Frances. O. Reg. 33/98, s. 3; O. Reg. 386/02, s. 2.

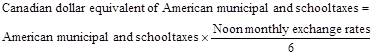

4. For the purposes of paragraph 1 of subsection 320 (3) of the Act, the American municipal and school taxes in a year shall be converted to Canadian dollars as follows:

where,

“Noon monthly exchange rates” means the aggregate of the noon monthly exchange rates for the months from January to June in a year published under Schedule II in the Bank of Canada review first issued after June in that year.

O. Reg. 33/98, s. 4; O. Reg. 248/98, s. 2; O. Reg. 386/02, s. 3.