Training Completion Assurance Fund: 2018 Annual Report

The Training Completion Assurance Fund (TCAF) protects students in the event of a closure of a registered private career college.

The Training Completion Assurance Fund (TCAF) protects students in the event of a closure of a registered private career college.

Introduction

Private career colleges are independent businesses offering a broad range of postsecondary training and education programs. For over 100 years, private career colleges have played an important role in preparing Ontario students for entry into occupations. There are currently over 400 registered private career colleges in the province, and approximately 600 campuses.

Private career colleges have a common objective of bringing students to the level of a beginning practitioner in the shortest possible time. Private career colleges generally appeal to individuals who:

- need practical skills to enter or re-enter the work force as quickly as possible (for example, Employment and Social Development Canada and Workplace Safety and Insurance Board sponsored training)

- are mature students not interested in academic studies at this point in their lives and who want to compress their length of training to minimize time out of the workforce (programs usually range in duration from one to 18 months to complete)

- want to acquire specific practical skills in addition to their academic qualifications in order to become more competitive in the marketplace

- are looking for flexible delivery of programs such as multiple intakes, schedule, location

Private career colleges prepare students for careers in areas such as business, information technology, health care, tractor-trailer operation, welding, automotive technology, fashion design, hospitality, and beauty.

Registered private career colleges range in size, from those offering single programs, to large multi-campus organizations. Private career colleges also vary in organizational structure, from sole proprietorships to franchises, and multinational corporations.

In Ontario, the Private Career Colleges Act, 2005, regulates the private career college sector and outlines requirements for registration, fees, tuition fee refunds, student contracts, financial securities, instructional staff qualifications, and advertising. A key component of the act is the Training Completion Assurance Fund, or TCAF

, which was established in 2007 in order to ensure greater student protection. The TCAF model and other financial matters are outlined in Ontario Regulation 414/06 (O. Reg. 414/06).

Purpose of the TCAF

The purpose of the TCAF is to ensure that when a registered private career college prematurely closes, enrolled students are given the opportunity to either:

- complete their vocational program as provided by another private career college or other postsecondary education institution (for example, a community college)

or

- receive a refund of the portion of the fees for which they did not receive instruction or any other benefits

Prior to the establishment of the TCAF, private career colleges were required to post financial securities with the Ministry of Colleges and Universities. These securities were used to compensate students if a private career college closed prior to the completion of their training. Although the average private career college was required to post approximately $60,000 in financial security, the amount was often insufficient to cover all costs associated with training completion.

An assurance fund was identified as a model used in other jurisdictions which allowed private career college students impacted by premature closures to choose between either completing their training at no additional cost, or receiving a refund for amounts paid to the closed private career college. On January 1, 2009, following a two-year build-up period, the ministry launched the TCAF.

How the TCAF operates

Following the closure of a private career college, the ministry issues a request for training completion proposals to the private career college sector. If viable training completion options are identified, students are given the choice of either completing their training or receiving a refund of unearned fees.

Provided that a student has paid all fees due to the closed private career college, the full costs of training completion are covered by the TCAF. In cases where a student has not paid all of his or her fees to the closed private career college, the student remains responsible for the payment of those fees to the training completion provider.

If a student does not opt for training completion, the TCAF provides a partial refund for fees paid to the closed private career college for which the student did not receive services.

If a training completion option cannot be identified, the TCAF will provide refunds to students for all fees paid in respect to their vocational training, whether or not partial services have been received.

In addition, the TCAF reimburses students for incremental travel and dependent care costs related to their training completion.

The TCAF model

In accordance with O. Reg. 414/06 under the Private Career Colleges Act, 2005, private career colleges are required to:

- provide the Superintendent of Private Career Colleges with prescribed amounts of financial security

- pay annual premiums into the TCAF General Fund

Financial security requirements

For the financial year ending March 31, 2018, the requirements for posted financial securities were:

For newly registered private career colleges:

- the greater of $10,000 or between 10% and 20% (depending on the institution’s assessed risk level) of the forecasted gross annual revenue from fees that will be paid by students in respect of vocational programs during the first 12 months of operations

For private career colleges renewing their registration:

- the greater of $10,000, or between 25% and 50% (depending on the institution’s assessed risk level) of the private career college’s highest monthly prepaid unearned revenue from fees paid by students during the private career college’s last fiscal year

In both cases, the Superintendent maintains the authority to adjust the amount of required financial security if the change is necessary to provide appropriate protection for the students of a private career college.

Private career colleges that are registered charities are not required to provide financial security.

TCAF premiums

Every private career college that registers under the Private Career Colleges Act, 2005 must pay TCAF premiums. Funds from premiums are paid into the TCAF General Fund.

Newly registered private career colleges are required to pay initial annual premiums for two years. Initial premium amounts are equal to 0.875% of a private career college’s annual gross revenue from vocational programs.

After a private career college’s first two years of registration, the required annual premium is equal to the greater of:

- $500

or

- the private career college’s highest monthly prepaid unearned revenue multiplied by its Premium Rate

The Premium Rate is based on the private career college’s credit rating. Premium Rates are 0.75% for low risk colleges, 1.00% for medium risk, and 1.25% for high risk.

Private career college closures

If a private career college suddenly closes while students are actively completing their training, funds paid to students or training providers are first drawn from the private career college’s posted financial security. If the amount of financial security is insufficient, money from the TCAF General Fund is used.

TCAF administration

The Superintendent is responsible for the administration of the TCAF. The current Superintendent is also the Director of the Private Career Colleges Branch in the Ministry of Colleges and Universities.

An Advisory Board, comprised of sector and non-sector representatives, provides recommendations to the Superintendent on the administration of the TCAF. For details regarding TCAF administrative and management expenses, see administrative and management expenses (Appendix A).

TCAF Advisory Board

The TCAF Advisory Board’s mandate is to provide advice to the Superintendent on items including the:

- financial administration of the TCAF (for example, setting premium and levy amounts)

- retention of experts (for example, actuaries, auditors)

- criteria to be used in assessing a private career college’s financial viability

- general guidelines for responding to private career college closures

All Board members are appointed by the Minister of Colleges and Universities. The Minister identifies one member as Board Chair and another as Board Vice-Chair. Board members are expected to be committed to ensuring a high-quality experience for private career college students, and to providing students with adequate protection if an institution closes. All Board members’ positions are voluntary.

The Board aims to hold a minimum of three in-person meetings per year. The Board may also meet as required, in person or via teleconference, to develop responses to private career college closures as they occur. A majority of members constitutes a quorum.

Any reasonable expenses incurred by members in relation to Board meetings are eligible for reimbursement from the TCAF General Fund, in accordance with the Ontario Public Service Travel, Meal and Hospitality Expenses Directive.

See the biographies of TCAF Advisory Board members in 2018 (Appendix B).

Agency risk

The Agencies and Appointments Directive requires ministries to have strategies in place to manage and reduce exposure to risk for any agencies that they oversee.

A key mechanism of this risk management approach is a mandatory risk assessment prepared by the Board, and a ministry evaluation of the agency’s risks prepared by the Private Career Colleges Branch.

A risk assessment and evaluation were completed for 2018–19, and both the TCAF Advisory Board and the ministry assert that no high risks or concerns have been identified.

The ministry worked closely with the Board to manage all potential risks and will continue to support the agency in this regard.

Accounting and financial reporting

The Ontario Government’s Integrated Financial Information System is the sole financial system supporting the administration of the TCAF. A TCAF Special Purpose Account was established within the Integrated Financial Information System in 2007 to represent cash inflows and outflows received or collected by Ontario for the TCAF.

According to the Public Sector Accounting Board, the TCAF is considered a government not-for-profit organization. A government not-for-profit organization is an organization that has all of the following characteristics:

- counterparts outside the public sector

- an entity normally without transferable ownership interests

- an entity organized and operated exclusively for social, educational, professional, religious, health, charitable or any other not-for-profit purpose

- members, contributors and other resource providers do not, in such capacity, receive any financial return directly from the organization

As a government not-for-profit organization, the TCAF must use the deferral method to present its financial statements. Under the deferral method of accounting for contributions, restricted contributions related to expenses of future periods are deferred in the statement of financial position and recognized as revenue in the period in which the related expenses are incurred.

Endowment contributions are reported as direct increases in net assets. Endowment contributions are not recognized as revenue, since they must be maintained permanently. All other contributions are reported as revenue of the current period.

Audited financial statements

The TCAF’s financial statements have been audited on an annual basis since 2011. The TCAF’s December 31, 2018 statements were audited by Weiler & Company Chartered Accountants, and an unqualified audit opinion was issued.

Download the 2018 Accrual Based TCAF Audited Financial Statements.

TCAF reports are also available for each year through 2007–17. If you require one of these reports, contact pcc@ontario.ca.

2018 private career college closures

Three private career college closures with TCAF impact occurred in fiscal 2018.

- 2120759 Ontario Ltd. o/a Niagara Welding Academy ceased operations in March 2018

- FlyCanadian Inc. ceased operations in November 5, 2018

- Emmanuel Academy of Business, Healthcare & Technology Inc., ceased operations in November 2018

These closures resulted in training completion and student refund related costs of $21,164 (Niagara Welding Academy) and $210,000 (FlyCanadian) in 2018.

Niagara Welding Academy’s $17,985 financial security and FlyCanadian’s $15,000 financial security were all exhausted, and the remaining costs associated with the closures were financed through the TCAF General Fund. Although Emmanuel Academy of Business, Healthcare & Technology Inc. was closed in 2018, the financial security of $23,955 was not forfeited until 2019 and fully exhausted.

Student claims related to 2018 closures

A total of 91 student TCAF claims were submitted in 2018. Three related to the closure of Niagara Welding Academy, 32 (including one ineligible claim) to FlyCanadian, and 56 to Emmanuel Academy of Business, Healthcare & Technology. All claims, except for one related to FlyCanadian, were found to be eligible for protection under the TCAF.

Student selections related to 2018 closures

- 72 students opted to participate in training completion

- 18 students selected a refund (including two students with full refund)

2018 closure expenses

In 2018, the TCAF incurred a total of $231,164 in costs related to two private career colleges closed in 2018. Emmanuel Academy of Business, Healthcare & Technology expenses were processed after 2018.

TCAF costs in 2018

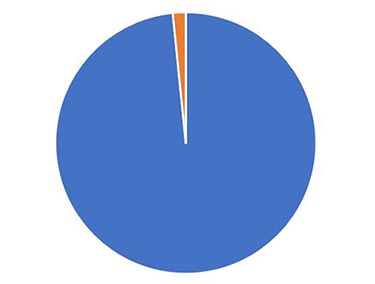

Pie chart shows total Training Completion Fund costs in 2018 of $231,164.00. Of that total, $227,466.00 (98%) was for training completion costs and $3,698.00 (2%) was for student refunds.

2018 year-in-review

Financial position

On December 31, 2018, the TCAF fund balance was $14.2 million, an increase of 4.7% compared to prior year’s balance ($13.5 million). The TCAF’s asset balance was 4.7% higher in fiscal 2018, predominantly due to an increase in cash of $694,731. The TCAF’s liabilities also grew by 4.7% in 2018, partially offsetting its increase in assets, with student refund and training completion costs payable rising by $46,628.

Fund surplus

As of December 31, 2018, the TCAF was overfunded by $1.7 million relative to its target balance of $12.5 million (17.5% of total maximum prepaid unearned revenue for the sector).

Operations

In fiscal 2018, the TCAF recognized revenue of $1,049,209, an 8.4% increase compared to 2017 ($968,206). An increase in premiums revenue of $180,462 and interest on investments of $98,754 which was partially offset by a decrease in earned financial securities of $199,384.

The TCAF incurred $410,173 worth of expenses in 2018, a 48.6% decrease compared to 2017. A $288,971 decrease in training completion costs and $88,064 decrease in student refunds were the main drivers behind this decline. A total of $31,473 was recovered from expenses related to training completion costs and student refunds from 2017.

TCAF administrative costs declined by 4.5% compared to 2017, from $177,427 to $169,408. As outlined in administration and management expenses (Appendix A), $148,878 in administrative costs was recovered from the TCAF in 2018.

Cash flows

While the fund balance described above represents the difference between the TCAF’s assets and liabilities, the cash balance indicates the amount of cash being held by the fund. As of December 31, 2018, the TCAF’s cash balance was $14.2 million, a 5.1% increase compared to prior year’s balance ($13.6 million).

Sector highlights

In 2018, the number of private career colleges in Ontario increased from 436 to 451 with the number of campuses increasing from 602 to 626. The number of programs offered by private career colleges was 4,956. Aggregate enrolment grew from 122,908 students in 2018 to 134,449 (Information is aggregated based on audited student enrolment data submitted by private career colleges).

Prior year comparison

The TCAF’s revenue, expense, and fund balances compared to 2017 are highlighted in the tables below:

TCAF's revenue

| Year | 2017 $ |

2018 $ |

|---|---|---|

| Revenue | 968,206 | 1,049,209 |

TCAF’s expenses

| Expenses | 2017 $ |

2018 $ |

|---|---|---|

| Administrative costs | (177,427) | (169,408) |

| Student refunds | (88,687) | (623) |

| Training completion costs | (498,284) | (209,313) |

| Travel and dependent care costs | (9446) | 0 |

| Other costs | (23,590) | (30,829) |

| Total expenses | (797,434) | (639,036) |

TCAF’s fund balances

| Year | 2017 $ |

2018 $ |

|---|---|---|

| Fund balance beginning of year | 13,354,699 | 13,525,471 |

| Fund balance end of year | 13,525,471 | 14,164,507 |

Administrative and management expenses (Appendix A)

Pursuant to O. Reg. 414/06 s.18, the Superintendent has the authority to redirect Fund monies for any expenses incurred for purposes of the administration and management of the Fund. The Superintendent and Ministry staff currently perform the following key TCAF administrative support and management functions:

- TCAF Advisory Board oversight

- TCAF premium processing and billing

- TCAF related closures (refunds and training completions)

- Fund reconciliation and reporting

- annual audit and reports

- financial security identification and forfeiture

The Superintendent has estimated the monthly cost of TCAF support services to be $12,406 in 2018, as per the calculation below:

| Ministry Staff | Full Time Equivalent |

|---|---|

| Sr. Financial Analyst | 100% |

| Financial and Business Coordinator | 20% |

| Manager – Quality and Partnerships Unit | 10% |

| Expense | Amount $ |

|---|---|

| Annual salaries, benefits and other direct operating expenses | 148,878 |

| Monthly chargeback | 12,406 |

TCAF Advisory Board members (Appendix B)

In 2018 there was one active member of the TCAF Advisory Board.

Eric R. Keen, FCIA, FCAS, is an independent consulting actuary. He is a Fellow of the Canadian Institute of Actuaries and the Casualty Actuarial Society. His most recent position was Director in the Audit and Assurance Group for PricewaterhouseCoopers Canada. Previously, Eric was the chief actuary at two reinsurance companies, one in Toronto and one in Bermuda. At the Bermuda Company, he also held the title of Vice President of Underwriting. He was also employed as an insurance specialist at another major accounting firm in Bermuda.