Associated employers

Eligible employers who are members of an associated group are required to enter into an agreement to share the tax exemption for the year. The exemption must be shared even if the associated employers operate completely independently. Employers are associated if they are associated with each other at any time in the year.

The federal election to not be associated for the purposes of the small business deduction [federal Income Tax Act (ITA) section 125] does not apply for EHT purposes. Corporations cannot opt out of being associated to claim the EHT exemption.

Associated employers are connected by ownership or by a combination of ownership and relationships between individuals.

Extension of associated corporations rules

The rules for associated corporations under section 256 of the federal ITA are used to determine whether or not employers are associated for EHT purposes.

Although these federal rules refer to corporations, the EHT Act extends these rules to include individuals, partnerships, and trusts. Individuals, partnerships, and trusts are deemed to be corporations with one class of voting shares.

Rules to determine ownership of shares:

Sole Proprietor

The individual owns all of the shares of the corporation.

Partnership

Each partner owns shares in the same proportion in which they share the income or loss of the partnership.

Trust

Each beneficiary of a trust owns shares in the same proportion in which they share the income or loss of the trust.

Determining if a business is associated

To find out if a business is associated with another employer, you can look at Schedules 9 and 23 of the corporation’s Federal T2 Corporation Income Tax Return. If the employer is not incorporated, the owner of the business will have this information.

The flowchart and information provided below can also be used to help determine whether a business is an associated employer.

Control

Employers are associated if one company controls or holds significant influence over another employer.

Situations when control can occur

Majority votes

When a person owns enough shares to give them a majority of the votes.

Majority fair market value

When a person owns more than 50% of the fair market value of all shares, regardless of whether or not these shares have voting rights.

Direct or Indirect Influence

When a person has direct or indirect influence that, if exercised, would result in control of the corporation. For example, the ability to cause the corporation to change the board of directors, or to make decisions relating to vital actions of the corporation, would result in control of the corporation. A potential influence, even if it is not actually exercised, would be enough to result in control in fact. Control can occur regardless of share ownership.

Factors to be considered in determining direct or indirect influence

The ministry will consider the following factors in its determination of associated employer:

- whether the board, committee (or majority of the members) or person in charge is the same for two or more organizations

- whether the board, committee or person in charge of each organization is reporting to the same body or larger organization

- whether the board, committee or person in charge is appointed (or could be appointed) by another organization

- whether the employer is a member of a larger organization under an agreement/contract (whether verbal or written)

- whether a larger organization has the ability to directly or indirectly terminate the existence of the employer or its business

- whether the larger organization has the ability to make alternative decisions concerning the actions of the employer in the short, medium or long term

- what would happen to the ownership of assets upon dissolution of the employer

- whether there is a third-party ownership of a large debt on demand

- who has the responsibility of outstanding debts/liabilities upon dissolution

- whether there is economic dependence on the larger organization

Situations when control does not occur

Arm's length

A person at arm's length may have influence over a corporation, regarding how the business is to be conducted, from a legal arrangement (for example, under a franchise, license, lease, distribution, supply or management agreement). This influence is not control.

Examples demonstrating association through control

All of the following examples show employers which are associated.

One controls the other

One of the corporations controls the other.

Example (a) One controls the other

A parent company controls a subsidiary.

Example (b) One controls the other

A doctor hires a superintendent to manage their rental properties, and hires a medical secretary in their practice. The doctor also owns an art gallery.

This diagram shows a doctor, who is the employer of a superintendent and a medical secretary, owns 100% of a subsidiary, named Art Gallery Ltd, which is more than 50% of the shares, meaning the doctor, as the parent, controls the subsidiary.

One controls both

Example (a) Both of the corporations are controlled by the same person:

This diagram shows a dentist owns 83% of one business, named Art Gallery Ltd., and 75% of another business, named Laboratory Equipment Co., which is more than 50% of the shares of each of these businesses, and shows the dentist controls both of the businesses.

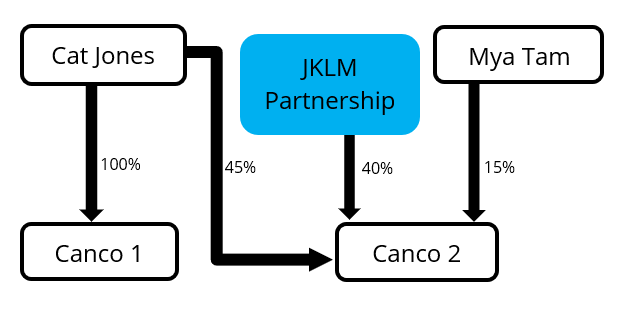

Example (b) Partnership:

This diagram shows that there is a partnership - JKLM Partnership – that owns 40% of the shares of Canco 2. This Partnership has four equal partners – Cat Jones, Kwan Kim, Chen Leung, and Amara Morris - and each of the four partners indirectly owns 10% of the shares of Canco 2. Cat Jones owns 100% of the shares of Canco 1 and 55% of Canco 2 (45% on her own and 10% indirectly through the partnership). Therefore, Canco 1 and 2 are associated with each other under paragraph 256(1.2)(e) of the Income Tax Act (Canada) because both corporations are controlled by Cat Jones.

Group controls both

Both of the corporations are controlled by the same group of persons:

Relationship

Employers can also be associated by a combination of ownership and relationships between individuals.

Related individuals

Individuals can be related by blood, marriage, or adoption. For tax purposes, you are related to your spouse or common-law partner; parents, children and in-laws; siblings and in-laws; and grandparents, grandchildren, and in-laws. However, you are not related to your uncles, aunts, nieces, nephews and cousins.

Related group

Related group is defined as a group of people, with each member related to every other member of the group.

For example, three brothers form a related group.

A group consisting of a son, father, and brother of the father does not form a related group, because an uncle and a nephew are not considered to be related for tax purposes.

References

For more details on relationships, refer to the CRA's web page entitled S1-F5-C1, Related Persons and Dealing at Arm's Length.

Examples of Association through Relationship

All of the following examples show employers which are associated through relationship.

Related individuals

Each corporation is controlled by a different individual and the persons are related to each other. One of them owns at least 25 % of any class of shares of each corporation (other than shares of a specified class).

Example (a):

- Ms. A owns 94% of Lumber Co. and 25% of Furniture Co.

- Mr. B is Ms. A's brother

- Mr. B owns the other 75% of Furniture Co.

Each corporation is controlled by a different individual and the persons are related to each other. One of them owns at least 25 % of any class of shares of each corporation (other than shares of a specified class). Even though the corporations may operate independently, the two companies are still associated because the relationship between the parties and their cross-ownership fits the federal definition of associated corporations, under paragraph 256(1)(c) of the Income Tax Act (Canada).

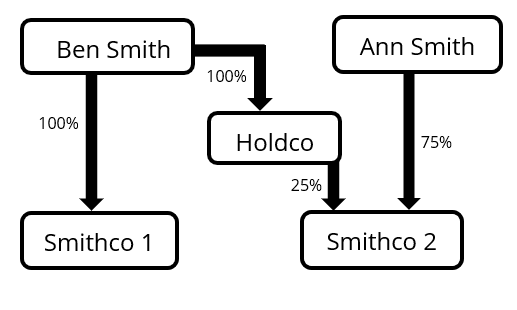

Example (b) Indirect ownership:

In this diagram, Ben Smith owns 100% of Smithco 1 and 25% of Smithco 2 through indirect ownership through Holdco (a holding company). The other 75% of Smithco 2 is owned by Ann Smith, his spouse. As a result, Smithco 1 and Smithco 2 are associated under paragraph 256(1)(c) of the ITA.

One to group

One corporation is controlled by one individual, and that person is related to all members of the group that controls the other corporation. That one individual also owns at least 25% of the shares of the other corporation (other than shares of a specified class). It is not necessary that the members of the group be related to each other.

- Mr. X owns 92% of Fish Market Inc. and 25% of Laundry Ltd.

- Mr. Y is Mr. X's brother

- Mr. Z is Mr. X's son

- Mrs. W is Mr. X's sister-in-law

- Mr. X, Mr. Y, Mr. Z and Mrs. W each own 25% of Laundry Ltd.

Mr. X controls Fish Market and is related to all members of the group that controls Laundry (Mr. Y, Mr. Z, Mrs. W). Mr. X also owns at least 25% of the shares of Laundry. Therefore, Fish Market and Laundry are associated under paragraph 256(1)(d) of the ITA.

Group to group

Each corporation is controlled by a related group, with all members of one group related to all members of the other group. One or more persons who are members of both groups, either alone or together, own at least 25% of the shares of each corporation (other than shares of a specified class). It is not necessary for every member of a group to own shares in the other corporation.

Example (a):

- Mrs. X and Mr. X are married

- Mrs. X owns 60% of Garden Centre Ltd.

- Mr. X owns the other 40% of Garden Centre Ltd.

- Mr. X also owns 25% of Factory Outlet Inc.

- The other 75% of Factory Outlet Inc. is owned by Mr. X's brother (25%), Mr. Y (25%) and Mr. X's sister, Mrs. Z (50%)

Garden Centre is controlled by a related group and all members of that related group are related to all members of the group that controls the other corporation, Factor Outlet. Mr. X own at least 25% of the shares of each corporation. Therefore, Garden Centre and Factory Outlet are associated under paragraph 256(1)(e) of the ITA.

Example (b):

- Mr. C, Mrs. C, Mr. D, Mrs. E and Mr. F are all related to each other.

- Mr. and Mrs. C are married

- Mr. D is Mrs. C's brother

- Mrs. E is Mrs. C's sister

- Mr. F is Mrs. C's brother

- Mr. and Mrs. C are married

- Company XY is owned by:

- Mrs. A (25%)

- Mr. B (20%)

- Mr. C (30%)

- Mrs. C (15%)

- Mr. D

- XYZ Limited is owned by:

- Mrs. C (5%)

- Mr. D (20%)

- Mrs. E (15%)

- Mr. F (11%)

- Mr. G (49%)

- Company XY is controlled by the group of Mr. & Mrs. C and Mr. D since they own 55%, and

- They are all related to the group of Mrs. C, Mr. D, Mrs. E and Mr. F, which as a group controls XYZ Limited, since they own 51% of the shares.

- Together, Mrs. C and Mr. D who are related own 25% of XY, and 25% of XYZ

Therefore, Company XY is associated with XYZ Limited under paragraph 256(1)(e) of the ITA.

Third corporation

Where one corporation is associated with another corporation, which is in turn associated with a third corporation but otherwise wouldn't be associated with the first corporation, all of the corporations are deemed to be associated with each other under paragraph 256(2)(a) of the ITA.

Corporations cannot opt out of being associated for EHT purposes.

Example (a) Both of the employers are associated through a third corporation:

- Global Pharmacy Holding company is associated with Pharmacy 1 employer through 55% ownership

- Global Pharmacy Holding company is associated with Pharmacy 2 employer through 75% ownership

- Global Pharmacy Holding company is associated with both Pharmacy 1 employer and Pharmacy 2 employer.

Therefore Pharmacy 1 and 2 are associated to each other.

The employers are associated even if the third corporation is not an employer (e.g. if it is a holding company).

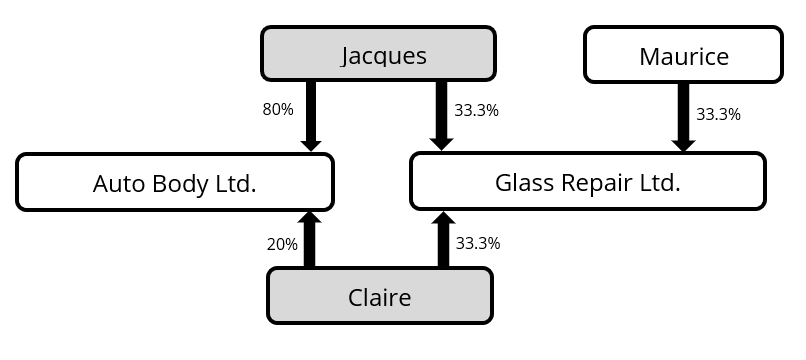

Husband and wife with third corporation:

Each corporation is controlled by a different individual and they are related. One of them owns at least 25% of any class of shares of each corporation (other than shares of a specified class).

Both employers are associated through a third corporation.

Becoming Associated part way through the year

Your business becomes associated with the other business for the whole year if they became associated at any time during the year. For example, if your business was acquired and became associated with Company B on April 1, 2021, your business and Company B are considered associated for all of the 2021 tax year, and onward.

Acquisitions

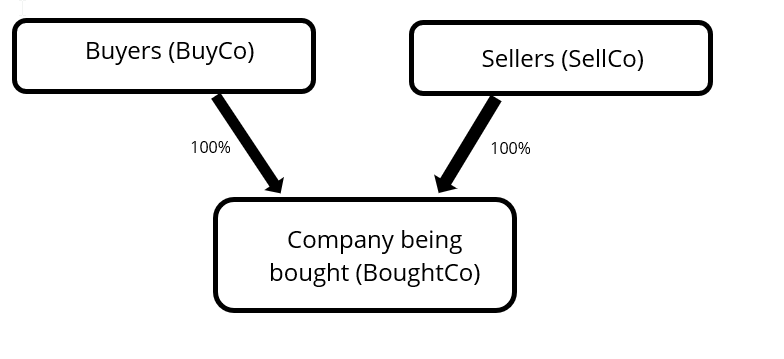

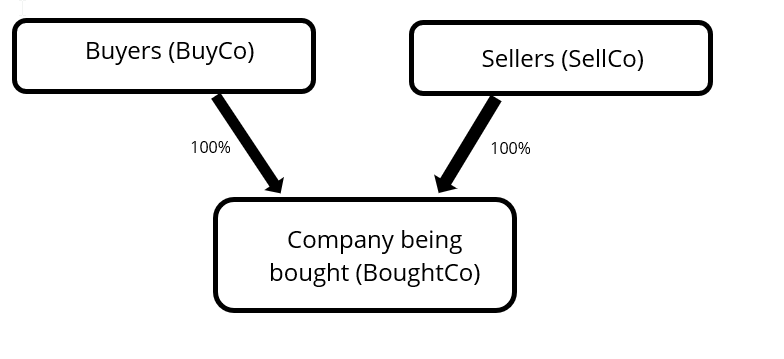

Generally, if an eligible employer (BuyCo) purchases a sufficiently significant interest (i.e. enough interest to indicate control) in another employer (BoughtCo) in a given year, BuyCo and BoughtCo will be considered associated with each other for the year.

If the acquired employer (BoughtCo) was associated with another employer (for example, the seller, SellCo) prior to the purchase, the acquired employer (BoughtCo) is still associated with that other employer (SellCo) in the year that the acquisition occurred. The acquired employer (BoughtCo) is also associated with the buyer (BuyCo) in that same year, i.e., as a result of the purchase.

Therefore, the buyer, any employer associated with the buyer, and the purchased employer are associated in the year in which the sale occurred; and the purchased employer and the seller, and any other employer associated with the purchased employer prior to the sale would also be associated in the year in which the sale occurred.

Two separate Associated Employers Exemption Allocation forms would have to be filed, with an overlapping claim for the employer being bought (BoughtCo).

In subsequent years, the seller would not continue to be associated with BoughtCo.

Until December 31, 2024, in the year of an acquisition, a buyer (or buyer group) and seller (or seller group) must combine their payrolls to determine if they exceed the $5 million exemption threshold if they are associated with a common standalone company at any time in the year.

Effective January 1, 2025, in the year of acquisition, only the companies that are associated with each other in the year must combine their payrolls to determine if they exceed the $5 million exemption threshold.

- In the year of acquisition, the company being sold and the seller (or seller group) will combine their payrolls to determine if that group exceeds the $5 million exemption threshold.

- Similarly, in the year of acquisition, the company being sold and the buyer (or buyer group) will combine their payrolls to determine if that group exceeds the $5 million exemption threshold.

Effective January 1, 2025, the seller group and the buyer group do not need to aggregate their payrolls (as they did until December 31, 2024), as they are not all associated with each other at the same time in the year.

This diagram shows a Buyer (BuyCo) buying 100% of BoughtCo, the company being bought, from SellCo, the seller.

Example: Buyers and sellers associated at time of acquisition (after January 1, 2025)

A large holding company (SellCo), decides to sell 100% of its shares of a company (BoughtCo) to another business (BuyCo). The total Ontario remuneration for each company is in the year of sale is:

- SellCo: $2,200,000

- BuyCo: $2,700,000

- BoughtCo: $3,000,000

On the day of sale, BoughtCo is associated with its parent company, SellCo, as well as with every other employer SellCo controls, including a number of Ontario employers. Later that same day, when the sale is processed, BoughtCo is now owned 100% by BuyCo, and is considered to be associated with BuyCo, and with every other employer that BuyCo is associated to.

This diagram shows a Buyer (BuyCo) buying 100% of BoughtCo, the company being bought, from SellCo, the seller.

Up until the day of sale, BoughtCo is considered associated at any time with SellCo; and immediately after the sale, BoughtCo is considered associated at any time with BuyCo; therefore, we consider that SellCo is associated with BoughtCo for that year, and BuyCo is associated with BoughtCo for that year. SellCo is not associated with BuyCo.

In the year of acquisition, one exemption would be available for SellCo and BoughtCo, since the combined payroll for all of the employers in that associated group is below the $5 million exemption threshold for the year. No exemption would be available for BuyCo and BoughtCo, since the combined payroll for all the employers in that associated group exceeds the $5 million exemption threshold for the year.

Share ownership

Share ownership includes both direct beneficial ownership and indirect ownership.

Indirect ownership occurs when shares of a corporation are held by another corporation. For example, when Bob owns 100% of Company X which owns 50% of Company Y, Bob is considered to own 50% of Company Y.

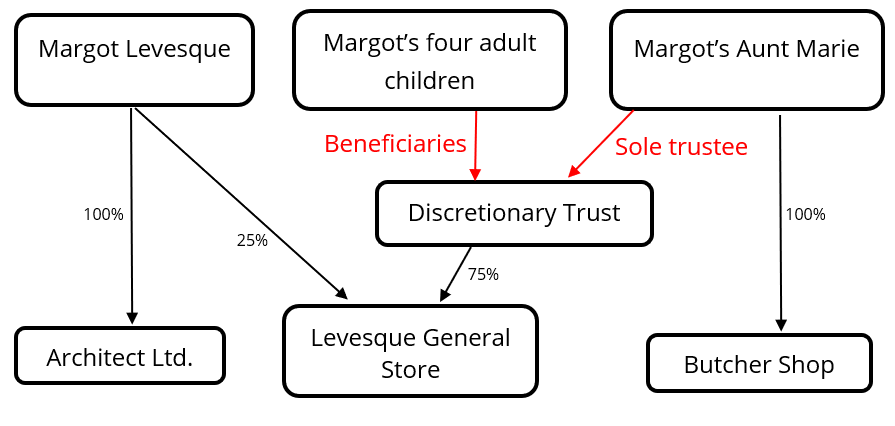

Example: Deemed ownership of shares of a trust

- Margot Levesque owns 100% of Architect Ltd. and 25% of Levesque General Store

- The other 75% of Levesque General Store is owned by a discretionary trust

- The beneficiaries of the discretionary trust are Margot Levesque's children, who are all over 18 years old

- The sole trustee of the discretionary trust is Margot Levesque's Aunt Marie

- Margot Levesque's Aunt Marie owns 100% of Butcher Shop

Since Margot Levesque's children are the beneficiaries of the discretionary trust, they are each deemed by Income Tax Act subparagraph 256(1.2)(f)(ii) to own all of the shares of Levesque General Store that are owned by the trust.

Therefore, since each one of Margot Levesque's adult children controls Levesque General Store, Architect Ltd and Levesque General Store are associated with each other.

Also, since Margot Levesque's aunt is the sole trustee of the trust, she is considered to control Levesque General Store.

Therefore, Levesque General Store and Butcher Shop are associated with each other. Architect Ltd. and Butcher Shop will also be associated with each other by virtue of subsection 256(2).

Non-share capital and non-profit corporations

For non-share capital and non-profit corporations, the association rules dealing with control through share ownership do not apply. We rely on direct or indirect influence.

Filing for Associated Employers

If you are a member of an associated group of employers at any time during the year, and are eligible for the exemption, you must enter into an agreement to allocate the $1,000,000 exemption amount among the group. You must not claim more than your allocated portion of the exemption amount for the year.

If the combined total Ontario payrolls of the members of the associated group exceed $5 million, none of the members of the associated group are entitled to an EHT exemption.

Only one member is required to complete the Associated Employers Exemption Allocation form and submit it to the Ministry of Finance by the return due date (March 15). All members of the associated group should be included on the form, even if they have not been allocated any portion of the exemption or do not have any payroll. The exemption for all members of the group will be denied if a completed form is not received by the ministry.

Visit the Ministry of Finance’s Online Services Page to file and submit your Associated Employers Exemption Allocation Form online.

The tax rate for each associated employer is based on the Ontario payroll for that employer.

Employers ceasing operations partway through the year

If an associated employer ceases operations partway through the year, no exemption may be claimed when their final return is filed. If they wish to claim any exemption, the employer must submit an amended return after the rest of the associated group files their annual returns and the Associated Employers Exemption Allocation form.

Tax exemption examples

Example one: charity associated with employer

Boss Co and Daycare are associated with each other. Boss Co is an eligible employer for the full year with annual payroll of $3 million. Daycare is a registered charity for the full year with annual payroll of $6 million.

Since Daycare is a registered charity for the full year, it is eligible for a $1,000,000 exemption regardless of the amount of remuneration it paid during the year.

Boss Co is not required to include Daycare's payroll for the purpose of determining exemption eligibility. Boss Co is eligible for a $1,000,000 exemption since its payroll of $3 million is below the $5 million threshold.

Example two: over the exemption threshold

Kings Ltd and Queens Ltd are associated with each other. Both are eligible employers for the full year. Kings Ltd's payroll is $3 million for the year. Queens Ltd's payroll is $4 million for the year.

Kings Ltd and Queens Ltd are not eligible for the $1,000,000 exemption because their combined total Ontario remuneration of $7 million exceeds the exemption threshold of $5 million.

If Kings and Queens accounted for an allocated exemption on their instalment payments (because they did not know if their combined payroll would exceed $5 million for the year), the exemption remuneration must be included on the monthly instalment immediately following the month where $5M combined remuneration was exceeded. Failure to "catch up" the exemption remuneration on the subsequent instalment may result in penalty and interest being assessed.

Example three: below the exemption threshold

Drums Co, Flutes Co and Horns Co are associated with each other. All are eligible employers for the full year. Drums Co, Flutes Co and Horns Co each has payroll of $1 million.

Drums Co, Flutes Co and Horns Co are eligible for the $1,000,000 exemption because the combined total Ontario remuneration of the group is $3 million. Drums Co, Flutes Co and Horns Co may share the exemption according to with their agreed upon allocation.

No instalments are required on any of the accounts as their individual payrolls are under the instalment threshold of $1.2 million.

Example four: part-year new employers

If a part-year employer is a member of the associated group, the calculation of the exemption threshold for the group is based on the group member that has been an eligible employer the longest in the year.

Sweet Ltd, Spicy Ltd and Sour Ltd are associated with each other. Sweet Ltd is an eligible employer for the full year. Spicy Ltd is also an eligible employer and begins operations on April 1. Sour Ltd becomes an eligible employer on September 1.

Sweet Ltd's payroll is $2 million. Spicy Ltd's payroll is $1.5 million. Sour Ltd's payroll is $1 million.

The exemption threshold for the group would be based on Sweet Ltd's exemption threshold that is $5 million since Sweet Ltd has been an eligible employer for the entire year.

Calculation

Total allowable exemption for the group = $1,000,000

Maximum exemption for Sweet Ltd = $1,000,000

Maximum exemption for Spicy Ltd = $753,425 ($1,000,000 × 275/365 days)

Maximum exemption for Sour Ltd = $334,247 ($1,000,000 × 122/365 days)

Explanation

Sweet Ltd, Spicy Ltd and Sour Ltd are eligible for the exemption because the combined total Ontario remuneration of the associated group is $4.5 million. Sweet Ltd, Spicy Ltd and Sour Ltd may share the $1,000,000 exemption but cannot allocate all of the exemption to either Spicy Ltd or Sour Ltd.

Since Spicy Ltd and Sour Ltd are part-year eligible employers, the maximum that Spicy Ltd can claim is $753,425 and the maximum that Sour Ltd can claim is $334,247.

However, regardless of the individual maximum amounts, the total claim for the associated group cannot exceed $1,00,000 for the year.

Example five: ceasing business

Pie Co and Apple Co are associated with each other. Apple Co ceases operations on March 31. Pie Co's payroll is $3.5 million for the year. Apple Co's payroll is $1 million for the period January through March.

The exemption threshold for this group is $5 million since Pie Co is an eligible employer for the entire year.

Calculation

Total allowable exemption for the group = $1,000,000

Maximum exemption for Pie Co = $1,000,000

Maximum exemption for Apple Co = $246,575 ($1,000,000 × 90/365 days)

Explanation

Pie Co and Apple Co are eligible for the exemption because the combined total Ontario remuneration of the associated group is $4.5 million. Pie Co and Apple Co may share the $1,000,000 according to their agreed upon allocation. Since Apple Co is a part-year employer, the maximum exemption that it can claim is $246,575.

Note: Apple Co cannot claim any exemption on its Final Return, which is due within 40 days of it ceasing operations, because it will not know at that time if the combined total Ontario remuneration of the group will exceed the $5 million exemption threshold. However, Apple Co may file an amended return if any exemption is allocated to it by the group at year end.

Example six: part-year eligible employer

Apple Pie Enterprises is an eligible employer that is not associated with any other employer. Apple Pie Enterprises begins operating in March but did not have any payroll until July 1. Its payroll from July 1 to December 31 is $2 million.

The exemption threshold and the exemption amount will be prorated from July 1.

Calculation

Exemption threshold = $2,520,548 ($5,000,000 × 184/365 days)

Maximum exemption = $504,110 ($1,000,000 × 184/365 days)

Explanation

Apple Pie Enterprises is eligible for a maximum exemption in the amount of $504,110 because its total payroll of $2 million during the period July through December is below its allowable exemption threshold of $2,520,548.

Example seven: amalgamation

Rob Ltd and Bert Ltd are eligible employers. Rob Ltd and Bert Ltd are not associated with each other or any other employer. On March 31 Rob Ltd and Bert Ltd amalgamated to form Robert Ltd. Robert Ltd is not an associated employer.

Rob Ltd's payroll for the period January through March is $1 million. Bert Ltd's payroll for this same period is $1.5 million.

Robert Ltd's payroll for the period April through December is $3.5 million.

Calculations

Exemption thresholds for both Rob Ltd and Bert Ltd = $1,232,876 ($5,000,000 × 90/365 days)

Maximum exemptions for both Rob Ltd and Bert Ltd = $246,573 ($1,000,000 × 90/365 days)

Exemption threshold for Robert Ltd = $3,767,123 ($5,000,000 × 275/365 days)

Maximum exemption for Robert Ltd = $753,425 ($1,000,000 × 275/365 days

Explanation

Rob Ltd is eligible for a maximum exemption of $246,575 because its total payroll of $1 million is below its allowable exemption threshold of $1,232,876.

Bert Ltd is not eligible for the exemption because its total payroll of $1.5 million exceeds its allowable exemption threshold of $1,232,876.

Robert Ltd is eligible for a maximum exemption of $753,425 because its total payroll of $3.5 million is below its allowable exemption threshold of $3,767,123.

Example eight: change in association status partway through the tax year, and catch up instalment

Yellow Inc. and Blue Inc. are eligible employers, monthly filers and are not associated with each other or any other employers. On October 15, 2021, Green Inc. acquires both Yellow and Blue and, in doing so, Yellow and Blue become part of an associated group with each other and Green as of October 15, 2021 (date of acquisition). Yellow and Blue continue to operate under the same business names and numbers after the acquisition.

Since Yellow and Blue were not associated employers at the beginning of the 2021 tax year, each employer had claimed the $1 million EHT exemption when filing their instalments.

Yellow and Blue become part of an associated group with the buyer, Green, and any other businesses with which Green is associated in the year of acquisition (2021 in this case). They are associated with each other for the whole year if they became associated at any time during the year. Eligible employers who are associated with each other at any time in a year must share one tax exemption amount. Since Yellow and Blue became part of an associated group with Green in 2021, they must all share one tax exemption for the 2021 tax year. However, if the total combined payrolls of the associated group are above $5 million for 2021, then none of the businesses may claim an exemption for 2021.

Because their total combined payrolls are below $5 million, Yellow, Blue and Green are required to enter into an agreement to allocate the tax exemption amount amongst themselves for the year. The group decided to allocate the exemption to Green.

Because Yellow and Blue each already claimed the EHT exemption on instalments prior to being acquired by Green, an adjustment will need to be made in the month following the change in status to associated to re-allocate the one exemption among the members of the associated group and "catch up" EHT payments made.

Both Yellow and Blue had claimed $1 million of exemption on their previous instalments, and to "catch up" both employers are required to report the exemption remuneration of $1 million on their October 2021 instalment form in addition to the regular October remuneration (the instalment would be due on November 15, 2021). To avoid penalty and interest charges, the "catch up" payment for monthly filers must be received by the ministry on the next instalment due date. If the "catch up" is not reported until the annual return is filed, penalty and interest may be assessed for employers that would have been required to file monthly instalments once the $1 million "catch up" remuneration is added (i.e. if the Total Ontario Remuneration greater than $1.2 million).

One member of the associated group will need to file the Associated Employer Exemption Allocation form by the annual return due date.

Example nine: associated part-year employers

ACo and BCo are associated employers. ACo becomes an eligible employer on July 2. BCo opens for business (has a location and payroll) on December 2, as an eligible employer. How much exemption can ACo and BCo claim for 2020?

Name | # of days as eligible employer | Remuneration for 2020 (366 days) | Prorated Exemption Threshold | Maximum allocated exemption (prorated) |

ACo

| 183 | $ 2,000,000

| $ 2,500,000

| $500,000

|

BCo

| 30 | 450,000

| 409,836

| 0

|

Group

| $ 2,450,000

| $ 2,500,000

| $500,000

|

Conclusion

Because the group combined remuneration is below the calculated prorated exemption threshold, there is a prorated amount of exemption is available for allocation. Individually BCo's remuneration exceeds their calculated prorated exemption threshold, so no exemption may be allocated to BCo. ACo may claim the available prorated maximum exemption of $500,000 (183 days/366 days x $1 million exemption).

Example 10: associated with employers outside Canada

GlobalCo has four subsidiaries: OntarioCo A, OntarioCo B, AustraliaCo and AlbertaCo. The four subsidiaries are associated employers because they are all controlled by the same parent company (GlobalCo). AustraliaCo operates exclusively in Australia, and AlbertaCo operates exclusively in Alberta. Neither AustraliaCo nor AlbertaCo has a permanent establishment or employees in Ontario.

Because only OntarioCoA and OntarioCO B have Ontario payroll, the EHT exemption must be shared between only OntarioCoA and OntarioCoB.

If, however, OntarioCoB was a holding company and had no payroll, OntarioCo A does not need to share the EHT exemption, and can claim the full exemption amount.