Government Notices Respecting Corporations

Certificate of Dissolution

Notice Is Hereby Given that a certificate of dissolution under the Business Corporations Act, has been endorsed. The effective date of dissolution precedes the corporation listings.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2011-05-16 |

Custom Concept Engineering Inc. |

000603394 |

|

2011-05-16 |

Custom Concept Solutions Inc. |

002013802 |

|

2011-05-16 |

Frankhall Corporation Ltd. |

001509421 |

|

2011-05-16 |

International Village (Wasaga) Inc. |

000668291 |

|

2011-05-16 |

Kick’n It Freestyle! Inc. |

001672766 |

|

2011-05-16 |

Maccen Holdings Ltd. |

002002800 |

|

2011-05-16 |

Nicmac Holdings Ltd. |

002002799 |

|

2011-05-16 |

Ragnelg Holdings Limited |

000842104 |

|

2011-05-16 |

Ssfi Incorporated |

002107837 |

|

2011-05-16 |

Toro Fence Co. Ltd. |

000544608 |

|

2011-05-16 |

1326068 Ontario Ltd. |

001326068 |

|

2011-05-16 |

1527154 Ontario Limited |

001527154 |

|

2011-05-16 |

1726409 Ontario Inc. |

001726409 |

|

2011-05-16 |

2124450 Ontario Ltd. |

002124450 |

|

2011-05-16 |

471302 Ontario Limited |

000471302 |

|

2011-05-16 |

868870 Ontario Ltd. |

000868870 |

|

2011-05-17 |

1687674 Ontario Inc. |

001687674 |

|

2011-05-18 |

A. Mike Brubacher Limited |

000135995 |

|

2011-05-18 |

Alexander Muir Residence Limited |

001266510 |

|

2011-05-18 |

Bajwa Developers Canada Ltd. |

002075230 |

|

2011-05-18 |

Gerry B. Enterprises Inc. |

000905033 |

|

2011-05-18 |

Grayling Enterprises Inc. |

001323885 |

|

2011-05-18 |

Hamilton Offset Service Limited |

000383951 |

|

2011-05-18 |

Jr Dollar Store & More Inc. |

002131972 |

|

2011-05-18 |

Pinter Trucking Inc. |

001246779 |

|

2011-05-18 |

Ted Padley & Associates, Inc. |

002166894 |

|

2011-05-18 |

Tender Loving Care Cafe Inc. |

001651961 |

|

2011-05-18 |

Trillium Equine Trailering Inc. |

002064716 |

|

2011-05-18 |

1022518 Ontario Inc. |

001022518 |

|

2011-05-18 |

1414051 Ontario Inc. |

001414051 |

|

2011-05-18 |

1433984 Ontario Ltd. |

001433984 |

|

2011-05-18 |

1470399 Ontario Inc. |

001470399 |

|

2011-05-18 |

1501448 Ontario Inc. |

001501448 |

|

2011-05-18 |

1784069 Ontario Ltd. |

001784069 |

|

2011-05-18 |

2004181 Ontario Inc. |

002004181 |

|

2011-05-18 |

2115198 Ontario Inc. |

002115198 |

|

2011-05-18 |

2127121 Ontario Inc. |

002127121 |

|

2011-05-18 |

2246642 Ontario Inc. |

002246642 |

|

2011-05-18 |

698685 Ontario Inc. |

000698685 |

|

2011-05-19 |

Penvue Farms Ltd. |

000675216 |

|

2011-05-30 |

Canturc Corp. |

001757752 |

|

2011-05-31 |

The Dollar Post Ltd. |

001539373 |

|

2011-05-31 |

Zagrodney Engineering Limited |

000347752 |

|

2011-05-31 |

2184009 Ontario Limited |

002184009 |

|

2011-06-01 |

Bld Financial Incorporated |

001658065 |

|

2011-06-01 |

M. J. Smolkin Limited |

001803706 |

|

2011-06-01 |

Polyprime Properties Limited |

000848280 |

|

2011-06-01 |

Romolin Investments Ltd. |

001357081 |

|

2011-06-01 |

1025129 Ontario Inc. |

001025129 |

|

2011-06-02 |

Graham Planning Group Inc. |

001595118 |

|

2011-06-02 |

Heatim Capital Corporation |

000529902 |

|

2011-06-02 |

Mcintyre Employment Agency Inc. |

000914911 |

|

2011-06-02 |

Neighbour’s Enterprise Inc. |

001730310 |

|

2011-06-02 |

Noctorum Holdings Inc. |

000651988 |

|

2011-06-02 |

Prochem Inc. |

002016373 |

|

2011-06-02 |

Ws Excavations Inc. |

001581612 |

|

2011-06-02 |

1058636 Ontario Ltd. |

001058636 |

|

2011-06-02 |

1561643 Ontario Inc. |

001561643 |

|

2011-06-02 |

1589852 Ontario Inc. |

001589852 |

|

2011-06-02 |

1639917 Ontario Limited |

001639917 |

|

2011-06-02 |

1685743 Ontario Inc. |

001685743 |

|

2011-06-03 |

Artel Graphics Inc. |

000440832 |

|

2011-06-03 |

Di Cresce & Associates Inc. |

000679096 |

|

2011-06-03 |

Hd Media Corp. |

002086740 |

|

2011-06-03 |

Lovic Developments Ltd. |

000281380 |

|

2011-06-03 |

Memonco Holdings Ltd. |

001262171 |

|

2011-06-03 |

T.I.P.S. Accounting & Financial Inc. |

001801221 |

|

2011-06-03 |

The Joy Of Learning Montessori School Inc. |

001586582 |

|

2011-06-03 |

Top Network & Security Inc. |

002169568 |

|

2011-06-03 |

1413777 Ontario Inc. |

001413777 |

|

2011-06-03 |

1503940 Ontario Inc. |

001503940 |

|

2011-06-03 |

1626118 Ontario Inc. |

001626118 |

|

2011-06-03 |

1663743 Ontario Limited |

001663743 |

|

2011-06-03 |

1802669 Ontario Inc. |

001802669 |

|

2011-06-03 |

2021825 Ontario Inc. |

002021825 |

|

2011-06-03 |

978532 Ontario Ltd. |

000978532 |

|

2011-06-06 |

Brisbois Pharmacy Limited |

000355455 |

|

2011-06-06 |

L. A. And B. Investments Limited |

000207219 |

|

2011-06-06 |

Labcad Contracting Group Inc. |

002161098 |

|

2011-06-06 |

Rockmeyer Innovations Inc. |

002022418 |

|

2011-06-06 |

Rumpel Holdings Limited |

000018244 |

|

2011-06-06 |

Wallar’s Ladies Wear Limited |

000137634 |

|

2011-06-06 |

1295065 Ontario Inc. |

001295065 |

|

2011-06-06 |

2042894 Ontario Inc. |

002042894 |

|

2011-06-06 |

2108810 Ontario Corporation |

002108810 |

|

2011-06-07 |

Alva Thompson & Sons Limited |

000070810 |

|

2011-06-07 |

Frank Watts Sod Ltd. |

000106446 |

|

2011-06-07 |

Front/York (G.P.) Limited |

002036821 |

|

2011-06-07 |

Hei Long Enterprise Inc. |

002139706 |

|

2011-06-07 |

Imagimate Solutions Inc. |

002172563 |

|

2011-06-07 |

Insignia Global Inc. |

001646027 |

|

2011-06-07 |

Westech Informatics Limited |

001680251 |

|

2011-06-07 |

151 Front Street West Holdings Limited |

002036820 |

|

2011-06-07 |

1832752 Ontario Inc. |

001832752 |

|

2011-06-07 |

1832753 Ontario Inc. |

001832753 |

|

2011-06-07 |

2127730 Ontario Inc. |

002127730 |

|

2011-06-08 |

Hejjam Investments Ltd. |

000279329 |

|

2011-06-08 |

1041307 Ontario Ltd. |

001041307 |

|

2011-06-08 |

953239 Ontario Inc. |

000953239 |

|

2011-06-09 |

Woodbine Place Iii Inc. |

001228046 |

Katherine M. Murray

Director, Ministry of Government Services

(144-G307)

Cancellation of Certificate of Incorporation (Business Corporations Act)

Notice Is Hereby Given that by orders under subsection 241(4) of the Business Corporation Act, the certificates of incorporation set out hereunder have been cancelled and corporation(s) have been dissolved. The effective date of cancellation precedes the corporation listing.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2011-06-13 |

The Personnel Network Inc. |

1247176 |

Katherine M. Murray

Director

(144-G308)

Cancellation for Filing Default (Corporations Act)

Notice Is Hereby Given that orders under Section 317(9) of the Corporations Act have been made cancelling the Letters Patent of the following corporations and declaring them to be dissolved. The date of the order of dissolution precedes the name of the corporation.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2011-06-13 |

St. Catharines Ringette Association |

682584 |

Katherine M. Murray

Director

(144-G309)

Notice of Default in Complying with the Corporations Information Act

Notice Is Hereby Given under subsection 241(3) of the Business Corporations Act that unless the corporations listed hereunder comply with the filing requirements under the Corporations Information Act within 90 days of this notice orders dissolving the corporation(s) will be issued. The effective date precedes the corporation listings.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2011-06-13 |

Vienna Sandwiches Inc. |

1711997 |

|

2011-06-13 |

1712913 Ontario Limited |

1712913 |

Katherine M. Murray

Director, Ministry of Government Services

(144-G310)

Notice of Default in Complying with a Filing Requirement under the Corporations Information Act

Notice Is Hereby Given under subsection 317(9) of the Corporations Act, that unless the corporations listed hereunder comply with the requirements of the Corporations Information Act within 90 days of this Notice, orders will be made dissolving the defaulting corporations. The effective date precedes the corporation listings.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2011-06-13 |

The Fellowship Christian Centre (Peterborough County) Inc. |

334104 |

Katherine M. Murray

Director

(144-G311)

Erratum Notice

Ontario Corporation Number 643906

Vide Ontario Gazette, Vol. 144-13 dated March 26, 2011 Notice Is Hereby Given that the notice issued under section 241(4) of the Business Corporations Act set out in the March 26, 2011 issue of the Ontario Gazette with respect to DJA Enterprises Ltd., was issued in error and is null and void.

Katherine M. Murray

Director

(144-G312)

Marriage Act

Certificate Of Permanent Registration as a person authorized to solemnize marriage in Ontario have been issued to the following:

June 6 - June 10

|

Name |

Location |

Effective Date |

|---|---|---|

|

Perry, Timothy Scott |

Sudbury, ON |

09-Jun-11 |

|

Wilson-Garrett, Roberta |

Blind River, ON |

09-Jun-11 |

|

Schust, Edward D |

Barrie, ON |

09-Jun-11 |

|

Brown, David Patrick |

Kingston, ON |

09-Jun-11 |

|

Andrews, Evelyn |

Peterborough, ON |

09-Jun-11 |

|

Fernando, Faustin P |

Mississauga, ON |

09-Jun-11 |

|

Gazaneo, Andrew D |

Toronto, ON |

09-Jun-11 |

|

Hartwick, Richard |

Strathroy, ON |

09-Jun-11 |

|

Long, Sandra L |

Mississauga, ON |

09-Jun-11 |

|

Vafaie, Melanie |

Brampton, ON |

09-Jun-11 |

|

Elgby, Jonathan |

Ear Falls, ON |

09-Jun-11 |

|

Ung, Peter Hoi Ian |

Thornhill, ON |

09-Jun-11 |

|

Crawford, Steven E W |

Oshawa, ON |

09-Jun-11 |

|

Stockley, Anne Marie E |

Milton, ON |

09-Jun-11 |

|

Jantzi, Ryan |

Clinton, ON |

09-Jun-11 |

|

Gritzke, Richard |

Buffalo, NY |

09-Jun-11 |

Re-registrations

|

Name |

Location |

Effective Date |

|---|---|---|

|

Edwards, Jeffrey T |

Val Caron, ON |

09-Jun-11 |

Certificates Of Temporary Registration as person authorized to solemnize marriage in Ontario have been issued to the following:

|

Date |

Name |

Location |

Effective Date |

|---|---|---|---|

|

June 9, 2011 to June 13, 2011 |

Bomhof, Gerrit Johannes |

Red Deer, AB |

07-Jun-11 |

|

June 30, 2011 to July 4, 2011 |

Corcuera, Roseller |

Markham, ON |

07-Jun-11 |

|

July 1, 2011 to July 5, 2011 |

Mikelberg, Daniel Jonathan |

Vancouver, BC |

07-Jun-11 |

|

July 7, 2011 to July 11, 2011 |

Lambert, George Victor |

Prescott, ON |

07-Jun-11 |

|

July 9, 2011 to July 13, 2011 |

Nelson, Kenneth Michael |

Surrey, BC |

07-Jun-11 |

|

July 28, 2011 to August 1, 2011 |

Hill, Douglas K |

Orlando, FL |

07-Jun-11 |

|

August 4, 2011 to August 8, 2011 |

Cardoso, Victor |

Montreal, QC |

07-Jun-11 |

|

September 22, 2011 to September 26, 2011 |

Guther, Daniel H |

Manotick, ON |

07-Jun-11 |

|

September 22, 2011 to September 26, 2011 |

Ryan, Thomas |

Washington, DC |

07-Jun-11 |

|

September 29, 2011 to October 3, 2011 |

Towsley, Peter J |

Bridgeport, CT |

07-Jun-11 |

Judith M. Hartman

Deputy Registrar General

(144-G313)

Change of Name Act

Notice Is Hereby Given that the following changes of name were granted during the period from June 6, 2011 to June 12, 2011 under the authority of the Change of Name Act, R.S.O 1990, c.c.7 and the following Regulation R.R.O 1990, Reg 68. The listing below shows the previous name followed by the new name.

|

Date |

Previous Name |

New Name |

|---|---|---|

|

June 6, 2011 to June 12, 2011 |

Abbas-Tehrani, Morteza. |

Abba, Morteza. |

|

June 6, 2011 to June 12, 2011 |

Abdalah, Faraj.Ali. |

Al-Salhi, Yousef.Ali. |

|

June 6, 2011 to June 12, 2011 |

Abdullahu, Fadil. |

Basha, Albert. |

|

June 6, 2011 to June 12, 2011 |

Adam, Fadi. |

Youkhana, Fadi. |

|

June 6, 2011 to June 12, 2011 |

Aditya, Aditya. |

Chauhan, Aditya.. |

|

June 6, 2011 to June 12, 2011 |

Adnan, Ahmed. |

Ahmed, Adnan. |

|

June 6, 2011 to June 12, 2011 |

Ahmed, Ashraf.Abdel.Ra. |

Ahmed, Ashraf.Abdel.Raouf.Mahmoud. |

|

June 6, 2011 to June 12, 2011 |

Akinlana, Ayodele.Taiwo. |

Marshall, Dele.Taiwo. |

|

June 6, 2011 to June 12, 2011 |

Alghadban, Nora.Mithaq. |

Badaa, Nora.Sadea. |

|

June 6, 2011 to June 12, 2011 |

Altunyuva, Ayten. |

Kuru, Ayten. |

|

June 6, 2011 to June 12, 2011 |

Ambersley, Laureen.Joy. |

Ambersley, Laurayn.Joy. |

|

June 6, 2011 to June 12, 2011 |

Andrews, Miriam.Judith. |

Andrews, Mia.Jenifer. |

|

June 6, 2011 to June 12, 2011 |

Areej, Areej. |

Idrees, Areej. |

|

June 6, 2011 to June 12, 2011 |

Auld, Grant.Allan.Thomas. |

Thomas, Grant.Allan. |

|

June 6, 2011 to June 12, 2011 |

Bahjat, Dunia.Saad. |

Ghali, Dunia.Saad.Bahjat. |

|

June 6, 2011 to June 12, 2011 |

Bahjat, Sally.Saad. |

Ghali, Sally.Saad.Bahjat. |

|

June 6, 2011 to June 12, 2011 |

Beauchesne, Deandra.Christina |

Cormier, Deandra.Christina. |

|

June 6, 2011 to June 12, 2011 |

Berkers-Eardley, Deanna.Lee. |

Arksey, Deanna.Lee. |

|

June 6, 2011 to June 12, 2011 |

Bhombal, Osama.Mushtaq. |

Bhombal, Bilal.Mushtaq. |

|

June 6, 2011 to June 12, 2011 |

Birenbaum, Anton. |

Snegiroff, Anton.Scorp. |

|

June 6, 2011 to June 12, 2011 |

Boisselle, Jennifer.Jacqueline.Lisa. |

Boisselle, Michelle.Jennifer.Jacqueline.Lisa. |

|

June 6, 2011 to June 12, 2011 |

Boniface, Brittany.Marlowe. |

Brown, Brittany.Marlowe.June. |

|

June 6, 2011 to June 12, 2011 |

Bonner, Daniel.Christopher. |

Foss, Dan.Christopher. |

|

June 6, 2011 to June 12, 2011 |

Boomer, Jessica.Carol-Ann. |

Carneiro, Jessica.Carol-Ann. |

|

June 6, 2011 to June 12, 2011 |

Boukari Abokou, Roucaiyatou. |

Boukari, Roucaiyatou. |

|

June 6, 2011 to June 12, 2011 |

Brake, Alexa.Marie. |

Deligioridis, Alexa.Marie. |

|

June 6, 2011 to June 12, 2011 |

Broderick, Megan.Ashley. |

Hyde, Megan.Ashley. |

|

June 6, 2011 to June 12, 2011 |

Brown, Sharla.Maxlene. |

Gillies, Sharla.Maxlene. |

|

June 6, 2011 to June 12, 2011 |

Bukirwa, Juliet.Kabanda. |

Nsumba, Juliet.Kabanda. |

|

June 6, 2011 to June 12, 2011 |

Burmistrov, Dmytro.Anatoliy. |

Burmistrov, Dmitriy.Anatoliy. |

|

June 6, 2011 to June 12, 2011 |

Butac, Marilou.Mata. |

Kulin, Marilou.Mata. |

|

June 6, 2011 to June 12, 2011 |

Butt, Tiffany.Maureen.. |

Johnson-Butt, Tiffany.Maureen. |

|

June 6, 2011 to June 12, 2011 |

Byun, Dong.Gyoo. |

Byun, Michael.Donggyoo. |

|

June 6, 2011 to June 12, 2011 |

Cai, Li.Qing. |

Choi, Becky.. |

|

June 6, 2011 to June 12, 2011 |

Cain, Michael.Ryan.Ivany. |

Becker, Michael.Ryan.Ivany. |

|

June 6, 2011 to June 12, 2011 |

Carkner, Logan.Xavier.Scot. |

Anderson, Logan.Xavier-Scot. |

|

June 6, 2011 to June 12, 2011 |

Carlucci, Mario-Frank. |

Carlucci, Mario.Frank. |

|

June 6, 2011 to June 12, 2011 |

Cecchini, Kayla.. |

Cecchini, Kayla.Cianfarani. |

|

June 6, 2011 to June 12, 2011 |

Chandler, Tripta.Sood. |

Sood, Tripta.. |

|

June 6, 2011 to June 12, 2011 |

Chaudhri, Anum. |

Hashmi, Anum. |

|

June 6, 2011 to June 12, 2011 |

Chen, Chu.Zhi. |

Chen, Kenji.Chuzhi. |

|

June 6, 2011 to June 12, 2011 |

Chen, Chuqi. |

Chen, Calvin.Chuqi. |

|

June 6, 2011 to June 12, 2011 |

Chen, Jie.Mei. |

Chen, May.Jiemei. |

|

June 6, 2011 to June 12, 2011 |

Chen, Xiao.Jun. |

Chen, Leo. |

|

June 6, 2011 to June 12, 2011 |

Cheng, Hiu.Yan. |

Cheng, Chloe.Hiu.Yan. |

|

June 6, 2011 to June 12, 2011 |

Choeden, Jampa. |

Chamshug, Jampa.Choeden. |

|

June 6, 2011 to June 12, 2011 |

Chubeta, Andru.Rubo. |

Choubeta, Andrew.Beyan. |

|

June 6, 2011 to June 12, 2011 |

Chukwudubem, Sean. |

Ajufo, Sean.Chukwudubem. |

|

June 6, 2011 to June 12, 2011 |

Cole, Brittany.Michelle. |

Cray-Brown, Brittany.Michelle. |

|

June 6, 2011 to June 12, 2011 |

Cole, Victoria.Margaret. |

Cray-Brown, Victoria.Margaret. |

|

June 6, 2011 to June 12, 2011 |

Colvin, Christian.Bev'Ronte. |

Colvin-Graham, Christian.Bev'Ronte. |

|

June 6, 2011 to June 12, 2011 |

Corbeil-Charpentier, Eric.Joseph.Guy. |

Charpentier, Eric.Joseph.Guy.Corbeil. |

|

June 6, 2011 to June 12, 2011 |

Craig, David.William.Edson. |

Mccausland, David.William.Edson. |

|

June 6, 2011 to June 12, 2011 |

Creasor, Ethan.James.Randolph. |

Schrank, Ethan.James.Randolph. |

|

June 6, 2011 to June 12, 2011 |

Curry Snyder, Marie.Catherine. |

Snyder, Marie.Catherine. |

|

June 6, 2011 to June 12, 2011 |

Dadole, Rhea.Kaye. |

Salonga, Rhea.Kaye. |

|

June 6, 2011 to June 12, 2011 |

De Vacas Cabezas, Francisco.E. |

De Vacas, Francisco.Eduardo. |

|

June 6, 2011 to June 12, 2011 |

De Vacas Cugliari, Francesco.Antonio. |

De Vacas, Francesco.Antonio. |

|

June 6, 2011 to June 12, 2011 |

Desai, Jigneshkumar.N. |

Desai, Jigneshkumar.Navinchandra. |

|

June 6, 2011 to June 12, 2011 |

Deschamp, Lee. |

Deschamp, Crystal.Lee. |

|

June 6, 2011 to June 12, 2011 |

Di Paulo, Silvia. |

Di Paolo, Silvia. |

|

June 6, 2011 to June 12, 2011 |

Docherty, Adrianna.June.Anne. |

Brown, Adrianna.June.Anne. |

|

June 6, 2011 to June 12, 2011 |

Docherty, Nicholas.Charles.James. |

Brown, Nicholas.James.Charles. |

|

June 6, 2011 to June 12, 2011 |

Dogariu, Viorica.Eugenia. |

Cioc, Viorica.Eugenia. |

|

June 6, 2011 to June 12, 2011 |

Dolbeck, Alexander.Michael.John. |

Males, Alexander.Michael.John. |

|

June 6, 2011 to June 12, 2011 |

Dolbeck, Gracie.Linda.Rose. |

Males, Gracie.Linda.Rose. |

|

June 6, 2011 to June 12, 2011 |

Dolgov, Pavel.Vadimovitch. |

Dolgov, Paul. |

|

June 6, 2011 to June 12, 2011 |

Dong, Ji.Min. |

Mormile, Ji.Min. |

|

June 6, 2011 to June 12, 2011 |

Dong, Ling.Yi. |

Dong, Alan.Lingyi. |

|

June 6, 2011 to June 12, 2011 |

Doucet, Courtney.Marie. |

Mohyla, Courtney.Marie. |

|

June 6, 2011 to June 12, 2011 |

Dow, Khadijah.Imoni. |

Dow, Khadijah.Imani. |

|

June 6, 2011 to June 12, 2011 |

Drynan, Nash.. |

Drynan, Nash.Robert. |

|

June 6, 2011 to June 12, 2011 |

Duffenais, Roger.John. |

Conrad, Roger.John. |

|

June 6, 2011 to June 12, 2011 |

Duong, Nghia.Trong. |

Duong, Jeffrey.Nghia. |

|

June 6, 2011 to June 12, 2011 |

Easterbrook, Rachel.Stark. |

Easterbrook, Rachael.Stark. |

|

June 6, 2011 to June 12, 2011 |

Edwards, Klohie.Jahcynta.Canning. |

Lamar, Klohie.Jahcynta.Canning. |

|

June 6, 2011 to June 12, 2011 |

Emad, Merriam. |

Youkhana, Merriam. |

|

June 6, 2011 to June 12, 2011 |

Emad, Neveen. |

Youkhana, Neveen. |

|

June 6, 2011 to June 12, 2011 |

Erickson-Lyons, Vanessa.Elizabeth.Leah. |

Riley, Myles.Liam. |

|

June 6, 2011 to June 12, 2011 |

Eugene, Keisha.Theresa. |

Laurent-Eugene, Raine.Theresa. |

|

June 6, 2011 to June 12, 2011 |

Farmer Mombourquette, Jordell.Jody.James. |

Farmer, Jordell.Jody.James.Mombourquette. |

|

June 6, 2011 to June 12, 2011 |

Federley, Jaana.Hannelie. |

Federley-Schwarz, Jaana.Hannelie. |

|

June 6, 2011 to June 12, 2011 |

Fennell, David.Brian. |

Daigle, David.Brian. |

|

June 6, 2011 to June 12, 2011 |

Fletcher, Vanessa.Anne. |

Dion Fletcher, Vanessa.Anne. |

|

June 6, 2011 to June 12, 2011 |

Fournier, Vanessa.Ashley.. |

Sarsfield, Nessa.Ashley. |

|

June 6, 2011 to June 12, 2011 |

Friedman, Michele.Tania. |

Friedman, Michelle.Tanya. |

|

June 6, 2011 to June 12, 2011 |

Friesen, Lisa.Michelle. |

Freed, Lisa.Michelle. |

|

June 6, 2011 to June 12, 2011 |

Funglo, Chayaporn. |

Piyapatmetakul, Jitpicha. |

|

June 6, 2011 to June 12, 2011 |

Funglo, Waenfa. |

Piyapatmetakul, Piyawan. |

|

June 6, 2011 to June 12, 2011 |

Fyfe, Victoria.Nicole. |

Reynolds, Victoria.Nicole. |

|

June 6, 2011 to June 12, 2011 |

Gagliardi-Tedesco, Stefanie.Maria. |

Gagliardi-Tedesco, Stefania.Maria. |

|

June 6, 2011 to June 12, 2011 |

Garaad, Marian. |

Mahamed, Marian.Abdiaziz. |

|

June 6, 2011 to June 12, 2011 |

Garcha, Jasbir.Kaur. |

Bhatti, Jasbir.Kaur. |

|

June 6, 2011 to June 12, 2011 |

Garcia-Ishtiaq, Shafia. |

Ishtiaq, Shafia. |

|

June 6, 2011 to June 12, 2011 |

Giles, Marion.Joan. |

Searles, Marion.Joan. |

|

June 6, 2011 to June 12, 2011 |

Goldy, Katherine.Irena.. |

Goldy, Katherine. |

|

June 6, 2011 to June 12, 2011 |

Gonidis, Veronika.Asia. |

Gonidis-Marijan, Veronika.Asia. |

|

June 6, 2011 to June 12, 2011 |

Grant, Marie-ThÉRÈSe.Virginia. |

Patterson, Marie-Ann.ThÉRÈSE. |

|

June 6, 2011 to June 12, 2011 |

Grewal, Sundeep.Singh. |

Grewal, Micky.Singh. |

|

June 6, 2011 to June 12, 2011 |

Grillet, Nikole. |

Price, Nikole. |

|

June 6, 2011 to June 12, 2011 |

Grillet, Taylor.Morgan. |

Price, Taylor.Morgan. |

|

June 6, 2011 to June 12, 2011 |

Gross, Brendan.Christian.. |

Christian, Brendan. |

|

June 6, 2011 to June 12, 2011 |

Habiboglu, Habip. |

Sert, Adam. |

|

June 6, 2011 to June 12, 2011 |

Hamid, Mohamed.Huza.Huzaifath. |

Fernando, Mohamed.Rohan. |

|

June 6, 2011 to June 12, 2011 |

Hanke, Jennifer.Reanne. |

Chesnut, Jennifer.Reanne. |

|

June 6, 2011 to June 12, 2011 |

Harness, Justin.Tyler. |

Adventure, Justin.Tyler. |

|

June 6, 2011 to June 12, 2011 |

Hartman, Kate.Leigh. |

Elson, Kate.Leigh. |

|

June 6, 2011 to June 12, 2011 |

Henry, Mike.Bryan.Michael. |

Henry, Michael.Bryan. |

|

June 6, 2011 to June 12, 2011 |

Hewitt, Zachary.David. |

Doyon, Zachary.Paul. |

|

June 6, 2011 to June 12, 2011 |

Hing, Brandi.Marie.. |

Gonsalves, Brandi.Marie. |

|

June 6, 2011 to June 12, 2011 |

Ho, Lyana.Lok.Tone. |

Su, Lyana. |

|

June 6, 2011 to June 12, 2011 |

Hong, Daniel.Vi.Auc. |

Randhawa, Daniel.Singh. |

|

June 6, 2011 to June 12, 2011 |

Hoyland, Mimi.Lee. |

Hoyland, Mya.Cameron.Rose. |

|

June 6, 2011 to June 12, 2011 |

Hsu, Yu.Wei. |

Tam, Angela.Yuwei. |

|

June 6, 2011 to June 12, 2011 |

Hughes, Mafie.Sernias. |

Hughes, Mafie.Santa.Maria. |

|

June 6, 2011 to June 12, 2011 |

Hull, Jacob.Louis. |

O'Connell, Jacob.Louis. |

|

June 6, 2011 to June 12, 2011 |

Husain, Sana.Kamilla. |

Fancy, Sana.Kamilla. |

|

June 6, 2011 to June 12, 2011 |

Hutchinson, Carol.Rosemary. |

Hutchinson, Carol.Rosemary.Reay. |

|

June 6, 2011 to June 12, 2011 |

HÉRoux , Josephte.Marie.Colombe. |

HÉRoux, Josette.Colombe.Marie. |

|

June 6, 2011 to June 12, 2011 |

Ioannou, Kyden.Nicholas. |

Orr, Kyden.Nicholas. |

|

June 6, 2011 to June 12, 2011 |

Iqbal, Raja.Naeem. |

Raja , Naeem.Iqbal. |

|

June 6, 2011 to June 12, 2011 |

Iskat, Larissa. |

Murphy, Larissa.Iskat. |

|

June 6, 2011 to June 12, 2011 |

Jackson, Jayne.Ellen. |

Cook, Jayne.Ellen. |

|

June 6, 2011 to June 12, 2011 |

James, Esther.Elizabeth.Keisha. |

De Freitas, Esther.Elizabeth.Keisha. |

|

June 6, 2011 to June 12, 2011 |

Jesuthasan, Vijitha. |

Sellathurai, Vijitha. |

|

June 6, 2011 to June 12, 2011 |

Jjombwe, Kenneth. |

Nsumba, Kenneth.Jjombwe. |

|

June 6, 2011 to June 12, 2011 |

Johnson, Laura.Rachel. |

Johnson, Laura.Rachel.Lowe. |

|

June 6, 2011 to June 12, 2011 |

Johnston, Martha.Mary. |

Skelly, Martha.Mary. |

|

June 6, 2011 to June 12, 2011 |

Jraidini, Adel. |

Juraydini, Adel. |

|

June 6, 2011 to June 12, 2011 |

Jraidini, May. |

Juraydini, May. |

|

June 6, 2011 to June 12, 2011 |

Kang, Peter.Hyunil. |

Kim, Peter.Joo.Hyung. |

|

June 6, 2011 to June 12, 2011 |

Kanhai, Joanne.Gail.. |

Simmons, Joanne.Gail.. |

|

June 6, 2011 to June 12, 2011 |

Kapurura, Wiriranai.Will. |

Kapurura, Wiriranai.. |

|

June 6, 2011 to June 12, 2011 |

Karim, Hesham.Abdulmajeed.Ali. |

Toorani, Hesham.Karim. |

|

June 6, 2011 to June 12, 2011 |

Karim, Redha.Abdulmajeed.Ali. |

Toorani, Redha.Karim. |

|

June 6, 2011 to June 12, 2011 |

Kaur, Manjinder. |

Goraya, Manjinder. |

|

June 6, 2011 to June 12, 2011 |

Kaur, Sarbjit. |

Mann, Sarbjit.Kaur. |

|

June 6, 2011 to June 12, 2011 |

Keeping, Roseanne.Charlotte.Eileen. |

Barnes, Roseanne.Charlotte.Eileen. |

|

June 6, 2011 to June 12, 2011 |

Khaira, Pawandeep.Kaur. |

Brar, Pawandeep.Kaur. |

|

June 6, 2011 to June 12, 2011 |

Khalil, Mustafa. |

Khalil, Mustafa.Noah. |

|

June 6, 2011 to June 12, 2011 |

Khan, Muhammad.Mubashir. |

Naeem, Mubashir. |

|

June 6, 2011 to June 12, 2011 |

Khan, Muhammad.Owais. |

Khan, Owais. |

|

June 6, 2011 to June 12, 2011 |

Kim, So.Yon. |

Kim, Nicole.Soyon. |

|

June 6, 2011 to June 12, 2011 |

Kocab, Eliza.Maria. |

Siuda, Eliza.Maria. |

|

June 6, 2011 to June 12, 2011 |

Koritar, Mackenzie.Alexander. |

Podstatzky-Lichtenstein, Mackenzie.Alexander. |

|

June 6, 2011 to June 12, 2011 |

Koritar, Peter.Nandor. |

Podstatzky-Lichtenstein, Peter.Nandor. |

|

June 6, 2011 to June 12, 2011 |

Krywchuk, Austin.Abe.Russel. |

Voth, Austin.Abe.Russel. |

|

June 6, 2011 to June 12, 2011 |

Krywchuk, Autumn.Carol.Mae. |

Voth, Autumn.Carol.Mae. |

|

June 6, 2011 to June 12, 2011 |

Krywchuk, Nathaniel.Abram.Voth. |

Voth, Nathan.Abe. |

|

June 6, 2011 to June 12, 2011 |

Kuiperij, Martin.Robert. |

Kuipery, Martin.Robert. |

|

June 6, 2011 to June 12, 2011 |

Kumar, Sanjay. |

Verma, Sanjay. |

|

June 6, 2011 to June 12, 2011 |

Laflamme-Snow, Marque.Andrew.. |

Laflamme, Marque.Andrew. |

|

June 6, 2011 to June 12, 2011 |

Laforge, Joseph.David.Julien. |

Arcand, Julien.David.Joseph. |

|

June 6, 2011 to June 12, 2011 |

Laforge, Marie.Carolin.CÉLine. |

Arcand, CÉLine.Carolin.Marie. |

|

June 6, 2011 to June 12, 2011 |

Leach, Joyce.Ann. |

Leach, Judith.Ann. |

|

June 6, 2011 to June 12, 2011 |

Lee, Jiun.Houy. |

Lee, Queenia.Jiun.Houy. |

|

June 6, 2011 to June 12, 2011 |

Lejbjuk, Peter.Adam. |

Leibiuk, Peter.Adam. |

|

June 6, 2011 to June 12, 2011 |

Leone, Danielle.Nancy. |

Fisher, Danielle.Nancy. |

|

June 6, 2011 to June 12, 2011 |

Leone, Lauren.Olivia. |

Fisher, Lauren.Olivia. |

|

June 6, 2011 to June 12, 2011 |

Leroux, Marie.Yvette.Linda. |

Leroux, Lynda.Nicole. |

|

June 6, 2011 to June 12, 2011 |

Levoir, Kerry. |

Lally, Kerry.Levoir.. |

|

June 6, 2011 to June 12, 2011 |

Li, Jing.Yi. |

Li, Jenny.Jingyi. |

|

June 6, 2011 to June 12, 2011 |

Li, Li. |

Li, Lillian.Allison. |

|

June 6, 2011 to June 12, 2011 |

Lian, Zhi.Jun. |

Lian, Jeffrey. |

|

June 6, 2011 to June 12, 2011 |

Lilly, Lawrence.Keith. |

Sullivan, Lawrence.Keith. |

|

June 6, 2011 to June 12, 2011 |

Liu, Yaonan. |

Liu, Diana.Yaonan. |

|

June 6, 2011 to June 12, 2011 |

Liu, Yufei. |

Liu, Hansen.Yufei. |

|

June 6, 2011 to June 12, 2011 |

Lock, April.Caroline. |

Elliott, April.Caroline. |

|

June 6, 2011 to June 12, 2011 |

Lopez Hollywood, Vida.Gabriela. |

Mack Hollywood, Vida.Gabriela. |

|

June 6, 2011 to June 12, 2011 |

Lotfalizadeh-Kashefi, Aria. |

Kashefi, Aria. |

|

June 6, 2011 to June 12, 2011 |

Lowe, Jonathan.James. |

Lowe, Jonathan.James.Johnson. |

|

June 6, 2011 to June 12, 2011 |

Ly, Nghi. |

Ly, Nghi.Christine. |

|

June 6, 2011 to June 12, 2011 |

Maertens, Michael.Ronald. |

Martens, Michael.Ronald. |

|

June 6, 2011 to June 12, 2011 |

Majeed, Muhammad.Hammad. |

Majeed, Hammad.Muhammad.. |

|

June 6, 2011 to June 12, 2011 |

Malarczuk, Kimberley.Anne. |

Leonard, Kimberley.Anne. |

|

June 6, 2011 to June 12, 2011 |

Malhortra, Shweta. |

Verma, Shweta. |

|

June 6, 2011 to June 12, 2011 |

Markham, Chad.Robert. |

Fenlon, Chad.Robert. |

|

June 6, 2011 to June 12, 2011 |

Marshall, Margaret.Henrietta. |

Miller, Margaret.Henrietta. |

|

June 6, 2011 to June 12, 2011 |

Martin, Brodan.Jesy. |

Beaumont, Brodan.Jesy. |

|

June 6, 2011 to June 12, 2011 |

Math, Ikdeep.Singh. |

Matharu, Ikdeep.Singh. |

|

June 6, 2011 to June 12, 2011 |

Math, Kamal. |

Matharu, Kamal. |

|

June 6, 2011 to June 12, 2011 |

Math, Narinder.Singh. |

Matharu, Narinder.Singh. |

|

June 6, 2011 to June 12, 2011 |

Math, Sukhjit.Kaur. |

Matharu, Sukhjit.Kaur. |

|

June 6, 2011 to June 12, 2011 |

Matson, Shirely.Violet. |

Matson, Shirley.Violet. |

|

June 6, 2011 to June 12, 2011 |

Mc Millan, Lesley.Ann.. |

O'Connor, Lesley.Ann. |

|

June 6, 2011 to June 12, 2011 |

Mcfarlane, Candice.Elizabeth.Lynn. |

Cain, Candice.Elizabeth.Lynn. |

|

June 6, 2011 to June 12, 2011 |

Mehta, Manjariben.Anil. |

Mehta, Manjari. |

|

June 6, 2011 to June 12, 2011 |

Mejali, Maryam. |

Al-Shammeri, Maryam.Awadh.Mejali. |

|

June 6, 2011 to June 12, 2011 |

Mendes, Kayla.Destiny. |

Rosmaninho, Kayla.Destiny. |

|

June 6, 2011 to June 12, 2011 |

Miller, Darnel.Chukwuma. |

Miller, Darnel.Alfred. |

|

June 6, 2011 to June 12, 2011 |

Minin, Nicole.Maria. |

Ivanov, Nicole.Ella. |

|

June 6, 2011 to June 12, 2011 |

Mohammad, Saher.Nasser. |

Mohammad, Awatef. |

|

June 6, 2011 to June 12, 2011 |

Mohammed, Alyssia.Rebecca.Vicente. |

Vicente, Alyssia.Mohammed. |

|

June 6, 2011 to June 12, 2011 |

Mohammed, Lucas.John. |

Vicente, Lucas.Mohammed. |

|

June 6, 2011 to June 12, 2011 |

Mohammed, Safa.Maryam. |

Syed, Safa.Maryam. |

|

June 6, 2011 to June 12, 2011 |

Moharram-Zadeh-Kalya, Sina. |

Moharramzadeh, Sina. |

|

June 6, 2011 to June 12, 2011 |

Morley, Susan.Elizabeth. |

Dudas, Susan.Elizabeth.Morley. |

|

June 6, 2011 to June 12, 2011 |

Morsillo, Francesca.Anna. |

Porco, Francesca.Anna. |

|

June 6, 2011 to June 12, 2011 |

Morwood, Taylor.Marie.Michelle. |

Morwood, Tayla.Marie.Michelle. |

|

June 6, 2011 to June 12, 2011 |

Mulamootil, Dylan.Zachariah.. |

Abraham, Dylan.Zachariah. |

|

June 6, 2011 to June 12, 2011 |

Mykhaylyuk, Maksym. |

Mihailuk, Max. |

|

June 6, 2011 to June 12, 2011 |

Nadeau, Joseph.Roger. |

Nadeau, Mario.Joseph.Roger. |

|

June 6, 2011 to June 12, 2011 |

Navaratnam, Melane. |

Navaratnam, Milani. |

|

June 6, 2011 to June 12, 2011 |

Nessan, Nazik. |

Nessan, Samantha.Nazik. |

|

June 6, 2011 to June 12, 2011 |

Nguyen, Thu.Ha. |

Phan, Joanna.Thu-Ha. |

|

June 6, 2011 to June 12, 2011 |

Niu, Andrew. |

Ding, Chendong. |

|

June 6, 2011 to June 12, 2011 |

Noor, Hassan. |

Noor, Hansen. |

|

June 6, 2011 to June 12, 2011 |

Nowak, Anna.Maria. |

Witkowski, Anna.Maria. |

|

June 6, 2011 to June 12, 2011 |

Oglan, Ronald.John. |

Urso, Ronaldo.John. |

|

June 6, 2011 to June 12, 2011 |

Okobi, Onyebuchi.Cathe. |

Ajufo, Onyebuchi.Catherine. |

|

June 6, 2011 to June 12, 2011 |

Okonkwo, Ewehiwe.Gloria. |

Uboho, Ewehiwe.Gloria.Nsikan-Abasi. |

|

June 6, 2011 to June 12, 2011 |

Omandac, May.Pulido. |

Helberg, May.Omandac. |

|

June 6, 2011 to June 12, 2011 |

Pamintuan, Eliza.Estera. |

Capraru, Eliza.Estera. |

|

June 6, 2011 to June 12, 2011 |

Panos, Seta. |

Youkhana, Seta. |

|

June 6, 2011 to June 12, 2011 |

Paolucci, Marin. |

Paolucci, Robert.Marin. |

|

June 6, 2011 to June 12, 2011 |

Pariagh, Vickram. |

Pariagh, Vickram.Angad. |

|

June 6, 2011 to June 12, 2011 |

Parker, Janet. |

Amiel, Janet. |

|

June 6, 2011 to June 12, 2011 |

Pasqualini, Sandra.Auxiliadora.De.Fatima. |

Saradesi, Sandra. |

|

June 6, 2011 to June 12, 2011 |

Patel, Dhanishabahen.A. |

Patel, Dhanisha. |

|

June 6, 2011 to June 12, 2011 |

Patel, Keyuriben.Jagidishkumar. |

Patel, Keyuri.Jigneshkumar. |

|

June 6, 2011 to June 12, 2011 |

Patel, Kishorbhai. |

Patel, Kishorbhai.Devjibhai. |

|

June 6, 2011 to June 12, 2011 |

Patel, Purnima.K. |

Patel, Purnima.Kishorbhai. |

|

June 6, 2011 to June 12, 2011 |

Patel, Shitalben.Rasikbhai. |

Patel, Shital.Bharatbhai. |

|

June 6, 2011 to June 12, 2011 |

Persaud, Karen.Nirmala-Devi. |

Singh, Karen.Nirmala-Devi. |

|

June 6, 2011 to June 12, 2011 |

Phan, Nghia.Thanh. |

Phan, Timothy.Thanh-Nghia. |

|

June 6, 2011 to June 12, 2011 |

Philip Pilipovsky, Ronen. |

Philip Dubrovsky, Ronen.. |

|

June 6, 2011 to June 12, 2011 |

Pleau, Joseph.Renald.Marc. |

Floccari, Marco.Vincenzo. |

|

June 6, 2011 to June 12, 2011 |

Polkki, Pekka.Antero.. |

Polkki, Peter.Andrew. |

|

June 6, 2011 to June 12, 2011 |

Popson, Dorothy.Marie. |

Johnson, Michelle.Marie. |

|

June 6, 2011 to June 12, 2011 |

Porcellato, Darian.Blair. |

Armstrong, Darian.Blair. |

|

June 6, 2011 to June 12, 2011 |

Porcellato, Paislie.Anne. |

Armstrong, Paislie.Anne. |

|

June 6, 2011 to June 12, 2011 |

Presniak, Michael.Scott. |

James, Michael.Scott. |

|

June 6, 2011 to June 12, 2011 |

Prince, Sivan. |

Abdurachmanov, Sivan. |

|

June 6, 2011 to June 12, 2011 |

Prong, Elmer.Earl. |

Prang, Elmer.Iram. |

|

June 6, 2011 to June 12, 2011 |

Qi, Jia. |

Qi, Grace. |

|

June 6, 2011 to June 12, 2011 |

Qlab, Sandra. |

Qalab, Sandra. |

|

June 6, 2011 to June 12, 2011 |

Rafay, Abdur. |

Khan, Abdurrafay. |

|

June 6, 2011 to June 12, 2011 |

Rafo, Patricia.Kamal. |

Kazanji, Patricia.Kamal.Rafo. |

|

June 6, 2011 to June 12, 2011 |

Ragoo, Elijah.Bon. |

Longo, Elijah.Charlie. |

|

June 6, 2011 to June 12, 2011 |

Rasaiah, Vasantharani. |

Balasiri, Vasantharani. |

|

June 6, 2011 to June 12, 2011 |

Rasmussen-Waymann, John.Roberts.. |

Waymann, John.Roberts.Rasmussen. |

|

June 6, 2011 to June 12, 2011 |

Reilly, Shannon.Patricia. |

Boustead, Shannon.Patricia. |

|

June 6, 2011 to June 12, 2011 |

Remisiar Mariya Bern, Shanthi. |

Sylvester, Shanthi. |

|

June 6, 2011 to June 12, 2011 |

Roblin, Jordan.Nathan. |

Molella, Jordan.Nathan. |

|

June 6, 2011 to June 12, 2011 |

Rosato, Liberata.. |

Furgiuele, Lina. |

|

June 6, 2011 to June 12, 2011 |

Rosiak, Gale.Marie. |

Serson, Gale.Marie. |

|

June 6, 2011 to June 12, 2011 |

Ryan, Marie.Anne. |

Ryan, Mouse.Marie.Anne. |

|

June 6, 2011 to June 12, 2011 |

Sadri, Mansourehsadat. |

Sadri, Sara.MansorÉ. |

|

June 6, 2011 to June 12, 2011 |

Sahi, Kuldeep.Kaur. |

Saini, Kuldeep.Kaur. |

|

June 6, 2011 to June 12, 2011 |

Salem, Dina. |

Al-Aswad, Dina.Salem. |

|

June 6, 2011 to June 12, 2011 |

Samreena, Samreena. |

Liaqath, Samreena. |

|

June 6, 2011 to June 12, 2011 |

Saquine, Eleanor.. |

Saquine, Jenny.Eleanor. |

|

June 6, 2011 to June 12, 2011 |

Sarah, Sahar. |

Habib Zai, Sahar. |

|

June 6, 2011 to June 12, 2011 |

Saravanapavah, Ajindran. |

Saravanapavah, Ajaay.Venkatt. |

|

June 6, 2011 to June 12, 2011 |

Sarveswaran, Kiruththiga. |

Bonnyface, Kiruththiga. |

|

June 6, 2011 to June 12, 2011 |

Scopino, Amber.Kaelie. |

Fenton, Amber.Kaelie. |

|

June 6, 2011 to June 12, 2011 |

Shamsi, Basmah.Eqbal. |

Noman, Basmah. |

|

June 6, 2011 to June 12, 2011 |

Shamsi, Shahneela.Eqbal. |

Adnan, Shahneela. |

|

June 6, 2011 to June 12, 2011 |

Shbber, Hammad. |

Shabbir, Hammad.Abdul.Wahhab. |

|

June 6, 2011 to June 12, 2011 |

Shi, Wei.Min. |

Stone, Raymond. |

|

June 6, 2011 to June 12, 2011 |

Shirvanyan, Grisha. |

Shirvanian, Gregory. |

|

June 6, 2011 to June 12, 2011 |

Shisho, Ghada. |

Younan, Ghada. |

|

June 6, 2011 to June 12, 2011 |

Shoara, Nasrollah. |

Shoara, Amin.Aron. |

|

June 6, 2011 to June 12, 2011 |

Singh, Gurman. |

Bhatti, Gurman.Singh. |

|

June 6, 2011 to June 12, 2011 |

Singh, Gurpal. |

Metharu, Gurpal.Singh. |

|

June 6, 2011 to June 12, 2011 |

Singh, Kuldip. |

Mann, Kuldip.Singh. |

|

June 6, 2011 to June 12, 2011 |

Singh, Kulvinder. |

Bains, Kulvinder.Singh. |

|

June 6, 2011 to June 12, 2011 |

Singh, Shivtar. |

Bhatti, Shivtar.Singh. |

|

June 6, 2011 to June 12, 2011 |

Singh, Surjit. |

Boparai, Surjit.Singh. |

|

June 6, 2011 to June 12, 2011 |

Singh, Yashwattie. |

Somwaru, Yashwattie. |

|

June 6, 2011 to June 12, 2011 |

Sivasubramaniam, Madura. |

Siva-Nandakumar, Madura. |

|

June 6, 2011 to June 12, 2011 |

Sizer, Alexis-Aevry.Gabriella. |

Sizer-Thompson, Alexis-Aevry.Gabriella. |

|

June 6, 2011 to June 12, 2011 |

Skapare, Oksana. |

Nweze, Oksana. |

|

June 6, 2011 to June 12, 2011 |

Slabbert, Susanna.Aletta. |

Slabbert, Sunet.Susanna.Aletta. |

|

June 6, 2011 to June 12, 2011 |

Slade, Vernica.Eden. |

Dulic, Vernica.Eden. |

|

June 6, 2011 to June 12, 2011 |

Smith, Karly.Elizabeth.Ruth. |

Hacohen, Karly.Elizabeth.Ruth. |

|

June 6, 2011 to June 12, 2011 |

Smith, Noah.David. |

Smith Cooper, Noah.David. |

|

June 6, 2011 to June 12, 2011 |

Smith, Tyler.Robert. |

Cook, Tyler.Robert. |

|

June 6, 2011 to June 12, 2011 |

Snowball, Riley.Kale. |

Snowball-Rea, Riley.Kale. |

|

June 6, 2011 to June 12, 2011 |

Snudden, Richard.Benjamin. |

Paul, Richard.Benjamin. |

|

June 6, 2011 to June 12, 2011 |

Solmaz, Fayik. |

Birk, Jeff. |

|

June 6, 2011 to June 12, 2011 |

Soskin, Lauren.Sydney. |

Polster, Lauren.Sydney.Soskin. |

|

June 6, 2011 to June 12, 2011 |

Soskin, Olivia.Fern. |

Polster, Olivia.Fern.Soskin. |

|

June 6, 2011 to June 12, 2011 |

Spielvogel, Victoria.Lynn. |

Detoro, Victoria.Lynn. |

|

June 6, 2011 to June 12, 2011 |

Ssekabira, Beatrice.Lugoloobi. |

Nabasirye, Beatrice.Lugoloobi. |

|

June 6, 2011 to June 12, 2011 |

Stade, Gerald.Walter. |

Pilon, Gerry.Walter. |

|

June 6, 2011 to June 12, 2011 |

Stoddart, Kerrian.Tamara. |

Stoddart Ebanks, Kerrian.Tamara. |

|

June 6, 2011 to June 12, 2011 |

Tagudin, Merlina.Detoro. |

Detoro, Merlina.Pangilinan. |

|

June 6, 2011 to June 12, 2011 |

Tajafari Alinia Dabagh, Ava. |

Niconfar, Ava. |

|

June 6, 2011 to June 12, 2011 |

Tajafari-Ali-Nia-Dab, Mohammad-Hassan.. |

Nicanfar, Hasen. |

|

June 6, 2011 to June 12, 2011 |

Tajafari-Alinia-Daba, Koussar. |

Nicanfar, Hana. |

|

June 6, 2011 to June 12, 2011 |

Takeda, Dana.Kiyoko. |

Glory, Dana.Kiyoko.Carnelian.Blood.. |

|

June 6, 2011 to June 12, 2011 |

Tang, Chen.Chen. |

Tang, Sophia.Chen.Chen. |

|

June 6, 2011 to June 12, 2011 |

Teal, Reginald.Veron. |

Leyland, Rick. |

|

June 6, 2011 to June 12, 2011 |

Tencer, Catherine. |

Mindich, Katherine. |

|

June 6, 2011 to June 12, 2011 |

Terwilligar, Wilson.Merlon. |

Terwilligar, Wilson.Russell. |

|

June 6, 2011 to June 12, 2011 |

Tittle, Jennifer.Nicole. |

Shaw, Jennifer.Nicole. |

|

June 6, 2011 to June 12, 2011 |

Tomashewski, Kenneth.Lyil. |

Tomcheski, Kenneth.Lyil. |

|

June 6, 2011 to June 12, 2011 |

Toor, Manminder.Singh. |

Toor, Michael. |

|

June 6, 2011 to June 12, 2011 |

Trottier, Marilyn.Adele. |

Beaulieu, Marilyn.Adele. |

|

June 6, 2011 to June 12, 2011 |

Turvey, Aaron.Glen. |

Turvey, Angela.Erin. |

|

June 6, 2011 to June 12, 2011 |

Usmaara, Usmaara. |

Idrees, Usmaara. |

|

June 6, 2011 to June 12, 2011 |

Vaccaro, Rachael.Kathleen. |

Mccluskey, Rachael.Kathleen.Julie. |

|

June 6, 2011 to June 12, 2011 |

Valentic, Launa.Suzanne. |

Belanger, Launa.Suzanne. |

|

June 6, 2011 to June 12, 2011 |

Valnycki, Maria-Anna. |

Valnycki, Mary.Anna. |

|

June 6, 2011 to June 12, 2011 |

Vankiani, Chetna.Kishore.Kumar. |

Jadeja, Chetna.Aniruddh. |

|

June 6, 2011 to June 12, 2011 |

Vatsko, Mykhaylo. |

Traublinger, Michael. |

|

June 6, 2011 to June 12, 2011 |

Veloso Castrelo, Maryanne.W. |

Veloso Castrelo, Maryanne.Wayne. |

|

June 6, 2011 to June 12, 2011 |

Verkouville, Lora.Jean. |

Gibbens, Lora.Jean.Verkouville. |

|

June 6, 2011 to June 12, 2011 |

W Arachchillage, Archana.Weeraso. |

Weerasooriya, Archana. |

|

June 6, 2011 to June 12, 2011 |

Wan, Kin.Wing. |

Wan, Jenny.Jian.Ying. |

|

June 6, 2011 to June 12, 2011 |

Warrick, Jaxon.John.William. |

Cowell, Jaxon.John.William. |

|

June 6, 2011 to June 12, 2011 |

Washchuk, Eric.Gregory. |

Seberras, Eric.Gregory. |

|

June 6, 2011 to June 12, 2011 |

Watters, Keira.Maria.Lynn. |

Kavanagh, Keira.Mary.. |

|

June 6, 2011 to June 12, 2011 |

Weerasooriya Arachch, Chandana.Kumara. |

Weerasooriya , Chandana.. |

|

June 6, 2011 to June 12, 2011 |

Wesley, Deborah.Daisy. |

Corston, Deborah.Daisy. |

|

June 6, 2011 to June 12, 2011 |

Wheeler, Kerrie-Ann.Sherrie.Michelle.. |

Wheeler, Kerrie.Ann.Sherrie.Michelle. |

|

June 6, 2011 to June 12, 2011 |

Wheesk, Darrell..Douglas. |

Wheesk, Darrell.Steven.James. |

|

June 6, 2011 to June 12, 2011 |

Wong Cheung, Wai.Lan. |

Wong Cheung, Carmen.Wai.Lan. |

|

June 6, 2011 to June 12, 2011 |

Woods, Cristin.Anne. |

Woods-Ladner, Cristin.Anne. |

|

June 6, 2011 to June 12, 2011 |

Wu, Ji.Xin. |

Wu, Jason.Ji.Xin. |

|

June 6, 2011 to June 12, 2011 |

Yaghoubi-Araghi, Hadiseh.Sadat. |

Rezaei, Hadiseh.. |

|

June 6, 2011 to June 12, 2011 |

Yap, Jee.Keen. |

Mckeen, Charles.Yap. |

|

June 6, 2011 to June 12, 2011 |

Yaso, Vasudeva. |

Mathivannan, Yaso. |

|

June 6, 2011 to June 12, 2011 |

Ye, Xi.Yan. |

Tan, Cecilia.Xi.Yan. |

|

June 6, 2011 to June 12, 2011 |

Yoon, Dong.Ho. |

Yoon, Thomas.Dong.Ho. |

|

June 6, 2011 to June 12, 2011 |

Yu, Yen.Ching.Wen. |

Yu, Emma.. |

|

June 6, 2011 to June 12, 2011 |

Zakaryan, Shushanik. |

Zakaryan, Susan. |

|

June 6, 2011 to June 12, 2011 |

Zang, Shu. |

Zang, Bryan.Shu. |

|

June 6, 2011 to June 12, 2011 |

Zhu, Li.Guang. |

Chu, Bobby. |

|

June 6, 2011 to June 12, 2011 |

Zymantas, Vytautas. |

Zymantas, Victor. |

Judith M. Hartman

Deputy Registrar General

(144-G314)

Alcohol & Gaming Commission of Ontario

The Liquor Licence Act, R.S.O 1990, Chapter L.19

Notice Of Vote

Notice Is Hereby Given of the receipt of Returns of votes taken in the hereinafter named municipality on the 25th day of October, 2010 under the provisions of the Liquor Licence Act, 1990.

Municipality:

Township of Hudson, District of Timiskaming

Question:

7(2) Are you in favour of the sale of spirits, beer and wine for consumption in licensed premises?

Result:

Votes polled for the Affirmative Side 159

Votes polled for the Negative Side 43

Dated at Toronto this 16th day of June, 2011.

Jean Major, Registrar

Alcohol & Gaming Commission of Ontario

Financial Services Commission of Ontario July 2011

Professional Services Guideline

Superintendent’s Guideline No. 01/11

This Guideline is issued pursuant to subsection 268.3 (1) of the Insurance Act for the purposes of subsections 15 (2) (b), 16 (4) (a), 17 (2) and 25 (3) of the Statutory Accident Benefits Schedule – Effective September 1, 2010 (Sabs), and applies to expenses related to services rendered on or after July 1, 2011.

The maximum hourly rates and the maximum fees for the forms listed in this Guideline apply to services rendered on or after July 1, 2011, even if they are approved prior to July 1, 2011.

Purpose

This Guideline establishes the maximum expenses payable by automobile insurers under the Sabs related to the services of any of the health care professions or health care providers listed in the Guideline. These maximums are applicable to:

- a medical benefit under clauses 15 (1) (a), (b), or (h) of the Sabs;

- a rehabilitation benefit under clauses 16 (3) (a) to (g) or (l) of the Sabs;

- case management services under subsection 17 (1) of the Sabs; or

- conducting an examination, assessment or provision of a certificate, report or treatment plan under subsection 25 (3) of the Sabs.

Insurers are not prohibited from paying above any maximum amount or hourly rate established in the Guideline.

Services provided by health care professionals/providers, unregulated providers and other occupations not listed in the Guideline are not covered by the Guideline. The amounts payable by an insurer related to services not covered by the Guideline are to be determined by the parties involved.

Maximum Hourly Rates and Fees

Automobile insurers are not liable to pay for expenses related to professional services rendered to an insured person that exceed the maximum hourly rates set out in the Appendix.

Forms

The maximum fees payable for the listed forms include all examinations, assessments and expenses related to professional services (as referred to below) that are involved in such examinations and assessments, and all other activities, tasks and expenses involved in the completion and submission of forms, whether they are made through the Health Claims for Auto Insurance (Hcai) system or otherwise. Automobile insurers are not liable to pay for any expenses related to the listed forms that exceed the maximum fees set out in the Appendix.

The $200 maximum fee referred to in this Guideline and in Superintendent’s Guideline No. 06/10 (July 2010 Professional Services Guideline) for a Treatment and Assessment Plan (OCF-18) applies only to the services of a health practitioner as referred to in subsection 25 (1) 3 of the Sabs, namely reviewing and approving an OCF-18 under subsection 38 (3) (c), including any assessment or examination necessary for the purpose of that review and approval by the heath practitioner. The $200 maximum fee does not apply to assessments or examinations that are proposed in an OCF-18 and that an insurer agrees to pay for under subsection 38 (8) of the Sabs.

As stipulated in section 25 (1) 3 of the Sabs, the fee for the OCF-18 is payable only if any one or more of the goods, services, assessments or examinations described in the OCF-18 have been:

- approved by the insurer;

- deemed by the Sabs to be payable by the insurer; or

- determined to be payable by the insurer on the resolution of a dispute in accordance with sections 279 to 283 of the Insurance Act.

Although the Sabs does not expressly set out the criteria an insurer is to apply in determining whether or not to agree to pay for a proposed assessment or examination under subsection 38 (8), an insurer should not act arbitrarily or fetter its discretion, but should instead consider each proposed assessment or examination on its merits with regard to the insurer’s obligation to adjust and settle claims fairly and without unreasonable delay or resistance.

As provided in subsection 25 (5) (a) of the Sabs, an insurer may agree under subsection 38 (8) to pay fees of up to $2,000 for any one assessment or examination proposed in an OCF-18.

Expenses Related to Professional Services

“Expenses related to professional services” as referred to in the Sabs and the Professional Services Guideline include all administration costs, overhead, and related costs, fees, expenses, charges and surcharges. Insurers are not liable for any administration or other costs, overhead, fees, expenses, charges or surcharges that have the result of increasing the effective hourly rates, or the maximum fees payable for completing forms, beyond what is permitted under the Professional Services Guideline.

Collateral Benefits

In respect of any expense referenced in this Guideline or in previous Superintendent’s Professional Services Guidelines, the amount which an insurer would otherwise be liable to pay is subject to reduction by that portion of the expense for which payment is reasonably available under any insurance plan or law, or under any other plan or law.

Harmonized Sales Tax (HST)

The applicability of the HST to the services of any health care professionals or health care providers listed in this Guideline falls under the jurisdiction of the Canada Revenue Agency (Cra). If the HST is considered by the CRA to be applicable to any of the services or fees listed in this Guideline, then the HST is payable by an insurer in addition to the fees as set out in this Guideline.

Appendix – Revised Rates And Fees

|

Health Care Profession or Provider |

Maximum Hourly Rate except catastrophic impairments |

Maximum Hourly Rate catastrophic impairments* |

|---|---|---|

|

Chiropractors |

$108.65 |

$130.37 |

|

Massage Therapists |

$56.04 |

$85.70 |

|

Occupational Therapists |

$96.07 |

$115.50 |

|

Physiotherapists |

$96.07 |

$115.50 |

|

Podiatrists |

$96.07 |

$115.50 |

|

Psychologists and Psychological Associates |

$144.10 |

$172.68 |

|

Speech Language Pathologists |

$108.09 |

$129.22 |

|

Registered Nurses, Registered Practical Nurses and Nurse Practitioners |

$88.06 |

$105.22 |

|

Unregulated Providers |

||

|

Case Managers |

$56.04 |

$85.79 |

|

Kinesiologists |

$56.04 |

$85.79 |

|

Family Counsellors |

$56.04 |

$85.79 |

|

Psychometrists |

$56.04 |

$85.79 |

|

Rehabilitation Counsellors |

$56.04 |

$85.79 |

|

Vocational Counsellors |

$56.04 |

$85.79 |

*This rate applies to all services rendered on or after July 1, 2011 to an insured person whose impairment is determined to be a catastrophic impairment as defined in Sabs s. 3 (2) whether such services are rendered before or after such determination is made.

|

Form |

Maximum Payable for Completion of Form |

|---|---|

|

Disability Certificate (OCF-3) |

$200.00 |

|

Treatment and Assessment Plan (OCF–18) |

$200.00 |

|

Automobile Insurance Standard Invoice (OCF-21) |

$0.00 |

(144-G317)

Financial Services Commission of Ontario

Statement Of Priorities & Strategic Directions June 2011

Introduction

The Financial Services Commission of Ontario (FSCO) is an integrated financial services regulator. FSCO is an agency of the Ministry of Finance established under the Financial Services Commission of Ontario Act, 1997 (FSCO Act). It regulates insurance, pension plans, loan and trust companies, credit unions and caisses populaires, mortgage brokerages and administrators and co-operative corporations in Ontario.

FSCO’s legislative mandate is to provide regulatory services that protect the public interest and enhance public confidence in the sectors it regulates.

FSCO is comprised of a five-member commission, the Superintendent of Financial Services and staff.

FSCO in Profile

FSCO delivers regulatory services that protect the public interest, support a strong financial services industry and build public confidence in the regulated sectors. The following chart covers FSCO’s core regulatory activities.

As of March 2011, FSCO licensed or registered

- 361 insurance companies

- 8,569 pension plans

- 167 credit unions and caisses populaires

- 57 loan and trust companies

- 1,213 mortgage brokerages

- 2,684 mortgage brokers

- 8,757 mortgage agents

- 85 mortgage administrators

- 1,639 co-operative corporations

- 44,203 insurance agents

- 4,420 corporate insurance agencies

- 1,499 insurance adjusters

Customer Service Commitment

FSCO';s Customer Service Commitment posted on our website outlines the levels of quality service the public and our regulated sectors can expect from FSCO. This commitment identifies FSCO's service principles which are designed to meet or exceed client needs and expectations. In addition, it supports service excellence and Ontario Public Service values.

2011 Priorities

Section 11 of the FSCO Act requires that FSCO publish in The Ontario Gazette and deliver to the Minister of Finance by June 30 of each year a statement setting out FSCO’s proposed priorities.

This, FSCO’s 14th Statement of Priorities, outlines FSCO priorities and initiatives to meet changing economic and marketplace conditions in the coming year. The statement includes a report-back section listing FSCO’s key accomplishments in the previous year.

From November 2010 to March 2011 FSCO met with stakeholders from across the regulated sectors and developed a Strategic Plan for 2011-2014. The 2011 priorities and initiatives included in this Statement of Priorities are consistent with the direction FSCO identified in that Strategic Plan.

Philip Howell

Chief Executive Officer and

Superintendent of Financial Services

John M. Solursh

Chair

Financial Services Tribunal

Financial Services Commission of Ontario

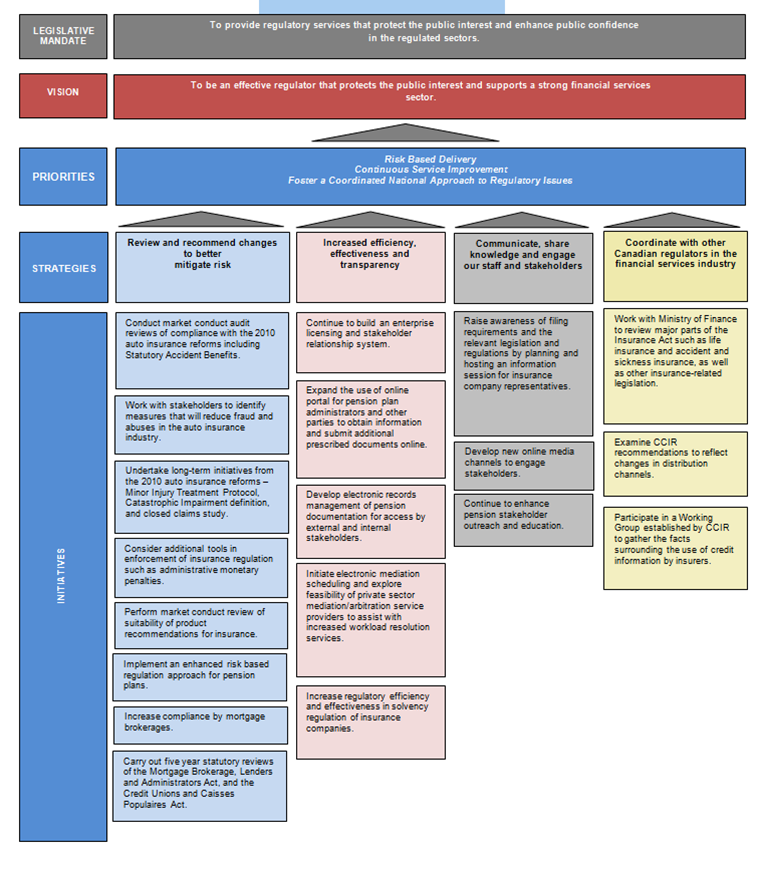

Strategic Directions

FSCO has a legislative mandate to provide regulatory services that protect the public interest and enhance public confidence in the regulated sectors. As an organization, it is committed to being a progressive and fair regulator, working with stakeholders to support a strong financial services industry. FSCO’s current vision, priorities and strategies were developed to support its legislative mandate.

Legislative Mandate

To provide regulatory services that protect the public interest and enhance public confidence in the regulated sectors.

Vision

To be an effective regulator that protects the public interest and supports a strong financial services sector.

Priorities

- Risk Based Delivery

- Foster a Co-ordinated National Approach to Regulatory Issues

- Continuous Service Improvement

Strategies

- Review and recommend changes to better implement controls and mitigate risk

- Increase efficiency, effectiveness and transparency

- Communicate, share knowledge and engage our staff and stakeholders

- Co-ordinate with other Canadian regulators in the financial services industry

FSCO Priorities

In order to achieve its legislative mandate FSCO has established three priorities.

- Risk Based Delivery

- Foster a coordinated National Approach to Regulatory Issues

- Continuous Service Improvement

Strategies and initiatives have been developed in order to achieve these priorities. The following chart provides the details of these strategies and initiatives.

FSCO Priorities, Strategies, Initiatives at a Glance

FSCO Initiatives in Detail

The following strategies and initiatives have been developed in order to achieve our priorities.

Review and recommend changes to better mitigate risk

Conduct market conduct audit reviews of compliance with the 2010 auto insurance reforms including Statutory Accident Benefits.

Automobile insurance represents approximately 56 percent of all general insurance premiums paid by Ontario residents. The auto insurance product and system changed in 2010 and this also increases risk of non compliance with the law. FSCO will be assessing how well insurance companies have implemented the changes to ensure that consumers are being treated fairly and in accordance with the law. A high compliance rate supports achieving those outcomes. FSCO intends to conduct compliance audits, with a special emphasis on governance and controls in place at insurance companies.

Work with stakeholders to identify measures addressing fraud and abuse in auto insurance industry.

Control over fraud is also important since the cost of fraud increases the cost of insurance premiums. FSCO will work with stakeholders and the Ministry of Finance to strengthen existing tools and develop additional measures to address fraud and abuse in the automobile insurance system. FSCO will support the Ministry of Finance in establishing an anti-fraud taskforce to determine the scope of auto insurance fraud in Ontario as well as working groups of stakeholders to develop collaborative approaches and solutions. FSCO will support the Ministry of Finance in making recommendations regarding detection, investigation, and enforcement and consumer education.

Consider additional tools in enforcement of insurance regulation such as administrative monetary penalties.

FSCO will work with the Ministry of Finance to enhance regulatory effectiveness by considering the enforcement tool of administrative monetary penalties in insurance.

Undertake long-term initiatives extending from 2010 auto insurance reforms – Minor Injury Treatment Protocol, Catastrophic Impairment definition, and closed claims study.

As part of the 2010 auto insurance reforms, the government announced a commitment to consult with stakeholders on possible amendments to the definition of “catastrophic impairment.” FSCO appointed a panel of medical experts to review the definition in December 2010. FSCO is committed to consulting with stakeholders on the report from the panel and making final recommendations to the Ministry of Finance this year.

The government also announced an initiative to develop a treatment protocol for minor injuries that reflects the current scientific and medical literature. This project began in 2010 and will be completed in 2014. A consultant will oversee the work to provide FSCO with an evidence-based treatment protocol, clinical prediction rules to identify patients at risk of becoming chronic, and a marketing strategy for educating the public and health providers on the new protocol.

FSCO will be working with the auto insurance industry to conduct a study of closed automobile insurance claims. Many existing data sources do not provide a detailed breakdown of claims costs. The results of the study will assist industry and government actuaries in properly assessing the impact of past and future auto insurance reforms.

Perform market conduct review of suitability of product recommendations for insurance.

Insurance products are complex. Recent studies on financial literacy in Canada have shown that many consumers have difficulty in understanding many products. This creates a risk for consumers. Insurance agents and companies have an important role to ensure these consumers are empowered to make informed decisions and are presented with suitable product recommendations. A market conduct review will be undertaken to determine how the industry is ensuring that these two outcomes are achieved. The focus of the review will be to understand and assess the processes agents use in making recommendations to consumers and the processes in place at insurance companies when developing and distributing products. The review will also consider the actions agents and insurance companies are taking to support the financial literacy of their clients.

Implement an enhanced risk based regulation approach for pension plans.

The goal of the enhanced risk based regulation project for pension plans is to protect plans and plan beneficiaries by developing an enhanced risk based program of monitoring, examinations and investigations directed at pension plans that may be at risk of failure or of significant under-funding. This is in line with FSCO’s strategic priority of conducting regulatory activities in accordance with risk based principles.

In March 2011, FSCO published a consultation paper on a proposed risk based regulation framework. The framework will be finalized based on input from pension stakeholders. For 2011-12, FSCO will develop the detailed design features of the new framework including risk indicators and measures, risk assessment methodology, regulatory response actions, and supporting business processes.

In 2012-13, FSCO will prepare for the rollout and implementation of the risk based monitoring program and develop a plan for ongoing evaluation of the program.

Increase compliance by mortgage brokerages.

The Mortgage Brokerages, Lenders, and Administrators Act that came into effect on July 1, 2008, enhanced protections and fair treatment of borrowers and private investors. Achieving these outcomes requires a high compliance rate with the law. FSCO will employ multiple strategies including education and outreach, risk based compliance audits, targeted enforcement activities, implementing a new mandatory continuing education policy for agents and brokers, and working with industry associations to achieve these outcomes.

Carry out five year statutory reviews of the Mortgage Brokerage, Lenders and Administrators Act, and the Credit Unions and Caisses Populaires Act.

FSCO will assist the Ministry of Finance in conducting these reviews to ensure that the law stays current so that risks in the marketplace are mitigated.

Increased efficiency, effectiveness and transparency

Continue to build an Enterprise Licensing and Stakeholder Relationship System.

FSCO continuously looks for ways to increase efficiency and to provide quality service to stakeholders and clients. FSCO continues to develop a stakeholder relationship system that will provide the tools and resources to ensure that it has a complete view of the individuals and businesses it regulates. The new system will support FSCO’s focus on user needs, better manage risk and facilitate work with other regulators.

Expand the use of online portal for pension plan administrators and other parties to obtain information and submit additional prescribed documents online.

In March 2010, FSCO launched the Pension Services Portal to provide stakeholders with a secure electronic channel for the submission of the Annual Information Return (Air) in a flat file format. In September 2010, the portal was enhanced to provide for the filing of online fillable forms. The AIR was selected as the first of the prescribed pension filings to allow online filing.

Development of the portal continues with planned expansion to encompass all other prescribed pension filings. Once the system can accept all prescribed filings, work will begin on electronic submission of other applications and automatic notifications. It is anticipated that ultimately the website portal will become the conduit between FSCO and pension stakeholders for the submission of all filings and applications.

Develop electronic records management of pension documentation for access by external and internal stakeholders.

Across FSCO solutions are being developed to deal with the growing volume of paper in archival storage. In 2010 the Pension Division applied a solution with the launch of the Pension Services Portal.

FSCO will pilot an additional solution, electronic imaging, in 2011. Once key documents have been imaged, pension stakeholders will have an effective and efficient method of access to historical pension plan documentation. FSCO will apply these as well as other appropriate solutions to other branches and divisions.

Initiate electronic mediation scheduling and explore feasibility of private sector mediation/arbitration service providers to support the increased workload.

As part of FSCO’s legislative mandate to provide fair, accessible, cost-effective and timely dispute resolution services, electronic scheduling will provide the parties to mediation with the ability to book mediation meetings using an online scheduling system administered by FSCO.

FSCO is exploring the feasibility of engaging the services of external dispute resolution service providers, to deal with the significant backlog that has developed as a result of unprecedented increases in mediation applications.

Increase regulatory efficiency and effectiveness in solvency regulation of insurance companies.

FSCO will work with the Ministry of Finance to assess whether changes are required in the law to provide for a more effective, efficient and harmonized approach to solvency regulation of insurance companies incorporated in Ontario.

Communicate, share knowledge and engage our staff and stakeholders

Raise awareness of filing requirements and the relevant legislation and regulations by planning and hosting an information session for insurance company representatives.

FSCO will raise awareness of automobile insurance filing requirements and the relevant legislation and regulations by planning and hosting an information session for insurance company representatives. Over the past two years, FSCO has taken steps to improve the automobile insurance rate filing process. Improvements have included clarifying the filing guidelines, enhanced communication to insurers on activities and issues, and e-filing implementation.

As a member of the Canadian Automobile Insurance Rate Regulators (Carr) association, FSCO is assisting in the development of a training session for regulatory staff on rate filing analysis. FSCO is also hosting the Carr conference on automobile insurance issues that will include participation from the industry and from other regulators.

Develop new online media channels to engage stakeholders.

FSCO will explore expanding communications channels to better engage stakeholders.

Continue to enhance pension stakeholder outreach and education.

FSCO has launched a multi-year project focusing on outreach and educational efforts targeted to pension stakeholders. Initiatives will include the development of regulatory policies supporting legislative changes to the Pension Benefits Act, and governance matters to support the risk based regulation initiative.

FSCO will also hold additional webinars on various topics of interest. The webinars will be posted online. FSCO will develop an online tool kit for pension plan members covering pension plans as well as important recent changes. FSCO will also develop a tool kit for pension plan administrators.

Coordinate with other Canadian regulators in the financial services industry

Work with Ministry of Finance to review major parts of the Insurance Act such as life insurance and accident and sickness insurance, as well as other insurance-related legislation.

FSCO will work with the Ministry of Finance to consider changes to further promote consumer protection and harmonization with other Canadian jurisdictions. This will be the first review of these major parts of the legislation since 1962.

Examine Ccir recommendations to reflect changes in distribution channels.

The provisions in the Insurance Act dealing with insurance distribution were enacted many years ago when insurance was largely distributed by agents representing a single company. There is now more diversity in distribution channels. The Canadian Council of Insurance Regulators (Ccir) recently published a paper on managing general agencies. Ccir is researching the role of MGAs in the distribution of life insurance and the nature of risks involved.

Participate in a Working Group established by Ccir to gather the facts surrounding the use of credit information by insurers.

In order to get a clear understanding of what is happening in the marketplace, FSCO is participating in a Working Group established by Ccir to gather the facts surrounding the use of credit information by insurers.

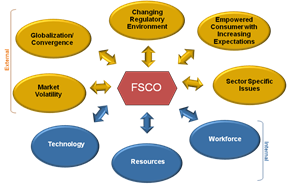

FSCO’s Approach

To fulfill its legislative mandate and set effective organizational priorities, FSCO considers environmental risks and factors influencing the financial services industry. FSCO identifies risks that may impact our capacity to conduct business operations and ensure a high level of regulatory oversight. Over the next three years, we will continue to strengthen and enhance this risk based regulatory framework

The Environment

The economic recovery is well underway in Ontario. All major indicators have improved from lows posted during the recession. Several economic indicators point to stronger activity in the financial services sector. Ontario’s real GDP is growing while consumer confidence is up significantly since the same period in 2010.

With the spread of information technology, consumers have different expectations of financial service providers. At the same time, te chnological changes are shaping new products and distribution channels for financial products. This is a changing environment where the role of the regulator is also evolving.

In order to ensure we are providing effective regulatory services in this environment, it is important that we make the best use of limited resources as well as engage regularly with the sectors.

FSCO has established committees and advisory groups in the insurance, pensions, cooperative corporations, credit unions and caisses populaires and mortgage brokerage sectors. Meeting with these groups promotes a dialogue where the objectives are to improve regulation, gain an understanding of current and emerging issues and streamline the system.

Performance Measures FSCO works to continuously improve its performance throughout the organization in order to deliver its services in a cost efficient and effective manner.

To support this, FSCO will develop improved performance measures and establish standards against which it can be judged in all the sectors it regulates. The existing measures will be reviewed and updated over the coming year.

FSCO is also working on new ways to measure outcomes and report on results.

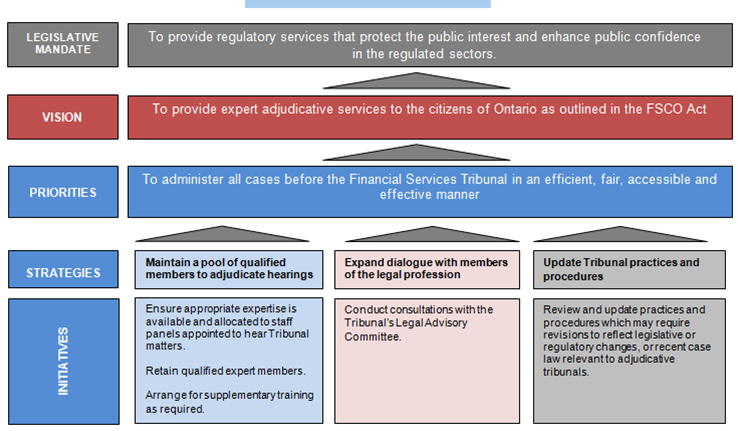

Financial Services Tribunal Priorities at a Glance

Financial Services Tribunal Initiatives in Detail

The Financial Services Tribunal (Fst) is an expert adjudicative tribunal established under the FSCO Act. It is comprised of members appointed to it on a part time basis.

The FST is charged with hearing applications and appeals from certain decisions made or proposed by the Superintendent, or other authorized persons or entities, under a range of Ontario statutes governing financial services matters including: