Ontario Jobs Training Tax Credit

Learn how you could get help with your training expenses for 2021 and 2022.

Overview

The Ontario Jobs Training Tax Credit is a temporary, refundable personal income tax credit that helps workers get training that may be needed:

- for a career shift

- for re-training

- to sharpen their skills

The credit provides up to $2,000 per year in relief for 50% of a person’s 2021 or 2022 eligible expenses.

Eligibility

Who is eligible

The Ontario Jobs Training Tax Credit has the same eligibility requirements as the Canada Training Credit available on the federal tax return.

To claim the credit for 2021 or 2022, you must:

- have a positive Canada Training Credit limit for that year

- be an Ontario resident on December 31 of that year

- be aged 26 to 65 years old at the end of that year, and

- meet the other requirements set out in the federal Income Tax Act for at least one of 2019, 2020 or 2021.

You can find your Canada Training Credit limit for a tax year on your latest notice of assessment or reassessment, which is provided by the Canada Revenue Agency (CRA).

You can visit the Canada Revenue Agency’s website to learn more about who can apply.

Which expenses are eligible

Expenses eligible for the Ontario Jobs Training Tax Credit are the same as those that can be claimed for the Canada Training Credit that is available on the federal tax return. These include:

- tuition and other fees paid to an eligible educational institution in Canada for courses taken in 2021 or 2022

- fees paid to certain bodies in respect of an occupational, trade or professional examination taken in 2021 or 2022

These expenses can include:

1. Occupational skills courses

Fees for occupational skills courses if they are paid to a university, college or certain other educational institutions, if the student is enrolled in the institution to obtain or improve their skills in an occupation.

2. Occupational, trade or professional exams

Fees for an occupational, trade, or professional examination required to obtain a professional status, or to be licensed or certified as a tradesperson, and that are paid to a:

- university

- college or other educational institution

- professional association

- provincial ministry, or other similar institution

3. Postsecondary education courses

Fees for one or more courses at the postsecondary level can qualify, if the courses provide credit towards a degree, diploma or certificate.

To learn if a particular program or course may be eligible for the credit, contact the college, university or career college where it is offered. You can visit the Canada Revenue Agency’s website to learn more about which expenses are eligible.

How much can you receive

The Ontario Jobs Training Tax Credit is calculated as 50% of eligible expenses for the tax year, up to a maximum credit of $2,000 per year.

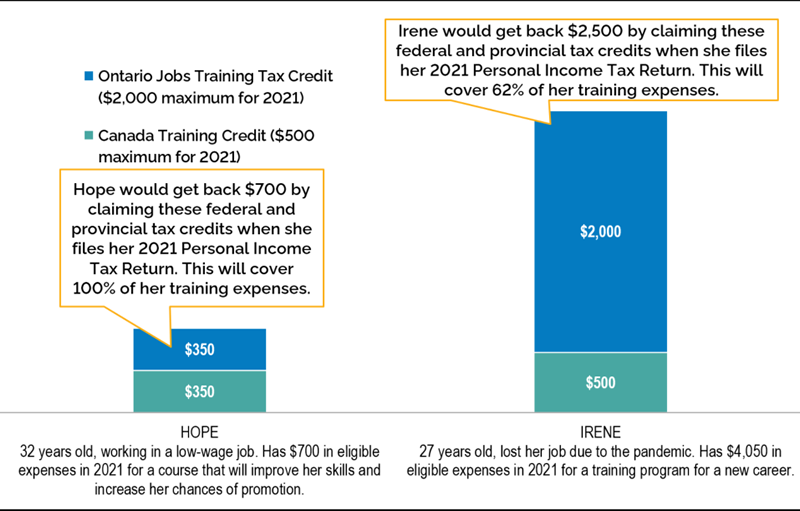

The chart below shows two examples of savings in 2021 due to the supports from the Canada Training Credit and the Ontario Jobs Training Tax Credit. In the first example, Hope would get back $350 through the Ontario Jobs Training Tax Credit. In the second example, Irene would get back $2,000 through the Ontario Jobs Training Tax Credit. They would get this money when they file their 2021 personal Income Tax and Benefit Return.

Examples

Note: Examples assume that Hope has a Canada Training Credit limit for 2021 of at least $350, and that Irene has a Canada Training Credit limit for 2021 of $500.

Source: Ontario Ministry of Finance.

How to claim the credit

The Ontario Jobs Training Tax Credit is a temporary, refundable personal income tax credit for 2021 and 2022. This means that if you're eligible, you can get a credit regardless of whether you owe income taxes.

You can claim the credit on your personal Income Tax and Benefit Return.

Contact the Canada Revenue Agency

If you have questions about the Ontario Jobs Training Tax Credit, please contact Canada Revenue Agency:

- Tax services offices and tax centres

- Individual tax enquiries line:

1-800-959-8281

More information is also available on the Canada Revenue Agency website.

Accessible description of figure: Ontario Jobs Training Tax Credit

The bar chart shows two examples of savings in 2021 due to the supports from the Canada Training Credit and the Ontario Jobs Training Tax Credit. In the first example, Hope is 32 years old, working in a low-wage job. She has $700 in eligible expenses in 2021 for a course that will improve her skills and increase her chances of promotion. Out of the $700 of expenses, Hope receives $350 back through the Canada Training Credit, and $350 from the Ontario Jobs Training Tax Credit. In total, Hope will receive $700 in support from training credits, or 100% of her eligible expenses. This example assumes that Hope has a Canada Training Credit limit for 2021 of at least $350.

In the second example, Irene is 27 years old and lost her job due to the COVID‑19 pandemic. She has $4,050 in eligible expenses in 2021 for a training program for a new career. Out of the $4,050 of expenses, Irene receives $500 back through the Canada Training Credit (the maximum amount of this credit available for 2021), and $2,000 from the Ontario Jobs Training Tax Credit (the maximum amount of this credit available for 2021). In total, Irene will receive $2,500 in support from training credits, or 62% of her eligible expenses. This example assumes that Irene has a Canada Training Credit limit for 2021 of $500.

Source: Ontario Ministry of Finance.