This page is part of a migration project

We've moved this content over from an older government website. We'll align this page with the ontario.ca style guide in future updates.

Understanding your property tax bill and the services supported

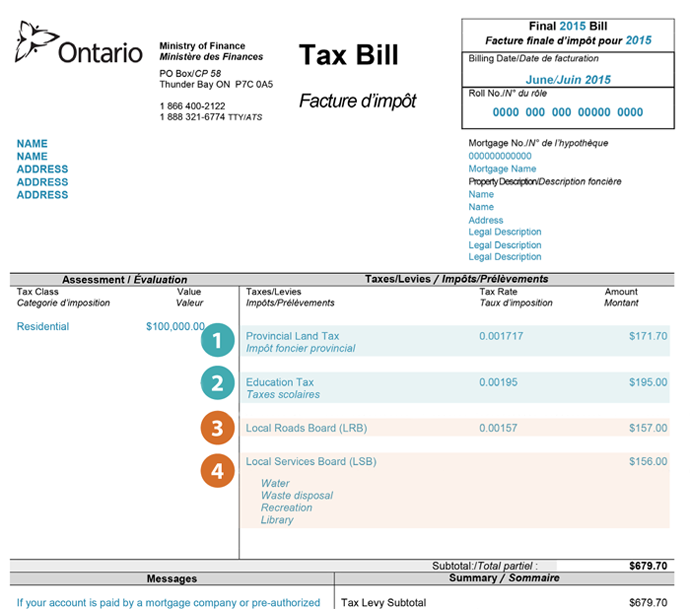

Sample property tax bill for unincorporated area

Provincial taxes

1. Provincial Land Tax (PLT)

Contributes toward:

- Social Assistance

- Child Care

- Land Ambulance

- Social Housing

- Public Health

- Policing

- Other (includes PLT administration and assessment, planning boards, waste disposal sites and fire suppression on Crown Land, Crown Land management, and Provincial contribution to LRBs and LSBs)

Who pays?

All unincorporated area taxpayers

PLT = PLT Rate × Assessment

- Rates are set by the Province

- PLT contributes a small portion toward the cost of these services. The Province contributes the rest.

2. Education Tax

Helps support:

- Elementary and Secondary Education

Who pays?

All Ontario property owners except those with unincorporated area properties located outside schoolboard areas.

Education Tax = Education Tax Rate × Assessment

- The Province sets a single residential rate across Ontario

Local board taxes and levies

3. Local Roads Board Tax

Helps support:

- Road Maintenance and Repair

Who pays?

Taxpayers in Local Roads Boards (LRB)

LRB Tax = LRB Rate × Assessment

- Rates are set by the LRB Rate to raise 1/3 of the costs. The Province provides 2/3 of the costs.

4. Local Services Board Levy

Helps support any or all of the following:

- Water Supply

- Fire Protection

- Garbage Collection

- Sewage

- Street or Area Lighting

- Recreation

- Roads

- Public Library Service

- Emergency Telecommunications

Who pays?

Taxpayers in Local Services Boards (LSB)

LSB levies:

- A fee or a tax is charged by each LSB to cover the cost of the services it provides

- Costs may also be partially covered through fundraising and Provincial grants

Updated: January 09, 2026

Published: March 28, 2022