Published plans and annual reports 2016-2017: Treasury Board Secretariat

Plan for 2016-2017 and results and outcomes of all provincial programs delivered by the Treasury Board Secretariat in 2015-2016.

Part I: 2016-17 Published Plan

Ministry overview

Mandate

Treasury Board Secretariat (TBS) was established to support the President of the Treasury Board in leading the government’s efforts on accountability, openness and modernization. TBS supports the government’s goal in achieving its fiscal targets, while continuing to deliver the services that the people of Ontario rely on and achieving the best possible value-for-money.

TBS’s responsibilities include:

- Providing planning, expenditure management and controllership to support Treasury Board and the government’s fiscal plan, and to ensure sound stewardship and investment of public funds;

- Providing advice and support to Treasury Board/Management Board of Cabinet;

- Steering and co-ordinating the implementation of Ontario’s Poverty Reduction Strategy in support of the President of the Treasury Board’s role as Minister Responsible for the Poverty Strategy;

- Managing corporate policy and agency governance including responsibilities for agency accountability, transparency and modernization and the Open Government initiative;

- Implementing measures to transform business delivery and improve outcomes, including reducing administrative burden on transfer payment recipients;

- Leading human resource policy and planning for the government;

- Overseeing labour relations in the Ontario Public Service and the broader public sector; and

- Overseeing government-wide information and information technology.

TBS also:

- Supports the development of the Ontario Budget, Printed Estimates, Economic Outlook and Fiscal Review, the province’s Public Accounts and Public Sector Salary Disclosure;

- Co-ordinates the government’s annual fiscal planning process and expenditure management strategies for both operating and capital expenditures; and

- Provides internal audit services across the government to ensure ministries meet their business objectives while employing sound management practices.

Ministry contribution to priorities and results

The government is committed to transforming and modernizing public services by finding new and smarter ways to both improve outcomes for Ontarians and meet the province’s fiscal challenge. In 2016-17, TBS will continue to focus on strategies to transform government and build better public services for the future of Ontario.

To achieve better outcomes for Ontarians living in poverty, TBS will continue to:

- Implement the five-year Poverty Reduction Strategy in partnership with relevant ministries and community partners, to help all Ontarians realize their potential.

- Roll out the Local Poverty Reduction Fund, a $50 million, six-year initiative designed to support and evaluate local efforts to prevent and reduce poverty and to build a made-in-Ontario body of evidence of what works. As part of round two, which will launch in spring 2016, the government is providing up to $10 million over two years in targeted funding from the Local Poverty Reduction Fund to help prevent and end homelessness across the province. A minimum of $2 million from the fund will also be dedicated to support indigenous communities and indigenous-led organizations.

To achieve a balanced budget by 2017-18 and improve outcomes for Ontarians, the ministry in 2016-17 will:

- Continue with Program Review, Renewal and Transformation. This multi-year, “one-government” approach to planning will remain focussed on improving outcomes for government programs and services to ensure they are effective, efficient and sustainable. Through cross-ministry horizontal collaboration, the government is taking focussed action on major transformation and efficiency initiatives that will improve outcomes for Ontarians while helping to free up resources to reinvest in key priorities, such as health care and education.

- Build capacity through the Centre of Excellence for Evidence-Based Decision Making to assess how programs are performing by setting standards for the use of evidence and tracking of performance across government, and equipping public service staff with the necessary tools and training.

- Continue to partner with ministries to apply insights from the behavioural sciences to design and implement policies and programs that are more effective, efficient and human-centric, to improve program outcomes.

- Continue to support the work of the Premier’s Advisory Council on Government Assets, which is examining how to get the most out of key government assets to generate better returns and revenues for Ontarians.

- Continue to work with ministries on the implementation of recommendations from the Commission on the Reform of Ontario’s Public Services report regarding efficiency.

- Implement opportunities identified through the Information and Information Technology Baseline and Benchmark review to further lower information technology (IT) costs and improve how technology supports the delivery of government programs and services. Through the first phase, the government will improve IT productivity and cost efficiency to achieve $100 million in savings by 2020. The second phase will focus on modernizing how IT supports government business and citizen-centred service delivery, including management and oversight of large projects, more agile technology development, risk management and procurement.

- Release a Digital Government Action Plan that unveils a vision for transforming government online, including creating a new digital service office, led by a chief digital officer, to drive change across government. The action plan will serve as a public roadmap for Ontario’s digital transformation — setting new organizational standards, empowering the next generation of digital talent and shifting government culture to deliver the best possible customer experience.

- Implement the Transfer Payment Administrative Modernization initiative to modernize processes and rules for administering transfer payments so that delivery partners can spend more time planning, co-ordinating and enabling outcomes they committed to deliver.

This initiative will, among other changes, create a “one window” online system to help transfer payment recipient organizations submit and update information online. It will also require transfer payment recipients to provide their Canada Revenue Agency business numbers as a unique identifier for organizations. This will allow a better view of the financial relationship between the government and recipient organizations. Recipient organizations will have much easier access to complete and accurate account information, and the government will have easy access to information that supports improved risk management and evidence-based decision-making.

To further support an open, transparent and accountable government, TBS will:

- Continue to implement the Open Government action plan to create a more open, accountable and transparent government that works for all Ontarians. Open Government includes three key elements: Open Dialogue, Open Information and Open Data. A public engagement framework and tool kit will be launched to help the province engage more Ontarians and increase the quality of public consultations taking place. The framework will lay out fresh approaches to engage the public in a meaningful way and provide ministries with guidance on public consultations. At the same time, the Province’s new online consultations directory will provide one location for Ontarians to learn about and participate in government consultations. These Open Dialogue initiatives will enable a broader, more diverse range of views from Ontarians to inform the policies, programs and services that affect their daily lives.

- Ontario has committed to taking an open-by-default approach to sharing data online unless there are privacy, security or legal reasons not to do so. The Open Data Directive will be implemented to enable more businesses, not-for-profits and public-sector partners to discover and use high-value data and develop customer-centric tools. This will include creation of an authoritative inventory of Ontario government data, as well as growing the number of data sets published online.

- Collaborate with other ministries to ensure that provincial agencies remain aligned with the expectations of government and Ontarians. Effective agency management contributes to the efficient use of public funds and public confidence in agency service delivery. The government now requires ministries to review the mandates of their provincial agencies at least once every seven years to ensure that an agency’s mandate aligns with government priorities.

- Prepare and release the Province’s Public Accounts, including the Annual Report and Consolidated Financial Statements of the Province. The government is using Open Government principles to present its public accounts information online. Ontarians can visit “2014-15 Public Accounts of Ontario” online to learn more about government spending.

- Post a compendium reporting the salaries of Ontario Public Service and broader public service employees who were paid $100,000 or more in accordance with the Public Sector Salary Disclosure Act, 1996. Public Sector organizations subject to the Act are required to annually disclose the names, positions, salaries and total taxable benefits of employees paid $100,000 or more in a calendar year.

To build a modern infrastructure, the ministry will:

- In partnership with Ministry of Economic Development, Employment and Infrastructure, continue to ensure the prioritization and approval of the government’s infrastructure investments, while living within the government’s fiscal plan. The government has committed to invest more than $137 billion over the next 10 years in public infrastructure such as roads, bridges, public transit, hospitals and schools. Building on previous commitments, this results in about $160 billion in public infrastructure investments over 12 years, starting in 2014–15. Planned investments would support more than 110,000 jobs, on average, each year.

To oversee labour relations and manage compensation, TBS will:

- Continue to work with Ontario Public Service (OPS) and broader public sector (BPS) to reach collective agreements that are fair and reasonable to employees, and are consistent with the province’s fiscal plan.

- Develop an appropriate long-term compensation strategy to address retention, recruitment and succession planning for OPS management and non-bargaining employees based on advice from the external Advisory Panel on Management and Non-Bargaining Staff Recruitment and Retention.

- Continue to work with partners in BPS to develop sector-specific executive compensation frameworks following consultation and compensation data collection.

- Develop a strategic plan for public service renewal to ensure the public service has the diversity, skills and leadership capacity required to support innovation in the OPS. The plan will build on:

- The OPS HR Plan 2015–20;

- The OPS Anti-Racism Action Plan; and

- Recommendations to be made by the Advisory Panel on Management and Non-Bargaining Staff Recruitment and Retention.

Key performance measures

TBS is committed to delivering on the ministry’s objectives and mandates. Tracking progress ensures that the ministry will be aware of its progress and able to modify its approach where the desired outcomes are not being realized.

Improve outcomes for Ontarians living in poverty

Breaking the cycle of poverty for children and youth is a key commitment of the Ontario Government. The government has committed to reducing child poverty in Ontario by 25 percent in 5 years.

In July 2015, the government increased the Ontario Child Benefit to $1,336, indexing it to inflation for the first time; completed the roll-out of full-day kindergarten in all publicly funded schools, saving families on average $6,500 a year in childcare costs and provided more than $1 billion in annual childcare funding.

The Poverty Reduction Strategy (PRS) measures child poverty through a measurement method called the fixed Low-Income Measure (LIM). PRS LIM-50 measures the percentage of children under 18 living in a family with a household income of less than half the median household income, benchmarked to 2008, the year the government set its original target to reduce child poverty.

Between 2012 and 2013, approximately 21,000 children were lifted out of poverty, with the child poverty rate standing at 17.1 percent.

Child poverty in Ontario 2008-2011 (Fixed LIM-50)

| Year | Number of children |

|---|---|

| 2008 | 416,000 |

| 2009 | 417,000 |

| 2010 | 403,000 |

| 2011 | 399,000 |

| Change 2008 to 2011 | (16,000) |

Based on Statistics Canada’s revised dataset for Canada’s Survey of Labour and Income Dynamics (2008 to 2011)

Child poverty in Ontario 2012-2013 (Fixed LIM-50)

| Year | Number of children |

|---|---|

| 2012 | 477,000 |

| 2013 | 456,000 |

| Change 2012 to 2013 | (21,000) |

Based on Statistics Canada’s Canadian Income Survey (2012 and 2013)

Notes:

- There is a break in the data series between 2011 and 2012 due to methodological differences in surveys. Numbers may not add up due to rounding.

- These figures are estimates based on a survey of a sample of the population, so results should be interpreted in light of confidence intervals, which are used to express the precision of the estimate. For example: a 90% confidence interval means that if the survey were repeated many times, 90% of the samples would contain the true estimate within the confidence ranges. In the case of child poverty results in Ontario, the approximate 90% confidence interval ranges from 394,000 to 518,000 for 2013.

Detailed results for the other indicators used to report progress under the Strategy can be found in the Poverty Reduction Strategy 2015 Annual Report.

Support the government in achieving its fiscal targets

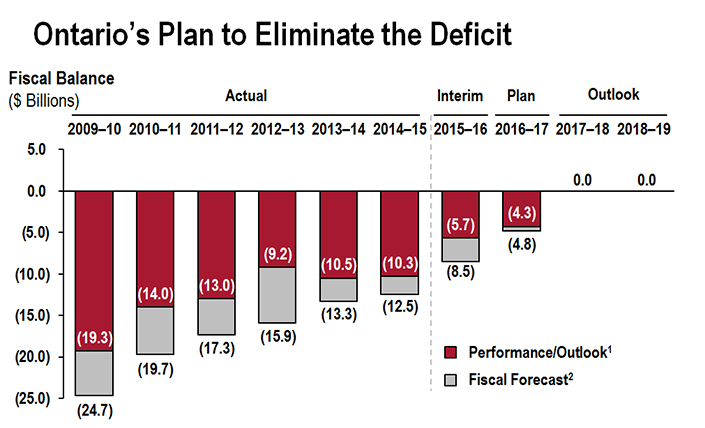

The government is committed to eliminating the deficit by 2017-18.

1Represents the 2016 Budget outlook for 2015-16 to 2018-19. For 2009-10 to 2014-15, actual results are presented.

2Forecast for 2009-10 is based on the 2009 Ontario Economic Outlook and Fiscal Review; 2010-11 to 2013-14 is based on the 2010 Budget; 2014-15 is based on the 2014 Budget and 2015-16 to 2016-17 is based on the 2015 Budget.

Source: Ontario Ministry of Finance

The government is projecting a deficit of $5.7 billion in 2015–16 — an improvement of $2.8 billion compared with the 2015 Budget forecast and an improvement of $1.8 billion compared with the projection laid out in the 2015 Ontario Economic Outlook and Fiscal Review. It is also a $4.6 billion improvement compared with the 2014–15 deficit of $10.3 billion. This represents the Province’s largest year-over-year reduction in the deficit in the last five years.

Support an open, transparent and accountable government

Accurate and timely financial reports

The release of the Public Accounts of Ontario is a major accountability document which presents the audited financial results of the province, including financial highlights of the past fiscal year, and reports on performance against the goals set out in the Ontario Budget. The Public Accounts is released within 180 days of the end of the province’s fiscal year (March 31).

The 2014-15 Public Accounts received a clean audit from the Auditor General, meaning the financial statements present fairly, in all material respects, the consolidated financial position of the province as at March 31, 2015 and the consolidated results of operations, changes in net debt, changes in accumulated deficit and cash flows for the year ended in accordance with Canadian Public Sector Accounting Standards. This marked the 22nd year in a row in which Ontario’s financial statements received a clean audit from the Auditor General.

Internal auditors’ certification

Quality assurance certification of internal audit by an external body signifies the independence, quality and professionalism of Ontario’s internal audit program.

Internal audit has strengthened controllership, accountability frameworks and better practices across all ministries by effectively partnering with management to provide both assurance and advisory services in key risk areas. This model supports the continued achievement of the Institute of Internal Auditors quality assurance certification every five years. The Ontario Internal Audit Division (OIAD) was first certified in 2009 and re-certified in 2014. The ministry’s goal is to be re-certified every five years. The next year for certification will be in 2019. In addition, the OIAD’s Forensic Investigation Team was certified in January 2016 by the International Standardization Organization for its investigative professional practices and standards.

Oversee labour relations and compensation

Managing compensation

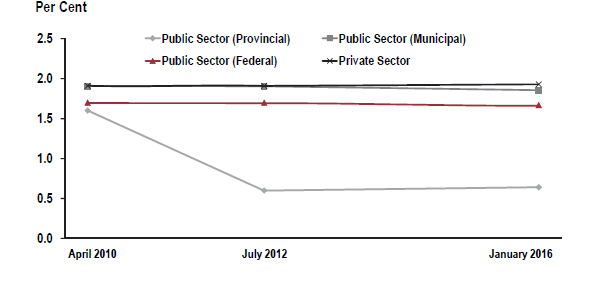

It has been TBS’s goal that negotiated wage outcomes and trends in the provincial public sector track below the federal, municipal and private sectors and align with the fiscal plan.

The 2015 Budget required any modest negotiated wage increases to be offset by other measures to create a net-zero outcome. The Ontario government continues to work with sector-level partners to identify opportunities to support mutually beneficial bargaining outcomes that are consistent with the Province’s fiscal plan. In the latest round of bargaining, agreements were reached with Ontario Public Service Employees Union (OPSEU) Central/Unified, Ontario Secondary School Teachers’ Federation (OSSTF), Ontario English Catholic Teachers’ Association (OECTA), Association des enseignantes et des enseignants franco-ontariens(AEFO), Elementary Teachers’ Federation of Ontario (ETFO) and Canadian Union of Public Employees (CUPE) and with unions at Hydro One, Ontario Power Generation and Ontario Northern Transportation Commission, all of which were fair and reasonable, and had a net-zero impact on the fiscal plan.

Note: Based on agreements with 150 employees, ratified between April 1, 2010 and January 13, 2016. April 2010 represents the start of the government’s compensation restraint mandate. The period from July 2012 to January 2016 represents the most complete picture of a full bargaining cycle across the public sector.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Labour

Chart Source: 2016 Ontario Budget

Since July 2012, the provincial public sector annual wage increase has averaged 0.6 percent compared to the municipal sector at 1.8 percent, the private sector at 1.9 percent and the federal public sector in Ontario at 1.7 percent.

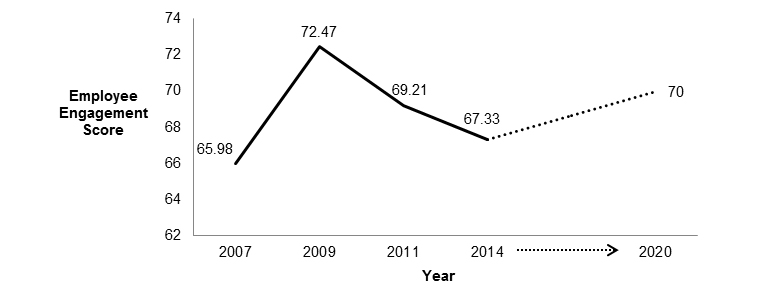

Employee engagement

Employee engagement is an important determinant of an organization’s success. High employee engagement benefits both the OPS and the public we serve; it helps maximize productivity and encourages employee commitment which helps retain valuable knowledge and experience.

2007: 65.98

2009: 72.24

2011: 69.21

2014: 67.33

Forecast 2020: 70

The OPS is targeting an employee engagement score of 70 by 2020. In 2014, engagement fell to 67.3 from the previous score of 69.2. The OPS is committed to being a top employer and continues to develop workplace policies and strategies incorporating feedback identified in the employee survey.

Ministry programs and activities

Treasury Board Secretariat is committed to innovation and to transforming processes, programs and services to help government function better.

The Ministry Administration Program provides administrative and support services to enable the ministry to deliver results to support the government’s objectives and fiscal priorities. Its functions include financial and human resource management, as well as accommodations and facilities management. The program also provides legal and communications services, and planning and results monitoring. The program assists and supports ministry program areas in achieving their business goals.

The Bargaining and Compensation Program supports the government’s commitment to positive labour relations in the Ontario Public Service (OPS) and broader public sector (BPS).

The program represents the Crown as the employer in all collective bargaining and labour relations in the Ontario Public Service, provides employee and labour relations advisory services, supports ongoing union-management relations, manages corporate compensation strategies and programs and represents the Crown at four separate judicial remuneration commissions.

The program analyzes internal and external factors that drive collective bargaining outcomes in the BPS to develop and provide evidence-based strategic guidance and advice to government, ministries and BPS employers related to ongoing collective bargaining and labour relations issues. The program also provides policy advice and support on government initiatives impacting executive compensation in the BPS.

The Employee and Pensioner Benefits (Employer Share) Program provides for the government’s expenses as Employer for insured benefits, statutory programs, non-insured benefits and certain public service pension plans including third party administration and adjudication costs. The expenses are based on changes in the accrued liabilities of the government as sponsor or co-sponsor of certain insured benefit plans, pension plans and termination of employment entitlements.

The Treasury Board Support Program supports the development of the province’s fiscal plan, provides expertise and advice on sound program design of government initiatives, develops and implements infrastructure strategies for the province, develops and implements the fiscal and financial management framework, and fosters greater accountability and fiscal integrity in the public sector in Ontario.

The program assists the President of the Treasury Board, Deputy Minister and Secretary of the Treasury Board/Management Board of Cabinet, and the government in reporting the results of the Province through the Ontario Quarterly Finances, the Public Accounts, and the annual Printed Estimates process to seek spending authority from the Legislature. Additionally, the program supports Treasury Board/Management Board of Cabinet by providing advice on ministries' annual multi-year business and infrastructure planning processes and ministries' management of in-year expenditures to ensure the appropriate use of public resources to meet government priorities. The program also provides the Ontario Public Service and broader public sector with accounting and financial management policy and controllership advice, and supports the development of performance measurement frameworks.

The Governance, Agency Oversight, and Centre for Leadership and Learning Program provides leadership to ministries and provincial agencies through the delivery of strategic enterprise-wide policies, directives and advice that support an effective public service and enhance the oversight and accountability of provincial agencies.

The program includes the Open Government initiative to improve transparency, accountability and collaboration by giving Ontarians more opportunities to weigh-in on input into government decision-making, and by sharing more government data and information online with the public. The transfer payment administrative modernization initiative is working to reduce the administrative burden on transfer payment recipients and the OPS and to achieve better value for money and increase savings through improved oversight and administrative efficiencies.

As an enterprise program supporting leadership and learning, the program also provides services that support recruitment and executives, learning and leadership development, talent management, internships and employee engagement strategies.

The Audit Program provides objective assurance and consulting services to the ministries of the Government of Ontario. It ensures its client ministries meet their business objectives by evaluating and making recommendations to improve governance, risk management, control, accountability and compliance processes and to improve the effectiveness, efficiency and economy of ministry and agency operations.

The Poverty Reduction Strategy Program has been established to support Ontario’s multi-year priority outcome of reducing poverty and social exclusion. The program supports initiatives to continue lifting people out of poverty. The Local Poverty Reduction Fund will support, showcase and evaluate grass-roots community action projects that target local solutions to poverty.

The Enterprise Information Technology Services Program provides leadership in establishing modern information and information technology (I&IT ) to meet the needs of Ontarians and the Ontario Public Service. This includes formulating and implementing strategy, ensuring security of systems and data, developing policies, and the implementation of common infrastructure, governance and accountability. It also includes the delivery of OPS-wide common services such as hosting services and network capabilities.

The Central Agencies Cluster (CAC) Program provides leadership and cost-effective IT support to its clients. The CAC program develops and maintains the underlying information technology solutions necessary to modernize government operations, efficiently delivering cluster services and helping Ontario Public Service clients to optimize the value of their services to taxpayers.

The Agencies, Boards and Commissions Program provides oversight to ensure effective governance, accountability, and relationship management.

The Conflict of Interest Commissioner has responsibility for certain conflict of interest and political activity matters as they apply to chairs and designated ethics executives of public bodies, and to certain employees of ministries and public bodies with respect to financial declarations. The Commissioner provides advice or determinations on specific conflict of interest or political activity matters, advises on financial declarations, approves conflict of interest rules submitted by public bodies and reviews and approves adjudicative tribunals’ ethics plans.

The Bulk Media Buy Program supports the purchase of media time for government marketing campaigns. Funding also covers associated agency fees, creative production costs, market research costs and the development of related marketing materials to support integrated campaigns associated with government initiatives. Paid government advertising is subject to the Government Advertising Act, 2004 and reviewed and reported on by the Auditor General.

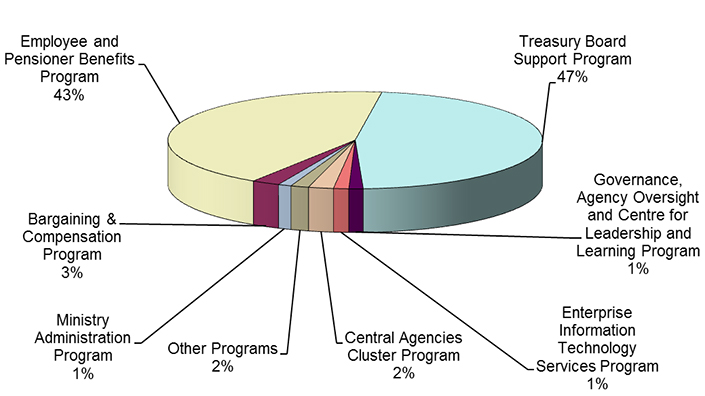

Table 1: Ministry Planned Expenditures 2016-17

| Expenditure type | Expenditure amount |

|---|---|

| Operating | $2,558.1 million |

| Capital | $111.3 million |

| Total | $2,669.4 million |

Employee and pensioner benefits program – 43%

Treasury board support program – 47%

Governance, agency oversight, entertprise leadership and learning program – 1%

Enterprise information technology services program – 2%

Central agency cluster program – 2%

Other programs – 2%

Ministry administration program – 1%

Bargaining, labour relations and compensation program – 3%

* Other Programs include Bulk Media Buy, Conflict of Interest Commissioner, Poverty Reduction Strategy Program and Audit Program

Highlights of 2015-16 achievements

Treasury Board Secretariat’s (TBS) vision is to lead transformation that builds better public services for the future of Ontario. Below are the highlights of TBS’s 2015-16 achievements. For more detail, see the Appendix: 2015-16 Annual Report.

Improve outcomes for Ontarians living in poverty

- Final report from the Expert Advisory Panel on Homelessness was released in October 2015. It will inform current and long-term initiatives to help achieve the government’s commitment to end chronic homelessness in 10 years.

- The Local Poverty Reduction Fund was launched from the 2015 call for proposals. It is supporting 41 projects across Ontario in more than 20 communities. The second round of applications for the fund will begin in spring 2016.

- The Poverty Reduction Strategy 2015 Annual Report was released in March 2016 providing updates on progress under the Poverty Reduction Strategy.

Support the government in achieving its fiscal targets

- TBS led Program Review, Renewal and Transformation (PRRT) and supported ministries in their multi-year plans and in-year Treasury Board/Management Board of Cabinet submissions.

- The government met its 2015-16 program review savings target of $500 million.

- A new Centre of Excellence for Evidence-Based Decision Making Support was launched in 2015-16 to build capacity to assess how programs are performing, use evidence to inform choices and lead change in critical public services.

Review, modernize and transform public services to increase efficiency and sustainability

- Annual savings and revenues of $28 million achieved by 2015-16 with the implementation of the Information Technology Services Rationalization initiative through activities including:

- Consolidating data centres;

- Rationalizing software requirements;

- Providing some public sector organizations with access to the Guelph Data Centre; and

- Increasing the efficiency of government information technology operations.

Support an open, transparent and accountable government

- Significant progress has been made to make government more open and transparent, including an easy-to-use tool to illustrate the province’s Public Accounts in an appealing and interactive way; engaging the public to develop the Open Data Directive and finalizing that directive to reflect input of the public; and publishing more than 420 open data sets on Ontario’s open data catalogue.

- TBS is strengthening the accountability of provincial agencies by requiring more robust risk assessments and quarterly reporting to Treasury Board/ Management Board of Cabinet. Like ministries, provincial agencies are also required to submit attestations on compliance to legislation, regulation, directives and policies.

- The government met its commitment to reduce the number of provincial agencies by 30 percent below the 2011 benchmark. By the end of 2015-16, it is expected that mandate reviews will be completed for 57 provincial agencies.

- TBS supported the development of the Ontario Budget, Printed Estimates, Economic Outlook and Fiscal Review and prepared the province’s Public Accounts.

Building tomorrow’s infrastructure now

- In the 2016 Budget, the government committed to investing more than $137 billion over the next 10 years in public infrastructure.

- This includes the continued roll-out of existing commitments, such as the Moving Ontario Forward plan to develop an integrated transportation network across the province and ongoing investments in public transit, transportation, health, education, child care, and community infrastructure.

- The Infrastructure for Jobs and Prosperity Act, 2015 was passed in the spring 2015 to ensure alignment of infrastructure investments with Ontario’s economic development priorities through long-term planning. It will come into force on May 1, 2016.

Oversee labour relations and compensation

- Net-zero compensation agreements were reached in a number of key sectors, including the Ontario Public Service, the education sector and provincial energy corporations.

- Compensation information from all colleges and universities as well as several provincial agencies was collected to inform the development of the broader public sector compensation frameworks.

- An Ontario Public Service Sexual Harassment Prevention Action Plan was launched to raise awareness, enhance prevention, and improve supports in the workplace which continue to be advanced.

- A new Ontario Public Service Human Resources Plan 2015-20 was launched addressing workplace culture, leadership and HR practices.The Ontario Public Service was recognized as one of Canada’s Top 100 Employers for 2016.

Organizational chart

This is a text version of an organizational chart for the Treasury Board Secretariat as of March, 2016. The chart shows the following hierarchical structure with the top level assigned to the Deputy Premier and President of the Treasury Board.

- Deputy Premier and President Treasury Board – Hon. Deb Matthews

- Group of 5 Chair positions:

- Chair, Public Service Commission

- Chair, OPSEU Pension Trust

- Chair, Ontario Public Service Pension Board

- Chair, Provincial Judges Pension Board

- Conflict of Interest Commissioner

- Deputy Minister, Treasury Board Secretariat & Secretary of Treasury Board and Management Board of Cabinet – Greg Orencsak

- Chief Information Officer, Central Agencies Cluster – Ron Huxter

- Legal Director – Sean Kearney

- Director of Communications – Anne Matthews

- Associate DM, Bargaining and Compensation – Reg Pearson

- ADM, Employee Relations Division – Marc Rondeau

- Director, Labour Relations Secretariat – Michael Uhlmann

- Director, HR Policy & Planning – Janet O’Grady (A)

- Associate DM, Office of the Treasury Board – Karen Hughes (Functionally interdependent with the Ministry of Finance [Budget Development])

- ADM, Capital Planning – Artur Arruda

- ADM, Planning and Expenditure Management – Maria Duran-Schneider (A)

- ADM, Provincial Controller – Sanjeev Batra (A)

- Director, Centre of Excellence – Didem Proulx

- ADM, Corporate Policy, Agency Governance and Open Government Division (Functionally interdependent with Office of the Treasury Board and supports Management Board of Cabinet)

- ADM, Poverty Reduction Strategy Office – Karen Glass

- ADM & Chief Internal Auditor, Internal Audit Division – Richard Kennedy (Functionally accountable to the Corporate Audit Committee)

- Corporate Chief Information & Information Technology Officer – David Nicholl

- Corporate Chief Strategist, I&IT Strategy & Cyber Security– Fred Pitt

- Executive Lead Infrastructure Technology Services – Rocco Passero

- Cluster Chief Information Officers

- Chief Talent Officer, Centre for Leadership and Learning – Diane McArthur

- ADM/Chief Administrative Officer, Corporate Services Division – Melanie Fraser

- Group of 5 Chair positions:

Acts administered by the Treasury Board Secretariat

Adjudicative Tribunals Accountability, Governance and Appointments Act, 2009, S. O. 2009, c. 33, Sched. 5

Auditor General Act, R.S.O. 1990, c. A.35

Broader Public Sector Accountability Act, 2010, S.O. 2010, c. 25, in respect of sections 1-4, 7, 7.1-7.20, 9-13.2, 16, 19 and 21-23

Broader Public Sector Executive Compensation Act, 2014, S.O. 2014, c. 13, Sched. 1

Cabinet Ministers' and Opposition Leaders' Expenses Review and Accountability Act, 2002, S.O. 2002, c. 34, Sched. A

Crown Foundations Act, 1996, S.O. 1996, c. 22

Financial Administration Act, R.S.O. 1990, c. F.12, in respect of sections 1.0.1 to 1.0.10; and in respect of all other sections, except section 1.0.19 and Parts III and V, the administration of the Act is shared between the President of the Treasury Board and the Minister of Finance

Fiscal Transparency and Accountability Act, 2004, S.O. 2004, c. 27, in respect of section 10 and clause 15 (b), the administration of which is shared between the President of the Treasury Board and the Minister of Finance

Flag Act, R.S.O. 1990, c. F.20

Floral Emblem Act, R.S.O. 1990, c. F.21

Government Advertising Act, 2004, S.O. 2004, c. 20

Interim Appropriation for 2016-2017 Act, 2015, S.O. 2015, c. 38, Sched. 11

Lobbyists Registration Act, 1998, S.O. 1998, c. 27, Sched.

Management Board of Cabinet Act, R.S.O. 1990, c. M.1

Ministry of Government Services Act, R.S.O. 1990, c. M.25, in respect of services provided by the Treasury Board Secretariat

Ontario Provincial Police Collective Bargaining Act, 2006, S.O. 2006, c. 35, Sched. B

Ontario Public Service Employees' Union Pension Act, 1994, S.O. 1994, c. 17, Sched.

Poverty Reduction Act, 2009, S.O. 2009, c.10 (Minister Responsible for the Poverty Reduction Strategy)

Public Sector Compensation Restraint to Protect Public Services Act, 2010, S.O. 2010, c. 1, Sched. 24

Public Sector Expenses Review Act, 2009, S.O. 2009, c. 20

Public Sector Salary Disclosure Act, 1996, S.O. 1996, c. 1, Sched. A

Public Service of Ontario Act, 2006, S.O. 2006, c. 35, Sched. A

Public Service Pension Act, R.S.O. 1990, c. P.48

Agencies, Boards and Commissions (ABCs)

Case Management Masters Remuneration Commission

Commissioner: Larry Banack

Established by Order in Council. Conducts inquiries and makes non-binding recommendations to the President of the Treasury Board regarding the remuneration of Ontario Case Management Masters (provincially appointed judicial officers). The Commission’s report is submitted to the Lieutenant Governor in Council for a response.

Deputy Judges Remuneration Commission

Commissioner: Marilyn Ann Nairn

Established by Order in Council. Conducts inquiries and makes non-binding recommendations to the President of the Treasury Board regarding the remuneration of Deputy Judges. The Commission’s report is submitted to the Lieutenant Governor in Council for a response.

Justices of the Peace Remuneration Commission

Chair: Patrick J. LeSage

Established by regulation under the Justices of the Peace Act. Conducts inquires and makes non-binding recommendations to the President of the Treasury Board regarding the remuneration of Ontario Justices of the Peace. The Commission’s report is submitted to the Lieutenant Governor in Council for a response.

Office of the Conflict of Interest Commissioner

Commissioner: Hon. Sidney B. Linden

Established under the Public Service of Ontario Act, 2006. Offers advice and makes determinations on specific conflict of interest, political activity and financial declaration matters related to in-service and post service obligations on Ontario’s public servants. Provides advice and direction to public bodies, upon request. Approves the conflict of interest rules of public bodies and approves the ethics plans of adjudicative tribunals. Serves as a resource for developing and sharing information and promoting awareness of the conflict of interest and political activity rules.

Ontario Public Service Employees’ Union Pension Plan Board of Trustees

Chair: Michael Grimaldi

An independent Trust organization (not a provincial agency or a public body) established under a Joint Sponsorship Agreement between Ontario (represented by the President of the Treasury Board) and the members (represented by the OPSEU Executive Board) under the Ontario Public Service Employees’ Union Pension Act, 1994. Administers the OPSEU Pension Plan (adjudication and provision of pension benefits) and the OPSEU Pension Fund (investing assets).

Ontario Public Service Pension Board

Chair: Vincenza Sera

A public body and Trust agency established under the Public Service Pension Act. Administers the Public Service Pension Plan (PSSP), including the investment of the Public Service Pension Fund and the adjudication and provision of benefits under the Plan. Also carries out administrative functions in relation to the Provincial Judges Pension Plan for the Provincial Judges Pension Board.

Provincial Judges Pension Board

Chair: Deborah Anne Oakley

A public body and Trust agency established by Ontario Regulation 67/92 made under the Courts of Justice Act. The Board is responsible for administering the pensions and survivor allowances for provincial judges and their survivors.

Provincial Judges Remuneration Commission

Chair: William Kaplan

Established under the Framework Agreement between Ontario and the Provincial Judges set out as a schedule to the Courts of Justice Act. Conducts inquiries and makes binding recommendations to the President of the Treasury Board regarding the salaries and benefits and non-binding recommendations regarding the pensions of Provincial Judges.

Public Service Commission

Chair: Greg Orencsak

Established under the Public Service of Ontario Act, 2006 (PSOA). It replaced the Civil Service Commission that was established under the previous Public Service Act. Ensures the effective management and administration of human resources in relation to public servants appointed under Part III of PSOA. Ensures non-partisan recruitment and employment of public servants.

Public Service Grievance Board

Chair: Kathleen G. O’Neil

Continued under the Public Service of Ontario Act, 2006 (PSOA), it exercises the powers and duties conferred upon it as a labour relations tribunal under PSOA and O. Reg. 378/07. Provides dispute resolution services to certain management and excluded members of the Ontario Public Service and their employers. Hears grievances regarding discipline, dismissal, working conditions and terms of employment.

Agencies, boards and commissions – financial summary

| Agency, board or commission | classification | 2016-17 Estimates | 2015-16 interim actuals | 2014-15 actuals |

|---|---|---|---|---|

| Case Management Masters Remuneration Commission | Advisory | 29,000 | 175,651 | 186,615 |

| Deputy Judges Remuneration CommissionA | Advisory | 29,000 | n/a | 15,765 |

| Justices of the Peace Remuneration CommissionA | Advisory | 59,000 | 34,752 | 7,785 |

| Office of the Conflict of Interest CommissionerB | Regulatory | 857,500 | 843,076 | 875,072 |

| Ontario Public Service Employees’ Union Pension Plan Board of Trustees | n/a | n/a | n/a | n/a |

| Ontario Public Service Pension Board | Trust | 85,910 | 41,651 | 58,781 |

| Provincial Judges Pension Board | Trust | 238,260 | 153,746 | 162,248 |

| Provincial Judges Remuneration CommissionA | Advisory | 56,500 | n/a | n/a |

| Public Service Commission | Regulatory | n/a | n/a | n/a |

| Public Service Grievance BoardC | Adjudicative | 1,000 | n/a | 2,602 |

A Amounts do not include legal services costs recoverable from the Ministry of the Attorney General.

B Represents the full allocation of the Office of the Conflict of Interest Commissioner. Appears as its own vote item in the TBS Printed Estimates.

Note: For all provincial agencies above, except for Office of the Conflict of Interest Commissioner, the figures represent expenses incurred on behalf of these agencies by Treasury Board Secretariat. The amounts above do not represent these agencies' full allocations.

Detailed financial information

Table 2: Operating and capital summary by vote

| Vote/program (Operating and capital expense) | Estimates 2016-17 | Change from 2015-16 estimates | Change from 2015-16 estimates | Estimates 2015-16 | Interim actuals 2015-16 | Actuals 2014-15 |

|---|---|---|---|---|---|---|

| Ministry Administration Program | $30,401,300 | $1,496,600 | 5.2% | $28,904,700 | $28,104,671 | $25,384,378 |

| Bargaining & Compensation Program | $64,500,500 | $132,900 | 0.2% | $64,367,600 | $25,056,222 | $29,309,868 |

| Employee and Pensioner Benefits Program | $944,538,000 | $33,088,000 | 3.6% | $911,450,000 | $911,450,000 | $843,391,595 |

| Treasury Board Support Program | $1,255,338,300 | $554,878,800 | 79.2% | $700,459,500 | $58,554,867 | $39,370,886 |

| Governance, Agency Oversight and Centre for Leadership and Learning Program | $32,797,800 | $2,888,000 | 9.7% | $29,909,800 | $30,658,140 | $28,354,751 |

| Audit Program | $5,242,400 | $220,000 | 4.4% | $5,022,400 | $4,871,727 | $5,527,152 |

| Poverty Reduction Strategy Program | $10,477,100 | $5,977,100 | 132.8% | $4,500,000 | $4,547,668 | n/a |

| Enterprise Information Technology Services Program | $34,700,600 | $(81,800) | (0.2%) | $34,782,400 | $28,246,679 | $40,417,803 |

| Central Agencies Cluster Program | $57,238,300 | $10,771,000 | 23.2% | $46,467,300 | $53,292,599 | $56,349,222 |

| Agencies, Boards and Commissions Program | $857,500 | n/a | n/a | $857,500 | $843,076 | $875,072 |

| Bulk Media Buy Program | $25,000,000 | n/a | n/a | $25,000,000 | n/a | n/a |

| Total Operating and Capital Expense to be Voted | $2,461,091,800 | $609,370,600 | 32.9% | $1,851,721,200 | $1,145,625,649 | $1,068,980,727 |

| Statutory Appropriations | $373,832,014 | $(80,698,000) | (17.8%) | $454,530,014 | $248,708,714 | $389,380,164 |

| Consolidation & Other Adjustments | $(165,498,800) | $(89,496,800) | 117.8% | $(76,002,000) | $(76,002,000) | $(45,066,411) |

| Total Including Consolidation & Other Adjustments | $2,669,425,014 | $439,175,800 | 19.7% | $2,230,249,214 | $1,318,332,363 | $1,413,294,480 |

| Vote/program (Operating and capital assets) | Estimates 2016-17 | Change from 2015-16 estimates | Change from 2015-16 estimates | Estimates 2015-16 | Interim actuals 2015-16 | Actuals 2014-15 |

|---|---|---|---|---|---|---|

| Ministry Administration Program | $1,000 | n/a | n/a | $1,000 | n/a | n/a |

| Governance, Agency Oversight and Centre for Leadership and Learning Program | $4,308,200 | $4,308,200 | n/a | n/a | n/a | n/a |

| Enterprise Information Technology Services Program | $67,389,400 | $4,824,800 | 7.7% | $62,564,600 | $62,564,600 | $55,097,003 |

| Central Agencies Cluster Program | $1,000 | n/a | n/a | $1,000 | n/a | n/a |

| Total pperating and capital assets to be voted | $71,699,600 | $9,133,000 | 14.6% | $62,566,600 | $62,564,600 | $55,097,003 |

| Statutory appropriations | n/a | n/a | n/a | n/a | n/a | n/a |

| Treasury Board Support Program | $1,000 | n/a | n/a | $1,000 | $1,000 | $680,258,684 |

| Total Statutory appropriations | $1,000 | n/a | n/a | $1,000 | $1,000 | $680,258,684 |

| Total operating and capital assets | $71,700,600 | $9,133,000 | 14.6% | $62,567,600 | $62,565,600 | $735,355,687 |

For additional financial information, see:

The Public Accounts of Ontario

Appendix: 2015-16 annual report

2015-16 Achievements

Treasury Board Secretariat (TBS) was established to support the President of the Treasury Board to lead transformation that builds better public services for the future of Ontario. Its vision is:

To lead transformation that builds better public services for the future of Ontario

During the past year, the ministry engaged in a number of activities to achieve its vision. Many of which aligned with the recommendations of the Commission on the Reform of Ontario’s Public Services, including:

- Creating efficiencies in the administration of transfer payments;

- Rationalizing information technology services;

- Managing compensation costs; and

- Finding efficiencies in provincial agencies.

Improve outcomes for Ontarians living in poverty

There has been significant progress since the Ontario government launched its first Poverty Reduction Strategy in 2008. Ontario’s renewed strategy, Realizing Our Potential, was launched in 2014 and builds on progress, sets new goals, calls on new partners, and focuses on investing in what works.

In January 2015, the government established an Expert Advisory Panel on Homelessness to provide advice on how to define and measure homelessness in Ontario. The panel’s final report was released in October 2015 and is informing government actions to end chronic homelessness in 10 years.

The government continued to work closely with community and not-for-profit partners to plan and deliver poverty reduction initiatives. The Local Poverty Reduction Fund is a $50 million, six-year program to support communities with innovative and evidence-based projects to prevent and lift people out of poverty. In 2015, 41 projects in more than 20 communities across Ontario received funding.

Outreach discussions and planning for next steps on the Local Poverty Reduction Fund with indigenous partners are also under way. The government has participated in over 30 engagement activities with indigenous communities and organizations and continues to seek advice from both technical and political partners on the Local Poverty Reduction Fund.

In January 2016 a Poverty Reduction Strategy Open Dialogue project was launched with over 30 communities that have poverty reduction strategies or initiatives.

For more details on progress made to date under the Poverty Reduction Strategy, see the 2015 Poverty Reduction Strategy Annual Report, which was released in March 2016.

Support the government in achieving its fiscal targets

Led by the President of the Treasury Board, and supported by a sub-committee of Treasury Board/Management Board of Cabinet, Program Review, Renewal and Transformation (PRRT) is both the government’s ongoing fiscal planning and expenditure management approach and a continuous review of programs, including public services and internal administration.

Through cross-ministry collaboration, the government is taking focused action on major transformation initiatives that will improve outcomes for Ontarians while helping to free up resources to reinvest in key priorities, such as health care and education.

TBS provided analysis and advice to ministries to support their PRRT multi-year plans and in-year Treasury Board/Management Board of Cabinet submissions (operating and capital) as well as promoted effective partnerships with ministries, provincial agencies and other central agencies to support the prioritization of infrastructure investments. The PRRT process will continue to play an important role in helping ministries achieve the government’s fiscal targets while delivering the services that Ontarians need.

The government met its $250 million savings target for 2014-15 and its $500 million program review savings target for 2015-16.

A new Centre of Excellence for Evidence-Based Decision Making Support was launched in 2015-16 to build capacity to assess how programs are performing, use evidence to inform choices and lead change in critical public services.

Review, modernize and transform public services to increase efficiency and sustainability

In 2015, TBScontinued with the implementation of the Infrastructure Technology Services Rationalization initiative, which was launched in 2013-14. The initiative has now achieved over $28 million in annual savings and revenue by consolidating data centres, rationalizing software requirements, providing some public sector organizations with access to the government’s modern and highly secured data centre in Guelph and increasing the efficiency of government information technology (IT) operations. Highlights include:

- 20 data centres have been consolidated and 18 have been decommissioned, creating annual electricity savings equal to electricity used in more than 1,800 households and CO2 reductions equal to more than 850 cars;

- Broader public sector organizations are also sharing space in the Guelph Data Centre; and

- A number of large IT contracts have been renegotiated or retendered, resulting in better service at a lower cost.

Support an open, transparent and accountable government

TBS has made significant progress, through its Open Government strategy, in making government more open, transparent and accessible. Achievements include:

- Used digital technology to illustrate the province’s Public Accounts information in an interactive and easy-to-understand way;

- Directly engaged the public to develop and finalize an Open Data Directive to maximize the government data that is publicly available. The draft directive was shared through five in-person consultations with more than 150 participants, and a thorough multi-platform online consultation that reached over a million Twitter users, resulting in over a hundred GoogleDoc comments and 3,000 web hits;

- Consulted with the public on the 2016 Budget through the innovative online Budget Talk platform;

- Released more than 420 open data sets to date; data sets have been downloaded more than 200,000 times by the public;

- Initiated testing of a public engagement framework with four unique demonstration projects from across the OPS to apply a range of public engagement approaches and support Open Dialogue to bring more voices to the decision-making table; and

- Worked with ministries to develop ministry-specific Open Government Plans that will drive implementation of the Open Government strategy.

The Public Sector and MPP Accountability and Transparency Act, 2014, amended the Broader Public Sector Accountability Act, 2010 to allow the introduction of the Broader Public Sector Business Documents Directive. This new directive, which went into effect on January 1, 2016, requires designated broader public sector organizations to prepare and publish online their business plans and other business and financial documents.

Through a new Agencies and Appointments Directive, TBS has strengthened accountability of provincial agencies by requiring ministries and provincial agencies to deliver robust risk assessments and reporting to Treasury Board/Management Board of Cabinet:

- Since April 2015, provincial agencies have been required to publicly post their key governance documents and expenses for senior executives and appointees. Ministries are accountable for ensuring that their agencies are in compliance with the Agencies and Appointments Directive;

- Starting in 2015-16, the Chairs and CEOs of provincial agencies are required, to prepare and submit attestations that their agencies are in compliance with applicable legislation, regulations, directives and policies. Guidance documents, templates and webinar materials have been developed to support agency compliance with the new requirement; and

- In-class training is now mandatory for all new appointees to board-governed provincial agencies, as well as those who are reappointed and have not yet completed the training. In addition, all new appointees are required to complete appointee orientation available through an online e-module. More than 223 appointees to board-governed provincial agencies have taken the in-class training, and more than 630 appointees have completed the orientation e-module.

The Conflict of Interest Commissioner delivered ethics executive orientation sessions for newly appointed or re-appointed chairs of public bodies and other designated ethics executives as part of conflict of interest education, outreach and capacity building to support ethics training, good governance and accountability.

In May 2015 the Ontario Government met its budget commitment to reduce the number of agencies by 30 percent below the 2011 benchmark. By the end of 2015-16, 57 mandate reviews of provincial agencies were completed to ensure that agencies’ mandates align with government priorities. Further agency dissolutions may be recommended based on these reviews.

In keeping with Ontario’s commitment to openness and transparency, the government released the salaries of Ontario Public Service and broader public sector employees who were paid $100,000 or more in 2015. The Public Sector Salary Disclosure Act requires most organizations that receive public funding from the Province of Ontario to disclose annually the names, positions, salaries and total taxable benefits of employees paid $100,000 or more in a calendar year.

TBS supported the development of the Ontario Budget, Printed Estimates and Economic Outlook and Fiscal Review.

The ministry is also responsible for preparing and releasing Ontario’s Public Accounts, Annual Financial Report and Consolidated Financial Statements of the Province. The 2014-15 Public Accounts marked the 22nd year in a row in which Ontario’s financial statements received a clean audit from the Auditor General. Ontario again received an A grade in the April 2015 C.D. Howe Institute commentary on the fiscal accountability of Canadian senior governments, indicating that Ontario continues to be ranked among the best in the world in its overall quality of financial results reporting.

The ministry provided audit assurance and advisory services to ministries and provincial agencies and participated in key enterprise-wide initiatives to support transformation and strong fiscal management. These services have helped to strengthen risk management, controllership, effectiveness, transfer payment accountability and agency governance.

Building tomorrow’s infrastructure now

TBS, in partnership with the Ministry of Economic Development, Employment and Infrastructure, is ensuring the government’s infrastructure investments are prioritized and properly approved, while also ensuring they conform to the government’s fiscal plan.

The 2016 Budget expanded on Ontario’s plan to make an unprecedented investment of more than $137 billion in public infrastructure over 10 years, in public infrastructure such as roads, bridges, public transit, hospitals and schools. This builds on the 2014 Budget commitment to invest in infrastructure, resulting in about $160 billion over 12 years, starting in 2014–15. This represents the largest investment in public infrastructure in the province’s history. Planned investments would support over 110,000 jobs, on average, each year.

The Infrastructure for Jobs and Prosperity Act, 2015 was passed in the spring 2015. This Act, which will come into force on May 1, 2016, will align infrastructure investments with Ontario’s economic development priorities through long-term planning, while strengthening the province’s competitive edge globally. When fully implemented, the legislation will support the evaluation and prioritization of infrastructure investments.

The province launched consultations for the Moving Ontario Forward plan, which will inform the design of new infrastructure programs and provide a framework to prioritize needs for communities outside the Greater Toronto and Hamilton Area.

Oversee labour relations and compensation

The 2015 Budget required any modest negotiated wage increases to be offset by other measures to create a net-zero outcome. The Ontario government continues to work with sector-level partners to identify opportunities to support mutually beneficial bargaining outcomes that are consistent with the Province’s fiscal plan. In the latest round of bargaining, agreements were reached with Ontario Public Service Employees Union (OPSEU) Central/Unified, Ontario Secondary School Teachers’ Federation (OSSTF), Ontario English Catholic Teachers’ Association (OECTA), Association des enseignantes et des enseignants franco-ontariens(AEFO), Elementary Teachers’ Federation of Ontario (ETFO) and Canadian Union of Public Employees (CUPE) and with unions at Hydro One, Ontario Power Generation and Ontario Northern Transportation Commission, all of which were fair and reasonable, and had a net-zero impact on the fiscal plan.

The Broader Public Sector (BPS) Executive Compensation Act allows the government to manage and control executive compensation in the BPS sector by establishing compensation frameworks. TBS has collected compensation information from all colleges and universities as well as several provincial agencies under the Act. This material will inform compensation frameworks that balance sector- specific requirements with the need to prudently manage public funds.

Launched in November 2015, the Ontario Public Service (OPS) Human Resources Plan 2015-2020 provides the OPS with a roadmap to continue to foster a high performing public service that attracts and retains the best employees, and focuses on key priorities:

- Fostering a positive and inclusive workplace culture

- Developing engaged and innovative leaders

- Implementing effective and fair HR practices

As one of the province’s largest employers, the Ontario Public Service has developed a sexual harassment prevention action plan to raise awareness, enhance prevention and improve supports in the workplace. This plan supports the Premier’s provincial action plan to stop sexual violence and harassment. TBS continued its efforts in partnership with the Ministry of Government and Consumer Services to strengthen and enhance existing policies and programs, including the ongoing development of tools and communications, and the completion of a Workplace Discrimination and Harassment Prevention Policy and program evaluation.

The OPS continued to be recognized as an employer of choice in 2015-16. The OPS was recognized as one of:

- Canada’s Top 100 Employers for 2016;

- Canada’s Top Family-Friendly Employers for 2015;

- Canada’s Best Diversity Employers for the ninth year in a row;

- Greater Toronto Area’s Top Employers for the eighth year in a row;

- Canada’s Top Employers for Canadians Over 40;

- Canada’s Greenest Employers for the sixth year in a row; and

- Canada’s Top Employers for Young People for the third year in a row.

The ministry continued to attract top talent from diverse backgrounds to the OPS, through different employment programs such as the Ontario Internship Program, OPS Internship Program for Internationally Trained Individuals and the OPS Internship Program for Internationally Trained Engineers. In 2015-16, these programs attracted more than 170 youth and professionals into the OPS. The OPS Learn and Work Program is a leading example of how the OPS, as an employer, models corporate leadership. A specialized co-op program designed to re-engage high-school students from priority communities in Hamilton, Thunder Bay, Toronto and Windsor, the OPS Learn and Work Program provides youth with the opportunity to earn credits toward their high school diplomas and gain meaningful, paid, work experience. In 2015-16, the Learn and Work Program placed 143 students and had a program completion rate of 90 percent.

In 2016-17, Treasury Board Secretariat will continue to lead transformation across the Ontario Public Service and broader public sector to build better public service for the future of Ontario.

TBS interim actual expenditures 2015-16

| Expenditure type | Expenditure amount 2015-16 * |

|---|---|

| Operating | 1,306.2 million |

| Capital | 12.1 million |

| Staff Strength ** (as of March 31, 2016) | 2,703 |

* Interim actuals reflect the numbers presented in the 2016 Ontario Budget

** TBS Full-Time Equivalent positions