Guidelines to develop an economic cluster plan

These guidelines help clusters develop plans with the Ontario government to grow their industries.

Overview

The Partnerships for Jobs and Growth Act, 2014 (the "Act") is designed to strengthen connections between businesses, research institutions, governments and other organizations to make the province’s clustered industries more productive, innovative and globally competitive.

Businesses and like-minded organizations in a given region can form economic clusters and benefit from sharing a common vision, an action plan, information and resources.

By working together, we can develop plans that will support innovative emerging or established clusters and boost Ontario’s overall economy.

This approach can help our province leverage its strengths and:

- accelerate innovation

- foster networks of entrepreneurs

- strengthen linkages between research institutions and businesses

- attract and retain talent

- increase competitiveness of cluster firms

- encourage new investment

A key ingredient in the competitive success of clusters is the set of linkages and relationships between clustered companies and others in the regional ecosystem. Together, these partners can form a group of like-minded companies and organizations or cluster consortium.

What is an economic cluster

Clusters are geographically concentrated groups of interconnected businesses and institutions that do business with each other and/or are related in some way.

Economic clusters can include a combination of:

- businesses

- research and postsecondary institutions

- business associations

- municipalities

- economic development organizations

- regional and/or sector innovation and accelerator centres

- risk capital

- other entities that share a vision and plan for growing their cluster’s competitiveness

We expect that there will be a sub-provincial geographic focus to the cluster plan, though it may also identify partners in other geographic areas, given the current age of digitization and globalization.

Economic cluster plans can address:

- skills

- technology

- supply chains

- markets

- other linkages

For example, a traditional cluster focused on talent attraction (e.g. information and communication technology in Ottawa, mining in Sudbury, and financial services in Toronto) or a cluster focused on adopting an emerging technology such as robotics (e.g. manufacturing in southwestern Ontario).

Cluster partners, and the work they do together, may differ depending on the stage of the cluster in its life cycle (see Appendix 1: Cluster life cycle).

Benefits of economic clusters

The multiple types of organizations that can be part of an economic cluster may have their own individual goals and different ways of working but when all of these organizations work together as a cluster, there are many shared benefits.

These benefits could include:

- research ideas and new technology from universities can be commercialized and used by firms to strengthen their ability to compete globally

- uptake of new innovations by large, established firms can help drive the growth of start-ups, small and medium sized firms

- colleges and universities produce talent and skilled employees who are in demand at local firms

All of these diverse players, including companies, colleges, universities, and others, have a role in the cluster ecosystem but the connections between these organizations — and the potential benefits — do not happen spontaneously. This is why a cluster plan can help.

Working with the government on a cluster plan

A cluster and the Government of Ontario may choose to work together in order to accomplish goals articulated in a cluster plan. The benefits of working with the government could include:

- exploring/resolving a regulatory constraint to the cluster’s success

- global marketing/branding of a cluster

- stronger connections between players within the cluster brought together with the support of the government

- other actions in which government may be able to facilitate a better business environment

The government’s role

To work with a consortium/group to develop and implement a cluster plan, the government’s role could be to:

- advise whether a particular cluster plan opportunity aligns with government priorities, and if it is likely to be considered under the Act

- provide data and analysis that may be available to the ministry, in coordination with a cluster consortium, on cluster ecosystems and economic performance at the sub-provincial level

- provide coordinated, one-window advice on policy or program opportunities across government

- provide advice about best practices to develop and prepare cluster plans

- promote the cluster’s vision and plan, where relevant, within the provincial public service, other levels of government and among organizations outside of the Government of Ontario

Eligible cluster opportunities

Creating a consortium to develop cluster plans

A consortium is a group of organizations within the economic cluster that come together to develop and implement a cluster plan. The networks and partnerships between organizations are essential to a cluster’s dynamism and success.

A consortium is made up of businesses and related entities and must include at least:

- two or more local companies; and

- two or more local partner organizations, such as:

- academic or research institutions

- Regional Innovation or Sector Innovation Centres that belong to the Ontario Network of Entrepreneurs (ONE) and/or other, relevant not-for-profit incubator/accelerator centre

- municipal governments

- local or regional economic development organizations (which could also include federal agencies)

- Aboriginal government

- industry and/or trade associations

We encourage the participation of other relevant partners, such as private foundations, investors, and buyers/procurement entities, etc.

The consortium must also identify at least two international stakeholders or prospective partners that can help the cluster leverage global market opportunities. The government may contact these stakeholders or partners during the cluster plan review process.

Key contact organization

There must be one organization within the consortium that:

- agrees to be the government’s key contact for a cluster plan

- facilitates strategic planning on behalf of the consortium partners

It must be a non-profit with a relevant mandate (potentially one of the above).

Anchor company

A cluster should have at least one anchor company that has 500 or more employees. We may consider an anchor company of a smaller size if the consortium builds a compelling case.

The anchor company:

- attracts the specialized talent, firms and investment to a region

- helps the cluster take full advantage of growth opportunities in export markets

Types of eligible clusters

An eligible consortium should have a shared vision of the global market strengths and opportunities of their cluster.

A cluster plan must articulate a key geographic concentration of businesses and their partners that together form the primary hub of economic activity, even if their consortium has broad geographic representation. The consortium must demonstrate a strong network and why all partners should work together on a cluster plan.

The following are not eligible to work with the government on a cluster plan:

- a single company without other partners

- consortia lacking meaningful industry participation

Clusters at the early stages of their development (see Appendix 1: Cluster life cycle) that have not yet attracted or built an anchor firm may still engage with the government to develop a cluster if their products or services are closely aligned with the government’s focus on leading-edge innovations that are increasingly driving emerging global market opportunities.

Cluster plans

A cluster plan is a roadmap to help economic clusters grow and succeed. It provides a framework for organizations within a cluster to come together and identify shared goals and determine how these can be achieved.

The Act does not prescribe how all economic cluster plans are developed in Ontario – only plans by clusters that wish to work with the government.

Contents of a cluster plan

The Act requires cluster plans to at least include:

- a description of the cluster

- an assessment of the challenges and opportunities related to the development of the cluster

- the objectives and intended outcomes of the cluster plan

- a description of actions that could be taken by the Minister, or businesses or other entities that form the cluster, to assist in achieving those objectives and intended outcomes of the plan

- performance measures to evaluate whether the objectives and intended outcomes of the plan are being achieved

Cluster plans will have a five-year timeline (or multiples of five years) to align with the five-year review requirement under the Act.

Evaluation criteria for cluster plans

When evaluating cluster plan opportunities, we will consider:

Alignment with the government’s economic priorities

Read the government’s mandate letters and the Ontario Budget to find out what these are.

Contribution to productivity, innovation and export competitiveness (PIE)

Does the cluster plan enhance productivity, innovation, and exports?

Alignment with the government’s objectives for climate change and greenhouse gas reduction

Does the cluster plan support the goals of Ontario’s Climate Change Strategy, particularly as it relates to greenhouse gas emissions?

Potential to capitalize on disruptive technology opportunities

Does the cluster have unique strengths that allow the development or the adoption of disruptive technologies (e.g. big data, robotics, internet of things, mobile, genomics, etc.)?

Consortium strength (cluster leadership and governance)

How strong is the local industry leadership, and can a partner organization with the appropriate governance and administrative structures coordinate the plan development and implementation?

- Market opportunity

- What is the potential for global market growth of the cluster’s products and services?

- Has the consortium identified a minimum of two international stakeholders or prospective partners that can help the cluster leverage global market opportunities?

- Current conditions within the cluster

- What is the level of talent (highly qualified personnel) and research strength within the cluster, and does the cluster include an anchor company?

- What are the cluster’s unique areas of specialization as well as its key strengths?

- Current performance of the cluster

- Does the cluster have a critical mass of specialization?

- Is there a critical mass of employment and establishments?

- Does the cluster attract high wage, highly qualified talent?

- Does the cluster attract foreign direct investment?

- How market expansion/export-focused is the cluster?

- What are the cluster’s unique challenges, and how can the objectives identified in the cluster plan help to address them?

The role of the consortium

Does the cluster plan opportunity clearly outline how the government and the other members of the consortium can support the economic cluster’s objectives for competitiveness?

Performance measures

Does the plan identify inputs, activities, outputs and immediate outcomes (qualitative and quantitative, as relevant) that logically drive to the longer-term results for cluster plans under the Act?

Process to develop cluster plans

Step 1: Initial discussion

Contact the government at clusters@ontario.ca on behalf of your cluster consortium.

Once you've emailed us, an advisor will get back to you within 48 hours.

Step 2: Evaluating the cluster plan opportunity

Based on discussion with your consortium, we will analyze the proposed opportunity to determine if it aligns with government priorities.

If the opportunity aligns with government priorities we will complete a preliminary overview with the consortium’s input, and will undertake some initial data-driven analysis for your cluster.

If the opportunity does not align with government priorities we may advise you of other possible supports, if relevant.

If your cluster opportunity is approved, you will receive a letter inviting you to develop a draft cluster plan and additional details about the contents of a cluster plan.

Step 3: Preparing a cluster plan

Government staff will provide advice and work collaboratively with you to complete a draft cluster plan using the Cluster Plan Template. This may include reciprocally sharing data to better assess the cluster.

Step 4: Evaluating the cluster plan

Once the government and the consortium agree that the draft cluster plan is ready for review, it will be evaluated against the eligibility and evaluation criteria detailed above.

Step 5: Consultation

If the draft cluster plan is approved:

- we must post it online for public consultation

- we will collect feedback to consider and integrate in the revised version of the cluster plan, as relevant

If the draft cluster plan is not approved:

- we may advise the consortium of other possible supports, if relevant

Step 6: Submit and publish a final cluster plan

The consortium submits its final cluster plan to the government. We will:

- review and evaluate the plan to determine if it is ready to be implemented

- consider how you have integrated feedback from the consultation in the revised plan

- if the plan has substantially changed as a result of the feedback collected through the consultation, we may refer to the eligibility and evaluation criteria once more to evaluate the final plan, in order to provide a final recommendation to decision makers

- post the final approved cluster plan online

Step 7: Implementation and amendments

All partners begin the implementation of the cluster plan, based on the priorities and actions identified in the final cluster plan.

Any modifications made to the cluster plan, during its implementation, will need to be approved by the government and posted online with an explanation.

To discuss possible modifications to your final cluster plan during this phase, contact your advisor directly, or email us.

Step 8: Reviewing final cluster plans

In five years, we will conduct a review of the cluster plan to determine:

- whether the objectives and expected outcomes have been achieved

- the performance of each party involved in the cluster plan

- whether the cluster plan should be continued

As part of this review process, we will conduct stakeholder consultations. We will publish the final results of the five-year review online, including a summary of the results of the consultations.

If we decide to continue a given cluster plan after its five-year review, the cluster plan will be reviewed again five years later, and so on.

Programs and services

Explore Ontario’s funding programs and pay attention to each program’s description and eligibility criteria to determine if you or your cluster could be eligible. It may help in the development of cluster plans, or it may help to clarify that program funding, instead of a cluster plan, is more relevant to an organization or consortium’s current needs.

Government advisors may be able to help identify relevant programs as they work with your consortium on cluster planning.

Confidentiality and public reporting

The government must comply with the Freedom of Information and Protection of Privacy Act. According to the Act, everyone has a right to access information in the custody or under the control of the government.

Any information provided to the government in connection with cluster plans or with the Partnerships for Jobs and Growth Act may be subject to disclosure in accordance with the Freedom of Information and Protection of Privacy Act.

There are limited exemptions (Section 17 of the Act) for third party information that reveals a trade secret or scientific, commercial, technical, financial or labour relations information provided to the government in confidence, if disclosure of the information could reasonably be expected to result in certain enumerated harms.

Any trade secret or any scientific, technical, commercial, financial or labour relations information submitted to the government in confidence should be clearly marked. If the government receives an access request, the government will notify you before granting access to a record that the Ministry believes might contain information referred to in Section 17 so that you may make representations to the Province concerning disclosure.

There are three key requirements for information to qualify for an exemption, and the information must meet all three:

- it is a trade secret, scientific or technical financial information,

- that was supplied to the ministry in confidence, and

- if released would be harmful to your organization

If the government decides that your information does not meet the criteria to be exempted, you will have the right to appeal that decision to the Information and Privacy Commissioner.

Please read the Freedom of Information and Protection of Privacy Act and ensure you understand it fully.

Contact us

If you have questions or wish to discuss a cluster plan opportunity, email us.

Appendix 1: Cluster life cycle

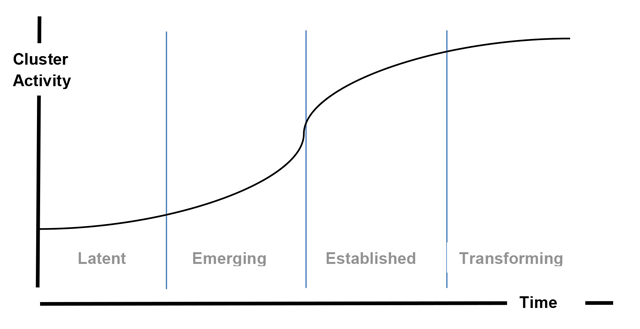

This is a simple line diagram1 that shows the four stages of a cluster’s life cycle across time: the longer a cluster exists, the greater the clustered activity.

1Adapted from MEDEI Cluster Evaluation Framework: Review and Validation Final Report, Hickling Arthurs Low, July 2015.

Latent cluster

- a number of companies emerge based on a new technology or an interconnected set of products

- other actors begin to cooperate around a core activity and identify common opportunities through linkages

- the overall number of emerging companies is still relatively small and the linkages among the actors are too weak to fully constitute a cluster

Emerging cluster

- lead or anchor companies or research institutes are spinning-off new companies

- new actors in the same or related activities emerge or are attracted to the region

- there are stronger linkages between companies

- entrepreneurs may take initial steps to create formal or informal clusters

Established cluster

- the number of companies and supporting institutions has significantly increased

- self-sustaining dynamic of start-ups, joint ventures, and spin-off companies

- clustered companies' economic performance is superior when compared to other regions, which increases the concentration of industry in a smaller number of successful clusters

Transforming cluster

- in order to survive, the firms and organizations within a mature cluster must regularly re-evaluate their operations and re-orientate to their customers to avoid stagnation and decline

- the cluster may transform by making changes to products, methods and markets, or it may transform into new clusters focused on other activities