When you arrive in Ontario

What to expect when you arrive at Toronto Pearson International Airport in Ontario

Learn about the process for entry into Canada and how to receive your work permit.

Check your work permit details when you receive it from the Canada Border Services Agency (CBSA) officer

At the airport

Verify the information on your work permit is correct. For example, make sure your name is spelled correctly. Ask the CBSA officer to correct any errors before you leave the airport.

Outside the airport

If you leave the airport and later notice an error on your work permit, you will need to request an amendment from IRCC. This is done by completing the “Request to Amend the Record of Landing, Confirmation of Permanent Residence or Valid Temporary Resident Documents” form and mailing the form and supporting documents per IRCC’s instruction guide. You can contact IRCC's call centre (

Get your Social Insurance Number at Toronto Pearson International Airport

Your Social Insurance Number (SIN) is a 9-digit number required to:

- work and receive pay in Canada

- access government programs and benefits

- file your tax return

Your SIN automatically expires on the end date of your work permit and will need to be renewed if you return to work in Canada.

At the airport, you can get your SIN before leaving the secure baggage claim area. There is a Service Canada kiosk in the secure baggage claim area of the airport where you can apply for a SIN for the first time, get confirmation of your SIN or update your information (for example, legal name change, correct an error).

If you did not receive your SIN or update your information while at the airport, you can visit a Service Canada location in-person, renew or apply for your SIN by mail, or apply online to update or receive a new SIN.

Getting help while inside Toronto Pearson International Airport

Polycultural Immigrant and Community Services (Polycultural) is a support organization that provides information and orientation to IAWs arriving at the Toronto Pearson International Airport. Their staff speak many languages. They can connect you with support organizations in the area where you will live and work and can also help you get your SIN while inside the airport or if you notice errors on your work permit.

Look for Polycultural staff. They are wearing orange jackets or lanyards in the secure baggage claim area.

When you arrive at your destination for employment

After leaving the airport and arriving at your destination for employment, you should:

- get your Ontario Health Insurance Plan (OHIP) health card or renew your card

- know important phone numbers for help, health services and workplace safety

- find where to access financial services and open a bank account

- learn what income taxes you will be expected to pay and how to pay them

- know how to get a driver’s licence in Ontario, if needed

Get your Ontario Health Insurance Plan (OHIP) health card or renew your card

The Ontario Health Insurance Plan (OHIP) pays for many of the health services you may need while living and working in Ontario.

Under the Seasonal Agricultural Worker Program, workers are eligible for coverage under OHIP from the first day of their arrival in Ontario. All other IAWs that have a valid work permit will need to provide proof of employment by an Ontario business in a full-time job for a minimum of 6 consecutive months.

You will need to present an OHIP health card (Figure 1) when accessing health services to prove you are covered by OHIP. There is no cost to receive an Ontario health card or to receive health services fully covered under OHIP.

Apply for an OHIP health card.

All OHIP health card applications must include:

- a valid passport for identification purposes

- a valid work permit

- your previous health card or the health card number (if you had OHIP coverage in previous years while in Ontario)

- one of the following application forms:

- If you are a worker under the Seasonal Agricultural Worker Program, you must complete the Seasonal Agricultural Workers Registration for Ontario Health Coverage (Form 3715-82). You may also be given this form when you arrive.

- For all other workers, complete the Registration for Ontario Health Insurance Coverage (Form 0265-82).

New health card applications

If you are an IAW who has never held an Ontario health card or who had not held an Ontario health card with a valid photo and signature within the last 5 years, you must apply in-person at a ServiceOntario location. Find a ServiceOntario location near you or call

To apply for a new health card, you will need to have your photo taken at a ServiceOntario location. Bring your application form and required documents to your appointment. You can book an appointment time in advance by calling

You may also speak with your employer about making an appointment on your behalf. ServiceOntario locations will have translation devices/services available, if needed.

Returning workers renewing a health card

If you are an IAW who has previously held an Ontario health card, you have 2 options to renew your Ontario health card.

If your photo and signature on your health card are less than 5 years old:

- You can apply in-person to renew your health card with the required documents at any ServiceOntario location near you. You can call

1-888-376-5197 to book an appointment. You can mail in your renewal application. Photocopies of required documents are acceptable for mailed-in renewals. Mail your OHIP application and photocopies of documents to:

ServiceOntario Hamilton

119 King Street West, 4th Floor

Hamilton, ON L8P 4Y7

If your photo and signature on your health card is more than 5 years old you must have a new photo taken in-person at a ServiceOntario location. Call

When you go in-person to a ServiceOntario location to apply for a new Ontario health card or apply to renew, you will be given a “Transaction Record” as a confirmation document. Keep this document. It identifies your health number and new version code and can be used to access health care services until you receive your new health card in the mail.

Your new health card will be mailed within 4 to 6 weeks to the address provided on the application form.

If you need to access health services before you receive your new card, you can present the “Transaction Record” confirmation document you received when you applied to health care providers. Call the ServiceOntario INFOline at

Important phone numbers for help, health services and workplace safety

Know who to call for help or during an emergency

If there is an emergency, call 9-1-1.

For emergencies

If you have an immediate health emergency, or an emergency requiring other emergency services (police, fire or ambulance) call 9-1-1.

9-1-1 can be dialed from any phone. The call is free, even when calling from a pay phone or cell phone. Service is available in non-English languages, with language support dependent on region. If your region does not have 9-1-1 service, call

You cannot dial 9-1-1 directly within social media or mobile apps such as WhatsApp or WeChat.

Be prepared to give the exact location of the emergency. Provide a street address rather than landmarks to help emergency services respond quickly. All Ontario property owners must display their address number. Look for an address number near a building’s entrance, on a mailbox or on a reflective 9-1-1 address sign along a road.

You can also determine your exact location using what3words, a smartphone app and website that create location keywords. A what3words keyword can precisely identify a location away from streets and buildings. 44 municipal police organizations and the Ontario Provincial Police use and accept what3words addresses. Knowing your location can also help determine services and supports available in your region.

For non-emergencies

For assistance when it is not an emergency, call

For non-emergency health questions contact Health811 online (online chat available 24 hours a day, 7 days a week), by calling

Other important phone numbers

- Legal Aid Ontario:

1-800-668-8258 - Mental health supports for workers (also available in Spanish):

1-866-267-6255 - Canadian Human Trafficking Hotline:

1-833-900-1010 - Assaulted Women’s Help Line:

1-866-863-0511 or #7233 - Report workplace abuse:

1-866-602-9448

For questions about services and programs available in your area, you can also contact Ontario211 online (online chat available 24 hours a day, 7 days a week), by texting 2-1-1 or calling

Access financial services and open a bank account

Most employers will pay wages through direct deposit to a Canadian bank account. If you receive a cheque, you will need a bank account to deposit and withdraw money from the cheque.

You do not need to be a Canadian citizen to open a Canadian bank account. However, you must have at least 2 pieces of acceptable, original identification (banks will not accept photocopies). You can open a bank account even if you do not have money to put in the account right away.

Learn more about:

Taxes and benefits

Paying income taxes

Some international agri-food workers must pay federal and provincial taxes on income earned in Ontario. In most cases, your employer will automatically deduct income tax from your pay.

Paying taxes is mandatory for all workers and is based on your residency status while working in Ontario or if your home country has a tax treaty with Canada.

At the end of your employment or at the end of each year, you will need to file your personal Income Tax and Benefit Return (tax return) with the Canada Revenue Agency (CRA). The tax return reports your total income and taxes deducted from your pay and will determine if you are eligible for a refund of income taxes paid while working in Ontario.

Learn more about paying taxes in Ontario:

- Understand the taxes you pay while working in Ontario as a seasonal agricultural worker at Government of Canada’s guide on taxation and seasonal agricultural workers.

- The Ministry of Finance hosts free webinars to help you learn about Ontario taxes, tax credits and benefits.

- How do I file my tax return?

- Setting up an account to file your tax return with CRA

- CRA NETFILE (filing taxes online)

Third-party representative

You can assign a representative to communicate with the CRA on your behalf. A representative can be:

- an individual

- a group of individuals

- a business entity

You can do this by completing and signing Form AUT-01 – Authorize a Representative for Offline Access. This form allows the designated representative to access information related to your tax accounts.

Submit the completed and signed form within 6 months of the signature date to the following address:

Sudbury Tax Centre

Post Office Box 20000, Station A

Sudbury, ON P3A 5C1

Canada

Benefits under the Canada Pension Plan

All workers in Canada must pay into the Canada Pension Plan (CPP), which provides income benefits due to retirement, disability or death. The type of benefit you are eligible to receive will depend on the amount you have contributed into the CPP while working in Canada. Contributions to the CPP will be automatically deducted from your pay by the employer.

If you contributed to the CPP during your employment in Canada, you can later receive an income benefit in your home country. Your spouse and next of kin could also be entitled to survivor benefits under the CPP.

To be eligible for the CPP, you are required to make more than $3,500 in a year working in Canada on a valid work permit. If you make less than that amount, any contributions made will be returned to you when you submit your tax return at the end of your employment or the year.

You must have a SIN to access benefits offered in the CPP. To view your contributions made to the CPP, you will need to create an online account using the My Service Canada Account portal using your SIN.

You must apply at least 11 months before you want to start receiving the CPP benefit. If you are living outside of Canada, you must fill out an application and mail it to Service Canada. Payments of CPP benefits can be sent anywhere in the world to a foreign account by direct deposit or delivered as a cheque to any address.

For questions about the CPP, how to apply and receive benefits, you can contact the Canada Pension plan while in Canada at

Getting a driver’s licence

Driving in Ontario: what you need to know

To legally drive a vehicle on roads in Ontario, you need to:

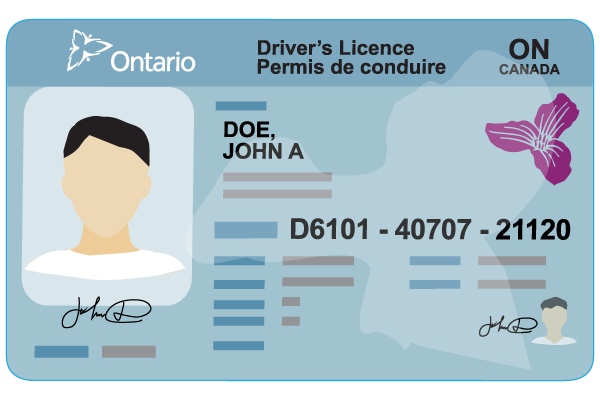

- have a valid driver’s licence (Figure 2)

- have a valid owner’s permit, licence plate and insurance policy for the vehicle you are driving

- drive safely and obey all traffic laws

If you already have a valid driver’s licence from another province, state or country, you can use that licence for 60 days. After 60 days, you are required to get an Ontario driver’s licence.

If you do not have a valid driver’s licence and want to drive in the province, you must be at least 16 years old and get an Ontario driver’s licence.

To drive on Ontario roads, you need:

- a G class licence if you want to drive a car, van and/or small truck

- a M class licence if you want to ride a motorcycle, motor scooter and/or moped

Ontario uses a graduated licensing system designed to give new drivers time to practice and gain driving experience over time. Drivers start at level 1 (G1 or M1 licence), progress to level 2 (G2 or M2 licence) and may qualify for a full G or M licence. Each level has specific rules and testing requirements.

Learn more about:

- driver’s licences for new drivers

- the Driver’s Handbook, the guide to help you study for your written test

Exchanging a foreign driver’s licence

If you have a driver’s licence from a country that has an exchange agreement with Ontario, you may be eligible to exchange your licence for an Ontario driver’s licence.

- You need to apply in-person at a DriveTest Centre or the ServiceOntario Bay and College location in Toronto.

You need to bring:

- an original acceptable identity document(s) proving your legal name and complete date of birth including the day, month and year

- your original, valid out of province/foreign driver’s licence

- a supporting document, authentication letter or abstract showing additional driving experience (if required)

- a certified translation by an MTO-recognized translator if your licence is not in English or French

- an official letter from your home licensing authority confirming your driving experience

Learn more:

Videos about how to get a driver’s licence

You can access informational videos that explain how to get an Ontario driver's licence. These videos are available in:

Impaired driving

Driving under the influence of drugs or alcohol is dangerous and illegal. Know the dangers and penalties of driving while impaired by alcohol, cannabis or other substances.