Published plans and annual reports 2015-2016: Treasury Board Secretariat

Plans for 2015-2016, and results and outcomes of all provincial programs delivered by the Treasury Board Secretariat in 2014-2015.

Part 1: 2015-16 Estimates Briefing Book

Overview

Treasury Board Secretariat (TBS) was established in July 2014 to support the President of the Treasury Board to lead the government’s efforts on accountability, openness and modernization. TBS supports the government’s goal of eliminating the deficit by 2017-18, while continuing to get the best possible value for money and deliver the services that the people of Ontario rely on. The ministry was created by realigning resources from the former Ministry of Government Services, the former Ministry of Infrastructure and the Ministry of Finance as well as transferring responsibility for the Poverty Reduction Strategy along with the Local Poverty Reduction Fund into the new ministry.

TBS’ responsibilities include:

- Providing planning, expenditure management and controllership to support Treasury Board and the government’s fiscal plan, and to ensure sound stewardship and investment of public funds;

- Providing advice and support to Treasury Board/Management Board of Cabinet;

- Supporting and co-ordinating the implementation of Ontario’s Poverty Reduction Strategy;

- Managing corporate policy and agency governance including responsibilities for agency accountability, transparency and reform and the Open Government initiative;

- Leading human resource policy and planning for the government and oversees labour relations between the government and the Ontario Public Service (OPS) and the broader public sector (BPS); and

- Overseeing government-wide information and information technology. TBS also:

- Supports the development of the Ontario Budget, Printed Estimates, Economic

- Outlook and Fiscal Review, and the province’s Public Accounts;

- Co-ordinates the government’s annual fiscal planning process and expenditure management strategies for both operating and capital expenditures; and

- Provides internal audit functions to ensure ministries meet their business objectives.

Transformation: 2015-16 and onward

In 2015-16, TBS will continue to focus on strategies to transform government and build better public services for the future of Ontario.

To achieve budget balance and improve outcomes for Ontarians, the ministry will:

- Continue to implement Program Review, Renewal and Transformation (PRRT) to help inform decisions about government programs and services by reviewing all programs based on relevancy, effectiveness, efficiency and sustainability. PRRT is a new, multi-year planning and budgeting process which focuses on outcomes while improving efficiency and reducing overlap across government programs.

- Develop a Centre of Excellence for Evidence-Based Decision Making Support to build capacity to assess how government programs are performing, using evidence to inform choices and lead change in critical public services. The Centre’s work will also be supported by a Behavioural Insights Unit that designs interventions to assess programs and offer low-cost ways to redesign programs for better outcomes.

- Continue to negotiate fair collective agreements that balance the interests of employees with the need to provide sustainable and affordable public services, making sure that any modest wage increases negotiated through the collective bargaining process are offset by savings.

To further support an open, transparent and accountable government, TBS will:

- Continue to work with ministries to implement the Open Government strategy so the public can better access and participate in government. In 2015-16, TBS will implement a comprehensive, integrated strategy, which will build on progress to date, including making more data available online and increasing the public’s participation in government initiatives.

- Continue to work with partners in other ministries, agencies and the broader public sector to implement the Public Sector and MPP Accountability and Transparency Act. Passed in December 2014, the Act strengthens political accountability, makes the business of government more transparent, and gives Officers of the Legislature more responsibility in their roles.

- Measures in the Act which are led by TBS include:

- Managing executive compensation in designated agencies and broader public sector organizations;

- Online posting of expense information of Cabinet ministers, parliamentary assistants, opposition leaders and their respective staff;

- Modernizing lobbyist registration;

- Enabling the Integrity Commissioner to review expenses of all provincial agencies and the two hydro organizations on a selective basis; and

- Requiring BPS organizations to post business plans and other relevant business or financial documents online.

- Measures in the Act which are led by TBS include:

- Collaborate with other ministries to improve oversight of provincial agencies to ensure efficient service delivery and value for money.

- Prepare and release the Province’s Public Accounts, Annual Financial Report and Consolidated Financial Statements of the Province. The Public Accounts compares the Province’s actual financial results for the fiscal year to the Budget plan for that fiscal year.

- Release the salaries of OPS and BPS employees who were paid $100,000 or more in accordance with the Public Sector Salary Disclosure Act. The Act requires most organizations that receive public funding from the Province of Ontario to disclose annually the names, positions, salaries and total taxable benefits of employees paid $100,000 or more in a calendar year.

- Implement measures to transform business delivery and improve outcomes, including:

- A Transfer Payment Modernization initiative to implement a common registration process for transfer payment recipient entities. This common registration process will result in less time spent on administration by the government and service delivery partners and more time spent on delivering services to Ontarians.

- Establish an Enterprise Risk Management initiative to ensure the enterprise wide integration of risk management into strategy/policy development, business processes, and decision making across ministries, central agencies and business lines.

- Assist the government to streamline, modernize and simplify I&IT services and processes through the Information and Information Technology Baseline and Benchmarking Review to be completed in fall 2015.

- Propose amendments to the Financial Administration Act to support implementation of the enhanced role for TBS in strengthening oversight and fiscal management, as well as other technical amendments to enhance legislative clarity.

To achieve better outcomes for Ontarians living in poverty, TBS is:

- Implementing the new five-year Poverty Reduction Strategy in partnership with relevant ministries and community partners, to break the cycle of poverty for Ontarians.

- The $50 million Local Poverty Reduction Fund is designed to help community organizations provide local solutions to help people out of poverty and demonstrate progress, evaluate programs and build a collective body of evidence of poverty reduction initiatives that work. The fund is expected to provide funding over six years, starting in the fall of 2015.

- Working with the Ministry of Municipal Affairs and Housing to support the Expert Advisory Panel on Homelessness that will advise on a provincial definition of homelessness, methods to improve the collection of data about homelessness, and applying evidence to promote the most effective approaches to preventing and ending homelessness.

Major programs and activities

Treasury Board Secretariat is committed to innovation and to transforming processes, programs and services to help government function better.

The Ministry Administration Program provides administrative and support services to enable the ministry to deliver results to support the government’s objectives and fiscal priorities. Its functions include financial and human resource management, as well as accommodations and facilities management. The program also provides legal and communications services, and planning and results monitoring. The program assists and supports ministry program areas in achieving their business goals.

The Bargaining, Labour Relations and Compensation Program supports the government’s commitment to positive labour relations with the Ontario Public Service and broader public sector. The program represents the Crown as the employer in all collective bargaining and labour relations in the Ontario Public Service, provides employee and labour relations advisory services, supports ongoing union- management relations and manages corporate compensation strategies and programs.

Representing the Ontario Public Service as Employer, the program establishes legal/policy frameworks for effective human resource management and develops human capital strategies to address current and emerging trends.

The program analyzes internal and external factors that drive collective bargaining outcomes in the broader public sector to develop and provide evidence-based strategic guidance and advice to government, ministries and broader public sector employers related to ongoing collective bargaining and labour relations issues. The program also provides policy advice and support on government initiatives impacting executive compensation in the broader public sector.

The Employee and Pensioner Benefits (Employer Share) Program provides for the government’s expenses as Employer for insured benefits, statutory programs, non-insured benefits and certain public service pension plans including third party administration and adjudication costs. The expenses are based on changes in the accrued liabilities of the government as sponsor or co-sponsor of certain insured benefit plans, pension plans and termination of employment entitlements.

The Treasury Board Support Program supports the development of the province’s fiscal plan, provides expertise and advice on sound program design of government initiatives, develops and implements infrastructure strategies for the province, develops and implements the fiscal and financial management framework, and fosters greater accountability and fiscal integrity in the public sector in Ontario.

The program assists the President of the Treasury Board, Deputy Minister and Secretary of Treasury Board/Management Board of Cabinet, and the government in reporting the results of the Province through the Ontario Quarterly Finances, the Public Accounts, and the annual process to seek spending authority from the Legislature. Additionally, the program supports Treasury Board/Management Board of Cabinet by providing advice on ministries' annual multi-year business and infrastructure planning processes and ministries' management of in-year expenditures to ensure the appropriate use of public resources to meet government priorities. The program also provides the Ontario Public Service and broader public sector with accounting and financial management policy and controllership advice, and supports the development of performance measurement frameworks.

The Governance, Agency Oversight, Enterprise Leadership and Learning Program provides leadership and advice for corporate and agency governance, strategic corporate policy and public appointments with a focus on transparency and accountability.

The program also supports Open Government through leadership across the Ontario Public Service to increase civic engagement, make government more accessible to the public, and improve accountability and transparency through Open Dialogue, Open Data and Open Information.

As an enterprise program supporting leadership and learning, additional services include: recruitment and support of executives’ learning and leadership development, talent management, internships, employee engagement, and green transformation strategies.

The Audit Program provides objective assurance and consulting services to the ministries of the Government of Ontario. It ensures its client ministries meet their business objectives by evaluating and making recommendations to improve governance, risk management, control, accountability and compliance processes and to improve the effectiveness, efficiency and economy of ministry and agency operations.

The Poverty Reduction Strategy Program has been established to support Ontario’s multi-year priority outcome of reducing poverty, inequality and exclusion. The program supports initiatives to continue lifting people out of poverty. The Local Poverty Reduction Fund will support, showcase and evaluate grass-roots community action projects that target local solutions to poverty.

The Enterprise Information Technology Services Program provides leadership in establishing modern information and information technology (I&IT) to meet the needs of Ontarians and the Ontario Public Service. This includes formulating and implementing strategy, ensuring security of systems and data, developing policies, the implementation of common infrastructure, governance and accountability. It also includes the delivery of OPS-wide common services such as hosting services, and network capabilities.

The Central Agencies Cluster Program (CAC) provides leadership and cost- effective IT support to its clients. The CAC program develops and maintains the underlying information technology solutions necessary to modernize government operations, delivering cost-effective services and helping Ontario Public Service clients to optimize the value of their services to taxpayers.

The Agencies, Boards and Commissions Program provides oversight to ensure effective governance, accountability, and relationship management.

The Conflict of Interest Commissioner has responsibility for certain conflict of interest and political activity matters as they apply to appointees and employees of ministries and public bodies, and to certain employees of ministries with respect to financial declarations. The Commissioner handles requests for advice or rulings on specific conflict of interest or political activity matters, advises on financial declarations, approves conflict of interest rules submitted by public bodies and reviews and approves adjudicative tribunals’ ethics plans.

The Bulk Media Buy Program supports the purchase of media time for government marketing campaigns. Funding also covers associated agency fees, creative production costs, market research costs and the development of related marketing materials to support integrated campaigns associated with government initiatives. Paid government advertising is guided by the Government Advertising Act, and reviewed and reported on by the Auditor General.

Highlights of ministry’s achievements

TBS’ vision is to lead transformation that builds better public services for the future of Ontario. In 2014-15, the ministry engaged in various activities to achieve its mandate. Highlights of achievements are listed below and more detail can be found in the Annual Report section.

Support the government in achieving its fiscal targets

- The ministry launched Program Review, Renewal and Transformation (PRRT), a fundamentally new approach to multi-year planning and budgeting. Led by the President of the Treasury Board, and supported by a sub-committee of Treasury Board of Cabinet, PRRT is taking an across-government perspective, identifying both short- and longer-term opportunities to transform programs and services.

- The 2014 Budget included a $1.1 billion year-end savings target in addition to a $250 million program review savings target. The government has overachieved on its savings targets by taking action to produce results. The government is on track to exceed the year-end savings target by more than 50%.

- On behalf of the government, TBS reached a collective agreement with AMAPCEO (the Association of Management, Administrative and Professional Crown Employees of Ontario) with no new funding for wage increases. The cost of wage increases is being offset through changes to benefits and entitlements. This will reduce future costs and save taxpayers approximately $45 million in 2014-15.

- TBS provided analysis and advice to ministries in support of the development of their Treasury Board/Management Board of Cabinet submissions (operating and capital), as well as promoted effective partnerships with ministries, agencies and other central agencies to support prioritization of infrastructure investments.

- The ministry also provided audit assurance and advisory services to ministries and agencies to support transformation and strong fiscal management. More than 90% of the audit plan was delivered as planned with overall client satisfaction at 84%, up three percentage points from last year.

Review, modernize and transform public services to increase efficiency and sustainability

- TBS continued to implement the Information Technology Rationalization initiative and has already realized over $18 million in savings and revenue through internal efficiencies in data centres, desktop and service management operations, and providing some public sector organizations with access to the Guelph Data Centre.

- Seven data centres were successfully consolidated. The ministry remains on track to consolidate more than 875 applications running on more than 4,000 servers into two data centres in Guelph and Kingston.

- The Information and Technology (I&IT ) Baseline and Benchmarking Review was launched to further identify areas for improvement and modernization. The review will help ensure IT costs and expenditures provide value for money and are aligned to government priorities.

Support an open, transparent and accountable government

- As part of the Open Government initiative, an integrated team has been established to implement strategies to promote a more open, transparent and accessible government.

- The Open Data Catalogue was launched in 2012 with 63 data sets and grew to 213 as of March 31, 2015. This online inventory includes the titles and descriptions of more than 1,000 data sets.

- The ministry is responsible for preparing and releasing Ontario’s Public Accounts, Annual Financial Report and Consolidated Financial Statements of the Province. The 2013-14 Public Accounts marked the 20th year in a row in which Ontario’s financial statements received a clean audit from the Auditor General. For 2013, the C.D. Howe Institute also recognized Ontario as a leading jurisdiction in Canada on fiscal transparency and gave the Province an “A” ranking for its clarity in presentation of financial results.

- The ministry led the development and ongoing implementation of the Public Sector and MPP Accountability and Transparency Act, 2014. The Act strengthens political accountability and makes the business of government more transparent. It also authorizes the government to set compensation frameworks for senior executives in designated agencies and organizations in the broader public sector.

- The government is committed to reducing the number of provincial agencies by approximately 30% below the 2011 baseline (246 provincial agencies). Since 2011, the government has taken a thoughtful approach and has eliminated 67 agencies, with additional reductions possible as the government undertakes and considers the outcomes of regular mandate reviews

Improve outcomes for Ontarians living in poverty

- Ontario launched its second five-year Poverty Reduction Strategy, Realizing Our Potential, in September 2014 with a focus on long-term and sustainable solutions that break to the cycle of poverty.

- The ministry released the Poverty Reduction Strategy 2014 Annual Report in March 2015 which outlines the positive impact that programs have had in reducing poverty. The report measures progress against poverty indicators and identifies key achievements for 2014.

- The government established an Expert Advisory Panel on Homelessness which will provide practical advice and expertise to help set a provincial definition of homelessness, improve the collection of data about homelessness, and apply evidence to promote best approaches to preventing and ending homelessness.

- The ministry established the Poverty Reduction Strategy Office to support Ontario’s multi-year priority outcome of reducing poverty, inequality and exclusion. The office expects to launch the Local Poverty Reduction Fund in 2015-16 to support, showcase and evaluate grass-roots community action projects that target local solutions to poverty.

- It is anticipated that the fund will provide $50 million over six years to support local solutions to poverty by identifying and evaluating sustainable, community driven and innovative approaches to preventing, or lifting people out of, poverty.

Create an OPS workplace culture that attracts and retains capable and diverse talent

- The government continued to be recognized as employer of choice in 2014-15, and was recognized as one of Canada’s Top 100 Employers for 2015.

- The ministry continued to attract top talent from diverse backgrounds to the OPS, including attracting over 5,500 youth and new professionals through different employment programs such as summer employment programs and the Ontario Internship Program.

Organizational chart

This is a text version of an organizational chart for the Treasury Board Secretariat as of April 1, 2015. The chart shows the following hierarchical structure with the top level assigned to the Deputy Premier and President of the Treasury Board.

-

- Deputy Premier and President Treasury Board – Deb Matthews

- Group of 5 Chair positions:

- Chair, Public Service Commission – Angela Coke

- Chair, OPSEU Pension Trust – Michael Grimaldi

- Chair, Provincial Judges Pension Board – Deborah Anne Oakley

- Commissioner, Conflict of Interest – Sidney Linden

- Chair, Ontario Pension Board – Vincenza Sera

- Deputy Minister, Treasury Board Secretariat Secretary of Treasury Board and Management Board of Cabinet – Greg Orencsak

- Director of Operations – Kyle MacIntyre (A)

- Sr. Manager & Special Advisor – Sofie Di Muzio (A)

- Legal Director – Sean Kearney (A)

- Communications Director – Anne Matthews

- Executive Director, Proverty Reduction Strategy Office – Karen Glass (A)

- ADM, Corporate Policy, Agency Governance and Open Government Division – Sam Erry

- ADM, Centre for Leadership and Learning – Kerry Pond

- ADM/CAO, Corporate Services Division – Melanie Fraser

- ADM, Internal Audit Division – Richard Kennedy

- Associate DM, Bargaining and Compensation – Reg Pearson

- ADM, Employee Relations Division –Marc Rondeau (A)

- Director, Labour Relations Secretariat – Michael Uhlmann

- Director, HR Policy & Planning – Brian Fior

- Associate DM, Office of the Treasury Board – Kevin French

- ADM, Capital Planning – Joe Iannace (A)

- ADM, Planning and Expenditure Management – Karen Hughes

- ADM, Provincial Controller – Murray Lindo

- Corporate Chief I&IT Officer, Corporate Chief Information Office – David Nicholl

- CIO – Central Agencies Cluster (CAC) – Ron Huxter (Dual reporting relationship between Corporate Chief I&IT Officer David Nicholl and Deputy Ministry Greg Orencsak)

- Cluster CIOs

- Corporate Chief, Infrastructure Technology Services – Marty Gallas

- Corporate Chief Strategist, Controllership and Strategy Division – Fred Pitt

- Group of 5 Chair positions:

- Deputy Premier and President Treasury Board – Deb Matthews

Download printer-friendly organizational chart (JPG).

Acts administered by the Treasury Board Secretariat

Adjudicative Tribunals Accountability, Governance and Appointments Act, 2009, S. O. 2009, c. 33, Sched. 5

Auditor General Act, R.S.O 1990, c. A.35

Broader Public Sector Accountability Act, 2010, S.O. 2010, c. 25, in respect of sections 1-4, 7, 7.1-7.20, 9-13.2, 16, 19 and 21-23

Broader Public Sector Executive Compensation Act, 2014, S.O. 2014, c. 13, Sched 1

Cabinet Ministers' and Opposition Leaders' Expenses Review and Accountability Act, 2002, S.O. 2002, c. 34, Sched. A

Crown Foundations Act, 1996, S.O. 1996, c. 22

Financial Administration Act, R.S.O. 1990, c. F.12, in respect of sections 1.0.1 to 1.0.10; and in respect of all other sections, except section 1.0.19 and Parts III and V, the administration of the act is shared between the President of the Treasury Board and the Minister of Finance

Fiscal Transparency and Accountability Act, 2004, S.O. 2004, c. 27, in respect of section 10 and clause 15 (b), the administration of which is shared between the President of the Treasury Board and the Minister of Finance

Flag Act, R.S.O. 1990, c. F.20

Floral Emblem Act, R.S.O. 1990, c. F.21

Government Advertising Act, 2004, S.O. 2004, c. 20

Lobbyists Registration Act, 1998, S.O. 1998, c. 27, Sched.

Management Board of Cabinet Act, R.S.O. 1990, c. M.1

Ministry of Government Services Act, R.S.O. 1990, c. M.25, in respect of services provided by the Treasury Board Secretariat

Ontario Provincial Police Collective Bargaining Act, 2006, S.O. 2006, c. 35, Sched. B

Ontario Public Service Employees' Union Pension Act, 1994, S.O. 1994, c. 17, Sched.

Poverty Reduction Act, 2009, S.O. 2009, c.10 (in support of the Minister Responsible for the Poverty Reduction Strategy)

Public Sector Compensation Restraint to Protect Public Services Act, 2010, S.O. 2010, c. 1, Sched. 24

Public Sector Expenses Review Act, 2009, S.O. 2009, c. 20

Public Sector Salary Disclosure Act, 1996, S.O. 1996, c. 1, Sched. A Public Service of Ontario Act, 2006, S.O. 2006, c. 35, Sched. A Public Service Pension Act, R.S.O. 1990, c. P.48 Supply Act, 2015, S.O. 2015, c. 1

Agencies, boards and commissions

Case Management Masters Remuneration Commission

Commissioner: Larry Banack

Established by Order in Council. Conducts inquiries and makes non-binding recommendations to the President of the Treasury Board regarding the remuneration of Ontario Case Management Masters (provincially appointed judicial officers). The Commission’s report is submitted to the Lieutenant Governor in Council for a response.

Deputy Judges Remuneration Commission

Commissioner: Marilyn Ann Nairn

Established by Order in Council. Conducts inquiries and makes non-binding recommendations to the President of the Treasury Board regarding the remuneration of Deputy Judges. The Commission’s report is submitted to the Lieutenant Governor in Council for a response.

Justices of the Peace Remuneration Commission

Chair: Patrick J. LeSage

Established by regulation under the Justices of the Peace Act. Conducts inquires and makes non-binding recommendations to the President of the Treasury Board regarding the remuneration of Ontario Justices of the Peace. The Commission’s report is submitted to the Lieutenant Governor in Council for a response.

Office of the Conflict of Interest Commissioner

Commissioner: Hon. Sidney B. Linden

Created by the Public Service of Ontario Act, 2006. Offers advice and makes determinations on specific conflict of interest, political activity and financial declaration matters related to in-service and post service obligations on Ontario’s public servants. Provides advice and direction to public bodies, upon request. Approves the conflict of interest rules of public bodies and approves the ethics plans of adjudicative tribunals. Serves as a resource for developing and sharing information and promoting awareness of the conflict of interest and political activity rules.

Ontario Public Service Employees’ Union Pension Plan Board of Trustees

Chair: Michael Grimaldi

An independent Trust organization (not a Crown Agency or a public body) established under a Joint Sponsorship Agreement between Ontario (represented by the President of the Treasury Board) and the members (represented by the OPSEU Executive Board) under the Ontario Public Service Employees’ Union Pension Act, 1994. Administers the OPSEU Pension Plan (adjudication and provision of pension benefits) and the OPSEU Pension Fund (investing assets).

Ontario Public Service Pension Board

Chair: Vincenza Sera

A public body and Trust agency established in 1990 under the Public Service Pension Act. Administers the Public Service Pension Plan (PSSP), including the investment of the Public Service Pension Fund and the adjudication and provision of benefits under the Plan. Also carries out administrative functions in relation to the Provincial Judges Pension Plan for the Provincial Judges Pension Board.

Provincial Judges Pension Board

Chair: Deborah Anne Oakley

A public body and Trust agency established in 1992 by Ontario Regulation 67/92 made under the Courts of Justice Act. The Board is responsible for administering the pensions and survivor allowances for provincial judges and their survivors.

Provincial Judges Remuneration Commission

Chair: William Kaplan

Established under the Framework Agreement between Ontario and the Provincial Judges set out as a schedule to the Courts of Justice Act. Conducts inquiries and makes binding recommendations to the President of the Treasury Board regarding the salaries and benefits and non-binding recommendations regarding the pensions of Provincial Judges.

Public Service Commission

Chair: Angela Coke

Established in 2006 pursuant to the Public Service of Ontario Act, 2006 (PSOA) replacing the Civil Service Commission that was established under the previous Public Service Act. Ensures the effective management and administration of human resources in relation to public servants appointed under Part III of PSOA. Ensures non-partisan recruitment and employment of public servants.

Public Service Grievance Board

Chair: Kathleen G. O’Neil

Established in 1959 as an independent labour relations tribunal. Exercises the powers and duties conferred upon it by the Public Service of Ontario Act, 2006 and O. Reg. 378/07. Provides dispute resolution services to certain management and excluded members of Ontario’s public service and their employers. Hears grievances regarding discipline, dismissal, working conditions and terms of employment.

Agencies, boards and commissions - financial summary

| Agency, board or commission | classification | 2015-16 estimates | 2014-15 interim actuals | 2013-14 actuals |

|---|---|---|---|---|

| Case Management Masters Remuneration Commission | Advisory | 15,000 | 200,000 | 16,574 |

| Deputy Judges Remuneration Commission A | Advisory | 15,000 | 15,765 | 5,444 |

| Justices of the Peace Remuneration Commission A | Advisory | 45,000 | 15,000 | 10,801 |

| Office of the Conflict of Interest Commissioner B | Regulatory | 857,500 | 885,372 | 1,064,802 |

| Ontario Public Service Employees’ Union Pension Plan Board of Trustees | n/a | n/a | n/a | n/a |

| Ontario Public Service Pension Board | Trust | 75,000 | 100,000 | 72,136 |

| Provincial Judges Pension Board | Trust | 236,550 | 187,700 | 127,686 |

| Provincial Judges Remuneration Commission A | Advisory | 56,500 | n/a | 37,103 |

| Public Service Commission | Regulatory | n/a | n/a | n/a |

| Public Service Grievance Board C | Adjudicative | n/a | n/a | n/a |

A Amounts do not include legal services costs recoverable from the Ministry of the Attorney General.

B Represents the full allocation of the Office of the Conflict of Interest Commissioner. Appears as its own vote item in the TBS Printed Estimates.

C Administered by the Ministry of Labour on behalf of TBS.

Note: For all agencies above, except for Office of the Conflict of Interest Commissioner, the figures represent expenses incurred on behalf of these agencies by Treasury Board Secretariat. The amounts above do not represent these agencies' full allocations.

Ministry financial information

Table 1 - Ministry planned expenditures 2015-16

| Expediture type | Expenditure amount |

|---|---|

| Operating | $2,118.2 million |

| Capital | $112.1 million |

| *Total | $2,230.2 million |

*Includes statutory appropriations, consolidation and other adjustments (excludes operating and capital assets)

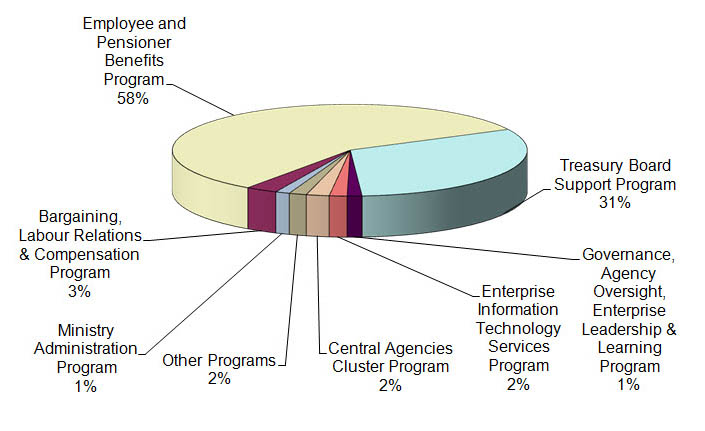

Ministry Operating and Capital (excluding Assets)

Employee and pensioner benefits program – 58%

Treasury board support program – 31%

Bargaining, labour relations and compensation program – 3%

Central agency cluster program – 2%

Enterprise information technology services program – 2%

Other programs – 2%

Governance, agency oversight, entertprise leadership and learning program – 1%

Ministry admnistration program – 1%

*Graph includes Statutory Appropriations, Consolidations & Other Adjustments. Other Programs include Bulk Media Buy, Agencies Boards and Commissions, Poverty Reduction Strategy Program and Audit Program

Table 2 - Operating and capital summary by vote

| Vote/program (Operating and capital expense) | 2015–16 estimates | Change from 2014–15 estimates | Change from 2014–15 estimates | 2014–15 estimates | 2014–15 Interim actuals | 2013–14 actuals |

|---|---|---|---|---|---|---|

| Ministry Administration Program | $28,904,700 | ($2,368,700) | (7.6%) | $31,273,400 | $28,081,884 | $33,332,139 |

| Bargaining, Labour Relations & Compensation Program | $64,367,600 | $27,221,700 | 73.3% | $37,145,900 | $26,554,067 | $25,109,744 |

| Employee and Pensioner Benefits Program | $911,450,000 | $6,102,000 | 0.7% | $905,348,000 | $905,348,000 | $828,270,237 |

| Treasury Board Support Program | $700,459,500 | $48,842,000 | 7.5% | $651,617,500 | $90,485,010 | $33,373,487 |

| Governance, Agency Oversight, Enterprise Leadership & Learning Program | $29,909,800 | ($1,600,000) | (5.1%) | $31,509,800 | $29,032,948 | $26,754,492 |

| Audit Program | $5,022,400 | ($734,300) | (12.8%) | $5,756,700 | $5,584,000 | $5,489,465 |

| Poverty Reduction Strategy Program | $4,500,000 | $2,500,000 | 125.0% | $2,000,000 | n/a | n/a |

| Enterprise Information Technology Services Program | $34,782,400 | $2,742,500 | 8.6% | $32,039,900 | $41,349,207 | $34,827,526 |

| Central Agencies Cluster Program | $46,467,300 | ($13,667,500) | (22.7%) | $60,134,800 | $57,271,366 | $59,984,331 |

| Agencies, Boards and Commissions Program | $857,500 | n/a | 0.0% | $857,500 | $885,372 | $1,064,802 |

| Bulk Media Buy Program | $25,000,000 | n/a | 0.0% | $25,000,000 | $1,303,100 | n/a |

| Less: Special Warrants | n/a | ($358,613,400) | (100.0%) | $358,613,400 | n/a | n/a |

| Total Operating and Capital Expense to be Voted | $1,851,721,200 | $427,651,100 | 30.0% | $1,424,070,100 | $1,185,894,954 | $1,048,206,223 |

| Special Warrants | n/a | ($358,613,400) | (100.0%) | $358,613,400 | n/a | n/a |

| Statutory Appropriations | $454,530,014 | ($48,673,200) | (9.7%) | $503,203,214 | $446,237,081 | $494,223,818 |

| Consolidation & Other Adjustments | ($76,002,000) | ($46,002,000) | 153.3% | ($30,000,000) | ($30,000,000) | ($45,648,969) |

| Total Including Consolidation & Other Adjustments | $2,230,249,214 | ($25,637,500) | (1.1% ) | $2,255,886,714 | $1,602,132,035 | $1,496,781,072 |

| Vote/program (Operating and capital assets) | 2015-16 estimates | Change from 2014-15 estimates | Change from 2014-15 estimates | 2014-15 estimates | 2014-15 interim actuals | 2013-14 actuals |

|---|---|---|---|---|---|---|

| Ministry Administration | $1,000 | n/a | 0.0% | $1,000 | n/a | n/a |

| Enterprise Information Technology Services Program | $62,564,600 | $1,000 | 0.0% | $62,563,600 | $57,563,600 | 39,770,247 |

| Central Agencies Cluster Program | $1,000 | n/a | 0.0% | $1,000 | n/a | n/a |

| Less: Special Warrants | n/a | ($13,039,300) | (100.0%) | $13,039,300 | n/a | n/a |

| Total Operating and Capital Assets to be Voted | $62,566,600 | $13,040,300 | 26.3% | $49,526,300 | $57,563,600 | 39,770,247 |

| Special Warrants | n/a | ($13,039,300) | (100.0%) | $13,039,300 | n/a | n/a |

| Statutory Appropriations | n/a | n/a | n/a | n/a | n/a | n/a |

| Treasury Board Support Program | $1,000 | n/a | 0.0% | $1,000 | n/a | 593,434,473 |

| Total Statutory Appropriations | $1,000 | n/a | 0.0% | $1,000 | n/a | 593,434,473 |

| Total Operating and Capital Assets | $62,567,600 | $1,000 | 0.0% | $62,566,600 | $57,563,600 | 633,204,720 |

* Treasury Board Secretariat was established in July 2014. Financials for 2013-14 and 2014-15 reflect the financials of these programs under the previous structure.

For additional information see:

The Public Accounts of Ontario

Appendix 1: 2014-15 annual report

Treasury Board Secretariat was established in July 2014 to support the President of the Treasury Board to lead transformation that builds better public services for the future of Ontario. Its vision/mission is:

To lead transformation that builds better public services for the future of Ontario

During the past year, the ministry engaged in a number of activities to achieve its mission.

Support the government in achieving its fiscal targets

In 2014-15, the ministry launched the Program Review, Renewal and Transformation (PRRT) process, a new approach to multi-year planning and budgeting. Through PRRT, the ministry is looking at how every dollar across government is being spent, and using evidence to identify opportunities to improve services and outcomes, and meet annual program review savings.

TBS provided analysis and advice to ministries to support their PRRT multi-year plans and in-year Treasury Board/Management Board of Cabinet submissions. The PRRT process will continue to play an important role in achieving the government’s fiscal targets while delivering the services that Ontarians need. For 2015-16, the government has identified, through the PRRT process, a number of opportunities to improve outcomes for Ontarians while managing costs.

The 2014 Budget included a $1.1 billion year-end savings target in addition to a $250 million program review savings target. The government has overachieved on its savings targets by taking action to produce results. The government is on track to exceed the year-end savings target by more than 50%.

TBS continued to monitor ministries’ implementation of the Commission on the Reform of Ontario’s Public Services (CROPS) recommendations. PRRT builds on the work of CROPS, focusing on program objectives to assess outcomes in an effective, efficient, relevant and sustainable way.

In 2014-15, TBS, on behalf of the government, reached a collective agreement with AMAPCEO (the Association of Management, Administrative and Professional Crown Employees of Ontario) with no new funding for wage increases. The cost of wage increases is being offset through changes to benefits and entitlements. This will reduce future costs and save taxpayers approximately $45 million in 2014-15. This agreement supports the government’s commitment to fairness to employees while protecting valued public services.

Building modern infrastructure and transportation networks

Renewing and expanding public infrastructure supports Ontario’s industries, creates jobs and positions Ontario to better compete in the global economy. The government is investing more than $130 billion to fund projects in public transit, highways, schools, health facilities, postsecondary institutions and other assets over 10 years. TBS continues to support Ontario’s infrastructure plan by providing oversight to the infrastructure projects and proposing options regarding prioritization of projects.

Review, modernize and transform public services to increase efficiency and sustainability

This year TBS continued to implement the Information Technology Rationalization Initiative, consistent with the CROPS recommendations and commitments made in the 2013 Provincial Budget. The initiative has now realized over $18 million in savings and revenue by consolidating data centres, rationalizing software requirements, providing some public sector organizations with access to the Guelph Data Centre, and reviewing the efficiency of government IT operations. In 2014, the ministry launched the I&IT Baseline and Benchmarking Review, which will identify areas for further transformation in I&IT services across the OPS. Results of the review are expected in fall 2015.

The government’s I&IT organization has also continued to achieve savings by negotiating lower contract costs for cellular phone plans and 1-800 lines, resulting in additional savings of approximately $7 million in 2014-15.

A new I&IT Assistive Technology Support Service was introduced to simplify the process for acquiring and supporting assistive technology. The initiative enhances services for OPS employees with disabilities and those who require assistive or adaptive technology such as screen-reading and speech recognition software, and provides enhanced flexibility in procuring this technology.

The ministry is also developing enhanced strategic financial management and business analysis tools and processes to support transformational improvements in ministries’ operations and improve interactions with business partners and the public.

TBS continued to provide leadership in reducing the environmental impact of OPS operations through the Ontario Public Service Green Office. Efforts to date have resulted in significant reductions in greenhouse gas emissions from fuel use, air travel and energy use in government-owned buildings. From 2006-07 to 2014-15, the OPS reduced its fuel usage by 7.5 million litres and greenhouse gas emissions by 18.1% by implementing a green fleet strategy. It also reduced emissions from energy-use in government owned buildings by an estimated 30.1% since 2006. The OPS is also ensuring the responsible stewardship of public resources by reducing paper use, as well as recycling electronics and batteries. For 2014, the OPS was recognized as one of Canada’s Greenest Employers.

The ministry is also working on a Transfer Payment Modernization project to identify opportunities for improvements to transfer payment administration across the OPS. The purpose of the project is to identify and implement efficiencies by streamlining and automating processes to reduce the administrative burden on organizations receiving transfer payments, create efficiencies for the OPS and support improved oversight of transfer payment agreements.

Support an open, transparent and accountable government

As part of the Open Government initiative, an integrated team has been established to implement strategies to promote a more open, transparent and accessible government. Open data is available to the public in open, standardized, machine- readable formats at no cost. The Open Data Catalogue was launched in 2012 with 63 data sets and grew to 213 sets as of March 31, 2015. Ontario became the first jurisdiction in Canada to release its data inventory for public voting. This online inventory includes the titles and descriptions of more than 1,000 data sets. Public votes help the government to prioritize the release of new data. Work is also underway across the government to expand the number of high-value data sets available within the open data catalogue.

Through the Open Government initiative, new forms of in-person and online public engagement will be introduced to seek public feedback and stakeholder input on major transformational initiatives. There will also be increased focus on progress tracking and public reporting.

TBS provided analysis and advice to ministries in support of the development of their Treasury Board/Management Board of Cabinet submissions (operating and capital), as well as promoted effective partnerships with ministries, agencies and other central agencies to support prioritization of infrastructure investments.

TBS supported the Premier in her discussions with her provincial and territorial counterparts. This included supporting the Premier’s hosting of the Building Canada Up summit in August 2014, which brought together experts, stakeholders and government, and at which the Premier called on the federal government to significantly increase investment in public infrastructure.

TBS supported the development of the Ontario Budget, Printed Estimates, Economic Outlook and Fiscal Review, and the province’s Public Accounts.

The ministry is responsible for preparing and releasing Ontario’s Public Accounts, Annual Financial Report and Consolidated Financial Statements of the Province. The 2013-14 Public Accounts marked the 20th year in a row in which Ontario’s financial statements received a clean audit from the Auditor General. For 2013, the C.D. Howe Institute also recognized Ontario as a leading jurisdiction in Canada on fiscal transparency and gave the Province an “A” ranking for its clarity in presentation of financial results.

The ministry provided audit assurance and advisory services to ministries and agencies and participated in key enterprise-wide initiatives to support transformation and strong fiscal management. These services have helped to strengthen risk management, controllership, effectiveness, transfer payment accountability and agency governance.

The ministry supported the government through the co-ordination of accountability legislation, the Public Sector and MPP Accountability and Transparency Act, 2014. Passed in December 2014, the Act strengthens political accountability, makes the business of government more transparent, and gives Officers of the Legislature more responsibility in their roles. In addition, corporate policy improvements were made to modernize the governance of provincial agencies, including new requirements to enhance transparency.

The ministry has been implementing a five-point plan to enhance agency governance and oversight, including:

- Conducting the first round of mandate reviews for provincial agencies;

- Releasing a new Agencies and Appointments Directive;

- Introducing governance training for public appointees;

- Enhanced risk assessment, evaluation and reporting to Treasury Board/Management Board of Cabinet; and

- Strengthening and building relations with provincial agencies.

The government is committed to reducing the number of provincial agencies by approximately 30% below the 2011 baseline (246 provincial agencies). Since 2011, the government has taken a thoughtful approach and has eliminated 67 agencies, with additional reductions possible as the government undertakes and considers the outcomes of regular mandate reviews.

In keeping with Ontario’s commitment to openness and transparency, the government released the salaries of OPS and BPS employees who were paid $100,000 or more in 2014. The Public Sector Salary Disclosure Act requires most organizations that receive public funding from the Province of Ontario to disclose annually the names, positions, salaries and total taxable benefits of employees paid $100,000 or more in a calendar year.

Improve outcomes for Ontarians living in poverty

There has been significant progress since the Ontario government launched its first Poverty Reduction Strategy in 2008. By 2011, 47,000 children and their families had been lifted out of poverty, while thousands were prevented from falling into poverty.

In the fall of 2014, the government launched its second five-year Poverty Reduction Strategy: Realizing our Potential. The innovative and transformative strategy is designed to address the root causes of poverty. The new strategy recommits to the government’s target to reduce child poverty by 25%, using 2008 as the base year. It sets a new goal to end homelessness and focuses on investing in evidence- based initiatives to ensure the best possible results for Ontarians.

The ministry established the Poverty Reduction Strategy Office to support Ontario’s multi-year priority outcome of reducing poverty, inequality and exclusion. The strategy recognizes the important work that is required to continue reducing poverty and making a difference in the lives of the province’s most vulnerable people.

In January 2015, the government established an Expert Advisory Panel on Homelessness which will provide practical advice and expertise to help set a provincial definition of homelessness, improve the collection of data about homelessness, and apply evidence to promote best approaches to preventing and ending homelessness.

The government also released its Poverty Reduction Strategy 2014 Annual Report in March 2015 which highlights the progress that is being made.

In April 2015, the government launched the Local Poverty Reduction Fund which is investing $50 million to support grassroots community partners in lifting people and families out of poverty. The fund will help build a body of knowledge of effective programs that work on the ground and demonstrate positive outcomes for people in poverty which will help inform future policy change and lead to more strategic investments and targeted interventions.

Create an OPS workplace culture that attracts and retains capable and diverse talent

The government continued to be recognized as an employer of choice in 2014-15. The OPS was recognized as one of:

- Canada’s Top 100 Employers for 2015, the first time since 2012;

- Canada’s Top Family-Friendly Employers for 2015, the first time since 2012;

- Canada’s Best Diversity Employers for the seventh year in a row;

- Greater Toronto Area’s Top Employers for the seventh year in a row;

- Canada’s Greenest Employers for the fifth year in a row; and

- Canada’s Top Employers for Young People for the second year in a row.

The ministry continued to attract top talent from diverse backgrounds to the OPS, including more than 5,500 youth and new professionals through different employment programs such as the Ontario Internship Program, OPS Internship Program for Internationally Trained Individuals, and the OPS Internship Program for Internationally Trained Engineers. The OPS Learn and Work Program is a leading example of how the OPS models corporate leadership. The OPS Learn and Work Program is a specialized co-op program designed to re-engage high-school students from selected priority communities in Hamilton, Thunder Bay, Toronto and Windsor. The program provides priority youth with the opportunity to earn credits toward their high school diploma and gain meaningful, paid, work experience. In 2014-15, the Learn and Work Program placed a total of 141 students and had a program completion rate of 89%.

Ministry Interim Actual Expenditures 2014-15

| Expenditure type | Expenditure amount for 2014-15 |

|---|---|

| Operating* | $1,589.2 million |

| Capital* | $12.9 million |

| Staff strength** (As of March 31, 2015) | 2,712 |

* Includes Statutory Appropriations, Consolidation and Other Adjustments (excludes Operating and Capital Assets)

** Staff Strength adjusted to reflect 2015-16 TBS Organization Structure.