Published plans and annual reports 2017-2018: Ministry of Finance

Plans for 2017-2018, and results and outcomes of all provincial programs delivered by the Ministry of Finance in 2016-2017.

Ministry of Finance Overview

Mandate

The Ministry of Finance’s mandate is to create an environment that fosters a dynamic, innovative and growing provincial economy and to manage the government’s fiscal responsibilities as well as financial and related regulatory affairs.

Ministry Contribution to Priorities And Results

Through its mandate, the ministry works to achieve the government’s priorities which include investing in people’s talents and skills, building retirement security, building modern infrastructure and transportation networks, and supporting a dynamic and innovative business climate.

The ministry works with the Treasury Board Secretariat to manage the Province’s

$141.1 billion

In addition, the ministry supports government-wide initiatives and provides key fiscal, taxation, statistical and economic policy advice to the Minister of Finance, Cabinet committees and the Premier. It also regulates the financial services sector through its agencies.

The ministry provides leadership in transforming Ontario’s public services — helping to develop new strategies, policies and processes designed to drive government-wide efficiencies and enable modernization initiatives — while also remaining focused on implementing measures that meet annual budget targets.

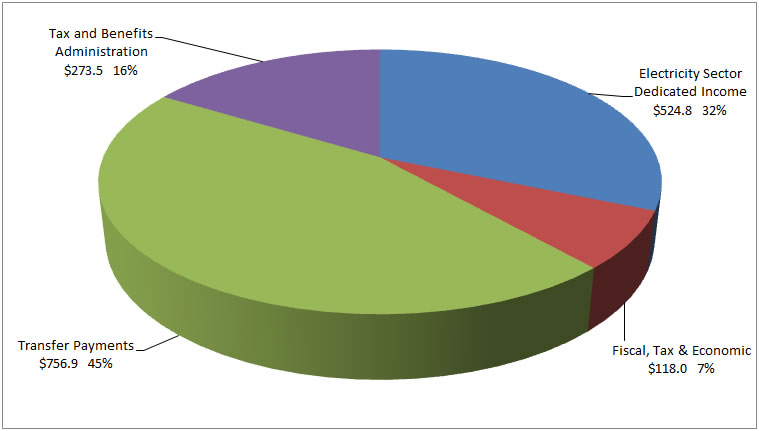

Ministry of Finance Voted Operating Allocation ($M) $1,673.2

(Excludes Statutory Appropriations, Consolidations and Treasury Program)

- Tax and Benefits Administration $273.5 16%

- Electricity Sector Dedicated Income $524.8 32%

- Transfer Payments $756.9 45%

- Fiscal, Tax & Economic $118.0 7%

Ministry of Finance Plan: Looking Forward

The ministry is leading transformational activities across government to strengthen Ontario’s economy and is also reviewing its own structure, processes and resources to effectively support the implementation of government priorities.

Its responsibilities and activities are aligned to provide financial and economic stewardship, and policy and program delivery leadership.

Meeting Fiscal Targets and Effective Financing

The 2017 Budget plan delivers on the government’s 2010 Budget commitment to restore fiscal balance in 2017–18. The Province is also projecting balanced budgets in both 2018–19 and 2019–20.

The balanced budgets from 2017–18 onwards will limit the increase in the provincial net debt to net investments in capital assets. These investments will contribute to Ontario’s economy growing at a faster rate than the provincial net debt. This will, in turn, allow the government to set an interim net debt-to-GDP target of 35 per cent in 2023–24 and reduce the net debt-to-GDP ratio to its pre-recession level of 27 per cent (projected to be achieved by 2029–30).

Ontario’s net debt-to-GDP ratio peaked in 2014–15 at 39.1 per cent and is now trending downwards. The ratio is forecast to continue to decline to 37.5 per cent in 2017–18, 37.3 per cent in 2018–19 and 37.2 per cent in 2019–20.

Interest on Ontario’s debt expense is forecast to be $11.6 billion in 2017–18 and $12.0 billion in 2018–19 — $872 million and $1,072 million lower than forecast in the 2016 Budget, respectively.

These savings continue a trend apparent since 2010, driven by lower deficits and borrowing requirements, and lower‐than‐forecast interest rates. The savings on Ontario’s interest on debt over the period to balance now total $24.0 billion, relative to the 2010 Budget forecast.

Going forward the ministry will continue to review its programs to deliver the best possible results at the lowest cost, using evidence to improve outcomes and ensure the long-term sustainability of provincial programs and services.

Strong Economy and Dynamic Business Climate

The ministry’s activities include delivering economic analysis and advice to support the development and implementation of government policy that fosters economic growth and job creation on a regional, sectorial and business level.

To ensure Ontario’s economy is strong and its business climate dynamic, the ministry is dedicated to maintaining a fair and competitive corporate tax system — one that balances the benefits of an internationally competitive tax system with the need to raise revenue to fund essential provincial programs and services.

To help ensure the best possible programs and services for Ontarians, the ministry is also supporting Program Review, Renewal and Transformation, the government’s evidenced-based decision-making process that is modernizing services, finding savings and improving outcomes.

Additionally, the ministry is supporting the Financial Accountability Office of Ontario in its work conducting independent analysis on Ontario’s finances, trends in the economy and related matters important to the Legislative Assembly.

In 2017–18 the ministry will produce the Ontario Economic Accounts, quarterly reports on the status of the provincial economy that include information on its GDP, labour market, financial markets and key external factors such as U.S. economic growth and oil prices.

It will also continue to support the implementation of the province’s asset optimization strategy, which is helping to fund further investments in transit, transportation and other priority infrastructure through the Trillium Trust.

Maximizing Revenues

Maximizing revenues due to the province is within the mandate of Ontario’s treasury. Key to that work is developing the revenue forecast found in the 2017 Budget (updated in the fall Ontario Economic Outlook and Fiscal Review), including identifying risks to each major revenue component — and working to ensure the forecast is met. The ministry’s work in 2017–18 and ongoing includes:

- Creating a new tax avoidance unit to identify and close tax planning loopholes.

- Maximizing the performance of government business enterprises by implementing the Premier’s Advisory Council on Government Assets’ beverage alcohol retail and distribution recommendations and adapting the Liquor Control Board of Ontario to changes to the retail marketplace as well as its new roles in wholesaling and e-commerce.

- Working with the Ontario Lottery and Gaming Corporation as it continues to implement its modernization plan for slots, casinos and lottery, as well as integrating horse racing into its gaming strategy.

- Launching an underground economy communication campaign to inform the public on the risks of participating in the underground economy.

- Developing a comprehensive strategy to address the sharing economy.

- Renewing or replacing the Aggressive International Tax Planning and Underground Economy fee-for-service agreement with the Canada Revenue Agency.

- Launching a pilot project in the hospitality and retail sectors to test the feasibility of the sales integrity program.

- Leading tobacco tax policy with an aim to support public health objectives under the Smoke-Free Ontario Strategy, while also considering impacts on the untaxed tobacco market.

- Using third-party service providers to aid collecting debts owing to the Province.

- Strengthening tools to enhance collection of non-tax revenue.

Effective Regulation and Innovative Policy

The Ministry of Finance has an instrumental role to play ensuring effective regulations and innovative policies. Its actions in 2017–18 and ongoing include:

- Simplifying personal income tax credits for caregivers by creating a new consolidated Canada Caregiver Credit.

- Introducing a new Ontario Seniors’ Public Transit Tax Credit for all Ontarians aged 65 or older.

- Proposing a 15 per cent Non-Resident Speculation Tax to help address unsustainable demand for housing, discourage speculative behaviour and increase housing affordability.

- Working to stop practices that may be contributing to tax avoidance and excessive speculation in the housing market, such as requiring more information about assignments of agreements and similar arrangements through the Land Transfer Tax system.

- Exploring more comprehensive reporting requirements with the Canada Revenue Agency to ensure the correct federal and provincial taxes, including income and sales taxes, are paid on purchases and sales of real estate in Ontario.

- Consulting municipalities, tenants and apartment building owners and others on the potential implications of multi-residential property taxation on rent affordability (Based on early feedback received during this review, the Ministry of Finance is ensuring property tax for new multi-residential apartment buildings is charged at a similar rate as other residential properties. This will encourage developers to build more new purpose-built rental housing).

- Providing advice on — and advancing policy initiatives focused on — capital markets, securities and derivatives such as legislative and Ontario Securities Commission rule proposals as well as regulatory changes to respond to G20 financial regulatory reform commitments.

- Representing Ontario and advancing Ontario’s interests in working towards the implementation of the proposed Cooperative Capital Markets Regulatory System, such as developing uniform capital market laws and establishing the new cooperative regulator in partnership with participating jurisdictions.

- Establishing a regulatory framework for the oversight of individuals who offer financial planning services in Ontario.

- Increasing the representation of women on boards of directors and in executive positions.

- Developing an Ontario financial technology strategy.

- Developing, with the federal government and other provinces and territories, regulations to ensure the Canada Pension Plan enhancement is financially sustainable.

- Providing central agency support to line ministries on Ontario’s Basic Income Pilot.

- Developing a regulatory policy for new retirement savings models such as target benefit plans and defined contribution pension plans.

- Strengthening the regulation of registered pension plans through measures to improve disclosure and transparency for members.

- Changing the regulatory framework for pension plans — including funding frameworks for single employer and target benefit pension plans — and changing the Ontario Pension Benefits Act and regulations that govern the conversion or merger of single-employer pension plans into jointly-sponsored pension plans.

- Strengthening the protection for investors in syndicated mortgages by developing amendments to regulations and planning for the transfer of regulatory oversight of these products from the Financial Services Commission of Ontario (FSCO) to the securities regulator.

- Transferring the responsibility for incorporating co-operative corporations from FSCO to the Ministry of Government and Consumer Services, consolidating the incorporation of co-operatives with the processes in place for other types of businesses.

- Modernizing auto insurance, including enabling all insurers to provide insurance coverage for ride-sharing as well as consulting on the recommendations by Ontario’s advisor on auto insurance David Marshall, aimed at delivering better outcomes for accident victims while creating a more efficient and cost-effective system.

- Engaging with the initial board of the Financial Services Regulatory Authority of Ontario and making progress toward establishing this new regulatory body.

- Analyzing and tracking changes in major areas of the underground economy focusing on unregulated tobacco and construction, retail and hospitality sectors.

- Identifying other high-risk industries in the underground economy through advanced analytics and the application of innovative tools, including cognitive computing.

- Completing the automation of the tax compliance verification process to modernize the means for ensuring that vendors awarded provincial contracts valued at $25,000 or more are tax compliant.

- Addressing the unregulated tobacco market by enhancing regulatory oversight of tobacco products.

Modern Transfer Payment Programs and Effective Partnerships

The Province’s vision for an effective, efficient and equitable system of fiscal federalism in Canada emphasizes strong partnerships in key areas. As the branch of government most responsible for those partnerships, the ministry maintains contact with the ministries of Finance at the federal level and in other provinces and territories as well as First Nation communities and municipalities.

The following initiatives that support these partnerships are underway:

- Supporting the Ministry of Energy in respect of an agreement-in-principle with First Nations in Ontario, as represented by the Chiefs‐in‐Assembly, for ownership of Hydro One shares.

- Representing Ontario’s position in inter-governmental negotiations on the retirement income security system, including the CPP.

- Providing funding support to municipalities through a number of transfer payments including the Ontario Municipal Partnership Fund, the Province’s main unconditional transfer payment to municipalities, which is being redesigned to better target funding to northern and rural municipalities with more challenging fiscal circumstances.

- Establishing information- and data-sharing partnerships to enhance advanced underground economy data analytics.

- To address the unregulated tobacco sector, building partnerships with federal and provincial partners, including police agencies, the Canada Revenue Agency, Canada Border Services Agency, public health units and the Alcohol and Gaming Commission of Ontario.

- Supporting the integration of the delivery of Ministry of Community and Social Services social assistance programs to achieve cost efficiencies and improve client experience.

- Working with First Nation communities toward agreements on tobacco regulation and revenue sharing.

Highlights of 2016–17 Achievements

The Ministry of Finance performs a variety of critical roles, focused on supporting effective economic, fiscal and financial management for a stronger Ontario. Its 2016–17 achievements include:

Delivering on the Balanced Budget Plan

The ministry was active in a variety of sectors that enabled the government to restore balance to the Province’s finances in 2017–18. Through targeted, measured and fiscally responsible decisions, the government has restored the province’s fiscal and economic strength.

Supporting a Dynamic Business Climate

To improve the province’s overall business climate, the ministry supported a variety of initiatives that make Ontario an attractive environment for business investment.

Strengthening the Financial Services Sector

The ministry led a variety of initiatives focused on enhancing the province’s financial services sector.

Building Retirement Security

The ministry led the implementation of a variety of pension reform measures aimed at improving the adequacy and coverage of pensions in Ontario.

Addressing the Underground Economy

The ministry led several innovative pilots and projects aimed at ensuring all citizens pay their fair share of taxes as well as enhancing the competitiveness of legitimate businesses.

Working with Indigenous Partners

The ministry continued to take the lead in government dialogue with First Nation communities and leaders on tobacco, gasoline and the energy sector for mutually beneficial outcomes for the province and First Nation communities.

Facilitating Openness and Accountability

The ministry continued to further strengthen transparency, financial management and fiscal accountability to ensure Ontarians receive the best value for their tax dollars.

Further detail of the ministry’s achievements can be found in the Appendix: 2016–17 Annual Report.

Ministry of Finance Organizational Structure

- Minister of Finance

- Parliamentary Assistant

- Chief of Staff

- Chair, Ontario Financing Authority

- CEO, Ontario Financing Authority

- ADM, Corporate & Electricity Finance Division (also reports to Deputy Minister of Finance)

- Chair, Ontario Electricity Financial Corporation

- CEO & Vice Chair, Ontario Electricity Financial Corporation

- Chair, Ontario Securities Commission

- CEO/Superintendent, Financial Services Commission

- Chair, Financial Services Commission & Financial Services Tribunal

- Chair, Deposit Insurance Corporation of Ontario

- Chair, Liquor Control Board of Ontario

- Chair, Ontario Lottery & Gaming Corporation

- Deputy Minister of Finance

- CIO, Central Agencies I&IT Cluster (also reports to Ministry of Government Services)

- Director of Communications Services Branch

- Director, Finance Audit Services Team, Ontario Internal Audit Division (also reports to Treasury Board Secretariat)

- Director, Legal Services Branch (also reports to the Ministry of the Attorney General)

- Director, Strategic Policy & Organizational Renewal

- ADM, Corporate & Electricity Finance Division (also reports to CEO, Ontario Financing Authority)

- ADM, Office of the Budget

- Office of the Budget

- ADM & Chief Economist, Office of Economic Policy

- Industrial Economics Branch

- Macroeconomics & Revenue Branch

- Labour Economics Branch

- Statistics Integration Branch

- Executive Lead, Cooperative Capital Markets Regulatory

- Securities Reform Policy Branch

- ADM, Financial Services Policy Division

- Financial Institutions Policy Branch

- Financial Services Regulation Modernization Secretariat – (Temporary)

- ADM, Provincial-Local Finance Division

- Property Tax Policy Branch

- Municipal Funding Policy Branch

- Assessment Policy & Legislation Branch

- CAO & ADM, Corporate & Quality Service Division

- Business Services Branch

- Corporate Planning & Finance Branch

- Strategic HR Services Branch

- ADM, Taxation Policy Division

- Personal Tax Policy & Design Branch

- Corporate & Commodity Taxation Branch

- Associate Deputy Minister, Tax and Benefits Administration

- ADM, Strategy, Stewardship & Program Policy Division

- Strategy, Stewardship & Risk Management Branch

- Program Policy & Analytics Branch

- Benefits Transformation Branch

- Sales Integrity Policy Office (Temporary)

- ADM, Tax Compliance & Benefits Division

- Compliance Branch

- Advisory, Objections, Appeals and Services Branch

- Account Management & Collections Branch

- Director

- ADM, Strategy, Stewardship & Program Policy Division

- Assistant Deputy Minister, Income Security & Pension Policy Division

- Pension Policy Branch

- Income Security Policy Branch

- BPS Pensions Branch

- Strategic Stakeholder Relations (Temporary)

- Associate Deputy Minister, Office of Government Business Enterprises & Strategic Initiatives

- Strategic Initiatives Branch

- ADM, Electricity Investment & Governance Secretariat

- ADM, Revenue Agencies Oversight Division

- Gaming Policy Branch

- Alcohol Policy Branch

- Special Project Director, Beverage Alcohol

Download printer-friendly organizational chart (JPG)

Agencies, Boards and Commissions

Deposit Insurance Corporation of Ontario (DICO): promotes the safety and soundness of Ontario’s credit unions and caisses populaires by undertaking regulatory oversight activities, establishing standards for sound business and financial practices, and providing deposit insurance coverage within statutory limits.

Financial Services Commission of Ontario (FSCO): an integrated regulator of Ontario’s insurance industry; pension plans; loan and trust companies; credit unions and caisses populaires; the mortgage brokering sector; health service providers and co-operative corporations.

Financial Services Tribunal: an independent, adjudicative body that conducts hearings arising from regulatory and proposed regulatory decisions of the Superintendent of Financial Services.

Liquor Control Board of Ontario (LCBO): responsible for the importation, distribution and sale of beverage alcohol in the province in an efficient and socially responsible manner.

Ontario Electricity Financial Corporation (OEFC): the legal continuation of the former Ontario Hydro responsible for managing that organization’s legacy debt and other liabilities.

Ontario Financing Authority (OFA): conducts borrowing, investment and financial risk-management activities for the Province; manages the provincial debt; advises on financial policies and projects; provides financial and centralized banking and cash management services and advice to the Ontario Electricity Financial Corporation.

Ontario Lottery and Gaming Corporation of Ontario (OLG): responsible for the conduct, management and operation of slots and casinos, lottery operations, internet gaming and electronic games at charitable bingo halls across Ontario.

Ontario Securities Commission (OSC): the regulatory body responsible for overseeing Ontario’s capital markets, which includes the equities, fixed-income and derivatives markets.

Detailed Financial Information

Table 1: Ministry Planned Expenditures 2017-18 ($M)

| ($M) | Ministry Planned Expenditures 2017-18 |

|---|---|

| Operating | 13,304.7 |

| Capital | 6.6 |

| Total | 13,311.3 |

Table 2: Combined Operating and Capital Summary by Vote

| VOTES / PROGRAMS | Estimates 2017-18 $ |

Change from 2016-17 Estimates $ |

Change from 2016-17 Estimates % |

Estimates * 2016-17 $ |

Interim Actuals * 2016-17 $ |

Actual * 2015-16 $ |

|---|---|---|---|---|---|---|

| Operating Expense - Ministry Administration | 40,552,700 | 940,400 | 2.4 | 39,612,300 | 39,587,100 | 44,383,354 |

| Operating Expense - Government Business Enterprises, Income Security and Pension Policy | 106,976,000 | 82,900 | 0.1 | 106,893,100 | 113,996,700 | 106,662,025 |

| Operating Expense - Economic, Fiscal and Financial Policy | 1,112,182,100 | 391,168,800 | 54.3 | 721,013,300 | 996,684,800 | 613,266,482 |

| Operating Expense - Financial Services Industry Regulation | 2,438,600 | (51,000) | (2.0) | 2,489,600 | 4,474,600 | 1,298,270 |

| Operating Expense - Tax and Benefits Administration | 411,082,400 | (24,545,200) | (5.6) | 435,627,600 | 347,060,300 | 333,269,394 |

| Operating Expense - Ontario Retirement Pension Plan | - | (1,531,000) | (100.0) | 1,531,000 | 2,504,600 | 17,723,110 |

| Total Operating Expense to be Voted | 1,673,231,800 | 366,064,900 | 28.0 | 1,307,166,900 | 1,504,308,100 | 1,116,602,635 |

| Statutory Appropriations: Treasury Program | 11,298,251,700 | (9,176,900) | (0.1) | 11,307,428,600 | 10,725,962,600 | 10,395,378,070 |

| Statutory Appropriations: Other Statutory Appropriations | 50,785,914 | (19,715) | (0.0) | 50,805,629 | 79,383,193 | 384,495,405 |

| Total Operating Expense | 13,022,269,414 | 356,868,285 | 2.8 | 12,665,401,129 | 12,309,653,893 | 11,896,476,110 |

| Consolidation Adjustment - Ontario Financing Authority | 26,711,000 | 524,000 | 2.0 | 26,187,000 | 26,187,000 | 23,020,996 |

| Consolidation Adjustment - Ontario Securities Commission | 112,303,000 | 7,046,900 | 6.7 | 105,256,100 | 106,841,000 | 94,762,900 |

| Consolidation Adjustment - Ontario Electricity Financial Corporation | (216,818,300) | (737,897,700) | (141.6) | 521,079,400 | 337,442,000 | 713,717,735 |

| Other Adjustments - Financial Services Commission of Ontario | 77,134,600 | (20,447,200) | (21.0) | 97,581,800 | 84,724,000 | 97,215,107 |

| Consolidation Adjustment - Treasury Program | 523,498,500 | (62,181,800) | (10.6) | 585,680,300 | 600,060,700 | 505,312,679 |

| Consolidation Adjustment - Treasury Program - Interest Capitalization for Other Sectors | (240,430,200) | (103,321,300) | 75.4 | (137,108,900) | (76,023,300) | 66,108,336 |

| Total Operating Expense Including Consolidation & Other Adjustments | 13,304,668,014 | (559,408,815) | (4.0) | 13,864,076,829 | 13,388,885,293 | 13,396,613,863 |

| Operating Assets - Economic, Fiscal and Financial Policy | 275,000,000 | 275,000,000 | - | - | 109,964,191 | |

| Operating Assets - Financial Services Industry Regulation | 1,000 | - | 1,000 | - | - | |

| Operating Assets - Tax and Benefits Administration | 400,000 | - | 400,000 | 400,000 | 280,537 | |

| Total Operating Assets to be Voted | 275,401,000 | 275,000,000 | - | 401,000 | 400,000 | 110,244,728 |

| Operating Assets - Statutory Appropriations | 29,000,000 | (239,200,000) | (89.2) | 268,200,000 | 28,719,000 | 47,709,111 |

| Total Operating Assets | 304,401,000 | 35,800,000 | 13.3 | 268,601,000 | 29,119,000 | 157,953,839 |

| Capital Expense - Ministry Administration | - | (1,000) | (100.0) | 1,000 | - | - |

| Capital Expense - Economic, Fiscal, and Financial Policy | 1,000 | - | 1,000 | - | - | |

| Capital Expense - Financial Services Industry Regulation | 1,000 | - | 1,000 | - | - | |

| Capital Expense - Investing In Ontario | 1,000 | - | 1,000 | - | - | |

| Capital Expense - Tax and Benefits Administration | 1,000 | - | 1,000 | - | - | |

| Ministry Total Capital Expense to be Voted | 4,000 | (1,000) | (20.0) | 5,000 | - | - |

| Statutory Appropriations - Trillium Trust Program | 288,790,600 | 288,789,600 | - | 1,000 | 266,781,000 | - |

| Other Statutory Appropriations | 2,639,600 | (1,000) | (0.0) | 2,640,600 | 2,638,600 | 2,637,609 |

| Total Capital Expense | 291,434,200 | 288,787,600 | - | 2,646,600 | 269,419,600 | 2,637,609 |

| Capital Expense Adjustment - Trillium Trust Reclassification | (288,790,600) | (288,790,600) | - | (266,780,000) | - | |

| Consolidation Adjustment - Ontario Financing Authority | 789,000 | (92,000) | (10.4) | 881,000 | 863,000 | 782,000 |

| Consolidation Adjustment - Ontario Securities Commission | 3,150,000 | 91,300 | 3.0 | 3,058,700 | 3,000,000 | 2,761,000 |

| Total Capital Expense Including Consolidation & Other Adjustments | 6,582,600 | (3,700) | (0.1) | 6,586,300 | 6,502,600 | 6,180,609 |

| Capital Assets - Ministry Administration | - | (1,000) | (100.0) | 1,000 | - | - |

| Capital Assets - Economic, Fiscal, and Financial Policy | 1,000 | - | 1,000 | - | - | |

| Capital Assets - Financial Services Industry Regulation | 7,708,600 | 2,839,900 | 58.3 | 4,868,700 | 872,900 | 212,085 |

| Capital Assets - Tax and Benefits Administration | 1,000 | - | 1,000 | - | - | |

| Ministry Total Capital Assets to be Voted | 7,710,600 | 2,838,900 | 58.3 | 4,871,700 | 872,900 | 212,085 |

| Capital Assets - Trillium Trust Program | 118,850,000 | 118,849,000 | - | 1,000 | 13,691,000 | - |

| Total Capital Assets | 126,560,600 | 121,687,900 | - | 4,872,700 | 14,563,900 | 212,085 |

| Capital Asset Adjustment - Trillium Trust Reclassification | (118,850,000) | (118,850,000) | - | - | (13,690,000) | - |

| Total Capital Asset Including Adjustments | 7,710,600 | 2,837,900 | - | 4,872,700 | 873,900 | 212,085 |

| Ministry Total Operating & Capital Including Consolidation and Other Adjustments (not including assets) | 13,311,250,614 | (559,412,515) | (4.0) | 13,870,663,129 | 13,395,387,893 | 13,402,794,472 |

| * Estimates, Interim Actuals and Actuals for prior fiscal years are re-stated to reflect any changes in ministry organization and/or program structure. Interim Actuals reflect the numbers presented in the 2017 Ontario Budget. | ||||||

Contact Us

If you have questions about the programs and/or services of the Ministry of Finance, visit www.ontario.ca/finance or contact the ministry by:

- Phone: 1-866-ONT-TAXS (668-8297) or 1-800-263-7776 for teletypewriter (TTY)

- Mail:

Ministry of Finance

33 King Street West

PO Box 627

Oshawa ON

L1H 8H5

You can also visit a ServiceOntario location in person, or call 1-866-ONT-TAXS (668-8297) to schedule an appointment if you wish to meet with a representative at one of our tax offices.

Appendix: 2016-17 Annual Report

2016-17 ACHIEVEMENTS

In 2016–17, the Ministry of Finance engaged in a number of activities to achieve its key priorities. These highlights of the ministry’s achievements include:

1. Delivering on the Balanced Budget Plan

Fiscal Framework

- Led the development, and provided strategic oversight of, the fiscal plan including tracking the government’s progress in meeting fiscal targets with key partners at the Treasury Board Secretariat and Cabinet Office. Reported on the fiscal plan through the Budget, Quarterly Finances, Economic Outlook, and Fiscal Review and Public Accounts.

- Delivered the 2016 Ontario Economic Outlook and Fiscal Review, the 2017 Long-Term Report on the Economy, the 2016–17 First and Third Quarter Finances and the 2017 Budget that supports the government’s plan to balance the budget and maintain balance to 2019–20.

- Advised on Ontario’s fiscal relations with the federal government and maintained contact with federal, provincial and territorial finance partners to advance Ontario’s fiscal priorities.

Transforming Government and Managing Costs

- In cooperation with several ministries, delivered benefit programs and continued to explore opportunities for benefits transformation to achieve better client service, streamlined administration and enhanced policy development and coordination.

- Passed new framework legislation, the Benefits Administration Integration Act that will allow information-sharing across benefit programs.

- Partnered with the Canada Revenue Agency to provide Automated Income Verification for applicants to a growing number of programs.

- Supported the Basic Income Pilot being implemented in early 2017–18.

- Continued working with line ministries and municipalities to expand services for benefits delivery.

- Launched the Vector Institute, a new artificial intelligence (AI) lab mandated to advance research and drive the adoption and commercialization of AI technologies across Canada.

Taxation Policy

- With other provinces, territories and the federal government, improved the Tax Collection Agreement to ensure it reflects Ontario’s interests.

- As part of modernizing Ontario’s Land Transfer Tax (LTT) system, doubled the refund for eligible first-time homebuyers; updated rates and brackets; restricted the refund for first-time homebuyers to Canadian citizens and permanent residents; and launched a transformational initiative collecting additional information about Ontario’s real estate market to be used for LTT enforcement and support evidence-based policy development.

Borrowing and Debt Management

- Through the Ontario Financing Authority (OFA), continued to efficiently manage the Province’s borrowing program.

- Completed the government’s annual borrowing program in 2016–17, borrowing $27.0 billion. (This is up from the $26.4 billion forecast in the 2016 Budget, as the OFA capitalized on low interest rates and a strong demand for Ontario bonds to prefund $3.2 billion of the 2017–18 requirement).

- Through prudent and cost-effective debt management, continued to keep interest on debt costs below budget projections. (Interest on debt expense is projected to be $11,250 million for 2016–17 — $506 million lower than forecast in the 2016 Budget — reflecting lower-than-forecast interest rates, the lower forecast deficit for 2016–17 and cost-effective debt management).

2. Supporting a dynamic business climate

Policy/Taxation Measures

- Partnered with the Canada Revenue Agency and Airbnb on a pilot project to increase awareness of tax obligations for Ontarians sharing their homes.

- Worked with the Ministry of Economic Development and Growth to identify potential opportunities for small business, through the Small Business Innovation Challenge.

- Worked with the insurance industry to develop the legislative and regulatory changes necessary to fully integrate the sharing economy into Ontario’s auto-insurance system, such as the interim fleet insurance policy for the Uber ridesharing program.

- Implemented the Trillium Trust and related asset optimization initiatives to help fund infrastructure investments, including crediting to the trust $3.7 billion from the sale of Hydro One shares.

- Continued to upload social assistance benefit programs off the property tax base to ensure that municipalities have more property tax dollars to invest in local priorities.

- Planned the lowering of business electricity costs with the end of the debt retirement charge effective April 1, 2018, nine months earlier than previously estimated.

- Implemented changes to the Ontario Innovation Tax Credit and the Ontario Research and Development Tax Credit.

- Implemented legislative and regulatory changes to cultural media tax credits, e.g., introducing an application deadline for the Ontario Interactive Digital Media Tax Credit and clarifying the excluded productions for Ontario’s film and television tax credits.

- Provided the Auditor General and the Financial Accountability Office with information on tax credits to support their reviews of business support programs.

- Recovered over $450 million in debts owing to the province and over $2 million for employees owed money under the Employment Standards Act.

- Consulted with industry and raw leaf tobacco producers on amendments to the Tobacco Tax Act and supporting regulation.

- Completed the online Notice of Objection project, allowing taxpayers to submit their notices online, saving them time, effort and money.

Alcohol and Gaming (Ministry, LCBO and OLG)

- Continued the modernization of the alcohol and gaming sectors and increased provincial revenues within a framework of social responsibility.

- Continued to introduce the sale of beer, cider and wine into grocery stores, giving consumers more choice and convenience while creating a more dynamic and competitive business environment for producers: up to 130 grocery stores were authorized to sell beer and cider, of which 70 can also sell wine; and launched an allocation for up to 80 more beer and cider authorizations.

- The LCBO launched its e-commerce platform, which features almost 5,000 different products from across Ontario, Canada and 85 other countries for pick-up at local stores and home delivery.

- Announced the Ontario Small Cidery and Small Distillery Support Program, which will invest $4.9 million over three years to support small cider and small spirits producers to scale up into medium and large businesses.

- Closed the sale of LCBO’s head office, with the net proceeds of $246 million credited to Trillium Trust.

- Awarded three of eight gaming bundles to private sector service providers (four more bundle procurements are in progress) and opened a new casino in Belleville, major strides in OLG’s modernization plan.

- Continued OLG’s modernization of lottery, charitable and internet gaming lines of business as well as integrating horse racing into its gaming strategy.

Economic Analysis, Reporting and Policy Advice

- Provided analytical, policy and research support to the Premier’s Office, Cabinet Office and ministries on a number of priorities, including the Business Growth Initiative, the Highly Skilled Workforce Expert Panel Report, the Poverty Reduction Strategy and the Changing Workplace Review Panel.

- Renewed a three-year agreement with the Toronto Financial Services Alliance to support the organization’s strategic objective to grow the Toronto region as a global financial hub and cluster.

- Reviewed investment proposals under the government’s Jobs and Prosperity Fund and regional programs.

3. Strengthening the financial services sector

- Introduced and passed legislation that sets out the initial parameters for the new Financial Services Regulatory Authority of Ontario following the June 2016 final report of the expert advisory panel that recommended establishing a new regulator.

- Amended regulations under the Credit Unions and Caisses Populaires Act, 1994 to improve the regulatory framework for credit unions.

- Continued to make auto insurance more affordable for Ontario’s almost 10 million drivers, such as requiring insurers to offer a discount for the use of winter tires and creating a new dispute resolution system to help Ontario claimants get faster access to the benefits they need.

- Amended the Insurance Act to improve life insurance and accident and sickness insurance disclosure requirements and improve industry efficiencies.

- Continued to play a leadership role in working towards the implementation of the proposed Co-operative Capital Markets Regulatory System, including the finalization and proposed introduction of the legislative framework that will be set out in a new Capital Markets Act and related legislation.

- Supported the 2015 and 2016 review and 2017 final report by an independent expert committee of the regulatory framework relating to financial planning and financial advisory services.

- Worked with partner ministries and stakeholders on developing a new women’s economic empowerment strategy that addresses the gender wage gap and accelerates greater representation of women on boards.

4. Building retirement security

- Enhanced the Canada Pension Plan with the federal government, other provinces and territories.

- Created the Investment Management Corporation of Ontario to provide lower-cost and improved pension investment returns to Ontario’s broader public sector pension plans.

- Reviewed the Pension Benefits Act solvency funding framework for defined benefit plans that included issuing a consultation paper on changes to the solvency funding framework.

- Extended temporary solvency funding relief measures first introduced in 2009 and 2012.

- Finalized the legislative and regulatory frameworks for Pooled Registered Pension Plans (PRPPs).

- Helped develop a multilateral agreement for PRPPs to facilitate the regulation and supervision of multi-jurisdictional PRPPs that Ontario signed in March 2017.

5. Addressing the underground economy

- Enhanced oversight of raw-leaf tobacco-growing: addressed the links between organized crime and tobacco through a partnership with the Ontario Provincial Police’s Contraband Tobacco Enforcement Team, and enhanced retail inspections with public health units.

- Negotiated new fee-for-service agreements with the Canada Revenue Agency to protect Ontario revenue including enhanced compliance measures (e.g., auditing) and a service level agreement for underground economy specialist teams.

- Addressed underground economic activity through a public awareness campaign targeting multiple high-risk sectors, including home renovation, and partnered with the Ministry of Transportation on a pilot project to determine the tax compliance of construction subcontractors the ministry procured.

6. Working with Indigenous partners

- Engaged with First Nations and industry in modernizing the Ontario Gas Card Program, resulting in increasing card security for tax-exempt gasoline sales transactions in First Nation communities.

- Supported the Ministry of Energy on an agreement-in-principle with First Nations in Ontario, as represented by the Chiefs‐in‐Assembly, for ownership of Hydro One shares and by engaging with the Métis Nation of Ontario.

- Continued to implement the Aboriginal Loan Guarantee Program, which loan guarantees to support equity investment by Indigenous groups in renewable wind, hydro, and solar electricity generation and transmission projects.

7. Facilitating openness and accountability

- Provided advice and support to other ministries to ensure an open and productive relationship with the Financial Accountability Office.

- Initiated the development of new ways to deliver data and statistical services that are efficient, cost-effective and transparent in support of evidenced-based decision-making and advancing the government’s commitments to Open Government and collaboration with external experts and academic institutions on difficult policy challenges.

- Capitalized on new methods of public and stakeholder participation in the Ontario pre-budget consultation and budget development processes.

- Implemented the recommendations of the Special Purpose Business Property Assessment Review report for the 2016 reassessment (2017 tax year) in collaboration with the Municipal Property Assessment Corporation, municipalities and other stakeholders. These are expected to increase the transparency, accuracy and predictability of property assessments, reducing the number and impact of appeals, and promoting greater revenue stability from the $27 billion shared property tax base.

- Provided additional property tax flexibility to enable municipalities to better tailor programs to reflect their local needs and circumstances, while ensuring the property tax system continues to remain fair and competitive.

- Reported on the Trillium Trust to help support public transit, transportation and other priority infrastructure projects.

Table 3: Ministry Interim Actual Expenditures 2016-17

| Ministry Interim Actual Expenditures* 2016-17 ($M except Staff Strength) |

|

|---|---|

| Operating and Capital | 901.5 |

| Ontario Municipal Partnership Fund | 505.0 |

| Power Supply Contract Costs | 739.0 |

| Interest on Debt | 11,250.0 |

| Staff Strength as of March 31** | 1,888.9 |

*Refer to page(s) 240-241 of the 2017 Ontario Budget

**Ontario Public Service Full-Time Equivalent positions

Footnotes

- footnote[1] Back to paragraph 2017 Ontario Budget

- footnote[2] Back to paragraph 2017 Ontario Budget

- footnote[3] Back to paragraph 2017 Ontario Budget