Part 1: Overview

1.1 Message from the Chair

Job creation and economic prosperity. Fundamentally, these are the most important outputs of a successful capital markets regime. Ontario first enacted its capital markets laws in 1928. For decades, Ontario has been at the forefront of investor protection and market efficacy. We cannot fall behind. Late last year, former Minister Rod Phillips formed the Capital Markets Modernization Taskforce to review the current status of Ontario’s capital markets. By February 2020, Rupert Duchesne, Wes Hall, Melissa Kennedy, Cindy Tripp, and I were appointed to conduct this review.

Since the financial crisis in 2008, the global financial system has undergone significant changes. The ongoing COVID‑19 pandemic has highlighted the need to be adaptive and forward-looking in developing a modernized capital markets. The Taskforce aimed to address the issues of tomorrow’s capital markets with bold and innovative recommendations that will make Ontario one of the most attractive capital market destinations globally.

The Taskforce worked diligently for ten months, through the COVID‑19 pandemic. We met over 110 different stakeholders in our preliminary consultations, meeting with some repeatedly, and received over 130 stakeholder comment letters in response to our consultation report released in July 2020.

One of our main objectives is to amplify growth and competitiveness in Ontario’s capital markets. The decline in new issuers and initial public offerings in Ontario is alarming. The real consequences of this trend are fewer head offices, fewer entrepreneurs, and fewer growth investment opportunities, all of which could drive Ontario to become a “branch plant” economy. To address this, the Taskforce proposes recommendations to incubate junior issuers in this province by reducing the regulatory burden, providing new opportunities for capital-raising through the expansion of prospectus exemptions, and streamlining disclosure requirements, among others.

The recommendations we have made are generational in their impact on the Ontario capital markets.

Walied Soliman

Recommending proposals designed to spur the growth and establishment of independent dealers will increase the number of intermediaries who focus on connecting capital with smaller companies. Smaller companies, in particular, rely heavily on the independent dealer community to raise capital.

To give more choice to Ontario investors, we put forward recommendations to ensure that wealth management distribution channels provide greater access to competitive and independent wealth management products. Competition among product manufacturers leads to better and more innovative products, resulting in greater choice for investors.

Although developing recommendations to foster growth and innovation is important, all of our recommendations were made through the lens of investor protection. Instilling confidence in our capital markets is critical and investors need to feel safe. One way that confidence is instilled in our capital markets is through a transparent and effective corporate governance framework. Changes are being recommended to modernize governance standards and the proxy voting framework for Ontario’s public companies to make it easier for companies to address stakeholder concerns, increase transparency, and encourage shareholder participation.

Our recommendations also support enhanced enforcement powers to protect investors and ensure a fair playing field for all market participants, while providing enhanced certainty and clarity on the enforcement process. We have also recommended new ways for funds to be returned to harmed investors.

In all, we have made over 70 consequential recommendations. The Taskforce was incredibly honoured to have had the confidence of, and encouragement from former Minister Rod Phillips in this endeavor. I would also like to thank the OSC for their support throughout this process. Ontario is privileged to have the hardworking individuals at the OSC working for us. They are talented, global capital markets leaders and we hope these recommendations will give them enhanced tools to help drive our capital markets objectives.

On behalf of the Taskforce, I would like to thank the stakeholders who have provided input during the preliminary consultations and submitted detailed, written comment letters. We are encouraged by the enthusiasm displayed by all stakeholders to work towards enhancing Ontario’s capital markets.

This report is a result of a dedicated team effort and I extend my greatest gratitude to my fellow Taskforce members, Rupert Duchesne, Wes Hall, Melissa Kennedy and Cindy Tripp for their tremendous dedication and commitment to public service throughout this process. I want to thank Eric de Roos, Deputy Minister Greg Orencsak, Assistant Deputy Minister David Wai, Assistant Deputy Minister Sunita Chander, Shameez Rabdi, Jeet Chatterjee, Luc Vaillancourt and Diane Yee at the Ministry of Finance. I would also like to thank my partners Heidi Reinhart and Rowan Weaver, and my colleagues Abigail Court, Daniel Weiss and Scott Thorner from Norton Rose Fulbright, for their pro bono assistance to the Taskforce. Lastly, I would also like to thank members of the Expert Advisory Group for their advice and feedback throughout this process. The Government of Ontario is committed to modernizing our capital markets regulatory framework. The recommendations we have made are generational in their impact on the Ontario capital markets. Together, these changes will make our province more prosperous, entrepreneurial, competitive, and help position us as a global leader.

Respectfully submitted in December 2020, with thanks for this opportunity.

Walied Soliman

Taskforce Chair

1.2 Context

The Ontario capital markets regulatory framework was last reviewed in 2003.

As part of the Government of Ontario’s commitment to modernize Ontario’s capital markets, former Minister Rod Phillips established the Capital Markets Modernization Taskforce (Taskforce) in February 2020 and appointed five members to review and make recommendations to modernize Ontario’s capital markets regulation. The Taskforce consists of the following members:

Walied Soliman,

Taskforce Chair, Canadian Chair,

Norton Rose Fulbright

Rupert Duchesne

CEO,

Mattamy Ventures

Wesley J. Hall

Founder and Executive Chair,

Kingsdale Advisors

Melissa Kennedy,

Executive Vice President, Chief Legal Officer and Public Affairs,

Sun Life

Cindy Tripp,

Founding Partner, former Managing Director, Co-Head Institutional Trading,

GMP Securities L.P.

Since then, the ongoing COVID‑19 pandemic has resulted in an economic downturn. The effects of the pandemic caused growth in Canada’s real GDP to decline by 11.5 per cent in the second quarter of 2020 — the steepest decline since quarterly GDP data was first recorded in 1961.

By the end of June 2020, the S&P/TSX Composite Index had rebounded about 44 per cent since its March 2020 low, but it was still 9.6 per cent below its February 2020 peak.

Given this continued uncertainty, the COVID‑19 pandemic has highlighted the need for a modernized capital markets to assist businesses in raising capital, particularly to deal with the short-term economic impacts of the pandemic. In addition, Ontario’s capital markets regulatory framework must be modernized to incubate innovative companies, protect investors, attract investments and foster digitization in our capital markets.

Beyond the immediate feedback received from stakeholders, the Taskforce also considered market and industry trends. The trends affecting Ontario’s capital markets are often complex and not mutually exclusive.

Many of these trends have been evolving and are constantly changing with today’s environment. In this final report, the Taskforce has provided wide-ranging recommendations to address the multitude of issues brought to their attention.

The importance of public markets

Strong public markets, both primary and secondary, are an important component of capital formation. The primary market is where securities are first issued and sold to investors. It allows an entrepreneur with a dream to raise capital and hire more people, develop new technology, explore for natural resources or build a factory. The primary market is central to the success of Ontario’s economy. It is where we incubate new jobs and companies and where Ontarians can participate in a growth story at the ground level. This is where our capital markets will incubate made-in-Canada success stories and support the creation of the next Shopify or Barrick Gold.

In many countries, over the last decade, we have witnessed widespread modernization of securities regulation, including those jurisdictions with whom we fiercely compete for risk capital. Meanwhile, Ontario’s securities legislation has not been modernized since 2003. A modernization review was both long overdue and critically urgent to re-establish the domestic and international competitiveness of Ontario’s capital market.

NEO Exchange

Secondary markets are where investors buy and sell securities. The secondary market functions through an efficient pricing mechanism, giving investors further opportunity to participate in growth prospects. Secondary markets can provide companies with additional capital, but are also used by institutional and retail investors to create wealth, save for retirement, and achieve other financial goals

The public markets are a great economic equalizer, allowing small retail investors, supported by appropriate investor protections, to participate directly in the growth of Ontario’s economy. Strong primary and secondary markets that are transparent and liquid are a hallmark of healthy and competitive capital markets and must be safeguarded. Protecting and growing our primary and secondary markets is critical to ensuring Ontario remains a thriving capital markets jurisdiction.

The decline of primary markets

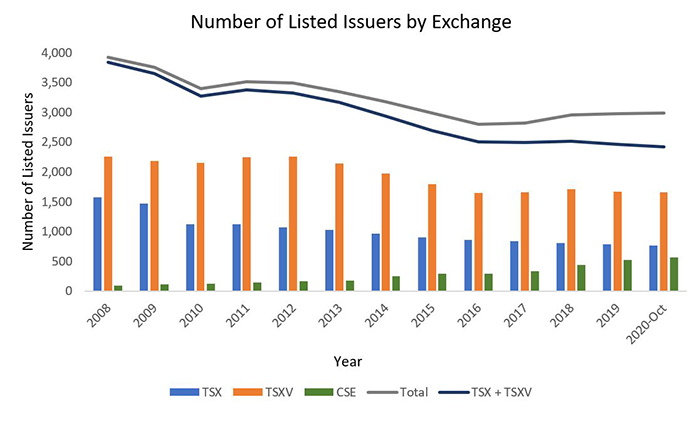

In the past two decades, the total number of listed issuers in Canada has declined.

Notes: Data in the graph excludes exchange-traded funds, closed-end funds and other structured products. Annual listing numbers are reported as of December for TSX and TSX Venture (TSXV) issuers and as of January the following year for CSE issuers.

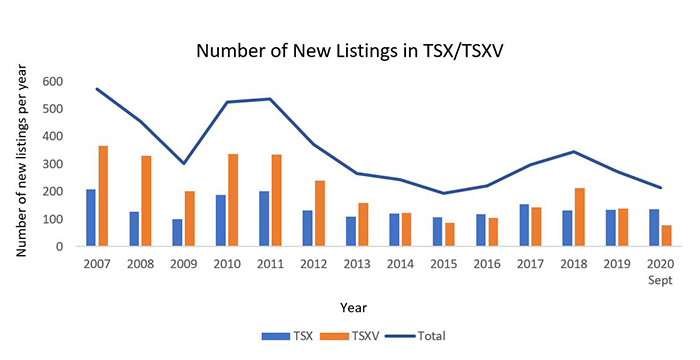

Trends show a noticeable decline of primary market activity in Canada. Apart from the overall number of listed issuers declining throughout the years, the number of new listings per year has also declined. Although the TSXV has had an increase in capital pool company/special purpose acquisition company activity between the years of 2015 and 2018, new listings in other sectors, in general, have stabilized or declined.

Note: Data in the graph includes IPOs, capital pool company/special purpose acquisition company IPOs, qualifying transactions, qualifying acquisitions, reverse takeovers, graduates and others.

In particular, the annual number of new listings on the TSXV has dropped from 337 in 2010, to 77 as of September 2020. In 2010, there were 187 new listings per year on the TSX, compared to 137 as of September 2020. From stakeholder feedback, the Taskforce heard that the cost to access public markets is a significant barrier to capital raising, especially for smaller issuers and entrepreneurs.

Filing an initial public offering (IPO) prospectus can be exceptionally costly, with many fixed costs. This disproportionately impacts smaller companies. For example, when a company chooses to list on the public markets, it uses the services of investment dealers that charge underwriting fees. Apart from underwriting fees, companies must also pay the associated legal, accounting and numerous other “friction” costs. Costs may increase significantly depending on the complexity or novelty of the IPO.

After the initial cost and resourcing pressures, public companies experience ongoing regulatory reporting requirements, with costs varying between venture and senior issuers. Listed companies are subject to greater disclosure requirements and regulatory and public scrutiny regarding their business, operations and financial results, share price movements, management and director performance, executive compensation, corporate governance practices and insider reporting.

Instead of proceeding through the traditional route to list publicly, emerging companies are increasingly relying on the availability of alternative sources of funds, such as angel investors, venture capital and private equity, often to avoid the significant costs and compliance that comes with public funding. Among other consequences, this reduces the opportunity for direct retail investor participation in the economic growth of our province.

Conversely, there has been a significant increase in the number of exchange-traded funds (ETFs). In just the last decade, ETFs in Canada have grown eightfold from 110 regular class ETFs listed in 2009, to 877 as of 2019.

Although ETFs have a comparatively small market share compared to the Canadian mutual fund industry, they outsold mutual funds for two years in a row in 2019.

The rise of the private markets

Globally in the last decade, private market assets have increased by 170 per cent and the number of active private equity firms has doubled during the same period.

For sophisticated investors, the private markets have become an important element of portfolio diversification, given the opportunities to earn higher returns than in the public markets. Over the past decade, private equity has outperformed its public market equivalents by most measures.

Apart from the lower cost to accessing private markets, company shareholders with the greatest decision-making powers also elect to remain private to maintain control, maximize returns, or seek exit or cash-out options outside of public markets. The increased allocation of capital to private markets and the growth of alternative exit options have reduced the demand for IPOs.

Exempt market activities

Exempt markets are private markets where securities can be sold without filing a prospectus.

The Ontario Securities Commission (OSC) recently published a report highlighting the following key trends in Ontario’s exempt market:

- In 2019, approximately 3,200 corporate issuers from Canada, the United States and other foreign countries reported $88.6 billion in capital raised from approximately 35,200 Ontario investors through prospectus-exempt distributions.

- The accredited investor (AI) exemption was the most used exemption in 2019, with 9 in 10 Canadian and foreign issuers relying on this exemption, which accounted for 95 per cent of the gross proceeds invested by Ontario investors.

- Other exemptions such as the offering memorandum (OM), family, friends and business associates (FFBA), and existing securities holder exemptions, have been used by over 1,300 issuers to raise just over $1 billion from 2017 to 2019.

Institutional investors, unlike individual investors, often easily meet the requirements to invest in exempt market products. In 2019, institutional investors were the predominant source of capital (96.3 per cent) in Ontario’s exempt market, investing approximately $85.3 billion, although they only represented approximately 20 per cent of investors.

Most investors in the exempt market are individuals, with the number of individual investors growing year-over-year. Trends indicate that individual investors allocate most of their capital to Ontario or Canadian-based issuers (81 per cent), in contrast to institutional investors who allocate most of their capital to foreign issuers (63 per cent). Overall, Ontario-based issuers accounted for approximately 65 per cent of the gross capital proceeds raised by Canadian issuers.

Importantly, most individual investors do not qualify to purchase exempt or private market products unless they meet certain criteria that demonstrate they can accept the investment risks. This is because most individual investors do not possess the financial capacity or risk tolerance to safely participate in the higher-risk exempt markets.

Decline in active independent investment dealers

Independent investment dealers play a key role in marrying capital with issuers, particularly with respect to venture opportunities, thereby playing a central role in the incubation and growth of the primary market. Given the higher risk profile that smaller companies typically exhibit, smaller intermediaries play an important role in early-stage capital-raising activities that smaller companies undertake.

The decline in small and medium-sized investment dealers has been attributed, in part, to the rise of large financial intermediaries in Canada with inherent competitive advantages, making it difficult for smaller intermediaries to compete.

This competitive dynamic has negatively impacted the ability of smaller intermediaries to continue providing services in Ontario’s capital markets. It has led to a decline in the number of smaller intermediaries, with an accompanying decline in new issuers. The decline of smaller investment dealers leaves a supply gap in our capital markets to meet the needs of small, higher-risk entrepreneurial companies to raise capital in the early stages of their business.

Opportunities in the market for retail fund products

There are approximately 60,000 different investment products held by clients through the Mutual Fund Dealers Association of Canada (MFDA) channel.

A broad array of available products, both proprietary and independent, is essential to increase profit opportunities for businesses and investors. Additionally, increasing the variety of products increases competition and innovation in the secondary market space. The Taskforce has heard concerns that bank‑owned shelves incentivize the sale of proprietary products and restrict access to other independent products, which may particularly affect smaller independent manufacturers.

Competition and innovation

Competition is critical to fostering fair and efficient capital markets. Investors benefit from healthy competition by way of better and innovative products and lower fees. By fostering capital formation and competition, businesses of all sizes can thrive, find creative solutions to industry concerns and challenges, increase economic growth and promote capital markets that are nimbler and more innovative.

A more competitive framework would help Ontario’s capital markets become a more attractive marketplace to investors and would help stimulate economic growth. Assessing other countries’ innovative efforts and best practices would assist Ontario in developing new, innovative ideas for job growth and economic sustainability.

Leading international jurisdictions have introduced regulatory sandboxes that have the potential to spur innovative ideas. These sandboxes allow companies to test their novel ideas in a light-touch but controlled regulatory environment, while ensuring appropriate investor protection.

Recently, financial technology (FinTech) emerged as competition to traditional and incumbent financial services. For example, crowdfunding platforms supplanted some traditional financial intermediaries by allowing peer-to-peer money exchange with minimal advice to investors. Robo-advisors facilitated a new, electronic medium for easy access to diversified portfolio services. Cryptocurrency has the potential to disrupt the intermediary role of traditional banks. However, similar to other FinTech, cryptocurrency is largely unregulated and does not provide the same quality of investor protection as other investments. Such new emerging trends will need to be incorporated into regulatory frameworks, potentially initially through regulatory sandboxes and eventually through formal regulation.

Legislation, rules and policies need to be flexible enough to respond to, but not stifle, technological innovation, while still adequately protecting investors and maintaining confidence in the capital markets. Aspiring to a more optimal balance between innovation and regulation is necessary for Ontario’s capital markets to succeed in the future.

Increased investor interest in environmental, social and governance (ESG) factors

Recently, capital markets across the world have seen a rise in ESG-driven investing. 98 per cent of Canadian institutional investors expect ESG-integrated portfolios to perform on par or better than those that do not integrate ESG factors.

A recent survey of institutional investors, consultants and investment professionals from RBC Global Asset Management, listed the top ESG concerns for investors as corruption, climate change risk and shareholder rights.

Progress in achieving diversity

There has been an increase in attention to diversity on boards and executive positions, both domestically and internationally. Greater corporate diversity does not just address long-standing inequities — it may improve governance and business decisions by helping to identify a variety of issues and concerns.

From 2015 to 2019, the percentage of women on corporate boards rose by only 9.3 per cent to 27.6 per cent and the percentage of women on executive teams rose only 2.9 per cent to 17.9 per cent.

In the past number of years, the idea of diversity has expanded beyond gender diversity. Recent amendments to the Canada Business Corporations Act (CBCA) require corporations to report on representation of, at minimum, the following groups: women, Indigenous peoples, persons with disabilities and members of visible minorities.

Indeed, there is an expectation for action. A survey of 500 capital markets professionals, completed by Women in Capital Markets and the Canadian Association of Urban Financial Professionals, found that 92 per cent of respondents supported targets for women and Black, Indigenous and people of colour (BIPOC) on boards and executive management positions.

Then and Now: S&P/TSX Composite Index over 5 yearsfootnote 30

| S&P/TSX Composite Index | 2015 | 2019 |

|---|---|---|

| Number of companies | 240 | 234 |

| Per cent of women on boards | 18.3% | 27.6% |

| Per cent of women on executive teams | 15.0% | 17.9% |

Increased shareholder activism

In addition to the rise of institutional shareholder activism in areas such as board diversity and ESG matters, there has been increased operational and transactional activism by former insiders and professional activists (i.e., hedge funds). Activists often challenge boards and management in the market for corporate influence by putting forward board nominees and strategic alternatives for shareholder approval. By providing shareholders with an alternative to existing boards and management, activists can improve public company performance. However, there are concerns that activists are too short-term focused and may exploit regulatory gaps in advancing their claims.

The need for enhanced enforcement and investor protection

Currently, it is difficult for investors who fall victim to financial misconduct, such as misleading sales practices, fraudulent investment scams and unsuitable investment advice to seek redress. In many cases, harmed investors have difficulty navigating a complex and fragmented regulatory framework. This leads to lost confidence in the integrity and fairness of the capital markets and the ability of regulatory bodies to provide meaningful investor protection.

Based on feedback from stakeholders, the Taskforce notes the need for a strengthened enforcement framework in Ontario. There is a perception that Ontario’s capital markets regulatory regime is not stringent enough with respect to white-collar crime and that bad actors in comparable jurisdictions face enforcement action earlier, which can hurt investor confidence. Limitations on enforcement can deter investments in Ontario’s capital markets, driving competition and innovation elsewhere. Healthy and thriving capital markets balance competition, growth and innovation with investor protection. Strengthened enforcement instills confidence in our capital markets and attracts investment, which plays a key role in our economic growth.

Public concerns about the effectiveness of enforcement of securities laws…are aggravated by the fact that in most cases the victims recover very little or none of their losses. This can lead to lost confidence in the integrity and fairness of the capital markets and the ability of regulatory bodies to provide meaningful investor protection.

Canadian Foundation for Advancement of Investor Rights (FAIR Canada)

COVID‑19 pandemic impact on the markets

Governments around the world have been working to stimulate global and domestic economies, create jobs and help sustain businesses that have been impacted by the COVID‑19 pandemic. Several industry sectors such as manufacturing, travel, hospitality, entertainment and recreation have experienced a decline in their growth compared to last year. The number of initial public offerings (IPOs) worldwide declined by 19 per cent and proceeds decreased by 8 per cent in the first half of 2020 compared to the first half of 2019. The number of IPOs and proceeds in the North, Central and South American regions declined by 30 per cent over the same period.

Studies have shown a significant increase in the risk and volatility of the U.S. stock market and other capital markets around the world, with early results showing that changes in volatility are more sensitive to COVID‑19 news than other economic indicators.

COVID‑19 has delayed companies’ ability to hold in-person annual general meetings (AGMs) and has resulted in more virtual AGMs. The Canadian Securities Administrators (CSA) have provided guidance on holding virtual and hybrid AGMs, while other regulatory agencies continue to provide relief and flexibility towards virtual and deferred meetings.

In addition, enforcement activities have gone virtual. The OSC published the “Guide to Virtual Hearings Before the OSC Tribunal” which provides general information about the conduct of virtual hearings.

COVID‑19 amplified the need for greater digital participation in financial services. Finding long‑term economic solutions will be dependent on digital proficiency and the ability to adapt to new changes in a digitally dominant, fast-paced capital markets environment.

The pandemic has forever changed the way consumers think, behave and financially transact. While Canadians continue to struggle with financial insecurity due to widespread job loss and business disruption remains unabated, the response of Ontario’s Ministry of Finance to this unprecedented challenge has the potential to not only pivot the economy skyward but to completely revitalize the financial sector if the right strategies are applied.

Questrade

The importance of a modernized capital markets regulatory framework

Market trends and changes since the 2008 financial crisis and the overall economic impact of COVID‑19 have reinforced the need to assess and seek ways to modernize Ontario’s capital markets regulatory structure. An effective capital markets regulator with a modernized governance structure and mandate supports Ontario’s overall economic recovery plan in a post-pandemic world. The modernization of the capital markets regulatory framework will better position Ontario to attract capital investment, help businesses grow and instill market confidence.

Cooperative Capital Markets Regulatory System (CCMR) initiative

The Taskforce is mindful of the important work being done by all the participating governments and the Capital Markets Authority Implementation Organization to establish the CCMR. As part of CCMR, Ontario is working with its partners towards the establishment of a new Capital Markets Regulatory Authority (CMRA), a single regulator operating in all participating jurisdictions. CCMR would increase harmonization in capital markets regulation and enhance investor protection by providing for stronger enforcement in capital markets.

However, given the urgent need for modernization in Ontario’s capital markets, the Taskforce is putting forward recommendations that will improve Ontario’s capital markets, in advance of future progress on the CCMR initiative. The Taskforce encourages participating jurisdictions to consider carrying forward its recommendations and adopting them as part of CCMR.

1.3 Stakeholder Feedback

From February to the end of June 2020, the Taskforce met with over 110 stakeholders to elicit preliminary feedback on the challenges faced by businesses and investors in our capital markets ecosystem. The Taskforce published the Capital Markets Modernization Taskforce Consultation Report in July 2020 to seek further stakeholder feedback.

By the time the comment period closed in September 2020, the Taskforce had received feedback from more than 130 stakeholders and held numerous follow-up discussions with stakeholders.

Throughout the consultation period, stakeholders provided more than 130 detailed responses to the Taskforce’s proposals and offered comprehensive feedback for the Taskforce to consider in preparation for its final recommendations. Overall, stakeholder comments covered a broad set of themes related to the capital markets, including, but not limited to, the following:

- Improving corporate and regulatory governance structures to improve efficiency and effectiveness;

- Re-invigorating the intermediary sector and improving capital-raising opportunities, particularly for smaller issuers;

- Creating a flexible regulatory framework that is adaptable to changing conditions;

- Facilitating a level playing field between large and smaller market participants;

- Reducing regulatory burden and streamlining processes/requirements to save businesses’ resources;

- Enhancing investor protection to instill confidence in Ontario’s capital markets and attract investments;

- Encouraging innovation in the sector that will ultimately benefit businesses and investors alike;

- Ensuring enforcement practices and procedures are effective; and

- Aligning final recommendations, where possible, with other regulatory jurisdictions.

Chart Descriptions

Number of Listed Issuers by Exchange

The chart shows the total number of listed issuers in Canada has declined from 2008 to October 2020. There has been a decrease in the total number of listed issuers on the Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV), and an increase in the total number of listed issuers on the Canadian Securities Exchange (CSE) over time from 2008 to October 2020.

| Year | TSX | TSXV | CSE | TSX + TSXV | Total |

|---|---|---|---|---|---|

| 2008 | 1,574 | 2,261 | 89 | 3,835 | 3,924 |

| 2009 | 1,468 | 2,178 | 109 | 3,646 | 3,755 |

| 2010 | 1,121 | 2,154 | 126 | 3,275 | 3,401 |

| 2011 | 1,123 | 2,249 | 144 | 3,372 | 3,516 |

| 2012 | 1,068 | 2,256 | 163 | 3,324 | 3,487 |

| 2013 | 1,023 | 2,138 | 179 | 3,161 | 3,340 |

| 2014 | 963 | 1,971 | 246 | 2,934 | 3,180 |

| 2015 | 903 | 1,791 | 294 | 2,694 | 2,988 |

| 2016 | 860 | 1,648 | 290 | 2,508 | 2,798 |

| 2017 | 836 | 1,653 | 332 | 2,489 | 2,821 |

| 2018 | 804 | 1,707 | 442 | 2,511 | 2,953 |

| 2019 | 786 | 1,671 | 523 | 2,457 | 2,980 |

| 2020-Oct | 765 | 1,655 | 562 | 2,420 | 2,982 |

Number of New Listings in TSX/TSXV

The chart shows the total number of new listings on the TSX and TSXV has declined from 2007 to September 2020.

| Year | TSX | TSXV | Total |

|---|---|---|---|

| 2007 | 207 | 366 | 573 |

| 2008 | 126 | 329 | 455 |

| 2009 | 100 | 202 | 302 |

| 2010 | 187 | 337 | 524 |

| 2011 | 201 | 334 | 535 |

| 2012 | 132 | 240 | 372 |

| 2013 | 108 | 158 | 266 |

| 2014 | 121 | 122 | 243 |

| 2015 | 107 | 87 | 194 |

| 2016 | 117 | 104 | 221 |

| 2017 | 153 | 143 | 296 |

| 2018 | 132 | 212 | 344 |

| 2019 | 134 | 139 | 273 |

| 2020-Sept | 137 | 77 | 214 |

Footnotes

- footnote[1] Back to paragraph Capital Markets Modernization Taskforce. (2020, July). Capital Markets Modernization Taskforce consultation report. https://www.ontario.ca/document/capital-markets-modernization-taskforce-consultation-report-july-2020

- footnote[2] Back to paragraph Five Year Review Committee. (2003, March 21). Reviewing the Securities Act (Ontario). https://www.osc.gov.on.ca/documents/en/Securities/fyr_20030529_5yr-final-report.pdf

- footnote[3] Back to paragraph The Appendix contains the biographies of all Taskforce members.

- footnote[4] Back to paragraph Statistics Canada. (2020, August 28). Gross domestic product, income and expenditure, second quarter 2020. https://www150.statcan.gc.ca/n1/daily-quotidien/200828/dq200828a-eng.htm.

- footnote[5] Back to paragraph Ontario Economics Accounts. (2020). Second Quarter of 2020. Ontario Ministry of Finance.

- footnote[6] Back to paragraph Ontario Economics Accounts. (2020).

- footnote[7] Back to paragraph TMX Group. (n.d.) Market Intelligence Group (MiG) Archives. https://www.tsx.com/listings/current-market-statistics/mig-archives.

- footnote[8] Back to paragraph Canadian Securities Exchange. Note: The Ontario Securities Commission reached out personally to the Canadian Securities Exchange for this data.

- footnote[9] Back to paragraph TMX Group. (n.d.).

- footnote[10] Back to paragraph National Bank of Canada. (2020). December and full-year 2019: A decade of investment milestones. http://www.cetfa.ca/files/1578316922_Year%20End%202019.pdf.

- footnote[11] Back to paragraph National Bank of Canada. (2020).

- footnote[12] Back to paragraph National Bank of Canada. (2020).

- footnote[13] Back to paragraph McKinsey & Company. (2020). A new decade for private markets: McKinsey global private markets review 2020. https://www.mckinsey.com/~/media/mckinsey/industries/private%20equity%20and%20principal%20investors/our%20insights/mckinseys%20private%20markets%20annual%20review/mckinsey-global-private-markets-review-2020-v4.ashx.

- footnote[14] Back to paragraph McKinsey & Company. (2020).

- footnote[15] Back to paragraph Almazora, L. (2019, November 7). How NEO is taking the fight to investment inequity. Wealth Professional. https://www.wealthprofessional.ca/archived/how-neo-is-taking-the-fight-to-investment-inequity/321649

- footnote[16] Back to paragraph https://www.osc.gov.on.ca/documents/en/Securities-Category4/sn_20201210_45-717_ontario-exempt-market.pdf.

- footnote[17] Back to paragraph Investment Industry Association of Canada (IIAC). (2020, January). Structural change in investment industry will break loose this coming year as competitive conditions intensify. Letter from the President, 131https://iiac.ca/wp-content/uploads/Letter-from-the-President-Vol.-131.pdf.

- footnote[18] Back to paragraph Mutual Fund Dealers Association. (2020). Client research report 2020.https://mfda.ca/wp-content/uploads/2020_ClientResearchReport-1.pdf.

- footnote[19] Back to paragraph Mutual Fund Dealers Association. (2017). 2017 MFDA Client Research Report. https://mfda.ca/wp-content/uploads/2017_MFDA_ClientResearchReport.pdf.

- footnote[20] Back to paragraph Royal Bank of Canada. (n.d.). Our latest independent research: Responsible investment: Global adoption – regional divide. RBC Global Asset Management. https://www.rbcgam.com/en/ca/about-us/responsible-investment/our-latest-independent-research.

- footnote[21] Back to paragraph World Economic Forum. (2020, September). Measuring stakeholder capitalism towards common metrics and consistent reporting of sustainable value creation. http://www3.weforum.org/docs/WEF_IBC_Measuring_Stakeholder_Capitalism_Report_2020.pdf.

- footnote[22] Back to paragraph Ward, M. (2020, September 22). ‘The time is now,’ says EY CEO Carmine Di Sibio, as the Big Four corporate accounting firms get serious about ethical governance and endorse official ESG reporting standards. Business Insider. https://www.businessinsider.com/big-4-deloitte-pwc-ey-kpmg-announce-esg-reporting-standards-2020-9#:~:text=Leaders%20of%20Deloitte%2C%20PwC%2C%20EY,Financial%20Times'%20Gillian%20Tett%20reports.&text=As%20of%20June%202019%2C%20more,using%20ESG%20standards%2C%20per%20Forbes.

- footnote[23] Back to paragraph Langton, J. (2020). Canadian institutional investors have high hopes for ESG portfolios. Investment Executive. https://www.investmentexecutive.com/news/research-and-markets/canadian-institutional-investors-have-high-hopes-for-esg-portfolios/?utm_source=newsletter#038;utm_medium=nl&.

- footnote[24] Back to paragraph Langton, J. (2020).

- footnote[25] Back to paragraph Catalyst & 30% Club. (2020). Women in leadership at S&P/TSX companies. https://www.catalyst.org/wp-content/uploads/2020/03/Women-in-Leadership_SP_TSXCompanies_report_English-Final-1.pdf

- footnote[26] Back to paragraph Canadian Securities Administrators. (October 2019). Report on Fifth Staff Review of Disclosure Regarding Women on Boards and in Executive Officer Positions. https://www.osc.gov.on.ca/documents/en/Securities-Category5/sn_20191002_58-311_staff-review-women-on-boards.pdf.

- footnote[27] Back to paragraph Government of Canada. (2019, July 18). Diversity disclosure for boards of directors and senior management comes into force. https://www.ic.gc.ca/eic/site/cd-dgc.nsf/eng/cs08317.html.

- footnote[28] Back to paragraph Osler, Hoskin & Harcourt LLP. (October 2020). 2020 Diversity Disclosure Practices. https://www.osler.com/osler/media/Osler/reports/corporate-governance/Diversity-and-Leadership-in-Corporate-Canada-2020.pdf.

- footnote[29] Back to paragraph Women in Capital Markets & Canadian Association of Urban Financial Professionals. (2020, August). Targets: Capital markets are ready WCM quick-hit research corporate board diversity in Canada. https://wcm.ca/files/about/WCM-Research-Targets-for-Corporate-Board-Diversity.pdf

- footnote[30] Back to paragraph Catalyst & 30% Club. (2020).

- footnote[31] Back to paragraph EY Canada. (2020). Is your equity story adapting to the new norm? Global IPO trends: Q2 2020. https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/growth/ey-q2-2020-global-ipo-trends-report-v1.pdf.

- footnote[32] Back to paragraph Baek, S. et al. (2020). COVID‑19 and stock market volatility: An industry level analysis. Science Direct . https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7467874/

- footnote[33] Back to paragraph Ontario Securities Commission. (2020). Guide to virtual hearings before the OSC Tribunal. https://www.osc.gov.on.ca/documents/en/Proceedings/tribunal_guide-virtual-hearings-before-osc-tribunal.pdf.

- footnote[34] Back to paragraph Capital Markets Modernization Taskforce. (2020, July).