Ontario’s Affordable Energy Future: The Pressing Case for More Power

Learn about the government’s vision for Ontario’s energy future.

Minister’s message

Ontario’s energy policy will determine the success of our province, today and for the next generation.

Six years ago, the people of Ontario put their trust in us to end the previous government’s failed and ideologically driven energy experiments that burdened hardworking people and businesses with billions of dollars of bad deals that led to some of the highest increases in electricity costs on the continent. High energy costs that destroyed our manufacturing sector and eliminated more than 300,000 good paying jobs for people, and the families and communities that depended on them. They hired us to fix the hydro mess and bring back good jobs by restoring Ontario’s energy advantage.

We got to work.

Now, gone are the days of the previous government’s sweetheart deals that paid several times the going rate for power. Instead, we’re advancing a competitive all-of-the-above approach to meet growing energy demands while reducing emissions.

Gone are the days of families having to choose between putting food on the table or paying their energy bills. Instead, we’re keeping energy costs down for families and workers.

Gone are the days when skyrocketing energy prices drove businesses to leave Ontario. Instead, our government has lowered the cost of doing business in the province by $8 billion every year, including by lowering the cost of power.

As a result, we already have one of the cleanest grids in the world and renewed access to affordable and clean energy has put Ontario back on the map. Companies and foreign investment are surging into our province, with $44 billion in new investment in electric vehicle and battery plants alone, with billions more in the province’s growing tech and life sciences sectors. We’re revolutionizing and connecting industries like world-leading electric-powered green steel production in Hamilton and Sault Ste. Marie and sustainably-sourced critical minerals from across Ontario’s north to a growing manufacturing base.

These investments are creating better jobs with better paycheques in every region of Ontario. They’re also putting new and unprecedented demand on the province’s clean power grid.

Ontario’s Independent Electricity System Operator (IESO) now forecasts that electricity demand alone will increase by 75 per cent by 2050. That means Ontario needs 111 TWh more energy by 2050, the equivalent of four and a half cities of Toronto. We need to take steps now to address this challenge. Failing to do so puts Ontario’s economic growth at risk. We must do everything we can to protect jobs by strengthening our nuclear advantage which powers our status as the economic engine of Canada

Planning for our future first requires that we understand the challenges ahead of us.

This document is the next step forward. It provides a full accounting of the challenges facing Ontario’s energy system as we work with workers, regulators, sector stakeholders, builders, businesses, Indigenous communities and union partners to confront them. In doing so, this document also affirms our government’s commitment to energy policies that keep energy rates down while supporting more jobs with bigger paycheques.

This is our choice. A pro-growth agenda that takes an all-of-the-above approach to energy planning, including nuclear, hydroelectricity, energy storage, natural gas, hydrogen and renewables and other fuels, rather than ideological dogma that offers false choices and burdens hardworking people and businesses with a costly and unnecessary carbon tax.

Our government is choosing growth and affordability. Our vision is centered on the needs of families as we remain relentlessly focused on keeping costs down and growing Ontario’s economy.

This is a vision rooted in ambitious work well underway. We’ve got shovels in the ground to prepare for the largest expansion of nuclear energy on the continent with the first small modular reactor in the G7, as we upgrade and refurbish existing reactors at Darlington, Pickering and Bruce Power to safely extend their lifespan, all on-time and on-budget. We are launching new energy efficiency programs, helping families reduce their energy use to save money. And we’ve launched the largest energy procurements of its kind in Canadian history to build the energy we need in the 2030s.

But there is so much more to do. We will not set Ontario up for failure because of a lack of ambition or desire to invest in our shared prosperity. We will do what previous generations have done for us: ensure that we put in place the building blocks for future success today. We will do this in partnership and consultation with Indigenous communities to ensure that everyone benefits from our energy investments and that we respect Aboriginal and treaty rights.

When we find that right balance, the opportunities for our prosperity extend beyond Ontario’s borders. The truth is there is massive demand for clean energy around the world. Not only will we meet our own domestic demand, our government sees a chance to become an exporter of clean energy and clean tech to our neighbours and allies, which will lead to lower costs for our families and businesses, reduce emissions beyond our borders and promote North American energy security.

To get this right, however, we need to move away from the current siloed approach to energy planning that left previous governments playing catch-up. That’s why I’m starting the work now to put forward a new, integrated approach that brings together every part of the energy sector to fuel our growing economy. Early next year, I intend to introduce the province’s first ever integrated energy resource plan so that we can support economic growth for decades to come without ever burdening families with a costly carbon tax.

Stephen Lecce

Ontario’s Minister of Energy and Electrification

How we got here: fixing the hydro mess

Introduction

Prior to 2018, high energy costs were chasing jobs and investments out of the province. Between 2008 and 2016 the previous government signed more than 33,000 contracts that paid up to ten times the going rate for power, adding billions of dollars to energy bills for families and businesses. They also planned to shut down the Pickering Nuclear Generating Station rather than refurbishing it. They cancelled planning on critical infrastructure projects, including new nuclear at the Darlington site, leaving the province with limited options to power new homes and businesses.

As a result, demand for electricity flatlined as manufacturing jobs fled the province and businesses chose not to expand their footprint. Today, our government is reversing that trend. Over the past six years we’ve been focused on lowering costs for consumers while we build out new energy generation. That includes putting a plan in the window — Powering Ontario’s Growth — to provide certainty for businesses and lay out the first steps of the province’s plan to expand access to reliable, affordable and clean energy.

Step one: getting electricity bills under control

In 2018, electricity bills were out of control. Families were being forced to choose between heating and eating. Under the previous government’s Fair Hydro Plans, electricity rates were expected to increase by about 5 per cent a year on average from 2025 to 2029 — representing a $28 dollar a month increase — which is unsustainable for families and businesses.

This was partially the result of 33,000 contracts signed by the previous government that paid up to ten times the going rate for power.

Rural and northern Ontarians were uniquely disadvantaged with fewer options to meet their energy needs.

Our government recognized it was not fair for ratepayers — whether they be businesses or families — to shoulder the burden of these overpriced and ideologically driven contracts. That’s why the government moved forward with programs, including the Comprehensive Electricity Plan and the Ontario Electricity Rebate, to protect ratepayers and return stability to the province’s electricity sector.

Comprehensive Electricity Plan (CEP)

Ontario’s Comprehensive Electricity Plan (CEP) is lowering electricity costs for all consumers by funding the above-market costs of the approximately 33,000 existing renewable energy contracts, signed between 2004 and 2016. The need for this support will be reduced over time as 20-year contracts signed by the previous government come to an end.

Ontario Electricity Rebate (OER)

Introduced in 2018, the Ontario Electricity Rebate (OER) provides electricity rate relief to eligible households, farms, long-term care homes and small businesses. The OER and CEP are automatically applied to consumers’ bills.

| Line Items | With OER and CEP | Without OER and CEP |

|---|---|---|

| Commodity | 96.21 | 96.21 |

| Commodity Adjustment due to CEP | −18.47 | N/A |

| Adjusted Commodity | 77.74 | 96.21 |

| Delivery | 49.32 | 49.32 |

| Losses | 3.80 | 4.70 |

| Regulatory | 4.07 | 4.07 |

| Subtotal | 134.92 | 154.29 |

| OER | −26.04 | N/A |

| OER Percentage | 19% | N/A |

| HST | 17.54 | 20.06 |

| Total | 126.42 | 174.35 |

| Details | With OER and CEP | Without OER and CEP |

|---|---|---|

| Target Bill | 126.44 | N/A |

| Base Delivery ($/700 kWh) | 49.32 | 49.32 |

| Base Commodity ($/700 kWh) | 96.21 | 96.21 |

Step two: Powering Ontario’s Growth

Our work to get electricity rates back under control has provided the certainty that businesses need to start investing, for the province to build new homes, and for consumers to electrify.

To provide businesses and builders with the certainty that power would be there when they needed it, we introduced Powering Ontario’s Growth in June 2023. Powering Ontario’s Growth laid out the first steps for new energy production including generational decisions, like starting pre-development work for a new nuclear station at Bruce, the first large scale nuclear build since 1993, and advancing four small modular reactors at Darlington, which will provide the dependable, zero-emissions electricity that businesses around the world are looking for.

Nuclear

Nuclear power accounts for more than half of Ontario’s electricity supply. It was critical in Ontario’s efforts to phase out coal power generation and will be just as important as our economy electrifies and demand for energy grows. In addition to a proven safety record and ability to deliver a clean, reliable supply of the baseload electricity required by homes, business and industry, nuclear power has significant economic benefits.

Refurbishments

CANDU reactors require refurbishment after 30–40 years of operation. The Darlington Nuclear Generating Station and Bruce Nuclear Generating Station have now reached that point in their operating lives and refurbishments are underway. The Pickering Nuclear Generating Station will reach that stage in the coming years and the government has announced its support for refurbishing the station’s four “B” units.

Altogether the refurbishments at Darlington, Bruce and Pickering would maintain more than 12,000 MW of existing generation capacity that will be necessary if our province is going to continue to grow.

New build at Bruce Power

Ontario’s Bruce Nuclear Generating Station (6,550 MW) is one of the largest operating nuclear generating stations in the world.

In 2023, the province launched pre-development work to site the first large-scale nuclear build in Ontario since 1993 at the existing Bruce nuclear site. In August 2024, Bruce Power submitted its Initial Project Description to the Impact Assessment Agency of Canada, officially kicking off the regulatory approvals process with the intent of locating up to 4,800 MW of new nuclear generation on the Bruce site, enough power for 4.8 million homes.

Small Modular Reactor (SMR) program

To meet growing demand, the province is also advancing four SMRs at the existing Darlington nuclear site which would provide a total of 1,200 MW of electricity generation, enough power for 1.2 million homes.

This “fleet approach” for SMRs in Ontario (i.e., building multiple units of the same technology) is providing significant benefits for the province’s SMR program. For example, it reduces costs as common infrastructure such as the cooling water intake, transmission connection and control room that can be shared across four units instead of one. The modular nature of SMR manufacturing is also expected to reduce the cost of each additional unit.

Ontario’s leadership in new nuclear technologies, particularly SMRs, is also raising the province’s profile to an unprecedented level, with other jurisdictions following Ontario’s lead. In Canada, OPG is working with power companies in Alberta, Saskatchewan and New Brunswick as they work towards the development and deployment of SMRs in their jurisdictions leveraging Ontario’s supply chains and expertise.

OPG and the province’s world-leading nuclear sector are preparing to sell equipment to partner companies in the United States, Poland, Romania, the United Kingdom and other countries who are looking to deploy SMRs and watching Ontario’s nuclear expansion closely, with more than $1 billion of export agreements already signed with Ontario-based nuclear supply chain companies that will see Ontario workers and companies be a workshop for the world — selling and exporting equipment we build right here in Ontario.

Hydroelectricity

Ontario built its electricity system on the power of water in the 1920s and today it continues to provide roughly a third of Ontario’s total energy capacity and accounts for about 25 per cent of Ontario’s electricity generation in 2022.

Some hydroelectric generating sites, like Niagara Falls’ Sir Adam Beck facility, have served Ontario for more than a century and the province’s commitment to the maintenance and upgrading of these facilities ensure that they will serve the province for the century ahead. In the past year, the government has announced a total investment of over $1.6 billion to extend the life of these stations by an additional 30 years or more.

Competitive procurements

The government has adopted a competitive approach for procuring non-baseload electricity resources to drive costs down. Ontario has already conducted three competitive procurements to recontract existing resources and build new resources to meet growing demand.

Families and businesses are already seeing the benefits of this competitive approach. In the government’s first procurement, the province successfully procured more than 700 megawatts of existing resources at a 30 per cent savings when compared to the previous government’s contracts. This will result in lower electricity system costs and lower costs for ratepayers.

The government also concluded the largest battery storage procurement in Canada’s history which secured nearly 3,000 MW of battery energy storage, as well as natural gas and clean on-farm biogas generation capacity, to support the province’s growing population and economy through the end of the decade.

In August 2024, the government announced the next procurement, with targets that would make it the largest competitive energy procurement in the country’s history. As part of that work the Minister directed the IESO to identify options to expand and accelerate this procurement to meet growing energy demands.

Energy efficiency

With demand increasing, the government has also expanded energy efficiency programs, an essential and cost-effective component of the province’s plan. As Ontarians choose to electrify their homes and businesses there is an opportunity to install more efficient appliances and smarter controls to save money and energy while benefitting our energy system as a whole.

In September 2022, the provincial government increased funding for energy-efficiency programs by $342 million, bringing total funding to more than $1 billion over the current 2021–2024 framework. The government intends to build on this strong foundation and will unveil new energy efficiency programs aimed at helping families and businesses reduce their bills and save energy later this year.

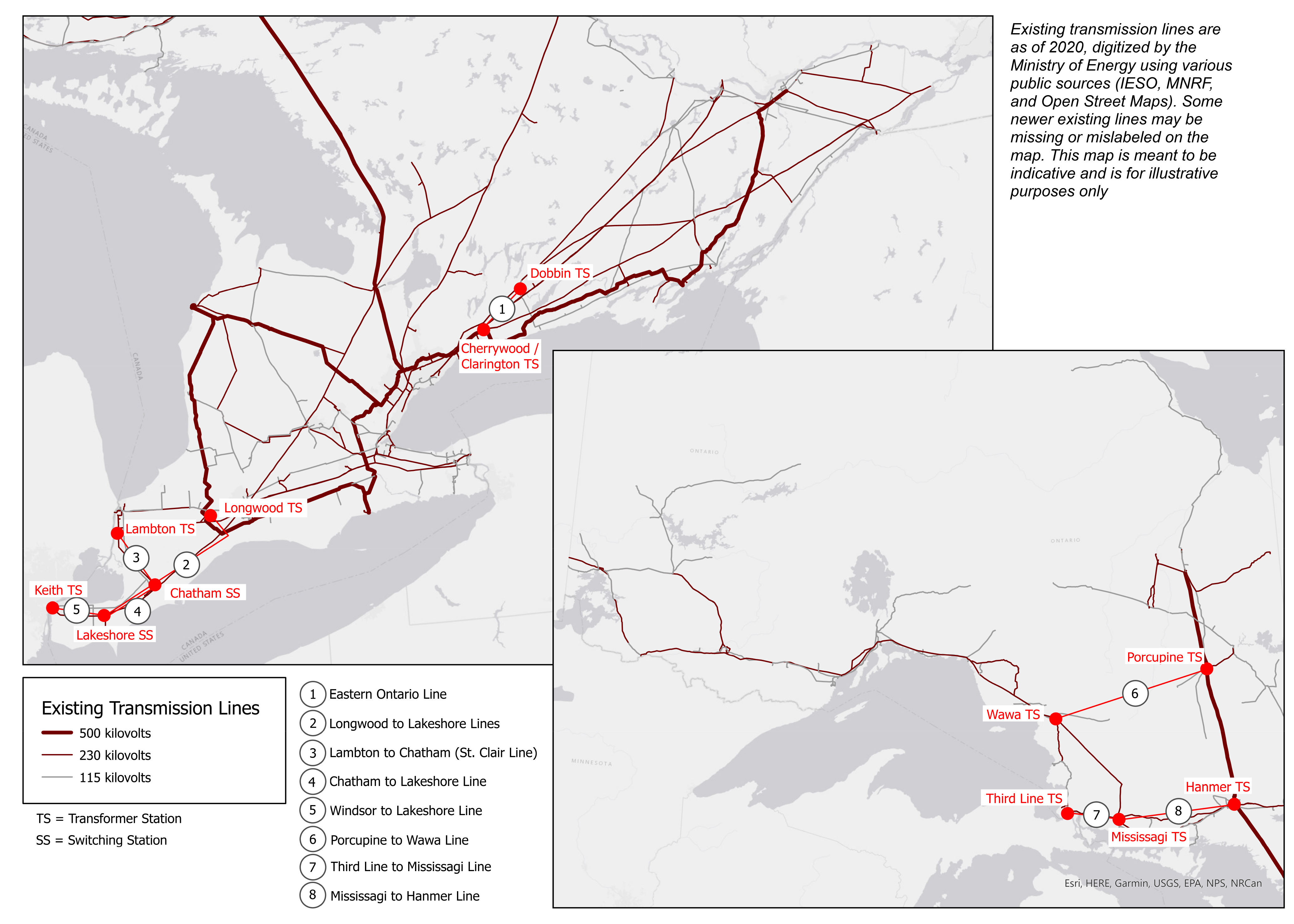

Transmission expansion

High voltage transmission lines act as a highway that carries electricity from where it is produced to directly connected large customers and local utilities. As the province builds out new generation, we’re also expanding our transmission network with new lines in all corners of the province to get that energy where it needs to go.

Over the past six years, the government has accelerated development for five new lines in southwestern Ontario to meet growing demand from auto manufacturing and agriculture, two new lines in northeastern Ontario to support Algoma steel’s planned conversion to electric steelmaking as well as mining opportunities, and one new line in eastern Ontario to support demands in the Peterborough and Ottawa regions.

Figure 3: Map of transmission expansion

Step three: Ontario’s clean grid reduces provincewide emissions

Ontario’s expansion of clean energy generation has already put the province on the path to reduce province-wide emissions through the electrification of the economy, even with a small increase in emissions produced by using natural gas for electricity. It has also supported the province being on track to meet its 2030 emissions targets, unlike the federal government and other provinces.

According to a 2024 estimate by the IESO, by 2035, through electric vehicle adoption and electrification of steel production, province-wide emissions may reduce by a magnitude of about three times that of the electricity sector. Overall, this amount could represent the equivalent emissions reduction of taking over three million gas-powered cars off the road.

| Year | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 | 2039 | 2040 | 2041 | 2042 | 2043 | 2044 | 2045 | 2046 | 2047 | 2048 | 2049 | 2050 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Electricity Sector, Historical Emissions | 34 | 31 | 34 | 28 | 15 | 20 | 14 | 13 | 10 | 6 | 6 | 6 | 3 | 4 | 4 | 4 | 5 | 5 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Electricity Sector, Forecast Emissions | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 3 | 4 | 6 | 9 | 8 | 10 | 9 | 10 | 10 | 10 | 9 | 8 | 8 | 8 | 9 | 8 | 4 | 3 | 3 | 3 | 3 | 3 | 2 | 2 | 2 | 2 | 3 |

| Electricity Sector less Emission Reductions | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 1 | 1 | 0 | 2 | 0 | −1 | −4 | −5 | −8 | −11 | −14 | −19 | −22 | −24 | −26 | −29 | −35 | −38 | −40 | −42 | −43 | −44 | −45 | −46 | −46 | −47 | −46 |

Source: Independent Electricity System Operator website, 2024 Annual Planning Outlook and Emissions Update.

The IESO’s analysis also confirms that by 2040 electricity sector emissions will be lower than 2016 levels, once nuclear refurbishments are complete and new non-emitting sources of power like those the government is procuring and building today come online.

This emissions reduction opportunity is also built on consumers choosing clean electricity and switching away from fuels that have higher emissions. Whether it is a family deciding to install an electric heat pump in the home or a mining operation considering an all-electric mine, these choices require consumer confidence that our clean electricity system will remain reliable and affordable over the long term.

Going forward: economic growth and electrification driving energy demand

Ontario’s economy and the day-to-day lives of its 15 million residents depend on a reliable electricity system that delivers power on demand. As a result of a historic run of investments and unprecedented economic growth, demand on that system is growing quickly.

According to the IESO’s latest forecast, demand for clean, reliable and affordable power is expected to increase by 75 per cent by 2050, an increase of 15 per cent over the previous year’s forecast. A 75 per cent increase in demand would require 111 TWh of new energy — the equivalent of four and a half cities of Toronto.

| Item | Hour | Value | Value | Value |

|---|---|---|---|---|

| Today’s system capacity | megawatts (MW) | 38193 | 38,193 | N/A |

| Capacity needed in IESO P2D Pathways Scenario | megawatts (MW) | N/A | N/A | 88,393 |

| Capacity needed by 2050 in IESO P2D | megawatts (MW) | N/A | 50,200 | N/A |

Source: IESO. 2023 Year In Review. IESO. Pathways to Decarbonization report.

This growth will be driven primarily by economic growth, continued increases in Ontario’s population, mining and steel industry electrification, and through Ontario’s success in attracting unprecedented investment in Ontario’s industrial base, including the electric-vehicle supply chain. In fact, five major investments alone are expected to increase industrial demand in the province by the equivalent of 36 per cent of today’s industrial load, almost the entire demand of the City of Ottawa (figure 7). In Windsor, NextStar Energy, a joint venture between LG Energy Solution, Ltd (LGES) and Stellantis N.V., is investing more than $5 billion to manufacture batteries for EVs, which at the time in 2022 represented the largest automotive manufacturing investment in the province’s history.

| Use | Megawatt-hours |

|---|---|

| Electric Vehicles | 730 |

| Green Steel | 580 |

| Green Steel and EVs (Combined) | 1,310 |

| Hydro Ottawa | 1,398 |

Since then, Volkswagen Group announced a $7 billion investment to build an EV battery manufacturing facility in St. Thomas. The plant, Volkswagen’s largest to date, will create up to 3,000 direct and 30,000 indirect jobs. Once complete in 2027, the plant will produce batteries for as many as one million EVs a year, bolstering Canada’s domestic battery manufacturing capacity to meet demand now and into the future.

In April 2024, the government also welcomed a $15 billion investment by Honda Canada to create Canada’s first comprehensive electric vehicle supply chain, located in Ontario.

This large-scale project will see four new manufacturing plants in Ontario. Honda will build an innovative and world-class electric vehicle assembly plant — the first of its kind for Honda Motor Co. Ltd. — as well as a new stand-alone battery manufacturing plant at Honda’s facilities in Alliston. To complete the supply chain, Honda will also build a cathode active material and precursor (CAM/pCAM) processing plant through a joint venture partnership with POSCO Future M Co., Ltd. and a separator plant through a joint venture partnership with Asahi Kasei Corporation. Once fully operational in 2028, the new assembly plant will produce up to 240,000 vehicles per year.

Ontario has also secured major investments in clean steelmaking projects in Hamilton and Sault Ste. Marie with ArcelorMittal Dofasco and Algoma Steel. These once-in-a-generation investments will transform the province into a world-leading producer of green steel.

These investments will also boost the robust auto parts supply chain and skilled workforce in communities with deep roots in steel manufacturing and help meet the global demand for low-carbon auto production.

Ontario’s technology sector is also continuing to grow. The IESO reports that data centres will consume a total of 137 megawatt of demand by the end of 2026, roughly equal to adding the demand of the city of Kingston to the grid. The rise of artificial intelligence (AI) and the data centres that power advances in computing could also lead to significant increases in demand on energy grids. AI applications, particularly large language models, require substantial computational power, leading to higher energy consumption.

Several sectors are in a period of significant growth driven by longer-term trends that are driving higher demand. For example, greenhouse expansions and increased lighting requirement have resulted in the IESO projecting consumption from the agriculture sector to grow from around 5 TWh to 8 TWh by 2050, which is a 60 per cent increase, the equivalent of adding another City of London to the grid. Mining processes in northern Ontario will electrify some of their processes to improve efficiency and reduce emissions. The IESO is projecting this to contribute towards already robust industrial growth in the forecast.

At the same time, Ontario’s population is expected to grow by almost 15 per cent or two million people by the end of this decade.

All of these homes will require reliable electricity, especially as households increase their consumption by electrifying heating, cooling, and transportation. The IESO states that electricity demand from electric vehicles is forecast to grow from about 1.6 TWh in 2025 to 41.6 TWh in 2050, an average annual growth rate of about 13.9 per cent.

Access to other fuels and sources of energy such as natural gas also continue to be critical to attracting new jobs in manufacturing, including the automotive industry and agriculture. Natural gas currently makes up almost 40 per cent of Ontario’s overall energy mix and is the dominant fuel used for heating, serving about 3.8 million customers. All of this growth highlights the need for Ontario to move forward with plans for bolder action and investment to ensure the energy system supports continued growth.

Our vision: an economy powered by affordable, reliable and clean energy

1. Planning for growth

Challenge: Ontario needs to plan for electricity, natural gas and other fuels to ensure that the province’s energy needs are anticipated and met in a coordinated way.

Introduction

Ontario cannot afford to repeat the same mistakes as past governments and must move forward with energy planning that considers all sources of energy to meet our growing energy needs.

This is a complex undertaking that will require a comprehensive view of how all energy sources are used across the economy. The pace of change has accelerated, and this is likely to continue as Ontario becomes home to new technologies and growing industries. Ontario must also plan for localized needs in certain communities and regions, changing the way power must flow across the province.

To meet this challenge, Ontario needs planning and regulatory frameworks that support building infrastructure and resources quickly and cost-effectively, and in a way that continues to promote Indigenous leadership and participation in energy projects. There is also a need to accelerate processes for building out the last mile to connect new homes and businesses supported by growth-oriented energy agencies to keep Ontario open for business.

Integrated energy resource planning

Building the energy infrastructure necessary to power Ontario’s future is a complex undertaking that requires the highest level of strategic energy planning and coordination.

The Ontario government can lead Canada in implementing an integrated energy planning process to ensure it is making the most cost-effective decisions for a clean energy future. This all-energy approach to planning would consider electricity, natural gas, hydrogen and other fuels. An integrated energy resource plan would help manage change and growing demand by providing clear signals and long-term confidence to the sector and investors.

By planning for all sources of energy and ensuring the energy system supports key goals such as building housing and attracting investment, Ontario will have a pathway to achieving its energy vision. The pace of change will be driven by the emergence of new major energy users, such as in the electric vehicle supply chain and data centres, and by individual decisions made by consumers with respect to how they power their homes, vehicles and businesses. Maintaining customer choice as a driving principle of Ontario’s vision requires regular planning to ensure that energy sources are available for customers when they need them.

A key component of any integrated plan is a forecast for energy needs into the future. The IESO will continue to play a critical role in providing forecasts that drive investments in the electricity system. However, there is a need to enhance energy forecasting and coordinated planning so that there is greater alignment across energy sources.

Priorities for integrated energy resource planning:

- Ontario’s energy sector needs to be guided by an integrated energy resource plan that ensures the province has the affordable power needed for a clean and growing economy.

- Integrated planning needs to be done on a regular cycle and incorporate all energy sources and input from Indigenous communities, the public and energy sector stakeholders.

- The IESO as well as electricity and natural gas utilities need to coordinate their planning frameworks around shared, evidence-based forecasts for all types of energy use.

- The OEB will need to consider outputs from planning in its adjudication and other regulatory activities.

- There is a need for independent, external advice into the energy planning framework, including advice on the integration of energy planning with other government objectives, such as housing and economic development.

- Electricity forecasts must consider scenarios that reflect high growth, driven by population and GDP growth, accelerated electrification, and evolving technological trends.

- There is a need for greater electricity and natural gas coordination in system planning that is informed by evidence-based forecasts that take the pace of electrification into account.

Electricity generation

The province recognizes the challenge ahead and will continue to build on its successful planning for baseload resources and procurement processes to bring additional energy resources online so they support growth. That approach will ensure Ontario can take advantage of the full range of generation technologies and leverage competitive approaches wherever possible to keep electricity affordable.

To extend its clean energy advantage, Ontario needs to consider how more clean energy sources can be brought online.

Baseload nuclear and hydroelectricity: the backbone of Ontario’s clean electricity system

Ontario’s plan will prioritize clean and reliable baseload electricity from nuclear and hydroelectricity. These resources have provided more than 75 per cent of the province’s electricity over the last 20 years.

Ontario will continue to advance work on new nuclear and hydroelectric generation, which requires much longer lead times and long-term certainty than other resources, but could serve the province well into the next century. This includes generational decisions to start pre-development and preparation for deployment of new nuclear — including work at Bruce Power and on the Darlington New Nuclear Project.

Priorities for electricity generation:

- Ontario’s plan will prioritize clean and reliable baseload electricity from nuclear and hydroelectricity.

- Meeting the accelerating pace of growth will require:

- A cadence of competitive long-term procurements that ensures new energy resources are built at lowest cost, thereby protecting ratepayers and taxpayers.

- Securing energy from existing resources through competitive procurements, refurbishments, and specialized programs.

- Exploring the strategic value of other long-life assets, such as long-duration storage.

- Ontario’s energy procurements must continue to advance economic reconciliation with Indigenous communities by including opportunities for Indigenous leadership and participation in generation projects, supported by community capacity funding and access to financing.

Electricity transmission

As the province builds out new generation, the transmission network must be expanded to get that energy where it needs to go. And as the system grows and new businesses set up shop, the system must move quicker — including enhanced transmission planning and pre-development activities so lines can proceed to construction quickly with the support of sector participants, municipalities, and Indigenous Communities.

Priorities for electricity transmission:

- Ontario must continue to expedite the development of transmission infrastructure including through enhanced transmission planning and pre-development activities.

- Customers wishing to connect to the transmission system or electrify their processes need to be able to do so efficiently and at costs that are fair for everyone.

- New transmission infrastructure development needs to continue to advance reconciliation with Indigenous communities through early engagement and by creating opportunities for Indigenous leadership and partnership, economic participation and capacity building.

Last mile connections

Building new housing means there will be many new customers to connect to the energy system. An efficient connections framework that reduces barriers to customers will be essential to ensure the energy system supports growth.

The ability to attract investment and realize the province’s housing goals will also depend on having dynamic, responsive and high-performing utilities as well as supportive and efficient regulatory processes.

Priorities for last mile connections:

- There is a continued need for a regulatory framework that ensures last mile connections to homes and businesses are completed quickly to support growth.

- Ontario must look for opportunities to enhance information sharing and communication between developers, utilities, municipalities, and local Indigenous communities to help address connection timeline challenges.

- Ontario’s utilities need to continue to be high-performing and cost-efficient in their work to connect new homes and businesses to the province’s grid.

Natural gas

Natural gas currently makes up almost 40 per cent of Ontario’s overall energy mix and is the dominant fuel used for heating, serving about 3.8 million customers. Natural gas is a vital component of Ontario’s energy mix and the province’s first integrated energy resource plan.

It fulfills diverse roles across the industrial, residential, commercial and agricultural sectors. It is also a critical component of the province’s electricity generation mix to maintain reliability: increased electricity generation through natural gas can help reduce province-wide emissions by supporting cost-effective electrification in other sectors.

There is a need for the energy system to adapt to the pace of change so consumers continue to be empowered to make choices about their energy sources. That will require coordination among natural gas utilities, electricity utilities and the IESO to manage energy system costs and ensure reliability as significant investments in energy infrastructure are needed to support a growing and evolving economy. This coordination would ensure that electricity resources keep pace with demand as an increasing number of consumers switch energy sources over time, while reducing the risk of stranding assets before the end of their useful life.

Over the long-term, an economically viable natural gas network can also support the integration of clean fuels to reduce emissions, including renewable natural gas (RNG) and low-carbon hydrogen. Consumers in Ontario already have access to programs offered by Enbridge or non-utility suppliers (e.g., Bullfrog Power) to voluntarily add RNG to their gas supply. Pilot projects are also underway to increase low-carbon hydrogen production and use, including projects supported through the Hydrogen Innovation Fund.

Carbon capture and storage is another emerging technology that could reduce emissions generated by the continued use of natural gas by large industrial consumers. Ontario is committed to developing and implementing a framework to regulate commercial-scale geologic carbon storage projects in the province.

Going forward, Ontario will include a Natural Gas Policy Statement in its integrated energy resource plan to provide clear direction on the role of natural gas in Ontario’s future energy system.

Priorities for natural gas:

- The build out of a cleaner and more diversified economy must be paced according to the needs of homes, businesses and economic investment, including the need to keep energy costs competitive, not ideologically driven.

- There is a need for an economically viable natural gas network to support a gradual energy transition, to attract industrial investment, to drive economic growth, to maintain customer choice and ensure overall energy system resiliency, reliability and affordability.

- Ontario must continue to seek opportunities to support energy efficiency, clean fuels and carbon capture to reduce emissions from the natural gas system while lowering energy costs for consumers.

- The OEB should continue to play its role as the natural gas system’s economic regulator to protect consumers, to ensure utilities can invest in their systems and earn a fair return, and to enable the rational expansion and maintenance of the system.

Other fuels

Ontario’s first integrated energy resource plan will also consider other fuels including petroleum-based fuels (e.g., gasoline), propane, and low-carbon fuels that make up just under 40 per cent of Ontario’s energy mix.

Petroleum products are critical fuels to move goods and people and heat homes. They also have non-energy applications in the manufacturing and agricultural sector where electric options are not currently commercially available.

While the first oil well in North America was drilled in Oil Springs, near Sarnia, the province’s crude oil production now accounts for less than one per cent of Ontario’s total oil demand today. Ontario relies almost entirely on imported crude oil delivered from Western Canada and the United States by interprovincial and international pipelines to four refineries in Ontario. Ontario’s refineries supply approximately 78 per cent of Ontario’s refined product demand, with Quebec and the U.S. supplying the remainder.

Gasoline, diesel and jet fuel currently dominate the fuels sector, however, exciting and innovative advances in low-carbon fuels such as RNG, ethanol, renewable diesel, biodiesel and low-carbon hydrogen continue to provide sustainable alternatives. These may also provide a more cost-effective pathway than electrification to reduce emissions for some types of energy use.

Priorities for other fuels:

- Ontario needs to continue to ensure a secure supply of fuels and fuel transportation infrastructure through its work with industry stakeholders, the federal government, potentially impacted Indigenous communities, and other provincial governments.

- Further work is needed to explore opportunities to increase production of clean fuels and identify end-use applications where these clean fuels can be best deployed.

- There is a need for enhanced integration of all fuels in planning and coordination with other provincial strategies, such as for transportation, agriculture, forestry and the environment.

Indigenous leadership and participation

Indigenous communities are already leaders and key partners in Ontario’s energy sector, with many First Nation and Métis communities owning or partnered on energy projects across the province. Those communities see immediate and lasting economic benefits that come from their participation in energy projects, including stable streams of revenue and knock-on benefits such as increased opportunities for Indigenous businesses, job creation and skills development.

These partnerships also offer mutual benefits by creating opportunities for the province and energy proponents to learn from Indigenous leaders, elders and community members and ensure that energy developments consider potential impacts to Aboriginal and treaty rights. Indigenous participation in energy projects can ultimately help to get critical infrastructure built on time with better outcomes, such as reduced environmental impacts and employment and other economic benefits for Indigenous communities.

Priorities for Indigenous leadership and participation

- Early and meaningful engagement and consultation with Indigenous communities on energy planning and major energy projects is critical to building out our energy system.

- Continued capacity funding and support for Indigenous ownership and participation in energy projects is needed, through programs like the provincial Aboriginal Loan Guarantee Program and the recently expanded IESO Indigenous Energy Support Program.

- Energy procurements need to incorporate the value of Indigenous leadership and participation by building on existing incentives and engagement requirements.

- Ontario must continue to build meaningful relationships with Indigenous communities and organizations and seek regular dialogue on regional and territorial energy interests underpinned by capacity support and relationship agreements.

- Indigenous representation is critical to ensuring there are Indigenous voices at the table on provincial energy matters.

Local, regional and interjurisdictional energy planning

Ontario has empowered municipalities as part of the energy planning process. This includes through the important role of municipal support in the energy procurement process.

Going forward, there is value in municipalities taking on a greater leadership role in energy planning in their communities because many are experiencing rapid growth. When communities are growing, municipal planning and energy planning needs to work in lockstep to support the build out of housing and business development.

There are also opportunities to work with Ontario’s neighbouring jurisdictions and the federal government on energy issues that cross borders. This includes codified approaches to electric vehicle charging and to expanding electricity interties.

System planning needs to be done in a way that serves all Ontarians and ensures no one is left behind. An integrated planning approach will consider how energy choices can support healthy, diverse populations and communities.

Priorities for local, regional and interjurisdictional energy planning:

- There is a need for strengthened local energy planning, including through municipal guidance, support and capacity building — such as through the Municipal Energy Plan program — as well as better alignment with the province’s integrated energy planning process and other planning processes.

- There is a need for Ontario to work with the IESO, the OEB, Indigenous communities and stakeholders to continue to improve the Regional Planning Process so it supports coordination with natural gas planning, supports high growth regions and appropriately integrates municipal energy plans.

- There is an opportunity to work with neighbouring jurisdictions on interjurisdictional infrastructure planning (e.g., electricity interties).

Growth-oriented agencies

The IESO and the OEB are essential partners in achieving Ontario’s vision for an affordable and clean energy system. Ontario’s forecasted growth will increasingly challenge its agency partners to undertake their planning and approval functions rapidly and transparently.

In recent years, significant work has been undertaken at both the IESO and the OEB to modernize processes, support innovation, and prepare for growth and electrification. This focus on continuous improvement is essential and must be accelerated to ensure planning and approvals can best serve high-growth areas and support Ontario’s ability to attract future investment.

Ontario’s energy sector participants, businesses, and the public expect that energy planning decisions are made at the pace of growth. They also expect that planning information, such as growth forecasts and available system capacity is informed by the best available data, which is updated regularly and made publicly available to support investment decisions. Regional planning cycles, particularly in high-growth regions, must be responsive to the pace of change.

Priorities to support growth-oriented agencies:

- There is an opportunity for the IESO to continue to build on its forecasting and planning framework to ensure there are tools to support high-growth regions.

- Ontario needs its energy agencies to continue to seek opportunities to expedite their approvals, decisions and other processes while continuing to prioritize reliability and affordability.

- Businesses need greater and more timely access to information on the state of the system to support connection decisions.

- The OEB should continue to seek opportunities to improve the efficiency of its independent adjudication and make greater use of non-adjudicative tools in regulating the sector.

2. Affordable and reliable energy

Challenge: Energy affordability must be prioritized as Ontario’s energy system expands to meet demand and support economic growth.

Affordability is central to customers’ having fair access to energy and the affordability of clean electricity is essential to driving customer choices to electrify. Customers need the right tools and data to manage their energy consumption so that they can make informed choices for their homes and transportation. This Ontario government will offer an alternative to any carbon tax, which maintains the pace of growth in the province while not applying new costs and makes energy available and affordable so that customers choose to switch.

Ontario’s alternative to the carbon tax

Affordability is a critical concern for families across Canada, but the carbon tax is only making life more expensive.

On April 1, 2024, the federal government increased the carbon tax by 23 per cent making it more expensive to build a new home, for a family to put gas in their car, put food on the table or buy everyday essentials.

Today the carbon tax adds 17.57 cents per litre to gasoline prices in Ontario. That will rise to about 30 cents by 2030. The carbon tax is adding about $350 on average to a household’s annual natural gas bills.

The Government of Ontario has been clear in its opposition to the carbon tax. Ontario’s first-of-a-kind integrated energy resource plan will invest in the province’s prosperity and its energy systems to give residents and businesses affordable choices to use clean energy. This is Ontario’s alternative to the carbon tax.

Priorities for Ontario’s opposition to a carbon tax:

- Ontario will never include a carbon tax in its plan.

- For Ontario’s vision for a clean energy economy to be achieved, people and industry must have choice over their energy sources and no one can be left behind.

- Ontario will meet its 2030 emissions target with clean, affordable and reliable power that supports families and businesses as they make the choice to move away from higher emitting sources of energy, without a costly and unnecessary carbon tax.

Helping Ontarians save through energy efficiency

As Ontarians choose to electrify their homes and businesses, there is an opportunity to install more efficient appliances and smarter controls to save energy and participate in programs and initiatives that benefit Ontario’s energy system as a whole.

Ontario can build on accomplishments to date by expanding energy efficiency programs and empowering customers through energy data and tools, to lower costs for families and businesses. The government intends to unveil new energy efficiency programs aimed at helping families and businesses reduce their bills and save energy later this year.

Priorities for helping Ontarians save through energy efficiency:

- There is an opportunity to expand energy efficiency to help consumers lower their energy costs and to help offset investments in new, more expensive electricity infrastructure.

- Households, businesses and institutions would benefit from easier-to-access information about their energy use to make informed decisions about their building’s energy performance, through streamlined processes that protect consumer information.

- Encouraging and supporting consumers who want to reduce their overall energy use to save money and lower emissions should be a continued priority over the long term.

Supporting Electric Vehicles (EVs)

As more families and businesses make the switch to electric vehicles, the government must ensure that electricity remains reliable and affordable, and that Ontarians can find public chargers when and where they need them.

There is a continued need to improve access to and remove roadblocks for building affordable EV charging infrastructure (e.g., public stations, home, work, and fleet charging) and allow for greater choice, access, and safe uptake of electric mobility options across Ontario.

Priorities for supporting EVs:

- Ontario’s regulatory framework for electricity must continue to support the efficient integration of EVs and growing EV adoption.

- Any opportunity to reduce barriers to the build out of affordable EV charging infrastructure must be explored to support greater choice, access, and uptake of EVs.

- Strong collaboration across government is needed to support continued growth in private and public EV charging infrastructure.

Empowering energy consumers to participate in the grid

Industrial, commercial and residential customers are increasingly leveraging technologies like solar photovoltaic panels, batteries, electric vehicles, thermal storage, smart thermostats and electric water heaters to manage their energy use, reduce their energy costs, and provide back-up power or heat. These small-scale energy systems that generate, store or manage electricity close to where they are used, in homes and businesses, are referred to as distributed energy resources (DER). These DER systems can also be directly connected to the distribution grid and provide energy and other services to local or bulk grid.

Giving customers more ways to participate in the grid, with a focus on creating new ways for families and businesses to save money while reducing province-wide energy demand, benefits us all. As the grid evolves with the increasing adoption of DER, the policy framework too must evolve to support customer choice and reduce barriers to all types of DER investments that can support local energy needs and improve the efficient utilization of these resources within the energy system.

Priorities for empowering energy consumers to participate in the grid:

- There is an ongoing opportunity to expand the use of DERs where it is cost-effective and beneficial to meeting local and system needs.

- Customers would benefit from increased opportunities for customer-sited generation and storage that offers bill savings or resiliency benefits for residential, small business and farm customers.

- There are opportunities to examine broader implementation of projects piloted by OEB and IESO that have demonstrated customer, local and system benefits.

- There is an opportunity to improve collection and sharing of DER data to the mutual benefit of LDCs, the OEB, the IESO, customers and DER developers.

Grid modernization

Distribution grids throughout the province will need to modernize, utilizing and integrating innovative technologies that facilitate active monitoring of their systems, while building better resiliency to changes in weather patterns and extreme weather events.

Ontarians expect that their LDC will serve them safely, reliably, cost effectively, and that over time they will steadily improve. These expectations must be met as LDCs concurrently confront the necessary modernization of the grid, improve the grid’s overall resilience, and directly support Ontario’s economic development and housing targets. The government continues to support voluntary consolidation in the electricity distribution sector which can help local distribution companies be better positioned to support Ontario’s electrification needs and improve services for customers well into the future.

By providing further clarity on what are considered grid modernization activities, the province can help LDCs make prudent investments to support increasing energy demand.

Priorities for grid modernization:

- Ontario recognizes the need to work with the OEB to provide greater clarity and predictability to LDCs so that they can modernize their infrastructure to provide the energy and services that ratepayers need into the future.

- There are opportunities for the government, IESO and the OEB to accelerate implementation of grid innovation projects that provide ratepayer value.

- There is a need to strengthen the governance and accountability of LDCs to improve operational efficiencies, increase reliability, and support investments necessary for the increasing energy demand.

Grid resiliency

As concerns about climate change and extreme weather events such as flooding, wildfires and ice storms rise, building grid resiliency across the province is essential to Ontario’s economic growth and energy future.

Ontario has released the Vulnerability Assessment for Ontario’s Electricity Distribution Sector which summarizes anticipated extreme weather risks to Ontario’s electricity distribution networks. Further actions can be taken by working with agencies and LDCs to strengthen Ontario’s grid and ensure the energy system is prepared to respond to future extreme weather events.

Priorities for grid resiliency:

- There is a need to build capacity in the sector to conduct risk assessments to drive more effective action in making Ontario’s grid resilient.

- Ontario must ensure that reducing impacts on vulnerable populations is a key consideration in resiliency and adaptation planning in the sector.

- Any efforts to enhance grid resiliency must be done in an economically efficient manner that prioritizes value for customers.

Programs for energy affordability

Maintaining affordable electricity pricing will be critical to driving customer decisions to electrify their lives with clean energy.

Several energy support programs are in place, including broad support programs like the Ontario Electricity Rebate. The government also offers targeted support to people who need it most. Earlier this year the government expanded access to the Ontario Electricity Support Program (OESP) by increasing the eligibility thresholds by up to 35 per cent.

To maintain the sustainability of the programs and ensure support is available to those who need it most, it will be crucial to monitor the costs and designs of these programs, and to adjust where necessary.

Priorities for programs for energy affordability:

- Cost-effective, competitive and technology-agnostic procurement of energy resources is an enduring priority to manage system costs.

- There is a continued need for targeted supports to those who need it most, including low-income households.

- Ontario’s suite of electricity rate mitigation programs must provide continued stability and predictability for families and businesses.

Affordable home heating

Not all communities have access to the same sources of energy for home heating. While more than 70 per cent of homes are heated with natural gas, many still rely on other more expensive sources including propane and home heating oil.

The government is providing families with multiple options to help make home heating more affordable.

To help families and businesses in rural Ontario transition off higher-cost and higher-emission forms of energy, the government provides support through the Natural Gas Expansion Program (NGEP). Work is underway to explore how to continue these efforts and provide financial support and affordable home heating to more communities.

This is complemented by programs like the former Clean Home Heating Initiative (CHHI), the Energy Affordability Program and the HomeEnergySaver program, which provide opportunities for households to complement their existing heating source with an electric heat pump.

Priorities for affordable home heating:

- There is a need to ensure Ontarians have affordable options for home heating from different energy sources.

- Affordable home heating options should be available that take advantage of Ontario’s clean electricity system, such as through heat pumps and other new technologies as well as energy efficiency measures.

3. Becoming an energy superpower

Challenge: Ontario has the opportunity to use our competitive advantage to export clean energy and technology across the continent and beyond.

Energy will be a cornerstone of the province’s economic strategy and success. Creating stability of supply through prudent investments and planning will foster an environment in which companies from around the world can be assured that Ontario is an ideal place to conduct business for generations to come.

That also creates an additional opportunity where other jurisdictions recognize that as they seek to meet their own clean energy goals that Ontario can be a partner in their work.

Exporting power and expertise

Ontario has a diverse, world-class and clean electricity system, powered by nuclear, hydroelectricity, solar, wind, natural gas, biomass, biogas and electricity storage. Ontario also has a proven ability to build complex energy projects on- time and on-budget, benefitting from strong agencies that have led to a cost effective and highly reliable energy system.

That combination positions Ontario as a continental leader in clean energy. Across North America, many jurisdictions and businesses are establishing clean energy targets for their electricity grids that will require historic investments and lengthy lead times to accomplish. Ontario is well-placed to step in and play a critical role as a clean energy leader and help these jurisdictions reduce their emissions.

History of electricity imports and exports

Electricity imports and exports are a normal part of the operation of the electricity market. Ontario’s electricity system currently has 26 interties connected with five neighbouring jurisdictions: three with Manitoba, eleven with Quebec, one with Minnesota, four with Michigan and seven with New York, with a total nominal transfer capacity of approximately 6,000 megawatts (MW).

Since 2006, Ontario has been a net exporter to these jurisdictions. In 2023, Ontario scheduled net exports of 12.4 terawatt-hours (TWh), an increase of 29 per cent from the 9.6 TWh net exports of 2022. For context, Ontario exported 11 per cent of its total generation in 2023.

Those exports have not always been in the province’s favour. Historically, Ontario experienced periods of Surplus Baseload Generation (SBG), which occurred when output from baseload generation resources exceeded Ontario demand. These periods of SBG, which typically occurred overnight in the spring and fall, required the IESO to use market mechanisms such as exports or economic curtailment of certain resources to balance supply and demand.

SBG can result in a low, or even negative, wholesale prices for participants in the electricity market. This is because hydro and nuclear generation are considered “non-dispatchable,” meaning they have limited to no flexibility to reduce energy production. Therefore, they will offer very low prices so that their production is the last to be curtailed. According to the IESO, for a sample period between 2016 and 2020, between 5 to 9 per cent of all exports were sold at $0 per megawatt-hour or less. Although the surplus power was made available to consumers, there was often limited or low demand at the time this power was available.

Future opportunities for electricity exports

The IESO is forecasting that Ontario energy demand will increase by 75 per cent over the course of the next 25 years. Ontario will position itself to not just meet that domestic demand, but where it makes sense for the province, and is in the best interests of ratepayers, to exceed it.

As part of the exploration of further export opportunities, the IESO has been tasked with supporting the development of an export strategy that generates new revenue streams and creates good jobs here at home. The IESO’s analysis will act as the foundation for any plan development on an export strategy. As Ontario’s electricity system grows, expanding the interconnections with neighbouring jurisdictions will be important to help provide operational flexibility and mitigate risks. Many of Ontario’s interconnected jurisdictions have an anticipated shortfall or a clean energy commitment to meet (i.e., New York, Maryland and Illinois) or both (i.e., Michigan and Minnesota), but are currently reliant on resources like coal which could be replaced with clean energy imports. The government believes that pursuing further export opportunities would require increasing generation.

The IESO’s analysis will include:

- A scoping of the generation resources and transmission infrastructure required to serve the best opportunities to Ontario and its ratepayers while also being able to deliver the desired exports to neighbouring jurisdictions; and

- An assessment of the required commercial, market pathways and mechanisms to capture cost effective export opportunities.

The province currently has robust transmission interties with neighbouring provinces and states and trades electricity every day as a core function of the Ontario market. As the province builds out its competitive advantage in energy, there may be greater opportunities to leverage trade to benefit Ontario ratepayers and provide clean energy to other jurisdictions.

It would also improve the resilience of the Ontario energy system by expanding the option to import power when needed to meet peak demand, such as during extreme weather events.

Ontario has experience negotiating export arrangements with its neighbours. For instance, Ontario currently has an agreement in place to “swap” 600 megawatt of capacity on a seasonal basis with Hydro Quebec, and the IESO has a separate agreement with New York’s ISO (NYISO) to facilitate imports and exports of capacity between the two jurisdictions.

Additional opportunities might exist in these and in other neighbouring jurisdictions to which Ontario is interconnected. Both NYISO and Midcontinent ISO (MISO), which serves most of the US midwestern states, are projecting significant shortfalls in the years ahead. There may be opportunities for firm export agreements with these jurisdictions that could offset the costs of building new generation in Ontario and actually help reduce bills for Ontario families while also creating good jobs.

Ontario’s generators and electricity traders already participate extensively in the US through wholesale electricity markets. In addition, both NYISO and MISO administer capacity auctions in their jurisdictions. Ontario would not participate in a long-term export commitment unless a firm revenue agreement was in place to protect and actually drive value for Ontarians.

Any export deals with other jurisdictions would need a lead counterparty in Ontario, such as a generator or the IESO, as well as firm transmission rights to ensure delivery when the power is needed. With support from the province, the province believes Ontario’s market participants are both sophisticated and capable of executing such deals.

Leadership in nuclear projects and innovation

The province is a leader in nuclear projects and technology. The Canada Deuterium Uranium (CANDU) reactor technology used in our current fleet was developed in Ontario and has been exported around the world. Our multi-billion-dollar nuclear industry supports 65,000 jobs across the province and is helping our nuclear operators, OPG and Bruce Power, to deliver complex refurbishment projects at their stations on-time and on-budget. Ontario companies are also sharing their know-how beyond our borders through partnerships in the United States and Europe. The nuclear sector is advancing innovation in nuclear and non-nuclear applications, such as SMRs and medical isotopes that are used for diagnosing and treating life-threatening diseases and sterilization of medical equipment around the world.

Priorities for exporting power and expertise:

- Ensure Ontario families directly benefit from any agreement to export power through lower bills, enhanced revenue streams for the province and good, local jobs.

- Ontario has an opportunity to work with the IESO and other sector partners to explore cost-effective opportunities to increase trade with neighbouring jurisdictions, including through new or expanded interties.

- Ontario’s nuclear leadership in SMRs, large-scale nuclear technology and other nuclear innovations, could continue to create new export opportunities, drive economic growth, and create jobs across the province.

- Ontario’s nuclear fleet can continue to advance key opportunities in research, development and production of medical isotopes and make Ontario a global isotope superpower.

Next steps

Ontario intends to take early actions towards meeting the challenges laid out in this document in the weeks and months ahead. These actions would build on steps already taken the release of Powering Ontario’s Growth.

The priorities articulated in this document will also guide Ontario’s first integrated energy resource plan. In building the plan, input from the public, stakeholders and Indigenous communities will help to inform the actions needed to achieve our energy vision.

Your feedback will be carefully reviewed as Ontario moves forward with launching its first integrated energy resource plan in 2025.

Glossary of terms

- Baseload generation

- Baseload generators are typically designed to run at a constant rate and typically include nuclear and large hydroelectric facilities.

- Bioenergy

- Energy produced from organic material sources. Sources for bioenergy generation can include agricultural residues, food-process by-products, animal manure, waste wood and organic kitchen waste.

- Distributed Energy Resources (DERs)

- Resources that generate energy, store energy, or control load and are directly connected to the distribution system or located behind a customer’s meter.

- Electric Vehicle (EV)

- Any vehicle that is partially or fully powered by electricity and plugs in to recharge. They can reduce fossil fuel consumption and emissions.

- Energy Efficiency

- Any conservation program or action which reduces the amount of electricity consumed or reduces the amount of power drawn from the electricity grid.

- Independent Electricity System Operator (IESO)

- The provincial entity that delivers key services across the electricity sector, including managing the power system in real-time, planning for the province’s future energy needs, enabling conservation and designing a more efficient electricity marketplace to support sector evolution.

- Local Distribution Company (LDC)

- A utility that owns and/or operates a distribution system that delivers electricity to consumers.

- Megawatt(MW)

- A standard unit of power that is equal to 1 million watts (W) used to depict peak energy demand or generation capacity. For instance, a nuclear reactor can generate approximately 800-900 MW while a large wind turbine can generate up to 3 MW. Peak demand for the city of Ottawa is on the order of 1,500 MW.

- Megawatt-hour (MWh) / Terawatt-hour (TWh)

- Measure of energy demand (and generation) over time. Note: 1 million MWh is equal to 1 terawatthour (TWh).

- Ontario Energy Board (OEB)

- The Ontario Energy Board (OEB) is the independent agency that regulates Ontario’s electricity and natural gas sectors in the public interest.

- Peak Demand

- Peak demand or, peak load or on peak are terms describing a period in which demand for electricity is highest. In Ontario, the annual electricity power peak demand usually occurs in the mid to late afternoon during a hot, humid, sunny weekday in July or August.

- Small Modular Reactor (SMR)

- Nuclear reactors that are significantly smaller and more flexible than conventional nuclear reactors and can be factory-built. Small Modular Reactors (SMRs) could operate independently or be linked to multiple units, depending on the required amount of power.

Footnotes

- footnote[1] Back to paragraph This represents a future provincial electricity system forecast based in part on the development of the new non-emitting resources outlined in the province’s Powering Ontario Growth, and other new resources needed to meet system demand, reflecting the federal draft Clean Energy Regulation (CER), Canadian Gazette 1, assuming existing natural gas generators operate with a 30-year end of prescribed life. It is important to note there is high uncertainty beyond 2035 as it highly dependent on the CER and the pace at which non-emitting resources can be built to replace retiring gas plants. This emissions scenario was not included in the 2024 Annual Planning Outlook as it was conducted for assessing potential impacts of the proposed CER on Ontario’s electricity system and is not a scenario to plan to. In this scenario, IESO excluded gas as a potential new resource for meeting future needs and assessed one of many possible mixes of new non-emitting resources. This CER analysis was updated to include the LT1 procurement.

- footnote[2] Back to paragraph While gas generation will be required into the late 2030s and beyond to safeguard reliability, the electricity system is set to enable substantial emissions reductions in other sectors of the economy. This forecast shows electricity sector emissions net emissions reductions from electrification in transportation and manufacturing.