We've moved this content over from an older government website. We'll align this page with the ontario.ca style guide in future updates.

Certificate of Indian Status Identity Cards

Help us improve your online experience

Take a 2-minute survey and tell us what you think about this page.

Retail Sales Tax - Tax Tip

Published: April 2008

Content last reviewed: March 2012

ISBN: 978-1-4435-7232-3 (Print), 978-1-4435-7234-7 (PDF), 978-1-4435-7233-0 (HTML)

Effective September 1, 2010, Status Indians may claim an exemption from paying the eight per cent Ontario component of the Harmonized Sales Tax (HST) on qualifying property or services at the point of sale. Qualifying property and services are described in the Ontario First Nations Harmonized Sales Tax (HST) rebate. To receive the exemption, the Status Indian must present their "Certificate of Indian Status" identity card at the time of making a purchase.

Material contained in this Tax Tip was previously set out in a Tax Tip dated April 2008.

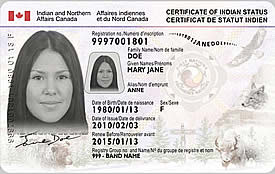

Secure Certificate of Indian Status

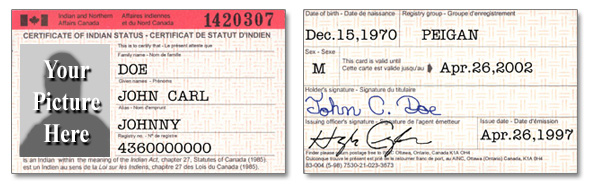

Laminated Certificate of Indian Status

Certificate of Indian Status "Pilot Project"

Vendor Responsibilities

In situations where a Status Indian is claiming the HST point-of-sale exemption, vendors should:

- visually confirm that the photograph on the Status card is that of the purchaser

- record the transaction date, person's name, card number, band registry number, and a brief description of the property or services sold.

Temporary Confirmation of Registration Document

In addition to the certificates listed above, Aboriginal Affairs and Northern Development Canada (AANDC) issues a Temporary Confirmation of Registration Document (TCRD) to newly registered individuals. This document may be used as proof of an individual's registration, pending issuance of the individual's Secure Certificate of Indian Status or Certificate of Indian Status.

Features of the TCRD:

- includes a statement that the individual named therein is registered as an Indian under the Indian Act Canada

- is printed on AANDC letterhead with red Canada logo

- the raised seal of the Indian Registrar is on the bottom right of the document

- indicates a "valid until" date after which it should no longer be used.

Suppliers may confirm the individual's identity by asking the individual to provide another piece of photo identification. To view a sample of the TCRD visit the AANDC website at www.canada.ca/indigenous-service-canada, or for more information call 1 800 567-9604, or fax your enquiry to 1 866 817-3977.

For More Information

For more information, please read Ontario First Nations Harmonized Sales Tax (HST) rebate.

More information on the "Certificate of Indian Status" identity cards can be found at: www.canada.ca/en/indigenous-services-canada.