Modernizing beer retailing and distribution

Read the recommendations from the Premier’s Advisory Council on Government Assets on how Ontario can modernize beer retailing and distribution in Ontario.

Executive summary

In November 2014, the Advisory Council on Government Assets presented our Initial Report to government entitled "Retain and Gain: Making Ontario's Assets Work Better for Taxpayers and Consumers". The Initial Report contained our overall assessment of the beverage alcohol and electricity sectors in Ontario and our thinking on the future direction for these sectors.

Following submission of our Initial Report, the government expanded the Council's mandate and authorized us to move into the second phase of our beverage alcohol review.

In Phase 2 of our review, the Council's first priority was to address the beer retailing and distribution system in the province. We further developed our thinking from Phase 1 with continued analysis and stakeholder consultation and engaged with the current owners of the Beer Store (TBS) directly to negotiate an agreement that will materially reframe the way that beer is sold in Ontario. This has necessitated that the Council work closely with the government at all times. Throughout our review, we have been guided by the government's broader public policy objectives in developing our proposals and negotiating with TBS. Our proposals were discussed in detail with government prior to completing negotiations with TBS and have the government's full support.

Although the issues involved were complex and the negotiations were challenging, the Council would like to acknowledge the business-like manner in which TBS and the management of the owner-brewers approached the process and demonstrated their willingness to voluntarily reach a new agreement with the Province that materially reshapes the system. We also recognize the important role that TBS and its owners play in the Ontario economy as employers and taxpayers.

This report represents our final report to government on the future direction for beer retailing and distribution in Ontario.

However, the scope of our review of beverage alcohol also includes both wine and spirits retailing. We recognize that many participants in the beverage alcohol sector would like the Council to lay out all the details for every part of the sector at the same time. Unfortunately, this is neither practical nor responsible. To achieve a positive outcome, it is essential that we understand in detail the implications of any decisions. This can only be achieved through extensive discussions and dialogues with all stakeholders and government.

Accordingly, the Council would ask that industry participants – and the public – continue to work with us in our review of the sector. The Council remains committed to improving the beverage alcohol sector for consumers, producers, and taxpayers in a socially responsible way. We expect to continue our consultations and analysis in the months following the tabling of the government's 2015 Budget, with a view to developing a carefully considered future direction for wine and spirits retailing in Ontario.

Beer retailing: our perspective

There were two core issues at the heart of the Council's review of beer retailing in Ontario:

- how to materially enhance customer convenience, choice and shopping experience, while continuing to ensure that Ontarians can buy their beer at prices below the Canadian average

- how best to establish a level playing field for all producers selling beer in Ontario

Through our work, we considered whether the best way to address these issues would be to scrap the current system completely and remove the existing quasi-monopoly held by TBS. Our conclusion was that, despite its faults, the current system has one redeeming feature: it is efficient and low cost, allowing consumers to enjoy prices below the Canadian average while supporting a competitive yield for taxpayers (see table).

Beer prices and provincial taxes (average 24-pack)1 all figures are approximate

| Ontario | Quebec | Alberta | British Columbia | |

|---|---|---|---|---|

| Consumer price (excluding deposit) | $34 to $35 | $34 to $35 | $40 | $40 |

| Provincial commodity and sales tax | $11 | $8 | $10 | $12 |

1Please see note in body of report (page 32).

Dismantling a quasi-monopoly system, as has been done elsewhere, provides for a small increase in convenience at either much higher prices for consumers and / or reduced revenues for government. Such a change also does not help to establish a level playing field, as expanded access oftentimes brings a focus on mainstream brands.

However, the current system is not equitable for all producers and TBS provides a basic customer experience.

In light of this, the Council determined that there is a need for material foundational change in TBS and the beer retailing system in Ontario as a whole. The Council's goal was to develop an agreed-upon solution that retains some of the best features of the existing system, introduces a number of significant improvements, and balances the interests of consumers, government, taxpayers, brewers, and restaurants and bars in a socially responsible way. On this basis, we have negotiated a new Memorandum of Understanding that will act as the framework (New Beer Framework) for a new agreement between the Province and the Beer Store, which will replace the current Beer Framework Agreement (2000) that exists between TBS and the LCBO.

Conclusion

The Council is satisfied that the New Beer Framework levels the playing field: we have returned the Beer Store to its co-op roots. In our view, the reframed beer retailing system:

- improves customer convenience, choice and shopping experience

- keeps beer prices for Ontario consumers below the Canadian average

- maintains efficiencies of the existing system

- treats suppliers fairly while improving retail access

- introduces additional competition

- increases revenue for government while maintaining competitive beer tax rates

- remains socially responsible

The new beer retailing landscape of Ontario will feature increased competition and consumer choice with the availability of beer in up to 450 grocery stores across the province in addition to the 450 existing TBS stores, 113 on-site brewery retail stores, and 651 LCBO stores and 217 LCBO agency stores, an increase of over 30% for a total of more than 1,800 outlets. These grocery stores will only be allowed to sell beer provided that they meet shelf space requirements for small brewers and that they purchase beer from the LCBO at a discount that represents a much lower cost than other retail channels. Uniform pricing and safeguards to ensure social responsibility will be maintained across all channels. Additionally, to protect consumers from the possibility of beer prices increasing in the short-term, prices for certain products of popular brands will be constrained until May 2017.

Throughout our work, the Council has been particularly concerned with improving the system for consumers and ensuring that all brewers are treated fairly. We have, of course, also focused on protecting the interests of Ontario taxpayers, consistent with our original Terms of Reference. We are satisfied that the new system offers each of these groups significant gains.

Consumers

The new system will provide consumers with improved convenience and choice by allowing beer to be sold in grocery stores. The customer experience in TBS stores will be greatly improved through a $100 million capital commitment to modernize their network, and all new stores will be open concept, self-serve formats. In addition, a limited pilot study of selling 12-packs through the LCBO offers an opportunity for greater access for consumers across the province. Furthermore, the New Beer Framework provides protection for LCBO combination stores that currently offer 12- and 24-packs of beer, and improves the mechanism for the LCBO or TBS to open new stores in underserved communities. If the 12-pack pilot is successful, there could be more than 220 LCBO stores (including the existing 167 LCBO combination stores) and 217 agency stores selling 12- or 24-packs of beer in smaller communities across Ontario.

Gains for consumers will not be achieved at the expense of social responsibility. The Council has worked carefully to ensure that increased access does not mean unrestricted access. The grocery store format that we are proposing is for urban grocery stores only, and there will be clear restrictions on hours of sale, uniform pricing, appropriate check-out safeguards, and social responsibility training for all employees facilitating the purchase of beer. In addition, the Ontario Deposit Return Program (ODRP) has been extended with TBS at a significantly improved price for the Province.

Finally, restaurants and bars (licensees) are charged different (and sometimes much higher) prices for beer today. The New Beer Framework will ensure that small licensees will be able to purchase beer through TBS at the same retail price as consumers. Almost 9,000 small licensees, over half the current licensees in the province, will be able to benefit from this change.

Producers

Under the new system, ownership of the Beer Store will be open to all brewers with facilities in Ontario, providing them with an opportunity to benefit from increases in the value of the business and associated shareholder rights. Additionally, their interests will be further protected by having four independent directors on the board with effective veto rights on brewer fairness and other important issues.

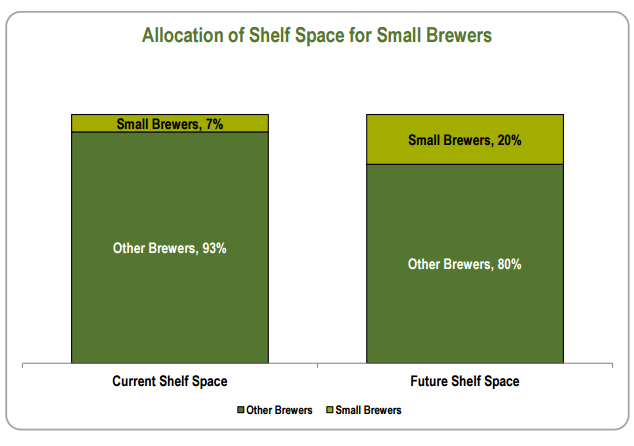

All brewers, except for the current owners, will see their costs of retailing beer through TBS decline. Small and mid-size brewers specifically will see their TBS costs fall by about 5% to 10%. Small brewers will have significant advantages, with a minimum of 20% shelf space allocation in TBS and grocery stores, and incentives for the grocers to sell more of their beer. As with existing channels, brewers will retain the ability to set prices in grocery stores and will earn the same margin as if the sale occurred in an LCBO store. Lastly, small brewers will gain the ability to more efficiently deliver their products directly to retail points of sale and licensees by pooling their products with the option of using third party carriers and warehousing.

Taxpayers

The new system provides for government, and by extension taxpayers, to share more equitably in the value currently generated by the system. This value will be achieved on a phased basis with price restrictions limiting the impact on consumer prices.

Any new system needs a degree of long-term stability to permit responsible capital planning by retailers and producers, while not locking the new model in perpetuity. The Council is satisfied that, with the protections built into the New Beer Framework, an initial 10-year term achieves this balance.

The Council recognizes that the new system represents significant change within the Province's current regulated environment for beverage alcohol. Some will argue that we should have gone further. We have examined other models in Canada and found that, in many cases, consumers pay more and taxpayers get less while convenience is not significantly improved. Conversely, some will argue that the current system should be left unchanged. However, today's system limits convenience and may not provide all producers with equitable treatment. The Council has opted for significant, controlled change – the biggest change in beer distribution in Ontario since prohibition. We believe that this new beer retailing system will better serve all Ontarians and stakeholders.

Final recommendations

The Council has now completed its review of TBS and beer retailing in Ontario. This section presents the final recommendations we made in support of the government's 2015 Budget that have been incorporated in the New Beer Framework.

- TBS should continue to operate, but with broader ownership, and fundamentally improved governance and operating practices, including:

- opening its ownership to all brewers with facilities in Ontario;

- establishing a new 'best practices' governance structure that allows it to operate at arm's-length from its owners, with brewer directors nominated based on relative market shares, and a critical mass of independent directors;

- requiring independent directors to approve any change related to brewer treatment and fairness, as well as any changes to the New Beer Framework;

- appointing an independent TBS Ombudsman to handle complaints;

- operating in a more open, transparent and accountable manner;

- enshrining a new mechanism for determining rates charged to all brewers, lowering costs for all brewers other than the current owners;

- changing its retail and marketing practices to ensure fairness and equity among brewers; and

- investing $100 million over four years, 80% of which will help modernize its stores.

- The Province should increase its annual revenues from beer sales in Ontario through a new beer charge as part of the existing beer tax framework. The principal brewers in the industry have separately confirmed to the Province their intention to comply with the Province's expectation that retail prices for certain products of their most popular brands will not increase before May 1, 2017. The only exceptions would be to reflect changes in the minimum retail price of beer (which is indexed to inflation) and circumstances where the industry context materially changes.

- The Ontario Deposit Return Program contract should be extended at a discount to the current rates without annual indexing to inflation.

- The LCBO should be permitted to conduct a 10-store pilot study to explore the viability of offering 12-packs with an option to expand to 60 stores.

- Small restaurants and bars should be able to buy beer from TBS at the same retail prices as consumers.

- Small brewers should be allowed to jointly deliver their products to the LCBO and licenced establishments with the ability to use third party carriers and warehousing.

- The Alcohol and Gaming Commission of Ontario (AGCO) should allow brewers with two production facilities to have an on-site retail store at each facility for the sale of their products only, regardless of the production size of their facilities.

The Province should offer to a number of qualifying grocery stores operating in Ontario up to 450 licences or other permissions to sell beer. This new channel should be phased in over time with up to 150 outlets in operation by May 1, 2017. Licences should be made available through an open and transparent process designed to achieve:

- fair market value for the Province;

- fair representation of privately-owned grocers;

- appropriate distribution across urban areas in Ontario; and

- a diversity of grocers to prevent the creation of a new monopoly.

Retail beer licences should include requirements to:

- operate with restricted hours of sale, appropriate check-out provisions, uniform pricing, and social responsibility training for all employees facilitating the purchase of beer;

- sell all beer – domestic and international – with specific requirements on shelf space and incentives for sales of small brewers' products;

- sell beer only in pack sizes of six or smaller (with no pack-up pricing);

- limit annual beer sales to an average cap per store of the volume equivalent of $1 million, which may be shared across a single grocer's licenced stores;

- position the LCBO as the wholesaler;

- purchase beer from the LCBO at a discount that represents a much lower cost than other retail channels, locked in for at least 10 years; and

- prohibit inducements or monies from suppliers.

- The New Beer Framework should last for an initial term of 10 years, with recurring options to renew for 5-year terms and beyond. The New Beer Framework should include termination provisions that facilitate an orderly wind-down of the agreement with TBS and avoid uncertainty if not renewed.

Introduction

Background

In November 2014, the Advisory Council on Government Assets presented to the government our Initial Report entitled "Retain and Gain: Making Ontario's Assets Work Better for Taxpayers and Consumers". The Initial Report included our overall assessment of the beverage alcohol sector in Ontario, detailed reviews of the LCBO, the Beer Store and off-site Winery Retail Stores and our thinking on the future direction of the sector.

Specific to TBS, the Council expressed its view that the TBS structure has the potential to generate advantages for the current owners. We also indicated that we wanted to explore opportunities to improve the customer experience, open up the market for small brewers, and introduce limited competition into Ontario's beer retailing system.

In response to the Council's Initial Report, the government issued a statement indicating its support for the direction of the proposals contained in the Initial Report and authorized the Council to move to the second phase of our review.

The government expanded the Council's mandate for Phase 2 of its review. The amended mandate authorized the Council to conduct further due diligence on the proposals presented in the Initial Report and to develop an implementation plan. The Council was also mandated to provide final recommendations to the government in support of its 2015 Budget process.

Our amended mandate recognized that the Council is both an advisory body and a representative of the interests of the Crown. In this latter capacity, the Council engaged with the current owners of the Beer Store directly to negotiate an agreement that will materially reframe the way that beer is sold in Ontario. This has necessitated that the Council work closely with the government at all times. Throughout our review, we have been guided by the government's broader public policy objectives in developing our proposals, which were discussed in detail with government prior to completing negotiations with TBS and have the government's full support.

Approach

The Beer Store (TBS)

Over the course of Phase 2, the Council held numerous discussions with representatives of TBS and the management of the owner-brewers. We consulted with over 30 stakeholders, including individual brewers, brewers' associations, representatives of restaurants and bars, as well as representatives of grocery chains and independent grocers operating in the province. Additionally, we greatly benefitted from consultations with representatives of a number of social responsibility and public health organizations in the province. We carefully considered input and reaction from these stakeholders.

We also conducted detailed analysis and further due diligence on the beer retailing system and considered a wide range of potential options and scenarios for the future of the system. The input from our consultations, together with our detailed analysis, enabled us to refine our thinking and to develop an actionable framework of proposals. This formed the basis for our negotiations with TBS and its owners on the New Beer Framework. The New Beer Framework is included in the Attachment.

The Council believes that the New Beer Framework appropriately balances the public interest with those of stakeholders and has been developed with a view to securing the best outcomes for the people of Ontario.

Although the issues involved were complex and the negotiations were challenging, the Council would like to acknowledge the business-like manner in which TBS and the management of the owner-brewers approached the process and demonstrated their willingness to voluntarily reach a new agreement with the Province that materially reshapes the system. We also recognize the important role that TBS and its owners play in the Ontario economy as employers and taxpayers.

LCBO

In parallel with our work on TBS, the Council has been working with the LCBO on an implementation plan for the proposals contained in the Council's Initial Report. These include:

- advanced e-commerce offerings;

- alternative store formats, including specialty boutiques for craft beer and spirits;

- co-labeling products;

- productivity improvements;

- revisions to its pricing and mark-up strategies to better leverage its buying power in a transparent and rule-based manner; and

- revised management accounting and reporting.

Good progress is being made on developing each of these areas. The Council will continue to work closely with the LCBO in the coming months as the LCBO's implementation program moves forward and will report on that program in due course.

Off-site winery retail stores

The third stream of our work focuses on wine retailing in Ontario. This is a complex area with a diverse set of stakeholders. It is important to recognize that alternative retail channels already exist for wine in Ontario – there are nearly 300 off-site Winery Retail Stores, three-quarters of which are co-located with large grocery stores in the province. These stores offer certain Ontario VQA wines as well as blended products that are often, in effect, low-cost imported wines containing at least 25% Ontario wine content (an important source of demand for Ontario grapes).

With that said, the Council believes there is an inherent unfairness to other producers in this structure that should be addressed as part of the future direction for beverage alcohol retailing in the province, while recognizing the investments made by existing retail licence holders to build out their channels. The Council will need to address how these existing licences will fit together with the introduction of beer in grocery stores and other private channels.

We expect to continue our consultation and analysis over the months following the tabling of the government's 2015 Budget, with a view to laying out our perspectives on wine retailing in Ontario and our recommendations for its future direction.

Spirits

Similarly, we are beginning work on spirits retailing, and we expect to undertake consultations and analysis of this area in parallel with our work on wine retailing and to bring forward proposals on future directions at the same time.

Our report

This report represents our final recommendations to the government on the future direction for beer retailing and distribution in Ontario. The report outlines the major issues that the Council considered in light of the detailed due diligence, analysis, and stakeholder consultations that we undertook in Phase 2 of our review, and it describes the significant points of the New Beer Framework reached with TBS.

The council's perspective

Guiding principles

As the Council considered the future direction for beer retailing and distribution in Ontario, we developed principles to guide our thinking on how best to reframe the system and balance the interests of taxpayers, the government, brewers (both the TBS owner-brewers and non-owner brewers) and consumers. Our principles were:

- Enhanced customer experience and convenience. There should be improved retail access to beer while maintaining social responsibility; the consumer experience should be improved in TBS.

- Increased competition. The new system should broaden competition with the existing quasi-monopolies.

- A level playing field. The new system should provide equal access to TBS and fair treatment for all beer producers and distributors in Ontario.

- Improved supplier access. Producers should have greater access to fair and competitive retail channels outside of the LCBO and TBS.

- Financial benefits to the Province. The new system should secure additional financial benefits for the government and the people of Ontario, and keep beer prices in Ontario below the Canadian average.

Key considerations

In our Initial Report, the Council acknowledged that TBS operates an efficient and relatively low-cost retail system that supports lower beer prices for consumers. However, as our work continued in Phase 2, we had a number of concerns about the system:

- The current owners of TBS face an inherent conflict of interest as its largest suppliers, and may be incentivized to operate the system in their own interests.

- TBS provides a basic customer experience.

- TBS does not provide enough opportunities for brewers to showcase their products.

- TBS lacks transparency and public accountability.

Our view was that the government should not continue to foster a marketplace that may provide unique benefits to a select few stakeholders. More broadly, we expressed the view that some degree of competition is always healthy to provide a challenge to any quasi-monopoly and to incentivize growth and innovation.

We also believe strongly that consumers should benefit from changes to the system. To this end, we have focused on improving customer convenience, choice and shopping experience. It is critical that this be done in a controlled and socially-responsible way that does not erode the efficiencies of the current system and raise prices for consumers.

Our review of the experiences in other jurisdictions showed that the introduction of new retail channels followed a troubling pattern. Over time, as the number of access points grew, retail and distribution costs increased, consumer prices went up, and, in some cases, government tax revenues declined. This is not a desirable outcome. It is our goal to find a better system that will lead to more convenience and competition, but not at the expense of consumers, taxpayers, or social responsibility.

Obtaining greater financial returns from the system was important, but secondary to our priorities of supplier fairness and consumer benefit. The Council believes that the government should earn a greater share of the financial benefits of the system as a whole only after the benefit accrues equitably to stakeholders. In addressing any inequities first, the government avoids the risk that greater value is extracted by crystallizing practices that may tilt the scales in the direction of a select few.

The Council listened to a wide range of views from stakeholders in Phase 2 of our review. The more we heard, the more convinced we became that meaningful change is required for beer retailing in Ontario. Moreover, we came to the view that such meaningful change should be foundational, not simply incremental. This implied a material redesign of the system including oversight and governance of TBS, alternative channels for beer in Ontario with accompanying competition for TBS and the LCBO, and financial arrangements to provide the government and taxpayers with a fair return.

Structure of the system

The first question we asked ourselves was whether we should consider a complete redesign of the beer retailing system. We explored a wide range of possible scenarios for alternative models that would essentially eliminate the current system and start again from scratch. We also looked carefully at possible ways to change the structure of TBS itself to better represent the interests of all brewers and customers. We were mindful of the on-going policy imperative that beverage alcohol remain a controlled and regulated substance.

After weighing these considerations against our guiding principles, we came to the conclusion that starting from scratch would risk losing many of the favourable elements of the existing system – not least the fact that it is relatively efficient and low cost. Such a system can generate competitive tax rates while keeping beer prices in Ontario below the Canadian average. We believe that preserving these benefits is important and is in the best interest of consumers. Accordingly, we focused on establishing foundational change using the current system as a starting point.

Ultimately, we came to the view that the public interest would be best served by materially reframing the agreement signed in 2000 between the government (through the LCBO) and TBS. The Council entered into extensive negotiations with TBS and its owner-brewers, as we prioritized balancing the interests of consumers, taxpayers, and brewers in a socially responsible way, while recognizing the investment in and merits of the beer retailing system operated by TBS. The New Beer Framework introduces a number of significant changes in the retail system for beer in Ontario.

The New Beer Framework

Ownership of TBS

As noted in our Initial Report, TBS was originally established in 1927 as a brewers' co-operative. Over time, ownership has been consolidated to the point that TBS is now owned and controlled by three brewers – Labatt, Molson Coors, and Sleeman. While the system is efficient and relatively low-cost, it has the potential to be inherently biased.

Under the New Beer Framework, TBS will continue to operate as a low-cost, efficient distributor of beer in Ontario. However, TBS will be returned to its co-op roots, opening up its ownership to all brewers with facilities in Ontario and operating on a self-sustaining break-even cash flow basis, where all brewers play by the same rules.

In this model, brewers with brewing facilities in Ontario that sell products through TBS will have the opportunity to become shareholders of TBS for a nominal price. Their ownership interest will reflect their share of the volumes sold through TBS. While existing owner-brewers will continue to own and be responsible for the business, TBS will be recapitalized so that all owners, both current and new, can participate in the appreciation in the book value of TBS' equity.

Governance of TBS

The New Beer Framework envisages a governance structure that moves TBS from a shareholder-managed business to a board-managed business, one which operates at an arm's-length from its owners. The structure will ensure fair treatment for all brewers, providing a voice for all owners and ensuring that consumer interests are properly represented.

Under the proposed model, TBS will be governed by a board of fifteen directors. Eleven of the board seats will be allocated across owner-brewers based on market share, with small brewers guaranteed at least one director. Based on current market shares in TBS, Molson and Labatt will continue to elect a majority of the board. The remaining owner-brewer directors will be elected by mid-sized brewers.

To address the inherent conflict of interest faced by owner-brewers in this system, the New Beer Framework proposes that four independent directors be appointed to the board. The initial four independent directors will be selected jointly by the government and the current TBS owner-brewers, after which new independents will be nominated by a majority vote of the independent directors themselves to ensure their continued independence. The Province will hold the right to require the removal of all of the independent directors. The independent directors will play a pivotal role in the governance of TBS. Specifically:

- key policies related to brewer fairness or neutrality (including retail and marketing principles such as categorization and rate sheet calculations) will require approval by a majority of independent directors;

- any transactions between TBS and its owners must be approved by a majority of independent directors and must be transparent, commercially reasonable, and auditable; and

- all committees of the board must include representation by independent directors.

A lead independent director will be selected by the independent directors and will have a tie-breaking vote on any resolution that is required to be passed by a majority of the independent directors.

The new TBS shareholders' agreement will embed the key governance principles, confirm the fiduciary duties of the board, and provide that the board, in addition to giving consideration to the best interests of TBS, will also be entitled to give consideration to broader stakeholder interests in supervising the management of TBS.

Finally, the New Beer Framework introduces the appointment of an independent TBS Ombudsman by the independent directors of TBS. The Ombudsman will report to the TBS board and will hear complaints from brewers and customers.

Openness and transparency

One of the Council's concerns about TBS in its current form is the limited degree to which information on its financial situation and operations is available to anyone other than its current owners.

Under the New Beer Framework, owners and independent directors will receive more detailed and timely information on financial performance, budgets and business and capital plans. TBS will continue to publish an annual Operations Report as well as information on key policies and decisions for the broader public.

The Council expects that the Alcohol and Gaming Commission of Ontario will provide enhanced regulatory oversight of the new TBS.

Retail and marketing practices

Today, the Beer Store allocates shelf space, marketing, and promotional programs on the basis of relative market share in Ontario. Although reasonably fair in aggregate, this serves to maintain the market share of existing brands and to limit the ability of small players to grow. Further, this gives the smaller brands no real opportunity for shelf space, even if they are growing at above-average rates.

To address this, the New Beer Framework requires that all shelf space and merchandising, marketing and promotional programs and decisions be made on a category basis and allocated based on local market share with meaningful adjustments for a brand's growth. Categorization decisions must be approved by the independent directors.

Much attention has been paid to the treatment of craft brewers in the Beer Store. However, it is worth noting the difference between small brewers and craft beer. Small refers to the size of a brewer, and can be objectively defined. The definition of craft beer, however, is a subjective marketing term and more of a consumer concept. There is no uniformly accepted definition of craft beer, but craft generally refers to beers that are brewed using traditional methods, natural ingredients, and innovative techniques. Not all small brewers produce craft beer, nor are all craft brewers small. The Council's focus has been primarily on small brewers because we believe they have the best potential to grow, create jobs, and stimulate innovation and competition.

Accordingly, the New Beer Framework requires TBS to allocate a minimum of 20% of all shelf space, and merchandising, marketing and promotional programs within TBS to small brewers, roughly triple their current market share and shelf space. This cannot be changed without the approval of a majority of the independent directors. At the same time, "craft" beer will be established as a category to recognize the growing importance of these products for consumers.

Rate sheet and operations

TBS will become self-sustaining and will run on a break-even cash flow basis: service fees charged by TBS for retail and distribution will represent the fully-loaded costs of running the system. In returning to its co-op roots, TBS will charge all users (including the current and new owners) their fair share of costs based on the same rate sheet.

We recognize that smaller brewers are less able to afford the costs to bring their brands to market. Accordingly, the New Beer Framework requires that the rate sheet continue to be tiered and graduated, similar to how personal income taxes are progressive today.

One of the important factors in computing the new rate sheet for TBS is how best to address the fact that there are currently material historical pension obligations in TBS. As part of the New Beer Framework, we have created a structure where small brewers are not required to pay fees toward these obligations, mid-size brewers are protected from future increases in cost above $3 per hectolitre, and the balance of any required contributions will be borne by large brewers and the current owners. We believe this structure fairly addresses who should bear the cost of these pension obligations, which have the potential to grow should interest rates remain low.

As a result of these changes, all brewers, except for the current owners, will see their costs of retailing beer through TBS decline. Small and mid-size brewers specifically will see their TBS costs fall by about 5% to 10%.

Improving the customer experience in TBS

Historically, TBS has provided a basic retail experience for its customers. This limits a consumer's ability to discover new products and a supplier's ability to competitively display its offerings. The Council believes that a key priority for the new TBS should be to improve the experience of its customers.

In order to deliver on this, TBS has committed to funding $100 million of capital spending to help modernize the TBS network over the next four years, 80% of which must be allocated to retail store improvements. TBS will publicly disclose the amounts and use of these investments in its annual Operations Report.

TBS has also committed to ensuring that all new stores will be the open-concept, self-serve format, as shown below. Finally, suppliers will be provided with greater in-store marketing and promotional opportunities, to ensure that consumers are better aware of new and exciting brands and products at the Beer Store.

Figure 1 - Front of TBS open concept, self-serve format

Sale of 12-packs

The Council's Initial Report recommended that in order to improve consumer access, the LCBO be enabled to sell 12-packs of beer.

Following further review of this issue in Phase 2, we continue to believe that this additional consumer convenience deserves consideration. However, we also recognize that this initiative may significantly erode the economics of TBS, especially in light of the Council's proposal to sell beer in grocery stores.

Accordingly, we are recommending a pilot study designed to assess the impacts of allowing the LCBO to sell 12-packs. We propose that 10 LCBO stores across Ontario located more than two kilometres away from a Beer Store be selected for the pilot study. The results of the pilot will be audited by an independent third party against agreed criteria to determine the impact on the Beer Store, LCBO, the government, and consumers.

If the pilot is found to be successful, the New Beer Framework provides that the LCBO be allowed to carry 12-packs in up to 60 of its regular stores. We expect that many of these stores will be located in smaller towns across the province.

Sale to licensees

One area that has caused concern is the prices that restaurants and bars (licensees) pay for their beer.

Currently, brewers are able to charge licensees different prices than they charge to retail consumers, in some cases significantly more. In our view, this practice reflects a lack of fairness in the system for licensees who purchase beer in smaller quantities and may not receive services such as free delivery or bottle pick-up from TBS.

Accordingly, the New Beer Framework allows for licensees with annual beer purchases of less than the equivalent of 250 24-packs to purchase beer at TBS retail outlets at the same price as consumers. This would impact almost 9,000 bars and restaurants, over half of all licensees in the province.

Pooled delivery for small brewers

In order to help small brewers manage costs and grow their businesses, the New Beer Framework will permit them to jointly deliver their products to the LCBO and to licenced establishments. Use of third party carriers and warehousing will also be allowed under the authority of the LCBO. This initiative will also benefit the licensees and retail channels themselves, as it will reduce the number of deliveries they each have to accept.

On-site brewery retail stores

Today, an Ontario brewer is only permitted to have one on-site retail store, even if it has more than one production facility in Ontario, unless its overall production exceeds a certain threshold. The Council believes this restriction unfairly favours larger brewers. Accordingly, we support the AGCO's proposal to eliminate the minimum production threshold. This change would allow any brewer with two production facilities to have an on-site retail store at each facility, subject to existing AGCO restrictions on sales.

Increasing the Province's revenue from beer

In our Initial Report, we stated that "Ontario taxpayers deserve their fair share of the profits generated from the Beer Store." As our discussions with industry stakeholders – including TBS owners – continued during our second phase of work, we looked at different alternatives for Ontarians to get this greater share.

The New Beer Framework is designed to return TBS more closely to its roots as a brewer-owned co-op, effectively eliminating any unique value that may accrue to the current owner-brewers, as all stakeholders will benefit equitably. We believe that the government should earn a greater share of the value of the system, but only once those benefits are distributed equitably to all market participants.

The measures contemplated in the New Beer Framework would allow the government to raise $100 million annually, to be phased in over the next four years. This will be achieved by applying a volumetric charge across all beer sold in all channels in Ontario. Annual increases in the legislative minimum retail price of beer have, over time, corresponded with beer price increases at all price points. Our proposal would increase the share of these price increases going to taxpayers and decrease the share going to beer producers. As we have previously stated, we do not believe that suppliers should receive windfall profits as a result of social policy objectives.

Further, the LCBO in-store and out-of-store cost of service charges on beer, which have not been raised in over 20 years, should be indexed to inflation in the future.

Price restrictions

In our negotiations, we wanted to mitigate the impact on consumers of these changes. As a result, we have separately discussed with some of the largest brewers in the industry the expectation of the Province that retail prices for certain products of their most popular brands will not increase before May 1, 2017. These brands represent around 50% of sales in the Beer Store. The principal brewers in the industry have separately confirmed to the Province their intention to comply with this expectation. The only exceptions would be to reflect changes in the minimum retail price of beer (which is indexed to inflation) and circumstances where the industry context materially changes.

Extension of the Ontario Deposit Return Program (ODRP)

Currently, TBS is the Province's service provider of ODRP, for which it charges a handling fee to the LCBO. TBS, which operates this program alongside their own recycling program for beer bottles, handles the returns of all alcohol containers sold by the LCBO, off-site Winery Retail Stores, and on-site winery, brewery, and distillery retail stores, providing the redemption of deposits to consumers and coordinating the recycling of containers. Through this program, no returned containers go to landfill or road bed. As part of the New Beer Framework, the current ODRP contract with TBS will be extended at $1 million per year less than the price of the current contract, with no more annual increases over the extension for inflation. We estimate that, relative to the current ODRP contract, this change could represent cumulative savings to the LCBO of over $30 million over the term of the extension.

Further, under the current ODRP contract, TBS can cancel with 90 days' notice should there be significant changes in the beverage alcohol system in the province. The New Beer Framework requires there be a standstill agreement regarding the current ODRP contract between the Province and TBS, which will prevent TBS from cancelling the contract and provide longer-term certainty to the Province.

Combination stores

Currently, the LCBO has 167 combination stores, which operate in rural locations where no TBS outlets exist. These stores are permitted to sell beer in 12- and 24-packs. Under the old model, if TBS opened a store near an LCBO combination store, the LCBO would have to convert its store to a regular format (i.e., one which only sells beer in package sizes of six or less). This model has, over time, created a disincentive for the LCBO to open new combination stores.

Under the New Beer Framework, existing LCBO combination stores are protected. Further, if the LCBO wishes to open a new combination store in a community in which TBS does not operate, it will notify TBS, which will have 90 days to decide whether it wishes to open a store in that community. If TBS declines, the LCBO may open its combination store, one which will also remain as-is should TBS subsequently decide to open an outlet in the community.

Instead of the stalemate that has occurred in the past, this change will make it more likely that a new store will be built in an area that the LCBO identifies as underserved. Whether through a TBS or an LCBO location, those consumers will have access to a new beer outlet in their community.

Term

One of our goals in reframing the beer retailing system was to provide for some degree of long-term stability without necessarily locking in the proposed model in perpetuity as the current agreement is structured. To achieve this goal, the initial term of the New Beer Framework has been set at 10 years to allow for responsible capital planning, particularly in the context of the Beer Store's commitment to invest $100 million into its network over the next four years. It will be subject to renewal for successive 5-year terms unless terminated by either party.

Should any party decide not to renew the New Beer Framework, there is provision for a minimum notice period of two years from the time at which that decision is made. The New Beer Framework also includes termination provisions that facilitate an orderly wind-down of the agreement with TBS and avoid uncertainty if not renewed.

Increasing consumer access and introducing competition

In our Initial Report, we expressed our belief that there could be a limited expansion of competition in Ontario's beverage alcohol retailing system and indicated that we would like to establish new outlets that would provide on-going competition to the existing quasi-monopolies and apply pressure for continued innovation in the system.

In our Phase 2 work, we spent a considerable amount of time exploring this issue, both for beverage alcohol generally and specifically for beer retailing. Developing a comprehensive proposal requires thoughtful consideration of each of beer, wine, and spirits. It also requires balancing the benefits of increased convenience and access for consumers with important issues such as social responsibility, fairness to all stakeholders, government revenues, consumer prices, and the financial viability of existing beverage alcohol retailers.

As indicated earlier in this report, our work on the potential direction for the wine and spirits retail system in Ontario is still on-going. This work will include consideration of alternative retail channels for wine. Depending on the outcome of that exploration, we will need to ensure that our proposals for an alternative retail channel for beer are aligned with our final recommendations for wine. Acknowledging the need for this further study to complete the picture, the Council has developed its thinking on a possible model for alternative retail channels with specific respect to beer.

Experience of other jurisdictions

In designing a private channel model for Ontario, the Council examined other models that operate in Canada, particularly in Alberta, British Columbia, and Quebec. Each model results in different and important consequences and implications that need to be carefully weighed against the principles of the Council.

Alberta

Alberta began fully privatizing liquor retailing in 1993. Store formats are limited to stand-alone stores carrying a full range of liquor products with no restrictions on the number of outlets. Today, Alberta has over 1,300 private liquor stores and no government-owned outlets. Alberta has uniform wholesale pricing, set by producers, and paid by liquor retailers and licensees. Retailers then apply a mark-up on top of the wholesale price to cover their costs and earn a profit. This retail mark-up can represent 15% to 25% of the retail price.

As a result of unrestricted privatization, consumer prices for beer in Alberta are some of the highest in the country. This pricing is primarily driven by three important aspects of Alberta's model: relatively high tax rates on beer, no limits on the number of liquor stores, and requirements that liquor stores be stand-alone format only.

Not limiting the number of liquor stores reduces sales per store, driving the retailer to increase its mark-up and, as a result, consumer prices to earn an appropriate profit. This also results in higher distribution costs, as beer must be delivered to more stores. Since suppliers set the wholesale price, any increased cost is passed on to consumers through higher prices. Further, stand-alone stores are inefficient relative to big box or grocery stores, which can spread fixed costs over greater volumes and more efficiently utilize store employees. This format requires higher retail mark-ups to cover costs, further increasing consumer prices.

British Columbia

In British Columbia, liquor retailing has evolved to become a partially privatized system. There are just under 200 government-owned outlets, just over 200 rural agency stores and about 670 privately-licenced retail stores selling a full range of liquor products. The BC Liquor Distribution Board (BCLDB) wholesales liquor products to private outlets.

Prior to BC's recent review of its beverage alcohol retailing and distribution system, private outlets purchased liquor from the BCLDB at a discount to the retail price. BC's experience is similar to Alberta's in that the distribution inefficiency caused by a high number of liquor outlets and the poor economics of stand-alone format liquor stores have led to higher consumer prices. However, under BC's old model, there was an additional consequence. Since the government was the wholesaler, the discount at which private retailers purchased beer directly impacted government revenues. Over time, this discount increased as the system became less efficient, negatively impacting government revenues.

Quebec

In Quebec, beer is primarily sold through over 8,000 grocery and convenience stores. The Quebec system benefits consumers by providing widespread, easy access and one-stop shopping convenience. The price for beer is set by retailers, not producers, based on market demand and competitive dynamics, including consumers' willingness-to-pay.

A source of debate throughout the Council's work has been whether Ontario or Quebec has lower beer prices. This is a challenging question to answer given that Quebec, unlike Ontario, has beer prices that are not uniform and that can differ significantly across retailers. Many academic studies have been conducted on this topic.

Based on our reviews of these studies and our own research, we do not believe that there is a meaningful difference in the average prices of beer between Ontario and Quebec. This does not mean that a consumer can't find a case of beer in Quebec at a cheaper price than in Ontario – non-uniform pricing in Quebec, including short-term promotions, virtually guarantees this. However, on average, we believe that prices within the two provinces are generally comparable.

Despite relatively similar prices, there is a significant difference in the amount of tax the two provinces receive on purchases of beer. Ontario's taxes are about $3 higher than Quebec's on a 24-pack of beer. In essence, retail prices are comparable, but taxes are much higher in Ontario.

There are two reasons why this is the case. First, distribution costs are higher in Quebec than in Ontario due to the greater number of beer outlets (more than 8,000 vs. 1,400, respectively). Second, there is no competitive advantage for selling beer because any grocery or convenience store is able to obtain a licence. Therefore, grocers are not able to achieve better efficiencies or benefit from incremental foot traffic. The Ontario taxpayer is better off because they enjoy the same low prices as the Quebec taxpayer, but substantially more revenues go to the government.

Our approach

Considering the consequences and implications of expanded liquor retail access in other jurisdictions, the Council has moved with deliberate caution to develop a proposal on how to introduce limited liquor retail competition into the Ontario marketplace. We want to maintain the efficiencies of the current quasi-monopoly system which, as shown, benefit both consumers and taxpayers:

Beer prices and provincial taxes (average 24-pack)2all figures are approximate

| Ontario | Quebec | Alberta | British Columbia | |

|---|---|---|---|---|

| Consumer price (excluding deposit) | $34 to $35 | $34 to $35 | $40 | $40 |

| Provincial commodity and sales tax | $11 | $8 | $10 | $12 |

2 Ontario consumer price range represents the weighted average price of all home consumer packaged beer products sold through TBS and the weighted average price of only those products that overlap with Quebec; Ontario provincial commodity tax represents the beer basic tax / mark-up, volume tax / levy and environmental tax / levy, weighted based on the share of non-refillable beer containers sold in Ontario.

Quebec consumer price range represents the weighted average price of all beer products and the weighted average price of only those products that overlap with Ontario; Quebec provincial commodity tax represents the beer tax for large brewers.

Alberta consumer price represents the weighted average Alberta Gaming and Liquor Commission wholesale beer price, adjusted for private liquor store mark-ups; Alberta provincial commodity tax represents the beer mark-up for large brewers.

British Columbia consumer price represents the weighted average large brewer price at BC Liquor Stores, agency stores, and Liquor Retail Stores (LRS); LRS price adjusted to remove Liquor Distribution Branch discount and apply a mark-up; BC provincial commodity tax represents the beer mark-up for large brewers.

Consumer prices exclude deposit and include sales tax. Consumer prices based on 2013 data, adjusted (for illustrative purposes) to include subsequent changes in provincial taxes.

Licences to sell beer

We are proposing that a limited number of licences or other permissions to sell beer be offered to grocery stores in Ontario. Key features of the licensing program include:

- Licences will be issued through a competitive process based on the discount off the retail price at which grocers will purchase the beer from the LCBO.

- There will be requirements for hours of sale, appropriate check-out provisions, uniform pricing, and social responsibility training for all employees facilitating the purchase of beer.

- The licences will be issued without territory protection, and there will be no restrictions on relative location to other liquor points of sale.

- Licences will be granted in urban areas and will be geographically dispersed across the province.

- Licences will be granted in a manner to ensure a fair representation of privately-owned grocers.

- Retailers will sell all beer – domestic and international – with specific requirements on shelf space and / or incentives for sales of small brewers' products.

- The licences will only allow the sale of beer in pack sizes of six or less. Sale of 12- and 24-packs will not be allowed nor would discount pricing on purchases of multiple six-packs (referred to as pack-up pricing).

- Except for liquor delivery licences currently issued by the AGCO, consumer electronic ordering and home delivery will not be permitted for the licenced grocery stores. However, existing arrangements currently permitted may continue.

- The licences will allow for beer sales at each outlet of, on average, around $1 million per year. Where a grocery chain operates more than one outlet, this limitation will apply to the average volume sold across all of its licenced outlets.

- Suppliers will not be permitted to pay grocers for any marketing, merchandising, or shelf space programs.

LCBO as wholesaler

Under the Council's proposal, the LCBO would act as the wholesaler, selling beer to grocers at a discount on or from the retail price. The discount is expected to be much lower than both the LCBO's cost of retailing beer as well as the discount currently provided to LCBO agency stores, and will be established through a competitive process. By positioning the LCBO as wholesaler, the Province will benefit from an additional low cost channel, and producers will be protected from direct negotiations with the grocers. To avoid the discount increasing over time, as has been the experience in other jurisdictions, a discount ceiling would be enshrined in legislation.

The LCBO and TBS will be allowed to physically distribute beer to the grocery retailers as will any brewer licenced by the regulator. Uniform pricing will continue to apply across Ontario, and consumers will pay the same price for the same product regardless of whether they buy it at TBS, the LCBO, or a grocery store.

Low cost channel

We believe that grocery stores are best positioned to serve as a low cost channel for retailing beer, while providing an enhanced customer experience and improved convenience. Operating in a highly competitive environment, grocers are motivated and organized to provide a shopping experience and product offering that customers want. We are confident that, given grocers' consumer-focused business models, grocers will be keen to celebrate and serve local and small brewers' products. This additional competition will apply pressure on the other liquor quasi-monopolies to innovate and improve their value proposition, all to the benefit of the consumer.

A critical component to a grocery store's competitive offering is price. To compete on price, grocers have evolved and innovated over the decades into a channel that can support low prices on food and beverage products. Unlike stand-alone stores selling only liquor products, grocers will be able to cross-sell other products. If carrying beer increases the overall foot traffic to a grocery store, sales of other products will increase. Grocers are therefore best able to offer the lowest discount to retail beer and the best return for the Province.

Limited number of licences

We believe that by offering a limited number of licences, scarcity will be maintained. Were beer sales simply allowed in all grocery stores, grocers would have a lower sales volume in each store and there would be no competitive advantage from carrying beer. Under our proposal, grocers with beer licences would have a differentiated product offering from competing grocery stores, attracting new customers and driving increased sales on non-beer products.

We believe this scarcity helps to address the challenges faced by other provinces. Distribution costs in BC, Alberta, and Quebec are higher than those in Ontario because there are significantly more outlets per capita with lower volumes. Limiting the number of new outlets in Ontario helps to mitigate this. Further, the cap on the number of outlets limits the potential cannibalization of the LCBO or the Beer Store, better maintaining the efficiencies of the quasi-monopoly system.

Customer convenience

The proposed model would allow for beer sales in up to 450 grocery stores across Ontario. This is the same number of outlets that TBS currently operates in Ontario. The Council believes that this level of density is reasonable both in terms of its competitive impact as well as in terms of consumer access. The New Beer Framework provides for a phased introduction of the new grocery channel, allowing up to 150 new outlets to be in operation by May 1, 2017.

In terms of access, we believe that the proposed landscape for beer sales would provide more-than-adequate access for Ontario consumers. Today approximately 86% of Ontarians live within a five minute drive of a store that sells beer. This figure is even higher in urban areas. Under the Council's proposals, the total number of points of sale for beer in Ontario would increase by over 30% to over 1,800 outlets. Although lower in density than in some provinces, the Council believes this allows for a high level of access for consumers. Most importantly, consumers will have a choice of whether to shop at an LCBO store for the experience, at a TBS store for larger pack sizes and greater value, or at a grocery store for one-stop shopping convenience.

Social responsibility

A critical component of any new retail channel for liquor in Ontario is maintaining the same social responsibility standards that exist today in the LCBO and not encouraging increased consumption. We believe that this is achieved by controlling the roll-out of grocery licences and the sales in each outlet, restricting operating hours, ensuring that the LCBO acts as the wholesaler, maintaining uniform pricing and minimum retail pricing, restricting sales to packs of six or less, and requiring appropriate check-out provisions and training for all employees facilitating the purchase of beer.

Figure 2 - Socially responsible format for beer in grocery stores (zoomed out)

Figure 3 - Socially responsible format for beer in grocery stores (zoomed in)

Flexibility going forward

While our analysis above contemplates beer in grocery stores, we have, through the New Beer Framework, preserved the flexibility to add beer to stand-alone stores as well. This will provide us and the government the ability to make adjustments during implementation or to incorporate future decisions that are made about wine and other categories of beverage alcohol. However, we accept – and agree with – the government's position that to sell liquor in convenience stores would not be a socially responsible decision.

The New Beer Framework represents a significant change in the beverage alcohol retailing system in Ontario. Its implementation will require thoughtful application and careful management, but the Council believes strongly that it offers a major step forward in terms of enhancing customer convenience, choice and shopping experience in a socially responsible manner, as well as acting as a catalyst for increased competition in the beer retailing sector.

The Council's view is that this model much more effectively balances the interests of brewers, consumers, and taxpayers while still offering a varied and relatively high-density of retail outlets. As noted earlier, we are still working through our approach to alternative channels for wine retailing. When this is complete, we will ensure that the two approaches are aligned.

Conclusion

The Council is satisfied that the New Beer Framework levels the playing field: we have returned the Beer Store to its co-op roots. In our view, the reframed beer retailing system:

- improves customer convenience, choice and shopping experience;

- keeps beer prices for Ontario consumers below the Canadian average;

- maintains efficiencies of the existing system;

- treats suppliers fairly while improving retail access;

- introduces additional competition;

- increases revenue for government while maintaining competitive beer tax rates; and

- remains socially responsible.

The new beer retailing landscape of Ontario will feature increased competition and consumer choice with the availability of beer in up to 450 grocery stores across the province in addition to the 450 existing TBS stores, 113 on-site brewery retail stores, and 651 LCBO stores and 217 LCBO agency stores, an increase of over 30% for a total of more than 1,800 outlets. These grocery stores will only be allowed to sell beer provided that they meet shelf space requirements for small brewers and that they purchase beer from the LCBO at a discount that represents a much lower cost than other retail channels. Uniform pricing and safeguards to ensure social responsibility will be maintained across all channels. Additionally, to protect consumers from the possibility of beer prices increasing in the short-term, prices for certain products of popular brands will be constrained until May 2017.

Throughout our work, the Council has been particularly concerned with improving the system for consumers and ensuring that all brewers are treated fairly. We have, of course, also focused on protecting the interests of Ontario taxpayers, consistent with our original Terms of Reference. We are satisfied that the new system offers each of these groups significant gains.

Consumers

The new system will provide consumers with improved convenience and choice by allowing beer to be sold in grocery stores. The customer experience in TBS stores will be greatly improved through a $100 million capital commitment to modernize their network, and all new stores will be open concept, self-serve formats. In addition, a limited pilot study of selling 12-packs through the LCBO offers an opportunity for greater access for consumers across the province. Furthermore, the New Beer Framework provides protection for LCBO combination stores that currently offer 12- and 24-packs of beer, and improves the mechanism for the LCBO or TBS to open new stores in underserved communities. If the 12-pack pilot is successful, there could be more than 220 LCBO stores (including the existing 167 LCBO combination stores) and 217 agency stores selling 12- or 24-packs of beer in smaller communities across Ontario.

Gains for consumers will not be achieved at the expense of social responsibility. The Council has worked carefully to ensure that increased access does not mean unrestricted access. The grocery store format that we are proposing is for urban grocery stores only, and there will be clear restrictions on hours of sale, uniform pricing, appropriate check-out safeguards, and social responsibility training for all employees facilitating the purchase of beer. In addition, the Ontario Deposit Return Program (ODRP) has been extended with TBS at a significantly improved price for the Province.

Finally, restaurants and bars (licensees) are charged different (and sometimes much higher) prices for beer today. The New Beer Framework will ensure that small licensees will be able to purchase beer through TBS at the same retail price as consumers. Almost 9,000 small licensees, over half the current licensees in the province, will be able to benefit from this change.

Producers

Under the new system, ownership of the Beer Store will be open to all brewers with facilities in Ontario, providing them with an opportunity to benefit from increases in the value of the business and associated shareholder rights. Additionally, their interests will be further protected by having four independent directors on the board with effective veto rights on brewer fairness and other important issues.

All brewers, except for the current owners, will see their costs of retailing beer through TBS decline. Small and mid-size brewers specifically will see their TBS costs fall by about 5% to 10%. Small brewers will have significant advantages, with a minimum of 20% shelf space allocation in TBS and grocery stores, and incentives for the grocers to sell more of their beer. As with existing channels, brewers will retain the ability to set prices in grocery stores and will earn the same margin as if the sale occurred in an LCBO store. Lastly, small brewers will gain the ability to more efficiently deliver their products directly to retail points of sale and licensees by pooling their products with the option of using third party carriers and warehousing.

Taxpayers

The new system provides for government, and by extension taxpayers, to share more equitably in the value currently generated by the system. This value will be achieved on a phased basis with price restrictions limiting the impact on consumer prices.

Any new system needs a degree of long-term stability to permit responsible capital planning by retailers and producers, while not locking the new model in perpetuity. The Council is satisfied that, with the protections built into the New Beer Framework, an initial 10-year term achieves this balance.

The Council recognizes that the new system represents significant change within the Province's current regulated environment for beverage alcohol. Some will argue that we should have gone further. We have examined other models in Canada and found that, in many cases, consumers pay more and taxpayers get less while convenience is not significantly improved. Conversely, some will argue that the current system should be left unchanged. However, today's system limits convenience and may not provide all producers with equitable treatment. The Council has opted for significant, controlled change – the biggest change in beer distribution in Ontario since prohibition. We believe that this new beer retailing system will better serve all Ontarians and stakeholders.

Final recommendations

The Council has now completed its review of TBS and beer retailing in Ontario. This section presents the final recommendations we made in support of the government's 2015 Budget that have been incorporated in the New Beer Framework.

- TBS should continue to operate, but with broader ownership, and fundamentally improved governance and operating practices, including:

- opening its ownership to all brewers with facilities in Ontario

- establishing a new 'best practices' governance structure that allows it to operate at arm's-length from its owners, with brewer directors nominated based on relative market shares, and a critical mass of independent directors

- requiring independent directors to approve any change related to brewer treatment and fairness, as well as any changes to the New Beer Framework

- appointing an independent TBS Ombudsman to handle complaints

- operating in a more open, transparent and accountable manner

- enshrining a new mechanism for determining rates charged to all brewers, lowering costs for all brewers other than the current owners;

- changing its retail and marketing practices to ensure fairness and equity among brewers

- investing $100 million over four years, 80% of which will help modernize its stores

- The Province should increase its annual revenues from beer sales in Ontario through a new beer charge as part of the existing beer tax framework. The principal brewers in the industry have separately confirmed to the Province their intention to comply with the Province's expectation that retail prices for certain products of their most popular brands will not increase before May 1, 2017. The only exceptions would be to reflect changes in the minimum retail price of beer (which is indexed to inflation) and circumstances where the industry context materially changes.

- The Ontario Deposit Return Program contract should be extended at a discount to the current rates without annual indexing to inflation.

- The LCBO should be permitted to conduct a 10-store pilot study to explore the viability of offering 12-packs with an option to expand to 60 stores.

- Small restaurants and bars should be able to buy beer from TBS at the same retail prices as consumers.

- Small brewers should be allowed to jointly deliver their products to the LCBO and licenced establishments with the ability to use third party carriers and warehousing.

- The Alcohol and Gaming Commission of Ontario (AGCO) should allow brewers with two production facilities to have an on-site retail store at each facility for the sale of their products only, regardless of the production size of their facilities.

The Province should offer to a number of qualifying grocery stores operating in Ontario up to 450 licences or other permissions to sell beer. This new channel should be phased in over time with up to 150 outlets in operation by May 1, 2017. Licences should be made available through an open and transparent process designed to achieve:

- fair market value for the Province

- fair representation of privately-owned grocers

- appropriate distribution across urban areas in Ontario

- a diversity of grocers to prevent the creation of a new monopoly

Retail beer licences should include requirements to:

- operate with restricted hours of sale, appropriate check-out provisions, uniform pricing, and social responsibility training for all employees facilitating the purchase of beer;

- sell all beer – domestic and international – with specific requirements on shelf space and incentives for sales of small brewers' products;

- sell beer only in pack sizes of six or smaller (with no pack-up pricing);

- limit annual beer sales to an average cap per store of the volume equivalent of $1 million, which may be shared across a single grocer's licenced stores;

- position the LCBO as the wholesaler;

- purchase beer from the LCBO at a discount that represents a much lower cost than other retail channels, locked in for at least 10 years; and

- prohibit inducements or monies from suppliers.

- The New Beer Framework should last for an initial term of 10 years, with recurring options to renew for 5-year terms and beyond. The New Beer Framework should include termination provisions that facilitate an orderly wind-down of the agreement with TBS and avoid uncertainty if not renewed.

Attachment

Modernizing the distribution of beer in Ontario framework of key principles

The following sets out the key principles (the "Key Principles") under which Brewers Retail Inc. operating under the name "The Beer Store" ("TBS"), Molson Canada 2005 ("Molson"), Labatt Brewing Company Limited ("Labatt"), Sleeman Breweries Ltd. ("Sleeman"), the Premier's Advisory Council on Government Assets (the "Council") and the Ontario Ministry of Finance (the "MoF") intend to negotiate in good faith detailed changes to the beer retail and distribution system in Ontario, on terms acceptable to the parties, in the implementation of the Council's recommendations to the Province of Ontario (the "Province") with respect to that system.

Certain additional defined terms are set out in a Schedule to this document.

Subject to clause 10(c), pursuant to the laws of Ontario the Province would direct, authorize and agree to a revised beer retail and distribution system for Ontario that would allow TBS and the Current Owners to retain certain elements of the existing system subject to the Key Principles and the more detailed terms and conditions of the documents necessary to implement the Key Principles (the "New Beer Agreements"). In consideration for that, and in accordance with the laws of Ontario, the parties will be authorized and agree to the following:

- TBS will continue to operate as a low cost, efficient distributor of beer in Ontario

- TBS will continue to operate on a self-sustaining basis as a low cost, efficient distributor of beer in Ontario.

- TBS will be operated as a self-funding corporation on a break-even cash flow basis. As an important element of this, the schedule of listing and service fees to be charged by TBS to all brewers selling products through TBS (the "Rate Sheet") will be set each year to provide sufficient, but not excess, revenue to cover all of the cash requirements of TBS consistent with approved operating and capital plans.

- The ownership of TBS will be open to all brewers with facilities in Ontario

- All Qualifying Brewers (as defined in the attached Schedule) will be offered a meaningful opportunity to become equity shareholders of TBS by subscribing for new shares of TBS as set out in part 3.

- Any transactions between TBS and its shareholders will be transparent, auditable, and commercially reasonable.

- TBS will be capitalized in such a way as to reflect any embedded value that should be attributed to the Current Owners while providing for the financing of ongoing capital requirements on commercial terms

- The capital of TBS will be divided between First Preferred Debentures, First Equity Shares and Second Equity Shares.

- The First Preferred Debentures will be issued to any Qualifying Brewers (including the Current Owners) providing new capital to TBS from time to time to fund capital replacement or improvements (e.g., when TBS cannot borrow from third parties on reasonable commercial terms), and will entitle the holders to annual interest at a reasonable commercial rate as well as the return of their principal when redeemed by TBS or upon liquidation of TBS, in priority to any distribution to the holders of any class of shares of TBS. The First Preferred Debentures will contain limited covenants only (such as with respect to the payment of interest and acceleration upon an event of insolvency).