Ontario energy quarterly: electricity in Q3 2021

Read an up-to-date snapshot of Ontario’s electricity sector for July to September 2021.

Overview

Download the data used to create this report from the Ontario open data catalogue.

Ontario Grid-Connected Peak Demand (Q3)

22,986 (MW) (Set on August 24, 2021, 5:00 pm EST)

Source: IESO

Ontario Grid-Connected Peak Demand (YTD)

22,986 (MW) (Set August 24, 2021, 5:00 pm EST)

Source: IESO

| Commodity | Q3 | YTD |

|---|---|---|

| Hourly Ontario energy price (arithmetic average) | 3.20 | 2.31 |

| Global Adjustment (Average, Class A) |

3.39 | 3.91 |

| Total | 6.59 | 6.22 |

Source: IESO

| Commodity | Q3 | YTD |

|---|---|---|

| Hourly Ontario energy price (weighted average) | 3.43 | 2.51 |

| Global Adjustment (Average, Class B) |

6.33 | 7.79 |

| Total | 9.76 | 10.30 |

Source: IESO

Ontario’s transmission grid

The IESO map displays generation facilities with installed capacity of more than 20 megawatts (MW) connected to the high-voltage transmission grid. Please note that this map is used for illustrative purposes only. All locations are approximate.

Electricity supply

Monthly energy grid output by fuel type

Ontario’s bulk electricity grid has a diverse supply mix, featuring baseload generators that provide energy around the clock, intermittent generators that generate when they are able (primarily wind and solar), and flexible generators that can change their output quickly (primarily natural gas).

Source: IESO

This line graph displays the amount of energy generated in megawatt-hours every month from April 2020 to September 2021. The types of energy sources are: nuclear, gas hydro, wind, biofuel and solar.

The data shown above is sourced from a report developed by the IESO. The report uses settlement data to provide information for all self-schedulers, intermittent and dispatchable Ontario generators registered as Market Participants. The report – which includes all grid-connected generators, plus those embedded generators that are also registered as market participants – is published monthly as per the Physical Settlement calendar.

Imports and exports

Ontario is connected to a large, stable network of transmission systems across North America, which supports system reliability and economic efficiency. Imports compete against domestic generation to provide energy at the best possible price and to support the province’s needs during periods of high demand. Ontario also exports energy when it is economic, which helps to bring in revenue to offset other system and infrastructure costs and maintain system reliability during times of surplus generation.

Ontario imports and exports power across 26 interties with two provinces and three states. While Ontario is electrically interconnected with Manitoba, Michigan, Minnesota, New York and Quebec, the interties allow for electricity trade in transactions that can reach across eastern North America, contributing to a more diversified and competitive pool of supply.

Q3 imports

This bar graph displays the data presented in table 3: the percentage of imported energy in Ontario from Manitoba, Michigan, Minnesota, New York and Quebec for Q3 2021.

| State/Province | % |

|---|---|

| Manitoba | 6.7% |

| Michigan | 1.3% |

| Minnesota | 4.6% |

| New York | 3.2% |

| Quebec | 84.3% |

Q3 exports

This bar graph displays the data presented in table 4: the percentage of exported energy from Ontario to Manitoba, Michigan, Minnesota, New York, and Quebec for Q3 2021.

| State/Province | % |

|---|---|

| Manitoba | 2.8% |

| Michigan | 46.1% |

| Minnesota | 2.1% |

| New York | 38.6% |

| Quebec | 10.5% |

| Q3 (GWh) | Imports | Exports |

|---|---|---|

| Manitoba | 156.50 | 116.80 |

| Michigan | 30.96 | 1,939.36 |

| Minnesota | 106.90 | 89.16 |

| New York | 74.63 | 1,624.48 |

| Quebec | 1,976.50 | 440.30 |

| Total | 2,345.49 | 4,210.10 |

Source: IESO

Note: Numbers may not add up to totals due to rounding.

Installed capacity connected to transmission grid

Changes to installed transmission grid capacity in this quarter highlight the continuing process of renewal in Ontario’s electricity sector. While nuclear, hydroelectric and natural gas resources accounted for the vast majority of system capacity, new wind, biofuel and solar generators continued to connect to the transmission grid. The IESO Active Generation Contract List provides the status of individual contracted electricity supply projects within different IESO procurement programs. The list is limited to generation facilities under contract to the IESO.

Grid-connected generation capacity (Q3)

This pie graph displays the data presented in table 6: the percentages of grid-connection generation capacity from nuclear, gas, hydro, wind, biofuel, and solar energy sources.

| Generation | % |

|---|---|

| Nuclear | 34% |

| Gas |

28% |

| Hydro | 23% |

| Wind | 13% |

| Biofuel | 1% |

| Solar | 1% |

Source: IESO

Note: Installed grid-connected generation capacity is the sum of all market participant generators who supply or bid into the IESO-administered market. Numbers may not add up to totals due to rounding.

The table below shows how Ontario’s generation capacity sources have changed since 2015.

| Type (MW) | 2021 (Q3) | 2021 (Q2) | 2021 (Q1) | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Nuclear | 13,089 | 13,089 | 13,009 | 13,009 | 13,009 | 13,009 | 13,009 | 12,978 | 12,978 |

| Hydro | 8,918 | 8,918 | 9,060 | 9,060 | 9,065 | 8,482 | 8,490 | 8,451 | 8,432 |

| Coal | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Gas |

10,515 | 10,515 | 11,317 | 11,317 | 10,277 | 10,277 | 10,277 | 9,943 | 9,942 |

| Wind | 4,783 | 4,783 | 4,786 |

4,486 | 4,486 | 4,486 | 4,213 | 3,923 | 3,504 |

| Biofuel | 296 | 296 | 295 | 295 | 295 | 295 | 495 | 495 | 495 |

| Solar | 478 | 478 | 478 | 478 | 424 | 380 | 380 | 280 | 240 |

| Total | 38,079 | 38,079 | 38,944 | 38,644 | 37,555 | 36,929 | 36,863 | 36,070 | 35,591 |

Note: Total IESO-contracted grid-connected generation in commercial operation at end of each period. Numbers may not add up to totals due to rounding.

Embedded generation (IESO-contracted)

Embedded generators supply electricity to local distribution systems, helping to reduce demand on the transmission grid and supporting some of the needs of local communities. While wind and solar make up the majority of contracted embedded generation, the IESO has contracted for increasing amounts of hydroelectric, combined heat and power, natural gas and biofuel systems that will also connect to local distribution networks.

By the end of Q3 2021, there was 3,165 MW of contracted generation in commercial operation within local distribution systems.

Contracted embedded generation capacity in commercial operation (Q3)

This pie graph displays the data presented in table 8: the amount of embedded generation (in megawatts and corresponding percentages) in Q3 2021 from the following energy sources: gas, hydro, wind, biofuel, solar and other.

| Generation | % | Amount |

|---|---|---|

| Gas | 9% | 320 MW |

| Hydro | 9% | 333 MW |

| Wind | 17% | 590 MW |

| Biofuel | 3% | 110 MW |

| Solar | 61% | 2,172 MW |

| Other | 1% | 24 MW |

Source: IESO Q3 Progress Report on Contracted Supply.

Note: Numbers may not add up to totals due to rounding.

A small amount (estimated 180 MW) of contracted embedded capacity is IESO-administered (market participant) generation and therefore reported in both grid-connected and contracted embedded generation totals. Totals do not include non-contracted embedded generation capacity, whose total annual output is approximately 1 TWh.

The chart below shows the increased use of embedded generation to supply electricity to local distribution systems in the province.

Contracted embedded generation capacity in commercial operation

This bar chart displays the amount of embedded generation (in megawatts) to supply electricity to local distribution systems in the province.

Total grid-connected and contracted embedded generation capacity

This table shows all grid-connected capacity and IESO-contracted embedded capacity in the province.

| Type | 2021 Q3 (MW) | 2021 Q3 (%) |

|---|---|---|

| Nuclear | 13,089 | 31% |

| Hydro | 9,224 | 22% |

| Gas |

10,836 | 26% |

| Wind | 5,374 | 13% |

| Biofuel | 406 | 1% |

| Solar | 2,650 | 6% |

| Total | 41,629 |

Source: IESO

Note: Numbers may not add up to totals due to rounding.

Conservation

Projects continue to be completed under three legacy electricity Conservation and Demand Management (CDM) frameworks, due in part to COVID-19 related delays. Previously, the province had established electricity savings targets for the 2015-2020 Conservation First Framework (CFF) and the 2015-2020 Industrial Accelerator Program (IAP) of 7.4 and 1.3 TWh, respectively. However, to streamline conservation programs, the Minister issued a Directive in March 2019 to wind down the CFF and IAP and establish a new Interim Framework for 2019-2020, for which IESO had set targets of 1.4 TWh and 189 MW. As a result of the wind down of the CFF and IAP, the IESO revised the CFF and IAP targets as follows: 1) CFF target of 6.0 TWh; 2) IAP target of 1.3 TWh. Together the CFF, IAP and Interim Framework (IF) are expected to achieve 8.7 TWh savings.

In 2021, the 2021-2024 CDM Framework was launched, with an energy target of 2,746 GWh and a demand target of 440.1 MW.

As of Q3 2021, CFF Programs have achieved 7,761 gigawatt-hours (GWh) in electricity savings representing 129% of the 6.0 TWh CFF target and the IAP Program has achieved 618.7 GWh in electricity savings representing 47.6% of the original 1.3 TWh target. IF programs have achieved 567.0 GWh and 67.5 MW in electricity and demand savings representing 40.5% and 35.7% of the targets, respectively.

As is common at the start of all conservation frameworks, participation levels in the 2021-24 CDM Framework took time to increase as new programs were implemented, program-delivery vendors were on-boarded, and customers became more familiar with new program offering's. Energy and demand savings from programs under the 2021-24 CDM Framework are forecasted to increase over time as more projects are completed and participation levels continue to increase. Actual savings for the Interim Framework are expected to continue to accrue through 2021-2022 as committed projects enter into service.

For more information on CDM results, please see the IESO's last annual report on the Framework: 2019-2020 Interim Framework.

| Incremental progress | 2021 Q3 Incremental |

2015-2020 Q3 Incremental | 2020 target progress (%) |

|---|---|---|---|

| LDC & IESO Delivered CFF Peak Demand Savings (MW) | 14.0 | 916.0 | - |

| LDC && IESO Delivered CFF Energy Savings (GWh) | 110.6 | 7,761 | 129 |

| IESO Delivered IAP Peak Demand Savings (MW) | 1.1 |

150.3 | - |

| IESO Delivered IAP Energy Savings (GWh) | 31.3 |

618.7 | 47.6 |

| IESO Delivered IF Peak Demand Savings (MW) | 7.3 | 67.5 | 35.7 |

| IESO Delivered IF Energy Savings (GWh) | 69.7 | 567.0 | 40.5 |

| Total Portfolio Total Peak Demand Savings (MW) | 20.2 | 1,133.8 | - |

| Total Portfolio Total Energy Savings (GWh) | 149.0 | 8,946.7 | - |

| Program | 2021 Q3 Incremental |

2021-Q3 2021 | 2024 target progress (%) |

|---|---|---|---|

| IESO Delivered 2021-24 Peak Demand Savings (MW) | 2.63 | 3.61 | <1% |

| IESO Delivered 2021-24 Energy Savings (GWh) | 19.01 | 26.99 | <1% |

Source: IESO

Note: Totals may not align due to rounding.

Incremental savings (2021 Q3)

| Program | Demand savings |

|---|---|

| 2021-24 CDM Programs | 2.6 MW |

| CFF Business Programs | 14 MW |

| IF Low-Income Programs | 0.4 MW |

| IF Business Programs | 6.9 MW |

| IESO IAP Program |

1 MW |

This pie graph displays the data presented in table 12: the 2021 annual peak demand savings Q3 2021 Incremental, in megawatts, from the following programs: Conservation First Framework Business Programs, Interim Framework Low-Income Programs, Interim Framework Business Programs, and IESO Industrial Accelerator Program.

| Program | Energy savings |

|---|---|

| 2021-2024 CDM Programs | 19 GWh |

| CFF Business Programs | 111 GWh |

| IF Low-Income Programs | 4 GWh |

| IF Business Programs | 66 GWh |

| IESO IAP Program |

-31 GWh |

This pie graph displays the data presented in table 13: the 2021 annual energy savings Q3 2021 Incremental, in gigawatt-hours, from the following programs: 2021-2024 Programs, Conservation First Framework Business Programs, Interim Framework Low-Income Programs, Interim Framework Business Programs, and IESO Industrial Accelerator Program.

Results presented for Q1 to Q3 2021 are ’reported’ (i.e. ’unverified’) based on project installation dates corresponding to the indicated period and are based on projects reported and invoiced to the IESO as of Q3 2021.

Demand response (DR)

Demand response and peak savings programs benefit the electricity system and lower energy costs for consumers by contributing to overall peak savings for the province.

In December 2015, DR capacity began to be procured through a competitive DR Auction process. The DR Auction provided a transparent and cost-effective way to select the most competitive providers of DR, while ensuring that all providers were held to the same performance obligations.

In 2020, the IESO’s Capacity Auction replaced the Demand Response (DR) Auction to enable competition between additional resource types. Capacity auctions help meet Ontario’s reliability needs in a cost effective manner while allowing the IESO to transparently adjust capacity procurement targets with changing system needs. The IESO held Capacity Auction #1 on Wednesday, December 2, 2020, securing 992.1 MW of capacity for the summer 2021 obligation period from a range of eligible resources including demand response, imports, generation, and energy storage. Forecasts indicated that it was not necessary to secure additional capacity for the winter 2021–2022 obligation period.

More information on the Capacity Auction is available on the IESO Capacity Auction page.

Peak savings from the Industrial Conservation Initiative

The Industrial Conservation Initiative (ICI) encourages large consumers to shift their energy use away from system-wide peaks. Customers who are able to reduce their impact on peaks benefit the system by reducing the need to build new infrastructure. In 2018, ICI is estimated to have reduced peak demand by 1,550 MW.

Participating customers pay Global Adjustment (GA), based on the percentage that their demand contributes to the top five system coincident peaks measured during a defined base period (May 1 to April 30).

Ontario provided ICI participants with temporary relief on their electricity bills as a COVID‑19 relief measure. Specifically, Ontario deferred a portion of GA charges from April to June 2020.

Beginning in January 2021, deferred GA is being collected from the same classes of consumers over a twelve-month period. The government also implemented a Peak Hiatus under ICI, so that participating companies did not need to reduce their electricity demand during peak hours in 2020-2021, allowing them to focus on returning to full levels of operations.

The table below lists the top five daily peaks for the base period that began on May 1, 2019 and ended on April 30, 2020.

| Date | July 5, 2019 | July 20, 2019 | July 29, 2019 | July 19, 2019 | July 4, 2019 |

|---|---|---|---|---|---|

| Hour Ending | 17 | 17 | 17 | 13 | 18 |

| Allocated Quantity of Energy Withdrawn (MW) | 21,275 | 21,147 | 21,068 | 21,006 | 20,956 |

| Embedded Generation (MW) | 1,024 | 956 | 1,069 | 1,135 | 732 |

| Energy Storage Injections (MWh) | 5 | 0 | 7 | 4 | 4 |

| Total (MW) | 22,294 | 22,103 | 22,129 | 22,368 | 21,639 |

Source: IESO

Note: The value in the Total (MW) column is the number used to calculate a customer's Peak Demand Factor.

Numbers may not add due to rounding.

The above values are used for the July 1, 2021 to June 30, 2022 adjustment period.

Information on peak tracking can be found on the IESO Peak Tracker page

More information on the ICI is available on the IESO website (PDF).

Greenhouse gas emissions

The marked decline in greenhouse gas emissions (measured in megatonnes of CO2 equivalents) is a result of the phase-out of coal-fired electricity generation in the province, uptake of emissions-free generation and conservation measures. Emissions of oxides of sulphur (SOx) – which are predominantly a by-product of coal combustion – have also shown a marked decrease with the phase-out of coal-fired electricity.

Greenhouse gas emissions for the Ontario electricity sector

The chart below shows annual greenhouse gas emissions (measured in megatonnes of CO2 equivalent) for the years 2013-2021. Year-to-date greenhouse gas emissions in Q3 2021 totalled approximately 3.4 megatonnes (Mt).

Source: IESO, Environment and Climate Change Canada

Note: Data to 2019 is as per Environment and Climate Change Canada’s National Inventory Report issued in April 2021. Data for 2020 onwards is estimated by the IESO using actual energy.

Air contaminants

Air contaminants, including oxides of sulphur (SOx), oxides of nitrogen (NOx) and fine particulate matter (PM2.5), are also released during combustion of fossil fuels.

| Emissions | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 (Q3) |

|---|---|---|---|---|---|---|---|---|---|---|

| SOx Emissions | 10,342 | 10,192 | 846 | 424 | 579 | 644 | 539 | 424 | 395 | 381 |

| NOx Emissions | 19,110 | 17,183 | 10,578 | 9,631 | 8,867 | 6,638 | 6,675 | 5,996 | 5,586 | 4,250 |

| PM2.5 Emissions | 499 | 440 | 309 | 301 | 395 | 197 | 203 | 161 | 202 | 152 |

Source: IESO, Environment and Climate Change Canada

Note: Data to 2019 is as per Environment and Climate Change Canada's Air Pollutant Emission Inventory (APEI) issued in March 2021. Data for 2020 onwards is estimated by the IESO using actual energy production and emissions factors aligned with data provided by Environment and Climate Change Canada's National Inventory Report.

Electricity demand

Electricity demand is generally shaped by several factors that have differing impacts – those that increase demand (population growth, economic change), those that reduce demand on the grid (conservation, embedded generation) and those that shift demand (time-of-use rates, the Industrial Conservation Initiative). The impact of each of these factors on electricity consumption varies by season and time of day.

Ontario Grid-Connected Peak Demand in Q3: 22,986 (MW) (Set on August 24, 2021, 5:00 pm EST)

Ontario monthly peaks and minimums

Source: IESO

This line graph displays Ontario monthly demand peaks and demand minimums between May 2020 and September 2021, in megawatts. The 2020 peak demand was 24,446 MW and the 2020 minimum demand was 9,831 MW. The Q3 2020 peak demand was 22,986 MW and the Q3 2020 minimum demand was 10,426 MW.

| Year | Total (TWh) | Change Over Previous Year |

|---|---|---|

| 2021 (YTD Q3) | 100.5 | n/a |

| 2020 | 132.2 | -2.9 |

| 2019 | 135.1 | -2.3 |

| 2018 | 137.4 | 5.3 |

| 2017 | 132.1 | -4.9 |

| 2016 | 137.0 | 0 |

| 2015 | 137.0 | -2.8 |

Source: IESO Power Data, Demand Overview

Note: Total does not include the impact of embedded generation to reduce demand.

Electricity prices

Commodity cost

Commodity cost comprises two components, the wholesale price (the Hourly Ontario Energy Price) and the Global Adjustment. The commodity cost is only a portion of the total energy bill.

| Month (¢/kWh) | July 2020 | August 2020 | September 2020 | October 2020 | November 2020 | December 2020 | January 2021 | February 2021 | March 2021 | April 2021 | May 2021 | June 2021 | July 2021 | August 2021 | September 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HOEP |

1.86 | 1.82 | 1.38 | 1.06 | 0.95 | 1.52 | 1.69 | 3.25 | 1.71 | 0.85 | 1.36 | 2.44 | 2.61 | 4.05 | 2.92 |

| Average Class A Global Adjustment Rate | 6.14 | 5.44 | 5.31 | 5.59 | 5.36 | 5.58 | 4.29 | 2.58 | 4.35 | 4.73 | 4.47 | 4.54 | 4.11 | 2.73 | 3.36 |

| Total Cost of Commodity | 8.00 | 7.26 | 6.69 | 6.65 | 6.31 | 7.10 | 5.98 | 5.83 | 6.06 | 5.58 | 5.83 | 6.98 | 6.72 | 6.78 | 6.28 |

Source: IESO

| Month (¢/kWh) | July 2020 | August 2020 | September 2020 | October 2020 | November 2020 | December 2020 | January 2021 | February 2021 | March 2021 | April 2021 | May 2021 | June 2021 | July 2021 | August 2021 | September 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HOEP | 2.05 | 1.94 | 1.44 | 1.13 | 1.05 | 1.60 | 1.74 | 3.38 | 1.76 | 0.89 | 1.46 | 2.69 | 2.76 | 4.34 | 3.07 |

| Class B Global Adjustment Rate | 10.23 | 10.35 | 12.18 | 12.81 | 11.71 | 10.56 | 8.30 | 5.04 | 9.08 | 10.93 | 10.05 | 8.63 | 7.36 | 4.60 | 7.57 |

| Total Cost of Commodity | 11.71 | 12.29 | 13.62 | 13.94 | 12.76 | 12.16 | 10.04 | 8.42 | 10.84 | 11.82 | 11.51 | 11.32 | 10.12 | 8.94 | 10.64 |

Source: IESO

Note: Amounts do not reflect Global Adjustment Deferral or Deferral Recovery. Values may not add up to the total due to dollar values that are rounded down to cents. Related reports can be found at http://reports.ieso.ca/public/PriceHOEPAverage and http://reports.ieso.ca/public/GlobalAdjustment

Monthly wholesale electricity prices

The wholesale electricity price fluctuates by the hour. This chart shows the average wholesale prices for each month. The monthly price varies depending on factors in the electricity market that shift the energy price higher or lower. A higher average monthly price exerts a downward pressure on costs that needs to be recovered through Global Adjustment.

Source: IESO

This chart shows the average wholesale electricity prices for each month, from July 2020 to September 2021, in cents per kilowatt-hour.

Time-of-use and tiered pricing under the Regulated Price Plan (RPP)

In accordance with the mandate provided under the Ontario Energy Board Act, 1998, the OEB developed the Regulated Price Plan (RPP), which provides residential and small business consumers with stable and predictable electricity pricing and encourages conservation. The plan has been in place since 2005.

RPP consumers with eligible time-of-use (or "smart") meters that can determine when electricity is consumed during the day pay RPP prices under a time-of-use or tiered price structure. The prices for the time-of-use plan are based on three time-of-use periods per weekday. These periods are referred to as off-peak, mid-peak and on-peak and are shown below. The hours for mid-peak and on-peak periods are different in the summer and winter months to reflect energy consumption patterns in those seasons, as explained below. With the tiered price plan, a consumer can use a certain amount of electricity each month at a lower price. Once that threshold is exceeded, a higher price applies. The threshold is different in the summer and winter months to reflect changing usage patterns in those seasons, as explained below.

Effective November 1, 2019, the OEB resumed setting RPP prices under section 79.16 of the Ontario Energy Board Act, 1998. At the same time, the Ontario government also introduced the Ontario Electricity Rebate, providing a rebate on the pre-HST amount of the bill, largely offsetting the RPP price changes on the Electricity line.

Summer and winter time-of-use hours

The RPP time-of-use periods are different in the summer than they are in the winter to reflect seasonal variations in how customers use electricity. During the summer, people use more electricity during the hottest part of the day, when air conditioners are running on high. In the winter, with less daylight, electricity use peaks twice: once when people wake up in the morning and turn on their lights and appliances, and again when people get home from work. The time-of-use (TOU) prices applicable from May 1, 2021 for RPP consumers with eligible time-of-use meters are shown in the table below.

Summer (May 1 – October 31) Weekdays

Off peak: 7pm to 7am

Mid peak: 7am to 11am, 5pm to 7pm

Peak: 11am to 5pm

Winter (November 1 – April 30) Weekdays

Off peak: 7pm to 7am

Mid peak: 11am to 5pm

Peak: 7am to 11am, 5pm to 7pm

Weekends and Statutory Holidays

Off peak: 24 hours a day

Summer and winter tier thresholds

The RPP tier thresholds are different in the summer than they are in the winter to reflect changing usage patterns – for example, there are fewer hours of daylight in the winter and some customers use electric heating. In the winter period, the tier threshold is 1,000 kwh, so that households can use more power at the lower price. In the summer period, the tier threshold for residential customers is 600 kwh. The tier threshold for small business customers is 750 kwh all year round. The tiered prices applicable from May 1, 2021, are shown in the table below.

| Tier | Threshold | Price ¢/kWh |

|---|---|---|

| Tier 1 | Residential – first 600 kwh/month Non-residential – first 750 kwh/month |

9.8/td> |

| Tier 2 | Residential – for electricity used above 600 kwh/month Non-residential – for electricity used above 750 kwh/month |

11.5 |

Source: OEB

| Time-of-use RPP Prices – ¢/kWh | Off-Peak | Mid-Peak | On-Peak | Average Price |

|---|---|---|---|---|

| Price (¢) | 8.2 | 11.3 | 17.0 | 10.4 |

| May 1, 2021, with weighted average delivery | $/700 kwh |

|---|---|

| Electricity | 72.55 |

| Delivery OEB calculated weighted average delivery | 43.77 |

| Losses | 3.58 |

| Regulatory | 3.11 |

| HST | 15.99 |

| Ontario Electricity Rebate | (23.25) |

| Total Bill: | 100.75 |

Source: OEB, Ministry of Energy

This table shows a monthly bill for a residential RPP TOU consumer with monthly usage of 700 kWh with 64% of consumption occurring off-peak, 18% occurring mid-peak and 18% occurring on-peak. The delivery and regulatory charges are weighted-average charges as calculated by the OEB. Line losses are based on the weighted-average loss factor as calculated by the OEB. Delivery charges and line losses will vary depending on utility. For additional information please see the OEB’s bill calculator.

Ontario industrial electricity rates

Industrial electricity consumers can either be directly connected to the high-voltage transmission grid or receive electricity from their local distributor (e.g., Toronto Hydro). Directly-connected consumers do not pay distribution charges, thus lowering their electricity cost. The table below shows the distribution of average all-in prices for all directly-connected consumers in Ontario for 2021. In Ontario, electricity rates for large industrial consumers in Ontario vary by customer as they are determined by individual consumption patterns. Generally speaking, the less energy a large industrial consumer uses during peak hours, the more these consumers reduce their impact on the provincial power system as well as their electricity costs. For most, the commodity cost incorporates both the fluctuating market price and the allocation of the Global Adjustment based on their energy use during peaks.

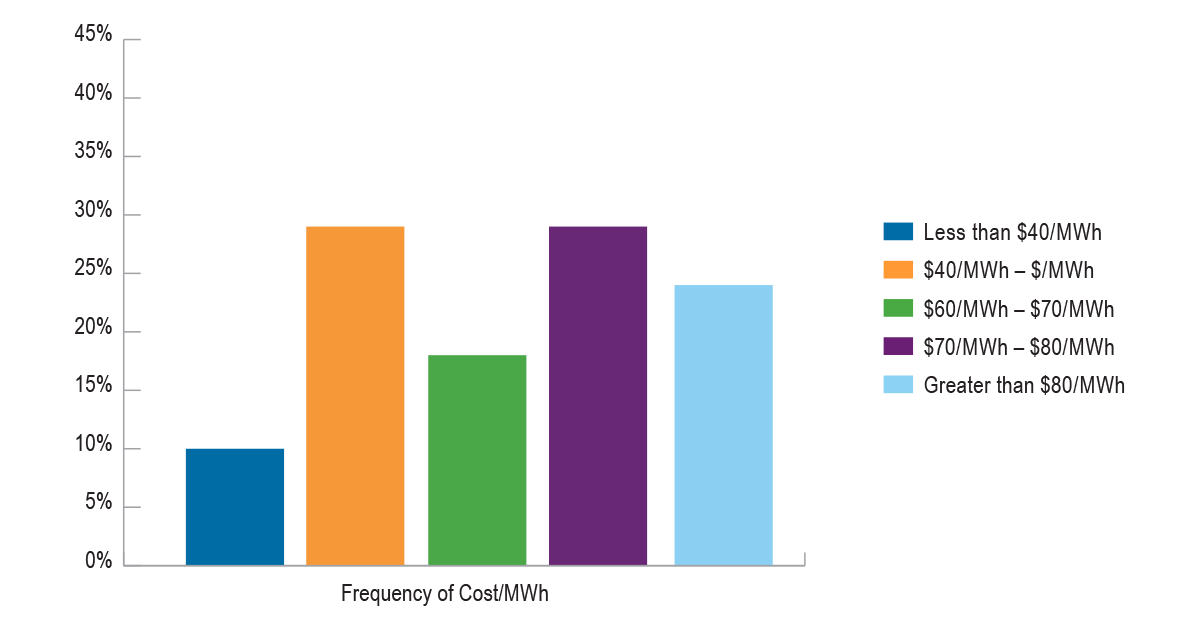

Transmission-Connected Industrial Ratesfootnote 11 (2020)

Frequency of Cost per MWh

This bar graph shows the distribution of average all-in prices for all directly-connected consumers in Ontario for 2021.

The table below shows average all-in electricity price for a distribution-connected industrial consumer inseveral service territories.

| Cost | Windsor (EnWin) | Hamilton (Alectra) | Ottawa | Sudbury | Toronto |

|---|---|---|---|---|---|

| HOEP |

$15.55 | $15.57 | $15.56 | $16.22 | $15.59 |

| Class A Global Adjustment | $32.11 | $32.16 | $32.14 | $33.49 | $32.19 |

| Delivery | $15.76 | $20.68 | $24.19 | $21.69 | $23.84 |

| Regulatory | $3.92 | $3.92 | $3.92 | $4.09 | $3.93 |

| All-In Price | $67.34 | $72.33 | $75.80 | $75.49 | $75.55 |

Source: IESO and OEB

Note: The Debt Retirement Charge ended for all electricity users on March 31, 2018.

2020 indicative industrial electricity prices (Canadian ¢/kWh)

The table below compares indicative retail industrial electricity prices across North American jurisdictions. For reference, Ontario – South reflects the average price for July 2019. Ontario – North is based on the same figure, along with the 2 cent per kilowatt hour Northern Industrial Electricity Rate Program rebate. See footnote for more details.

| Rank | Jurisdiction | Cost |

|---|---|---|

| 1 | Manitoba | 5.22 |

| 2 | Quebec | 5.47 |

| 3 | Ontario North | 5.90 |

| 4 | Oklahoma | 5.96 |

| 5 | Newfoundland | 6.33 |

| 6 | Nevada | 6.41 |

| 7 | Tennessee | 6.72 |

| 8 | Iowa | 6.90 |

| 9 | Kentucky | 6.92 |

| 10 | Virginia | 6.97 |

| 11 | Montana | 6.99 |

| 12 | British Columbia | 7.02 |

| 13 | South Carolina | 7.05 |

| 14 | Arkansas | 7.06 |

| 15 | Washington | 7.07 |

| 16 | Mississippi | 7.36 |

| 17 | Georgia | 7.37 |

| 18 | North Carolina | 7.37 |

| 19 | Louisiana | 7.39 |

| 20 | Arizona | 7.47 |

| 21 | Utah | 7.47 |

| 22 | Idaho | 7.50 |

| 23 | New Mexico | 7.54 |

| 24 | Oregon | 7.60 |

| 25 | Pennsylvania | 7.60 |

| 26 | West Virginia | 7.67 |

| 27 | Ohio | 7.72 |

| 28 | Texas | 7.72 |

| 29 | Ontario South | 7.90 |

| 30 | Alabama | 7.92 |

| 31 | Saskatchewan | 8.00 |

| 32 | Wyoming | 8.01 |

| 33 | Missouri | 8.06 |

| 34 | Canadian Average | 8.25 |

| 35 | Indiana | 8.32 |

| 36 | New Brunswick | 8.64 |

| 37 | Illinois | 8.68 |

| 38 | North Dakota | 8.71 |

| 39 | Wisconsin | 8.96 |

| 40 | Kansas | 9.07 |

| 41 | District Of Columbia | 9.10 |

| 42 | Florida | 9.21 |

| 43 | New York | 9.23 |

| 44 | Michigan | 9.25 |

| 45 | Colorado | 9.56 |

| 46 | South Dakota | 9.66 |

| 47 | Delaware | 9.81 |

| 48 | U.S. Average | 9.92 |

| 49 | Maryland | 10.03 |

| 50 | Nebraska | 10.11 |

| 51 | Minnesota | 10.48 |

| 52 | Prince Edward Island | 10.50 |

| 53 | Maine | 10.93 |

| 54 | Nova Scotia | 11.68 |

| 55 | Alberta | 11.70 |

| 56 | New Jersey | 12.53 |

| 57 | Vermont | 13.80 |

| 58 | Connecticut | 14.12 |

| 59 | California | 16.59 |

| 60 | New Hampshire | 16.89 |

| 61 | Massachusetts | 18.21 |

| 62 | Rhode Island | 19.77 |

| 63 | Alaska | 21.03 |

| 64 | Hawaii | 31.85 |

Note: Estimates may differ from actual costs to a consumer based on location, connection, and operational characteristics. Prices exclude taxes and participation in any applicable jurisdictional benefit programs.

The Ontario price reflects the average year-to-date August 2021 price and includes the Hourly Ontario Energy Price, Class A Global Adjustment, delivery, and wholesale market service charges. The Ontario price does not reflect Global Adjustment Deferral Recovery.

All other Canadian prices are from the Hydro Quebec Rate Comparison for rates effective April 1, 2021 for select local distribution companies servicing specific cities and reflects a 50 MW consumer with an 65% load factor. Where Hydro Quebec reports prices for two cities in a province (e.g. Calgary and Edmonton), an average of the two is used, in provinces where only one city is reported (e.g. Vancouver in BC, Montreal in QC), that one price is used to represent the province for indicative comparison purposes.

American jurisdictions reflect April 2021 data from the US Energy Information Administration’s survey of approximately 500 of the largest electric utilities. The price reflects the average revenue reported by the electric utility from electricity sold to the industrial sector. The value represents an estimated average retail price, but does not necessarily reflect the price charged to an individual consumer. Prices are converted at an exchange rate of 1 USD = 1.25 CAD.

Electricity – what’s new

| Information | Published By | Date |

|---|---|---|

| Market Surveillance Panel Report 35 | OEB | September 2, 2021 |

| Electricity and Natural Gas Yearbooks | OEB | September 10, 2021 |

| RPP Price Report | OEB | July 22, 2021 |

| OEB Five-Year Strategic Plan | OEB | July 30, 2021 |

| Stakeholder Engagement Framework | OEB | September 3, 2021 |

| Report of the OEB: Regulatory Treatment of Impacts Arising from the COVID-19 Emergency | OEB | September 17, 2021 |

| Pickering Performance Report – Q3 2021 | OPG | 2021 |

| Darlington Performance Report – Q3 2021 | OPG | 2021 |

| Nuclear Waste Performance Report – Q3 2021 | OPG | 2021 |

| Pickering Environmental Emissions Data Report Q3 2021 | OPG | 2021 |

| Darlington Environmental Emissions Data Report Q3 2021 | OPG | 2021 |

| Hydro One Quarterly Report (Q3 2021) | Hydro One | November 8, 2021 |

Footnotes

- footnote[1] Back to paragraph Class A customers are large electricity consumers that pay Global Adjustment based on their proportion of energy use during the five hours of the year with the highest demand. All other customers are Class B, and pay GA on a volumetric basis.

- footnote[2] Back to paragraph Units that use natural gas, oil or are dual fuel, such as Lennox, NP Kirkland and NP Cochrane, are included in the Gas category.

- footnote[3] Back to paragraph Installed grid-connected generation capacity is the sum of all market participant generators who supply or bid into the IESO-administered market. Numbers may not add up to totals due to rounding.

- footnote[4] Back to paragraph 300 MW increase due to Henvey Inlet Wind Farm becoming operational in 2020 - Q4.

- footnote[5] Back to paragraph Units that use natural gas, oil or are dual fuel, such as Lennox, NP Kirkland and NP Cochrane, are included in the Gas category.

- footnote[6] Back to paragraph Represents savings with an in-service date within the quarter.

- footnote[7] Back to paragraph Savings decrease due to adjustment to Energy Manager Non-Incented Savings

- footnote[8] Back to paragraph Measurement and Verification adjustment was made to certain IAP projects which resulted in decreased energy savings

- footnote[9] Back to paragraph (Unweighted) average of Hourly Ontario Energy Prices to reflect a typical (flat) industrial consumption profile.

- footnote[10] Back to paragraph Averages are weighted by the amount of electricity used throughout the province within each hour to broadly reflect the consumption profile of Class B (i.e., residential and commercial) consumers.

- footnote[11] Back to paragraph Does not include Northern Industrial Electricity Rate Program.

- footnote[12] Back to paragraph The distribution cost estimate for an industrial customer in Toronto reflects the assumption that 1 kVA is 1 kW for billing purposes.

- footnote[13] Back to paragraph HOEP is based on a three-month arithmetic average (July - September 31, 2021). The Global Adjustment shown in the table is an average of all distribution-connected Class A consumers for January to March 2020. Both quantities have been adjusted for losses using the applicable primary metered loss factor for each distributor.