Phase 1 was announced in 2019 with three pillars for action:

- a competitive business climate

- innovation

- talent

The industry responded by accelerating its shift towards next generation vehicle technologies.

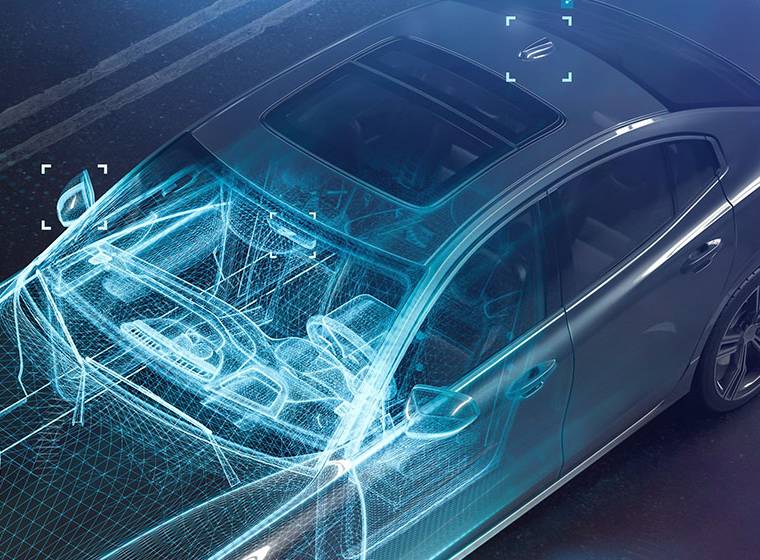

Phase 2 of Driving Prosperity focuses on supporting this market-driven momentum by bolstering our auto ecosystem and supply chain to support the continued pivot to electric, low-carbon, connected and autonomous vehicles.

Driving Prosperity Phase 2: getting ahead of the curve

Ontario is uniquely positioned to be a North American hub for developing and building the car of the future. We can do this by combining our strengths in the auto and tech sectors with our wealth of the critical minerals essential to electric vehicle batteries. And we can add to that our strengths in our cleantech sector ― the largest in Canada.

Phase 2 sets out ambitious goals for the auto sector over the next 10 years. And it establishes new initiatives to secure long-term success and growth for the benefit of Ontario's auto workers and the communities that depend on the sector.

Driving Prosperity ― Ontario’s Automotive Plan

Vision

Position Ontario as a North American hub for developing and building the car of the future through emerging technologies and advanced manufacturing processes.

Phase 1

Launched February, 2019.

Phase 2

Phase 2 builds on the success of Phase 1. It focuses on transforming the auto sector by building electric, autonomous and connected vehicles and supporting a broader supply chain that includes the exploration, mining and production of critical minerals for the fabrication of electric batteries in Ontario.

2030 Anchor Objective for Phase 2

Maintain and grow Ontario’s auto sector by building at least 400,000 electric vehicles and hybrids by 2030.

Ontario will partner with the auto industry to achieve these goals:

- reposition vehicle and parts production for the car of the future

- establish and support a battery supply chain ecosystem

- innovate in every stage of development

- invest in Ontario's auto workers

Message from the Premier and the Minister of Economic Development, Job Creation and Trade

Since taking office, our government has worked to lay the foundation to ensure that Ontario’s world-class automotive sector was not only successful, but highly competitive and ready to make the cars of the future. For years, we had heard from the auto makers that Ontario had become an expensive jurisdiction in which to do business. By lowering taxes, reducing electricity costs, and cutting red tape, we significantly reduced the cost of doing business in the province. The industry has taken notice: Ontario is getting back on the shortlist of the world’s best places to develop and manufacture the next generation of vehicles. Ontario is now fundamentally a more competitive place to build vehicles since Phase 1 of Driving Prosperity was announced in February, 2019.

Phase 1 of the Driving Prosperity plan was announced with three pillars for action: a competitive business climate, innovation and talent. The industry responded by accelerating its shift towards next-generation vehicle technologies. Recent announcements show automakers are investing around $4 billion in transformative electric vehicle investments at their Ontario assembly plants. Ford has solidified their commitment to Ontario by announcing $1.8 billion to produce battery EVs at its Oakville assembly complex, including the production of five new electric vehicle models. Stellantis announced it will invest up to $1.5 billion to upgrade its assembly plant in Windsor to build new electrified vehicles. GM announced it would invest $1 billion in its plant in Ingersoll to produce their BrightDrop EV delivery van; the first all-electric vehicle produced by a mainstream automaker in Canada.

These investments follow Toyota’s $1.4 billion upgrade to their Cambridge and Woodstock facilities that will establish Ontario as their manufacturing hub for its best-selling Rav4 crossover, and to bring Lexus NX production here. GM also announced a $1.3 billion investment to resume pickup truck production in Oshawa, with the next-generation Chevrolet Silverado and GMC Sierra. And Honda, which started building cars in Alliston in 1988, continues to produce their CR-V SUV and the Civic; Canada’s best-selling car for the past 23 years.

Of course, this didn’t happen by accident. Over the last couple of years, our government has put in a great amount of work to ensure we attract these game-changing investments to Ontario. With a lot of shoe leather, we continued to send the message that Ontario is the best jurisdiction for major auto manufacturers to make winning investments.

These investments are just the beginning, and we will continue to work directly with the industry by providing white glove service to support major investment in Ontario’s auto sector and its workers.

In addition to securing new OEM production mandates, we will use our critical mass to drive the industry’s transition and growth, including becoming a significant player in EV battery manufacturing, and exporting more Ontario-made auto parts and innovations. Our government supports the transformation of the supply chain and the creation of a domestic battery ecosystem, including research and commercialization.

And as the number one cleantech cluster in the country, we understand sustainability. Ontario’s electricity system was 94% emissions-free electricity in 2020, providing a key factor in helping companies meet their sustainability goals. As Ontario does not generate any electricity from burning coal, we offer the cleanest energy mix of any auto jurisdiction in North America. Ontario firms have options to further increase their use of emissions-free electricity, including power purchase agreements, behind-the-meter generation, and contracts with green electricity retailers. Despite being home to one of the cleanest electricity grids in the world, Ontario continues to look for ways to further this clean electricity advantage and is actively working with companies and investors to ensure access to 100% clean electricity.

Our new investment attraction agency, Invest Ontario, was created specifically to nurture investment and help businesses grow. Invest Ontario will move at the speed of business and will give companies the expertise they need to thrive in the province. Part of the agency’s offerings is a $400-million fund to encourage investments in the advanced manufacturing sector, such as investment in EV-related technologies.

Phase 2 of Driving Prosperity builds on the successes of our partnership with the industry to position Ontario as a North American leader in developing and building the car of the future through emerging technologies and advanced manufacturing processes.

As global economies emerge from COVID‑19, they will be working in overdrive to attract investment and spur economic recovery. Driving Prosperity shows that Ontario is open for business and ready to compete.

These commitments to excellence, our talented workforce, prime location, raw materials, and history of quality make Ontario the choice to build and export the next generation of green automotive technology. If you’re not already tapping into our EV ecosystem, now is the best time to connect with us and invest in Ontario.

Together, we will build a future-oriented automotive ecosystem with the supply chain capacity, skills base and technology clusters essential for long-term success.

Sincerely,

Doug Ford

Premier of Ontario

Vic Fedeli

Minister of Economic Development, Job Creation and Trade

Shifting gears - global trends driving demand

Ontario has a history of excellence as a top auto-producing jurisdiction in North America. For generations, the auto sector has supported the livelihoods of Ontario workers and has remained an essential part of Ontario’s economy. In 2019, the sector contributed $13.9 billion in GDP to the provincial economy and employed 100,000 people in auto assembly and parts manufacturing.

Despite this, Ontario has seen investment dollars go to competing jurisdictions. There is intense global competition for auto investments, and a major driver of this shift is that southern U.S. states and Mexico offered lower costs and less red tape.

In 2019, Phase 1 of Driving Prosperity: The Future of Ontario’s Automotive Sector took action to correct issues that reduced our competitiveness, that led to plant closures and put our communities at risk.

Today, a new technological wave is sweeping through the global auto industry, transforming it towards the production of electric vehicles (EVs) and other next-generation vehicles. Over the next decade, sales of EVs are forecast to grow exponentially. By 2040, EV sales are expected to eclipse the production of traditional internal combustion engines altogether.

Global sales of electric vehicles

2020

2025

2030

By 2030, one out of every three automobiles sold will be electric

To meet this demand, global automakers are rapidly shifting to adopt green production platforms, investing $US300 billion in EVs and EV battery manufacturing.

- German manufacturers are investing EU€50 billion to triple their electric car offerings to 150 models by 2023

- Ford and SK Innovations are investing US$11.4 billion in Kentucky and Tennessee to build new plants to produce electric vehicle batteries and electric pickup trucks

- In Ohio, General Motors and LG Chem will invest US$2.3 billion to build GM’s future electric vehicle batteries

The future of vehicle production is electric. Competing automotive jurisdictions are racing ahead — Ontario needs to act now and transform its auto production and supply chains so that critical investments do not drive past Ontario.

We are at a crossroads. Ontario has what it takes to become a pioneer in this new frontier in the auto industry by transforming the sector and positioning it for long-term success. By shifting gears from internal combustion engines to new areas of opportunity including electric vehicles and state-of-the-art manufacturing technologies, Ontario can not only stay ahead of the curve — it can lead it.

2030 goal 1: reposition vehicle and parts production for the car of the future

What we’ll do:

- secure new automaker production mandates that include hybrid and battery EVs

- land a new vehicle assembly plant

- make Ontario a significant player in EV battery manufacturing

- increase exports of Ontario-made auto parts and innovations

How we’ll do it:

- promoting Ontario

- encouraging EV adoption

- strengthening Ontario-U.S. relations

Promoting Ontario

The future of Ontario’s automotive sector depends on attracting new investment in our advanced manufacturing base and automotive technology ecosystem.

Leveraging the province’s new agency, Invest Ontario, along with the network of International Trade and Investment Offices, Agents General and industry partners, the province will position itself in select markets as a premier destination to attract leads and game-changing investments in auto manufacturing and technology.

Ontario will work to ensure that key markets in Asia, the U.S., Europe and beyond are aware of our strengths in electric, connected and autonomous vehicles. We will do so through targeted marketing and promotional tactics that showcase why the province is poised to build the innovative technologies that will define the future state of automotive design and production.

The Canada-United States-Mexico Agreement (CUSMA) will create new opportunities in Ontario’s auto supply chain. Regional content requirements for passenger vehicles and light trucks will increase in stages from 62.5% to 75% for Ontario-built vehicles to be shipped duty-free within North America. This means that automakers will need to locally source a higher percentage of core auto parts used in a passenger vehicle or light truck to meet those higher domestic content thresholds than existed under NAFTA. Phase 2 will leverage this preferential access within the North American trade corridor to increase investment attraction and export growth.

Just-in-time manufacturing requires proximity of suppliers. And Phase 2 of Driving Prosperity will help position the industry to take full advantage of growth opportunities among domestic suppliers through foreign investment.

Encouraging electric vehicle adoption

The province recently established a Transportation Electrification Council to inform a Transportation Electrification Policy that will drive EV uptake in Ontario.

With the advice of industry leaders and community stakeholders on the Council, we will remove barriers, develop best practices, and provide strategic support to enable EV uptake across the province for personal, commercial and transit use. Council discussions will support the government’s efforts to electrify the transportation sector and identify opportunities in the areas of charging infrastructure, information and awareness, upfront cost, and supply of EVs in Ontario. We will also look to improve consumer awareness of the benefits of EVs to ensure automakers with new EV production lines are well positioned to meet the growing demand.

The Ivy Fast Charging Network

Through the Ivy Charging Network, Hydro One and OPG are working together to install 160 fast-chargers at 60+ locations across Ontario by 2022. According to Natural Resources Canada, there are almost 1,600 Level 2 and Level 3 public charging station locations in Ontario.

Charging stations are being installed by companies and organizations across Ontario and municipalities across the province continue to develop their Electric Vehicle strategies and charging station plans.

Strengthening Ontario-U.S. relations

When it comes to auto manufacturing, Ontario and the U.S. are more than trading partners — we build things together. Effective cross-border collaboration has been a hallmark of our thriving auto industry, where an integrated supply chain sees vehicle parts crossing the border several times before rolling off the assembly line in finished vehicles.

To advocate on behalf of Ontario’s interests in the U.S., the province has two Agents-General leading Ontario’s Trade and Investment Offices based in Chicago and Dallas. Agents-General are active in promoting the province across a broad range of commercial territories, which include, the States of Illinois, Indiana, Iowa, Kentucky, Michigan, Minnesota, Missouri, Ohio, Wisconsin, Texas, Oklahoma, Arkansas, Louisiana, Mississippi, Alabama, Tennessee and Florida.

Ontario’s Agent-Generals act as the government’s primary representatives in the U.S. market, provide strategic advice and reporting while working closely with Ontario’s existing international network, including Trade and Investment Offices in San Francisco, New York and Washington, D.C. Together, Ontario’s team in the U.S. aids in strengthening strategic government-to-government relations and enhance Ontario’s profile in key markets for investment attraction to secure new business deals for Ontario’s job creators and grow Ontario’s exports to the U.S.

Ontario will continue to work closely with state partners and industry groups to emphasize the benefits of a balanced and open U.S.-Canada trading relationship that supports millions of jobs on both sides of the border. Strengthening partnerships with the U.S. will ensure emerging trade and economic policies allow for greater integration of new electric vehicle and battery supply chains across both nations.

Ontario will continue to build on the benefits emerging from the Canada-U.S. Joint Action Plan for Critical Minerals Collaboration supply chains as part of the Roadmap for a Renewed U.S.-Canada Partnership.

Active investment dialogue

Ontario’s historic investment of $295 million, matched by the federal government, will help transform Ford’s Oakville Assembly Complex into a global hub for electric battery and vehicle production that will supply Ford’s operations throughout the North American region. The landmark project, announced in October 2020, has an overall value of $1.8 billion. It is one of the most significant investments in the province's auto sector in a generation.

We continue to actively pursue similar opportunities with auto assemblers and parts manufacturers from around the world. We’re looking for investments that will further the long-term sustainability, transformation and resilience of Ontario’s auto sector while delivering value for taxpayers.

2030 goal 2: establish and support a battery supply chain ecosystem

What we’ll do:

- create a domestic battery ecosystem anchored with 2 to 3 battery plants

- connect communities, workers, and businesses across Ontario, creating linkages between mineral wealth in the north and manufacturing strength in the south

How we’ll do it:

- leveraging Northern Ontario’s mineral wealth

- creating an auto sector asset map

- Intellectual Property Action Plan

- Ontario Research Fund

Leveraging Northern Ontario’s mineral wealth

Ontario is Canada’s second-largest mineral producer, producing $10.5 billion worth of minerals, or 24% of Canada’s total mineral production in 2020

Canada is the only country in the Western Hemisphere with all the raw materials required for a lithium-ion battery, with Northern Ontario already being a key producer of nickel, cobalt and copper and home to several advanced lithium and graphite mineral development projects that could feed battery supply chains in the coming years.

The aptly named town of Cobalt, Ontario is home to North America’s only permitted cobalt refinery, and Canada is the number one producer of nickel in North America, with approximately 40% of all nickel coming from Ontario. The province’s mines and refineries have been key suppliers of Class-1 nickel for decades.

Ontario is also home to the world’s first all-electric, battery-powered underground mine, eliminating greenhouse gas emissions associated with moving materials. As a result, companies can be assured that the province’s mining practices, EV-related or otherwise, are among the most ethical on the planet.

Driving Prosperity Phase 2 aims to support the attraction of large-scale EV and electric battery production to anchor an advanced electric battery supply chain in Ontario. This will create the opportunity for Ontario’s mining sector to be a critical supplier of battery raw materials within this fully integrated electric battery and vehicle supply chain.

Growing local EV and battery manufacturing will drive economic activity in Ontario. The province will seek to unlock the economic value of Ontario minerals, including refining and processing, within our domestic electric battery supply chain. The province will also work to foster partnerships between our mining and auto manufacturing sectors for mineral processing and battery component manufacturing.

Ontario is currently developing its first-ever Critical Mineral Strategy. The framework for developing this strategy sets out a vision — one where Ontario can generate investment and increase competitiveness in the global market, while supporting the transition to a cleaner, sustainable global economy.

Asset map

Ontario will create a database for industry and investors to showcase and share information on the province’s leading auto assets, facilities and researchers.

The database will help promote promising new technologies and applications to investors while connecting Ontario businesses with researchers and testing facilities to help them with homegrown research and development (R&D) they can move up the value chain. Finding partners quickly and easily will help reduce time and costs.

In addition to industry and investors, Ontario organizations such as the Ontario Centre of Innovation (OCI), MaRS, Communitech and local economic development agencies will also be able to use this resource to support their own work to help grow Ontario companies.

Intellectual Property Action Plan

Supply chain innovation will be supported by Ontario’s research and commercialization ecosystem with targeted support for minerals and automotive R&D.

The province is moving forward with implementing Ontario’s Intellectual Property Action Plan, including establishing a new provincial resource organization focused on providing intellectual property (IP) services and resources. Automotive technologies and Ontario’s small- and medium-sized enterprises (SMEs) in the auto sector are expected to benefit from the entity’s new IP services and supports.

Ontario Research Fund

The province will also ensure Ontario companies that, in partnership with Ontario researchers, are looking to undertake research in critical minerals and automotive engineering, including battery, have the opportunity to secure support for their research projects through the Ontario Research Fund – Research Excellence.

2030 goal 3: innovate in every stage of development

What we’ll do:

Position Ontario to compete globally by innovating locally in the creation, design, production, and adoption of new products and services in the auto sector.

How we’ll do it:

- Ontario Vehicle Innovation Network

- Expanded Ontario Automotive Modernization Program

- Transit Toolkit

Ontario Vehicle Innovation Network (OVIN)

Fueled by a $56.4 million investment over the next four years, OVIN will create a new, regionally diverse network that incorporates electric and low-carbon vehicle technologies into its existing mandate of connected and autonomous vehicles.

OVIN will support innovation and transformation within our auto tech system through:

- R&D Partnership Fund: focused on electric vehicles (EV), connected and autonomous vehicles (C/AV) and WinterTech. The fund will include support for electric and low-carbon vehicle technology development projects that involve collaborations between Ontario SMEs and eligible partners, including automakers, global firms and municipalities.

- Regional Technology Development Sites: located across Ontario and centered on local innovation. A new Northern Ontario site will be established with a focus on EV battery technologies and to increase collaborations with the mineral sector.

- Talent Development program: continuing to support internship and fellowship opportunities for Ontario companies working on next-generation vehicles.

- Central Hub: will connect and coordinate Ontario’s EV and C/AV ecosystems to attract and create partnerships as well as provide networking opportunities, including for EV-related sectors.

-

Ontario has committed$56.4Mover the next four years to support innovation and transformation in our auto tech system.

Expanded Ontario Automotive Modernization Program (O-AMP)

The Ontario Automotive Modernization Program (O-AMP) is a key action item from Phase 1 of Driving Prosperity. It supports the modernization and competitiveness of the province’s automotive supply chain.

The program supports small- and medium-sized automotive parts suppliers to invest in projects that support technology adoption as well as training in Lean Manufacturing.

The successful O-AMP program, launched in September 2019, will be extended for a further three years beyond its current end date of March 2022 so it can continue helping Ontario SMEs in the auto supply chain to not only modernize their processes and practices, but also adopt tools and technologies that support the development of new innovative products for next-generation vehicles.

By extending the support provided by the program to cover tools and technologies for new product development, the program will better position Ontario SMEs in the auto supply chain to remain both competitive and innovative as they fulfill the needs of next-generation vehicles.

Transit Toolkit

A Transit Toolkit will be created to help communities across the province to adopt new transit solutions. It will raise awareness of cutting-edge mobility offerings like clean, connected and automated vehicle technologies, route and real-time information software, and intelligent transportation systems.

The toolkit will offer guidance on best practices for technology adoption, while also connecting transit technology companies, transit providers and municipalities.

2030 goal 4: invest in Ontario’s auto workers

What we’ll do:

- equip workers with the skills they need to secure rewarding, high-paying jobs in the auto sector and broader supply chain, including in battery and steel production, auto assembly, and research and innovation

How we’ll do it:

- expanding FIRST Tech Challenge

- skills training

- Ontario Made Manufacturing Day

Expanding FIRST Tech Challenge

The FIRST Tech Challenge provides students with hands-on and team-based learning opportunities to develop science, technology, engineering and mathematic (STEM) skills and readiness for the next generation of jobs in advanced manufacturing.

The FIRST Tech Challenge was introduced in 2019. It has shown the STEM interest and readiness of Ontario students, with 28 teams and 390 students from Grades 7 to 12 designing, building, programming and operating robots to compete in head-to-head challenges in the 2019-20 school year.

Additional provincial funding of $1 million per year for two years to expand the FIRST Tech Challenge would allow more than 8,000 elementary and secondary students to participate in additional STEM experiential learning opportunities by the end of the 2022-23 school year. This expansion would help students to develop interests and skills in advanced manufacturing to prepare them for the jobs of the future in Ontario’s transformed auto sector.

Funding would be used by FIRST Robotics to provide training materials for students and educators that include school visits from the FIRST team, robotics kits to teams of students and hosting robotics competitions across the province.

Skills training

Ontario remains committed to supporting workers in gaining the skills needed to remain competitive in a world of global competition and rapid technological change. The province’s workforce development system provides workers with training to find good jobs in a changing economy.

In Phase 1, we started investing in the skills of workers in our auto sector with programs like the Career-Ready Fund: Auto Stream, RapidSkills micro-credentials project, eCampusOntario micro-credential pilot, Digital Learning Program for Advanced Manufacturing, and Connected Vehicles/Automated Vehicles (CV/AV) talent roadmap. Building on the successes of these programs, Ontario will continue its training partnerships to meet the needs of employers and workers as the auto sector and its supply chain transforms.

We will also look to improve bridging with secondary, post-secondary and provincial job skills programs like Specialist High Skills Majors and the Ontario Youth Apprenticeship Program to ensure our next generation of auto workers have the skills they need to compete and succeed. As announced in Budget 2021, Ontario is providing an additional $39.6 million over three years ($13.2 million per year), beginning in the 2021-22 school year, to expand the Specialist High Skills Major program to provide more opportunities for students in Grades 11 and 12 to gain job-ready skills and explore opportunities in the skilled trades.

-

Ontario is providing an additional$39.6Mover 3 years to expand the Specialist High Skills Major program to help students gain job-ready skills in the skilled trades.

Ontario Made Manufacturing Day

We will support the Canadian Manufacturers & Exporters (CME) in its celebration of Ontario’s manufacturing sector during the Manufacturing Month of October.

The first year of programming will be marked by regional events on Ontario Made Manufacturing Day. The CME will showcase local manufacturing capabilities within our communities and highlight the convergence of advanced manufacturing and technology to inspire the next generation of industry talent. Ontario Made Manufacturing Day will shine a spotlight on our manufacturing sector by enabling youth in elementary schools, high schools and postsecondary institutions across the province to discover first-hand what careers in today’s innovative manufacturing companies offer.

Moving forward, Ontario Made Manufacturing Day will be celebrated on the first Friday in October with expanded activities that will support supply-chain development and business-to-business partnerships. These will profile Ontario manufacturers and their key suppliers to potential manufacturing customers through ongoing marketing campaign efforts, event tours, and networking.

Technological transformation is accelerating

Global economic trends and market forces are rapidly shifting towards new technologies that are transforming the next generation of vehicles and transportation experiences. Through Driving Prosperity Phase 2, we are repositioning Ontario’s auto sector to confront these new challenges and opportunities head-on. Examples of trends that are redefining the industry include:

Connected and autonomous vehicles

A connected car is linked via wireless networks to other vehicles, mobile devices and the infrastructure around it. Examples of connected vehicle technologies include information systems to help drivers travel safely while efficiently navigating traffic and driver assistance ― ranging from adaptive cruise control to full vehicle automation.

About 95% of new vehicles sold globally will be connected by 2030, up from around 50% today

Industry 4.0

The industry is investing in digital factory technologies such as smart sensors, cloud computing, and artificial intelligence for connected vehicles.

Investment in digital technologies, as a percentage of revenues, is expected to increase from 2.6% to 4.7% by 2025–30. Over the same timeframe, the use of smart sensors on shop floor machines, for example, is expected to increase from 35% to 76%

Changing the way we move

New auto technologies are changing not just the way people move, but how goods and services are delivered. Mobility technologies include a wide range of applications, essentially any use of technology to move people or goods. Examples of mobility technologies include:

- connected and autonomous vehicles

- electrification (electric vehicles, batteries and charging infrastructure)

- ride hailing and ride-sharing platforms

- e-scooters and e-bikes

- fleet management technology

- transportation logistics

Intelligent mobility technologies are expected to account for 40% of automotive industry profits by 2035

The road ahead: Ontario’s auto sector is poised for transformation

Ontario has competitive advantages that it can leverage to transform the sector for the next generation of auto manufacturing and technologies. By harnessing these strengths, expertise and assets in auto and tech, Phase 2 will help position these resources to secure new opportunities for job creation and growth.

Vibrant auto sector

Ontario is the only province in Canada that builds cars and trucks. And it is the only region in North America with five major global automotive assemblers – Stellantis (formerly Fiat Chrysler), Ford, General Motors, Honda and Toyota – as well as truck manufacturer Hino.

In North America, Ontario ranks as the #2 auto producer (after Michigan) and the #2 information technology cluster (after California).

The province’s vehicle assembly facilities are supported by a supply chain comprising over 700 parts firms and over 500 tool, die and mold makers. Ontario-based parts companies Magna, Linamar and Martinrea are among the world’s largest automotive suppliers.

In 2019, the auto sector contributed 16% of Ontario’s manufacturing GDP (equivalent to 1.9% of Ontario’s total GDP, or $13.9 billion). And it employs approximately 100,000 workers, while generating hundreds of thousands of spin-off jobs for Ontarians across the province (this employment number is pre-COVID‑19).

Major companies including GM, Ford, BlackBerry QNX and Renesas have made over $1 billion in C/AV investments in the province.

Ontario has 12 universities and 24 colleges with auto research and training programs, with over 54,000 science, technology, engineering and mathematics (STEM) graduates per year.

The province is home to over 300 companies and organizations pioneering connected and autonomous vehicle technologies. This ecosystem is strengthened by the Ontario Vehicle Innovation Network (OVIN), which connects Ontario’s world-leading auto-tech sector, high-quality post-secondary institutions, first-class talent and regional infrastructure to foster innovation and entrepreneurship.

Pioneering diverse mobility in Ontario through OVIN

- IBI Group and Weather Telematics are developing a Winter Ice and Snow Decision Support System for Operations Management (WISDOM) platform that will deliver cost savings by bringing precision to the dispatch of winter maintenance vehicles

- iNAGO Corporation and ABC Technologies are integrating AI-based intelligent conversational technology with smart interior components to create a seamless, safe, and fully interactive in-car experience for drivers and passengers

- NuPort Robotics and Canadian Tire are partnering on Canada’s first semi-autonomous heavy-duty trucking pilot using breakthrough technology developed in Ontario. The next-generation smart trucks are more fuel efficient, safer to operate, and provide an enhanced driver experience

- Pitstop and Fleet Complete are collaborating on vehicle diagnostic technology that can alert commercial fleet operators to a potential breakdown before it happens. Benefits include increased safety, prolonged vehicle service life and cost savings

Keeping Ontario’s auto sector open for business

Driving Prosperity is a responsive plan to help create the right conditions for our auto industry to adapt, grow and thrive. Marked by technological disruptions, shifts in global industry trends and fierce international competition, Phase 1 of Driving Prosperity: The Future of Ontario’s Automotive Sector established a vision for the future of the sector and outlined key action items centered on creating a competitive business climate, innovation, and talent.

Since the launch of Driving Prosperity, Ontario has made progress on these three pillars:

Competitive business climate

Cutting red tape

Ontario achieved $373 million in annualized savings to businesses since June 2018, by reducing regulatory compliance costs. In addition, more than 15 regulatory and policy amendments will streamline requirements for automotive and manufacturing.

Job Site Challenge

Ontario launched the Job Site Challenge, Canada’s first mega site program to help attract large-scale manufacturing and production projects with an inventory of shovel-ready sites. With 19 applications submitted and an expert site selector, Newmark, retained to attract large-scale manufacturing operations across the province, Ontario will be more agile as it competes for job-creating investments.

International trade missions

The province has been making international inroads to connect our auto sector to the global marketplace. This includes auto-focussed business missions to South Korea and Japan, TU-Automotive Detroit, India and Silicon Valley.

-

Ontario achieved$373Min annualized savings to businesses since June 2018.

-

More than15regulatory and policy amendments will streamline requirements for the automotive and manufacturing sectors.

Innovation

Ontario’s auto sector is recognized as a world-class manufacturing hub with a modernized supply chain and strong support system.

To ensure that Ontario continues to be an early adopter of advanced automated and connected vehicle infrastructure, the province launched the Ontario Automotive Modernization Program (O-AMP) with over 100 projects approved, leveraging about $21.4 million in industry investment. The Ontario Vehicle Innovation Network (OVIN) was also enhanced, featuring a new WinterTech Development Program and an expanded Talent Development Stream.

O-AMP results so far:

- Two intake rounds with over 100 projects supported

- Helping firms become more competitive and agile by investing in technology adoption and/or training in Lean Manufacturing

- Ontario’s commitment of $8.27 million to date will leverage about $21.4 million in industry investment

- Will create about 545 jobs

OVIN results so far:

- Ontario’s commitment of about $70 million has leveraged over $110 million in industry investment

- 1,880 jobs created and retained

- 54 R&D Partnership Fund projects

- 372 small- and medium-sized enterprises (SMEs) supported

- 419 internships and 54 year-long fellowship units supported

Talent

The skills needed for the next generation of auto workers are rapidly evolving.

Phase 1 of Driving Prosperity identified a need for greater collaboration with industry when it comes to skills planning and development to provide workers with the specific skill sets the auto sector requires. Industry, training institutions and government came together to create the supports needed to build a talent pipeline for the next generation of Ontario’s highly skilled manufacturing workforce.

Next generation skills and talent

The Career Ready Fund: Auto Stream (CRF-AS) supports work-integrated learning opportunities for students, recent graduates and apprentices in the auto and advanced manufacturing sectors. The first round of CRF-AS wrapped up in the Spring of 2020 and created nearly 1,500 placements. Currently, in round two, CRF-AS is expected to create 3,700 additional work placements in these sectors.

The RapidSkills micro-credentials pilot launched with 13 short training programs to help laid-off, at-risk, and underused workers gain the in-demand skills and knowledge required to find or retain work in the automotive and advanced manufacturing sectors.

The Digital Learning Program for Advanced Manufacturing (DLPAM) – following a successful trial of pilot modules, working in partnership with the Automotive Parts Manufacturers’ Association (APMA) – has launched a digital learning program for auto workers.

Open for Business: accelerating growth across industries

The province’s strong Open for Business mandate has driven efforts to establish an ecosystem for industries to thrive using bold new ideas to ensure Ontario is competitive in attracting future forward investments for next-generation jobs. These deliberate actions, together with Driving Prosperity, are ensuring that sectors like the auto sector are open for business, job creation and growth. This includes:

Invest Ontario

A new provincial agency focused on promoting Ontario as a key investment destination in an increasingly competitive global marketplace that will secure high-value business investments for the province. Invest Ontario will initially focus on sectors where Ontario enjoys a competitive advantage, such as advanced manufacturing and technology. Both of these sectors serve and support our auto industry and supply chain.

Tax incentives for manufacturing/accelerated write-offs

Ontario is encouraging business investment by allowing faster write-offs of the cost of capital investments such as new machinery and equipment. This means that businesses can immediately write off investments in manufacturing and processing machinery and equipment, as well as certain clean energy equipment and eligible zero-emission vehicles.

Additionally, Ontario cut its small business corporate income tax (CIT) rate to 3.2% from 3.5% starting in 2020 and continues to offer a preferential CIT rate of 10% on income from manufacturing and processing. Ontario also offers a Regional Opportunities Investment Tax Credit to corporations that build, renovate or purchase eligible commercial and industrial buildings (or other structures) in designated regions of Ontario.

Workplace Safety & Insurance Board (WSIB) premiums

Average WSIB premiums paid by employers have been cut almost in half over the past four years, without impacting benefits for injured workers and their families. WSIB has also eliminated its charge for unfunded liability, leading to further reductions in premiums for businesses.

2022 average premium rates are being reduced by 5.1%, which returns $168 million dollars to employers that can be reinvested in new jobs, technology, and health and safety protections for workers. In addition, the province has, through legislation and regulation, limited an unprecedented increase in the maximum insurable earnings for both the 2021 and 2022 premium year.

Overall, the savings realized through elimination of the unfunded liability will add $2 billion to Ontario’s economy that can be used for investments in jobs, technology and health and safety programs.

WSIB surplus distribution

In addition, the government has introduced legislation that, if passed, would allow for a significant portion of the WSIB’s current reserve, currently valued at $6.1 billion, to be distributed to safe employers. This proposed change would help employers cope with the impacts of COVID‑19.

Lower electricity costs

Our government reduced electricity costs for businesses by funding a portion of non-hydro renewable energy contract costs since January 1, 2021.

This is lowering electricity bills for Ontario’s industrial and commercial consumers, including manufacturers like those in the automotive industry who have traditionally not been able to benefit fully from the Industrial Conservative Initiative, by reducing Global Adjustment costs. Depending on location and consumption levels, consumers could see savings of between 15% and 17%.

Comprehensive savings like this are boosting the competitiveness of Ontario’s automotive and manufacturing sectors.

Driving Prosperity together

Automotive manufacturing and technology in Ontario has seen a remarkable turnaround – despite a global pandemic.

Walk around any Ontario auto or tech company now and you’ll feel the energy of an industry brimming with possibilities. Phase 2 of Driving Prosperity charts a course for the exciting road ahead to become a North American leader in developing and building the “car of the future.” Recent transformative investments offer a once-in-a-generation opportunity to leverage historic industry investments and transform, and grow, our auto sector.

We know the future is electric, connected and autonomous. That’s why we’re building on our collaborative partnerships across the industry. Ontario is ready to lead in the next wave of automotive innovation and investment.

Over the next decade, change will be constant – in industry and in the global economy. But we know one thing won’t change: the unceasing drive and passion of the people working in Ontario’s auto industry. It’s in their DNA.

Our government will be their greatest champion, every step of the way.

Driving Prosperty Phase 1

Families across Ontario rely on the auto sector for their livelihoods. Building cars, and the parts that go into them, is the economic lifeblood of communities across the province.

Ontario has a proud track record. The province was North America’s top auto-producing region in 2017 — building almost 2.2 million vehicles. But production has fallen 25% since 2000, and there is fierce global competition in the sector.

The auto sector in Ontario is at a crossroads. Technological disruption and global industry trends present both major challenges and opportunities for our auto sector. However, the province’s unique convergence of automotive and technology expertise gives Ontario a major advantage in designing and building the next generation of vehicles.

The Ontario government is reinforcing its commitment to the auto sector — it’s about being strategic, leveraging collective resources and collaborating. Industry and the Province working together, along with the research and education sector and other levels of government, will create a business climate that fosters growth, innovation and helps the industry adapt to global trends. Our government is cutting red tape and reducing business costs so that job creators ― including those in the auto sector ― can continue to grow and thrive right here in Ontario.

Our automotive plan sends a strong signal that Ontario is Open for Business.

Key principles

- Partnerships

- Forward-looking (10 years)

- Leveraging assets

- Accountability

Three pillars for action

Competitive business climate

- Modernize regulations and reduce red tape

- Enable investments and partnerships

- Support market diversification

- Reduce business costs and taxation

Innovation

- Support new mobility technologies

- Enhance the innovation ecosystem

- Promote SME technology adoption

- Support R&D and early stage technology development

- Increase commercialization and scale-up of technology

Talent

- Promote careers in advanced manufacturing

- Leverage industry input

- Enhance and raise awareness of existing employment and training programs

- Strengthen and formalize Ontario’s technical education pathways

Ontario’s auto industry ― facts and figures

Ontario has a strong track record of building cars and car parts. The auto industry is a key element of Ontario’s economy:

- 100,000+ direct jobs plus thousands more spin-off jobs in communities across the province

- 2.4% of Ontario’s overall GDP; 18.5% of manufacturing GDP (2017 figures)

- only province in Canada that builds cars and trucks

- with five automakers (Toyota, Honda, GM, Ford, Fiat Chrysler Automobiles) as the anchor for economic activity up and down the value chain, Ontario’s auto industry remains strong overall, with the province ranking as North America’s top auto-producing region for 2017, building almost 2.2 million vehicles.

- integrated supply chain ― 700+ parts firms and 500+ tool, die and mold makers

- 85% of Ontario-made vehicles and parts are exported ― industry represents largest share of Ontario goods exports (over 35% for 2017)

- 24 Ontario colleges and 11 Ontario universities offer auto-related research initiatives and training programs

- 200+ companies including GM, Ford, Google, Uber, Apple and BlackBerry QNX are developing connected and autonomous vehicle technologies in Ontario

- Ontario’s skilled labour force has been key to Ontario automakers. Thirty-one J.D. Power & Associates Initial Quality Awards, the industry’s benchmark for new vehicle quality manufacturing, have been presented to Ontario vehicle assembly plants since 1990.

Auto industry trends and challenges

There is intense global competition for auto investments and the auto industry is changing, driven by some defining trends:

A shift southward

In North America, auto manufacturing investment is shifting to the southern U.S. and Mexico.

While Ontario is responsible for 13% of North American vehicle production, since 2009 only 6% of new investment by auto makers has come to the province. Over the last 20 years, auto production in Ontario has declined by 25%.

A major driver of this shift is that southern U.S. states and Mexico offer lower costs and less red tape. To attract new jobs and investment, we need to cut red tape which drives up the cost of doing business in Ontario. Cutting red tape will bring jobs and investment back. We need to be faster than our competitors. Introducing an accelerated approval pathway for the development and deployment of the next generation of automobiles and production processes demonstrates that Ontario is willing to lead and gain first mover advantage.

Trade

The U.S. trade environment remains uncertain.

Fortunately, the s.232 auto side letter, secured as part of the Canada-U.S.-Mexico Agreement, provides continued access to the U.S. market for Ontario’s auto sector, although steel and aluminum tariffs continue to have a negative impact.

Government can’t hold back the tides of global economic trends or market forces.

But we can make sure the province is doing everything possible to protect jobs and make Ontario open for business.

Technological disruption

Cars that can drive themselves. Electric vehicles. Ride sharing apps. Smart manufacturing. Technology has made all these things possible ― today.

New technologies are rapidly changing longstanding business models. Keeping pace can be extremely challenging, demanding significant and ongoing technology investment.

Ontario is well-positioned to manufacture the next generation of vehicles. We can leverage our information and communications technology strengths and innovative automotive expertise to be at the forefront. But we know any company fighting an uphill battle against uncompetitive business costs and stifling red tape will never reach its innovation potential. We must get the fundamentals right first.

Talent development

Just as the vehicles of the future will be very different from those on the roads today, the skills required by the next generation of auto workers will be very different too.

Greater industry collaboration in skills planning and development is required to ensure the long-term supply of workers with the specific skills the auto sector requires.

There is low awareness of career options and new pathways opening up in manufacturing. Many of these careers are steeped in technology, but we are not preparing our children for this future.

We also want to minimize the disruption caused to workers and their families by technology and production mandate changes. We need to find new ways to respond to complex challenges. We need to establish new relationships with government partners in labour and academia to help Ontarians find faster and smarter training solutions.

Why Ontario? Track record, technology and talent

North American restructuring, trade uncertainty with the U.S., technological disruption and changing mobility trends all pose major challenges for Ontario’s auto industry. But they also offer significant opportunities. Working collaboratively and harnessing Ontario’s strengths, expertise and assets in auto and tech will position the auto industry for success.

There are already a lot of great things happening in the Ontario ecosystem.

Ontario is attracting major investments from global leading automotive and technology companies that are redefining mobility. For example:

- Ford established a new Research and Engineering Centre in Ottawa, with a focus on connectivity and mobile technologies.

- GM officially opened its Canadian Technical Centre in Markham (just north of Toronto) capable of housing 1,000 engineers focused on advanced driver assistance features, its fully autonomous vehicle program, and infotainment centre design and improvements.

- Uber announced a US$150 million investment in Toronto to expand its Advanced Technology Group and establish a new engineering hub.

- British AV Shuttle Company, RDM, announced it would set up its North American headquarters for its Aurrigo brand in Ottawa to take advantage of the amazing ecosystem growing in the region with BlackBerry, Ford, Nokia and many other key global players.

- Chinese mobility giant DiDi launched its second North American R&D lab in the Toronto-Waterloo corridor to take advantage of world class AI talent and leading university research.

Ontario companies, universities, research centres and innovation hubs are developing new technologies that are transforming the next generation of vehicles and transportation experiences. Highlights from the cutting edge of auto innovation include:

- Canada’s largest automotive company, Magna International based in Aurora, has increased its R&D investment to position itself at the forefront of vehicle electrification and autonomous driving.

- CanmetMATERIALS Lab, in Hamilton, is dedicated to innovation in metals and materials fabrication, processing and evaluation.

- The Fraunhofer Project Centre for Composites Research at the Western University in London is developing materials that are lightweight or have low life-cycle impact for manufacturers in the automotive sector.

- Global auto assembler Infiniti launched its first North American Innovation Lab program in Toronto to take advantage of the vibrant start-up ecosystem at the intersection of automotive and technology.

- The Windsor, Ontario-built Chrysler Pacifica is the only available hybrid option in the minivan segment and has received numerous industry awards since its launch.

- Ottawa has established one of North America’s leading all-weather test environments for connected and autonomous vehicles.

Talent is the new currency, whether in the form of people, start-ups or university teams. Ontario has the existing talent that industry needs, and we want to make sure people have the emerging skills required to build the next generation of cars — from machining to machine learning and everything in between. Our competitive business environment will also help encourage global investment and attract and retain talent.

- University of Toronto students won the First Challenge of the GM-SAE Auto Drive Challenge Competition in Yuma, AZ. Both University of Toronto and University of Waterloo teams are poised to challenge for gold in 2019.

- University of Waterloo’s Centre for Automotive Research (WatCAR) is working directly with Renesas on their AVs that are showcased at the Consumer Electronics Show in Las Vegas.

- Ontario companies dominated the Code Hackathon at Automobility LA, with Toronto-based Tribalscale and Waterloo-based Pitstop taking home the gold and silver respectively.

- Toronto and Ann Arbor-based P3 Mobility was recently selected to lead the Oakland County, MI Connected Vehicle Pilot program that promises to showcase leading technologies and business models for V2X.

- Toyota Motor Manufacturing Canada (TMMC) has established an Innovation Laboratory at Catalyst 137 in Kitchener-Waterloo, one of the world’s largest urban hubs for Internet of Things (IoT) technology development.

- Ontario-based The Knowledge Society is one of the leading innovation programs in the world for high-school aged students interested in STEM – global corporates such as Google, Microsoft and AirBnB are taking note.

Driving Prosperity: The Future of Ontario’s Automotive Sector

Ontario’s auto workers and dynamic companies are among the best in the world and have the expertise, ingenuity and passion to seize new opportunities. The Ontario government is doing everything possible to create the conditions for success, while continually listening and adapting to what the industry needs to thrive.

The plan’s action items build on the leadership and foresight already demonstrated by Ontario’s auto industry. For example, more than 200 companies in Ontario are already developing connected and autonomous vehicle technologies ― a global market expected to be worth over US$1.3 trillion by 2035.

This plan also responds directly to the insightful work previously completed, including Drive to Win, the report by Ray Tanguay, former automotive advisor to the governments of Canada and Ontario, and Industrie 2030 Ontario by the Canadian Manufacturers & Exporters (CME). Recommendations in these reports were widely supported by industry. As such, the government used these reports to lay the foundation of this plan.

Below is a summary of work already underway, and next steps under the plan’s three pillars for action:

- creating a competitive business climate

- driving innovation

- developing talent

Creating a competitive business climate

Goals for 2030

- a sustainable Ontario auto assembly and parts supply chain

- a business climate that is ready for industry changes, technological advancements, and global pressures

- Ontario businesses that can diversify and take advantage of global market opportunities

Work already underway

Removing carbon pricing

The Cap and Trade Cancellation Act, 2018, ended the previous government’s cap and trade carbon tax once and for all. Eliminating the carbon tax removes a burden from Ontario businesses, allowing them to grow, create jobs and compete around the world.

Cancelling Bill 148

By repealing the burdensome provisions imposed by Bill 148 and by capping the minimum wage increase at $14 per hour, Ontario is restoring auto sector competitiveness.

Reducing electricity prices

As a key input for manufacturing, high electricity rates negatively impact the auto industry. Ontario is reviewing the industrial electricity rate.

Trade issues

From testifying at s.232 tariff hearings to extensive state-level engagement, Ontario has advocated for the auto sector during Canada-U.S.-Mexico-Agreement (CUSMA) negotiations and continues to fight for Ontario workers.

Regulatory burden reduction

Ontario has listened to auto stakeholders’ concerns about burdensome regulations and is committed to reducing regulatory burden by 25% by 2020.

Lowering taxes

Ontario successfully lobbied the federal government for measures to accelerate the deduction of business expenses and has committed to match the federal measures as part of the province’s fiscal plan.

Next steps

Bold ideas

- maintain current assembly production volume and secure new assembly commitments

- attract leading production mandates, including connected, autonomous and electric vehicles (CV/AV and EV)

Immediate action areas

- explore support for strategic investments in the automotive industry — major strategic investments to drive long-term, sustainable growth and prosperity

- deliver further red tape and regulatory burden relief for the auto sector, including:

- a Job Site Challenge — a competition, open to municipalities, economic development corporations, and industrial developers, for a site (500 to 1,500 acres) capable of attracting a new assembly plant. Ontario would partner with the winning proponent on site-readiness and servicing to ensure the development opportunity is competitive

- eliminate long-standing irritants that add to the cost of doing business in Ontario — irritants the auto sector doesn’t face in the U.S. For example, improving the transparency and stability of property tax assessments

- streamline the approvals and certification process for auto manufacturing sites

- Market Ontario as a place to invest by selling Ontario’s value proposition, including Premier-led and Minister-led missions to key markets to increase foreign direct investment (FDI) into Ontario, and increase exports of Ontario-developed technology and auto parts

Explore other mechanisms to enhance business climate competitiveness in Ontario, including focused engagement with the auto sector during stakeholder consultations on industrial electricity pricing.

Driving innovation

Goals for 2030

- ontario’s auto sector is recognized as a world-class manufacturing hub with a modernized supply chain and strong support ecosystem

- more scaled-up auto and manufacturing technology firms

- ontario is an early adopter of advanced automated and connected vehicle infrastructure

Work already underway

Connected and autonomous vehicle development

Through its Autonomous Vehicle Innovation Network (AVIN), Ontario is supporting industry-led projects developing CV/AV technologies.

Autonomous vehicle testing

Ontario is the first Canadian province to allow on-road testing of autonomous vehicles. As of January 2019, Ontario amended its pilot regulation to align with other global AV testing jurisdictions.

Broadband and Cellular Strategy

In the 2018 Fall Economic Statement, the province committed to a Broadband and Cellular Strategy to expand broadband, digital services and cellular access in unserved and underserved areas.

5G

Allow an estimated 1,000 small- and medium-sized businesses to plug into a 5G platform and access related research and technology.

Next steps

Bold ideas

Enable the private sector to develop a province-wide network of CV/AV and EV supporting infrastructure.

Support the growth of Ontario-based CV/AV firms, including three to five North American leaders.

Immediate action areas

Launch the Ontario Automotive Modernization Program (O-AMP) to assist automotive parts suppliers become more productive, innovative and export-focused through the adoption of technology. O-AMP builds off the Automotive Supplier Competitiveness Improvement Program (ASCIP).

Support the creation of new mobility technologies in Ontario by enhancing the province’s Autonomous Vehicle Innovation Network (AVIN), including:

Launch a “wintertech” development stream to create a test-bed for mobility products and services in severe winter weather conditions.

Harnessing and developing our talent

Goals for 2030

- Ensure greater industry collaboration in skills planning and development.

- An established talent pipeline with the next generation of highly-skilled manufacturing workers.

- Industry, training institutions and government working collaboratively to ensure responsive supports for tomorrow’s workforce needs.

Work already underway

Skilled trades improvement

Skilled workers are vital to the auto industry. Ontario is phasing out the Ontario College of Trades and creating a modern skilled trades and apprenticeship system that will make it easier for employers to hire apprentices and for apprentices to get trained and certified quickly.

Enhancing STEM and AI grads

Through Raise AI, a two-year commitment to the Vector Institute, and by enhancing the pipeline of STEM graduates by improving math teaching, Ontario is ensuring that the auto sector will have the talent it needs in the future.

Next steps

Bold ideas

- Modernize apprenticeship training to make it more flexible and responsive to auto sector needs.

- Provide re-employment support to auto workers impacted by closures, including those in the broader supply-chain.

Immediate action areas

- Develop a talent roadmap and skills inventory. The talent roadmap will help identify current and future skills needs to support sector competitiveness.

- Launch a micro-credentials pilot to test the ability of short, employer-recognized credentials, including for skilled trades and technology, to help unemployed Ontarians and at-risk workers gain the skills they need to succeed.

- Create new internships and other experiential learning opportunities across all aspects of the auto sector, including parts suppliers.

- Establish an online learning and training portal focused on the skills needed to succeed in manufacturing.

- Increase funding to AVIN’s TalentEdge program to support internships and fellowships for Ontario students' research into connected and autonomous vehicles.

The road ahead

Hundreds of thousands of direct and spin-off jobs in communities across the province depend on Ontario’s auto sector. It is imperative that we have a path forward to protect and grow these important jobs. That’s why Driving Prosperity: The Future of Ontario’s Automotive Sector sets out key priorities and actions to transform the auto sector over the next 10 years.

Car manufacturing is a strong part of Ontario’s history and a critical part of the province’s future. This is why we will continue to work with our auto assemblers to ensure their continued growth in Ontario for many years to come. Ontario has a rare combination of automotive and technology expertise — that’s a major advantage that we will continue to build on.

Phase one of this plan identifies immediate action items to support industry competitiveness. Phase two will address longer-term challenges and opportunities facing the sector and for sustainable economic growth. We will work with industry, municipalities and the federal government to build upon the plan.

Industry leaders and experts have already come forward with constructive, workable suggestions for the longer term. Our government thanks the industry for its ongoing engagement and commitment to strengthening Ontario’s auto sector.

We’re listening and we look forward to working with you.

Footnotes

- footnote[1] Back to paragraph https://www2.deloitte.com/us/en/insights/focus/future-of-mobility/electric-vehicle-trends-2030.html

- footnote[2] Back to paragraph https://www2.deloitte.com/content/dam/insights/us/articles/22869-electric-vehicles/figures/Fig-02.png

- footnote[3] Back to paragraph Source: Ontario Mining Association

- footnote[5] Back to paragraph McKinsey & Company, Unlocking the full life-cycle value from connected-car data, February 11, 2021

- footnote[6] Back to paragraph Center for Automotive Research, Technology Roadmap: Materials and Manufacturing, 2019

- footnote[7] Back to paragraph Center for Automotive Research, Technology Roadmap: Intelligent Mobility Technologies, 2019