R.R.O. 1990, Reg. 677: VARIABLE INSURANCE CONTRACTS, ISSUED BEFORE JULY 1, 1997, WITH INSURERS NO LONGER ISSUING THEM, Insurance Act

Insurance Act

Loi sur les assurances

R.R.O. 1990, REGULATION 677

VARIABLE INSURANCE CONTRACTS, ISSUED BEFORE JULY 1, 1997, WITH INSURERS NO LONGER ISSUING THEM

Note: This Regulation was revoked on January 1, 2026. (See: O. Reg. 369/25, s. 1)

Last amendment: 369/25.

Legislative History: 133/97, 369/25.

This Regulation is made in English only.

1. In this Regulation,

“fund” means a separate and distinct segregated fund maintained by an insurer authorized to transact the business of life insurance in respect of the non-guaranteed benefits of a variable insurance contract;

“independent qualified appraiser” means a qualified appraiser who is not in full-time employment of the insurer whose fund is being valued, or any associate or affiliated companies of the insurer;

“qualified appraiser” means a person who,

(a) is a member in good standing for a continuous period of not less than two years of,

(i) The Appraisal Institute of Canada and has been designated as a member (C.R.A.) or accredited member (A.A.C.I.),

(ii) The Royal Institute of Chartered Surveyors (Britain) and has been designated A.R.I.C.S. or F.R.I.C.S. under its Valuation Subdivision,

(iii) The American Institute of Real Estate Appraisers and has been designated M.A.I.,

(iv) The Society of Residential Appraisers, or

(v) Corporation des Évaluateurs Agréés du Québec, or

(b) has been employed or in public practice primarily as a property appraiser for a period of not less than five years. R.R.O. 1990, Reg. 677, s. 1.

2. This Regulation applies only with respect to a variable insurance contract issued before July 1, 1997 that is with an insurer that no longer issues or offers to enter into such contracts. O. Reg. 133/97, s. 2.

3. Revoked: O. Reg. 133/97, s. 2.

4. Revoked: O. Reg. 133/97, s. 2.

5. Revoked: O. Reg. 133/97, s. 2.

6. Revoked: O. Reg. 133/97, s. 2.

7. The insurer shall furnish, at least annually, a statement to the insured showing,

(a) the amount, if any, allocated under the contract to the fund during the period covered by the statement;

(b) the value of the benefits related to the market value of the fund at the end of the period covered by the statement;

(c) the information required by Form 6, together with the amount of the charges, or the percentage rate of charges to the fund for taxes, management or other expenses, but excluding brokerage commissions, brokerage fees, transfer taxes and other expenses normally added to the cost of investments acquired or deducted from the proceeds of investments sold;

(d) in summary form, where mortgages are held in the fund to the extent that more than 15 per cent of the market value of the fund is invested in mortgages, an analysis of the mortgage portfolio by,

(i) location — (i.e., province),

(ii) class — (i.e., whether single-family residential, multiple-family dwelling up to four units, other residential, apartment, industrial, commercial, agricultural, NHA apartment, NHA other, insured or conventional),

(iii) market value — (i.e., indicate amount —

less than $50,000

$50,000 or more and less than $250,000

$250,000 or more and less than $500,000

$500,000 or more and less than $1,000,000

$1,000,000 or more),

(iv) contractual interest rate in groups of not more than one-half per cent together with the prevailing interest rate used for the purpose of valuing the mortgage; and

(e) in summary form, where real estate is held in a segregated fund to the extent that more than 15 per cent of the market value of the fund is invested in real estate, an analysis of the real estate portfolio by,

(i) location — (i.e., municipality and province),

(ii) class — (i.e., whether multiple-family dwelling, commercial and industrial or other),

(iii) market value — (i.e., indicate amount —

less than $50,000

$50,000 or more and less than $250,000

$250,000 or more and less than $500,000

$500,000 or more and less than $1,000,000

$1,000,000 or more),

(iv) the name of each independent qualified appraiser who has made an appraisal during the year identifying the property appraised in each case. R.R.O. 1990, Reg. 677, s. 7.

8. Revoked: O. Reg. 133/97, s. 2.

Forms 1-5 Revoked: O. Reg. 133/97, s. 3.

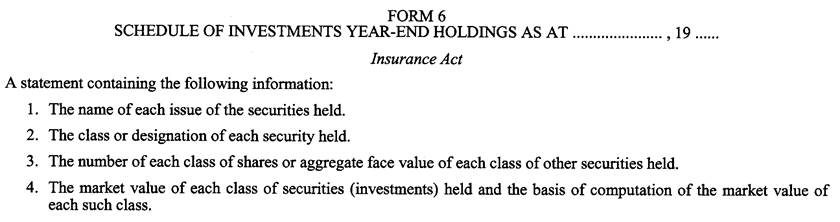

Form 6

SCHEDULE OF INVESTMENTS YEAR-END HOLDINGS AS AT ...................... , 19 ......

Insurance Act

Insert regs\graphics\1990\677\677001ae.tif

R.R.O. 1990, Reg. 677, Form 6.

Form 7 Revoked: O. Reg. 133/97, s. 3.