2021-22 Third Quarter Finances

The Third Quarter Finances report contains information about Ontario's 2021–22 fiscal outlook as of December 31, 2021 and also incorporates information on the use of contingencies and the Province's borrowing program to February 2, 2022.

Highlights

- The government remains committed to strengthening the economy. In the third quarter and early 2022, the government's focus was fighting the COVID‑19 pandemic, while supporting people and businesses impacted by public health restrictions to blunt the spread of Omicron.

- As of the 2021–22 Third Quarter Finances, the Province is investing an additional $2.3 billion, primarily in health care and supports for businesses and workers, offset from existing contingencies, relative to the 2021 Ontario Economic Outlook and Fiscal Review (also referred to as the Fall Economic Statement or FES).

- The government is now projecting a deficit of $13.1 billion in 2021–22, an improvement of $20.0 billion from the outlook presented in the 2021 Budget, and $8.4 billion lower than projected in the 2021 Ontario Economic Outlook and Fiscal Review.

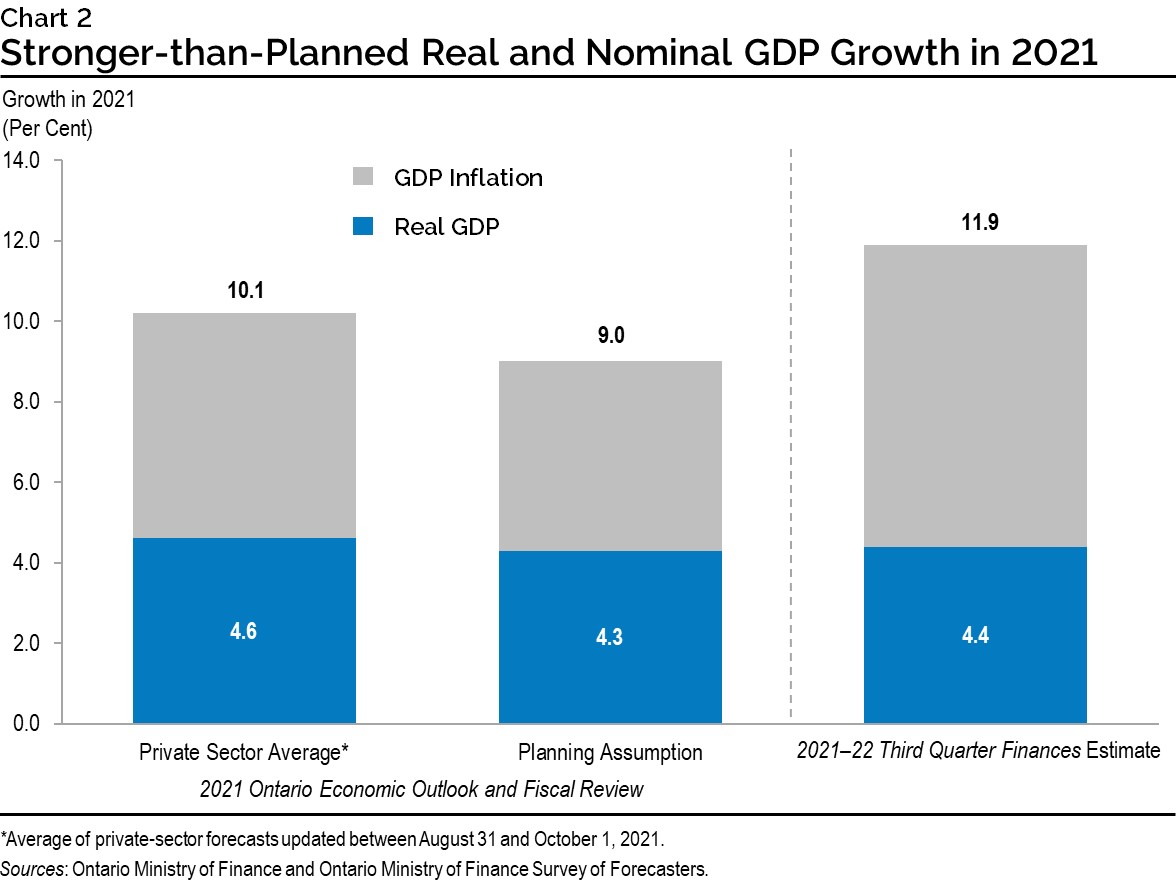

- Revenues in 2021–22 are projected to be $176.7 billion, $22.6 billion higher than forecast in the 2021 Budget and $8.0 billion higher than expected in the 2021 Ontario Economic Outlook and Fiscal Review. The increased revenue forecast is primarily due to higher than projected taxation revenue attributable to stronger than expected nominal gross domestic product (GDP) growth in 2021 and higher net tax assessments for 2020 and prior years. Nominal GDP is estimated to have increased 11.9 per cent in 2021, higher than the prudent 2021 Ontario Economic Outlook and Fiscal Review nominal GDP growth planning assumption of 9.0 per cent.

- Interest on debt is projected to be $13.0 billion, lower than the $13.1 billion forecast in the 2021 Budget, and is unchanged from the projection in the 2021 Ontario Economic Outlook and Fiscal Review.

- Ontario's real GDP increased 1.4 per cent in the third quarter of 2021, after a 1.2 per cent decline in the second quarter. As of the third quarter, Ontario's real GDP was 1.2 per cent below the fourth quarter of 2019.

- Many other major economic indicators, including employment, retail and wholesale trade and manufacturing sales, are now above, or close to, pre-pandemic levels.

- As of February 2, 2022, the Province has borrowed $39.2 billion of its $41.0 billion long-term borrowing program for 2021–22, which now includes pre-borrowing of $10.0 billion for 2022–23.

Introduction

The government continues to spare no expense in the fight against the global pandemic, making investments to protect people's health and the economy. These investments have proven to be effective, as evidenced by Ontario's response to the Omicron variant, the successful vaccine rollout, and responsive economic supports to manage the impacts of necessary public health measures and support businesses and workers. Significant progress has been made against COVID‑19 and the government remains vigilant in fighting the virus.

The release of this report illustrates that Ontario's plan to protect workers, jobs and the economy has been successful, as the province remains economically resilient two years into the COVID‑19 pandemic. This has allowed the government to continue to make the necessary investments required as the COVID‑19 situation continues to evolve, while laying a strong, stable foundation for economic recovery and growth. Since the release of the 2021 Ontario Economic Outlook and Fiscal Review, the government has invested an additional $2.3 billion, primarily in the health care system and supports for businesses and workers. Highlights include:

- $1.3 billion in additional funding to support hospitals with personal protective equipment, additional staff and Infection Prevention and Control measures, as well as funding to support the rollout of COVID‑19 vaccines;

- The new Ontario Business Costs Rebate Program, which provides eligible businesses required to close or reduce indoor capacity with rebate payments for up to 100 per cent of the property tax and energy costs they incur while subject to public health measures in response to the Omicron variant; and

- The new Ontario COVID‑19 Small Business Relief Grant, which provides eligible small businesses subject to closure under the modified Step Two of the Roadmap to Reopen with a grant payment of $10,000.

The government recognizes that economic uncertainty and challenges, including the rising cost of living, continue. That is why the government will continue to invest in a stronger economy through its plan to build Ontario.

This is the government's eighth financial update since the pandemic began, delivering on its commitment to provide regular updates on Ontario's finances, even during this uncertain economic period. The government remains committed to defeating the COVID‑19 virus and will provide its next financial update as part of the 2022 Budget.

Section A: Ontario's 2021–22 fiscal outlook

The Province's 2021–22 deficit is projected to be $13.1 billion — $20.0 billion lower than the outlook published in the 2021 Budget and $8.4 billion lower than projected in the 2021 Ontario Economic Outlook and Fiscal Review.

Revenues in 2021–22 are projected to be $176.7 billion — $22.6 billion higher than forecast in the 2021 Budget and $8.0 billion higher than projected in the 2021 Ontario Economic Outlook and Fiscal Review. The increased revenue forecast is primarily due to higher than projected taxation revenue attributable to stronger than expected nominal GDP growth in 2021 and higher net tax assessments for 2020 and prior years.

Program expense is projected to be $175.8 billion — $2.8 billion higher than the 2021 Budget outlook. Since the 2021 Ontario Economic Outlook and Fiscal Review, the government has made $2.3 billion in additional investments, primarily in health care and supports for businesses and workers impacted by public health restrictions to blunt the spread of Omicron. After offsetting the cost of these investments against existing contingencies and accounting for ministry underspending, program expense is projected to be $0.4 billion lower relative to the outlook presented in the 2021 Ontario Economic Outlook and Fiscal Review.

Since the beginning of the pandemic, the government's use of extraordinary contingencies has provided the flexibility to respond quickly. With the release of the 2021 Ontario Economic Outlook and Fiscal Review, the Time-Limited COVID‑19 Fund had a $2.7 billion allocation to respond to the ongoing uncertainty related to the pandemic and the future pace of economic recovery. In response to the rise of the Omicron variant and the resulting necessary public health restrictions, additional support has been provided through the Time-Limited COVID‑19 Fund. After the drawdowns reported in both the 2021 Ontario Economic Outlook and Fiscal Review and the 2021–22 Third Quarter Finances, the balance of this Fund is $500 million for the remainder of the fiscal year.

Ontario's net debt-to-GDP ratio is projected to be 40.8 per cent in 2021–22, 8.0 percentage points lower than the 48.8 per cent forecast in the 2021 Budget and 2.6 percentage points lower than projected in the 2021 Ontario Economic Outlook and Fiscal Review.

The 2021 Budget included a $1.0 billion reserve in 2021–22 to protect the fiscal outlook against any unforeseen adverse changes in the Province's revenue and expense forecasts. With the release of the 2021–22 Third Quarter Finances, the reserve has been maintained at $1.0 billion, which can be used to address any unforeseen events that could arise before the fiscal year-end.

| Item | Budget Plan |

Current Outlook1 |

In-Year Change |

|---|---|---|---|

| Revenue | 154,012 | 176,659 | 22,647 |

| Expense — Programs | 172,989 | 175,793 | 2,804 |

| Expense — Interest on Debt | 13,130 | 12,971 | (159) |

| Total Expense | 186,120 | 188,764 | 2,645 |

| Surplus/(Deficit) Before Reserve | (32,108) | (12,105) | 20,002 |

| Reserve | 1,000 | 1,000 | – |

| Surplus/(Deficit) | (33,108) | (13,105) | 20,002 |

[1] Current outlook primarily reflects information available as of December 31, 2021 and also incorporates information on the use of contingencies to February 2, 2022.

Note: Numbers may not add due to rounding.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Revenue

Revenues in 2021–22 are projected to be $8.0 billion higher than forecast in the 2021 Ontario Economic Outlook and Fiscal Review.

The forecast for Total Taxation Revenue has increased by $7.5 billion compared to the 2021 Ontario Economic Outlook and Fiscal Review. Key changes in the taxation revenue outlook compared to the 2021 Ontario Economic Outlook and Fiscal Review include:

- Corporations Tax revenue increased by $5.3 billion, mainly due to higher 2020 and prior year tax assessments;

- Personal Income Tax revenue increased by $1.3 billion, mainly due to higher compensation of employees growth for 2021, reflecting growth in employment, partially offset by weaker 2020 and prior year tax assessments;

- Employer Health Tax increased by $529 million, mainly due to higher compensation of employees growth for 2021, reflecting growth in employment;

- Gasoline and Fuel Taxes combined increased by $503 million, mainly due to higher than expected fuel consumption volumes, but are still down by $125 million compared to the 2021 Budget forecast;

- Land Transfer Tax is $424 million higher, reflecting strong home resales in 2021;

- Sales Tax revenue decreased by $595 million, mainly reflecting lower 2021 entitlement estimates, partially offset by higher entitlements for 2020 and prior years; and

- All Other Taxes combined increased by $43 million, mainly due to higher projected revenues from Electricity Payments-in-Lieu of Taxes, partially offset by lower projected revenues from Education Property Tax and Tobacco Tax.

Net income from Government Business Enterprises is $904 million higher, mainly due to increased forecasts for earnings from Ontario Power Generation, Hydro One Ltd. and the Liquor Control Board of Ontario.

Projected Government of Canada Transfers decreased by $361 million, mainly due to lower funding under the Investing in Canada Infrastructure Program.

Other Non-Tax Revenues combined are projected to increase by $4 million, mainly due to higher Power Supply Contract Recoveries.

| Item | 2021–22 |

|---|---|

| 2021 Budget Revenue Outlook | 154,012 |

| Revenue Changes in the 2021–22 First Quarter Finances | 2,885 |

| Revenue Changes in the 2021 Ontario Economic Outlook and Fiscal Review | 11,720 |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Corporations Tax | 5,303 |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Personal Income Tax | 1,288 |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Employer Health Tax | 529 |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Gasoline and Fuel Tax | 503 |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Land Transfer Tax | 424 |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Sales Tax | (595) |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — All Other Taxes | 43 |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Total Taxation Revenue | 7,495 |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Government of Canada Transfers | (361) |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Government Business Enterprises | 904 |

| Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Other Non-Tax Revenue | 4 |

| Total Revenue Changes Since the 2021 Ontario Economic Outlook and Fiscal Review | 8,042 |

| 2021–22 Third Quarter Finances Revenue Outlook | 176,659 |

Note: Numbers may not add due to rounding.

Source: Ontario Ministry of Finance.

There are further risks that could materially affect the 2021–22 revenue outlook. These include changes to the economic growth outlook, revenue collections from Ontario-administered taxes, the earnings of government business enterprises and government policy changes. The government will monitor these developments and will provide further details in future fiscal updates.

Expense

Total expense, including interest on debt, is projected to be $188.8 billion — $2.6 billion higher than the 2021 Budget projection. Since the release of the 2021 Ontario Economic Outlook and Fiscal Review, $2.3 billion in additional investments have been directed primarily towards health care and supports for businesses and workers. After offsetting the cost of these investments against existing contingencies and accounting for ministry underspending, total expense is projected to be $0.4 billion lower relative to the outlook presented in the 2021 Ontario Economic Outlook and Fiscal Review.

| Item | 2021–22 |

|---|---|

| 2021 Budget Total Expense Outlook | 186,120 |

| Total Expense Changes in the 2021–22 First Quarter Finances | 2,208 |

| Total Expense Changes in the 2021 Ontario Economic Outlook and Fiscal Review | 787 |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Additional Hospital Reimbursement for COVID-19 Expenses | 1,286 |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Ontario Business Costs Rebate Program | 300 |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Ontario COVID-19 Small Business Relief Grant | 293 |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Prevention and Containment of COVID-19 in Long-Term Care Homes | 164 |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Accelerated Personal Support Worker (PSW) Training Program | 108 |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Electricity Cost Relief | 75 |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Additional Funding for the Alcohol and Gaming Commission of Ontario | 58 |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Stabilization Funding for Provincial Tourism, Culture and Heritage Entities | 49 |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Wheatley Disaster Assistance | 6 |

| Subtotal: New Investments Since the 2021 Ontario Economic Outlook and Fiscal Review | 2,338 |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Lower than Forecasted Spending in Select Programs | (120) |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Underspending in Investing in Canada Infrastructure Program | (255) |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — Underspending in Infrastructure Programs | (350) |

| Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review — All Other Changes | 2 |

| Total Program Expense Changes | 1,615 |

| Net Drawdown of the Standard Contingency Fund | (301) |

| Drawdown of the Time-Limited COVID-19 Fund | (1,665) |

| Total Net Program Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review | (351) |

| Interest on Debt Change Since the 2021 Ontario Economic Outlook and Fiscal Review | – |

| Total Expense Changes Since the 2021 Ontario Economic Outlook and Fiscal Review | (351) |

| 2021–22 Third Quarter Finances Total Expense Outlook | 188,764 |

Note: Numbers may not add due to rounding.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Program expense update

Total program expense in 2021–22 is projected to be $175.8 billion, an increase of approximately $2.8 billion compared to the 2021 Budget. Total program expense is projected to be $0.4 billion lower than in the 2021 Ontario Economic Outlook and Fiscal Review.

The 2021–22 Third Quarter Finances include an additional $2.3 billion in investments since the 2021 Ontario Economic Outlook and Fiscal Review, offset against existing contingencies. These investments include:

- $1.3 billion in additional funding to support hospitals during the COVID‑19 pandemic, including expenses such as personal protective equipment, additional staff and Infection Prevention and Control measures, as well as funding to support the rollout of COVID‑19 vaccines;

- $300 million for the Ontario Business Costs Rebate Program to provide property tax and energy cost rebates to eligible businesses that were required to close or reduce indoor capacity as part of the additional public health measures in response to the Omicron variant;

- $293 million for the Ontario COVID‑19 Small Business Relief Grant to support small businesses that were subject to closures as part of the additional public health measures in response to the Omicron variant;

- $164 million to help long-term care homes prevent and contain the spread of COVID‑19, including increased staffing supports and purchasing additional personal protective equipment supplies;

- $108 million to train up to 8,200 new personal support workers (PSWs) for high-demand jobs in Ontario's health and long-term care sectors to address the personal support workforce shortage;

- $75 million in additional funding to support further electricity cost relief for eligible residential, farm and small business customers for the period January 18, 2022 to February 7, 2022;

- $58 million to support the operations of the Alcohol and Gaming Commission of Ontario as a result of reduced recoveries due to the closure of non-essential businesses during the pandemic, and to support the implementation of iGaming;

- $49 million to provide stabilization funding support for provincial tourism, culture and heritage entities that had to temporarily limit or close their operations due to COVID‑19; and

- $6 million to help residents and businesses of Wheatley who were evacuated as a result of the natural gas explosion with immediate needs such as housing and food, and to ensure the municipality can continue to deliver emergency services.

Other changes to program expense are outlined below:

- $120 million reduction in the Ministry of Energy, Northern Development and Mines, due primarily to lower than forecasted spending in select energy rebate programs;

- $255 million in underspending in federal flow-through expense under the Investing in Canada Infrastructure Program for municipal transit transportation projects to reflect updated municipal construction timelines;

- $350 million in underspending for planned infrastructure programs, such as the Investing in Canada Infrastructure Program, due to revised implementation timelines for a number of projects; and

- All other changes of $2 million.

Changes to program expense have been offset against contingencies, including the standard Contingency Fund with a net decrease of $301 million, and a $1,665 million draw against the Time-Limited COVID‑19 Fund.

Interest on debt expense update

Interest on debt expense is projected to be $13.0 billion, lower than the $13.1 billion forecast in the 2021 Budget and unchanged from the projection in the 2021 Ontario Economic Outlook and Fiscal Review. The Province's cost of borrowing has, however, increased to 2.1 per cent, higher than the 1.9 per cent forecast in the 2021 Budget and the 2021 Ontario Economic Outlook and Fiscal Review. Despite this increase, lower forecast long term borrowings for this year have allowed the interest on debt projection to remain unchanged, at $13.0 billion.

Fiscal prudence

As reported in the 2021 Budget, the government fully allocated the extraordinary contingencies previously made available for 2021–22 to respond to the COVID‑19 pandemic. In order to maintain continued flexibility during this uncertain time, as the 2021–22 fiscal year unfolded, the Province allocated $2.2 billion to the Time-Limited COVID‑19 Fund in 2021–22 as part of the 2021–22 First Quarter Finances, with an additional $500 million increase to this Fund announced in the 2021 Ontario Economic Outlook and Fiscal Review. After all projected drawdowns reported in the 2021–22 Third Quarter Finances, the remaining balance of the Time-Limited COVID‑19 Fund for 2021–22 is $500 million.

Standard Contingency Funds are also maintained to help mitigate expense risks — for example, in cases where health and safety may be compromised, and which may otherwise adversely affect Ontario's fiscal performance. The remaining standard Contingency Fund balance is currently projected to be $1.1 billion for 2021–22.

The use of extraordinary contingencies since the beginning of the pandemic provided Ontario with the flexibility to respond quickly to challenges posed by new COVID‑19 variants, including most recently the Omicron surge.

| Item | Current Outlook 2021–22 |

|---|---|

| COVID-19 Time-Limited Funding and Extraordinary Contingencies — Pandemic Fund | 4,000 |

| COVID-19 Time-Limited Funding and Extraordinary Contingencies — Support for People and Jobs Fund | 1,000 |

| COVID-19 Time-Limited Funding and Extraordinary Contingencies — Time-Limited COVID-19 Fund | 2,700 |

| COVID-19 Time-Limited Funding and Extraordinary Contingencies — Other COVID-19 Time-Limited Funding | 3,454 |

| Total COVID-19 Time-Limited Funding and Extraordinary Contingencies | 11,154 |

| Remaining Balances as of the 2021–22 Third Quarter Finances1 — Pandemic Fund | – |

| Remaining Balances as of the 2021–22 Third Quarter Finances2 — Support for People and Jobs Fund | – |

| Remaining Balances as of the 2021–22 Third Quarter Finances3 — Time-Limited COVID-19 Fund | 500 |

| Total Remaining Balances as of the 2021–22 Third Quarter Finances | 500 |

[1], [2], [3] As of February 2, 2022, net of new projected drawdowns in the 2021–22 Third Quarter Finances.

Note: Numbers may not add due to rounding.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

The Fiscal Sustainability, Transparency and Accountability Act, 2019 requires Ontario's fiscal plan to incorporate prudence in the form of a reserve to protect the fiscal outlook against unforeseen adverse changes in the Province's revenue and expense, including those resulting from changes in Ontario's economic performance. The 2021 Budget included a reserve of $1.0 billion in 2021–22, which has been maintained as part of the current fiscal outlook to ensure a prudent risk management approach, given uncertainties remaining in the fiscal outlook for 2021–22.

Section B: Ontario's recent economic performance and outlook

Recent economic performance

Economies around the world, including Ontario's, have experienced a significant rebound from the unprecedented impacts of the COVID‑19 pandemic. Ontario's real GDP increased by 1.4 per cent in the third quarter of 2021, following a decline in the second quarter. Third quarter growth was led by an increase in household spending and exports.

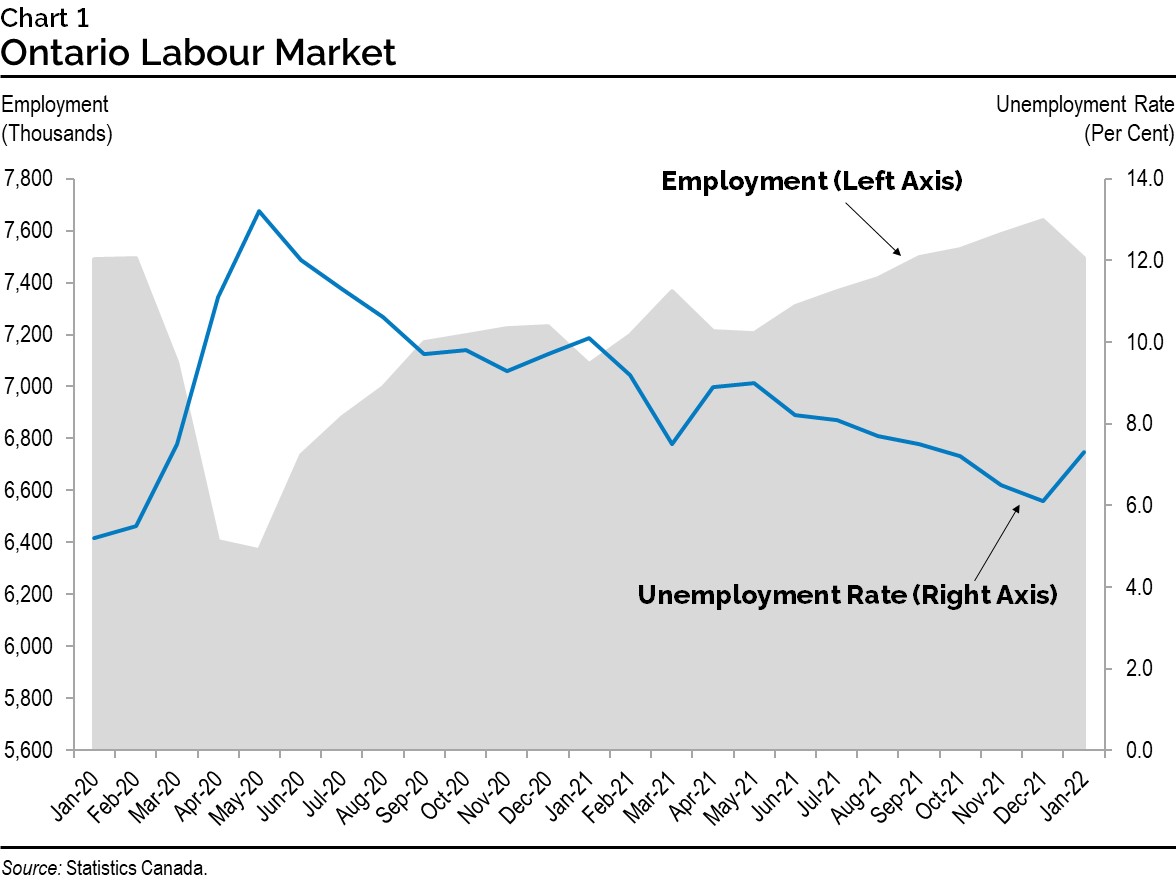

Recent economic indicators suggest growth continued in the fourth quarter of 2021. Employment in Ontario increased strongly in the fourth quarter and the unemployment rate declined to 6.1 per cent in December. Other indicators such as retail and wholesale trade and manufacturing sales have risen above their pre-pandemic levels.

Public health restrictions to blunt the spread of Omicron impacted employment in Ontario at the beginning of 2022. Employment declined by 145,700 and the unemployment rate increased to 7.3 per cent in January 2022. Despite this decline, employment in January 2022 was essentially unchanged compared to the February 2020 pre-pandemic level. The Province began to gradually lift public health restrictions on January 31, 2022, as key public health and health care indicators were showing signs of improvement.

Economic outlook

The outlook for global economic growth has remained resilient, despite impacts related to the Omicron variant of COVID‑19, continuing supply chain disruptions and rising inflation in many countries. The International Monetary Fund projects global real GDP to rise by 5.9 per cent in 2021, followed by 4.4 per cent growth in 2022. U.S. real GDP increased by 5.7 per cent in 2021 and, according to the Blue Chip Economic Indicators survey, forecasters expect U.S. real GDP to increase by 3.9 per cent in 2022.

The Ministry of Finance is estimating that Ontario real GDP increased 4.4 per cent in 2021, up slightly from the 2021 Ontario Economic Outlook and Fiscal Review real GDP growth planning assumption of 4.3 per cent. Ontario nominal GDP is estimated to have increased 11.9 per cent in 2021, higher than the prudent 2021 Ontario Economic Outlook and Fiscal Review nominal GDP growth planning assumption of 9.0 per cent.

The private-sector average forecast

The evolution of the COVID‑19 pandemic continues to represent a significant risk to the economic outlook. In addition, continuing supply chain disruptions risk further price inflation.

Central banks around the world have begun responding to rising inflation and signalled further changes in the months ahead. The Bank of Canada and the U.S. Federal Reserve have reduced asset purchase programs and indicated that increases in policy interest rates are likely imminent to achieve their two per cent consumer price inflation targets.

Section C: Details of Ontario's finances

| Item | 2021–22: 2021 Budget |

2021–22: Current Outlook |

2021–22: In-Year Change |

|---|---|---|---|

| Taxation Revenue — Personal Income Tax | 36,351 | 42,583 | 6,232 |

| Taxation Revenue — Sales Tax | 27,632 | 30,391 | 2,759 |

| Taxation Revenue — Corporations Tax | 14,389 | 22,283 | 7,894 |

| Taxation Revenue — Education Property Tax | 5,754 | 5,679 | (75) |

| Taxation Revenue — Employer Health Tax | 6,445 | 7,199 | 754 |

| Taxation Revenue — Ontario Health Premium | 4,141 | 4,493 | 352 |

| Taxation Revenue — Gasoline Tax | 2,421 | 2,322 | (99) |

| Taxation Revenue — Land Transfer Tax | 3,890 | 5,473 | 1,583 |

| Taxation Revenue — Tobacco Tax | 1,060 | 991 | (69) |

| Taxation Revenue — Fuel Tax | 814 | 788 | (26) |

| Taxation Revenue — Beer, Wine and Spirits Taxes | 618 | 638 | 20 |

| Taxation Revenue — Electricity Payments in Lieu of Taxes | 454 | 581 | 127 |

| Taxation Revenue — Ontario Portion of the Federal Cannabis Excise Duty | 245 | 185 | (60) |

| Taxation Revenue — Other Taxes | 605 | 756 | 151 |

| Taxation Revenue — Total | 104,819 | 124,362 | 19,543 |

| Government of Canada — Canada Health Transfer | 16,737 | 16,726 | (11) |

| Government of Canada — Canada Social Transfer | 6,005 | 6,001 | (4) |

| Government of Canada — Equalization | – | – | – |

| Government of Canada — Infrastructure Programs | 1,086 | 736 | (350) |

| Government of Canada — Labour Market Programs | 1,316 | 1,523 | 207 |

| Government of Canada — Social Housing Agreement | 299 | 299 | – |

| Government of Canada — Other Federal Payments | 1,577 | 3,679 | 2,102 |

| Government of Canada — Direct Transfers to Broader Public-Sector Organizations | 424 | 424 | – |

| Government of Canada — Total | 27,444 | 29,388 | 1,944 |

| Income from Government Business Enterprises — Liquor Control Board of Ontario | 2,435 | 2,551 | 116 |

| Income from Government Business Enterprises — Ontario Power Generation Inc./Hydro One Ltd. | 670 | 1,535 | 865 |

| Income from Government Business Enterprises — Ontario Lottery and Gaming Corporation | 1,266 | 1,324 | 58 |

| Income from Government Business Enterprises — Ontario Cannabis Store | 170 | 155 | (15) |

| Income from Government Business Enterprises — Total | 4,541 | 5,565 | 1,024 |

| Other Non-Tax Revenue — Fees, Donations and Other Revenues from Hospitals, School Boards and Colleges | 9,758 | 9,758 | – |

| Other Non-Tax Revenue — Vehicle and Driver Registration Fees | 2,096 | 2,040 | (56) |

| Other Non-Tax Revenue — Miscellaneous Other Non-Tax Revenue | 1,322 | 1,548 | 226 |

| Other Non-Tax Revenue — Other Fees and Licences | 1,208 | 1,209 | 1 |

| Other Non-Tax Revenue — Sales and Rentals | 1,402 | 1,402 | – |

| Other Non-Tax Revenue — Reimbursements | 1,031 | 1,031 | – |

| Other Non-Tax Revenue — Royalties | 284 | 284 | – |

| Other Non-Tax Revenue — Power Supply Contract Recoveries | 102 | 68 | (34) |

| Other Non-Tax Revenue — Net Reduction of Power Purchase Contracts | 5 | 5 | – |

| Other Non-Tax Revenue — Total | 17,208 | 17,344 | 136 |

| Total Revenue | 154,012 | 176,659 | 22,647 |

Note: Numbers may not add due to rounding.

Source: Ontario Ministry of Finance.

| Ministry Expense | 2021–22: 2021 Budget |

2021–22: Current Outlook |

2021–22: In-Year Change |

|---|---|---|---|

| Agriculture, Food and Rural Affairs (Base) | 310.9 | 312.0 | 1.1 |

| Agriculture, Food and Rural Affairs — Demand-Driven Risk Management and Time-Limited Programs | 417.2 | 417.6 | 0.3 |

| Agriculture, Food and Rural Affairs — COVID-19 Time-Limited Funding2 | 26.2 | 26.2 | – |

| Agriculture, Food and Rural Affairs (Total) | 754.3 | 755.7 | 1.5 |

| Attorney General (Base) | 1,675.0 | 1,709.3 | 34.3 |

| Attorney General — COVID-19 Time-Limited Funding3 | – | 35.6 | 35.6 |

| Attorney General (Total) | 1,675.0 | 1,744.9 | 69.9 |

| Board of Internal Economy (Total) | 273.0 | 273.0 | – |

| Children, Community and Social Services (Base) | 17,841.5 | 17,843.5 | 2.0 |

| Children, Community and Social Services — COVID-19 Time-Limited Funding4 | 69.1 | 78.0 | 8.9 |

| Children, Community and Social Services (Total) | 17,910.6 | 17,921.5 | 10.9 |

| Colleges and Universities (Base) | 9,312.8 | 9,312.8 | – |

| Colleges and Universities — Student Financial Assistance | 1,352.4 | 1,352.4 | – |

| Colleges and Universities — COVID-19 Time-Limited Funding5 | 12.7 | 21.4 | 8.7 |

| Colleges and Universities (Total) | 10,677.9 | 10,686.6 | 8.7 |

| Economic Development, Job Creation and Trade (Base) | 377.5 | 379.5 | 2.0 |

| Economic Development, Job Creation and Trade — Time-Limited Investments | 214.1 | 214.1 | – |

| Economic Development, Job Creation and Trade — COVID-19 Time-Limited Funding6 | 293.7 | 637.4 | 343.7 |

| Economic Development, Job Creation and Trade (Total) | 885.3 | 1,231.0 | 345.7 |

| Education (Base)7 | 31,263.0 | 30,800.7 | (462.4) |

| Education — Teachers’ Pension Plan8 | 1,630.9 | 1,630.9 | – |

| Education — COVID-19 Time-Limited Funding9 | 59.3 | 760.0 | 700.7 |

| Education (Total) | 32,953.2 | 33,191.6 | 238.3 |

| Energy, Northern Development and Mines (Base) | 1,083.8 | 1,084.0 | 0.2 |

| Energy, Northern Development and Mines — Electricity Cost Relief Programs | 6,493.6 | 6,381.3 | (112.3) |

| Energy, Northern Development and Mines — COVID-19 Time-Limited Funding10 | 62.0 | 327.1 | 265.1 |

| Energy, Northern Development and Mines (Total) | 7,639.5 | 7,792.4 | 153.0 |

| Environment, Conservation and Parks (Base) | 684.3 | 685.3 | 1.0 |

| Environment, Conservation and Parks — COVID-19 Time-Limited Funding11 | 2.3 | 12.9 | 10.6 |

| Environment, Conservation and Parks (Total) | 686.6 | 698.2 | 11.6 |

| Executive Offices (Base) | 39.9 | 40.4 | 0.5 |

| Executive Offices — COVID-19 Time-Limited Funding12 | – | 3.0 | 3.0 |

| Executive Offices (Total) | 39.9 | 43.4 | 3.5 |

| Finance (Base) | 850.9 | 850.9 | – |

| Finance — Investment Management Corporation of Ontario13 | 185.4 | 185.4 | – |

| Finance — Ontario Municipal Partnership Fund | 501.9 | 501.9 | – |

| Finance — Power Supply Contract Costs | 102.2 | 65.6 | (36.6) |

| Finance — Time-Limited COVID-19 Fund14 | – | 500.0 | 500.0 |

| Finance — COVID-19 Time-Limited Funding15 | 35.0 | 380.0 | 345.0 |

| Finance (Total) | 1,675.4 | 2,483.8 | 808.4 |

| Francophone Affairs (Base) | 6.5 | 6.5 | – |

| Francophone Affairs — COVID-19 Time-Limited Funding16 | 2.3 | 2.8 | 0.5 |

| Francophone Affairs (Total) | 8.8 | 9.3 | 0.5 |

| Government and Consumer Services (Base) | 743.4 | 759.5 | 16.1 |

| Government and Consumer Services — Realty | 1,144.6 | 1,144.6 | – |

| Government and Consumer Services (Total) | 1,887.9 | 1,904.0 | 16.1 |

| Health (Total) | 64,016.7 | 64,093.5 | 76.8 |

| COVID-19 Health Response17 | 5,144.1 | 6,656.1 | 1,512.0 |

| Heritage, Sport, Tourism and Culture Industries (Base) | 1,016.2 | 1,028.2 | 12.0 |

| Heritage, Sport, Tourism and Culture Industries — Ontario Cultural Media Tax Credits | 602.1 | 602.1 | – |

| Heritage, Sport, Tourism and Culture Industries — COVID-19 Time-Limited Funding18 | 205.4 | 236.8 | 31.4 |

| Heritage, Sport, Tourism and Culture Industries (Total) | 1,823.8 | 1,867.2 | 43.4 |

| Indigenous Affairs (Base) | 85.5 | 89.5 | 4.0 |

| Indigenous Affairs — COVID-19 Time-Limited Funding19 | 4.0 | 4.0 | – |

| Indigenous Affairs (Total) | 89.5 | 93.5 | 4.0 |

| Infrastructure (Base) | 365.4 | 198.0 | (167.4) |

| Infrastructure — Federal–Provincial Infrastructure Programs | 590.0 | 438.4 | (151.6) |

| Infrastructure — Waterfront Toronto Revitalization (Port Lands Flood Protection) | 155.6 | 155.6 | – |

| Infrastructure — Municipal Infrastructure Program Investments | 200.0 | 400.0 | 200.0 |

| Infrastructure — COVID-19 Time-Limited Funding20 | 233.5 | 198.2 | (35.3) |

| Infrastructure (Total) | 1,544.5 | 1,390.1 | (154.4) |

| Labour, Training and Skills Development (Base) | 175.1 | 189.3 | 14.1 |

| Labour, Training and Skills Development — Training Tax Credits (Co-operative Education and Apprenticeship Training)21 | 88.9 | 88.9 | – |

| Labour, Training and Skills Development — Demand-Driven Employment and Training Programs | 1,169.3 | 1,171.2 | 1.9 |

| Labour, Training and Skills Development — COVID-19 Time-Limited Funding22 | 288.0 | 579.4 | 291.4 |

| Labour, Training and Skills Development (Total) | 1,721.3 | 2,028.7 | 307.4 |

| Long-Term Care (Total)23 | 5,764.0 | 5,886.6 | 122.5 |

| Municipal Affairs and Housing (Base)24 | 512.3 | 480.9 | (31.4) |

| Municipal Affairs and Housing — Time-Limited Investments | 349.2 | 352.0 | 2.8 |

| Municipal Affairs and Housing — Social Housing Agreement – Payments to Service Managers | 284.5 | 284.5 | – |

| Municipal Affairs and Housing — COVID-19 Time-Limited Funding25 | 286.3 | 318.7 | 32.4 |

| Municipal Affairs and Housing (Total) | 1,432.3 | 1,436.1 | 3.8 |

| Natural Resources and Forestry (Base) | 573.4 | 574.0 | 0.7 |

| Natural Resources and Forestry — Emergency Forest Firefighting | 100.0 | 200.0 | 100.0 |

| Natural Resources and Forestry (Total) | 673.3 | 774.0 | 100.7 |

| Seniors and Accessibility (Base) | 66.5 | 66.5 | – |

| Seniors and Accessibility — Time-Limited Investments | 9.1 | 9.1 | – |

| Seniors and Accessibility — COVID-19 Time-Limited Funding26 | 6.0 | 27.0 | 21.0 |

| Seniors and Accessibility (Total) | 81.7 | 102.7 | 21.0 |

| Solicitor General (Base) | 3,096.4 | 3,122.9 | 26.4 |

| Solicitor General — COVID-19 Time-Limited Funding27 | – | 4.0 | 4.0 |

| Solicitor General (Total) | 3,096.4 | 3,126.9 | 30.4 |

| Transportation (Base) | 5,529.9 | 5,721.1 | 191.2 |

| Transportation — Federal–Provincial Infrastructure Programs28 | 702.9 | 277.0 | (426.0) |

| Transportation — COVID-19 Time-Limited Funding29 | – | 345.4 | 345.4 |

| Transportation (Total) | 6,232.8 | 6,343.4 | 110.6 |

| Treasury Board Secretariat (Base) | 454.8 | 393.1 | (61.7) |

| Treasury Board Secretariat — Employee and Pensioner Benefits30 | 1,766.5 | 1,766.5 | – |

| Treasury Board Secretariat — Operating Contingency Fund | 1,915.1 | 934.1 | (981.0) |

| Treasury Board Secretariat — Capital Contingency Fund | 165.3 | 165.3 | – |

| Treasury Board Secretariat (Total) | 4,301.7 | 3,259.0 | (1,042.7) |

| Interest on Debt31 | 13,130.1 | 12,971.0 | (159.1) |

| Total Expense | 186,119.5 | 188,764.1 | 2,644.6 |

[1] On June 18, 2021, the Premier announced changes to the Executive Council that led to the establishment of new ministries as well as the transfer of responsibilities between ministries. The corresponding changes to the new government structure will be reflected in future publications.

[2], [3], [4], [5], [6], [9], [10], [11], [12], [14], [15], [16], [18], [19], [20], [22], [25], [26], [27], [29] In the 2021 Budget, the government made available COVID‐19 Time‐Limited Funding. This funding continues to be presented separately in order to transparently capture the temporary nature of these investments.

[7] The Ministry of Education’s 2021–22 base allocation includes funding for Grants for Student Needs and Priorities Partnership Fund. At the time of the 2021 Budget the base allocation included funding for COVID-19, but the full level of funding required to specifically address the impacts of COVID-19 had not been finalized. Subsequently, $760 million of this funding was allocated to keep students and staff safe as part of Ontario’s response to COVID-19. On this basis, the amount associated with the Ministry’s COVID-19 Time Limited Funding was increased in the 2021 Ontario Economic Outlook and Fiscal Review. Compared to the 2021 Budget, total Ministry of Education funding is projected to be $238 million higher.

[8], [30] Numbers reflect the pension expense that was calculated based on recommendations of the Independent Financial Commission of Inquiry, as described in Note 19 to the Consolidated Financial Statements in Public Accounts of Ontario 2017–2018.

[13] Based on the requirements of Public Sector Accounting Standards, the Province consolidated the Investment Management Corporation of Ontario into the Ministry of Finance.

[17] For presentation purposes in the 2021–22 Third Quarter Finances, time-limited COVID-19 related spending has been included separately instead of within the Ministry of Health and Ministry of Long-Term Care. This change in presentation does not impact ministry allocations, which reflect the ministry structure(s) presented in the 2021–22 Expenditure Estimates.

[21] The Co-operative Education Tax Credit remains in effect. The Apprenticeship Training Tax Credit is eliminated for eligible apprenticeship programs that commenced on or after November 15, 2017.

[23] The Ontario Ministry of Long-Term Care total includes expenses incurred by Ontario Health for funding for long-term care. These amounts will be consolidated in the total expense of the Ontario Ministry of Health of $5.6 billion in 2021–22.

[24] The change in the Ministry of Municipal Affairs and Housing's base allocation reflects a one-time realignment to COVID-19 Time-Limited Funding for investments in the Social Services Relief Fund.

[28] The decrease in Federal-Provincial Infrastructure Programs is due to construction delays for municipal transit projects funded through the Investing in Canada Infrastructure Program (ICIP).

[31] Interest on debt is net of interest capitalized during construction of tangible capital assets of $236 million in 2021–22.

Note: Numbers may not add due to rounding.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

| Sector | 2021–22 Current Outlook: Investment in Capital Assets1,2 |

2021–22 Current Outlook: Transfers and Other Infrastructure Expenditures3 |

2021–22 Current Outlook: Total Infrastructure Expenditures |

2021 Budget: Total Infrastructure Expenditures |

In-Year Change: Total Infrastructure Expenditures |

|---|---|---|---|---|---|

| Transportation — Transit | 5,571 | 1,000 | 6,571 | 5,642 | 929 |

| Transportation — Provincial Highways | 2,487 | 186 | 2,673 | 2,592 | 81 |

| Transportation — Other Transportation, Property and Planning | 107 | 75 | 182 | 182 | – |

| Health — Hospitals | 1,616 | 3 | 1,619 | 1,619 | – |

| Health — Other Health | 60 | 244 | 304 | 304 | – |

| Education | 3,285 | 15 | 3,300 | 3,295 | 5 |

| Postsecondary Education — Colleges and Other | 829 | 64 | 893 | 893 | – |

| Postsecondary Education — Universities | – | 93 | 93 | 93 | – |

| Social | 19 | 318 | 337 | 328 | 9 |

| Justice | 886 | 105 | 992 | 983 | 9 |

| Other Sectors4 | 1,034 | 1,522 | 2,556 | 2,691 | (135) |

| Total Infrastructure Expenditures | 15,895 | 3,625 | 19,520 | 18,623 | 897 |

| Less: Other Partner Funding5 | 1,765 | – | 1,765 | 1,765 | – |

| Total6 | 14,130 | 3,625 | 17,755 | 16,858 | 897 |

[1] Includes $236 million in interest capitalized during construction.

[2] Includes provincial investment in capital assets of $13.3 billion.

[3] Includes transfers to municipalities, universities and non-consolidated agencies.

[4] Includes broadband infrastructure, government administration, natural resources and the culture and tourism industries.

[5] Other Partner Funding refers to third-party investments, primarily in hospitals, colleges, and schools.

[6] Includes federal/municipal contributions to provincial infrastructure investments.

Note: Numbers may not add due to rounding.

Source: Ontario Treasury Board Secretariat.

| Item | 2017–18 | 2018–19 | 2019–20 | Actual 2020–21 |

Current Outlook 2021–22 |

|---|---|---|---|---|---|

| Revenue | 150,594 | 153,700 | 156,096 | 164,893 | 176,659 |

| Expense — Programs | 142,363 | 148,751 | 152,273 | 169,023 | 175,793 |

| Expense — Interest on Debt2 | 11,903 | 12,384 | 12,495 | 12,274 | 12,971 |

| Total Expense | 154,266 | 161,135 | 164,768 | 181,297 | 188,764 |

| Reserve | – | – | – | – | 1,000 |

| Surplus/(Deficit) | (3,672) | (7,435) | (8,672) | (16,404) | (13,105) |

| Net Debt | 323,834 | 338,496 | 353,332 | 373,564 | 395,395 |

| Accumulated Deficit | 209,023 | 216,642 | 225,764 | 239,294 | 253,399 |

| Gross Domestic Product (GDP) at Market Prices | 824,979 | 860,104 | 892,226 | 866,940 | 969,793 |

| Primary Household Income | 541,501 | 567,484 | 592,605 | 590,677 | 640,168 |

| Population (000s) — July3 | 14,070 | 14,309 | 14,545 | 14,746 | 14,826 |

| Net Debt Per Capita (dollars) | 23,016 | 23,657 | 24,293 | 25,334 | 26,669 |

| Household Income Per Capita (dollars) | 38,486 | 39,660 | 40,744 | 40,058 | 43,178 |

| Net Debt as a Per Cent of Revenue | 215.0% | 220.2% | 226.4% | 226.5% | 223.8% |

| Interest on Debt as a Per Cent of Revenue | 7.9% | 8.1% | 8.0% | 7.4% | 7.3% |

| Net Debt as a Per Cent of GDP | 39.3% | 39.4% | 39.6% | 43.1% | 40.8% |

| Accumulated Deficit as a Per Cent of GDP | 25.3% | 25.2% | 25.3% | 27.6% | 26.0% |

[1] Amounts reflect a change in pension expense that was calculated based on recommendations of the Independent Financial Commission of Inquiry, as described in Note 19 to the Consolidated Financial Statements in Public Accounts of Ontario 2017–2018. Amounts for net debt and accumulated deficit also reflect this change.

[2] Interest on debt is net of interest capitalized during construction of tangible capital assets of $157 million in 2017–18, $175 million in 2018–19, $245 million in 2019–20, $230 million in 2020–21 and $236 million in 2021–22.

[3] Population figures are for July 1 of the fiscal year indicated (i.e., for 2017–18, the population on July 1, 2017 is shown).

Note: Numbers may not add due to rounding.

Sources: Statistics Canada, Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Section D: Ontario's 2021–22 borrowing program

| Item | 2021–22: 2021 Budget |

2021–22: Current Outlook1 |

2021–22: Change from 2021 Budget |

|---|---|---|---|

| Deficit/(Surplus) | 33.1 | 13.1 | (20.0) |

| Investment in Capital Assets | 11.8 | 13.3 | 1.5 |

| Non-Cash Adjustments | (9.5) | (9.5) | – |

| Loans to Infrastructure Ontario | 0.2 | 0.2 | (0.0) |

| Other Net Loans/Investments | 1.3 | 1.0 | (0.3) |

| Debt Maturities/Redemptions | 25.0 | 25.0 | 0.0 |

| Total Funding Requirement | 61.9 | 43.1 | (18.9) |

| Decrease/(Increase) in Short-Term Borrowing | (6.0) | – | 6.0 |

| Increase/(Decrease) in Cash and Cash Equivalents | 4.0 | 4.0 | – |

| Pre-Borrowing in 2020–21 for 2021–22 | (5.2) | (16.2) | (10.9) |

| Pre-Borrowing for 2022–23 | – | 10.0 | 10.0 |

| Total Long-Term Public Borrowing | 54.7 | 41.0 | (13.7) |

[1] The Current Outlook reflects additional pre-borrowing completed between the release of the 2021 Budget and fiscal year end.

Note: Numbers may not add due to rounding.

Source: Ontario Financing Authority.

The Province's funding requirements for 2021–22 are projected to decrease by $18.9 billion compared to the forecast in the 2021 Budget, primarily reflecting a decrease of $20.0 billion in the projected deficit offset by a $1.5 billion increase in capital investments. The Province's long-term borrowing program for 2021–22 is forecast to decrease by $13.7 billion, reflecting the decrease in the funding requirements along with an increase in pre-borrowing for 2022–23 to $10.0 billion. In an environment characterized by increasing interest rates, larger pre-borrowings provide the Province with mitigation against interest rate risk as well as potential market disruptions.

As of February 2, 2022, the Province has completed $39.2 billion or 96 per cent of its $41.0 billion 2021–22 long-term borrowing program. Approximately $30.1 billion or 77 per cent was completed in Canadian dollars, with the remaining $9.2 billion or 23 per cent completed primarily in U.S. dollars and euros.

On February 2, 2022, the Province issued its second Green Bond in fiscal 2021–22, and eleventh Green Bond overall. This issue was for $1.75 billion and follows a $2.75 billion issue in July 2021. Ontario remains the largest issuer of Canadian dollar Green Bonds, with $12.5 billion since 2014–15. Eight projects were selected to receive funding from the most recent Green Bond. This includes six Clean Transportation projects, one Energy Efficiency and Conservation project and one project under the Climate Adaptation and Resilience framework category.

| Canadian Dollar Issues | 30.1 |

|---|---|

| Foreign Currency Issues | 9.2 |

| Total | 39.2 |

Note: Numbers may not add due to rounding.

Source: Ontario Financing Authority.

Accessible chart descriptions

Chart 1: Ontario Labour Market

The chart shows Ontario's monthly employment level as a shaded area and unemployment rate as a line from January 2020 to January 2022. The unemployment rate increased from 5.5 per cent in February 2020 to 13.2 per cent in May 2020 and has since declined to 7.3 per cent in January 2022. Employment declined from 7.5 million in February 2020 to 6.4 million in May 2020. Employment has since risen to 7.5 million in January 2022.

Source: Statistics Canada

Chart 2: Stronger-than-Planned Real and Nominal GDP Growth in 2021

The stacked bar graph shows Ontario nominal GDP growth rates for 2021 by real GDP growth and GDP inflation rates.

According to the 2021 Ontario Economic Outlook and Fiscal Review private-sector average, (including forecasts updated between August 31 and October 1, 2021), Ontario real GDP growth in 2021 was 4.6 per cent and nominal GDP growth in 2021 was 10.1 per cent.

According to the 2021 Ontario Economic Outlook and Fiscal Review planning assumptions, Ontario real GDP growth in 2021 was 4.3 per cent and nominal GDP growth was 9.0 per cent.

According to the 2021–22 Third Quarter Finances estimate, Ontario real GDP growth in 2021 was 4.4 per cent and nominal GDP growth was 11.9 per cent.

Sources: Ontario Ministry of Finance and Ontario Ministry of Finance Survey of Forecasters