Exhibit D: Shareholders Agreement

Shareholders agreement

, 2015

Brewers Retail Inc.

and

Labatt Brewing Company Limited

and

Molson Canada 2005

and

Sleeman Breweries Ltd.

and

Qualifying brewer shareholders

Table of contents

Article 1: Definitions and principles of interpretation

1.1 Definitions

1.2 Additional definitions

1.3 Certain rules of interpretation

1.4 Accounting principles

1.5 Recitals, exhibit and schedules

Article 2: Purpose and scope

2.1 Unanimous shareholder agreement

2.2 Compliance with agreement

2.3 Provincial rights agreement

2.4 Compliance by corporation

Article 3: Financial participation in the corporation

3.1 Approach to operations and funding

3.2 Capital structure

3.3 Equity participation – First equity shares

3.4 Equity participation – Second equity shares

3.5 Additional capital

Article 4: Board of directors

4.1 Board of directors

4.2 Removal of directors and other vacancies

4.3 Directors’ terms

4.4 Process for nomination or removal

4.5 Chair of the board

4.6 Lead director

4.7 Chief executive officer

4.8 Mandate and meetings of the board

4.9 Committees of the board

4.10 Quorum

4.11 Approval of matters generally

4.12 Special approval of certain matters

4.13 Review of certain matters

4.14 Independent director compensation and expenses

4.15 Directors and officers insurance

4.16 Indemnification

4.17 Fiduciary duties

Article 5: Financial and other information

5.1 Auditors

5.2 Information for directors

5.3 Information for shareholders

5.4 Information for the public

5.5 Regulatory matters

Article 6: Matters relating to management of the corporation

6.1 Annual business plan and annual budget

6.2 Merchandising, marketing, promotions and shelf space

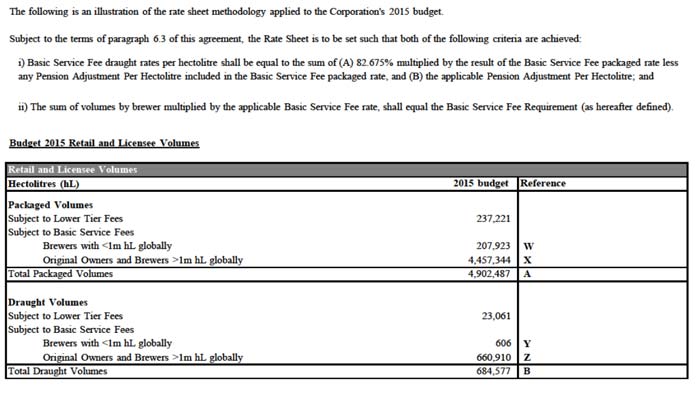

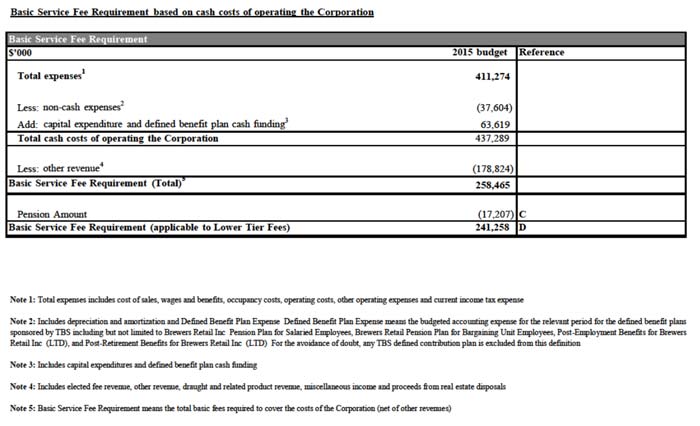

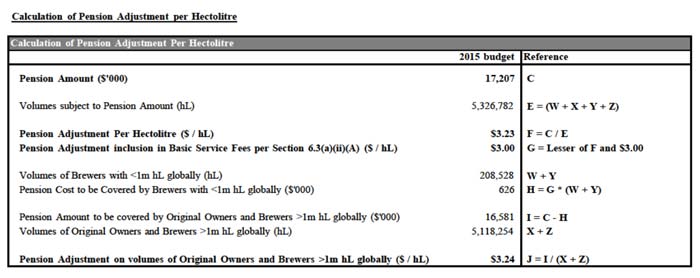

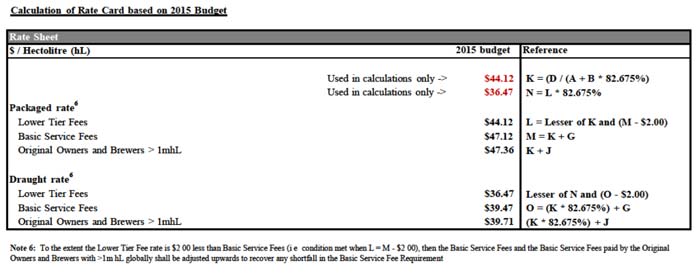

6.3 Rate sheet

6.4 Listing opportunities

6.5 Other channels

6.6 Beer ombudsman

6.7 Inclusion of draught sales in sales “through the corporation”

Article 7: Dealing with shares

7.1 Restrictions on transfer of shares

7.2 Endorsement on certificates

7.3 Issue of additional shares

7.4 Pledge of shares

7.5 Permitted transferees

7.6 Insolvency or default of a shareholder

Article 8: General

8.1 Confidentiality

8.2 Dispute resolution

8.3 By-laws and policies

8.4 Enurement

8.5 Entire agreement

8.6 Termination

8.7 Independent legal advice

8.8 Notices

8.9 Costs and expenses

8.10 Amendments and waivers

8.11 Regulatory authority

8.12 Assignment

8.13 Execution and delivery

Exhibit A – Form of subscription agreement

Exhibit B – Estimated rate sheet

Schedule 3.3(b) – Determination of book value

Schedule 4.12(a) – Certain apecial majority matters

Schedule 4.12(b) – Special majority matters (independent directors)

Schedule 6.2(c) – Marketing matters

Schedule 8.2 – Arbitration procedures

Shareholders agreement

This agreement is made , 2015 (the “Effective Date”).

Between:

Brewers Retail Inc. o/a The Beer Store, a

corporation governed by the laws of Ontario (the “Corporation”)

- and -

Labatt Brewing Company Limited, a corporation

governed by the laws of Canada (“Labatt”),

- and -

Molson Canada 2005, a partnership governed by the laws of

Ontario (“Molson”),

- and -

Sleeman Breweries Ltd., a corporation governed by the

laws of Canada (“Sleeman”),

- and -

Each qualifying brewer shareholder,

Recitals:

- On June 1, 2000, the Corporation and the LCBO, pursuant to the direction, authorization and agreement of the Province, entered into an agreement entitled “Serving Ontario Beer Consumers: A Framework for Improved Co-operation and Planning” (the “2000 Framework Agreement”), by which the LCBO regulates and controls various aspects of the sale of Beer in Ontario.

- In 2014, the Premier’s Advisory Council on Government Assets (the “Council”) was charged by the Premier of Ontario to review certain assets of the Province, including the beer and liquor distribution system in Ontario, and recommend ways to maximize their value to the people of Ontario.

- Prior to the subscription by other Qualifying Brewer Shareholders for shares in the Corporation as contemplated by this Agreement, Labatt, Molson and Sleeman (the “Original Owners”) owned all of the issued and outstanding shares in the capital of the Corporation.

- The Council made certain recommendations to the Province in its report dated April 16, 2015 entitled “Striking the Right Balance: Modernizing Beer Retailing and Distribution in Ontario” (the “Council’s Final Report”) to make changes to the regulation and control of Beer in Ontario, including to the retail and distribution system for Beer, following a negotiation with the Corporation and the Original Owners that resulted in the Council, the Corporation and the Original Owners entering into a non-binding statement of principles dated April 15, 2015 entitled “Modernizing the Distribution of Beer in Ontario: Framework of Key Principles” (the “Key Principles”), which was accepted by the Province. The Key Principles were set out in an attachment to the Council’s Final Report.

- The Corporation, the Original Owners and the Province entered into a master framework agreement dated as of , 2015 (the “Master Framework Agreement”) to record their agreement as to the manner in which the Key Principles shall be implemented.

- In order to implement certain aspects of the Key Principles, and as contemplated by the Master Framework Agreement, the Parties have entered into this Agreement to record their agreement as to the manner in which the Corporation’s business and affairs shall be conducted and to grant to each other certain rights and obligations with respect to the ownership of the Securities of the Corporation and other aspects of the governance and management of the Corporation.

Therefore, the parties agree as follows:

Article 1: Definitions and principles of interpretation

1.1 Definitions

Whenever used in this Agreement, the following terms shall have the meanings set out below:

“Act” means the Business Corporations Act (Ontario).

“Affiliate” means, with respect to a party, any person, firm, corporation, partnership (including general partnerships, limited partnerships and limited liability partnerships), limited liability company, joint venture, business trust, association or other entity that directly or indirectly Controls, is Controlled by or is under common Control with such party.

“Agreement” means this Shareholders Agreement, including the Recitals and all Exhibits and Schedules, and all amendments or restatements as permitted, and references to “Article” or “Section” mean the specified Article or Section of this Agreement.

“AGRPPA” means the Alcohol and Gaming Regulation and Public Protection Act, 1996 (Ontario).

“Annual Beer Volume” means, with respect to a particular Brewer (inclusive of its Affiliates), the volume of its Qualifying Sales that is produced at a facility in Ontario or imported into Ontario in accordance with the Inter-Plant Shipments Policy of the Liquor Control Board of Ontario, as it may exist from time to time.

“Annual Budget” means a financial budget for the Corporation for a full financial year of the Corporation as approved in accordance with this Agreement.

“Annual Business Plan” means an annual business plan for the Corporation for a full financial year of the Corporation as approved in accordance with this Agreement.

“Auditor” means the auditor of the Corporation appointed from time to time in accordance with the Act and this Agreement.

“Beer” has the meaning set out in the Liquor Licence Act (Ontario).

“Beer Ombudsman” means the independent beer ombudsman appointed from time to time in accordance with Section 6.6 of this Agreement.

“Board” means the board of directors of the Corporation constituted in accordance with this Agreement.

“Brewer” means a Person that manufactures Beer.

“Business Day” means any day, other than a Saturday or Sunday, on which the principal commercial banks in Toronto, Ontario are open for commercial banking business during normal banking hours.

“By-Laws” means the corporate by-laws of the Corporation, as may be amended from time to time in accordance with this Agreement.

“Capital Reorganization” means the reorganization of the share capital of the Corporation effected on , 2015 by amendment to the articles of the Corporation whereby all of the then issued and outstanding shares of the Corporation were converted into Second Equity Shares.

“Control” means:

(a) in relation to a corporation, the beneficial ownership at the relevant time of shares of such corporation carrying more than 50% of the voting rights ordinarily exercisable at meetings of shareholders of the corporation where such voting rights are sufficient to elect a majority of the directors of the corporation; and

(b) in relation to a Person that is a partnership, limited partnership, limited liability company or joint venture, the beneficial ownership at the relevant time of more than 50% of the ownership or voting interests of the partnership, limited partnership, limited liability company or joint venture in circumstances where it can reasonably be expected that the Person can direct the affairs of the partnership, limited liability company or joint venture;

and the words “Controlled by”, “Controlling” and similar words have corresponding meanings; the Person who Controls a Person shall be deemed to Control a corporation, partnership, limited liability company, joint venture or trust which is Controlled by such Person, and so on.

“Director” means a member of the Board.

“Eligible Qualifying Brewer” means a Qualifying Brewer that is (i) located or resident in the Province of Ontario and eligible to acquire First Equity Shares pursuant to the OSC Order, (ii) located or resident in a province or territory of Canada other than the Province of Ontario and eligible to acquire First Equity Shares pursuant to an exemption from prospectus requirements generally available under the applicable securities laws of that province or territory or (iii) neither located nor resident in Canada and that is eligible to acquire First Equity Shares pursuant to an exemption from the prospectus, registration or qualification requirements applicable under the securities laws of the jurisdiction outside of Canada in which the Qualifying Brewer is located or resident.

“First Equity Shares” means the First Equity Shares in the capital of the Corporation, issuable in series.

“First Preferred Debentures” means debentures that may be issued pursuant to Section 3.5 of this Agreement on terms to be approved as Special Majority Matters.

“Industry Participant” means any person, trade association or trade union involved in the beverage alcohol industry in Ontario including, for clarity, Canada’s National Brewers, the Original Owners, any other Qualifying Brewers or any of their Affiliates.

“LCBO” means the Liquor Control Board of Ontario.

“Licensee” means a Person holding a liquor sales licence issued under the Liquor Licence Act (Ontario).

“Liquor Control Act” means the Liquor Control Act (Ontario).

“New Beer Agreements” has the meaning ascribed thereto in the Master Framework Agreement.

“New Outlets” has the meaning set out in the Master Framework Agreement.

“Original Owners” has the meaning set out in the Recitals.

“OSC Order” means the decision of the Ontario Securities Commission rendered on , 2015 in response to an application filed by the Corporation pursuant to section 74(1) of the Securities Act (Ontario) confirming that the prospectus requirement contained in section 53(1) of the Securities Act (Ontario) will not apply to the issuance, from time to time, of First Equity Shares to Qualifying Brewers located or resident in the Province of Ontario.

“Parties” means, collectively, the Original Owners, the Corporation and each Qualifying Brewer Shareholder that becomes a party to this Agreement, and “Party” means any one of them.

“Person” means any individual, sole proprietorship, partnership, firm, entity, unincorporated association, unincorporated syndicate, unincorporated organization, trust, body corporate, limited liability company, unlimited liability company, government, government regulatory authority, governmental department, agency, commission, board, tribunal, dispute settlement panel or body, bureau, court and, where the context requires, any of the foregoing when they are acting as trustee, executor, administrator or other legal representative.

“Production Year” means, in relation to a Sales Year, the 12-month period that ends on December 31 immediately before the beginning of the Sales Year.

“Province” means Her Majesty the Queen in Right of Ontario.

“Provincial Rights Agreement” means the agreement between the Corporation and the Province dated as of the date of this Agreement.

“Qualifying Brewer” means a Brewer that operates one or more facilities manufacturing Beer in Ontario, sells Beer Through the Corporation and satisfies the following criteria:

(a) it has a valid Ontario manufacturing licence issued by the Regulator;

(b) it has a valid Canadian manufacturing licence issued by the Canada Revenue Agency;

(c) it conducts the full brewing process up to the point of packaging, including mashing, lautering, boiling, hop separation and fermentation, in its Ontario Beer manufacturing facilities; and

(d) it either (A) does not produce Beer in any other jurisdiction or (B) its Ontario Beer manufacturing facilities have a minimum annual capacity of 10,000 hectolitres of Beer in the aggregate and a minimum annual production of 2,500 hectolitres of Beer in the aggregate.

“Qualifying Brewer Shareholder” means a Qualifying Brewer that (i) has completed the purchase of 100 First Equity Shares in accordance with the terms of a Subscription Agreement entered into between the Qualifying Brewer and the Corporation on or any time after the Effective Date and (ii) continues to own such First Equity Shares as of the relevant date, and “Qualifying Brewer Shareholders” means all of such Persons collectively.

“Qualifying Sales” means sales of Beer by volume Through the Corporation.

“Rate Sheet” means the schedule of listing and service fees, including basic and elected service fees, to be charged by the Corporation to all Brewers selling Beer Through the Corporation.

“Regulator” means the LCBO, the Alcohol and Gaming Commission of Ontario and any other Ontario governmental authority or agent of the Province having jurisdiction over the sale, storage, distribution or consumption of beverage alcohol, or their successors.

“Sales Year” means a period of approximately 12 months:

(a) that begins on March 1 in a year or, if March 1 is a Saturday or Sunday, that begins on the following Monday; and

(b) that ends on the last day of February of the following year or, if the last day of February is a Friday or Saturday, that ends on the following Sunday.

“Second Equity Shares” means the Second Equity Shares in the capital of the Corporation.

“Securities” means, collectively, the First Preferred Debentures and the Shares.

“Shares” means all classes of shares in the capital of the Corporation authorized for issuance from time to time, including the First Equity Shares and the Second Equity Shares.

“Shareholders” means, collectively, the Original Owners and any Qualifying Brewer Shareholder that become a Party to this Agreement, and “Shareholder” means any one of such Persons.

“Small Brewer” means, in respect of a Sales Year, a Brewer that meets each of the following qualifications in respect of the prior Production Year:

(a) it has worldwide production of Beer in the previous Production Year that was not more than 400,000 hectolitres or, if this is the first Production Year in which it manufactures Beer, worldwide production of Beer for the Production Year that is not expected to be more than 400,000 hectolitres;

(b) is not a party to any agreement or other arrangement pursuant to which any Brewer that is not a Small Brewer manufactures Beer for it;

(c) is not a party to any agreement or other arrangement pursuant to which it manufactures Beer for any Brewer that is not a Small Brewer; and

(d) any Affiliate of it that manufactures Beer meets the qualifications set out in (a), (b) and (c) above.

For purposes of this definition:

(e) the following will be included in determining the amount of a Small Brewer’s worldwide production of Beer for a particular Production Year:

(i) all Beer manufactured during the Production Year by the Small Brewer, including Beer that is manufactured under contract for another Brewer, whether or not that other Brewer is a Small Brewer;

(ii) all Beer manufactured during the Production Year by an Affiliate of the Small Brewer, including Beer manufactured by the Affiliate under contract for another Brewer, whether or not that other Brewer is a Small Brewer; and

(iii) all Beer manufactured during the Production Year by another Small Brewer under contract for the Small Brewer or for an Affiliate of the Small Brewer; and

(f) an agreement or arrangement referred to in clause (b) of this definition does not include an agreement or arrangement that provides only for the final bottling or other packaging by a Brewer that is not a Small Brewer, including any incidental processes such as final filtration and final carbonation or the addition of any substance to the Beer that, if added, must be added at the time of final filtration.

The Board may on or before [Note: the date of the Master Framework Agreement], designate Qualifying Brewers, other than the Original Owners, to be Small Brewers for purposes of this Agreement. Once a Brewer qualifies as, or is so designated as, a Small Brewer it shall remain a Small Brewer for so long as it remains a Qualifying Brewer and does not become an Affiliate of a Brewer that is not a Small Brewer. As of the date of this Agreement, the Board has designated each of Brick Brewing Co. Limited and Moosehead Breweries Limited to be a Small Brewer.

“Subscription Agreement” means an agreement between the Corporation and an Eligible Qualifying Brewer substantially in the form of Exhibit A.

“Subsidiary” has, with respect to the Corporation, the meaning set out in the Act.

“Term” means the term (including any renewal terms) of the Master Framework Agreement.

“Through the Corporation” means, subject to Section 6.7, when used in relation to sales of Beer, sales by a particular Brewer and its Affiliates (including domestic and imported Beer manufactured by, produced for or distributed by that Brewer and its Affiliates) through the Corporation to Licensees and retail consumers, and in respect of sales through the Corporation to the LCBO (including northern agency stores and retail partners), one-half of the volume of such sales, but for clarity excluding sales of Beer to or through New Outlets.

“Total Annual Beer Volume” means the aggregate Annual Beer Volume for all Brewers (inclusive of their respective Affiliates).

“Transfer” includes any sale, exchange, assignment, gift, bequest, disposition, mortgage, charge, pledge, encumbrance, grant of security interest or other arrangement by which possession, legal title or beneficial ownership passes from one Person to another, or to the same Person in a different capacity, whether or not voluntary and whether or not for value, and any agreement to effect any of the foregoing; and the words “Transferred”,

“Transferring” and similar words have corresponding meanings.

1.2 Additional definitions

(a) Unless there is something inconsistent in the subject matter or context, or unless otherwise provided in this Agreement, all other words and terms used in this Agreement that are defined in the Act shall have the meanings set out in the Act.

(b) Additional definitions used in this Agreement:

| Definition | Where Defined |

|---|---|

| “2000 Framework Agreement” | Recital A |

| “Adjusted Local Market Share” | Schedule 6.2(c) |

| “Allocation” | Schedule 6.2(c) |

| “Basic Service Fees” | 6.3(a)(ii)(A) |

| “Board Mandate” | 4.8(a) |

| “Committees” | 4.9(a) |

| “Committee Mandate” | 4.9(d) |

| “Confidential Information” | 8.1(a) |

| “Corporation” | Page 1 |

| “Council” | Recital B |

| “Council’s Final Report” | Recital D |

| “Dispute” | 8.2(a) |

| “Dispute Parties” | 8.2(b) |

| “Executive Committee” | 4.9(c) |

| “Key Principles” | Recital D |

| “Independent Directors” | 4.1(c) |

| “Independent Director Qualifications” | 4.1(c) |

| “Labatt” | Page 1 |

| “Large Brewers” | Schedule 6.2(c) |

| “Lead Director” | 4.6 |

| “Local Market Share” | Schedule 6.2(c) |

| “Lower Tier Fees” | 6.3(a)(ii)(B) |

| “Major Shareholder” | 4.1(e) |

| “Major Shareholder Nominee” | 4.1(e) |

| “Master Framework Agreement” | Recital E |

| “Minimum Small Brewer Allocation” | Schedule 6.2(c) |

| “Molson” | Page 1 |

| “Notice” | 8.8 |

| “Offer Notice” | 3.5(b) |

| “Other Shareholders” | 4.1(f) |

| “Other Shareholder Nominee” | 4.1(f) |

| “Pension Adjustment Per Hectolitre” | 6.3(a)(iii) |

| “Pension Amount” | 6.3(a)(iii) |

| “Percentage Sales” | 4.1(e) |

| “Pro Rata Share” | 3.5(c) |

| “Permitted Transferee” | 7.5(a) |

| “Required Capital” | 3.5(b) |

| “Sleeman” | Page 1 |

| “Small Brewer Index Factor” | Schedule 6.2(c) |

| “Small Shareholder” | 4.1(d) |

| “Small Shareholder Nominee” | 4.1(d) |

| “Special Majority Matter” | 4.12 |

| “Subscribing Shareholder” | 3.5(c) |

| “Subscription Amount” | 3.5(c) |

| “Subscription Notice” | 3.5(c) |

| “Transferor” | 7.5(a) |

| “Zones” | Schedule 6.2(c) |

1.3 Certain rules of interpretation

In this Agreement:

(a) Time - Time is of the essence in the performance of the Parties’ respective obligations.

(b) Currency - Unless otherwise specified, all references to money amounts are to the lawful currency of Canada.

(c) Headings - Headings of Articles and Sections are inserted for convenience of reference only and shall not affect the construction or interpretation of this Agreement.

(d) Consent - Whenever a provision of this Agreement requires an approval or consent and such approval or consent is not delivered within the applicable time period, then, unless otherwise specified, the Party whose consent or approval is required shall be conclusively deemed to have withheld its consent or approval.

(e) Time Periods - Unless otherwise specified, time periods within or following which any payment is to be made or act is to be done shall be calculated by excluding the day on which the period commences and including the day which the period ends and by extending the period to the next Business Day following if the last day of the period is not a Business Day.

(f) Business Day - Whenever any payment to be made or action to be taken under this Agreement is required to be made or taken on a day other than a Business Day, such payment shall be made or action taken on the next Business Day following.

(g) Governing Law - This Agreement is a contract made under and shall be governed by and construed in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable in the Province of Ontario.

(h) Including - Where the word “including” or “includes” is used in this Agreement, it means “including (or includes) without limitation”.

(i) No Strict Construction - The language used in this Agreement is the language chosen by the Parties to express their mutual intent, and no rule of strict construction shall be applied against any Party.

(j) Number and Gender - Unless the context otherwise requires, words importing the singular include the plural and vice versa and words importing gender include all genders.

(k) Severability - If, in any jurisdiction, any provision of this Agreement or its application to any Party or circumstance is restricted, prohibited or unenforceable, such provision shall, as to such jurisdiction, be ineffective only to the extent of such restriction, prohibition or unenforceability without invalidating the remaining provisions of this Agreement and without affecting the validity or enforceability of such provision in any other jurisdiction or without affecting its application to other Parties or circumstances.

(l) Statutory References - A reference to a statute includes all regulations made pursuant to such statute and, unless otherwise specified, the provisions of any statute or regulation that amends, supplements or supersedes, or is the successor of, any such statute or any such regulation.

1.4 Accounting principles

Wherever in this Agreement reference is made to generally accepted accounting principles, such reference shall be deemed to be to International Financial Reporting Standards as issued by the International Accounting Standards Board, applicable as at the date on which the relevant calculation or action is made or taken or required to be made or taken in accordance with such standards.

1.5 Recitals, exhibit and schedules

The Recitals to this Agreement and the Exhibits and Schedules to this Agreement, as listed below, are an integral part of this Agreement:

- Exhibit A - Form of Subscription Agreement

- Exhibit B - Estimated Rate Sheet

- Schedule 3.3(b) - Determination of Book Value

- Schedule 4.12(a) - Certain Special Majority Matters

- Schedule 4.12(b) - Special Majority Matters (Independent Directors)

- Schedule 6.2(c) - Marketing Matters

- Schedule 8.2 - Arbitration Procedures

Article 2: Purpose and scope

2.1 Unanimous shareholder agreement

This Agreement is intended and shall be deemed to be a unanimous shareholder agreement within the meaning of the Act and the powers of the Directors to manage or supervise the management of the business and affairs of the Corporation is restricted in accordance with the terms of this Agreement.

2.2 Compliance with agreement

Each Shareholder agrees to vote and act as a shareholder of the Corporation to fulfil the provisions of this Agreement and in all other respects to comply with, and use all reasonable efforts to cause the Corporation to comply with, this Agreement and to the extent, if any, that may be permitted by law, shall cause the Director nominee(s) to act in accordance with this Agreement.

2.3 Provincial rights agreement

The Parties acknowledge that the Corporation shall enter into the Provincial Rights Agreement with the Province effective as of the Effective Date, and each Shareholder agrees to vote and act as a Shareholder of the Corporation to fulfill the provisions of the Provincial Rights Agreement and in all other respects to use all reasonable efforts to cause the Corporation to comply with the Provincial Rights Agreement and to the extent, if any, that may be permitted by law, shall cause the Director nominee(s) to act in accordance with the Provincial Rights Agreement.

2.4 Compliance by corporation

The Corporation undertakes to carry out and be bound by the provisions of this Agreement to the full extent that it has the capacity and power at law to do so.

Article 3: Financial participation in the corporation

3.1 Approach to operations and funding

(a) The Corporation will continue to operate on a self-sustaining basis as a low cost, efficient distributor and retailer of Beer in the Province of Ontario.

(b) The Corporation will be operated as a self-funding corporation on a break-even cash flow basis. As an important element of this, the Rate Sheet will be set each year in accordance with this Agreement to provide sufficient, but not excess, revenue to cover all of the cash requirements of the Corporation consistent with the Annual Business Plans and Annual Budgets from time to time. For each year, once the aggregate annual revenues of the Corporation and the actual costs of funding the operations of the Corporation are known, any revenues in excess of actual costs shall be refunded to each Brewer pro rata based on its Qualifying Sales relative to the aggregate Qualifying Sales for all Brewers for that calendar year by deducting from amounts subsequently owed by that Brewer to the Corporation and any costs in excess of revenues generated and received shall be paid by each Brewer pro rata based on its Qualifying Sales relative to the aggregate Qualifying Sales for all Brewers by adding to amounts subsequently owed by that Brewer to the Corporation, in each case in such amounts and at such times as determined by the Board.

(c) All transactions between the Corporation and its Shareholders will be transparent, auditable and on commercially reasonable terms.

3.2 Capital structure

The authorized share capital of the Corporation following the Capital Reorganization shall consist of an unlimited number of series of First Equity Shares, with each series consisting of 100 shares, and 10,000 Second Equity Shares.

3.3 Equity participation – First equity shares

(a) Each Eligible Qualifying Brewer (including the Original Owners) shall, upon executing a Subscription Agreement and tendering to the Corporation the sum of $100.00 in the form of cash, cheque or bank draft, be issued by the Corporation 100 First Equity Shares of a series separate from those First Equity Shares issued to any other Eligible Qualifying Brewer, at which time the Corporation shall duly register such Eligible Qualifying Brewer Shareholder as a registered holder of such First Equity Shares.

(b) Any determination of the Book Value of the Assets or Liabilities of the Corporation (as those terms are defined in the rights, privileges, restrictions and conditions attached to the First Equity Shares in the articles of the Corporation) shall be made in accordance with the provisions of Schedule 3.3(b).

3.4 Equity participation – Second equity shares

Pursuant to the Capital Reorganization, all of the shares in the capital of the Corporation (for clarity, other than the First Equity Shares issued or to be issued under Section 3.3) were converted into an aggregate of 10,000 Second Equity Shares, held as follows:

| Shareholder | Number of Second Equity Shares |

|---|---|

| Labatt | |

| Molson | |

| Sleeman |

Each of the Original Owners severally (and not jointly or jointly and severally) represents and warrants to the other Parties that it is the registered and beneficial owner of the number of Second Equity Shares indicated opposite its name above.

3.5 Additional capital

(a) Except as provided in this Agreement or as otherwise unanimously agreed by the Shareholders, none of the Shareholders shall be obligated to acquire additional Shares or to make loans to the Corporation or guarantee its indebtedness. It is the intention of the Parties that further funds required by the Corporation from time to time will be obtained, to the extent possible, by borrowing from Canadian chartered banks or other lenders acceptable to the Board.

(b) If the Board determines, consistent with the other provisions of this Agreement, that the Corporation requires an amount of additional capital or other funding (the “Required Capital”) and the Required Capital cannot be obtained from Canadian chartered banks or other lenders on reasonable commercial terms, the Corporation shall give notice (an “Offer Notice”) to each Shareholder, stating the aggregate amount of the Required Capital sought and the price and terms of the First Preferred Debentures to be issued by the Corporation to raise the Required Capital.

(c) Any Shareholder wishing to purchase First Preferred Debentures pursuant to an Offer Notice (a “Subscribing Shareholder”) shall, no later than 20 calendar days following the delivery by the Corporation of such Offer Notice, so indicate by Notice to the Corporation (a “Subscription Notice”). Such Subscription Notice must indicate the maximum principal amount of such First Preferred Debentures that such Subscribing Shareholder wishes to purchase (the “Subscription Amount”), which Subscription Amount may be greater than, equal to or less than such Subscribing Shareholder’s Pro Rata Share of the Required Capital. “Pro Rata Share” means a share equal to a fraction, the numerator of which is the number of votes that may be exercised in respect of the First Equity Shares held by such Subscribing Shareholder as at the date of the Offer Notice and the denominator of which is the aggregate number of votes that may be exercised in respect of all of the issued and outstanding First Equity Shares held by all such Subscribing Shareholders as at such date.

(d) If the aggregate Subscription Amounts of all Subscribing Shareholders wishing to purchase First Preferred Debentures pursuant to an Offer Notice is greater than or equal to the Required Capital, the Corporation shall issue to the Subscribing Shareholders, and the Subscribing Shareholders shall purchase, First Preferred Debentures pursuant to such Subscription Notices in an aggregate principal amount equal to the Required Capital, as follows:

(i) Each Subscribing Shareholder shall purchase First Preferred Debentures having a principal amount equal to the lesser of such Subscribing Shareholder’s Pro Rata Share of the Required Capital and such Subscribing Shareholder’s Subscription Amount.

(ii) To the extent that the allocation in Section 3.5(d)(i) results in the purchase of First Preferred Debentures in an aggregate principal amount less than the Required Capital, the remaining First Preferred Debentures shall be allocated to, and purchased by, Subscribing Shareholders whose Subscription Notices indicated a Subscription Amount in excess of their respective Pro Rata Shares of the Required Capital, pro rata in relation to their respective Pro Rata Shares, up to in each case the remaining Subscription Amount not purchased pursuant to Section 3.5(d)(i).

(e) If the aggregate Subscription Amounts of all Subscribing Shareholders wishing to purchase First Preferred Debentures pursuant to an Offer Notice is less than the Required Capital, the Corporation shall issue to the Subscribing Shareholders, and the Subscribing Shareholders shall purchase, First Preferred Debentures pursuant to such Subscription Notices as follows:

(i) Each Subscribing Shareholder shall purchase First Preferred Debentures having a principal amount equal to such Subscribing Shareholder’s Subscription Amount.

The Corporation may offer and sell any remaining First Preferred Debentures offered pursuant to the Offer Notice not purchased by Subscribing Shareholders to any Person or Persons at the same price and upon the same terms as specified in the Offer Notice; provided that it first gives the Subscribing Shareholders the right, exercisable within fifteen days, to subscribe for, all or part of, such remaining First Preferred Debentures on such terms.

(f) The purchase and sale of First Preferred Debentures pursuant to this Section 3.5 shall be completed on the date specified in the relevant Offer Notice, which date shall not be less than 60 days following the delivery by the Corporation of such Offer Notice.

Article 4: Board of directors

4.1 Board of directors

(a) The Corporation shall have a Board consisting of 15 Directors.

(b) The Shareholders shall vote their Shares, at least annually and otherwise as and when required, at a meeting of Shareholders or by written resolution:

(i) to nominate Directors, and to elect the Directors nominated, in accordance with this Agreement from time to time; and

(ii) to remove any Director specified to be removed in accordance with Section 4.2.

For clarity, on any vote, each Shareholder shall be entitled to exercise such number of Total Votes as shall be equal to such Shareholder’s Percentage Entitlement (as such terms are defined in the rights, privileges, restrictions and conditions attaching to the First Equity Shares).

(c) Four of the Directors (the “Independent Directors”) shall each meet the following qualifications (the “Independent Director Qualifications”):

(i) he or she need not be a Canadian or Ontario resident, except as may be required to ensure that the Board complies with any Canadian residency requirements under applicable law (provided that any such residency requirements shall not be required to be satisfied disproportionately by Independent Directors in relation to other Directors);

(ii) he or she has the appropriate level of experience and expertise to perform the duties of a director of a company of the size and complexity of the Corporation;

(iii) he or she has the ability to read and understand financial statements that present the breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can be expected to be raised by the Corporation’s financial statements; and

(iv) he or she does not have a direct or indirect material relationship with an Industry Participant or any of its Affiliates or the Province or any of its agencies that could reasonably be expected to interfere with the exercise of that person's independent judgment as a Director.

The initial Independent Directors shall be as follows:

Subject to Section 4.2(e), successors to the initial Independent Directors shall be nominated from time to time by the majority vote of the Independent Directors then in office (for clarity, an Independent Director may participate in any vote to nominate the successor to such Independent Director); provided, however, that each such successor Independent Director must satisfy the Independent Director Qualifications.

(d) One of the Directors (the “Small Shareholder Nominee”) shall be nominated by the majority vote of the Small Shareholders to serve a one-year term. A “Small Shareholder” is a Shareholder that (inclusive of its Affiliates) had less than 50,000 hectolitres of Qualifying Sales in the prior calendar year. Any Small Shareholder Nominee that has served as a Director in the capacity of the Small Shareholder Nominee during the last five years shall not be permitted to serve as a Small Shareholder Nominee in the then current year.

(e) Each Major Shareholder shall be entitled to nominate one Director (a “Major Shareholder Nominee”) for each full 10 percentage points of its Percentage Sales during the prior calendar year (rounded up, in the case of 7 percentage points or more, to the next full 10 percentage points), provided that, for so long as the aggregate Percentage Sales of Labatt and Molson are equal to or greater than 50% and less than 97%, Labatt and Molson will be entitled to nominate four Major Shareholder Nominees each.

“Percentage Sales” of a Shareholder means the percentage that the Annual Beer Volume of such Shareholder (inclusive of its Affiliates) in the preceding calendar year represents of the Total Annual Beer Volume in respect of such calendar year. A “Major Shareholder” is a Shareholder the Percentage Sales of which are equal to or greater than 10% (determined without any rounding up).

(f) The remaining Directors (each, an “Other Shareholder Nominee”) shall be nominated by Shareholders that are not Small Shareholders or Major Shareholders (the “Other Shareholders”), provided that no single Other Shareholder will as a result of this Section 4.1(f) be able to nominate more than one Director. For clarity, based on Total Annual Beer Volume as at the Effective Date, Sleeman shall be entitled to nominate one Other Shareholder Nominee.

(g) Notwithstanding the foregoing, if the aggregate Percentage Sales of Labatt and Molson are equal to or greater than 97%, the Board shall consist of up to 18 Directors, being comprised of one Small Shareholder Nominee, five Independent Directors, ten Major Shareholder Nominees, with Labatt and Molson being entitled to nominate five Major Shareholder Nominees each, and up to two Other Shareholder Nominees.

4.2 Removal of directors and other vacancies

(a) Directors may be specified to be removed from office as follows from time to time:

(i) Pursuant to the Provincial Rights Agreement, the Province may specify that all (but not less than all) of the Independent Directors be removed;

(ii) the Small Shareholders may by majority vote specify that the Small Shareholder Nominee be removed;

(iii) any Major Shareholder may specify that any Major Shareholder Nominee nominated by it be removed; and

(iv) the Other Shareholders may by majority vote specify that any Other Shareholder Nominee be removed.

(b) Any specification contemplated by Section 4.2(a) shall be effected by Notice to such Director, all other Directors and the Corporation.

(c) Any vacancy occurring on the Board by reason of the death, disqualification, inability to act, resignation or removal of any Director, shall, subject to Section 4.2(d) and Section 4.2(e), be filled only by a further nominee of the Shareholder or group of Shareholders whose nominee was so affected.

(d) Subject to Section 4.2(e), any vacancy occurring on the Board by reason of the death, disqualification, inability to act or resignation of an Independent Director shall be filled by a nominee that satisfies the Independent Director Qualifications selected by majority vote of the Independent Directors remaining in office.

(e) As contemplated by the Provincial Rights Agreement, vacancies occurring on the Board by reason of the removal of the Independent Directors pursuant to Section 4.2(a)(i) or the resignation of all of the Independent Directors shall be filled only by nominees that satisfy the Independent Director Qualifications chosen by majority vote of a selection committee composed of an equal number of members appointed by the Province, on the one hand, and by the Major Shareholders, on the other hand, in accordance with the terms of the Provincial Rights Agreement.

(f) If at any time a Shareholder loses its right to nominate any Director (including because such Shareholder ceases to be a Qualifying Brewer or because of a reduction in its Percentage Sales), such Director shall be removed from the Board effective as of such time and the vacancy thereby created shall be filled in accordance with Section 4.1.

4.3 Directors’ terms

Other than with respect to the Small Shareholder Nominee who will serve a one-year term, Directors shall be elected for terms of three years each, beginning on the Effective Date, provided, however, that the initial Independent Directors shall be elected for terms of one, two, three and four years, respectively. Subject to Section 4.1(d), Directors may serve on the Board for successive terms, provided that no Director shall serve on the Board for more than nine consecutive years following the Effective Date.

4.4 Process for nomination or removal

Shareholders entitled as a group to nominate or specify for removal any Directors shall do so by resolution in writing or by majority vote of such Shareholders present and voting at a meeting of such Shareholders duly called in accordance with the By-laws.

4.5 Chair of the board

One of the Directors shall be elected from time to time as Chair of the Board by majority vote of the Directors. The Chair of the Board shall chair meetings of the Board and meetings of Shareholders, but shall not be entitled to a second or casting vote.

4.6 Lead director

One of the Independent Directors shall be elected from time to time to serve as the lead director (the “Lead Director”) by majority vote of the Independent Directors then in office. The Lead Director will only have a second or casting vote if there is a tie vote among the Independent Directors on any Special Majority Matter or any matter that is required under this Agreement to be approved by a majority of Independent Directors.

4.7 Chief executive officer

The Chief Executive Officer of the Corporation shall not be a Director, but shall be invited to attend most meetings of the Board. At each regular meeting of the Board, the Chief Executive Officer shall report to the Board with respect to the current status of the operations of the Corporation and with respect to all major developments or planned action involving the Corporation and shall present to the meeting complete current financial information with respect to the Corporation and such other information as may be requested by the Board from time to time.

4.8 Mandate and meetings of the board

(a) The Board shall, with the approval of a majority of the Independent Directors then in office, adopt and keep current a board mandate document specifying the role and responsibilities of the Board and the skills and qualifications required of Directors (the “Board Mandate”). The Board Mandate shall reflect best practices for board governance and the special role played by the Independent Directors, including their mandate to represent the interests of all Shareholders, and to ensure that all business and affairs of the Corporation are conducted in a manner that is fair to all Shareholders. All material matters relating to the business and affairs of the Corporation shall be determined by the Board.

(b) The Board shall meet at least once every three months, or as may be more frequently scheduled or called by the Chair of the Board or the Lead Director. Directors may attend meetings of the Board in person, by telephone or by video conference or other communication facilities that permit all individuals participating in the meeting to hear and communicate with each other simultaneously, and a Director participating in such a meeting by such means shall be deemed to be present at the meeting. Written or electronic notice of any meeting of the Board shall be given to each Director at least five Business Days prior to the scheduled date of such meeting, unless such notice is waived by all of the Directors. Any four Directors shall be entitled to call meetings of the Board upon notice as set out in this Section 4.8.

4.9 Committees of the board

(a) The Board shall appoint the following committees of the Board (together with the Executive Committee, the “Committees”):

(i) Finance and Audit Committee;

(ii) Governance and Human Resources Committee (to have responsibility as well for health and safety matters); and

(iii) Retail and Marketing Committee.

(b) Each Committee shall include at least one Independent Director. The Retail and Marketing Committee shall include at least one Small Shareholder Nominee or Other Shareholder Nominee who is not a Nominee of an Original Owner.

(c) The Board shall appoint an executive committee (the “Executive Committee”) comprised of three directors, including the Lead Director. For so long as the aggregate Percentage Sales of Labatt and Molson are equal to or greater than 50%, the other two members of the Executive Committee shall be Major Shareholder Nominees of Labatt and Molson. The Executive Committee shall have the authority to deal with all matters, other than Special Majority Matters, specifically delegated to it by the Board with the additional approval of a majority of the Independent Directors, provided that such matters shall be limited to operational decisions that are not material (for this purpose, any matter or series of related matters that involves a payment, settlement, commitment or expense of less than $500,000 in aggregate shall not be material), including any specific capital expenditures that are generally provided for in an approved Annual Business Plan. All meetings of the Executive Committee shall be minuted and the minutes shall be distributed to all of the Directors in a timely manner. Directors shall be entitled to receive upon their request any additional information relating to matters approved by the Executive Committee, including any information available to the Executive Committee in connection with such matters.

(d) The Board shall, with the approval of a majority of the Independent Directors then in office, adopt and keep current a committee mandate document specifying the role and responsibilities of, and the powers of the Board delegated to, each Committee (each, a “Committee Mandate”).

4.10 Quorum

A quorum for any meeting of the Board or a Committee shall consist of:

(a) an equal number of Major Shareholder Nominees of each of Labatt and Molson, who together must constitute a majority of the Directors present at any meeting of the Board or any Committee for so long as Labatt and Molson are entitled to nominate and elect a majority of the Directors pursuant to Section 4.1(e) or Section 4.1(g); and

(b) at least two Independent Directors for any meeting of the Board and at least one Independent Director for any meeting of a Committee.

4.11 Approval of matters generally

Notwithstanding any other provision of this Agreement or the Act, but subject to Section 4.10 and Section 4.12, no obligation of the Corporation will be entered into, no decision will be made and no action taken by or with respect to the Corporation, directly or indirectly, with respect to any material matters of the Corporation (including any Special Majority Matters), without obtaining approval by a simple majority of the Directors serving on the Board at the relevant time and in attendance at the meeting of the Board (or, in the case of a written resolution, without obtaining approval from all Directors serving on the Board at the relevant time) or, with respect to any matter delegated by the Board to the Executive Committee, approval by the Executive Committee.

4.12 Special approval of certain matters

Notwithstanding any other provision of this Agreement or the Act, but subject to Section 4.10, in addition to the approval referred to in Section 4.11, no obligation of the Corporation will be entered into, no decision will be made and no action taken by or with respect to the Corporation, directly or indirectly, with respect to any of the matters (each, a “Special Majority Matter”):

(a) referred to in Schedule 4.12(a), without also obtaining the approval of such matter by at least 80% of the Directors then in office and present at the duly constituted meeting considering the matter; or

(b) referred to in Schedule 4.12(b), without also obtaining the approval of such matter by at least the majority of the Independent Directors then in office and present at the duly constituted meeting considering the matter, but in any case no fewer than two Independent Directors (or, in the case of a written resolution, without obtaining approval from all Independent Directors then in office).

4.13 Review of certain matters

During the one year period commencing six months following the Effective Date, the Board shall review and reconsider (as Special Majority Matters) all decisions and actions made or taken by the Corporation prior to the Effective Date that would have an ongoing application and that would have constituted Special Majority Matters referred to in Schedule 4.12(b) if made or taken on or after the Effective Date (including all policies implementing any aspects of the New Beer Agreements and the Board Mandate and Committee Mandates, but excluding the 2016 Annual Budget, the 2016 Annual Business Plan, the capital spending budget for 2016 and the designation of certain Qualifying Brewers to be Small Brewers for purposes of this Agreement) and such matters shall be subject to the approval of the Board and also by at least the majority of the Independent Directors then in office. In addition, upon the request of a majority of the Independent Directors at any time, acting reasonably, the Board shall review and reconsider any Special Majority Matters referred to in Schedule 4.12(b) that were previously made or taken.

4.14 Independent director compensation and expenses

(a) The Corporation shall compensate the Independent Directors for their services at reasonable commercial rates in effect from time to time as determined by the Board.

(b) The Corporation shall promptly reimburse in full each Independent Director for all of his or her reasonable out-of-pocket expenses incurred in attending each meeting of the Board or any Committee and in carrying out other duties or activities on behalf of the Corporation.

(c) In appropriate circumstances, the Independent Directors shall be entitled, acting reasonably, (with the prior approval of the Chairman of the Board, acting reasonably, as to subject matter and quantum of expense) to engage, at the expense of the Corporation, outside legal and other advisors to assist them in discharging their responsibilities as contemplated by this Agreement.

4.15 Directors and officers insurance

The Corporation shall maintain directors and officers liability insurance coverage for the Directors and officers of the Corporation on terms and conditions and in an amount consistent with customary practice and otherwise acceptable to the Board.

4.16 Indemnification

The Corporation shall indemnify each Director and such Director’s heirs and legal representatives against all reasonable and documented costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably incurred by such Director in respect of any civil, criminal or administrative proceeding to which such Director is made a party by reason of being or having been a Director provided (i) such Director acted honestly and in good faith with a view to the best interests of the Corporation; and (ii) in the case of a criminal or administrative proceeding that is enforced by a monetary penalty, such Director had reasonable grounds for believing that his or her conduct was lawful.

4.17 Fiduciary duties

(a) The Parties acknowledge that some or all of the Directors may have, from time to time, possible conflicts of interest arising from, among other matters, their past or present relationships with, or investments in, a Shareholder. Subject to their fiduciary duties to the Corporation under applicable law, the requirements of this Agreement and the Act, such conflicts of interest shall not, in and of themselves, disqualify such Directors from their office nor from exercising their rights and responsibilities as directors of the Corporation.

(b) The Shareholders and the Corporation acknowledge that the Directors may share Confidential Information of the Corporation with the Shareholders to permit the Shareholders to monitor the business and affairs of the Corporation; provided, however, that the receiving Shareholder must comply with Section 8.1. The Corporation acknowledges that such sharing of Confidential Information is not a breach of the fiduciary duty owed by the Directors to the Corporation.

(c) In addition to giving consideration to the best interests of the Corporation in carrying out their duties in supervising the management of the Corporation:

(i) the Directors may give due consideration to broader stakeholder interests in accordance with applicable law; and

(ii) in addition to clause (i), the Independent Directors may give due consideration to the Key Principles as reflected in the New Beer Agreements and their purposes and intent and the broader public interest.

The Independent Directors may consult with Qualifying Brewer Shareholders as appropriate to inform and assist them in carrying out their duties under this Agreement, provided that such consultation is done in a manner that reflects the fiduciary duty of all Directors to act in the best interests of the Corporation and all of its Qualifying Brewer Shareholders and not the interests of any individual Qualifying Brewer Shareholder or group of Qualifying Brewer Shareholders, subject to the principles in clauses (i) and (ii) of this Section 4.17(c).

(d) The Parties acknowledge that as part of the services that the Corporation provides to Brewers Distributing Ltd. pursuant to a services agreement that is based on cost recovery, the Corporation hosts certain data and information belonging to Brewers Distributing Ltd. and that all such data and information is confidential and proprietary and is subject to the protections afforded by such services agreement.

Article 5: Financial and other information

5.1 Auditors

PricewaterhouseCoopers LLP or another nationally recognized firm authorized to audit public companies in Canada shall be appointed as Auditor.

5.2 Information for directors

The Directors will be entitled to have access to information of the Corporation in accordance with the Act.

5.3 Information for shareholders

(a) In addition to the information that a Shareholder is entitled to receive under the Act, each Shareholder shall be entitled to receive the following:

(i) as soon as practicable, but in any event within 45 days after the end of each quarter of the Corporation’s financial year, unaudited financial statements of the Corporation for and as at the end of such quarter, prepared in accordance with generally accepted accounting principles, consistently applied, and accompanied by a discussion of variances from the Annual Budget;

(ii) as soon as practicable, but in any event within 90 days after the end of each financial year of the Corporation, audited annual financial statements of the Corporation for and as at the end of such financial year, prepared in accordance with generally accepted accounting principles, consistently applied, and accompanied by an audit report of the Auditor;

(iii) as soon as practicable, but in any event within 30 days after the beginning of each financial year of the Corporation, the Annual Budget and Annual Business Plan for such financial year, together with an analysis of the impact of the Annual Budget on the Rate Sheet; and

(iv) any information reasonably required by Shareholders whose securities are publicly traded to comply with their own reporting obligations.

(b) The Corporation shall operate on the principle that all Shareholders and their Affiliates are entitled to receive information relating to the Corporation on an equitable basis. To the extent that any information relating to the Corporation is being shared with certain Shareholders on a regular basis (other than information provided to a Shareholder relating only to such Shareholder, such as its own sales or other Confidential Information), the Corporation shall make arrangements to provide all Shareholders with access to such information (which may be shared with their respective Affiliates) on the same basis; provided, however, that, to the extent that the Corporation charges reasonable amounts for the provision of any such information, a Shareholder has paid the relevant amounts.

5.4 Information for the public

The Corporation shall make the following information available to the public on its website in a timely manner:

(a) the audited annual financial statements of the Corporation for and as at the end of each financial year, prepared in accordance with generally accepted accounting principles, consistently applied, and accompanied by an audit report of the Auditor;

(b) the Corporation’s annual operations report, prepared on a basis that provides no less information than has been consistent with recent past practice, including details of the amount and use of capital expenditures incurred in the year to which such report relates;

(c) any policies adopted by the Board that give effect to any of the provisions of the Key Principles as reflected in the New Beer Agreements;

(d) this Agreement, the Master Framework Agreement and the By-Laws; and

(e) the composition of the Board and the Committees, and the Board Mandate and Committee Mandates, as they exist from time to time.

5.5 Regulatory matters

(a) The Corporation shall continue to follow compliance protocols to ensure the manner in which it operates is in compliance with applicable laws.

(b) The Regulator is and will be empowered to require additional disclosure from the Corporation, and to monitor, investigate, audit and enforce applicable legislation and regulations and the Regulator’s policies in place from time to time, including compliance with social responsibility requirements, in order to ensure compliance with the New Beer Agreements.

Article 6: Matters relating to management of the corporation

6.1 Annual business plan and annual budget

(a) Prior to the beginning of each financial year of the Corporation, the Corporation shall prepare a detailed budget and a detailed business plan for such financial year, and shall present such budget and plan to the Board, including the Independent Directors, for approval in sufficient time that such budget and business plan may be approved in accordance with this Agreement (and thereby become the Annual Budget and Annual Business Plan for such financial year) prior to the beginning of such financial year.

(b) The Corporation shall conduct its business and affairs in a financial year substantially in accordance with the Annual Budget and Annual Business Plan in respect of such financial year and any variations from such Annual Budget or Annual Business Plan approved in accordance with this Agreement from time to time.

6.2 Merchandising, marketing, promotions and shelf space

(a) All merchandising, marketing, promotions and shelf space programs and policies relating to the operations of the Corporation shall incorporate the use of clearly defined Beer categories and, where applicable, subcategories except where the Corporation can demonstrate that to do so would not be practicable, with all categories and subcategories being distinctly and prominently incorporated. Categories and subcategories shall be established based on fair and reasonable criteria which, along with the categories and subcategories themselves and the brands included in those categories and subcategories, shall be as approved by a majority of the Independent Directors then in office. All Brewers shall be allowed to have products listed in all categories and subcategories, and the criteria established for each category or subcategory shall not be structured to exclude any Brewer from participating in any category or subcategory based on ownership or production volume. There shall be a subcategory called “Ontario craft beer” within the category of “Domestic specialty beer”:

(i) Any brand of Beer proposed to be included in the “Ontario craft beer” subcategory must also meet the requirements of the “Domestic specialty beer” category (i.e., premium pricing and domestic production).

(ii) In addition, to be included in the “Ontario craft beer” subcategory, at least 70% of the worldwide production of that brand must be produced at facilities in Ontario having annual production of Beer of less than 400,000 hectolitres.

(iii) The “Ontario craft beer” subcategory shall be distinctly displayed and marketed, with a prominence no less than that of the “Domestic specialty beer” category.

(b) The Corporation shall provide opportunities for all Brewers to participate in more merchandising, marketing and promotional activities and other activities directed to supporting the growth of all brands and Brewers that sell Through the Corporation greater than those in effect as of the Effective Date. All merchandising, marketing, promotions and shelf space shall be allocated in accordance with the New Beer Agreements except where the Corporation can demonstrate that to do so would not be practicable. Where the Corporation charges Brewers a fee for any merchandising, marketing, promotions or shelf space, such fees shall be paid for by Brewers based on competitively set rates.

(c) The Corporation shall allocate merchandising, shelf space, marketing and promotions as set forth in Schedule 6.2(c).

6.3 Rate sheet

(a) The Rate Sheet shall continue to be tiered and will be structured to achieve the objectives set out in Section 3.1 such that, from September 1, 2015:

(i) There shall be separate rate categories for packaged and draught beer, and the relative difference between the two categories shall be consistent with past practice.

(ii) For each of packaged and draught Beer, the following rates shall be established per hectolitre of Beer sold through the Corporation:

(A) “Basic Service Fees”, which shall not include more than $3.00 in respect of Pension Adjustment Per Hectolitre; and

(B) “Lower Tier Fees”, which shall not include any amount in respect of Pension Adjustment Per Hectolitre. The Lower Tier Fees will be at least $2.00 per hectolitre less than the Basic Service Fees.

(iii) All Brewers shall pay the same Basic Service Fees on volume of Beer sold through the Corporation with the following exceptions:

(A) Brewers (inclusive of their Affiliates) with worldwide production of Beer of less than 1,000,000 hectolitres per year shall be entitled to pay Lower Tier Fees on their first 50,000 hectolitres of Beer sold through the Corporation each year; and

(B) the Basic Service Fees to be paid by the Original Owners and Brewers (inclusive of their Affiliates) with worldwide production of Beer of 1,000,000 hectolitres per year or more shall be adjusted upwards to recover any portion of the Pension Amount that is not recovered by the Corporation as a result of clause 6.3(a)(ii) and 6.3(a)(iii)(A).

“Pension Adjustment Per Hectolitre” means the solvency amortization portion of the aggregate cash pension payments of the Corporation in any particular year (the “Pension Amount”) divided by the number of hectolitres of Beer sold through the Corporation in that year.

(iv) The methodology by which the Rate Sheet is calculated for each year shall remain constant during the Term, which methodology is reflected in the calculation of the estimated Rate Sheet set out as Exhibit B.

(v) All elected service fees, with the exception of those for merchandising, shelf space, marketing and promotions, shall reasonably approximate the actual cost of providing such services.

(vi) Except as otherwise contemplated by the New Beer Agreements, Qualifying Brewers other than the Original Owners shall be treated no less favourably than any other Brewer, including with respect to any rebates or other adjustments to service charges and elected service fees.

(b) To the extent that the Corporation reasonably determines in good faith that it is not practicable to begin immediately changing rates in accordance with Section 6.3(a) from and after September 1, 2015, it shall as soon as practicable following the implementation of the Rate Sheet in accordance with Section 6.3(a) make retroactive adjustments to the amounts charged to and paid by Brewers so as to put each Brewer in the position that it would have been in had such Rate Sheet been implemented effective September 1, 2015.

6.4 Listing opportunities

Qualifying Brewers (inclusive of their Affiliates) having Annual Beer Volume of less than 10,000 hectolitres per year shall be provided with 2 free product listings in 7 stores of the Corporation proximate to their breweries. All Qualifying Brewers shall be permitted 2 free seasonal SKU swaps for one existing SKU.

6.5 Other channels

The Corporation shall not impose any restrictions on the retail, distribution or marketing channels that Brewers may use and shall not penalize Brewers who use such channels outside the Corporation. For clarity, this would not apply to policies that the Corporation may adopt from time to time with respect to the use of its keg pool and similar owned assets.

6.6 Beer ombudsman

(a) There shall be an independent Beer Ombudsman, who shall be appointed from time to time by the majority of the Independent Directors then in office. The Beer Ombudsman shall hear complaints from Brewers and customers regarding operational issues relating to the Corporation. The reasonable compensation and expenses of the Beer Ombudsman shall be paid by the Corporation.

(b) If the Beer Ombudsman is unable to resolve a complaint, it may be submitted to the dispute resolution process established pursuant to Section 8.2.

(c) The Beer Ombudsman shall report to the Independent Directors at least annually and the Independent Directors shall by majority vote assess the performance of and, acting reasonably and in consultation with the Board, determine the compensation of the Beer Ombudsman from time to time. The annual report of the Beer Ombudsman shall be made available to the public on the Corporation’s website after its approval by the Independent Directors and presentation to the Board.

6.7 Inclusion of draught sales in sales “through the corporation”

A majority of the Independent Directors may, on one occasion during the two-year period following the date of this Agreement, require the Corporation to review whether the inclusion of sales of draught Beer in the definition of “Through the Corporation” for purposes of this Agreement creates results that are unfairly biased towards any group of Brewers that has a higher proportion of sales of draught Beer taking into consideration the revenues generated by the Corporation from fees charged to Brewers who sell draught Beer through the Corporation and the regulatory requirements for certain Brewers to sell Beer to Licensees through the Corporation. If, as a result of such review, a majority of the Independent Directors (without any requirement for Board approval) determines that such inclusion creates such results, the definition of “Through the Corporation” in Section 1.1 shall be amended to exclude sales of draught Beer.

Article 7: Dealing with shares

7.1 Restrictions on transfer of shares

(a) Except as expressly provided in this Agreement, no Shareholder shall Transfer any Securities held by it, or any of its rights or obligations under this Agreement, to any Person.

(b) Notwithstanding anything else contained in this Agreement, every Transfer of Shares held by a Shareholder, in addition to the requirements of the Corporation’s articles and the other requirements of this Agreement, shall be subject to the condition that the proposed transferee, if not already bound by the terms of this Agreement, shall first agree, in writing, to become a party to and be bound by the terms of this Agreement, by executing a form of counterpart and acknowledgement acceptable to the Corporation.

7.2 Endorsement on certificates

Share certificates of the Corporation shall bear the following language either as an endorsement or on the face of each such share certificate: “The shares represented by this certificate are subject to the terms and conditions of a unanimous shareholders agreement made , 2015 as it may be amended, which agreement contains, among other things, restrictions on the right of the holder to transfer or sell the shares. A copy of such agreement is on file at the registered office of the Corporation.”

7.3 Issue of additional shares

Without the prior written agreement of the Shareholders, the Corporation shall not issue any further shares in the capital of the Corporation, or other securities convertible or exchangeable into shares in the capital of the Corporation, other than 100 First Equity Shares issued to each Eligible Qualifying Brewer pursuant to Section 3.3.

7.4 Pledge of shares

Notwithstanding the provisions of Section 7.1, any Shareholder may pledge, charge, mortgage or otherwise encumber any of its Shares to a bank or other financial institution for the purpose of securing any borrowings by such Shareholder, provided that such bank or financial institution acknowledges to the Parties in writing that the pledge, charge, mortgage or encumbrance of such Shares shall at all times be subject to all the terms and conditions of this Agreement, including the prohibition against Transferring such Shares contained in Section 7.1 except as permitted pursuant to this Article.

7.5 Permitted transferees

(a) Subject to the provisions of this Section 7.5, each Shareholder (a “Transferor”) shall be entitled, upon prior Notice to the Corporation, to sell, transfer and assign all (but not less than all) of its Shares to (i) any Affiliate or (ii) any Person in connection with the acquisition by such Person of substantially all of the assets of the Shareholder (in each case, a “Permitted Transferee”). No such Transfer shall be effective until the Permitted Transferee executes and delivers to the Corporation a counterpart to this Agreement in compliance with Section 7.1(b). No such Transfer shall release or discharge the Transferor from any of its liabilities or obligations under this Agreement.

(b) The Transferor shall, at all times after the Transfer of Shares to a Permitted Transferee:

(i) be jointly and severally liable with the Permitted Transferee for the observance and performance of the covenants and obligations of the Permitted Transferee under this Agreement;

(ii) cause the Permitted Transferee to remain an Affiliate for so long as the Permitted Transferee has any registered or beneficial interest in the Shares; and

(iii) indemnify the other Parties against any loss, damage or expense incurred as a result of the failure by the Permitted Transferee to comply with the provisions of this Agreement.

(c) Any Permitted Transferee may, upon prior Notice to the Corporation, at any time Transfer back to the applicable Transferor all (but not less than all) such Shares held by such Permitted Transferee.

(d) The rights of any Permitted Transferee of a Shareholder shall not be any greater than the rights that its Transferor would have if it held Shares directly, and if those rights would have changed (for example, by a Qualifying Brewer Shareholder ceasing to be a Qualifying Brewer), the rights of such Permitted Transferee shall change at the same time and with the same effect.

7.6 Insolvency or default of a shareholder

If any Shareholder (i) makes an assignment for the benefit of creditors, (ii) is the subject of any proceedings under any bankruptcy or insolvency law, (iii) avails itself of the benefit of any other legislation for the benefit of debtors or (iv) takes steps to wind up or terminate its corporate existence other than in connection with a corporate reorganization that results in the shares of the Corporation held by such Shareholder being held by a successor or continuing entity, the Corporation shall redeem, in accordance with the articles of the Corporation, the First Equity Shares held by such Shareholder. In the event that, a Shareholder ceases to be a Qualifying Brewer, its First Equity Shares shall become subject to the restrictions set forth in the articles of the Corporation.

Article 8: General

8.1 Confidentiality

(a) Except as otherwise expressly provided for in this Agreement, none of the Parties shall, at any time or under any circumstances, without the consent of the Corporation, directly or indirectly communicate or disclose to any Person (other than its employees, agents, advisors and representatives and their respective Affiliates as reasonably necessary in connection with its interest in the Corporation, and to those of the other Parties) or make use of (except in connection with its interest in the Corporation) any Confidential Information howsoever acquired by such Party. In this Agreement, “Confidential Information” means any confidential knowledge or information howsoever acquired by such Party relating to or concerning the customers, products, technology, trade secrets, systems or operations, or other confidential information regarding the property, business or affairs, of the Corporation or any of its Subsidiaries. However, the foregoing obligation of confidentiality shall not apply to:

(i) information that is or becomes generally available to the public (other than by disclosure by such Party or its employees, agents, nominees, advisors or representatives contrary to this Section 8.1);

(ii) information that is reasonably required to be disclosed by a Party to protect its interests in connection with any valuation or legal proceeding in relation to this Agreement;

(iii) information that is required to be disclosed by law or by the applicable regulations or policies of any regulatory agency of competent jurisdiction or any stock exchange; or

(iv) disclosure of information by a Shareholder in connection with a proposed transaction relating to such Shareholder, provided such Shareholder obtains a prior written covenant of confidentiality on reasonable commercial terms from the Person to whom it proposes to disclose such information.

Notwithstanding the foregoing, if a Party in good faith determines that disclosure of Confidential Information to the Province (which in no event may include the LCBO) is warranted in the circumstances, such Party shall notify the Corporation and the Board requesting the Corporation to provide such information to the Province. Unless such information is subject to privilege, the Corporation shall provide such information to the Province within 15 Business Days of such Notice. The Corporation shall retain the right to prevent the disclosure of any information that is subject to the Freedom of Information and Protection of Privacy Act (Ontario) pursuant to the protections afforded by that Act.