Published plans and annual reports 2017-2018: Treasury Board Secretariat

Plans for 2017-2018, and results and outcomes of all provincial programs delivered by the Treasury Board Secretariat in 2016-2017.

Part I: 2017-18 Published Plan

Ministry overview

Mandate

Treasury Board Secretariat (TBS) was established to support the President of the Treasury Board in leading the government’s efforts on accountability, openness and modernization. TBS supports the government’s goal in achieving its fiscal targets, while continuing to deliver the services that the people of Ontario rely on and achieving the best possible value-for-money.

TBS’s responsibilities include:

- Providing planning, expenditure management and controllership to support Treasury Board and the government’s fiscal plan, and to ensure sound stewardship and investment of public funds;

- Providing advice and support to Treasury Board/Management Board of Cabinet;

- Overseeing labour relations in the Ontario Public Service (OPS) and the broader public sector

- Managing corporate policy and agency governance including responsibilities for agency accountability, transparency and modernization and the Open Government initiative;

- Leading human resource policy and planning for the government;

- Developing and implementing inclusive OPS-wide human resource strategies, programs and services to build leadership capacity that meets the current and future business needs of the OPS.

- Overseeing government-wide information and information technology; and,

- Implementing measures to improve outcomes, including reducing administrative burden on transfer payment recipients and the OPS.

TBS also:

- Supports the development of the Ontario Budget, Expenditure Estimates, Economic Outlook and Fiscal Review, prepares the province’s Public Accounts and the Public Sector Salary Disclosure Report and supports the Pre-Election Report

- Co-ordinates the government’s annual fiscal planning process and expenditure management strategies for both operating and capital expenditures; and

- Provides internal audit services across the government to ensure ministries meet their business objectives while employing sound management practices.

Ministry contribution to priorities and results

The government is committed to transforming and modernizing public services by finding new and smarter ways to both improve outcomes for Ontarians and meet the province’s fiscal targets. In 2017-18, the government is projecting a balanced budget and improved outcomes for Ontarians. TBS will continue to focus on strategies to transform government and build better public services for the future of Ontario

To continue to ensure fiscal sustainability and improve outcomes for Ontarians in 2017-18, TBS will:

- Use the Program Review Renewal and Transformation (PRRT) lenses of effectiveness, efficiency and long-term sustainability, to review and redesign programs to improve value for money. A coordinated and systematic approach will ensure that Ontarians will continue to get the supports they need in the most cost effective way possible, and programs that no longer meet people’s needs will be changed or eliminated.

- Promote the use of evidence‐based approaches to improve outcomes, harnessing innovative business practices and service delivery models, and maximizing the use of digital channels and solutions. The ministry will continue to identify opportunities to pilot and test new approaches, to find out what works. Steps will be taken to scale up new approaches where evidence shows that they help to improve outcomes or enhance service experience.

- Continue to focus on supporting initiatives that use behavioural science insights to improve outcomes and accelerate innovative program delivery. By pilot testing new, human‐centric approaches to improve outcomes and lower costs, TBS can generate the evidence to inform what does and doesn’t work.

- Develop, with OPS clients’, targeted proof of concept pilots for Cognitive Computing, an innovative way in which the government can better access and analyze data for program delivery, public engagement and evidence-based decision making.

- Further improve efficiencies and effectiveness of the government’s Information and Information Technology (I&IT) infrastructure. Continue to achieve cost savings identified through the I&IT baseline and benchmark review and improve how technology supports the delivery of government programs and services.

- To achieve planned savings and align with the 2016 Auditor General’s recommendations, TBS will:

- Convert additional fee-for-service I&IT consultants to full time equivalent OPS employees;

- Review and modernize IT Vendor of Record (VOR) arrangements to ensure the best value and pricing of IT services and consultants; and

- Implement service level agreements across the government following the creation of a single OPS enterprise service management group in October 2016.

- Continue to support the Transfer Payment Administrative Modernization project to reduce the administrative processes associated with transfer payments by introducing shared tools and resources that enable recipients to spend more time planning, co-ordinating and enabling outcomes.

- Continue to implement enterprise risk management across the OPS in order to ensure risk management is integrated into decision-making, policy development, operations and transformation activities of ministries and Provincial agencies.

To renew the public service, TBS will:

- Lead the development of a strategic plan for public service renewal to ensure the OPS has the diversity, skills and leadership capacity required to support innovation in the public service.

- Create a strategic framework for the OPS of the future to enable all ministries to work together to build a capable, resilient and innovative OPS

- Strengthen and diversify the leadership cadre through enhanced succession planning and accelerated development

- Increase the size of the government’s Ontario Internship Program for new graduates by 100 new placements per year.

To oversee labour relations and manage compensation, TBS will:

- Continue to take a balanced approach to managing compensation which recognizes the need to maintain a stable, flexible and high‐performing public-sector workforce that supports the government’s transformational priorities and at the same time ensures that public services remain affordable.

- Focus Ontario’s public‐sector labour relations framework on maintaining and enhancing the positive and productive working relationships with its public‐sector partners and bargaining agents.

- Undertake negotiations in key areas of the public and broader public service, including health care, postsecondary education and social services.

- Continue to ensure transparency and accountability in how broader public sector employers set executive compensation. In this regard, the government is enhancing its approach to ensure that employers are not only held accountable to specific requirements, but that they also must be consistent with responsible and transparent administration of executive compensation. The government will direct employers to revisit any proposed compensation program that is not reasonable.

To further support an open, transparent and accountable government, TBS will:

- Continue to implement the Open Government action plan to become the most open, transparent and digitally-connected government in Canada.

- Implement three key Open Government commitments, as part of the Open Government Partnership, by the end of calendar year 2017 in collaboration with the public and civil society.

- Expand uptake of the Public Engagement Framework through the implementation of a public engagement toolkit to support ministries in increasing civic engagement.

- Support transparency and accountability in its financial reporting, and sound fiscal policy decisions through the consistent application of accounting policies, reporting structures, and risk management and control activities.

- Prepare and release the Province’s Public Accounts, including the Annual Report and Consolidated Financial Statements of the Province and related volumes. The government is using Open Government principles to present its Public Accounts information online. Ontarians can visit ontario.ca/publicaccounts online to learn more about government spending.

- Introduce changes to the Province’s financial reports, consistent with the requirements of Public Sector Accounting Standards (PASA) and the introduction to the PSA Handbook. Specifically, the 2016-2017 Public Accounts will reflect:

- recognition of net pension assets for the Province’s jointly sponsored pension plans;

- a change in the basis of consolidation of the financial results for Ontario Power Generation and Hydro One on the Province’s financial statements; and

- line-by-line presentation of the annual operating results for hospitals, school boards and colleges on the Statement of Operations.

- Post a compendium reporting the salaries of Ontario Public Service and broader public service employees who were paid $100,000 or more in accordance with the Public Sector Salary Disclosure Act, 1996. Public Sector organizations subject to the Act are required to annually disclose the names, positions, salaries and total taxable benefits of employees paid $100,000 or more in a calendar year.

- Expand the use of a new accountability framework to track and report on the progress of designated-purpose spending commitments, based on identified revenue streams.

To build a modern infrastructure, the ministry will:

- In partnership with the Ministry of Infrastructure, continue to ensure the prioritization and approval of the government’s infrastructure investments, while living within the government’s fiscal plan. Over 13 years, starting in 2014-15, the government has committed to investing more than $190 billion in public infrastructure to build world-class public transit and transportation systems, as well as more schools and new hospitals.

Key performance measures

TBS is committed to delivering on the ministry’s objectives and mandate. Tracking results ensures that the ministry will be aware of its progress and able to modify its approach to ensure the desired outcomes are realized.

TBS will continue to promote the use of performance measures as a key component of decision-making, and support program decision-making through the inclusion of performance measures and metrics in ministry submissions. This will support continuous improvement.

Below are the ministry’s 2016 results against its key priorities.

Support the government in achieving its fiscal targets

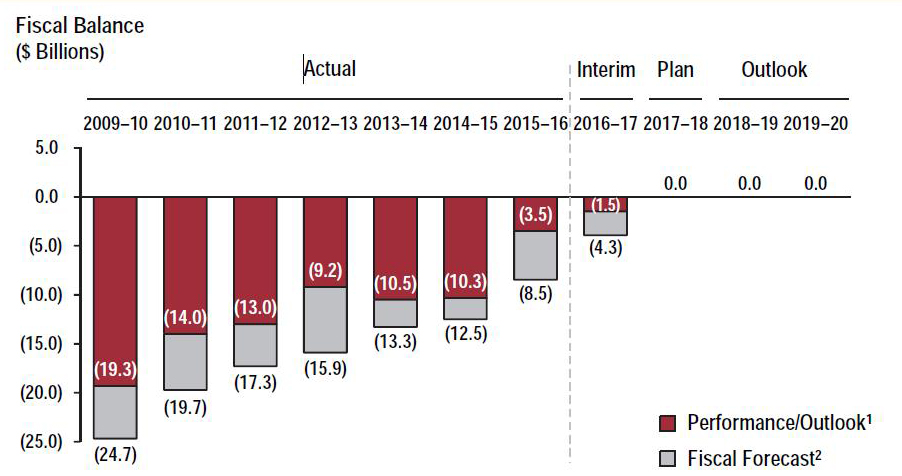

The 2017 Budget plan delivers on the government’s commitment to restore fiscal balance in 2017-18. The Province is also projecting balanced budgets in both 2018-19 and 2019-20.

For the 2016-17 fiscal year, the government is forecasting a deficit of $1.5 billion, the eighth year in a row that IT is projecting to beat its deficit target.

Represents the 2017 Budget outlook for 2016-17 to 2019-20. For 2009-10 to 2015-16, actual results are presented, with 2015-16 restated to reflect recognition of jointly sponsored net pension assets for the Ontario Public Service Employees’ Union Pension Plan and the Ontario Teachers’ Pension Plan on the Province’s financial statements, consistent with the 2016 Budget and as described in the 2016-17 Third Quarter Finances.

An accurate projection of the government’s budgeted expense supports the government’s commitment to balancing the budget in 2017-18.

In the 2017 Budget, the government is projecting an interim expense outlook of $134.8 billion for 2016-17, 100.6 per cent of what was originally forecast in the 2016 Budget. The higher than projected expense ($0.9 billion) is primarily the result of investments in health care, social services, the Green Investment Fund initiatives and the Ontario Rebate for Electricity Consumers, offset by lower interest on debt expense due to lower interest rates and cost-effective debt management.

Summary of expense changes since the 2016 Budget

| $ Millions | 2016-17 |

|---|---|

| Increase/(Decrease) in program expense since the 2016 Budget |

|

|

Health sector |

483 |

|

Education sector |

105 |

|

Postsecondary and training sector |

(69) |

|

Children’s and social services sector |

287 |

|

Justice sector |

115 |

|

Other programs |

441 |

|

Total increase/(decrease) in program expense since the 2016 Budget |

1,362 |

|

Interest on debt |

(506) |

|

Total expense changes since the 2016 Budget |

856 |

Overall, Ontario’s deficit for 2016–17 is projected to be $1.5 billion — an improvement of $2.8 billion compared with the 2016 Budget forecast.

Employee engagement and renewal of the public service

Employee engagement is an important determinant of an organization’s success. Engaged employees benefit both the OPS and the public through increased productivity, organizational commitment and retention of valuable knowledge and skills.

In March 2017, the employee engagement index score came in at 69.9, versus 67.8 in 2014. This increase can be attributed in part to the following initiatives implemented across government to support and strengthen the OPS as a positive and inclusive workplace:

- The OPS HR Plan 2015–2020

- OPS efforts to prevent discrimination and harassment

- OPS Anti-Racism Action Plan

- Healthy Workplace, Healthy Mind initiative to address stigma in the workplace

- Sexual Harassment Prevention Action Plan specific to the OPS; and

- Recommendations made by the Advisory Panel on Management and Non-Bargaining Staff Recruitment and Retention.

As part of the OPS’s commitment to increase employee productivity and engagement, employee engagement surveys will be administered annually, starting in 2018, with employee feedback incorporated in the development of innovative and responsive workplace policies that improve the employee experience in the workplace.

TBS will continue to work with partner ministries to implement the OPS Human Resource Plan to foster a high-performing public service that attracts and retains the best employees.

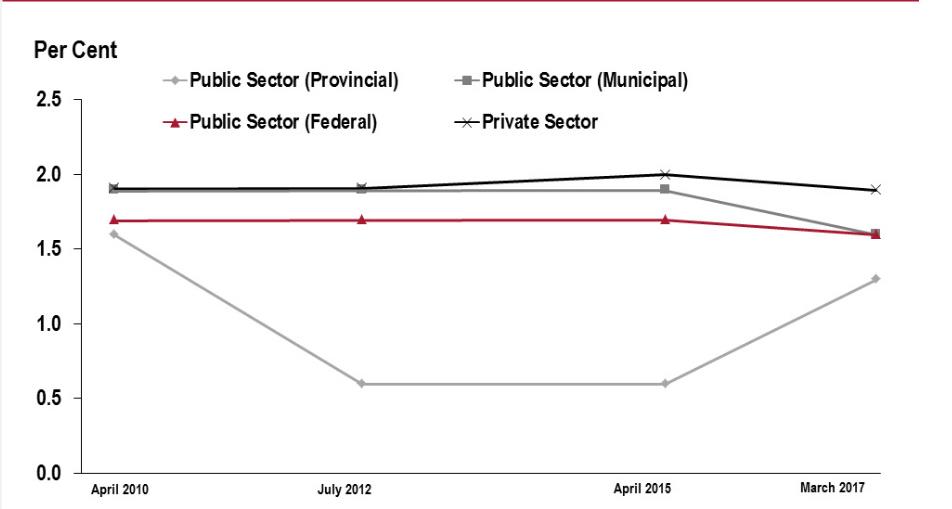

Managing compensation

TBS’s goal is to ensure that negotiated outcomes are consistent with the government’s transformation priorities and the Province’s fiscal plan.

The 2016 Budget stated that public-sector partners must work together to control current and future compensation costs in support of the government’s commitment to balancing the budget by 2017-18.

Between April 2015 to March 2017, wage outcomes in Ontario’s provincial public sector have continued to track below comparators. Since the 2016 Budget, the government has received an interest arbitration award for correctional staff represented by the Ontario Public Service Employees Union (OPSEU), an arbitration decision for the Ontario Provincial Police Association, and reached agreements with the Professional Engineers, Government of Ontario (PEGO) and the education sector, all of which are fair, reasonable and align with the fiscal plan.

Ontario public/private wage settlement trends

Notes: Based on agreements with over 150 employees, ratified between April 1, 2010 and March 27, 2017. April 2010 represents the start of the government’s compensation restraint mandate.

Improved Information and Information Technology (I&IT)

The government is committed to modernizing Information & Information Technology (I&IT) with reduced costs that support efficient and effective delivery of government programs and services.

To support this transformation, I&IT will implement numerous initiatives, which together are forecast to achieve annual savings and revenues of $100 million by 2020-21. The initiatives include:

- Better management of common contracts;

- Improved management of I&IT applications and infrastructure;

- Shared infrastructure services with the Broader Public Sector; and,

- Focused use of internal resources, focusing on where they are best served.

As of March 2017, the government realized over $17 million in annual savings by: working with software vendors and achieving reductions in contract costs, collaborating with the Broader Public Sector, and improving the management of I&IT applications and infrastructure.

Support an open, transparent and accountable government

Public Accounts of Ontario, a major accountability document for the Government of Ontario, presents the audited financial results of the province. IT is released within 180 days after March 31, the province’s fiscal year end, and includes financial highlights of the past fiscal year and reports on performance against the goals set out in the Ontario Budget.

In 2016-17, the Auditor General confirmed that the 2015-16 results were fairly stated in the 2015-2016 Public Accounts, but qualified her opinion, specifically in relation to pension accounting for the province’s jointly sponsored pension plans.

The government subsequently established an independent Pension Asset Expert Advisory Panel to further analyze and confirm the appropriate accounting policy for the Province’s jointly sponsored pension plans. The Panel concluded that the net assets for the jointly sponsored plans should be recognized on the Province’s financial statements for the following reasons:

- Recognizing the asset will provide a faithful representation of the province’s financial position.

- The accounting surplus in the plan has a future economic benefit.

- The government controls access to that accounting surplus.

- The accounting surplus exists as the result of past transactions and events.

- It would be misleading not to recognize the province’s share of the assets in Public Accounts.

The government has accepted the Panel’s advice and will prepare the 2016-2017 Public Accounts accordingly.

Quality assurance certification of internal audit by an external body signifies the independence, quality and professionalism of Ontario’s internal audit program. Internal audit has strengthened controllership, accountability frameworks and better practices across all ministries by effectively partnering with management to provide both assurance and advisory services in key risk areas. This model supports the continued achievement of the Institute of Internal Auditors quality assurance certification every five years. The Ontario Internal Audit Division (OIAD) was first certified in 2009 and recertified in 2014. The ministry’s goal is to be re-certified every five years. The next year for certification will be in 2019. In addition, the OIAD’s Forensic Investigation Team was certified in January 2016 by the International Standardization Organization for its investigative professional practices and standards.

Ontario’s Open Government Initiative is about creating a more open and transparent government for the people of Ontario. Ontario has made several advancements in 2016-17 towards the goal of becoming the most open, transparent and digitally- connected government in Canada.

- Agency mandate letters are made public within 30 days of ministry approval of an agency business plan.

- Ontario was selected to participate in the Open Government Partnership as a pioneer subnational government.

- Ontario’s Open Data Directive was implemented across all ministries and provincial agencies.

- Over 2,300 datasets are listed in Ontario’s data catalogue, and over 570 of these datasets have been made open to the public, including the visualization of Public Accounts data.

- The OPS has developed and pioneered a change lab method to sustain and model design thinking and the goals of Open Government.

- A dedicated Twitter channel, @OpenGovON, was launched to promote meaningful, two-way conversation and engage in open dialogue with the public and the open government community.

- The 2016 Public Sector Salary Disclosure compendium was released to the public as a downloadable, machine-readable format and as sortable, searchable data tables on Ontario.ca.

Ministry programs and activities

Treasury Board Secretariat is committed to innovation and to transforming processes, programs and services to help government function better.

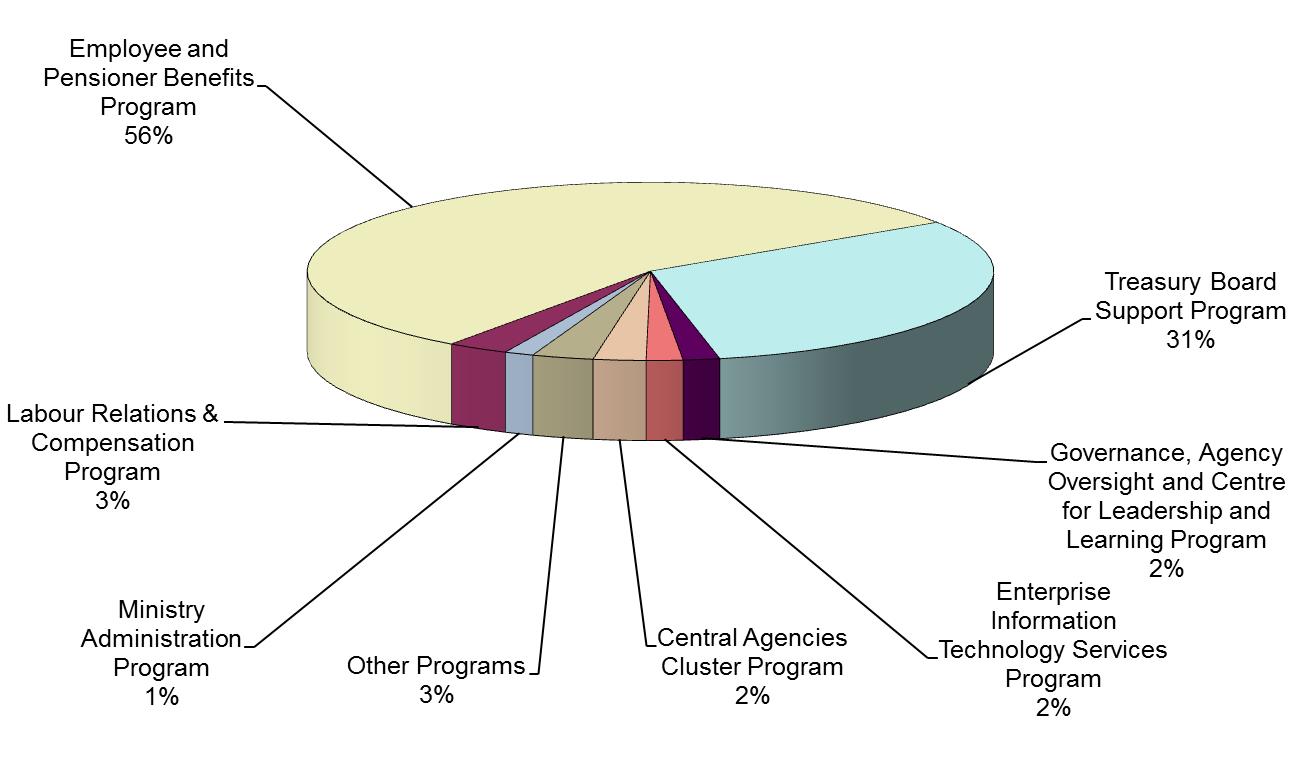

The Ministry Administration Program provides administrative and support services to enable the ministry to deliver results to support the government’s objectives and fiscal priorities. Its functions include financial and human resource management, and accommodations and facilities management. The program also provides legal and communications services, and planning and results monitoring. The program assists and supports ministry program areas in achieving their business goals.

The Labour Relations and Compensation Program supports the government’s commitment to positive labour relations within the Ontario Public Service (OPS) and Broader Public Sector (BPS).

The program represents the Crown as the employer in all collective bargaining and labour relations issues affecting the OPS, provides employee and labour relations advisory services, supports ongoing union-management relations, and manages corporate compensation strategies and programs.

The program analyzes internal and external factors that drive collective bargaining outcomes in the BPS to develop and provide evidence-based strategic guidance and advice to government, ministries and BPS employers related to ongoing collective bargaining and labour relations issues. The program also provides policy advice and support on government initiatives impacting executive compensation in the BPS.

The Employee and Pensioner Benefits (Employer Share) Program provides for the government’s expenses as an employer for insured benefits, statutory programs, non-insured benefits and certain public service pension plans, including third party administration and adjudication costs. The expenses are based on changes in the accrued liabilities of the government as sponsor or co-sponsor of certain insured benefit plans, pension plans and termination of employment entitlements.

The Treasury Board Support Program provides leadership and advisory services that support evidence-based decision making, prudent financial management, and transparent public reporting across the public sector in Ontario.

The program fosters accountability and fiscal integrity by providing expertise and advice on the development and implementation of fiscal, financial management, performance measurement and infrastructure frameworks. The program safeguards the appropriate use of public resources to meet government priorities by supporting Treasury Board/Management Board of Cabinet and providing advice on ministries' annual multi-year business, infrastructure, and Information Technology plans, the management of in-year expenditures, and the design of programs. In addition, the program assists the President of the Treasury Board, Deputy Minister and Secretary of the Treasury Board/Management Board of Cabinet, and the government with public reporting on plans and results through, for example, the Expenditure Estimates and the Public Accounts. The program also provides the Ontario Public Service and broader public sector with risk management, accounting, financial management policy, and controllership advice.

The Governance, Agency Oversight and Centre for Leadership and Learning Program provides leadership to ministries and provincial agencies through the delivery of strategic , evidence based, enterprise-wide policies, directives and advice designed to promote excellence in public service and enhance the oversight and accountability of provincial agencies.

The program includes the Open Government initiative to improve transparency, accountability and collaboration by giving Ontarians more opportunities to provide input into government decision-making, and by sharing more government data and information online with the public; and the Transfer Payment Administrative Modernization initiative to improve program outcomes by reducing the administrative burden on transfer payment recipients and the OPS and enabling more evidence-based decisions.

As an enterprise program supporting workforce strategies, the program also delivers services relating to recruitment and support of executives, learning and leadership development, talent management, internships, employee engagement strategies and workforce analytics; leads enterprise-wide human resource management policy; and researches and develops strategies to address current and emerging workforce trends.

The Audit Program provides objective assurance and consulting services to the ministries and key agencies of the Government of Ontario. IT provides audit services that support clients in meeting their business objectives by evaluating and making recommendations to improve governance, risk management, control, accountability and compliance processes and to improve the effectiveness, efficiency and economy of ministry and provincial agency operations

The Enterprise Information Technology Services Program provides leadership in establishing modern information and information technology (I&IT) in order to meet the needs of Ontarians and the Ontario Public Service. This includes formulating and implementing IT strategy, ensuring security of systems and data and the implementation of common infrastructure, governance and accountability. IT also includes the delivery of OPS-wide common services such as hosting services, service management and network capabilities.

The Central Agencies Cluster (CAC) Program provides leadership and cost-effective Information Technology (IT) support to its clients with the goal of improving the effectiveness of the government’s ability to deliver citizen-centred services. The Cluster develops and maintains the underlying IT solutions and services necessary to support a more modern, open, transparent and digitally connected government and helps its clients across the OPS to optimize the value of their services to taxpayers.

The Agencies, Boards and Commissions Program provides oversight to ensure effective governance, accountability, and relationship management.

The Conflict of Interest Commissioner has responsibility for certain conflict of interest and political activity matters as they apply to chairs and designated ethics executives of public bodies, and to certain employees of ministries and public bodies with respect to financial declarations. The Commissioner provides advice or determinations on specific conflict of interest or political activity matters, advises on financial declarations, approves conflict of interest rules submitted by public bodies and reviews and approves adjudicative tribunals’ ethics plans.

The Bulk Media Buy Program supports the purchase of media time for government marketing campaigns. Funding also covers associated agency fees, creative production costs, market research costs and the development of related marketing materials to support integrated campaigns associated with government initiatives. Paid government advertising is subject to the Government Advertising Act, 2004, and is reviewed and reported on by the Auditor General.

Table 1: ministry planned expenditures 2017-18 ($M)

|

Operating |

2,048.2 |

|

Capital |

111.6 |

|

Total |

2,159.8 |

* Other Programs include Bulk Media Buy, Conflict of Interest Commissioner and Audit Program

Highlights of 2016-17 achievements

Treasury Board Secretariat’s (TBS) vision is to lead transformation that builds better public services for the future of Ontario. Below are the highlights of TBS’s 2016-17 achievements. For more detail, see the Appendix: 2016-17 Annual Report.

Support the government in achieving its fiscal targets

- TBS leveraged and effectively managed Program Review, Renewal and Transformation (PRRT) and the in-year expenditure management process to support achievement of the government’s fiscal targets. The government is forecasting a deficit of $1.5 billion for 2016-17, the eighth year in a row that IT is projecting to beat its deficit target.

- The ministry worked with the Ministry of Finance to balance the budget. The 2017 Budget plan delivers on the government’s 2010 Budget commitment to restore balance in 2017-18. The Province is also projecting balanced budgets in both 2018-19 and 2019-20.

- TBS implemented initiatives to help accelerate government transformation, including use of behavioural insights science to pilot test new, human-centric approaches to improve outcomes and lower costs. Based on evidence from these pilots, effective solutions are scaled up. Transformation includes redesigning communications and access points to make programs and services easier to use.

Employee engagement and renewal of the public service

- TBS initiated the Public Service Renewal project with the goal of ensuring that the OPS workforce has the opportunities, skills, diversity, culture and leadership capacity to support innovation and deliver effective public services. More than 500 leaders/managers participated in engagements sessions in the last quarter of 2016-17.

- Through programs such as the Ontario Internship Program, OPS Internship Program for Internationally-Trained Individuals and the OPS Internship Program for Internationally-Trained Engineers, the ministry continued to attract top talent into OPS while building its diversity. These programs are contributing to the OPS human capital strategies and create a talent pipeline of future OPS leaders for the years ahead.

- The OPS Learn and Work co-op program placed 125 students in 2016-17 and had a program completion rate of 87 per cent.

- The Ontario Public Service launched a Respectful Workplace Policy that establishes a framework for preventing, identifying and effectively responding to all forms of workplace discrimination and harassment in the OPS, strengthening the focus on prevention and early intervention.

- The Ontario Public Service was recognized as one of Canada’s Top 100 Employers for 2017.

Managing compensation

- In May 2016, the government received an interest arbitration award for correctional staff represented by the Ontario Public Service Employees Union (OPSEU). This award provides modest wage increases that are offset through a freeze on salary grid progression.

- Similarly, the government received an arbitration decision for the Ontario Provincial Police Association, which provides outcomes below police‐sector norms.

- The government also reached a four‐year agreement with the Professional Engineers, Government of Ontario (PEGO) in which wage increases were offset through changes to benefits and termination pay.

- In February 2016, the government and the Ontario Medical Association took steps to re‐initiate negotiations of the Physician Services Agreement, beginning with negotiations of a process for binding interest arbitration. Re‐engagement will ensure that the government maintains a strong and productive relationship with physicians and will help enhance access, reduce wait times and improve the overall patient experience.

- The government successfully negotiated two‐year contracts in the education sector, which are set to expire in August 2019, and will continue to help achieve positive results for students and those who work in the sector. The contracts will help build upon the gains made in Ontario’s publicly-funded education system. These gains include the highest graduation rate in the province’s history, strong literacy results, and students who are equipped with the skills and knowledge they need today for tomorrow’s rapidly changing world.

Improved Information and Information Technology (I&IT)

- In 2016-17, the government achieved I&IT savings of over $17 million annually through negotiated reductions in contract rates, collaborating with the Broader Public Sector, and improving the management of IT applications and infrastructure.

- Information and Information Technology Service Management functions across the government were consolidated into a single organization. This will enable further efficiencies in service delivery.

Support an open, transparent and accountable government

- Significant progress has been made to make government more open and transparent, including; the implementation of Ontario’s Open Data Directive across all ministries and provincial agencies and listing over 2,300 datasets in Ontario’s data catalogue.

- Through the Transfer Payment Administration Modernization project, TBS facilitated standardized grants administration processes and an on-line, one-window common registration system for transfer payment recipients.

- TBS supported the development of the Ontario Budget, Expenditure Estimates and Economic Outlook and Fiscal Review.

- The Ministry released the OPS Enterprise Risk Management Framework which outlines an enterprise-wide approach to risk management, and the foundational components and strategic enablers to support its implementation across the Ontario Public Service and Provincial Agencies.

- Prepared the province’s Public Accounts including new data visualizations, a whiteboard video and more downloadable data sets in Ontario’s Open Data Catalogue.

- Launched a dedicated Twitter channel, @OpenGovON, to promote meaningful, two-way conversation and engage in open dialogue with the public and the open government community.

- Released the 2016 Public Sector Salary Disclosure compendium in a downloadable, machine-readable format and as sortable, searchable data tables on Ontario.ca.

Ministry organization chart

- President of the Treasury Board - The Honourable Elizabeth Sandals

- Group of 5 Chair positions:

- Chair, Public Service Commission

- Chair, OPSEU Pension Trust

- Chair, Ontario Public Service Pension Board

- Chair, Provincial Judges Pension Board

- Commissioner, Conflict of Interest

- Deputy Minister, Treasury Board Secretariat, Secretary of Treasury Board and Management Board of Cabinet – Helen Angus

- CIO, Central Agencies Cluster (CAC) – Ron Huxter (Dual reporting relationship between Corporate Chief I&IT Officer David Nicholl and Deputy Ministry Helen Angus)

- Legal Director – Len Hatzis (A)

- Communications Director – Sofie Di Muzio (A)

- Associate DM, Centre for Public Sector Labour Relations and Compensation - Reg Pearson

- ADM, Centre for Public Sector Labour Relations and Compensation - Marc Rondeau

- Associate DM, Office of the Treasury Board – Karen Hughes (Functionally interdependent with the Ministry of Finance [Budget Development])

- ADM, Capital Planning – Artur Arruda

- ADM, Planning and Expenditure Management – Maria Duran-Schneider

- ADM, Provincial Controller – Cindy Veinot

- ADM, Corporate Policy and Agency Coordination - Shawn Lawson - Shawn Lawson

- ADM & Internal Auditor, Internal Audit Division – Richard Kennedy (Functionally accountable to the Corporate Audit Committee)

- Corporate Chief I&IT Officer, Corporate Chief Information Office – David Nicholl

- CIO, Enterprise Service Management – Fred Pitt

- Executive Lead, Infrastructure Technology Services - Rocco Passero

- Cluster CIOs(Dual reporting relationship between Corporate Chief I&IT Officer David Nicholl and Ministry Deputy Ministers)

- Chief Talent Officer, Centre for Leadership & Learning - Diane McArthur

- ADM/CAO, Corporate Services Division – Melanie Fraser

- Group of 5 Chair positions:

Acts administered by the Treasury Board Secretariat

Adjudicative Tribunals Accountability, Governance and Appointments Act, 2009, S. O. 2009, c. 33, Sched. 5

Auditor General Act, R.S.O. 1990, c. A.35

Broader Public Sector Accountability Act, 2010, S.O. 2010, c. 25, in respect of sections 1-4, 7, 7.1-7.20, 9-13.2, 16, 19 and 21-23

Broader Public Sector Executive Compensation Act, 2014, S.O. 2014, c. 13, Sched. 1

Cabinet Ministers' and Opposition Leaders' Expenses Review and Accountability Act, 2002, S.O. 2002, c. 34, Sched. A

Crown Foundations Act, 1996, S.O. 1996, c. 22

Financial Administration Act, R.S.O. 1990, c. F.12, in respect of sections 1.0.1 to 1.0.10; and in respect of all other sections, except section 1.0.19 and Parts III and V, the administration of the Act is shared between the President of the Treasury Board and the Minister of Finance

Fiscal Transparency and Accountability Act, 2004, S.O. 2004, c. 27, in respect of section 10 and clause 15 (b), the administration of which is shared between the President of the Treasury Board and the Minister of Finance

Flag Act, R.S.O. 1990, c. F.20

Floral Emblem Act, R.S.O. 1990, c. F.21

Government Advertising Act, 2004, S.O. 2004, c. 20

Interim Appropriation for 2017-2018 Act, 2016, S.O. 2016, c. 37, Sched. 11

Lobbyists Registration Act, 1998, S.O. 1998, c. 27, Sched.

Management Board of Cabinet Act, R.S.O. 1990, c. M.1

Ministry of Government Services Act, R.S.O. 1990, c. M.25, in respect of services provided by the Treasury Board Secretariat

Ontario Provincial Police Collective Bargaining Act, 2006, S.O. 2006, c. 35, Sched. B

Ontario Public Service Employees' Union Pension Act, 1994, S.O. 1994, c. 17, Sched.

Public Sector Compensation Restraint to Protect Public Services Act, 2010, S.O. 2010, c. 1, Sched. 24

Public Sector Expenses Review Act, 2009, S.O. 2009, c. 20

Public Sector Salary Disclosure Act, 1996, S.O. 1996, c. 1, Sched. A

Public Service of Ontario Act, 2006, S.O. 2006, c. 35, Sched. A, except in respect of sections 21 to 27 and clause 31 (1) (b)

Public Service Pension Act, R.S.O. 1990, c. P.48

Agencies, boards and commissions (ABCs)

Case Management Masters Remuneration Commission

Commissioner: Vacant

Established by Order in Council. Conducts inquiries and makes non-binding recommendations to the President of the Treasury Board regarding the remuneration of Ontario Case Management Masters (provincially appointed judicial officers). The Commission’s report is submitted to the Lieutenant Governor in Council for a response.

Deputy Judges Remuneration Commission

Commissioner: William Kaplan

Established by Order in Council. Conducts inquiries and makes non-binding recommendations to the President of the Treasury Board regarding the remuneration of Deputy Judges. The Commission’s report is submitted to the Lieutenant Governor in Council for a response.

Justices of the Peace Remuneration Commission

Chair: Vacant

Established by regulation under the Justices of the Peace Act. Conducts inquiries and makes non-binding recommendations to the President of the Treasury Board regarding the remuneration of Ontario Justices of the Peace. The Commission’s report is submitted to the Lieutenant Governor in Council for a response.

Office of the Conflict of Interest Commissioner

Commissioner: Hon. Sidney B. Linden

Established under the Public Service of Ontario Act, 2006. Offers advice and makes determinations on specific conflict of interest, political activity and financial declaration matters related to in-service and post service obligations on Ontario’s public servants. Provides advice and direction to public bodies, upon request. Approves the conflict of interest rules of public bodies and approves the ethics plans of adjudicative tribunals. Serves as a resource for developing and sharing information and promoting awareness of the conflict of interest and political activity rules.

Ontario Public Service Employees’ Union Pension Plan Board of Trustees

Chair: Victoria (Vicki) Ringelberg

An independent Trust organization (not a provincial agency or a public body) established under a Joint Sponsorship Agreement between Ontario (represented by the President of the Treasury Board) and the members (represented by the OPSEU Executive Board) under the Ontario Public Service Employees’ Union Pension Act, 1994. Administers the OPSEU Pension Plan (adjudication and provision of pension benefits) and the OPSEU Pension Fund (investing assets).

Ontario Public Service Pension Board

Chair: Geraldine (Geri) Markvoort

A public body and Trust agency established under the Public Service Pension Act. Administers the Public Service Pension Plan (PSPP), including the investment of the Public Service Pension Fund and the adjudication and provision of benefits under the Plan. Also carries out administrative functions in relation to the Provincial Judges Pension Plan for the Provincial Judges Pension Board.

Provincial Judges Pension Board

Chair: Deborah Anne Oakley

A public body and Trust agency established by Ontario Regulation 67/92 made under the Courts of Justice Act. The Board is responsible for administering the pensions and survivor allowances for provincial judges and their survivors.

Provincial Judges Remuneration Commission

Chair: William Kaplan

Established under the Framework Agreement between Ontario and the Provincial Judges set out as a schedule to the Courts of Justice Act. Conducts inquiries and makes binding recommendations to the President of the Treasury Board regarding the salaries and benefits and non-binding recommendations regarding the pensions of Provincial Judges.

Public Service Commission

Chair: Angela Coke

Established under the Public Service of Ontario Act, 2006 (PSOA). IT replaced the Civil Service Commission that was established under the previous Public Service Act. Ensures the effective management and administration of human resources in relation to public servants appointed under Part III of PSOA. Ensures non-partisan recruitment and employment of public servants.

Agencies, boards and commissions - financial summary

>

| Agency Board or Commission | Classification | 2017-18 Estimates | 2016-17 Interim actuals | 2015-16 Actuals |

|---|---|---|---|---|

|

Case Management Masters Remuneration Commission |

Advisory |

- |

- |

175,651 |

|

Deputy Judges Remuneration Commission |

Advisory |

29,000 |

- |

- |

|

Justices of the Peace Remuneration Commission |

Advisory |

22,500 |

- |

34,752 |

|

Office of the Conflict of Interest Commissioner |

Regulatory |

857,500 |

884,143 |

826,957 |

|

Ontario Public Service Employees’ Union Pension Plan Board of Trustees |

- |

- |

- |

- |

|

Ontario Public Service Pension Board |

Trust |

125,000 |

85,546 |

117,929 |

|

Provincial Judges Pension Board |

Trust |

275,000 |

262,000 |

224,210 |

|

Provincial Judges Remuneration Commission |

Advisory |

30,000 |

- |

- |

|

Public Service Commission |

Regulatory |

- |

- |

- |

Note: For the provincial agencies above, excluding the Office of the Conflict of Interest Commissioner, the figures represent expenses incurred on behalf of these agencies by Treasury Board Secretariat. The amounts above do not represent these agencies' full allocations.

Detailed financial information

Table 2: combined operating and capital summary by vote

|

Vote/Program |

Estimates |

Change From |

Estimates |

Interim Actuals |

Actuals |

|

|---|---|---|---|---|---|---|

|

$ |

$ |

% |

$ |

$ |

$ |

|

|

Operating and capital expense |

||||||

|

Ministry Administration Program |

29,677,200 |

(724,100) |

(2.4%) |

30,401,300 |

26,546,259 |

27,526,920 |

|

Labour Relations & Compensation Program |

62,255,700 |

81,100 |

0.1% |

62,174,600 |

23,008,149 |

22,750,344 |

|

Employee and Pensioner Benefits Program |

925,538,000 |

(19,000,000) |

(2.0%) |

944,538,000 |

949,838,000 |

835,232,117 |

|

Treasury Board Support Program |

670,132,000 |

(583,185,500) |

(46.5%) |

1,253,317,500 |

80,194,991 |

41,977,033 |

|

Governance, Agency Oversight and Centre for Leadership and Learning Program |

37,001,200 |

3,877,500 |

11.7% |

33,123,700 |

34,349,459 |

32,070,065 |

|

Audit Program |

4,754,900 |

(487,500) |

(9.3%) |

5,242,400 |

5,275,403 |

4,865,238 |

|

Enterprise Information Technology Services Program |

37,101,000 |

(10,701,200) |

(22.4%) |

47,802,200 |

46,049,253 |

40,253,011 |

|

Central Agencies Cluster Program |

53,291,200 |

(1,510,500) |

(2.8%) |

54,801,700 |

53,084,600 |

49,715,691 |

|

Agencies, Boards and Commissions Program |

857,500 |

- |

- |

857,500 |

884,143 |

826,957 |

|

Bulk Media Buy Program |

56,681,500 |

31,681,500 |

- |

25,000,000 |

- |

- |

|

Total operating and capital expense to be voted |

1,877,290,200 |

(579,968,700) |

(23.6%) |

2,457,258,900 |

1,219,230,257 |

1,055,217,376 |

|

Statutory appropriations |

401,535,014 |

27,703,000 |

7.4% |

373,832,014 |

243,527,014 |

199,330,644 |

|

Total including consolidation & other adjustments |

2,278,825,214 |

(552,265,700) |

(19.5%) |

2,831,090,914 |

1,462,757,271 |

1,254,548,020 |

|

|

||||||

|

Consolidation & other adjustments |

||||||

|

Consolidation adjustment - employee and pensioner benefits |

(30,000,000) |

- |

- |

(30,000,000) |

(30,000,000) |

(46,600,922) |

|

Other adjustments - non-cash actuarial adjustment for pensions and retiree benefits |

(89,004,000) |

46,494,800 |

(34.3%) |

(135,498,800) |

- |

- |

|

Ministry total operating and capital including consolidation & other |

2,159,821,214 |

(505,770,900) |

(19.0%) |

2,665,592,114 |

1,432,757,271 |

1,207,947,098 |

|

|

||||||

|

Operating and capital assets |

||||||

|

Ministry Administration Program |

1,000 |

- |

- |

1,000 |

1,000 |

- |

|

Governance, Agency Oversight and Centre for Leadership and Learning Program |

- |

(4,308,200) |

(100.0%) |

4,308,200 |

3,249,167 |

- |

|

Enterprise Information Technology Services Program |

67,389,400 |

- |

- |

67,389,400 |

65,389,400 |

59,253,062 |

|

Central Agencies Cluster Program |

1,000 |

- |

- |

1,000 |

1,000 |

- |

|

Total operating and capital assets to be voted |

67,391,400 |

(4,308,200) |

(6.0%) |

71,699,600 |

68,640,567 |

59,253,062 |

|

Statutory appropriations |

||||||

|

Treasury Board Support Program |

1,000 |

- |

- |

1,000 |

1,000 |

702,451,636 |

|

Total statutory appropriations |

1,000 |

- |

- |

1,000 |

1,000 |

702,451,636 |

|

Total operating and capital assets |

67,392,400 |

(4,308,200) |

(6.0%) |

71,700,600 |

68,641,567 |

761,704,698 |

For additional financial information, see:

http://www.fin.gov.on.ca/english/budget/estimates/

http://www.fin.gov.on.ca/english/budget/paccts/

http://www.fin.gov.on.ca/en/budget/ontariobudgets/2017/

Appendix: 2016-17 annual report

2016-17 Achievements

Treasury Board Secretariat’s (TBS’s) mandate is to support the President of the Treasury Board and lead transformation that builds better public services for the future of Ontario. Its vision is:

During the past year, the ministry engaged in a number of activities to achieve its vision, including:

- Championing Program Review, Renewal and Transformation across the government in support of evidence-based decision making

- Rationalizing information and information technology services

- Creating efficiencies in the administration of transfer payments

- Managing compensation costs

Support the government in achieving its fiscal targets

TBS leveraged and effectively managed the Program Review, Renewal and Transformation (PRRT) and the in-year expenditure management process to support achievement of the government’s fiscal targets - for the 2016-17 fiscal year, the government is forecasting a deficit of $1.5 billion, the eighth year in a row that IT is projecting to beat its deficit target.

TBS worked collaboratively with the Ministry of Finance to balance the budget. The 2017 Budget Plan delivers on the government’s 2010 Budget commitment to restore balance in 2017-18. The Province is also projecting balanced budgets in both 2018-19 and 2019-20.

The ministry also implemented initiatives to help accelerate government transformation, leveraging the Behavioural Insights Unit to pilot test new, human-centric approaches to improve outcomes and lower costs — and use evidence to inform what does and doesn’t work — before scaling up, which includes redesigning communications and access points to make programs and services easier to use.

TBS worked with the Ministry of the Environment and Climate Change to integrate planning for the investment of proceeds from carbon allowances into the Program Review, Renewal and Transformation (PRRT) process.

Managing compensation

Over the past seven years, the government has been successful in moderating wage growth across the provincial public sector. Through a deliberate approach to managing compensation, the government met its fiscal commitments without compromising the quality of critical public services.

Wage outcomes in the provincial public sector continued to track below the municipal, federal and private sectors in Ontario.

Since the 2016 Budget, the government has reached a number of outcomes that are consistent with the fiscal plan:

- In May 2016, the government received an interest arbitration award for correctional staff represented by the Ontario Public Service Employees Union (OPSEU). This award provides modest wage increases that are offset through a freeze on salary grid progression.

- Similarly, the government received an arbitration decision for the Ontario Provincial Police Association, which provides outcomes below police‐sector norms.

- The government also reached a four‐year agreement with the Professional Engineers, Government of Ontario (PEGO) in which wage increases were offset through changes to benefits and termination pay.

- In February, the government and the Ontario Medical Association took steps to re‐initiate negotiations of the Physician Services Agreement, beginning with negotiations of a process for binding interest arbitration. Re‐engagement will ensure that the government maintains a strong and productive relationship with physicians and will help enhance access, reduce wait times and improve the overall patient experience.

- The government successfully negotiated two‐year contracts in the education sector, which are set to expire in August 2019, and will continue to help achieve positive results for students and those who work in the sector. The contracts will help build upon the gains made in Ontario’s publicly funded education system. These gains include the highest graduation rate in the province’s history, strong literacy results, and students who are equipped with the skills and knowledge they need today for tomorrow’s rapidly changing world.

The Ontario government continued work with sector-level partners to assist in identifying possible opportunities to support mutually beneficial bargaining outcomes that are consistent with Province’s fiscal plan.

TBS continues to support other ministries in an advisory capacity on labour relations matters including supporting the Ministry of Education on school board collective bargaining and the Ministry of Health and Long-Term Care to Community Care Access Centres and Ontario Medical Association (OMA) bargaining. TBS also continues to be actively engaged with the municipal police sector.

The Broader Public Sector (BPS) Executive Compensation Act allows the government to manage and control executive compensation in the BPS by establishing compensation programs. In 2015-16, TBS collected compensation information from all colleges and universities as well as several provincial agencies under the Act. This material informed compensation programs that balance sector-specific requirements with the need to prudently manage public funds. TBS continues to monitor the implementation of these programs, taking necessary action to ensure the responsible and transparent administration of executive compensation across the BPS.

Employee Engagement and renewal of the public service

TBS continued to implement the OPS Human Resources Plan for 2015-2020; this multi-year strategy provides the OPS with a roadmap to foster a high performing public service that attracts and retains the best employees and focuses on key priorities.

TBS worked across government focusing on the plan’s three priority areas:

- Fostering a positive and inclusive workplace culture;

- Developing engaged and innovative leaders;

- Implementing effective and fair HR practices.

Building on the OPS Human Resources Plan for 2015-2020, TBS initiated the Public Service Renewal project with the goal of ensuring the OPS workforce has the opportunities, skills, culture and leadership capacity to support innovation and deliver effective public services into the future. The Secretary of the Cabinet launched a discussion paper to engage staff and stakeholders in shaping the OPS of the future. More than 500 leaders/managers have participated in engagements sessions in the last quarter of 2016/17

TBS led the implementation of a new OPS-wide long-term compensation strategy to support our commitment to build the public service of the future. This strategy will support Ontario’s modernization of the public service and a culture of excellence.

As one of the province’s largest employers, the Ontario Public Service launched a Respectful Workplace Policy to establish a framework for preventing, identifying and effectively responding to all forms of workplace discrimination and harassment in the OPS; strengthening the focus on prevention and early intervention. TBS continued its efforts, in partnership with the Ministry of Government and Consumer Services to strengthen and enhance human resource policies and programs including ongoing development of tools and communications.

Through programs such as the Ontario Internship Program, OPS Internship Program for Internationally-Trained Individuals and the OPS Internship Program for Internationally-Trained Engineers, the ministry continued to attract top talent into OPS by valuing diversity. The programs are also contributing to the human capital strategies and are building a talent pipeline of future OPS leaders for the years ahead.

In 2016-17, these targeted programs attracted more than 170 new professionals into the OPS. The OPS Learn and Work Program is a leading example of how the OPS, as an employer, models corporate leadership. A specialized co-op program designed to re-engage high-school students from priority communities in Hamilton, Thunder Bay, Toronto and Windsor, the OPS Learn and Work Program provides youth with the opportunity to earn credits toward their high school diplomas and gain meaningful and paid work experience. In 2016-17, the Learn and Work Program placed 125 students and had a program completion rate of 87 percent.

In 2016-17, TBS launched the enterprise-wide employee survey to gather demographic data, employee engagement information and feedback on corporate initiatives. The survey was conducted online and introduced a self-serve electronic dashboard.

The OPS continued to be recognized as an employer of choice in 2016-17. The OPS was recognized as one of:

- Canada’s Top 100 Employers for 2017;

- Canada’s Best Diversity Employers for the ninth year in a row;

- Greater Toronto Area’s Top Employers for the ninth year in a row;

- Canada’s Top Employers for Canadians Over 40 for the fourth year;

- Canada’s Greenest Employers for the seventh year in a row; and,

- Canada’s Top Employers for Young People for the fifth year in a row.

Improved Information and Information Technology (I&IT)

The government is committed to modernizing Information & Information Technology (I&IT) with reduced costs that support efficient and effective delivery of government programs and services. To support this commitment, I&IT is implementing initiatives to achieve annual savings and revenues of $100 million by 2020-21. These initiatives include:

- Better management of common contracts;

- Improved management of IT applications and infrastructure;

- Shared infrastructure services with the Broader Public Sector; and,

- Focused use of internal resources, focusing on where they are best served.

Throughout 2016-17, the ministry continued to improve Information and Information Technology (I&IT) services while achieving cost savings. The government achieved I&IT savings of over $17 million annually through negotiated reductions in contract rates, collaborating with the Broader Public Sector, and increasing the efficiency of the management of IT applications and infrastructure.

In 2016, Information and Information Technology Service Management functions across the government were consolidated into Treasury Board Secretariat, to enable improved service delivery at a lower cost.

The ministry also undertook to lower the costs of information and information technology consulting services.

- Established market rate best practices to reduce rates of I&IT consultants and introduced early payment discounts.

- Implemented a Vendor Performance Management System, to ensure quality assurance and value for money of I&IT vendors and consultants.

- Converted operational consulting roles to full-time positions.

Support an open, transparent and accountable government

For the 2015-2016 Public Accounts, the government adopted a time‐limited regulatory amendment to reflect the Auditor General’s interpretation for the treatment of net pension assets for 2015–16 (the “Pension Adjustment”), and subsequently established an independent Pension Asset Expert Advisory Panel to further analyze and confirm the appropriate accounting policy for the Province’s jointly sponsored pension plans.

On February 13, 2017, the Panel released its report and recommendations related to the accounting for the Ontario Teachers' Pension Plan (OTPP) and the Ontario Public Service Employees Union Pension Plan (OPSEUPP), which concluded that the net assets for the jointly sponsored plans should be recognized on the Province’s financial statements under public sector accounting standards. The government has accepted the Panel’s advice, which will be reflected in the 2016–17 Public Accounts.

Consistent with the accounting policy the Province adopted in 2001 for jointly sponsored pension plans and the results of the Pension Asset Expert Advisory Panel, the Province’s 2016–2017 Public Accounts will report the net pension assets for the jointly sponsored pension plans, OTPP and OPSEUPP, in accordance with Public Sector Accounting Standards (PASA).

With the 2017 Budget, the government is reporting on the first investments to be tracked through a Designated Purpose Account, a new accountability framework created through the leadership of TBS. The Trillium Trust, along with the Greenhouse Gas Reduction Account, are the first two examples that use the new accountability framework to track and report on the progress of designated-purpose spending commitments based on identified revenue streams

In keeping with Ontario’s commitment to openness and transparency, the government released the salaries of Ontario Public Service and broader public sector employees who were paid $100,000 or more in 2016. The compendium was released in a downloadable, machine-readable format. The data is also available in sortable, searchable tables on Ontario.ca, making IT more accessible to the public. The Public Sector Salary Disclosure Act requires most organizations that receive public funding from Ontario to disclose annually the names, positions, salaries and total taxable benefits of employees paid $100,000 or more in a calendar year.

TBS supported the development of the Ontario Budget, Printed Estimates and Economic Outlook and Fiscal Review. The ministry is also responsible for preparing and releasing Ontario’s Public Accounts, Annual Financial Report and Consolidated Financial Statements of the Province.

The ministry provided audit assurance and advisory services to ministries and provincial agencies and participated in key enterprise-wide initiatives to support transformation and strong fiscal management. These services have helped to strengthen risk management, controllership, effectiveness, transfer payment accountability and agency governance.

TBS continues to make significant progress in making government more open, transparent and digitally connected. Achievements include:

- Agency mandate letters are made public within 30 days of ministry approval of an agency business plan.

- Ontario was selected to participate in the Open Government Partnership as a pioneer subnational government ;

- Ontario’s Open Data Directive was implemented across all ministries and provincial agencies ;

- Over 2,300 datasets are listed in Ontario’s data catalogue, and over 570 of these datasets have been made open to the public, including the visualization of Public Accounts data.

- The OPS has developed and pioneered a change lab method to sustain and model design thinking and the goals of Open Government.

- A dedicated Twitter channel, @OpenGovON, was launched to promote meaningful, two-way conversation and engage in open dialogue with the public and the open government community.

For 2016-17 TBS continued its work on the Transfer Payment Administrative Modernization project to standardize the grants administration process and help reduce the burden for transfer payment recipients.

As part of this initiative, TBS introduced an online, one-window common registration system for transfer payment recipients, as well as enhanced internal reporting capabilities to improve insight and oversight of the financial relationships between transfer payment recipient organizations and the Province.

The Conflict of Interest Commissioner continued to deliver ethics executive orientation sessions for newly appointed or re-appointed chairs of public bodies and other designated ethics executives as part of conflict of interest education, outreach and capacity building. In addition, new this year, the Conflict of Interest Commissioner co-hosted a conference on public sector ethics in September 2016. The conference brought together ethics practitioners from across Canada, academics, lawyers, public body chairs and senior executives to share ideas and best practices, expand networks and identity potential solutions to common challenges. Two publications were produced as a result of the conference. This work supports ethics training, good governance and accountability.

Table 3: ministry interim actual expenditures 2016-17

|

Interim actual |

|

|---|---|

|

Operating |

1,421.5 |

|

Capital |

11.3 |

|

Staff strength |

2729.1 |

Footnotes

- footnote[1] Back to paragraph Expense change by sector, restated for fiscally neutral transfers of programs between sectors.

- footnote[2] Back to paragraph Excludes Teachers’ Pension Plan. Teachers’ Pension Plan expense is included in Other Programs.

- footnote[3] Back to paragraph Amounts do not include legal services costs recoverable from the Ministry of the Attorney General.

- footnote[4] Back to paragraph Represents the full allocation of the Office of the Conflict of Interest Commissioner. Appears as its own vote item in the TBS Expenditure Estimates.

- footnote[5] Back to paragraph Estimates, Interim Actuals and Actuals for prior fiscal years are re-stated to reflect any changes in ministry organization and/or program structure. Interim actuals reflect the numbers presented in the 2017 Ontario Budget.

- footnote[6] Back to paragraph Interim actuals reflect the numbers presented in the 2017 Ontario Budget.

- footnote[7] Back to paragraph Ontario Public Service full-time equivalent positions..