The content on this page is no longer up to date. It will remain on ontario.ca for a limited time before it moves to the Archives of Ontario.

Changes on the horizon

Distribution and grid modernization

Innovation and changes in customer behaviour are encouraging the spread of new energy technologies. Energy storage, smart homes, microgrids, distributed energy resources, electric vehicles, and the increasing electrification of transit and transportation will change the way utilities interact with how their customers manage their systems.

For most electricity customers, local distribution companies (LDCs) are the face of Ontario’s electricity system, the enterprises that bring power to their door. LDCs are continuing to invest to update their assets to maintain reliable service to their customers. LDCs must balance the need to provide the expected level of service to customers with the ever-pressing need to limit cost increases. They will also need to incorporate innovative approaches to manage the core demands of their businesses. This includes meeting their customers' needs, managing their costs, maintaining and modernizing their assets, and leveraging the opportunities presented by new technologies and new business models.

LDCs are using new smart grid technologies to combine their old and new assets to build a modern, intelligent distribution system for Ontario. The modernization of the grid gives energy consumers access to new technologies that will improve their understanding and control of their energy consumption and even allow them to generate their own electricity. Greater adoption of electric vehicles and storage technologies will also have a significant impact on how Ontarians use electricity. These changes all require a modern distribution system.

Ontario used the Smart Grid Fund, as well as the IESO's Conservation and LDC Innovation Funds, to help LDCs explore new technologies that can contribute to a modern and efficient grid. But some LDCs may face challenges with the nature and pace of the expected changes. The Smart Grid Assessment and Roadmap report identified a number of barriers that prevent LDCs from achieving a fully modernized grid.

Ontario needs to create conditions in the distribution sector that are conducive to grid modernization and provide, at the same time, incentives for efficiencies, productivity gains and optimal levels of reliability. Ontario’s policy and regulatory frameworks should promote cost-effective improvements to the quality, reliability and efficiency of distribution service, as well as more opportunities for conservation and reducing peak demand. They also need to allow for enough flexibility in the LDCs' business models, so distributors can respond more effectively to increased efficiencies presented by emerging technologies.

Natural gas expansion

Access to natural gas especially helps smaller communities in Ontario. It can stimulate their economies by attracting new industry and providing less-costly energy to consumers. Natural gas can also make commercial transportation more affordable, and allow agricultural producers to use less-costly natural gas to dry their crops and heat their buildings.

In the 2013 LTEP, Ontario committed to working with natural gas distributors and municipalities to pursue options for expanding natural gas pipelines to more communities in rural and northern Ontario. These commitments were reinforced in the most recent Ontario Budget when the government announced it would offer loans and grants to help communities work with their utilities to acquire natural gas service.

With support from the Ministries of Energy; Agriculture, Food and Rural Affairs; and Infrastructure; the Ontario government is establishing two programs:

- A $200 million Natural Gas Access Loan program to help communities work with utilities to get access to natural gas; and

- A $30 million Natural Gas Economic Development Grant to accelerate projects that have a clear potential for economic development.

In June 2016, the OEB reviewed how it can facilitate the expansion of natural gas pipelines in the province. The OEB held hearings and received numerous submissions from interested parties. Its decision is expected in the early fall of 2016.

For consideration

- What are the significant challenges facing utilities and what can the government do to meet them?

- What are the most important benefits of a modern grid? Increased reliability? Greater information on your energy usage?

- What additional policies should the government consider to expand access to natural gas?

Microgrids

There is an interesting opportunity for microgrid technologies, brought on by a convergence between innovation, renewable generation, and new economic opportunities. Ontario is a big province with many rural and remote communities. These have traditionally been connected to single power lines, sometimes over long distances, which can affect the reliability of their supply. Other communities are not connected at all and rely on diesel generation. In both circumstances, an advanced microgrid may be a solution. Ontario is establishing itself as a leading innovator with this technology.

A microgrid, as the name suggests, is a miniature version of the main grid. It is a network that takes electricity generated from sources such as solar panels or a combined heat and power plant and distributes it to local users in houses, schools or offices. It can also be thought of as an "island" within the larger grid, but an "island" that responds to the larger system. In the event of a widespread outage, the microgrid has the potential to isolate itself and continue to produce power. This is critical for users such as a hospital campus, where resiliency and reliability are vital.

It is expected that innovation and the technical expertise gained from commercial scale demonstrations will drive a decline in the cost of microgrids. The Ministry of Energy is learning a great deal from the successful pilot projects its Smart Grid Fund has supported. Microgrids may already make sense in remote communities that rely on expensive and dirty diesel fuel to generate their electricity. In these communities, microgrids could use renewable energy to offset the use of diesel generators. They could also improve the reliability of supply in these isolated areas. While the government’s priority is to connect as many of these communities as possible to the transmission system, there may be complementary opportunities to use microgrids, particularly in the ones that cannot be connected at this time.

For consideration

- What are the best uses of microgrids in Ontario?

- Are there any barriers preventing the use of microgrids?

Transmission

Electricity transmission

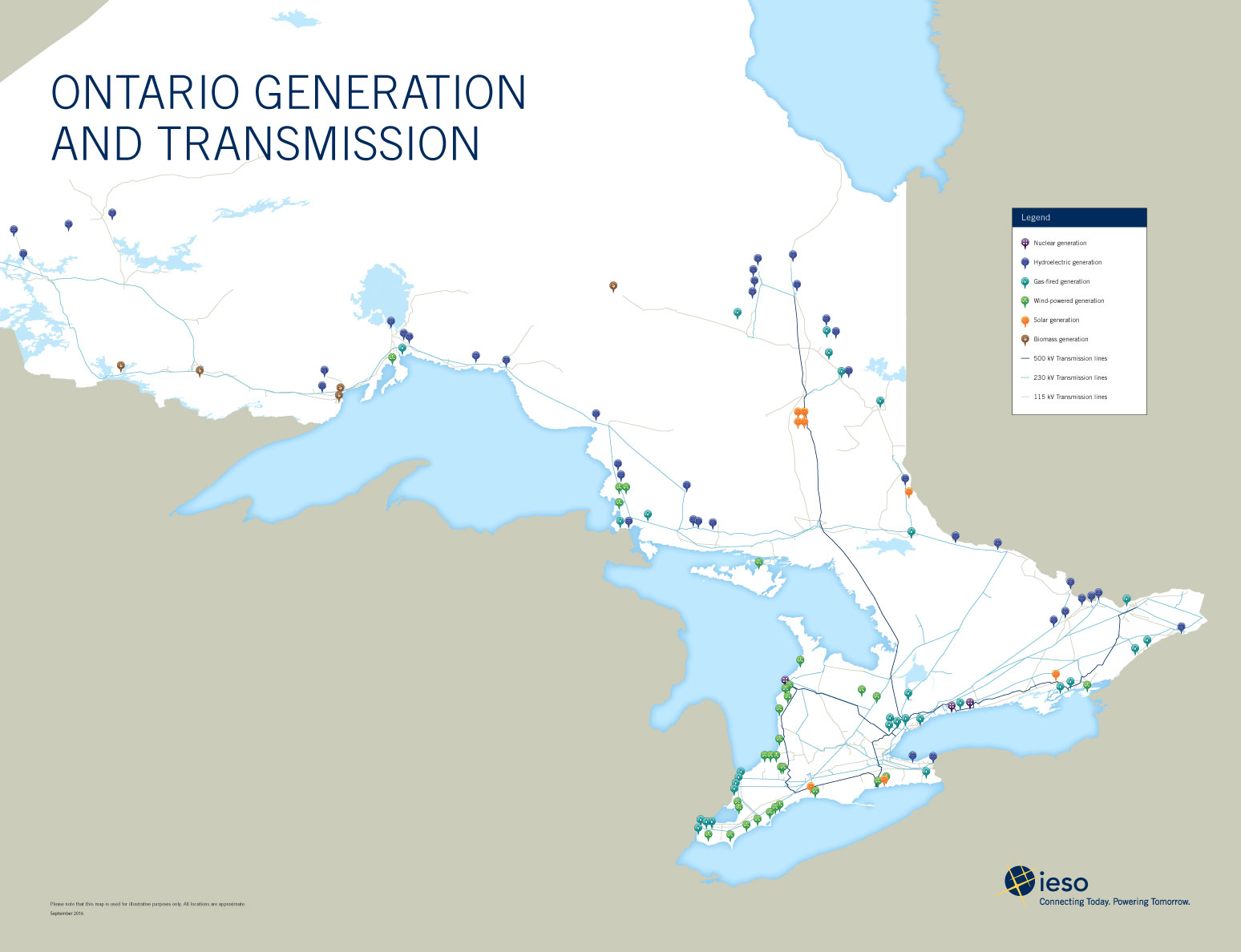

Ontario’s electricity transmission system is a network of high-voltage electricity wires that form the backbone of Ontario’s electricity grid. Most of it is owned and operated by Hydro One. Approximately $15 billion has been invested since 2003 to enhance and renew Hydro One’s systems. This includes upgrades to over 15,000 kilometres of transmission and lower-voltage distribution lines. As a result, Ontario’s residents and businesses have reliable access to clean electricity.

Map 1: Ontario’s transmission grid (Source: Ontario Energy Report Q2 2016)

The 2010 and 2013 Long-Term Energy Plans identified a number of priority projects for electricity transmission improvements in Northwestern Ontario:

- A Northwest Bulk Transmission Line to increase the supply and reliability of electricity to the area west of Thunder Bay;

- An East-West Tie line to reinforce the network between Wawa and Thunder Bay; and

- The connection of remote northwestern First Nation communities to the electricity grid, including a new line to Pickle Lake to support these connections.

Proponents are moving ahead on planning and implementing these projects, and are seeking the necessary regulatory approvals.

The existing electricity transmission system, including the projects already underway, is expected to be sufficient to meet current levels of electricity demand. Even so, transmitters will need to replace aging transmission equipment. This presents them with an opportunity to continually improve the system’s efficiency.

In outlooks with high demand, (Outlooks C&D in the IESO's OPO), electrification would require significant growth in Ontario’s electricity supply, and new sources of generation would also be needed. Additional investments in transmission would in turn be needed to connect the generation to users. For instance, the development of large scale hydroelectric projects in northern Ontario would require major transmission investments to connect the new generation to the grid, and reinforce the network to accommodate greater volumes of electricity flow. These would be system costs shared by the electricity ratepayers.

In a different scenario from the one above, if a specific customer requires a transmission upgrade to meet its own need, such as providing supply for new industrial plant, the cost of this upgrade must be paid for by that customer. Ontario currently applies a "user pay" principle to ensure the direct beneficiary picks up the costs and not the other ratepayers. By the same principle, transmission lines are not expanded to attract new customers.

Pipelines

The 2013 LTEP set out six principles Ontario would use to evaluate oil and natural gas pipelines, such as TransCanada’s Energy East project: The principles state that:

- Pipelines must meet the highest available technical standards for public safety and environmental protection;

- Pipelines must have world-leading contingency planning and emergency response programs;

- Proponents and governments must fulfill their duty to consult obligations with Indigenous communities;

- Local municipalities must be consulted;

- Projects should provide demonstrable economic benefits and opportunities to the people of Ontario, over both the short and long term; and

- Economic and environmental risks and responsibilities, including remediation, should be borne exclusively by the pipeline companies, who must also provide financial assurance demonstrating their capability to respond to leaks and spills.

Ontario and Quebec jointly adopted these six principles in November 2014, and added the need to take GHGs into account, as well as the interests of natural gas consumers.

In 2015, the OEB undertook province-wide public consultations on how to ensure there is an appropriate balance for Ontarians between the benefits and risks associated with Energy East. The OEB's report, Giving a Voice to Ontarians on Energy East, will help shape Ontario’s participation in the National Energy Board hearings on whether to approve the project.

The Ontario government is committed to ensuring that Energy East is in the best interest of Ontarians. This includes protecting the environment and the safety of the people of Ontario, maintaining the reliability of the province’s natural gas supply, and guaranteeing future economic benefits for the province.

For consideration

- How can Ontario continue to strengthen reliability of the transmission system in all regions of the province?

- Is the current "user pay" model an effective way to meet Ontario’s needs? Does it appropriately balance the goals of economic development and protecting taxpayers?

- Will Ontario’s pipeline principles protect the best interests of Ontarians and allow for informed participation in the National Energy Board’s review of the Energy East project? What considerations should be taken into account?

Storage

Like smart grid, energy storage is a term that captures a range of technologies, each with their own unique functions and abilities. The potential of energy storage has captured worldwide interest, particularly with the global push to use cleaner sources of energy like solar and wind. However, the simplicity of the concept conceals the true complexity of integrating energy storage into the grid.

This is where Ontario stands out as an innovator. The 2013 LTEP committed the province to procuring 50 MW of energy storage to learn how energy storage works in real-world applications. Over the next two years these projects – covering a full range of technologies and services – will come online and demonstrate the true potential of energy storage as a game-changing energy resource.

Ontario’s interest in storage does not end there. Several projects funded by the Smart Grid Fund test the use of energy storage in different scenarios and in combination with other complementary technologies. This will balance our knowledge about how storage at the high-voltage transmission level can serve the Ontario grid by helping local utilities and storage companies to test their devices on distribution grids.

The IESO released a report on energy storage earlier this year that outlines what has been learned to date, and identifies where storage has potential to solve bulk system issues. To compliment the IESO, the Ministry of Energy will publish am independent study this fall on the value of storage at the distribution level.

Storage is already being used to meet the seasonal demand for fuels used to heat homes and businesses. For natural gas, Ontario uses the Dawn Hub underground storage near Sarnia in southwestern Ontario to manage seasonal demand. The Dawn Hub does this by storing gas during the summer and providing it during the winter. The Dawn Hub is one the largest storage facilities in North America and is used to manage the demand for natural gas in Ontario, Quebec and the eastern U.S. The Sarnia-area also has storage facilities for propane and other natural gas liquids.

Since natural gas is also used to generate electricity, the storage facilities in Ontario can also be used to supply generators during periods of high electricity demand.

For consideration

- Would you be willing to participate in a program where your utility could use your home storage device from time to time to operate a more reliable electricity distribution system?

- What role do you foresee for natural gas to supplement and complement the province’s existing electricity storage options?

- How can Ontario further support innovative energy storage technologies that leverage our existing natural gas infrastructure assets and take advantage of our clean electricity system?

Innovation and economic growth

Ontario has made innovation in energy technology a priority. By encouraging innovation in our energy sector, Ontario has created opportunities for jobs and growth and kept pace with a changing energy environment. It has done this by supporting organizations such as the Advanced Energy Centre, whose mission is to encourage the adoption of new energy skills and technologies in Ontario and Canada, and export them internationally.

Ontario’s resolve to pursue energy innovation has led to the development and implementation of new technologies across the province. The Smart Grid Fund has established Ontario as an energy innovation leader, supporting 26 unique projects that are helping Ontario companies to grow. Another round of funding is nearly complete, which will continue to encourage a culture of innovation within the distribution sector, and further the adoption of many new technologies like energy storage and electric vehicles.

The government is also committed to cultivating a dynamic and innovative business climate in Ontario. Accordingly, it is actively exploring opportunities to push beyond our borders and share Ontario’s energy expertise abroad. The growing expertise in smart grid, energy efficiency, renewable, energy storage and energy innovation is expected to be an important export industry for Ontario. The Ministry is working with companies to develop and support trade initiatives that will strengthen international relationships and create new business opportunities. That way, our energy sector can use its growing expertise in energy innovation for the benefit of all Ontarians.

Another key priority for Ontario is to de-carbonize the province’s economy. The focus on reducing GHG emissions will affect the selection and consumption of fuels within the province. It is anticipated there will be a transition from conventional fossil fuels to lower-carbon alternatives. Initiatives under the current and future Climate Change Action Plans could accelerate this transition by spurring innovation and rewarding efficiency.

RNG is one example of a low carbon alternative with potential. RNG (also known as bio-methane) is methane derived from organic sources, such as landfill gas, agricultural residues and wastes from food and beverage manufacturing. Since RNG is produced from renewable resources, it is a carbon-neutral fuel. Once RNG is processed to remove impurities, it can be mixed in with conventional natural gas and use the same pipelines and equipment. Ontario’s Climate Change Action Plan proposes to require that natural gas contain renewable content. This will likely expand the supply and use of RNG.

Existing regulations in Ontario already require the use of ethanol and bio-based diesel in the transportation sector. Most ethanol currently used in Ontario is produced from corn. The use of alternative feedstock such as crop and wood residues, dedicated energy crops, and industrial wastes would reduce the GHG emissions that come from corn-based ethanol. Despite decades of research and development, these alternative sources of ethanol currently have little commercial viability.

The challenge will be how this transition in fuels is managed. The fuels sector in Ontario is owned and operated by commercial interests who meet the differing energy needs of the province’s residential, commercial, industrial and transportation sectors. Ontario will need to balance the goal of reducing GHG emissions and its effect on overall economic activity.

There are low-carbon technologies that are feasible today, or are expected to become more feasible over time. These alternative technologies will require policy changes and the removal of regulatory barriers before their widespread adoption. Additional barriers could include economies of scale and lack of infrastructure. The associated costs and benefits will also have to be carefully considered.

For consideration

- Which innovations offer the greatest benefit to your community and the energy system as a whole?

- How should the public and private sectors cooperate to encourage innovation in the energy section?

- What actions could the government take to support the adoption of alternative fuels?

Conservation and energy efficiency

In the 2013 LTEP, the government adopted a policy of putting Conservation First before building new energy infrastructure, wherever cost effective. Conservation is the cleanest and most cost-effective energy resource. It also offers households and businesses a way to manage their energy bills and reduces the need to build new energy infrastructure.

Significant progress was made by setting new and enhanced efficiency standards for products and appliances, establishing conservation frameworks for electricity and natural gas distributors, and consulting on additional government-led initiatives. Between 2005 and 2014, Ontarians conserved:

- 9.9 TWh of electricity supply - enough to power the cities of Ottawa and Windsor in 2014;

- 3,628 MW of peak demand - equal to more than the combined peak demands of Mississauga, Brampton and Ottawa in 2014; and

- 1,880 million cubic meters of natural gas from conservation programs alone – equivalent to the natural gas used annually by 817,000 homes.

Conservation and energy efficiency require a sustained commitment to achieve persistent savings over the long-term. Ontario has been setting energy efficiency standards for products and appliances for over 25 years, the first jurisdiction in Canada to do so. Since 2012, the province has set new or improved efficiency standards for over three-quarters of the more than 80 products and appliances it regulates. New and enhanced efficiency standards help reduce consumers' energy bills, increase the choice of energy efficient products available for sale, and play a significant role in reducing energy consumption and GHG emissions.

Ontario launched the 2015-2020 Demand Side Management Framework for natural gas in 2014, followed by the 2015-2020 Conservation First Framework for electricity in 2015. The new frameworks provide the rules, guidelines and funding that govern the delivery of conservation programs for electricity and natural gas energy efficiency programs in the province. Both frameworks give distributors the flexibility to meet local needs and require programs to be cost-effective to ensure value for money.

Here are two examples of the rebates and support that electricity and natural gas distributors offer households and businesses to improve their energy efficiency:

- Home audit and retrofit programs from Enbridge Gas Distribution and Union Gas provide rebates to homeowners for energy audits and energy efficient retrofits such as insulation, furnaces and water heaters, windows and doors; and

- The Small Business Lighting program provided by LDCs gives small businesses free assessments of their lighting and incentives towards upgrading to energy efficient lighting.

In response to direction from the Minister of Energy issued in March 2014, the IESO has successfully changed its demand response programs to a new market-based approach. In the first auction, about 400 MW were procured for 2016-2017. The next auction will take place in December 2016. Demand response can reduce the need to build costly generating facilities by reducing electricity usage during the hours of highest demand, typically on a hot summer day. Demand response can also reduce GHG emissions, as the plants that provide peaking power use natural gas to generate electricity.

Customer access to energy and water data can facilitate the tools and information needed to help households and businesses make informed decisions about their consumption. After completing a cost-benefit analysis, the Ministry consulted with a broad range of stakeholders earlier this year on a proposal to require the implementation of Green Button. Green Button enables households and businesses to electronically access and share their electricity, natural gas and water usage data in a standardized and secure way. They can then use software applications to view and better manage their usage, bills and GHGs. The 2013 LTEP promoted Green Button as a way to give consumers access to their electricity consumption data. In addition, the Climate Change Action Plan committed to expanding Green Button province-wide to help households and businesses manage and conserve energy and water use. The Ministry is reviewing comments received from stakeholders as it develops a proposal for implementing Green Button.

Government-owned facilities and broader public sector organizations in Ontario are already demonstrating leadership by annually reporting their energy consumption and GHG emissions. Organizations in the broader public sector are also required to publish conservation and demand management plans every five years.

To expand on the success of this initiative, the Ministry is proposing to extend reporting and benchmarking of energy and water use to commercial, multi-residential and some industrial buildings that are 50,000 or more square feet. It will also help building owners manage energy and water use and costs and allow a value to be put on the energy efficiency of buildings.

Using energy efficiency and low-carbon technologies to fight climate change

While acknowledging the success of the province’s conservation and energy efficiency programs, the Climate Change Action Plan committed the government to bolder action to achieve its GHG reduction targets.

The IESO and the OEB recently completed studies on the cost-effective savings in electricity and natural gas that can be achieved in Ontario. They show that:

- Ontario’s electricity conservation target of 30 TWh in 2032 is aggressive and that there is limited potential to achieve cost-effective conservation beyond this target; and

- There is significant potential beyond current levels of activity for cost-effective conservation of natural gas.

The province is investing $100 million as part of its Climate Change Strategy to enhance the existing home energy audits and retrofit programs offered by Enbridge Gas Distribution and Union Gas. Homeowners across Ontario who heat their homes with natural gas, oil, propane or wood can apply for rebates towards home energy audits and energy efficiency retrofits. This investment is expected to enable audits and retrofits of approximately 37,000 homes across the province and save approximately 1.6 Mt of GHG emissions.

The Climate Change Action Plan also committed the government to develop a program that would provide mandatory free energy audits before the sale of a home. Energy audits would be required before a new or existing single-family home could be listed for sale, and the home’s energy rating would be included in the real estate listing. The evaluation of a home’s energy performance is useful information for comparing the energy efficiency of properties and encouraging improvements to energy efficiency and reductions in GHG emissions. Sellers can use the audit to focus on where to make cost-effective energy improvements and buyers can use the audit when considering retrofits to increase energy efficiency. The province proposes to introduce the program by 2019.

There are low-carbon technologies that are feasible today, or are expected to become more feasible over time. These alternative technologies will require policy changes and the removal of regulatory barriers before widespread adoption. Additional barriers could include economies of scale and a lack of infrastructure. The associated costs and benefits will also have to be carefully considered.

Ontario’s Climate Change Action Plan points to a need to increase the use of low-carbon technology in Ontario homes and businesses, such as solar, battery storage, advanced insulation, and heat pumps. A number of programs funded by the proceeds from the cap and trade program will also be introduced to increase the choices that Ontarians have to use energy wisely.

For consideration

- Should Ontario set provincial conservation targets for other fuel types such as natural gas, oil and propane?

- To meet the province’s climate change objectives, how can existing or new conservation and energy efficiency programs be enhanced in the near and longer term?

- How can we continue to inform and engage energy consumers?

Clean energy supply

Renewables

Ontario has approximately 18,000 MW of wind, solar, bioenergy and hydroelectricity on-line or under contract and in development. This is helping offset our reliance on fossil fuels and reduce Ontario’s GHGs.

The success of the Feed-In Tariff (FIT) and microfit programs, and the competitive Large Renewable Procurement, have made the province one of the North American leaders in the development and use of renewable energy and the manufacturing of renewable energy technology. The 30 solar and wind manufacturers currently operating in the province have made Ontario home to the fastest-growing clean-tech sector in Canada.

Ontario firms are now poised to challenge foreign competition and export their products and expertise just as other jurisdictions accelerate their efforts to procure clean energy technologies following the 2015 United Nations Climate Change Conference in Paris (COP21).

This is not the only change in the renewable energy landscape. The Ministry of Energy is also implementing an updated and streamlined net metering program. This billing arrangement allows customers to generate renewable energy on-site for their own use, and then receive credits on their bill for any surplus electricity sent to the grid. In anticipation of a future with more distributed energy, the updated net metering regulation would support renewable energy developments that are better integrated into the electricity system.

In August 2016, the Ministry of Energy proposed updates to the existing net metering regulation and posted it on the Environmental and Regulatory Registries for public comment.

As the electricity system accommodates more distributed energy, renewable energy projects will find new opportunities to respond to the system’s changing needs. The Net Metering program would also support the construction of near-net zero and net-zero buildings, a key element of Ontario’s Climate Change Action Plan.

Nuclear

The Darlington, Pickering and Bruce nuclear generating stations currently provide about 60% of Ontario’s electricity. Nuclear generation is important because it is reliable, cost-effective and GHG-free. Nuclear power plants are also able to operate safely, reliably and continuously, making them ideally suited for meeting around-the-clock "baseload" energy needs, the basic demand that is always present in the system. There are currently 18 units operating at the three sites in Ontario, with a combined capacity of about 13,000 MW. Two units at Pickering have been shut down and are being decommissioned. Ontario has safely operated nuclear power plants for over 40 years.

The government supports nuclear power and is committed to its continued operation in Ontario. As laid out in the 2013 LTEP, Ontario is moving forward with plans to refurbish four units at Darlington and six units at Bruce between 2016 and 2033. Together with the two already refurbished units at Bruce, these investments will ensure Ontario has over 9,800 MW of affordable, reliable and GHG-free baseload generation. This, in turn, will help the province meet the GHG-reduction targets set by Ontario’s Climate Change Action Plan.

Ontario Power Generation will begin refurbishing the first of the Darlington units in October 2016. The first Bruce unit will start being refurbished in 2020. Ontario is proceeding cautiously and has built flexibility into the planning of both of these projects:

- Both Ontario Power Generation and Bruce Power will be subject to strict oversight.

- The government has off-ramps to ensure the work is only carried out if it continues to provide value to ratepayers; and

- Ontario also has the option of stopping the work if it expects that disruptive changes in technology or the province’s energy system will cause low demand for electricity over a sustained period of time.

Ontario Power Generation is also seeking regulatory approvals to allow it to operate the Pickering station until 2024. After that, it will be shut down and decommissioned. Keeping Pickering running until 2024 will ensure the province has a reliable source of GHG-free baseload electricity to carry it through the refurbishment of the Darlington and the initial Bruce units.

The nuclear industry is made up of over 180 companies and is an important driver of Ontario’s economy, employing about 60,000 people and generating billions of dollars in economic activity every year. Nuclear companies and research laboratories in communities across Ontario have expertise in the design and construction of sophisticated systems and components for current and future reactors. In addition to being used in all of Ontario’s nuclear plants, the Ontario-developed CANDU nuclear technology was exported to Argentina, Romania, South Korea, China, Pakistan and India. The Darlington and Bruce refurbishments will support Ontario’s globally-recognized nuclear industry for decades to come.

Clean electricity trade

The 2013 LTEP committed the government to seeking out agreements with other jurisdictions for the import of clean energy, where such imports would benefit the province’s electricity system and be cost-effective for Ontario ratepayers. This commitment led to discussions with Quebec, Manitoba and Newfoundland and Labrador.

Discussions with our provincial neighbours on potential electricity trade agreements were guided by the goals of reducing emissions, reducing costs for Ontario ratepayers, and supporting existing initiatives such as the development of a capacity auction.

So far these discussions have led to some positive outcomes, including:

- A 10-year agreement allowing Ontario and Quebec to trade up to 500 MW of capacity on a seasonal basis;

- Continuing discussions with Quebec on further trading opportunities; and

- A working group with Newfoundland to discuss the potential for clean electricity trade.

As Ontario investigates opportunities for electricity trade agreements, the impact on the reliability of supply will need to be considered, as will the impact on emissions and the province’s capacity auction process.

For consideration

- What role should distributed renewable energy generation play in the ongoing modernization and transformation of Ontario’s electricity system?

- What strategies should Ontario pursue to harness the potential of its nuclear sector to meet its future energy needs?

- What factors should Ontario focus on as it pursues opportunities for electricity trade agreements with nearby provinces and states?

Regional Planning

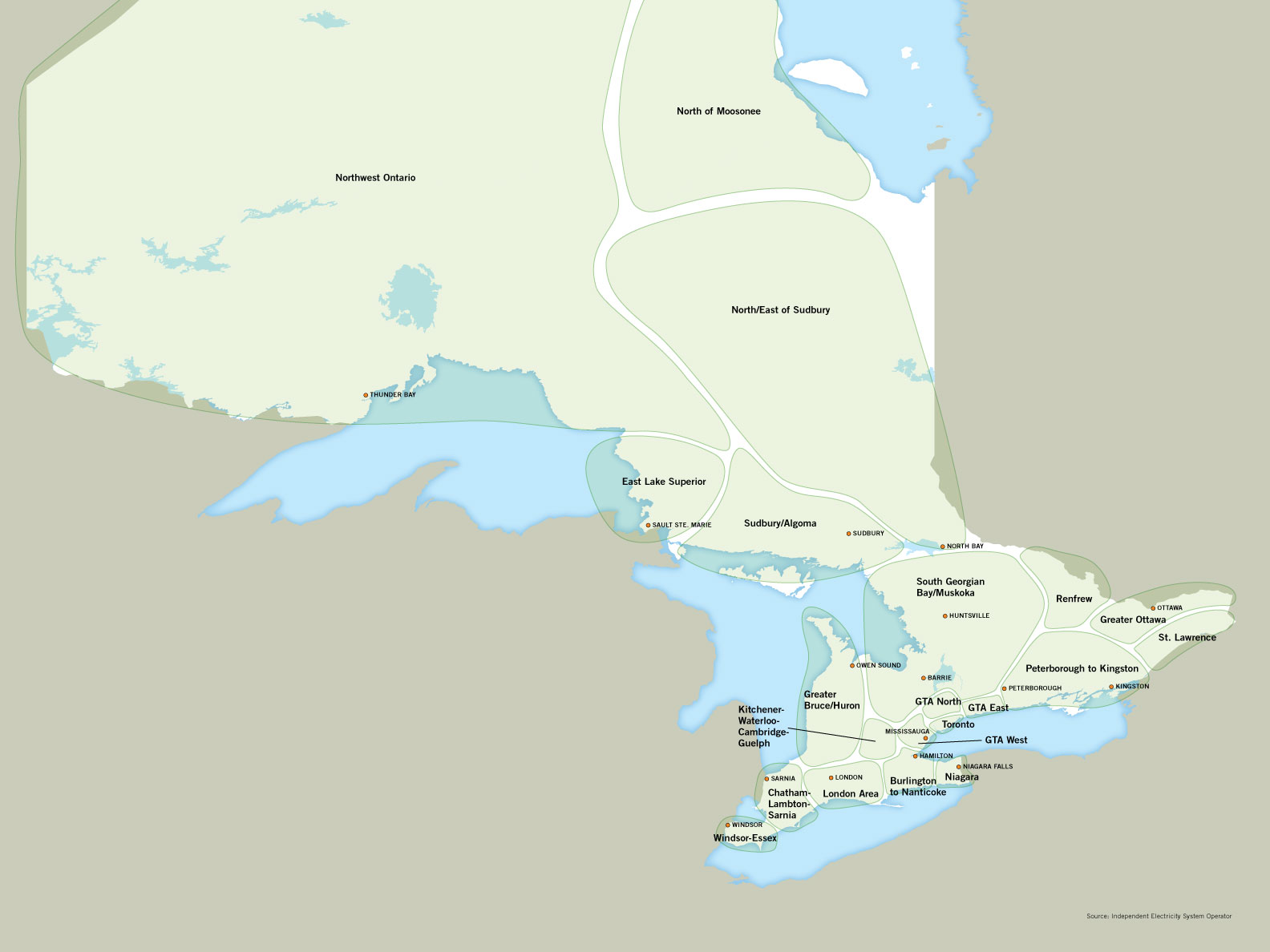

Ontario is a big province that is not the same everywhere you go. This is reflected in the use of electricity. Some regions may experience heavy growth in demand, while others may see flat or declining demand. Urban centres often have different needs than rural regions, and areas with heavy industry can have different energy priorities from residential communities.

The province’s regional planning process addresses these issues. It links provincial planning processes with local needs, so the planning of province-wide generation and transmission systems can be integrated with the energy plans of municipal or Indigenous communities. This will ensure the electricity needs of all 21 Ontario electricity regions are reliably met in ways that consider local preferences and priorities.

Map 2: Ontario’s 21 Electricity Regions (Source: Long-Term Energy Plan 2013)

In the 2013 LTEP, Ontario committed to promoting the policy of Conservation First in regional electricity planning and incorporating it into the planning processes used by both electricity and natural gas distributors. The Ministry continues to monitor the IESO's and OEB's progress in this area.

Regional planning is a collaborative process led by the IESO. The IESO collaborates with the transmitter and the local distribution companies to evaluate the electricity needs of a region over the near (1-5 years), medium (5-10 years), and long terms (10-20+ years).

Regional plans come in two varieties. A Regional Infrastructure Plan is a "wires only" solution that uses upgrades to transmission and distribution systems to meet the electricity needs of a region. This type of plan is led by the transmitter. The other type of plan, an Integrated Regional Resource Plan, considers a larger variety of options, including conservation, generation or other innovative solutions. An Integrated Regional Resource Plan could be implemented in combination with, or instead of, a "wires" solution, depending on the nature and urgency of the specific needs.

Integrated Regional Resource Plans are led by the IESO, together with a working group involving the region’s LDCs and the local transmitter. Since community engagement is an important part of regional planning, a Local Advisory Committee also provides recommendations on how to develop the regional plans and advises on aspects of broader community engagement. Local Advisory Committees are made up of municipal, Indigenous, environmental, business, sustainability and community representatives.

All 21 regions have begun or completed the first cycle of the regional planning process.

Following the release of the Climate Change Action Plan, there is an opportunity to consider changes to the regional planning process to support the possible growing use of electricity.

For consideration

- In areas expected to undergo a transformation from rural to suburban, through intense development, how could the province help to ensure that corridor lands are reserved/set-aside before development occurs to minimize the potential costs and inconvenience of acquiring and clearing developed lands in the future?

Indigenous energy policy

As the Ontario government strengthens and transforms its electricity and fuels systems, Indigenous communities have emerged as critical partners in the energy sector. Indigenous communities can bring unique perspectives, knowledge and leadership to energy projects and energy planning.

There are over 150 First Nation and Métis communities across Ontario, many with Aboriginal and treaty rights that are protected under Section 35 of the Canadian Constitution. Energy projects can affect these rights, as well as the social and economic well-being of the communities.

Indigenous communities across Ontario often face unique challenges when it comes to energy. These challenges have complex historical, jurisdictional, geographic and regulatory contexts. Ontario recognizes that participation in the energy sector can play a key role in the development and well-being of Indigenous communities. Ontario encourages First Nations and Métis communities to play an active role in the energy sector, through conservation, generation and major transmission projects. To support this, the government needs the leadership, input and guidance of Indigenous communities, and has established forums with community leaders to ensure this important dialogue occurs regularly.

Ontario brought in a range of policies and programs to support Indigenous participation and engagement in the energy sector, and to enhance the government’s relationship with Indigenous peoples across the province:

- First Nation and Métis communities and groups are leading or partnering in more than 550 different wind, solar and hydroelectric projects, as a result of incentives in renewable energy programs. In total, these projects have a contracted capacity of over 1,800 MW of clean energy;

- The Aboriginal Loan Guarantee Program delivered more than $200 million in guarantees for Indigenous partnerships in renewable energy and transmission projects;

- The Aboriginal Renewable Energy Fund helped 45 different communities and groups with over $8.5 million to assess and develop renewable energy projects. It has now been replaced by the new Energy Partnerships Program that will help Indigenous communities consider how to participate in major transmission and renewable generation projects;

- The Aboriginal Conservation Program provided energy-saving assessments and upgrades for homes in 46 First Nations communities; and

- 89 First Nation communities used provincial funding to develop community energy plans.

Many of these initiatives have resulted in rewarding and innovative partnerships between First Nation and Métis communities and energy developers. Others support Indigenous communities in taking control of their own energy needs and interests.

In August 2015, the Chiefs of Ontario signed an historic Political Accord with the Government of Ontario. This Accord guides the relationship between First Nations and the province. The government is committed to working on a range of issues, including jurisdictional matters and the sharing of resource benefits. The Accord is in line with the spirit and intent of the Calls to Action issued by the Truth and Reconciliation Commission and the United Nations Declaration on the Rights of Indigenous Peoples.

The government also took steps recently to facilitate the expansion of the transmission system to remote First Nation communities in northwestern Ontario that currently rely on diesel generation. A First Nation led company, Wataynikaneyap Power, is developing a project that will connect First Nations remote communities.

In addition to meeting its constitutional obligation to consult First Nation and Métis communities when energy projects could affect their recognized or credibly asserted Aboriginal and treaty rights, Ontario will work with Indigenous partners to support reconciliation and community economic development. As we update the LTEP, it is important to continue supporting Indigenous communities and individuals so they can engage in energy issues, explore opportunities and manage their energy use. Programs and policies will need to evolve to reflect technological innovation, an ever-changing electricity and fuels systems, and the broader implications of climate change. We look to the First Nation and Métis communities and organizations, developers, and other key partners to provide the ideas and guidance that will strengthen province’s long-term energy planning.

For consideration

- What are the best tools to support Indigenous community engagement and leadership in Ontario’s energy sector?

Supply mix

The 2013 LTEP took a pragmatic and flexible approach to planning for Ontario’s future energy needs. The plan was designed to balance the principles of cost-effectiveness, reliability, clean energy, community engagement, and an emphasis on Conservation First.

The government will continue to apply these principles in developing the next LTEP, while acknowledging the impact the Climate Change Action Plan will have on both the electricity and fuels sectors. Given the range of outlooks for the future demand for electricity and fuels, the need for flexibility in long-term planning is of particular importance. In addition, the government’s commitment to reducing Ontario’s GHG emissions will require an even greater emphasis on conservation and clean energy sources.

In the electricity sector, the OPO projects the province’s installed capacity will increase from 39,527 MW to 42,635 MW by 2035. There is potential that increased electrification will produce even higher demand. Outlooks C and D in the OPO present a number of ways to get the electricity needed to meet this demand. No single option can meet all consumer needs at all times. The OPO illustrates these choices with options that include mixes of wind, solar, hydroelectricity, natural gas, bioenergy, demand response, nuclear and long-term contracts for imports. New technologies that are not currently in Ontario’s supply mix are also included. Each combination will have a different impact on costs, reliability, emissions or supporting infrastructure, such as transmission systems.

When it comes to fuels, the government’s climate change policies are expected to put downward pressure on the demand for traditional fuels, while increasing the opportunity to use electricity and new cleaner fuels such as renewable natural gas or biofuels. How this transformation is accomplished over the next twenty years will have implications for customers' costs and the use of the province’s existing delivery infrastructure for fuels.

For consideration

- To meet a higher demand, what mix of new electricity resources would best balance the principles of cost-effectiveness, reliability, clean energy, community engagement, and an emphasis on Conservation First?

- What policies will Ontario need to adapt to a transformation in the fuels sector?