Advantage Ontario

In June 2012, the Premier asked 14 top business leaders to come up with new ideas for improving Ontario’s long-term productivity and competitiveness. This report outlines their recommendations.

Jobs and Prosperity Council members

- Gord Nixon (Chair) - President and CEO, Royal Bank Canada

- Kevin Lynch (Vice Chair) - Vice Chair, BMO Financial Group

- Bonnie Brooks - President, Hudson’s Bay Company

- George Cope - President and CEO, BCE Inc. and Bell Canada

- Linda Hasenfratz - CEO, Linamar Corporation

- Nitin Kawale - President, Cisco Systems Canada Co.

- Genevieve Knauff - Owner, gck Consulting Ltd. and hme Enterprises Ltd.

- Darryl Lake - Founder and former CEO, Northern Centre for Advanced Technology Inc.

- Mike Lazaridis - Founder and Vice Chair, Research In Motion Limited

- Michael McCain - President and CEO, Maple Leaf Foods Inc.

- Joe Repovs - Founder and CEO, Samco Machinery

- Reza Satchu - Managing Partner, Alignvest Capital Management

- Jim Stanford - Economist, Canadian Auto Workers

- Jeff Westeinde - Chair, Windmill Development Group

A letter to Ontarians from the Jobs and Prosperity Council

We are living in an era of increased global competition and the continuing aftermath of the financial crisis and global recession. Economic globalization has at once undermined traditional strengths and presented new opportunities. Ontario has some important advantages when it comes to positioning itself to benefit from these economic shifts, but it also has some difficult challenges to overcome.

Ontario’s Jobs and Prosperity Council was formed to provide advice on what actions are needed for the province to seize new opportunities. The Council consists of 14 experienced leaders from business, labour and other sectors. All of the members volunteered their time to contribute to a shared vision for action.

The ideas and approaches contained within this report took shape following numerous Council meetings, individual committee sessions and during the November 2012 Jobs and Prosperity Summit in Niagara-on-the-Lake. With our combined expertise and insights, we are confident that our recommendations will help equip Ontario to compete in the long term.

This is not a partisan report: it raises issues that all Ontarians need to address. One of the lessons of the global economic down- turn is that, when it comes to steering our economy, leadership cannot come from government alone. We need to act with a sense of common purpose and shared responsibility if Ontario is to emerge more competitive, more productive and more prosperous in the global economy.

The recommendations are forward-looking, realistic and optimistic. They offer a vision for growth that includes more international trade, increased productivity, more innovation by Ontario businesses and a reinvigorated manufacturing sector — things that will lead to better jobs and a better standard of living for all Ontarians. The report, "Advantage Ontario," is available at ontario.ca/economy and we encourage you to read and discuss it. We will ask the government of the day to reconvene the Council in 12 months to review progress by government, business, academia and others and update Ontarians.

In addition to the Jobs and Prosperity Secretariat, we would like to thank the dozens of organizations and individuals who contributed their time and ideas to this report. The current climate requires a collective approach and this report reflects that sense of cooperation and urgency.

Working together, we can turn Ontario’s core advantages into an enduring shared prosperity. At a time of global uncertainty, our calling card to the world is impressive: a sound political and legal environment; one of the best-educated, most diverse work forces in the world; a competitive tax system; and an attractive business climate. We have the building blocks for success, but if we fail to take action in a coordinated and strategic manner, we will lose ground and our prosperity will decline. We must do things differently; we must challenge the status quo and adapt to the changing global economy. It’s time to take Advantage Ontario to the world.

Sincerely,

Gord Nixon

Chair

Kevin Lynch

Vice Chair

Advantage Ontario: A call to action

The status quo is not an option

The world has changed. Emerging economies in Asia, South America and Africa are racing ahead, driving a new era of intense global competition. The Internet and information revolution have made the world smaller, entrenching globalization. Developed economies, still recovering from the worst financial crisis and global recession since the 1930s, are reinventing themselves to compete and win in the new global marketplace. Ontario is no exception – the status quo is not an option.

We must adapt to succeed or fall behind

The need for change is clear. Ontario’s prosperity will depend on innovative, highly productive firms that are flexible enough to capitalize on opportunities wherever and whenever they emerge. Governments, labour, the not-for-profit sector, academia and the private sector need to rethink and realign their roles and actions to build a competitive, globally oriented economy.

The beneficiaries of change are also clear. The more productive, innovative, entrepreneurial and global Ontario’s economy becomes, the more competitive we will be. Our renewed competitiveness will create new, better and sustainable jobs and afford Ontarians a higher standard of living.

The table is set

Ontario’s fundamental strengths make it an attractive place to do business. It is home to one of the world’s most talented, diverse and highly skilled workforces, with a higher level of postsecondary credential attainment than any other jurisdiction in the Organisation of Economic Co-operation and Development (OECD).1

Barriers to business investment and growth are low. Ontario can lay claim to a globally competitive tax system. The margin- al effective tax rate on new business investment has been cut in half, from just under 34 per cent in 2009 to approximately 16 per cent in 2013.2 The introduction of the Harmonized Sales Tax (HST), in combination with other recent tax reforms, has streamlined the tax system to support investment, exports and growth. In total, tax reductions are saving Ontario firms more than $8 billion annually.3

Ontario is home to the world’s soundest banking system.4 Our country boasts public institutions that are second to none5, bolstering business confidence and creating a stable environment for investment during a time of heightened global uncertainty.

One of Ontario’s strengths is that it is the most diversified economy in Canada, with a strong mix of agriculture, resource, manufacturing, and service sectors, which provides great resilience to the ups and downs of economic changes.

Ontario also benefits from strong regional clusters including information and communications technology, advanced manufacturing clusters (such as automotive and aerospace), financial services and life sciences. Concentrations of talent, suppliers, mentors and competitors spur innovation and attract investment. Ontario has created world class innovation hubs – organizations like Communitech and MaRS – that bring together entrepreneurs, researchers and other key players. Ontario firms also receive substantial support for research and development (R&D) through a combination of federal and provincial tax incentives. Taken together, these measures support vibrant innovation ecosystems.

Ontario’s fundamental are significant assets in a hyper competitive global economy. But talent is only valuable when it is productively deployed; a competitive tax system is only worth the investment it attracts; strong research capacity only creates wealth and jobs when it is commercialized; global opportunities only create jobs in Ontario when our firms take advantage of them. To get the most out of Ontario’s strengths, they must be aligned with clear economic opportunities and priorities. Determining those priorities requires an analysis of Ontario’s most promising opportunities and an honest assessment of the challenges we face in realizing them.

The opportunities and challenges are clear

While the U.S. remains the world’s largest and richest market, it is a mature and slower growing economy. At the same time, a new middle class is rapidly emerging in Asia, Latin America and Africa, increasing demand for high-quality goods and services. Ontario’s highly diversified economy can capitalize on this rising demand in sectors such as agri-food, infrastructure, housing, life sciences, information communications technology and education, advanced manufacturing, financial and business services and tourism.

In a world where 50 per cent of global consumers will soon be in Asia and other dynamic emerging economies,6 these sectors have enormous export potential to serve new customers in new markets with new products and services. Rapid industrial expansion in the same regions is pushing up demand for natural resources and other commodities. Ontario’s diverse, highly educated population and a strong business climate should enable its firms to seize these opportunities.

The Jobs and Prosperity Council believes that encouraging Ontario’s tradable sectors to better seize these new global opportunities is crucial to our future prosperity. Our manufacturers can produce the products the world needs, our world-class services sector can meet the demand for financial and other professional services, and resources in the north offer exciting opportunities for growth.

So what should Ontario do to reap the benefits of these opportunities? The Jobs and Prosperity Council has identified five key areas to focus on in order to strengthen Ontario’s economy and create good, sustainable jobs: export activity, productivity, innovation and entrepreneurship, skills and training, and regulation. Our objective is to take better advantage of Ontario’s wealth of human and physical resources, including our know-how, our strong work ethic, our geography, our multicultural communities and our competitive tax system. We want to encourage Ontario firms to make the investments in innovation, capital and export markets to seize these new global opportunities.

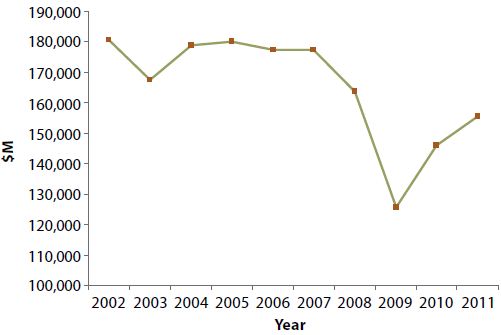

Ontario has always been a trading economy. As the global balance of economic power shifts, however, Ontario firms must adapt to new market opportunities. Our traditional export markets, primarily the U.S., but also the U.K. and European Union, are facing a period of low growth and high uncertainty. Ontario needs to position itself to take advantage of rising demand in high-growth developing economies. There is little evidence that Ontario firms are adapting: 77 per cent of Ontario’s exports go to the U.S., while only 1.4 per cent go to China and 0.3 per cent go to India.7 Entering new markets is always challenging; different cultures, market conditions, trade and regulatory barriers must be navigated. While the U.S. will continue to be our largest trade partner, Ontario firms need to focus on diversifying to rapidly growing emerging markets.

For many years our firms benefitted from a dollar that was substantially below parity and from proximity to a strong U.S. market. A rising dollar has impacted our cost advantage, U.S. growth has slowed and increasingly fierce competition from low-cost emerging economies – the same economies that our businesses need to develop stronger relationships with – has really changed the game.

The combination of slow U.S. growth and increased global competition means Ontario firms will have to compete based more on the inventiveness and quality of their products and services. How can we move from competing on cost for standardized goods and services to competing on innovation and quality? The key is investment. Ontario firms invest much less than their competitors in key areas: machinery and equipment (including information and communication technology), and R&D and innovation.

Ontario firms have access to one of the most educated workforces in the world, but are not equipping their employees with leading-edge technology. We invest less than U.S. firms in machinery and equipment, a key factor in our productivity gap. Even when firms do invest in world-class technology, Ontario’s workers often lack the skills needed to utilize this technology, a gap linked to both employers' under-investment in training and an education system that should focus more on skills training.

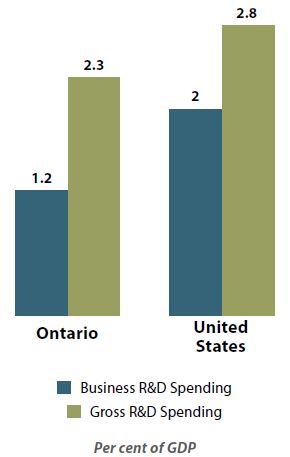

Investing in existing technologies is crucial to success, but Ontario will also need to go a step further and become a leader in developing the next generation of technologies. However, despite generous federal and provincial government support for R&D, private sector spending on R&D remains far too low. As a percentage of gross domestic product (GDP), U.S. firms invest nearly twice as much in R&D as Ontario firms.8 Other international comparisons are not much more flattering: Ontario business investment in R&D is 75 per cent of the OECD average.9 Ontario’s innovation performance is also weakened by an underdeveloped risk capital market, which inhibits the growth of innovative young firms.

The productivity gap between Ontario business as a whole compared to the U.S. is surprisingly large, approximately 25 percent in recent years,10 and exceedingly worrisome. While Ontario has a number of globally leading firms in many sectors, far too many firms in Ontario under-invest in productivity and innovation.

Manufacturing can play an anchor role in modern economies when it is knowledge – and capital – intensive. It is also an inherently tradable sector that creates spin-off benefits in other sectors of the economy. Manufacturers create products that can be sold around the world. Ontario’s manufacturing sector has been through tough times in the past decade, but it has turned the corner. Output, exports and employment are all growing again. Ontario manufacturers can drive a new era of prosperity for Ontarians, but to realize it they will need to start investing and scaling up their operations and do so at a rapid pace. Ontario must also adapt to the changing nature of manufacturing. Competition is intensifying, and we must enhance our capacity to produce innovative, high value-added products that can be sold at premium prices.

Collective action and effort, and better alignment are required. It is not just the private sector that has work to do. Government needs to rethink how it supports Ontario’s economy. Persistent deficits and growing public debt must be curtailed while still supporting essential investments in infrastructure and public services. Ontario’s long-term competitiveness depends on get-ting its fiscal house in order, and the measures we propose should be fiscally neutral. However, deficit reduction alone will not put Ontario on the path to sustainable growth; it is necessary but not enough in today’s profoundly changing world. Investment is also needed, along with a willingness to do things differently.

The regulatory burden on Ontario businesses is a significant impediment to growth, especially for small firms. Much of this regulatory burden should not be ascribed to high regulatory standards; rather, it is too often a consequence of an un-coordinated system that requires firms to navigate numerous regulatory bodies in multiple levels of government. While recent reforms have reduced the regulatory overhang, more work is needed to improve the efficiency of Ontario’s regulatory system. The goal must be to protect the public interest while imposing the fewest possible barriers to investment and job creation.

Government business support programs should focus public dollars on enhancing productivity, innovation and exports, and do so efficiently. The current mix of programs does not. It is too fragmented, with too many competing objectives. Simply put, the current design is cumbersome, drives up administrative costs and complicates access for firms.

While unemployment rates remain high, many employers cite the dilemma of their inability to find skilled labour. Education and training programs should be better aligned to ensure that young Ontarians are getting the skills that employers really need, and that will lead to good, sustainable jobs. The aging of Ontario’s population makes the successful integration of young Ontarians, new Ontarians and Aboriginal Ontarians – all of whom have above-average unemployment rates – into the labour market more important than ever.

The time to seize opportunities is now

The Jobs and Prosperity Council’s members come from a diverse array of sectors. Based on our experience, we believe Ontario has what it takes to succeed on a global scale.

The challenges we have outlined are well known. This report details key actions that government, the private sector, labour and academia must take to address them.

The fundamentals are in place in Ontario, and the global marketplace offers greater opportunities than ever before. We must collectively focus our efforts on building upon Ontario’s strengths in talent, innovation and entrepreneurial capacity while enhancing regulatory efficiency, matching education to labour market needs and developing new relationships with emerging economies. Improvement in these key areas is essential for creating a modern, prosperous Ontario economy.

Ontario has what it takes to succeed on a global scale.

Only an innovative, globally oriented economy will generate the growth and create the jobs we need to continue to invest in our communities and public services, and to raise living standards for current and future generations of Ontarians. At its core, our message to all Ontarians – businesses, community and labour leaders, governments and academics – is simple: now is the time to seize the opportunities.

Seizing opportunities: Going global

Increasing and diversifying exports is fundamental to the competitiveness and growth of Ontario firms, large and small. However, Ontario firms face obstacles in achieving global scale and in going global. Improved innovation, productivity performance and foreign market development are key drivers of export growth for large Ontario firms, whereas export capacity, management expertise and limited resources are primary challenges faced by small- and medium-sized firms.

Importance of targeting export growth opportunities

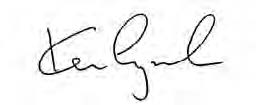

Rapidly changing global trade flows have presented new opportunities and reduced traditional ones. Today, while developed economies struggle through a prolonged period of limited growth, emerging markets continue to race ahead. Analysis by McKinsey & Company indicates that almost half of global GDP growth in the coming years will come from urban areas in developing economies (see Figure 1). It is clear that Ontario must go global. But to compete and win in the global economy, we need a strategic approach that targets tradable sectors where Ontario has a strong base and where global demand is growing.

Figure 1: Nearly half of global growth will come from 440 cities in emerging markets11

Exports matter, and we're not exporting enough

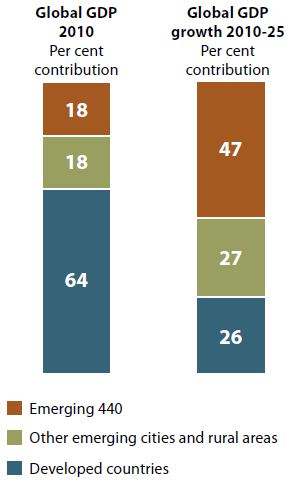

Firms that can sell their goods and services in foreign markets are typically more productive and more innovative than those that exclusively serve the domestic market. Why? Competition pushes exporters to develop truly cutting-edge products and adopt the best processes and technologies; Canada’s small domestic market does not exert the same pressure. Ontario’s recent export performance is cause for concern: stagnant even before the recession, the total value of Ontario’s exports re-mains well below its pre-recession peak (see Figure 2 below):

Figure 2: Total value of Ontario exports, 2002-20112

Despite the importance of exporting, only a small fraction of Ontario’s small- and medium-sized establishments export. Not only do too few Ontario firms export (only 6.4 per cent in 2008)13, but the average value of their exports is also low. We need better and more robust data on the trade, productivity and innovation performance of Ontario companies to measure progress in these critical areas of modern competitiveness.

Ontario firms must seize the opportunities presented by emerging markets, especially in light of diminished prospects for the level of growth that we have been accustomed to in our traditional markets. Emerging markets, for example, present an opportunity for northern Ontario to benefit from the rising global demand for natural resources and unique tourism destinations and experiences. But, on balance, there is little evidence that firms are fully capitalizing on these global opportunities. Ontario’s exports continue to flow to traditional markets, primarily the U.S. (see Figure 3).

Figure 3: Ontario exports of goods to select markets, 201114

Ontario’s export performance suggests that our firms' export capacity is under-utilized. Export capacity refers to the broad set of resources, skills, knowledge and relationships required to export successfully. Management expertise, training and know-how are drivers of export capacity. Owners, managers and employees need to recognize market opportunities, form and maintain relationships, and refine products and services to meet market needs and close deals.

Ontario firms must do more to leverage the diversity of Ontarians to tap into global market opportunities. Our work-force is multilingual and multicultural, giving us a natural advantage in creating networks and linkages around the globe, which should help Ontario firms export to non-traditional, emerging markets.

We must also focus our efforts where we will have the most results. Manufacturing represents 85 per cent of Ontario’s overall exports of goods,15 while services now constitute a rising share of our total exports. For manufacturing to be a key source of new jobs and prosperity in Ontario, we need to focus on advanced manufacturing on a global scale. Manufacturing activity related to innovative, high value-added products sup-ports higher incomes, and is less subject to competition from emerging markets.

Recommendations

- Ontario needs to both increase its overall export activity and to strategically target new markets in dynamic emerging economies.

Government, business, educational institutions, labour, financial institutions and other organizations must work together to develop concrete action plans to maximize opportunities and lay out what it will take to achieve them in key tradable sectors in the changing global economy. These include: agri-food, advanced manufacturing, tourism, health care, education, housing, infrastructure, financial services, natural resources, information communications technology and life sciences.

In the coming decades, growth will be more concentrated in emerging markets, and our economic success will depend substantially on capitalizing on those opportunities. The experience of other successful global jurisdictions indicates convincingly that we cannot assume successful, tradable sectors will automatically appear. We need deliberate, focused strategies to lay the groundwork for success in these key sectors.

The Council believes there should be a focus on export opportunities where Ontario has an inherent advantage and where global demand is rising. We have identified sectors where these new global opportunities currently exist: agri-food, advanced manufacturing, tourism, health care, education, housing, infrastructure, financial services, natural resources, information communications technology and life sciences.

We call on government to convene business, educational institutions, labour, financial institutions and others to develop concrete action plans for Ontario’s key tradable sectors. These plans should map out specific sectoral opportunities, and what it will take to achieve them.

- Small and medium enterprises (SMEs) are a key source of growth and job creation in Ontario, and their growth opportunities increasingly lie in tradable sectors. Ontario needs to leverage, align and enhance public and private sector resources to improve the export capacity of SMEs:

- Create a one-window online portal for SMEs to access government export information and supports;

- Develop a series of large "reverse trade missions" focused on key emerging markets;

- Further integrate and link export assistance to SMEs, including co-location of federal, provincial and non-governmental organizations;

- Increase partnership programs, such as the Global Growth Fund, with key business organizations, including ethno-cultural business organizations, that help SMEs access and export to foreign markets, and implement international business strategies; and

- Successful exporters should mentor and share expertise with less experienced SMEs.

Small and medium enterprises (SMEs) face particular challenges in exporting as a result of limited resources. While export services and assistance for SMEs are already in place, the Council believes there is considerable scope to enhance export capacity and activity. The Ontario government should ensure that there is a simple, integrated online portal for SMEs to access government export information and support. The portal should also provide easy access to federal government and non-governmental export assistance organizations.

All levels of government should work seamlessly together to ensure that SMEs can access export information and support through many channels in an integrated and cohesive way. Government resources should be organized around the specific needs of firms at various stages of development (e.g., potential exporters, new exporters or experienced exporters seeking new markets). In addition to improving online resources, the co-location of organizations that provide export expertise and support would enable SMEs to get in-person support at a single location. The Ontario government should also increase partnership programs, such as the Global Growth Fund, that focus on export capacity to help Ontario SMEs access and expand growth in foreign markets, as well as develop and implement international business strategies.

In partnership with the private sector, the Ontario government should develop a series of large "reverse trade missions" focusing on the most promising global opportunities. Reverse trade missions transform what we are currently doing to build export capacity (e.g., market seminars, incoming buyers' sessions and market studies) into bigger, integrated and high-impact events that are focused on emerging markets such as Brazil and involve partnership with the private sector, other levels of government and key economic organizations. While outward trade missions can at best accommodate dozens of firms at relatively high cost, reverse trade missions can engage literally thousands of Ontario firms, particularly SMEs, at much lower cost.

Ontario SMEs have a valuable but under-utilized asset in the Ontario Network of Excellence (ONE), which includes public-private-academic consortia like MaRS, Communitech and Invest Ottawa. The Council encourages Ontario SMEs to take advantage of this "soft innovation infrastructure" and leverage the resources and expertise that the ONE offers, such as mentorship and peer networking, to support the development of "born global" start-ups and accelerate their export growth.

The private sector has a mentoring role, sharing emerging market expertise to systematically broaden the knowledge base of Ontario firms with export potential. Private sector leaders should develop and strengthen SME export networks and provide mentorship to SMEs inexperienced in exporting to new markets.

Working together, the private sector, governments and academia can better leverage the many linkages Ontarians, especially recent immigrants to Ontario and international students, have to emerging markets. As described in the "Capitalizing on Strength in Talent" section of this report, we need to increase the number of spaces for international students at post-secondary institutions and expand programs to keep the most talented, entrepreneurial international students in Ontario after they graduate.

Seizing opportunities: Driving productivity growth

Importance of being productive

Productivity measures how effectively we work – how much value we create for each hour on the job. It means working smarter, not harder. Productivity growth is the key to produce high-paying, sustainable jobs over the long term. It improves competitiveness and enables firms to successfully enter new markets and maintain their presence in existing ones.

Ontario’s recent track record on productivity leaves much to be desired. From 2001 to 2010, private sector labour productivity growth in Ontario averaged only 0.5 per cent annually.16 As a result, Ontario’s productivity gap with key U.S. competitors has increased from approximately $6 of GDP/hour in 2001 to approximately $11 of GDP/hour in 2010.17 To compete and win in the global economy, Ontario must improve its productivity performance and catch up with key competitors. To do so, we must focus on using advanced processes to produce more innovative, higher value-added goods and services in all sectors of our economy.

Productivity and investment

Many factors impact productivity, from the mix of sectors that make up the economy to public services like education, health care and infrastructure. The most important factors are capital investment, particularly investment in technology (e.g., machinery, computer hardware and software), investments in R&D and innovation, and investments in talent.

Ontario firms have long invested less in machinery and equipment (M&E) than U.S. ones. M&E includes many types of capital investments. In 2011, the gap (on a per-employee basis rose to 38 per cent.18 The gap in M&E investment is a core driver of Ontario’s overall productivity gap with the U.S., and it is undermining our competitiveness.

In recent years, the Ontario government has taken significant measures to encourage more capital investment. The tax burden (i.e., marginal effective tax rate) on new investment has been cut in half through a combination of measures: cuts to federal and provincial Corporate Income Tax rates, introduction of the HST and elimination of the Capital Tax.19 However, global competition for business investment is intense, and Ontario policy-makers must continue to monitor competitiveness levers that drive investment decisions.

Ontario firms now have an opportunity to seize new markets, but they will have to invest to get there. The stronger dollar makes the purchase of M&E more affordable. The Council believes business should now seize this opportunity and invest in M&E to improve productivity and enhance competitiveness.

Role of public infrastructure

Investments in public infrastructure (including transportation, public transit and utilities) create both short- and long-term economic benefits. Building infrastructure creates jobs in the short term and boosts productivity performance in the long run. Analysis by the Conference Board of Canada demonstrates that as much as one-quarter of Ontario’s recent labour productivity growth could be attributed to improved infrastructure.20

However, more work needs to be done, especially with regard to transportation infrastructure, as highlighted in a recent report by the Toronto Board of Trade. Its analysis indicates that traffic congestion in the Toronto region alone cost the economy $6 billion in 2006 and that the cost would rise to $15 billion in 2031 if strong action is not taken.21 Delays at the U.S. border also have a significant impact on the movement of goods and people.

Such gaps in economic infrastructure are major impediments to future growth and must be addressed. Opportunities exist to fill these gaps with innovative, "smart" infrastructure and to export the expertise and technology that is developed in building it. However, addressing our infrastructure gaps will be expensive and, in a period of constrained government finances, will require new revenue sources and new approaches to achieving what is clearly in Ontario’s collective interest.

A number of Council members believe that Infrastructure Ontario, the Province’s dedicated infrastructure agency, represents a refreshing and different approach to building partnerships and pursuing commercial transactions with the private sector that are in the public interest. Opportunities exist to leverage Infrastructure Ontario’s expertise and experience globally.

Over $700 million is being invested in Ontario’s sport and recreation infrastructure and legacy through the 2015 Pan/Parapan American Games. These Games are also being supported by some major projects already underway — the revitalization of Union Station and the creation of the Union-Pearson Air Rail Link that will create a lasting economic benefit for Ontarians. Other infrastructure, including the Athletes' Village and major Games venue projects, are being delivered using Alternative Financing and Procurement and are being built to LEED Silver standard or better.

Manufacturing

Manufacturing has long been a pillar of Ontario’s economic strength. Due to its strong linkages to other sectors, there are actually more jobs outside of manufacturing that depend on a vibrant and healthy manufacturing sector than in manufacturing itself. Manufacturing is also crucial to export performance, accounting for almost 85 per cent of Ontario’s international exports of goods last year.22 When manufacturing grows, the entire economy benefits.

Ontario’s manufacturing sector endured difficult years over the last decade, grappling with multiple challenges including a dramatic restructuring in the North American automotive industry, a global recession and a sluggish recovery in our major export market, and a dollar that was substantially lower than the U.S. dollar for a long period of time and has now moved to parity. Since the recession, however, more than half of manufacturing sales have been regained, and firms are starting to hire.23

The Jobs and Prosperity Council strongly believes that a glob-ally competitive manufacturing sector is a key part of a diversified Ontario economy and a source of good, sustainable jobs and provincial prosperity. Modern, world-class manufacturing facilities embody the latest in technology and innovation and skilled labour. But to seize that opportunity, manufacturers need to address many of the same productivity challenges facing Ontario’s overall economy.

In mature economies the manufacturing sector becomes more important for attributes such as its ability to drive productivity growth, innovation, and trade – all of which determine national competitiveness.

McKinsey Global Institute, Manufacturing the future: The next era of global growth and innovation.

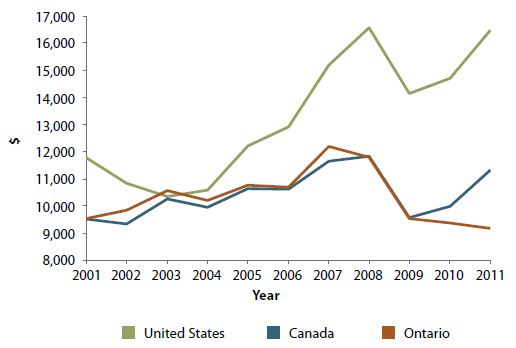

Many Ontario manufacturers under-invest in productivity-enhancing M&E relative to their peers in the other G7 countries. A significant gap in new capital expenditures has persisted since 2005. In 2010, these expenditures totaled almost $11,000 per employee in the U.S., compared to approximately $8,500 in Ontario.24 By 2011, annual total investment in (non-residential) fixed assets was over $16,000 per employee in the U.S., com-pared to just over $9,000 in Ontario (see Figure 4).

Ontario manufacturers and their workers are at a significant productivity disadvantage; they are not competing with the same quality of machinery, hardware or software as their competitors. This investment gap must be addressed if Ontario’s manufacturing sector is to once again become a global leader.

Figure 4: Investment in Non-Residential Fixed Assets per Employee in the Manufacturing Sector, 2001-201125

Centre for Spatial Economics Analysis

One analysis of the impact of an additional $1 billion dollars of investment in M&E in Ontario by 2016, conducted by The Centre for Spatial Economics, illustrates the "multiplier effects" of investment in the manufacturing sector. Although the specific results are dependent on the simulations assumptions – in this case, how the investments are financed and where demand comes from – they are indicative of the value of investment to the manufacturing sector and the Ontario economy in general.

- Total manufacturing exports could increase by $5.4 billion

- Manufacturing sector GDP could increase by $2.4 billion

- Manufacturing employment could increase by 20,000

- Ontario’s overall GDP could increase by $5.1 billion

- Over 10,000 new jobs could be created in other sectors

One important aspect of the productivity challenge in Ontario manufacturing is scale. Producing a sufficient volume of goods is required to justify and finance investment in expensive, world-class technology, and this underscores the need to tap into new global markets. For a number of products, large plants are much more productive. For example, a study of food processors showed that large plants add five times as much value per employee as small ones.26 Ontario plants tend to be much smaller than those of their U.S. competitors, making them less productive and competitive.27 It is time for Ontario manufacturers to invest and scale up.

Moving our natural resource sector up the value chain

Given the rising global demand for natural resources, tremendous opportunities exist in mining and forestry. Northern Ontario has long been a rich source of natural resources that have served the Ontario economy well, and rising global demand and prices mean that new reserves in the Ring of Fire area and elsewhere are very promising. To fully capitalize on these opportunities, northern Ontario’s natural resource sector should focus on supplying higher value-added products and services to global markets.

Northern Ontario’s Ring of Fire is a world class mineral find that has been called the most promising mining opportunity in Canada in over a century. Located in Ontario’s Far North, current estimates suggest multi-generational potential of chromite production, as well as significant production of nickel, copper and platinum will draw an initial capital investment of $4 billion. Opportunities abound for Northern Ontario through industrial development, direct and indirect employment exceeding 5000 jobs/year, broadening our global reach through sought-after natural resources, improving social and regional infrastructure in First Nations while contributing to the overall productivity of the province through higher value-added products and services.

The federal and provincial governments have launched initiatives that encourage investments in projects that support economic development and business growth in northern Ontario. But, to fully reap the potential benefits for all, we need to advance through the value chain from the purely extractive to higher value-added, more productive processing activities while leveraging Ontario’s advantages, such as a diverse, talented and highly skilled workforce, a strong research capacity and a competitive tax system.

Recommendations

- The Council recognizes the critical importance of the manufacturing sector to Ontario. We call upon the federal and provincial governments to work with stakeholders to develop a manufacturing strategy that will increase productivity and innovation and support increased scale, improved competitiveness and greater exports.

The strategy should include:- A call to the federal government, as part of its next budget, to increase the existing accelerated capital cost allowance rate to 100 per cent for a limited time to incent substantial incremental investment in manufacturing machinery and equipment. Ontario would automatically parallel the federal rate. Contingent upon sufficient business uptake, the government should consider making the current 50 per cent rate permanent.

- A plan to expand opportunities for Ontario manufacturers in the growing natural resources and energy sectors in Western Canada. Ontario firms have complementary skills to offer, and should view this more as a growth opportunity, beneficial to both economies.

- Measures to align education and training programs, including experiential learning, with the skills manufacturers need for the markets of today and tomorrow.

- Improved connections between manufacturers and research institutions to solve problems specific to the manufacturing sector through, for example, more applied research collaborations.

- A communications strategy that informs the public about the importance of Ontario’s manufacturing sector, the global opportunities open to it, and what it will take to be competitive in the changing global economy.

All levels of government need to recognize the economic significance of manufacturing. Manufacturing is an essential part of Ontario’s – and Canada’s – sustained competitiveness and prosperity. Ontario’s manufacturing sector has weathered tough times and turned the corner. The sector is now growing its output, exports and employment, and has significant potential to make a positive contribution to Ontario’s overall growth and prosperity – and we need to communicate that clearly.

The federal and Ontario governments need to jointly develop a manufacturing strategy in collaboration with the private sector, labour, universities and colleges and other stakeholders. It should build on the partnership-based approach articulated by bodies like the Ontario Manufacturing Council.

Global trends are dramatically changing the manufacturing landscape; Ontario’s manufacturing strategy needs to be based on detailed analysis of the risks and opportunities associated with these trends. It should focus on enabling Ontario’s manufacturers to scale up and continuously invest in world-class technology. These two critical factors go hand-in-hand: only with the best technology can Ontario manufacturers compete on a global scale, and global scale is required to make the business case for investing in world-class technology.

A central feature of the strategy should be the implementation of a 100 per cent accelerated capital cost allowance to stimulate investment in manufacturing and processing M&E. This would enable firms to write off qualified investments in a single year and would be focused on the manufacturing sector, where these investments are most critical to innovation, competitiveness and export activity. It would directly improve the business case for investing in the new machinery needed to attain better scale, productivity and quality. A time-limited 100 per cent accelerated capital cost allowance would send a powerful message to manufacturers – invest now and invest right here in Ontario. To provide time for business uptake, the 100 per cent rate should be in place for a sufficient amount of time, for example, for three years after implementation. The integrated Ontario-federal tax collection agreement means that the federal government would have to introduce this measure, which would then be automatically paralleled by the Province.

The manufacturing sector would benefit from better alignment with postsecondary institutions to meet its training needs. Partnerships among colleges, the aerospace sector and the tooling industry are examples of how training can be successfully connected with the needs of Ontario manufacturers. In addition, manufacturers need to create more opportunities for co-ops and other workplace-based education for students in Ontario.

Similarly, for research, closer cooperation between manufacturers and postsecondary and other public research facilities could focus expertise on solving the problems that manufacturers face.

Great opportunities for Ontario’s products and services also exist at home in Canada. Ontario businesses should target and pursue opportunities in major resource development projects in Western Canada. Government should continue to work with business to advance these opportunities and promote Ontario’s sector strengths such as innovative clean technology and water remediation capabilities.

The goal for the manufacturing strategy should be greater competitiveness through much strengthened productivity, innovation performance, and expanded market access.

- The Council believes that modern infrastructure, particularly in transportation, can form part of Ontario’s competitive advantage. We need new approaches that engage public and private sources of capital and new revenue models if we are to build the leading edge infrastructure that we need now and in the future.

Strong infrastructure is an important enabler of productivity and competitiveness, and Ontario must continue to reduce its infrastructure gap. The government’s long-term infrastructure plan, Building Together, commits to doing just that. In 2012, the Province will invest $13 billion in Ontario infrastructure. In the current fiscal circumstances, however, a number of Council members believe it is unrealistic to think that we can continue to fund all of our infrastructure needs through government funding and in the time frame that they can best contribute to competitiveness and growth.

We must look at innovative strategies to tap into other public and private sources of capital and the possibility of other revenue-generating models, including user-pay approaches. There is also a need for all three levels of government to work together to ensure that infrastructure dollars are invested in the most important projects and to improve asset management planning.

If we build next generation infrastructure in Ontario, the expertise and technology we develop can be exported around the world. Ontario manufacturers and service providers can achieve greater prominence globally for their ability to plan and build the modern infrastructure needed in rapidly growing cities in Asia and across the developing world.

- The Council believes that Ontario needs a comprehensive plan for developing the Ring of Fire and other natural resources in northern Ontario.

We recommend establishing a panel of distinguished Ontarians to develop a playbook for realizing our northern resource potential and report back within one year.

The challenge for northern Ontario is not so different from the challenge for all of Ontario: adapting to an ever-changing, increasingly global economy. But its opportunities are different they relate to our natural resource assets in the Ring of Fire and elsewhere, and how to take them to global markets. Determining an economic playbook for northern Ontario will require input and guidance from business, governments, Aboriginal and other community leaders across Ontario. We need to think big.

The Council recommends that the provincial government strike a panel comprising, say, five leaders from across the province. The panel should report back in a year on how to stimulate growth and create sustainable jobs in northern Ontario by tapping into our natural resource potential. As described in the Canadian International Council’s The 9 Habits of Highly Effective Resource Economies: Lessons for Canada, fully realizing this potential will require us to actively add, extract or build value on our resource base.28 The work of the panel should take into account the Province’s Growth Plan for Northern Ontario and the lessons from the Canadian International Council’s report. Its recommendations should aim to enhance prosperity for future generations.

Seizing opportunities: Unleashing innovation and entrepreneurship

Expanding and connecting the innovation ecosystem

Ontarians and their government have recognized the fundamental economic importance of entrepreneurship and innovation: we benefit from strong research institutions, innovative clusters and a set of targeted incentives and supports to promote entrepreneurialism and innovation. Yet, we have seen that Ontario businesses lag behind many of their competitors when it comes to investing in R&D, they file fewer patents than their competitors and they focus less on innovation.

While many factors influence these outcomes, we have focused on limited industry-academic collaboration, the scarcity of risk capital and the lack of an entrenched culture of entrepreneurship.

More private sector investment in R&D is required

Ontario should be a leader in R&D. Our university research capabilities are strong: postsecondary education expenditure on R&D (as a proportion of GDP) is first in the G7.29 And yet, our business sector’s innovation performance is relatively weak, investing less in R&D than U.S. firms despite generous tax incentives.30 As a result, Ontario’s gross expenditures on R&D remain well below U.S. levels (see Figure 5).

Figure 5: Ontario firms spend less on R&D, driving an overall R&D gap31

Patent and commercialization activity needs to be accelerated

The lack of R&D investment is manifested in a significant patent gap with North American peers, who produced 48 per cent more U.S. patents than Ontario firms on a per-employee basis from 2006 to 2010.32 Patents are the result of successful, novel R&D, and the number of patents granted (usually measured per capita or per employee) is an important indicator of a jurisdiction’s innovation capacity.33

Factors other than R&D spending impact patent activity as well. Ontario’s postsecondary institutions are leaders in producing high-quality scientific research papers (Ontario accounts for almost half of Canadian research output),34 but studies show only a small percentage of firms collaborate with public research organizations,35 potentially limiting commercialization activity. Further, Ontario’s approach to industry-academic collaboration tends to be driven by researchers rather than by private sector identification of market opportunities, and is not focused on commercialization. By shifting the nature of this collaboration so that businesses play a larger role in identifying applied research opportunities at academic institutions, Ontario’s economy would benefit from enhanced commercialization and innovation outcomes.

In general, Ontario businesses need to accelerate the development, production and commercialization of best-in-class products and services. Stronger linkages with research institutions will help in the earlier stages, but there is also a need to address gaps in venues for the demonstration of market-ready products. Many jurisdictions leverage public sector procurement to push the development of innovative products, particularly in dynamic growing companies. These types of strategic procurement policies and initiatives enable public sector buyers to become valuable reference clients for innovators, which can lead to accelerated growth plus a source of financing and this permits access to other sources and a boost in sales domestically and abroad.

Lack of risk capital

Young, innovative firms often have trouble accessing traditional sources of capital because these firms are taking significant risks on new technology, processes or markets. The availability of a broad range of risk capital, including angel funding and venture capital, is essential to the birth and growth of innovative Ontario firms. Talented entrepreneurs with new ideas may be lured to other countries or competing jurisdictions with stronger risk capital markets.

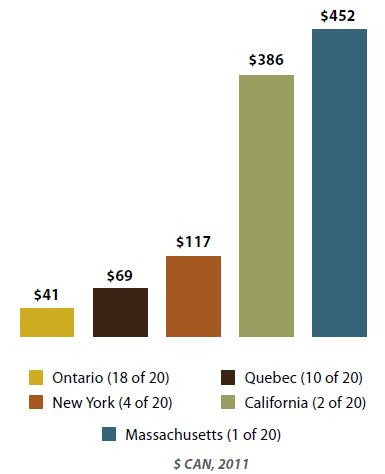

In a comparison of the top 20 North American jurisdictions for venture capital investment in 2011, Ontario ranked 18th on a per capita basis (see Figure 6). While Ontario appears to be improving, more needs to be done to expand sources of venture capital.

Figure 6: Venture capital investment per capita36

The quality of risk capital is as important as the quantity. High-growth innovative firms need a venture capital sector with a depth of expertise and knowledge that can provide advice on a range of business and market issues. Ontario’s venture capital sector needs to focus on attracting investors with such experience and a track record of success.

Strengthening Ontario’s culture of entrepreneurship

An entrepreneurial culture is essential for a globally competitive, innovation-based economy. By building new businesses, entrepreneurs create jobs and push established firms to new levels. However, Ontario lags behind leading Canadian jurisdictions. British Columbians, for example, were 20 per cent more likely to start a new business with at least one employee in 2011 than Ontarians were.37 Ontarians have actually been the most reluctant Canadians to launch new enterprises since the recession.38

To address this, we must focus on developing an entrepreneurial mindset beginning at an early age, raising Ontario youth’s awareness of the benefits of entrepreneurship.

An entrepreneurial culture not only encourages the creation of new firms; it also supports the development of those start-ups into high-growth companies and, ultimately, multinational success stories. Entrepreneurs rely on "soft infrastructure" – communities of thinkers, researchers, entrepreneurs and investors – to grow. In this respect, Ontario should be a great place to start an innovative business. It is home to established, successful clusters like the life sciences cluster in Toronto and the information and communication technology clusters in the Greater Toronto Area, Kitchener-Waterloo and Ottawa39, as well as to public-private-academic consortia such as MaRS, Communitech and Invest Ottawa. However, more could be done to enhance these clusters.

Entrepreneurs in Ontario also benefit from a successful pan-provincial regional entrepreneurship network – the Ontario Network of Excellence, Small Business Enterprise Centres and Business Advisory Services – which assists entrepreneurs and cultivates the growth of young innovative businesses.

Ontario also needs to focus more on a new wave of "social" entrepreneurs who are finding ways to apply novel approaches to solving social and environmental problems. The social innovation and social enterprise sector is undergoing rapid growth and is seen as a new way of doing business.

Recommendations

- We need to accelerate the commercialization of new products, ideas and services in Ontario that can compete globally by:

- Working in partnership with the federal government and the private sector to create a venture capital initiative to improve the quality and levels of risk capital funding in Ontario;

- Introducing a business-led commercialization voucher to better link research to business needs;

- Enhancing the collaboration between research institutions and the Ontario Network of Excellence (ONE) to meet the research needs of business and to improve the commercialization of the work of faculty and students;

- Rigorously reviewing the results of commercialization programs to ensure strategic outcomes are met while continuing to explore other measures that could increase the risk capital pool; and

- Examining modifications to security and investment rules to facilitate crowd-funding and access to capital for new and emerging ventures, while still providing appropriate protection to investors.

In light of the recent announcement of $400 million in federal funds to support venture capital, the Jobs and Prosperity Council recommends that the provincial and federal governments work together to consolidate their risk capital resources and align their strategies to create larger venture capital funds with the needed expertise. Success will require co-investment by institutional investors and the private sector. Achieving scale is important in attracting talented management with domain expertise. Fund managers should also co-invest in the fund to align incentives and maximize the potential positive impact for Ontario.

High-quality risk capital is imperative for creating high-growth firms and driving the province’s innovation ecosystem. The provincial government should explore other measures to promote investment in risk capital, such as an angel tax credit or other investor program, with a specific focus on assisting export-oriented growth companies. As a start, the provincial government should examine modifying its security and investment rules with the objective to eliminate barriers to crowd-funding and access to capital for new and emerging ventures, while still providing appropriate protection to investors.

To translate Ontario’s research strength into stronger patent and commercialization activity, the provincial government should create a business-led commercialization voucher, which would facilitate businesses approaching a public research institution to solve a specific problem. A business-led voucher would support firms in working with public research institutions to develop customer-focused innovations. To promote export growth, the voucher could be targeted to export-oriented companies in tradable sectors. Federal resources and programs (such as the Industrial Research Assistance Program) should be leveraged in order to maximize the voucher effectiveness and impact.

The Ontario government needs to ensure that collaborative research funding (specifically within the ONE) is industry driven, and better aligned with the research and innovation needs of more sectors and regional clusters with the greatest potential for growth. Technology transfer components of research institutions should expand and place greater emphasis on commercialization (i.e., the mobilization of knowledge to the private sector). At the same time, research institutions need to better utilize resources available within the ONE to support entrepreneurship activities and spin-off companies launched by students and faculty members.

There must be a more rigorous capacity to track the success of our commercialization programs and initiatives in Ontario. This should include regular review of outcome effectiveness and performance measurement and benchmarking.

- The Council believes that public-sector procurement can be better mobilized to support innovation and the growth of firms that are producing new and innovative tradable goods and services.

The government of Ontario should implement a strategic procurement policy to accelerate the growth of firms producing innovative goods and services in tradable sectors.

Many jurisdictions catalyze the growth of innovative firms by leveraging public sector procurement. The Small Business Innovation Research initiative in the U.S. is a well-known and successful example of such an approach. Other examples can be found from Israel to Scandinavian countries.

The Ontario government and broader public sector should transform their procurement policies and practices to support innovation in Ontario’s private sector. The public sector could use its buying power to drive economic benefit and increase public sector productivity. A procurement policy framework that encourages public sector buyers to purchase innovative goods and services could accelerate the growth of innovative firms and the modernization of public services. Firms selling to the public sector could demonstrate the value of their products and then use the public sector buyer as a reference client to promote sales in domestic and international markets and catalyze financing. The new policy framework would operate within Ontario’s trade obligations.

- We need a stronger culture of entrepreneurship in Ontario. The education sector and the private sector should work together to introduce youth to entrepreneurship as a viable career option by:

- Creating entrepreneurship high schools;

- Building an entrepreneurship focus in the Specialist High Skills Major program curricula in Ontario;

- Providing all teachers and guidance counsellors with an entrepreneur "toolkit" to assist youth in their entrepreneurial ideas and aspirations; and

- Including an entrepreneurship section in the Grade 10 Career Studies course.

While Ontario is home to many successful entrepreneurs, it lacks a pervasive entrepreneurial culture. There are a number of successful programs that promote entrepreneurialism to students that can be expanded and better linked to develop a new generation of entrepreneurs.

The Council recommends the creation of entrepreneurship high schools with curricula analogous to sports- or arts-focused high schools. We also believe that an entrepreneurship section should be included in the mandatory Grade 10 Career Studies course, and an entrepreneurship focus should be built into the curricula of the Specialist High Skills Major program in the secondary school system.

All teachers and guidance counselors in the secondary school system should have access to and actively promote an entrepreneur "toolkit" for youth. This toolkit would give a basic overview of how to start a business and would refer youth to successful private sector entrepreneur initiatives, such as Junior Achievement, Shad Valley and Youth in Motion.

Existing regional programs and infrastructure within the ONE should be utilized to connect the secondary school system with entrepreneurs and innovators, and to act as a link to private sector programs for youth.

The Council believes that the private sector has an integral role in creating this cultural change. Youth need opportunities to learn entrepreneurship skills directly from entrepreneurs. The education sector cannot do this alone – we need the experience and participation of private sector leaders and mentors to make this happen.

Seizing opportunities: Capitalizing on strength in talent

Our strong educational skills should be better aligned with evolving employer needs

In a modern, knowledge-based economy, educational attainment is essential to productivity growth and prosperity; it is a core part of today’s wealth of nations.

Ontario’s greatest strength is its people. The province has one of the most educated and diverse workforces in the world: it leads the OECD in educational attainment, with 64 per cent of the adult population holding postsecondary credentials.40 In a demographically challenged world, this is a real asset.

Ontario has a world-class education system, from primary school to postsecondary. Our students achieve high results in reading ability, mathematics and science,41 and nine of Ontario’s 20 publicly funded universities are ranked among the top 350 in the world.42 Our talent advantage is meaningful; a global survey of CEOs by McKinsey & Company indicates that finding talent is the key challenge moving forward.

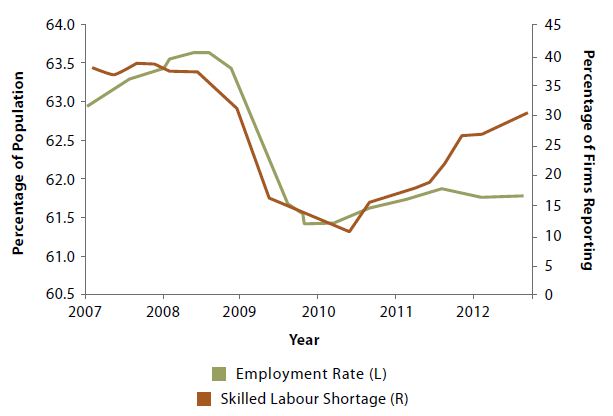

However, despite our high-performing education system and talented population, a number of sectors have identified challenges recruiting workers with specific skill sets and experience. Many firms identify a shortage of workers in the skilled trades, for example. As described in a recent report by CIBC, this short- age is limiting employment growth – the jobs are there, but the skills are not (see Figure 7).

Figure 7: Skills shortage limits employment growth43

A number of factors contribute to this shortage. Parents and students do not appreciate the benefits of trade and apprenticeship relative to other Ontario postsecondary education credentials. As a result, too few young Ontarians pursue the skilled trades as a career; only half of those that select apprenticeship will actually complete the training and receive a certificate of qualification.44

Various models exist at the local level to help identify and solve labour market gaps by engaging local employers and industry. For example, the Halton Industry Education Council leverages private sector expertise to help solve regional gaps in skills development and ease the transition from school to the workforce. These local, industry-led partnership models (e.g., local Business-Education Councils) have been successful, but would benefit from being better linked and coordinated with the Provincial Partnership Council. Ontario needs a strategic approach to partnering with employers and industry leaders.

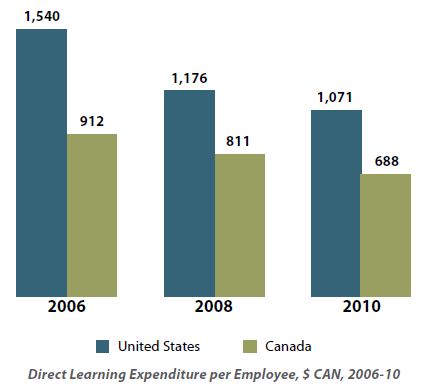

Workplace training and lifelong learning are also critical in today’s knowledge-based economy; they help employees adapt to evolving market needs and increase a firm’s ability to be globally competitive. However, Canadian employers under-invest in workplace training compared to their U.S. competitors. In 2010, Canadian employers invested only $688 per employee in learning and development, compared to $1,071 per employee in the U.S. (see Figure 8).45 Investment in training by Ontario employers has also lagged behind other provinces in recent years, particularly Quebec, Alberta and British Columbia.46

Figure 8: Canadian employers invest less in learning47

Government employment and training support programs contribute to the development of a modern, skilled work-force. To better prepare Ontarians to meet the challenges of globalization and rapid technological change, government employment and training supports need to be better aligned to changing labour market needs.

In an aging Ontario, youth, immigrants and Aboriginals will be economic game-changers

As Ontario ages, the millennial generation, Aboriginals and immigrants will all play distinct and critical roles in shaping our economic future. Each of these three segments of the population present unique challenges and opportunities moving forward.

Ontario must increase productivity growth and raise living standards despite the looming challenges of an aging population and the baby boomer generation contemplating retirement. The Ontario Ministry of Finance predicts that by 2026, when the majority of the baby boomer generation will be retired, the share of Ontario seniors (aged 65 and over) will increase from 14.6 per cent to more than 20 per cent. Our success in bringing the millennial generation, newcomers and our Aboriginal population into the labour force, as well as our approach to the retirement of baby boomers will significantly impact the shape of Ontario’s future economy. The province must capitalize on its talent in order to mitigate the consequences of our demographics. Ontario’s youth have historically experienced higher rates of unemployment compared to the rest of the workforce. The private sector can help ensure that young Ontarians choose their education and career paths with better information about the choices available. Internships, experiential learning and co-op programs can provide hands-on experience and a crucial first link with the working world.

Ontario’s Aboriginal population is young and growing quickly, representing an important talent pool across the province and especially in northern Ontario. However, Aboriginal Ontarians face persistent, systemic barriers that are preventing full participation in the labour force – an issue that must be addressed. It is in both the public and private sector’s interest that we address these challenges.

Ontario’s need for skilled workers is not unique; most developed nations are experiencing similar demographic trends. The aging of populations has created intense global competition for increasingly mobile talent. Eliminating barriers to immigration, settlement and labour market integration will improve Ontario’s position in the competition for talent.

Immigration is essential to Ontario’s long-term prosperity and will play a vital role in maintaining the province’s working-age population as baby boomers retire, and shortages of skilled workers loom. Immigration can help address these challenges, but only if newcomers have the requisite skills and are quickly and effectively integrated into the labour market as well as broader society. Today, immigrants to Ontario currently experience many barriers to employment when searching for work in their field.

Recommendations

- The Council believes that a diversified and dynamic Ontario economy needs a greater emphasis on skilled trades:

- Expand the Specialist High Skills Major program;

- Increase the effectiveness of local Business-Education Councils so that more students better understand the option of choosing a career in the skilled trades; and

- Develop up-to-date information on labour market opportunities working cooperatively with business, government and the education sectors, and make it available to students and parents to help inform decisions about career choices.

Despite the good incomes, engaging work and opportunities for entrepreneurship that skilled trades offer, students and their parents often overlook careers in the skilled trades. Employers in skilled trades are left unable to fill positions. Local Business-Education Councils can help overcome this by bringing together the secondary school system with the private sector and local communities. When educators are linked to the private sector, they can more effectively advise and raise awareness with students on the opportunities that skilled trades and apprenticeships present, such as becoming future entrepreneurs in a range of industry sectors. In the long term, the private sector and secondary school system should work together to increase the effectiveness and alignment of Ontario’s Business-Education Councils. These initiatives can build on the work done by other organizations, such as the Ontario College of Trades.

In the short term, the secondary school system, in partnership with the Ministry of Education, should expand the Specialist High Skills Major program. The Council believes this is a valuable program that is headed in the right direction – it sets students on the path to skilled trades and other education pathways. Moving forward, the Specialist High Skills Major program should be expanded, and opportunities for technology-enabled participation should be explored to give access to students from across Ontario. There may also be benefits in raising awareness about skilled trades as early as elementary school.

Ontario’s youth and their parents are often unaware of job opportunities in the skilled trades and the variety of educational programs that can prepare them for these jobs. The Council believes that it is the responsibility of business, government and the education sector to develop and disseminate up-to-date information on labour market opportunities and make it available when students are making decisions about what career path they will take.

- Experiential learning is important for equipping students with up-to-date workplace skills, and the Council believes that business must play a bigger role in offering placements for Ontario students.

The private sector must increase the number of experiential learning opportunities for high school and postsecondary students by providing more co-ops, work placements and apprenticeships.

Ontario’s public and private sectors must capitalize on the diverse talent of Ontarians and turn human capital potential into sustainable jobs and sustainable competitiveness. Experiential learning and cooperative education provide students with an opportunity to gain valuable real-world skills and start developing a network of potential employers. Formalized experiential learning programs (e.g., co-ops) also enable learners to gain valuable knowledge about labour market trends, needs and challenges. This will result in a stronger alignment between education outcomes and labour market needs.

If businesses want better skilled graduates, it is their responsibility to step up and provide more experiential learning opportunities for our youth. Private sector leadership is needed to increase the number of experiential education opportunities. Government also has a role to play in working with the postsecondary education system and high schools to ensure that the capacity, facilities and equipment required for experiential learning are widely available. For example, facilities such as Ryerson University’s Digital Media Zone and the University of Toronto’s DesignWorks offer education and resources to help students incubate their businesses and collaborate with a network of local and international partners while earning their degree.

- With an aging population, Ontario needs more skilled workers.

The Council believes that increasing the number of newcomers with the skills needed by Ontario employers will be an essential element in ensuring Ontario has a talented, world-class workforce. It will require:

- Increasing the number and proportion of economic-class immigrants to Ontario;

- Improving labour market integration for newcomers;

- Improving recognition and assessment of international qualifications;

- Increasing the number of spaces for international students and expanding pathways to immigration for international students after completion of postsecondary education;

- Leveraging immigrant global connections to promote and grow international exports; and

- Better aligning federal and provincial immigration objectives, policies and programs.

The Ontario government has acknowledged the fundamental importance of immigration in commissioning the Expert Roundtable on Immigration and responded to it with Ontario’s first formal immigration strategy. Both the panel and the strategy highlight the need for increased economic-class immigration to Ontario. Ontario must use all policy tools at its disposal to ensure it attracts more skilled immigrants.

Attracting more skilled immigrants is not enough; the current under-utilization of immigrants in Ontario’s workforce highlights the importance of collaboration between industry, Ontario’s education systems and all levels of government. As recommended in A New Direction: Ontario’s Immigration Strategy, governments need to work toward better aligning their immigration policies and programs.

The private and not-for-profit sectors, in partnership with the Ontario government, should improve their recognition and assessment of international qualifications and work experience to increase employment of immigrants in jobs commensurate with their skills for both regulated and non-regulated professions. Ontario’s postsecondary institutions should increase the number of spots for international students. To retain the best and brightest foreign students, the federal and provincial governments need to continue to promote and expand pathways to citizenship after these students complete their studies. To fully leverage the economic potential of Ontario’s diversity, private sector employers and their associations need to better capitalize on the global connections of Ontario immigrants to capitalize on new export markets.

Seizing opportunities: Delivering smart, efficient government

Targeted support for businesses and effective regulation promote growth

While government policy has a broad, systematic impact on Ontario’s business climate, few policy areas have a more direct impact than regulation and business supports. Governments use business support programs for a variety of reasons, including attracting investment and encouraging desired business activities like R&D. Their effectiveness depends on a rigorous alignment of incentives with key economic outcomes such as improved productivity and competitiveness.

Regulation is an important tool in protecting the public interest. It provides industry with a level playing field and certainty about the rules. It enhances the quality, safety and security of life for citizens, consumers and workers by establishing and protecting minimum standards and fair practices.

However, when regulation is inflexible, inefficient or poorly coordinated, it imposes unnecessary costs on business. Business owners and employees must devote time and resources to understanding regulatory obligations, completing paperwork and taking other steps to ensure compliance. Inefficient regulation limits investment and restrains productivity growth. Ontarians want high regulatory standards, but not burden-some processes. Governments need to find more effective and efficient processes that promote economic growth and job creation while maintaining standards consistent with our values.

The regulatory burden remains significant

The regulatory burden faced by Ontario businesses has been reduced, but remains significant. One study published by the Canadian Federation of Independent Business (CFIB) pegged the total cost of regulatory compliance in 2008 at almost $11 billion.48 Since then, Ontario’s Open for Business initiative has eliminated over 80,000 regulatory requirements, a reduction of more than 17 per cent.49

The move to a single, federally administered Corporate Income Tax is saving businesses more than $135 million per year in compliance costs.50 The Harmonized Sales Tax also simplifies tax compliance for businesses by streamlining tax administration and eliminating over 5,000 pages of outdated rules, regulations and operating procedures,51 and is saving businesses more than $500 million per year in compliance costs.52

Ontario’s major regulatory ministries, including the Ministry of the Environment, the Ministry of Natural Resources and the Ministry of Northern Development and Mines, have initiated risk-based modernization and transformation initiatives to focus limited resources on the activities that have the greatest positive impact. The momentum on these ministry-specific initiatives should be maintained and accelerated.

In furthering this regulatory reform process, there needs to be a rebalancing of the regulatory risk-management framework to reflect the importance of job creation and investment to sustainable growth. Such a balanced framework would manage risks responsibly and actively.

Delays in permit approval are taking a toll

Slow turnaround times for approving permits are creating significant delays for Ontario businesses looking to undertake job-creating development projects, especially natural resource projects in northern Ontario. These delays indicate that regulatory efficiency and approaches to risk management could be improved, especially with regard to environmental assessments and permitting approvals without affecting regulatory standards. Opportunities exist to better coordinate and facilitate approvals across regulatory bodies at all levels of government.

Transforming business supports

The Ontario government supports private sector growth and investment through an array of business support programs, both direct (primarily grant and loan) and indirect (tax credits and tax expenditures). Those programs have played, and will continue to play, a role in attracting and retaining investment, building networks and clusters in key sectors, and helping to ensure Ontario has a strong foothold in the high-value industries of the future.