Life Sciences Scale-Up Fund program guidelines

Read the full program guidelines for submitting your project to the Life Sciences Scale-Up Fund.

Overview and objectives

The Life Sciences Scale-Up Fund (LSSUF) supports small- to medium- sized life sciences enterprises (SMEs) to scale-up, innovate, and increase competitiveness by providing funding needed to commercialize a market ready product and prepare for procurement opportunities.

LSSUF is delivered by the Government of Ontario’s Ministry of Economic Development, Job Creation and Trade (MEDJCT or Ministry).

LSSUF aims to help build a pipeline of strong innovative companies based in Ontario (or intending to relocate to Ontario) that are ready to respond to procurement opportunities, whether in Canada or abroad.

These SMEs will drive growth and increase competitiveness in the life sciences sector, foster innovation by commercializing new products for healthcare adoption, build domestic manufacturing capacity and strengthen Ontario’s healthcare supply chain and help companies be procurement ready.

Priority will be given to those projects identified through the Health Innovation Pathway (HIP) and/or focused on made in Ontario products that align to solve the problem of domestic procurement.

Through LSSUF, SMEs may also benefit from initiatives that:

- support adoption of innovation into the healthcare system including:

- a streamlined pathway to identify, review and demonstrate the most promising health technologies

- support to help health service providers procure innovations from life science companies

- access to navigational and advisory supports

- will advance commercialization, including enhanced Intellectual Property Ontario supports and in collaboration with Clinical Trials Ontario, reduce the time it takes to get clinical trials up and running

- support the life sciences ecosystem by promoting investment into the sector

Eligibility criteria

Eligible companies

To be eligible for funding, life sciences companies

- Be a for-profit company with a business number designated by the Canada Revenue Agency (CRA)

- Have at least two (2) years of operations and financial statements

footnote 2 (audited or accountant reviewed) - Be an SME with at least five (5), to a maximum of 500, active full-time employees in Ontario by the project start date

- Must be in, or plan to locate in a community in Ontario by the project start date

The company is also expected to have taken the steps necessary to secure its intellectual property (IP), have a working prototype and/or commenced small-scale commercial production and initiated regulatory approvals and demonstrated a timeline to achieve those approvals.

All applicants must ensure compliance with all applicable laws and must not owe any fees, levies, or taxes to His Majesty the King in right of Ontario or his agencies. Applicants must also be compliant with the Accessibility for Ontarians with Disabilities Act, 2005, S.O. 2005, c. 11.

Eligible projects

The LSSUF will provide successful applicants conditional grants of up to 33%

Eligible activities

The LSSUF may support a range of eligible project activities, including but not limited to:

- projects that enhance or expand the production capacity and/or capability of the company to boost domestic manufacturing (for example, launching an additional product to expand current suite of manufacturing offerings)

- projects that advance new technologies through the latter stages of product development cycle (for example, testing, regulatory approvals, etc.) by covering infrastructure and/or operating costs to help bring the product to market (for example, market-ready support for a company that is facing commercialization hurdles in entering the Canadian market)

Eligible project costs

Eligible project costs means those costs, net of applicable HST, which are directly attributable to, and necessary for, the completion of the project and are not wholly or partially for another purpose.

Eligible project costs are incurred and paid for by the company after the application intake close date (project start date) up to and including the date that the project is completed (project completion date). Any costs for which the company is eligible to receive a rebate, credit or refund are not eligible project costs.

Eligible project costs do not include ongoing costs of production or operations. Eligible project costs are cash outlays which must be documented through invoices, receipts, or recipient records acceptable to Ontario. These are all subject to verification by an independent auditor. You must maintain evidence of payment for audit purposes.

The ministry has the unequivocal right to deny any expenditure that it deems ineligible. The ministry reserves the right to request additional supporting documentation and information regarding all expenditures.

Retroactive costs

Eligible project costs must be incurred and paid by the company on or after the application intake close date (project start date) up to, and including, the date the project is completed (project completion date). The project start date cannot be earlier than the application intake close date.

The ministry will acknowledge only eligible project costs incurred and paid after the project start date. Acting reasonably, the ministry’s decisions as to the expenditure eligibility and valuation shall be final and determinative.

Please refer to the eligible project cost categories table in the appendix for full details of the expenses that may be claimed as eligible project costs.

Note: If awarded funding, companies will be notified via letter and will include information on the date from which a successful applicant may begin to incur eligible project costs.

Third-party engagement

Working with an external firm (for example, mentor or consultants) for the purposes of preparing an application has no bearing on whether an application will be successful. Applications may only be submitted by the prospective recipients — any applications submitted by a third party on behalf of an applicant will not be considered. Any costs associated with the use of a consultant for preparing an application are not eligible project costs under LSSUF. The primary contact on the application form must be an employee of the applicant company.

Additional conditions

Stacking with other provincial programs for the same project is not permitted. Applicants may stack funding with other government sources (for example, federal funding programs), up to a maximum of 67% of the eligible project costs.

If a company has previously been approved for a project under a provincial business funding program, the project must have been successfully completed before any new project will be considered. Stacking with other provincial sources of financing for the project is not permitted except for projects receiving support from tax credits and company-wide programs (for example, electricity support programs), and/or projects receiving support through the Health Technology Accelerator Fund and Health Innovation Pathway.

Applicants with active loan agreements with the Government of Ontario may apply if the project and company are in good standing and at least 50% of the loan has been repaid.

Note that LSSUF is a discretionary, non-entitlement funding program. Even if an applicant meets all of the program objectives and eligibility criteria, the Government of Ontario is under no obligation to approve funding for your proposed project.

For questions concerning eligibility requirements or other criteria, kindly consider contacting a business advisor in your region to obtain information or clarification prior to submitting an application.

Application process

Applications to the LSSUF must be submitted through the Transfer Payment Ontario (TPON) platform. To submit an application to TPON, please include all of the following (only PDF format will be accepted):

- completed TPON application form signed by an individual with the authority to bind the company

- copy of Articles of Incorporation or Limited Partnership Agreement

- financial Statements (i.e., balance sheets, income statements, and cash flow statements) must submitted as two (2) separate documents, from the previous two consecutive fiscal years, and must be audited or accountant reviewed

- quotes from contractors/vendors for eligible project cost items

- letter of financial attestation from the senior management signing authority of the company (CEO, CFO, etc.) indicating that the company has the financial resources in place to complete the project. The letter must indicate the funding amount that the company will contribute to the project

- the company must submit a corporate family tree, detailing the relationships between the applicant company and its parent, subsidiaries, and/or affiliate companies

Only completed applications that are submitted on or before the application intake closing date will be assessed. Applications should be as detailed as possible as assessment will be based on the information provided in the application.

Tax compliance verification

- The Ontario Tax Compliance Verification (TCV) number must be included in the application form. Generate a TCV number.

- If the company is approved for funding, an Ontario TCV certificate will be required before any funds are disbursed. MEDJCT requires the Ontario TCV certificate to ensure that the company is compliant federally and provincially with its tax obligations.

All applications must be submitted by the deadline outlined on the TPON website.

Evaluation and assessment criteria

Applications are evaluated on their completeness, clarity, the feasibility of the project being proposed and its alignment with the goals and objectives of the LSSUF.

Projects will be assessed based on criteria such as (but not limited to):

- alignment with provincial priorities such as:

- investment in life sciences and biomanufacturing

- development of innovative technologies in the life sciences sector that will result in new commercialization opportunities

- scaling technology ready for healthcare adoption in Ontario

- enhancing healthcare resiliency and effectiveness

- building domestic manufacturing capacity and supply chain

- increasing competitiveness and productivity of life science companies in Ontario

- the extent to which government support improves project outcomes and/or impacts the project’s scope or timelines

- job creation outcomes

- feasibility of obtaining regulatory approval

- increased production throughput or productivity

- revenue growth, including new markets

- project risks (for example, management, financial and market risks)

After the submission deadline, applications will be assessed by a review committee comprised of external technical and financial due diligence experts and ministry reviewer(s). The review committee will assess and score projects and make funding recommendations.

Key funding conditions

Disbursements of grant funding

For approved projects, MEDJCT will fund up to 33% of the eligible project costs up to a maximum amount of $2.5 million.

No disbursements will be made until the funding agreement has been fully executed and the recipient has satisfied funding conditions, including but not limited to the following, to the satisfaction of the Ministry:

- evidence of project financing

- proof of insurance

- compliance with all applicable laws and must not owe any fees, levies, or taxes to His Majesty the King in right of Ontario or his agencies

Employees/job commitment

Companies must commit to maintaining the number of employees employed in Ontario at the time of the project start date and for the entire project period as well as making commitments to any jobs created as part of the project. These commitments must be maintained for 12 additional months after the project completion date.

Jobs target requirement and definitions

Companies must commit to retaining the number of FTE jobs at the time of application for the entire project period as well as making commitments to any jobs created as part of the project. The company must maintain these job targets for a 12-month period following the project completion date.

“Jobs” are full-time equivalent “Active Employees”.

“Active Employee” means an employee (or agency contract employee) of the recipient who is actively employed and actively paid.

An “FTE” is approximately 2000 working hours per year.

For greater certainty, a person on layoff is not considered to be “actively employed” and does not qualify as an “Active Employee” and an employee on a voluntary leave of absence, including parental leave, shall continue to be considered an “Active Employee” but his/her replacement during such absence shall not be considered as an additional active employee.

Applicants should not artificially inflate or deflate the number of employees for the purposes of the application.

Commitments and clawback

If approved for funding, successful applicants will be required to make commitments related to job creation and retention in the funding agreement.

If any of these commitments are not achieved by the date set out, the recipient may be required to pay pro rata clawback (payment based on formulas set out in the funding agreement).

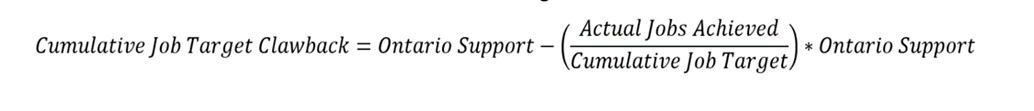

Cumulative job target and clawback

If by the project completion date, the cumulative job target is not met, the recipient shall repay a cash amount to the Ministry in accordance with the following formula:

Footprint

Funding agreements require recipients to make commitments related to maintaining their Ontario footprint (the company’s jobs and facilities in Ontario).

Failure to maintain an agreed-upon employment footprint in Ontario constitutes an event of default.

Other conditions

Other conditions may need to be met before disbursements are made. Insurance is not an eligible project cost and will not count towards the final project investment amount.

Funding agreements

Each successful applicant will be required to enter into a funding agreement with His Majesty the King in right of Ontario as represented by the Minister of Economic Development, Job Creation and Trade on terms and conditions satisfactory to the ministry.

Once funding agreements are fully executed and come into effect, successful applicants are obligated to report on specific milestones and performance measures that will be outlined in the funding agreement. Performance measures and milestones provide indications on the progress of the project and the achievement of commitments defined in its funding agreement.

Funding agreements will include provisions requiring funds to be repaid if performance measures and/or other terms and conditions of the funding agreement are not met.

Ministry funding agreements require each successful applicant to make a written representation that it is compliant with all applicable laws, including accessibility legislation. Any company that submits an application and has outstanding compliance issues must have them resolved before the company signs a funding agreement with the ministry.

Note the scope of the project cannot be significantly altered after companies have presented their proposed projects to the review committee. In particular, total eligible project costs may not be reduced by more than 10% prior to execution of a funding agreement with the ministry. A reduction of more than 10% of the original eligible project costs will lead to an application being reassessed and/or deemed ineligible for funding.

Project reporting and claims for eligible expense requirements

Interim report(s), including progress of project, proof of eligible project expenditures, and a request for disbursement shall be submitted halfway through the project.

A final report including results of the project, achievement of key performance metrics, proof of eligible project expenditures, financial attestations, job status, and a request for disbursement will be required upon project completion. A successful applicant must submit its final report within thirty (30) days of project completion to be reimbursed for expenses incurred for the eligible project costs.

Detailed reporting instructions will be sent to successful applicants at the time of contracting.

The interim progress report(s) and a final report must be received and approved by the ministry prior to the release of funds for eligible project expenditures.

Note that successful applicants must retain all proofs of purchase, paid invoices, receipts, and other relevant documentation related to expenses incurred for the eligible project costs. These should be included in the interim progress report(s) and final report. Companies must maintain all financial records (including original invoices of any items that have been purchased for the project and receipts or other evidence of payment for these items) for a period of seven (7) years from their creation.

How to apply using Transfer Payment Ontario

Transfer Payment Ontario (TPON) is the source for grants provided by several Government of Ontario ministries. TPON provides one-window access to information about grants that are available to companies. Learn more about applying for grants or check the status of an application.

To apply for LSSUF funding, companies must first register with TPON. To register:

- Create a ONe-key account and ID. ONe-key is used for secure access to the Government of Ontario system. It is strongly recommended that Account Recovery information is created during this process in case of forgotten log-in information. Administrators are not able to retrieve ONe-key IDs.

- Register the company on TPON. The following items are required for registration: Canada Revenue Agency Business Number (CRA BN), Legal Name, Operating Name, and information on at least two (2) contacts within the organization. Note: TPON could take up to five (5) business days to process the request but is typically faster.

- As soon as the company is registered, a “Funding Opportunities” button will appear. From here companies can apply for LSSUF funding and manage applications. Please ensure applications are submitted during a time when the specific program is open for applications (details are available on the website for each program).

Confidentiality and public reporting

Please note that the ministry is subject to the Freedom of Information and Protection of Privacy Act (the “Act”), as amended from time to time, and any information provided to the ministry, may be subject to disclosure under the Act. Section 17 of the Act provides an exemption from the disclosure of certain third-party information that reveals a trade secret, scientific, commercial, technical, financial, or labour relations information supplied in confidence where disclosure of the information could reasonably be expected to result in certain harms. Any trade secret or any scientific, technical, commercial, financial or labour relations information submitted to the ministry in confidence should be clearly marked.

The ministry will notify the applicant before granting access to a record that might contain information referred to in section 17 of the Act so that it may make representations to the ministry concerning disclosure.

Additionally, all information, statements and documents attached to this form or provided to MEDJCT in relation to this form may otherwise be disclosed pursuant to the Act as well as any other applicable laws.

Approved projects will be the subject of public announcements. The applicant agrees that any information provided to the province in this application and in any subsequent project-related agreement may be shared with:

- other ministries and agencies of Government of Ontario, experts and/or authorized third-party firms for the purposes of assessing this application and administering the program and satisfying government accountability and reporting obligations

- Statistics Canada for the purposes of program evaluation

- the Federal Government of Canada for the purposes of assessing this application (including but not limited to assessing the potential for stacking of government funding) and administrating the program, including jointly discussing and reviewing the project and, when required, by exchanging limited due diligence findings

Ministries must publicly report annually on the status of business support programs and strategic investments, including project description and project investment commitment; amount of government support; and results achieved to date.

The province is required to make agreements available for inspection by the public. However, commercially sensitive information contained in the agreement may be redacted.

Following submission of a signed application, applicants are subject to compliance checks overseen by the below listed Ministries including:

- Ministry of Labour, Immigration, Training and Skills Development — Health and Safety and Employment Standards

- Ministry of the Environment, Conservation and Parks

- Accessibility Compliance (Accessibility for Ontarians with Disabilities Act)

- Ministry of Finance — Tax Compliance

- Ministry of Municipal Affairs and Housing

Conflicts of interest

Includes, but is not limited to, any situation or circumstance where:

- In relation to the application process, the applicant has an unfair advantage or engages in conduct, directly or indirectly, that may give it an unfair advantage, including:

- Having, or having access to, information in the preparation of its application that is confidential to the Government of Ontario and not available to other applicants.

- Communicating with any person with a view to influencing preferred treatment in the application process, including the giving of a benefit of any kind, by or on behalf of the applicant to anyone employed by, or otherwise connected with the Government of Ontario.

- Engaging in conduct that compromises, or could be seen to compromise, the integrity of the funding application process and render that process unfair.

- In relation to the performance of its contractual obligations in a contract with the Government of Ontario, the applicant or any person who has the capacity to influence the applicant’s decisions has outside commitments, relationships or financial interests that could, or could be seen by a reasonable person to, interfere with the applicant’s objective, unbiased and impartial judgement relating to the project, the use of the proceeds of the funding, or both.

Contact information

For general inquiries and questions specifically related to contracting and funding claims, please contact us at lssuf@ontario.ca.

Applicants may also seek assistance from our senior business advisors to develop and strengthen an application. Contact us at:

Business Advisory Services — Southwestern Region Main Office

Business Advisory Services — Central Region Main Office

Business Advisory Services — Eastern Region Main Office

For inquiries specifically related to navigating the online application system, please contact TPON Client Care from Monday to Friday 8:30 a.m. to 5:00 p.m. EST, except for government and statutory holidays, at:

Eligible project cost categories

For all cost categories, provide a clear description to indicate what makes this cost eligible. Failure to provide detailed descriptions may result in costs being deemed ineligible.

This list of eligible project costs categories and ineligible cost categories is for reference only. A final determination of eligible project costs and/or ineligible costs will be made at the sole discretion of the Ministry.

Eligible capital costs

- construction and facility modifications or upgrades require Ontario’s approval. For projects involving expansion or relocation to a larger building, only the costs for the additional space (e.g., from 30,000 sq. ft. to 50,000 sq. ft., the eligible costs are for the extra 20,000 sq. ft.) are considered eligible

- site servicing, power service upgrades, etc. required to execute the project

- new hardware and software necessary for the successful completion of the project including setup costs and maintenance. equipment associated with the new technology or systems

- direct material costs including costs for specifically identified materials necessary for completing the project such as for: Configuring and testing production processes, systems, other materials directly related to the project as approved by Ontario

- software licencing costs are eligible only for the duration of the project up to the project completion date

- additional limits and conditions:

- costs must be incurred and paid during the project term. For equipment purchased or leased with monthly payments, each payment must be made within the project period

- invoice amounts in foreign currencies must be converted to CAD (Canadian Dollars) with the appropriate exchange at the time of the transaction

- exchange rates used must be shown either on the invoices or be drawn from the financial institution used. Proof of exchange rates used should be submitted along with the signed invoices

Ineligible capital costs

- purchase of land or buildings

- costs associated with landscaping and staff parking lots

- purchase/lease or operation of vehicles or off-site equipment

- materials used for the regular production of existing saleable items

- capital requirements not directly attributable to the project including debt service costs, federal or provincial taxes, surtaxes, and special expenses (for example, legal fees).

- tax expenses (including, but not limited to, HST, sales taxes, tax filing, income taxes, etc.)

- allowance for interest on invested capital, bonds, debentures, bank, or other loans together with related bond discounts and finance charges

- refinancing of existing business operations

- insurance

- restructurings or relocations to other jurisdictions within Ontario

- routine maintenance, repair and/or upgrades to existing production and equipment not directly related to the project

- costs of basic utility services

Eligible labour, training and talent costs

- incremental specialized labour that is directly related to the project is eligible to a maximum of the project duration

- costs of specialized expertise required for the project including third-party engineering services, software development, project management, etc.

- costs involved in providing employees with training and/or development required for the project for their role(s)

Ineligible labour, training and talent costs

- training costs supported by Ministry of Labour, Training and Skills Development Wages of staff for the time they are receiving the training

- salaries and wages

- overhead and/or indirect labour costs

- costs related to staff awards and recognition

- monthly parking fees

- costs related to proposal development (including staff and consultants)

- general or routine training

Eligible permit and fees costs

- costs incurred by the recipient for permits, inspections, and other fees directly attributable to the project

Ineligible permit and fees costs

- permits, inspections and fees attributable to ongoing operations

- fines or penalties related to non-compliance with regulations or permit

Other eligible costs

- purchases related to the project from suppliers located outside Ontario

Other ineligible costs

- preparation of the funding proposal

- costs associated with lobbying or government relations activities

- shareholder payments

- non-supplier costs incurred outside of Ontario

- mergers and acquisitions

- travel, hospitality, meal, and incidental expenses

- rebates, credit, or refund

- debt service costs, federal or provincial income taxes, surtaxes

- marketing, sales, or distribution

- costs not directly associated with meeting the deliverables and milestones as specified in the funding agreement with the ministry

- cost for research and development

- costs of a personal nature

- general office supplies not specifically required for the project

Footnotes

- footnote[1] Back to paragraph Life science companies in the Food and Animal Sciences industries are not eligible.

- footnote[2] Back to paragraph In instances where a parent/affiliate company is a source of funding, please also provide the financial statements for that entity.

- footnote[3] Back to paragraph Additional considerations may be applied by the ministry for projects that are considered strategically important to the Province of Ontario.

- footnote[4] Back to paragraph A project is a distinct undertaking, separate from ongoing operations, that will result in benefits to the successful applicant such as business growth or access to new markets, including healthcare procurement opportunities.