We've moved this content over from an older government website. We'll align this page with the ontario.ca style guide in future updates.

Interjurisdictional Carrier’s Manual

Published: April 2016

Content last reviewed: April 2016

ISBN: 978-1-4249-4792-8 (HTML)

This publication provides information about the International Fuel Tax Agreement (IFTA) program and outlines the requirements and responsibilities of a licensee. The information in this publication does not replace the law found in the Fuel Tax Act or Gasoline Tax Act and related regulations or the IFTA governing documents.

Introduction

What is IFTA?

The International Fuel Tax Agreement (IFTA) is an agreement among the 10 provinces in Canada and 48 states in the United States of America that simplifies the reporting by interjurisdictional carriers (IJCs) of motor fuel use taxes. The Agreement allows IJCs, operating qualified motor vehicle(s), to report and pay taxes owing to all jurisdictions to a single base jurisdiction.

Note: Northwest Territories, Nunavut, Yukon, Hawaii, Alaska and the District of Columbia are not member jurisdictions.

The International Fuel Tax Association, Inc. (IFTA, Inc.) oversees the activities necessary to administer IFTA on behalf of the member jurisdictions. Information about IFTA, including the governing documents and the quarterly IFTA tax rate matrices can be found at the IFTA, Inc. website.

Under IFTA, IJCs are required to account for and remit to jurisdictions based on the fuel consumed and the proportion of distance travelled in each jurisdiction.

Who is eligible to register under IFTA?

You must meet all of the following criteria to register in Ontario:

- your qualified motor vehicle(s) are registered in Ontario

- you have an established place of business in Ontario from which you maintain operational control of your qualified motor vehicle(s) and you keep records for your qualified motor vehicle(s) in Ontario, or will make your records available to any official of the Ministry of Finance (ministry) in Ontario, and

- your qualified motor vehicle(s) travel in Ontario and at least one other IFTA jurisdiction.

If you qualify for IFTA registration but choose not to participate in the program, you must obtain single trip permit(s) to travel interjurisdictionally, prior to travel. Information on single trip permits may be obtained by contacting one of the Single Trip Permit Agencies listed on our website.

If you travel through jurisdictions which are not members of IFTA, you must satisfy any motor fuel use taxes in accordance with the laws of those non-IFTA jurisdictions.

What is a qualified motor vehicle?

A qualified motor vehicle includes a motor vehicle that is used, designed or maintained to transport persons or property (does not include recreational vehicles), and has:

- two axles and a gross vehicle or registered gross vehicle weight of more than 11,797 kg (26,000 pounds), or

- three or more axles on the power unit, regardless of weight, or

- a total gross vehicle or registered gross vehicle weight of more than 11,797 kg (26,000 pounds) when used in combination with a trailer.

Recreational vehicles, regardless of weight or axle configuration, when not used in connection with any business endeavour, are not considered qualified motor vehicles. Recreational vehicles may include motor homes, pickup trucks with attached campers, and buses when used exclusively for personal pleasure by an individual.

Light trucks and vans with a gross vehicle or registered gross weight (including trailer weight, if any) equal to or below 11,797 kg (26,000 pounds) are not required to register under IFTA, even if they are being used for commercial transportation of goods or passengers inside and outside Ontario. Generally, these vehicles include delivery vans, service vehicles and pickup trucks used by local merchants, short haul carriers, intercity carriers and courier services.

Enforcement

Uniformed ministry inspectors are designated Provincial Offenses Officers who monitor interjurisdictional traffic for compliance with registration requirements under IFTA. Inspectors have the authority to stop and detain commercial motor vehicles for inspection purposes. Vehicles registered under IFTA are identified by the presence of IFTA decals attached to the cab of a vehicle.

Infractions carry a fines and provide audit leads for the ministry and other jurisdictions.

Inspectors may also sample the fuel tanks of diesel vehicles to identify operators who may be avoiding fuel tax of 14.3 cents per litre by using coloured fuel, or similar tax-exempt fuel, to power their vehicle. Tax-exempt fuel is coloured with red dye to aid its detection.

Coloured fuel violations carry a fine and will also result in an assessment of any fuel tax evaded in the previous four years, plus penalty and interest.

Registration and renewal procedures

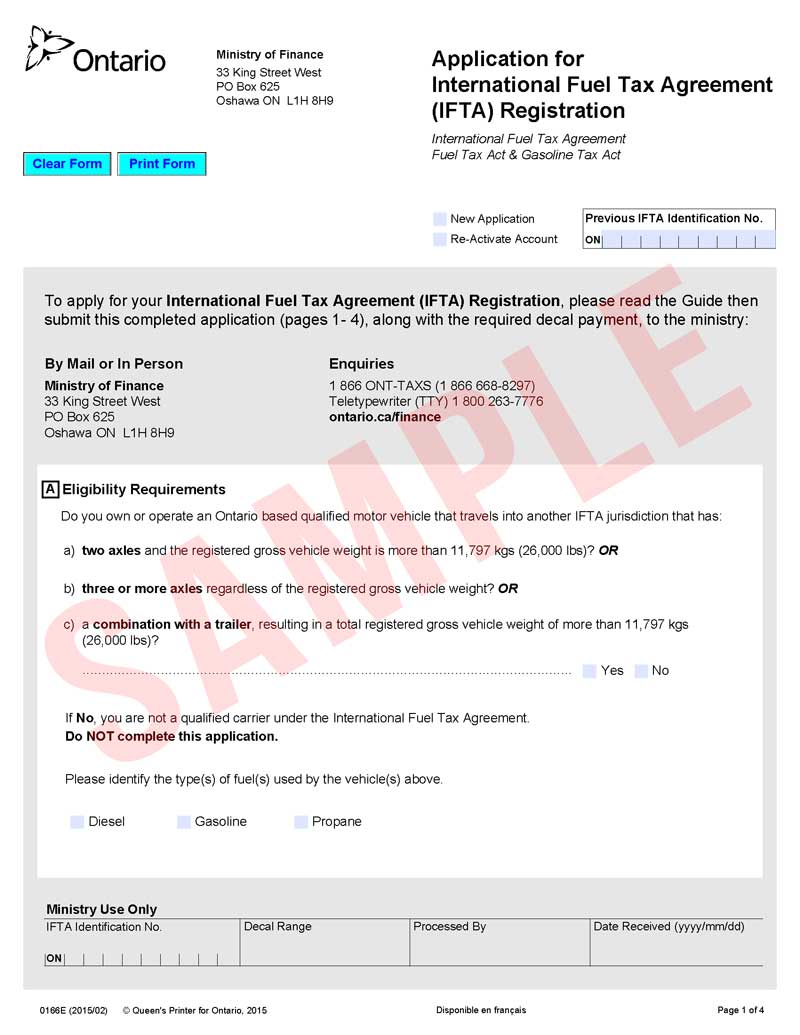

Initial application for licence

To apply for your IFTA licence and decals, submit a completed Application for IFTA Registration and the required decal fee payment ($10 per set) to our office. You can also request an application by phone, email or in person. Contact details are available at the end of this document.

The application asks for basic information about your business, your interjurisdictional operation and the number of decals you need during the licence year. The Federal Business Number (BN) of your business is also required. If you need further information relating to a Federal Business Number, please contact the Canada Revenue Agency for assistance.

Failure to provide the required information or the decal fee payment may result in a delay in processing your application. Once your application is approved, your licence and decals will be mailed to the address given on your application.

Walk in registration is available Monday to Friday from 8:30 a.m. to 4:00 p.m. at the Ministry of Finance Tax Information Centre located at 33 King Street West, Oshawa.

If you have an agent who will be acting on your behalf to deal with the ministry regarding your IFTA account, you must complete section 'K' of the application, Authorizing a Representative. Should you wish to change or cancel an existing agent's authorization, you may complete the Authorizing or Cancelling a Representative form.

If you change your address, the legal name of your business, the nature of your business, or terminate your business, you must notify the ministry immediately. Contact details are available at the end of this document.

Note: If your licence is currently under revocation in another IFTA member jurisdiction, you will not be eligible to register in Ontario.

When you register in Ontario under IFTA you will:

- receive two decals for each qualified motor vehicle, and a single IFTA licence, which will allow you to travel in all IFTA member jurisdictions

- file quarterly fuel tax returns only with Ontario, your base jurisdiction, to report your operations for all fuel types in each of the IFTA member jurisdictions

- calculate one tax due or credit owing by netting a motor fuel tax overpayment in one jurisdiction against a liability in another jurisdiction on your return

- maintain records to substantiate information reported on the tax returns, and

- be subject to tax audits for all fuel types for your travel in all IFTA member jurisdictions.

If you are based in an IFTA jurisdiction outside Ontario, a valid IFTA licence and decals issued from your base jurisdiction will meet Ontario's fuel use tax licensing requirements.

If you are based in and travel only in Ontario, no IFTA licence or reporting is required.

IFTA licence

The ministry will issue a single IFTA licence for your fleet of vehicles, valid for one calendar year (January 1 through December 31). Copies of the original licence must be placed in each of your qualified motor vehicles. The original licence should be kept with your business records, so that additional copies can be made when adding a qualified motor vehicle to your fleet during the registration year.

If you are found operating a qualified motor vehicle without an IFTA licence or without a valid trip permit, you will receive a fine and will be required to purchase a trip permit.

IFTA decals

You will receive two decals for each qualified motor vehicle in your fleet. IFTA decals are valid for one calendar year (January 1 through December 31). The decals must be affixed to the outside of each qualified motor vehicle, one on either side of the cab as shown in the Decal Placement guide. However, if you are a manufacturer, dealer or transporter (includes drive-away operators) of qualified motor vehicles, the decals need not be permanently affixed, but may be temporarily displayed in a visible manner on both sides of the cab.

When you renew your credentials, you may operate with the new IFTA decals and licence up to one month (December 1st) prior to the effective date shown on the credentials. Carriers must have the current and renewed licence available until the effective date of the new licence.

If you do not display the IFTA decals properly, you may receive a fine and will be required to purchase a single trip permit. You cannot transfer decals between vehicles.

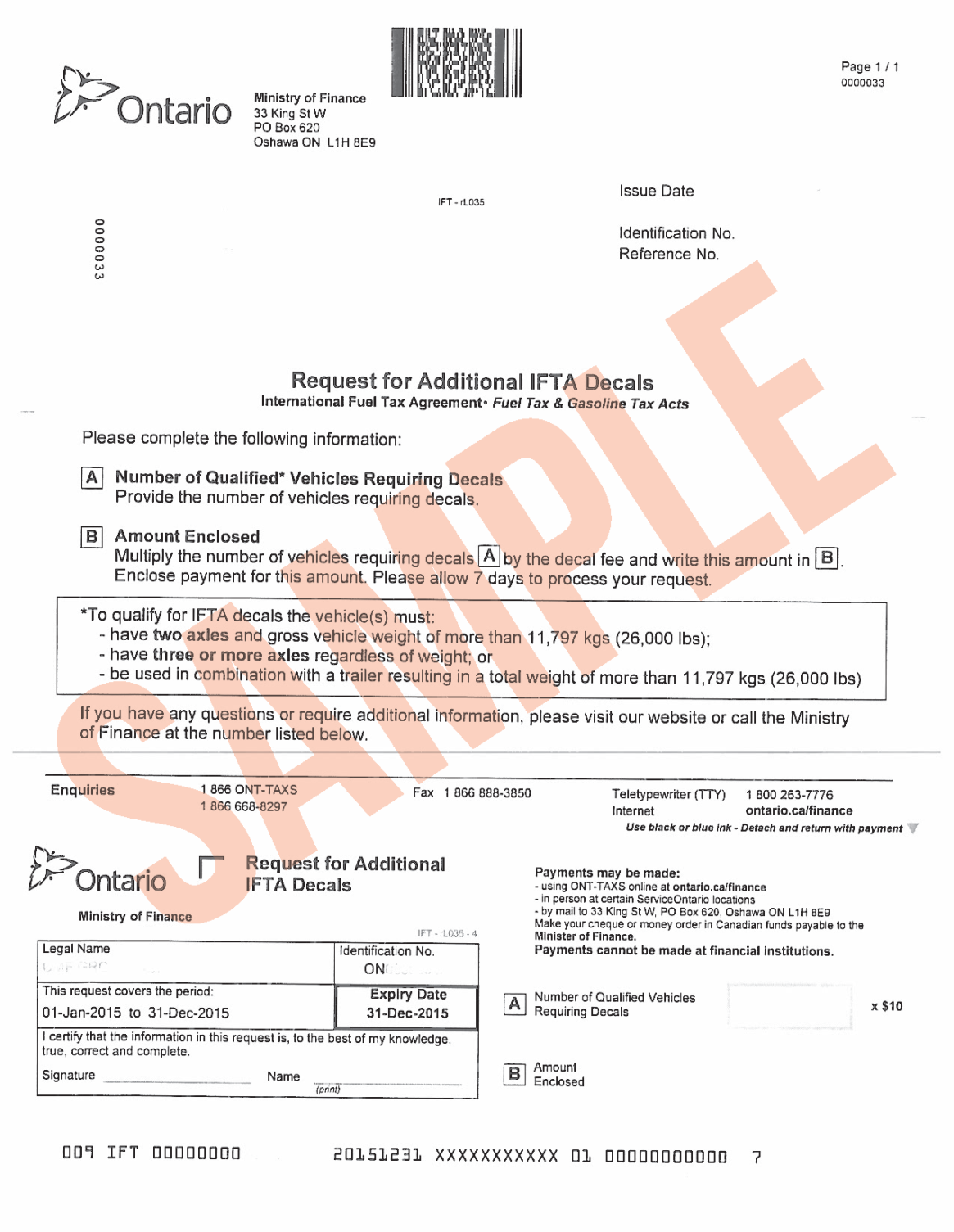

Additional IFTA decals

During the registration year, you may purchase decals for any qualified motor vehicle added to your fleet by submitting the Request for Additional Decals form that you received with your IFTA credentials. You may submit this request online through your ONT‑TAXS account, in person at the Oshawa Tax Information Centre, or by returning the completed form with your decal payment by mail to the ministry. Contact details are available at the end of this document.

Decal fees

A decal fee of $10 is charged for each set of IFTA decals that you order. The required decal fees must be paid before the ministry can issue your decals. Payment can be made by cheque or money order made payable to the Minister of Finance or by cash or debit in person at the Tax Information Centre. Contact details are available at the end of this document.

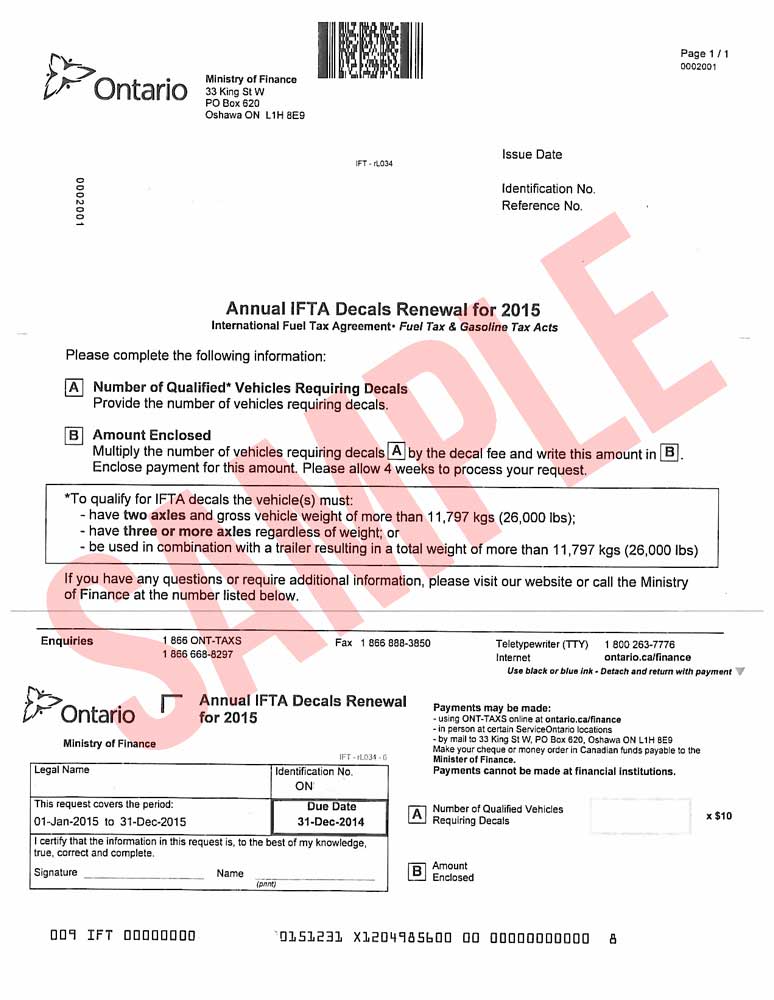

Annual licence renewal

Your IFTA licence and decals must be renewed each year before December 31. At least 30 days before your IFTA licence expires, provided your account is in good standing, you will receive the Annual Renewal Request for IFTA Decals form.

You may renew your licence online through your ONT‑TAXS account, in person at the Oshawa Tax Information Centre or by returning the completed application with your decal fee payment by mail to the ministry. Contact details are available at the end of this document.

Your renewal licence and decals will be issued after your account has been screened for compliance with all Ontario IFTA requirements. We cannot issue a renewal licence and decals if:

- your account has been cancelled or revoked

- you have failed to file a fuel tax return

- you have failed to remit any payments to Ontario to cover the liability for all IFTA-member jurisdictions

- you have shown no interjurisdictional operations over the last two quarters of the year, or

- you are not compliant with all ministry tax programs.

If you are renewing your IFTA licence and decals, you are allowed a two-month grace period to display the renewed IFTA licence and decals (credentials). If you have applied for, but not received your renewed IFTA credentials by January 1 of the licence period, you will need to continue to display your previous IFTA licence and decals until you receive your renewed IFTA credentials.

Contract agreements

Under IFTA, there may be situations where IJCs are under contract agreements or lease agreements. These agreements should detail which party, the owner of the vehicle or the carrier, is responsible for fuel tax reporting. These agreements need to specifically define the period the agreement covers. Keep a copy of the contract or rental agreement with your records indicating the party responsible for paying and reporting fuel taxes.

The following rules apply in determining who is responsible for reporting and paying fuel taxes:

Rental/leasing companies

Rental/Leasing Companies (Lessors) are companies which rent out a qualified motor vehicle, without a driver. The leases are either short term (29 days or less) or long term (30 days or more).

Short term leases

In the case of a short term motor vehicle lease, the lessor (Rental/Leasing Company) will report fuel usage unless the following two conditions are met:

- the lessor has a written rental contract which designates the lessee as the party responsible for reporting and paying the fuel tax, and

- the lessor has a copy of the lessee's IFTA fuel tax licence which is valid for the term of the rental.

Long term leases

In the case of a long term motor vehicle lease, the lessee is responsible for reporting and paying the fuel use tax. However, the lessor may apply to the ministry to be deemed the licensee and, if approved, the lessor will be responsible for reporting and paying the fuel use tax.

Independent contractors (owner/operators)

Independent Contractors differ from Rental/Leasing Companies in that they rent out both the qualified motor vehicle and the driver. The leases for Independent Contractors are either short term (29 days or less) or long term (30 days or more).

Short term leases

In the case of short term leases, the lessor (independent contractor, agent or service representative) reports and pays all fuel taxes.

Long term leases

In the case of long term leases, the lessee is responsible for reporting and paying fuel tax unless a written contract stipulates that the lessor (independent contractor, agent or service representative) will be responsible.

Household goods carriers

Household Goods Carriers (commonly known as 'moving companies') have separate rules from the above when under intermittent leases. These separate rules cover situations where a moving company hires a subcontractor to move household goods to another jurisdiction. The lessee (household goods carrier) is responsible for reporting and paying fuel tax when the qualified motor vehicle is being operated under the lessee's jurisdictional operating authority. The lessor (independent contractor) is responsible for reporting and paying fuel tax when the qualified motor vehicle is operated under the lessor's jurisdictional operating authority.

As an example, a moving company is hired to move household goods from Toronto to Calgary. The moving company then hires an independent contractor to move the household goods. The moving company (lessee) is responsible for reporting and paying fuel taxes, as the vehicle is operated under its authority. Once the goods are delivered to Calgary, the trip back by the independent contractor is under the independent contractor's authority, unless it rents out its qualified motor vehicle and driver to another moving company. The responsible party on the trip back will be the lessor (independent contractor) if the motor vehicle comes back empty or the independent contractor arranges for its own haul. However, if the independent contractor is hired by another moving company on the return trip, that moving company is responsible for reporting and paying the fuel tax.

Bus companies based in Ontario

Bus companies are required to report and pay fuel tax just as any other IJC based in Ontario.

Reporting requirements

IFTA Quarterly Tax Returns

The ministry will send an IFTA QuarterlyTax Return to you at least 30 days before each due date or you may file your returns through your ONT‑TAXS account. The Guide for Completing the International Fuel Tax Agreement Quarterly Tax Return and Schedule is available on line and is included in the IFTA registration package that is mailed to you upon registration.

Amended returns

If you need to correct a prior IFTA Quarterly Tax Return, please contact the ministry for a blank return for that reporting period.

- Mark the front page of your IFTA Quarterly Tax Return as an Amended Return.

- Ensure the reporting period dates reflect the period you are correcting.

- Fully complete the return with the correct information.

- Sign and date the return.

IFTA Quarterly Tax Returns can also be amended through your ONT‑TAXS account by completing the following steps:

- From the Financial screen, select View Return.

- Ensure the reporting period dates reflect the period you are correcting and select Amend.

- Enter the correct figures and Submit.

- Receive a Confirmation Number and either select Proceed to Payment to make a payment or select Ok if no tax is due.

Due dates

IFTA Quarterly Tax Returns must be postmarked or hand delivered by the due date shown on the top of every fuel tax return. If the due date falls on a Saturday, Sunday or a statutory holiday, the next business day is the due date. The reporting quarters and due dates are:

| IFTA Reporting Quarter | Return Due Date |

|---|---|

| 1st Quarter - January to March | April 30 |

| 2nd Quarter - April to June | July 31 |

| 3rd Quarter - July to September | October 31 |

| 4th Quarter - October to December | January 31 |

If your IFTA Quarterly Tax Return is late or full payment is not received, you will be subject to penalty and interest provisions. Failure to file a return with the ministry may result in your licence being revoked.

Reporting fuel types

The IFTA Quarterly Tax Return can be filed for one or multiple fuel types used to power your qualified motor vehicle(s). The fuel type(s) that you previously reported will be marked on the return. If you make any changes to the fuel type you are reporting, please contact the ministry to report these changes.

Reporting requirements

Once you obtain decals and put them on your qualified motor vehicle(s), you are required to report all travel of the vehicle(s) on your IFTA Quarterly Tax Return for as long as the IFTA decals are in effect. You are not permitted to exclude the travel on a fluctuating basis within the same year.

If you do not receive your IFTA Quarterly Tax Return, it remains your responsibility to file a return by the due date. Another copy may be obtained from the ministry. Contact details are available at the end of this document.

Note: You must file a complete IFTA Quarterly Tax Return each quarter even if you did not operate your vehicles in any IFTA jurisdiction or purchase any taxable fuel during the quarter.

New owner

IFTA Quarterly Tax Returns are pre‑addressed using information provided in the completed Application for IFTA Registration. IFTA licences are not transferable and returns pre‑addressed to the former owner should not be used.

Non‑standard returns

Prior approval is required if you use self-created or software-produced versions of the IFTA schedules which must provide a facsimile of the IFTA schedule. You must send a copy of your form to the Ministry of Finance for approval to ensure it meets all of the requirements before you can use your own version.

Note: Fuel and distance must be reported on the fuel tax return in litres and kilometres.

Measurements for fuel tax reporting

You must report fuel usage and distance travelled in kilometres and litres. Please convert gallons to litres and miles to kilometres by using the following table. Round your totals to the nearest whole litre or kilometre.

Conversion table

- 1 litre = 0.2642 US gallons

- 1 US gallon = 3.785 litres

- 1 mile = 1.6093 kilometres

- 1 kilometre = 0.62137 miles

Calculating total vs. taxable kilometres

IFTA requires that you report both total kilometres and taxable kilometres when filing IFTA Quarterly Tax Returns. On your return:

- include amounts for all distance travelled (both taxable and non‑taxable distance), as well as all fuel placed in the supply tank (both taxable and non‑taxable fuel), when calculating your kilometres per litres (KPL) for each fuel type. See explanation of non‑taxable fuel use below, and

- use the following formula to calculate the taxable kilometres for each jurisdiction in which you are claiming non-taxable distance.

Taxable kilometres = total kilometres per jurisdiction minus non‑taxable kilometres per jurisdiction.

Note: All jurisdictions require documentation to support a claim of non‑taxable distance.

Non-taxable distance

Non-taxable distance, which includes vehicle exemptions and distance exemptions, is allowed when your vehicle(s) qualify for an exemption that is provided by an IFTA jurisdiction. For example, some jurisdictions allow non‑taxable distance for travel on a toll highway or travel by a school bus.

Non-taxable fuel use (tax exempt fuel)

On your IFTA Quarterly Tax Return, you must report all fuel placed in the supply tank of your qualified motor vehicles as taxable. Some IFTA jurisdictions provide a refund of the tax paid on tax exempt fuel.

To claim a refund, you must submit your claim directly to each jurisdiction for tax paid on tax exempt fuel. You must maintain adequate records to support any refund claims. Contact the jurisdiction(s) directly to obtain information for any non-taxable fuel use in those jurisdictions.

To see all distance, vehicle and fuel exemptions for each jurisdiction, refer to the Exemption Database on the IFTA website.

Note: Refund claims submitted to Ontario by IFTA licensed carriers are limited by the proportion of distance travelled in Ontario to the total distance travelled during the claim period, whether or not the claimant has purchased fuel in Ontario.

1. Biodiesel

Effective April 1, 2014, biodiesel became taxable in the same way as diesel fuel.

To claim a biodiesel refund for prior periods, IFTA licensed carriers are required to submit an Application for Refund and a Calculation Worksheet showing the calculations used to determine the amount of biodiesel consumed. A copy of the IFTA Quarterly Tax Return for the period(s) covered in the refund claim must also be included. Contact details are available at the end of this document.

2. Power take off (PTO)

You may be eligible to claim a tax refund for power take-off equipment for fuel used to operate auxiliary equipment for power take-off purposes (PTO) by your licensed vehicle. Information can also be found in Power Take-Off Refunds for Interjurisdictional Carriers Licenced under the International Fuel Tax Agreement.

Do not claim a PTO refund on the regular IFTA Quarterly Tax Returns as you must obtain the appropriate forms from the ministry. You will need to include a copy of the IFTA Quarterly Tax Return for the period(s) covered, along with a Summary Worksheet showing the calculations used to determine the PTO consumption. Contact details are available at the end of this document.

Tax due and credits

When completing your IFTA Quarterly Tax Return, calculate your net tax due or credit claimed by netting the tax due andcredit amounts calculated for each jurisdiction in which you travelled for the reporting period. If the net result is tax due, you will need to send a payment to Ontario for the net tax due amount. If the net result is a credit claim, Ontario will refund the credit amount.

The IFTA Tax Rates form included with your return lists the current tax rates and surcharge rates for each IFTA member jurisdiction for that reporting quarter. In the event that a jurisdiction establishes a split tax rate for the period, you will need to refer to the complete quarterly IFTA tax rate matrices found at the IFTA website.

The tax rates chart provided by Ontario have been converted from American currency and miles to Canadian currency and a kilometre measurement. You cannot use old tax rate tables, as each quarter the tables are updated.

All tax payments should be made by cheque or money order payable to the Minister of Finance and remitted to the address noted under contact details at the end of this document.

Note: Payments cannot be made at financial institutions.

If cheques are returned by any financial institution, the ministry may assess a non‑negotiable cheque fee and will hold any refund or will use the refund amount to cover the returned cheque until full payment is received.

Failure to file a quarterly fuel tax return

Failure to file a complete fuel tax return

If you fail to file a complete IFTA Quarterly Tax Return, you will be subject to a penalty. A complete return allows the ministry to accurately report and transmit motor fuel taxes to each IFTA member jurisdiction on your behalf.

Failure to pay fuel taxes

Failure to pay the fuel taxes assessed by the due date will result in interest and penalty, and your licence may be revoked. If you do not agree with an assessment, you have 30 days from the date the assessment was mailed or personally delivered to file a Notice of Objection [PDF - 468 KB] to challenge the outcome. The tax owing on an assessment is due despite an objection being filed. If there are any tax credits pending on your account, or any credit from an audit, the credit will first be applied to any tax due, interest, or penalty owing from quarterly IFTA tax returns.

Penalty and interest provisions

Penalty

The Ministry of Finance imposes a penalty when:

- a return is filed late

- full payment for tax due is not received by the due date

- a complete fuel tax return is not filed, or

- an amended return is filed resulting in a substantial increase in tax due from that reported on the initial return.

The penalty is 5 per cent of the net tax due.

Interest charges

Interest is charged on tax due to a jurisdiction beginning on the due date of the return. It is calculated separately for each jurisdiction. If a return and full payment are not received by the due date, a full month's interest accrues for any portion of a month on which tax owed remains unpaid. If a return and full payment is not received by the due date, interest will be charged to the last day of the month in which full payment is received.

The interest rate is based on the Canadian Federal Treasury Bills rate, plus 2 per cent, adjusted every quarter. Quarterly interest rates are available by contacting the ministry.

Example: If you file your fuel tax return with a full tax payment on August 10, which is 10 days after the due date of July 31, you will be assessed a penalty and interest as shown below. In this example, the interest rate is 5 per cent per annum, and interest is calculated on the full month of August (31 days):

| Interest Calculation | Penalty Calculation | |

|---|---|---|

| Tax Due (DR) Credit (CR) on fuel tax return | Interest calculated only on tax due amounts; in this example, Ontario and Michigan. | Penalty is calculated on the net tax for the return |

Ontario $3,500 DR New York (1,000) CR Michigan 2,500 DR Net taxes $5,000 DR | Ontario interest = $14.86 New York interest = $ 0.00 Michigan Interest = $10.62 Total Interest = $25.48 | Penalty= $5,000 × 5% = $250 |

| Assessment amount | = interest + penalty = $ 25.48 + $250.00 = $ 275.48 | |

Failure to file fuel tax returns

If you fail to file your fuel tax return(s), the ministry will estimate your tax liability for each member jurisdiction based upon the information available to the ministry. Your past filing history, or a minimum amount as determined by the ministry, will be used for this tax assessment (including interest and penalty).

In these circumstances, it is your responsibility to prove that the ministry's assessment is incorrect. We suggest you file the required tax return for the period of the assessment so that the ministry can review the assessment.

The ministry may also require you to post security through a bond if you fail to file IFTA Quarterly Tax Returns.

Licence cancellation, revocation and reinstatement

Licence cancellation

You may cancel your IFTA licence when you are no longer operating qualified motor vehicles interjurisdictionally or you prefer to acquire single trip permits for interjurisdictional travel. If you wish to cancel your IFTA licence, either check the appropriate box in the top right‑hand corner of the IFTA Quarterly Tax Return and enter the last date of business or, cancel your licence through your ONT‑TAXS account.

The ministry may cancel your IFTA account if you choose not to renew your IFTA licence or you report no interjurisdictional operations over the last two quarters of the year.

If you no longer require IFTA registration, the licence may be cancelled at your request. An IFTA licence will be cancelled only if the licensee has complied with IFTA, filed all tax returns, and has paid all taxes, penalties and interest due. If an IFTA licence is cancelled, the original licence and any copies, and all decals must be destroyed. The Ministry of Finance has the discretion to conduct a final audit of your records after your IFTA account is closed. You must keep all records on which the quarterly tax returns are based for four years from the return due date or filing date, whichever is later. The ministry will notify all IFTA member jurisdictions of your cancellation.

To reactivate your cancelled account, submit a new application form to the ministry along with the required decal fee, and include your cancelled IFTA account number. Proof of travel may also be requested by the ministry.

Licence revocation

The ministry may revoke your IFTA licence, if you fail to:

- file complete quarterly returns on time

- pay taxes in full, or

- follow the ministry's record-keeping requirements.

A licence may also be revoked for an outstanding audit assessment or for failure to comply with any other requirements. A notice of revocation will be mailed to the mailing address listed on your application. The ministry will notify all IFTA member jurisdictions of your licence revocation.

For any interjurisdictional travel made while your licence is revoked, you must obtain single trip permits for each trip and for each jurisdiction, including Ontario, prior to travel.

Licence reinstatement

To reinstate your revoked IFTA licence, you must satisfy the requirements which resulted in the revocation and make all required payments. This includes payment of all taxes, penalties and interest, filing of all returns, and comply with the request for all records made by the ministry.

You will be required to complete a new application and pay the required decal fees to reactivate your account. The ministry may require that you post a bond to satisfy any potential liabilities to all member jurisdictions. The ministry will notify all IFTA member jurisdictions of your reinstatement.

Bankruptcy

If you file for bankruptcy, please notify the ministry. Contact details are available at the end of this document.

Bond requirements

IFTA registrants are not normally required to post a bond with Ontario. However, you may be required if you failed to file IFTA Quarterly Tax Returns, pay taxes, penalties or interest in the time allowed, or if an audit reveals that a guarantee is necessary to protect the interests of IFTA member jurisdictions.

You may also be required to post a bond if a cheque is returned by your banking institution, or to reinstate an account that has been previously revoked.

Recordkeeping requirements

Record retention period

You must maintain records to prove that the information reported on your fuel tax return is accurate. You must keep these records for four years from the return due date or filing date, whichever is later. You may keep the records on paper, microfilm, microfiche, or computerized storage system. You must be able to provide these records in a form acceptable to the ministry.

Distance records

Distance records must be maintained to show operations on an individual vehicle basis. This includes proof of taxable and non-taxable fuel use and taxable and non‑taxable distance travelled. A trip report is an acceptable source document.

The records must include:

- start and end dates of a trip

- point of origin and the destination

- list of highways used when leaving and entering a jurisdiction

- odometer or hubodometer readings at the beginning and end of each trip, as well as at each jurisdiction's borders

- total trip distance

- distance travelled in each jurisdiction (odometer or hubodometer readings at jurisdictional line)

- power unit number or vehicle identification number (VIN)

- fleet number or unit number of vehicle

- name of the registrant, and

- total trip distance.

Fuel records

Keep a complete record of all fuel purchased, received, and used in the operation of your vehicles. This includes proof of taxable and non-taxable fuel use. Separate totals must be calculated for each fuel type.

All original fuel receipts or invoices must include:

- date of fuel purchase

- seller's name and address

- number of litres purchased

- fuel tax paid on number of litres

- type of fuel

- price per litre or total amount of fuel sale

- unit numbers of the vehicles in which the fuel was placed

- purchaser's name - for contract or rental agreement, receipts will be accepted as long as the name on the contract provides a legal connection to the reporting party, and

- amount of fuel purchased while travelling under a single trip permit - you are required to keep a copy of your single trip permit.

Keep a copy of the contract agreement indicating the party responsible for reporting and paying the motor fuel use taxes. Refer to Contract agreements for details on who is responsible for reporting.

Acceptable fuel receipts include an invoice, credit card receipt, automated vendor‑generated invoices or transaction listings. Supplier's statements are not acceptable fuel receipts. Altered receipts will not be accepted.

Bulk fuel storage

If you own, lease or control a bulk storage facility, you may obtain credit for any tax paid on the fuel withdrawn from that storage facility and placed into the fuel tank of a qualified motor vehicle. You may claim the credit against the jurisdiction in which you purchased the bulk fuel and paid fuel tax.

All invoices for bulk fuel purchases must be kept and your records must distinguish between fuel placed in qualified motor vehicles and non‑qualified motor vehicles (such as cars, pickup trucks, small trucks, recreation vehicles or non-highway vehicles such as construction equipment and unlicenced farm vehicles) and third party sales. The records must show non-highway vehicles, such as construction equipment and farm vehicles, using bulk fuel.

Your records must contain the following information:

- date of withdrawal

- number of litres withdrawn

- fuel type

- unit number of the vehicle in which the fuel was placed

- purchase and inventory records to substantiate that tax was paid on all bulk purchases, and

- location of the bulk storage facility.

Decal inventory log

A record should be maintained identifying IFTA decals assigned to each IFTA qualified unit.

Records to support non‑taxable distance

Keep appropriate records to support non‑taxable distance travelled which you have claimed on your IFTA Quarterly Tax Return.

Audits

Audit approach and standards

Tax audits for all fuel types will be conducted by Ontario auditors on behalf of Ontario and all IFTA member jurisdictions in which your qualified motor vehicles travelled.

When you are selected for an audit, the ministry will contact you in advance to schedule the audit at a mutually convenient time. The ministry will advise you of the time period to be audited and the records to be reviewed.

If you do not keep your records in Ontario and the ministry must send its auditor to another jurisdiction, you will be required to pay all travel expenses connected with your audit.

Ontario's audits conform to the standards documented in the IFTA Audit Manual.

Audit communications

At the beginning of the audit, the auditor will meet with you to discuss such topics as your operation, audit procedures, records to be examined and the ministry's sampling methodology. Upon completion of the audit, the auditor will discuss the preliminary findings with you and recommend how to improve or simplify your record-keeping.

Non‑compliant record

If your records are non-compliant or lacking sufficient detail to support the information filed on your returns or to determine your tax liability, the auditor may take one or more of the following actions:

- estimate your distance travelled and fuel consumption based on your reporting history or the history of a similar operation

- apply a standard average 1.7 KPL (diesel) or 1.2 KPL (gasoline) or 1.0 KPL (propane) in calculating your tax liability, or

- not allow your unsupported claims for exemptions and tax paid purchases.

Note: Failure to keep proper records may result in revocation of your IFTA licence.

Audit results

The ministry will send you its audit findings which will address the completeness and accuracy of your records, including any areas where you need to take corrective action.

The ministry will send the audit results to the IFTA jurisdictions in which your qualified motor vehicles travelled. If the ministry's auditor finds that you owe taxes to any member jurisdiction, you are required to pay the tax, penalty and interest owed directly to the ministry, your base jurisdiction. The ministry will distribute your payment to each member jurisdiction. If the ministry finds that an IFTA jurisdiction owes you money, the ministry will credit your account for the amount owed to you by the other IFTA jurisdiction(s).

Audits are completed by Ontario's auditors; however, representatives of other IFTA member jurisdictions may join the audit if they wish. If another IFTA member jurisdiction chooses to re‑audit the ministry's findings, the auditors of the member jurisdiction must use the same sample period used during the original audit and conduct the re-audit in cooperation with Ontario's auditors.

Appeals

30‑day objection period

If you do not agree with an assessment, re‑assessment or disallowance of a refund claim, you may ask for an administrative review by filing a Notice of Objection. You are obligated to pay all amounts due even if the decision on your objection is outstanding.

Your objection must be filed within 30 days of the date of the original notice. If you do not file your objection within 30 days, the action or finding is final.

Decision on your objection

The ministry will provide you with its findings and decision on your objection. If the dispute involves an audit and you continue to disagree with the decision, you may request each jurisdiction in which you operate to audit your records. However, the jurisdiction may deny the request.

Jurisdiction(s) that agree to audit your records will audit only the information involving your operations within their jurisdiction. You will be responsible for all costs related to these audits.

Glossary

Auxiliary equipment

Equipment of a motor vehicle which is powered by motor fuel from the vehicle's fuel tank, but which is not used to propel the vehicle. Under certain circumstances, the operator may claim a Power Take-off refund for tax paid on the fuel used in the auxiliary equipment.

Base jurisdiction

The jurisdiction where qualified motor vehicles are based for vehicle registration purposes, where the operational control and operational records of the licensee's qualified motor vehicles are maintained or can be made available, and where some travel is accrued by qualified motor vehicles within the fleet.

Federal business number (BN)

The federal Business Number is a common identifier used in Canada which allows businesses to simplify their dealings with all levels of the public sector and each other.

To register a business for a business number, contact:

Canada Revenue Agency

1 800 959-5525

www.cra-arc.gc.ca

Hubodometer

The meter on the wheel of a tractor used to record mileage.

IFTA

International Fuel Tax Agreement

IFTA, Inc.

International Fuel Tax Association, Inc.

IFTA, Inc. was formed to assist member jurisdictions in the administration of the International Fuel Tax Agreement. Additional information is available at IFTA, Inc.

IJC

Interjurisdictional Carrier

Ministry

Ontario Ministry of Finance

Non‑taxable distance

Kilometres travelled that are not subject to the motor fuels use tax. Also kilometres travelled by an exempt vehicle. Each jurisdiction has its own unique definition of non-taxable kilometres and may include distance travelled in non‑member jurisdictions, any non‑taxable kilometres allowed by a jurisdiction, and travel during a valid period of a single trip permit.

Note: All jurisdictions require documentation to support a claim of tax exempt kilometres. Ontario does not have tax exempt kilometres on vehicles.

ONT‑TAXS

ONT‑TAXS online is the Government of Ontario's secure, convenient and free online tax service for businesses and their representatives, available 24 hours a day, seven days a week.

Qualified motor vehicle

A motor vehicle used, designed, or maintained for transportation of persons or property, not including recreational vehicles, and:

- having two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or 11,797 kilograms, or

- having three or more axles regardless of weight, or

- is used in combination with a trailer, when the weight of such combination exceeds 26,000 pounds or 11,797 kilograms gross vehicle or registered gross vehicle weight.

Recreational vehicles

Vehicles such as motor homes, pickup trucks with attached campers, and buses when used exclusively for personal pleasure by an individual. In order to qualify as a recreational vehicle, the vehicle shall not be used in connection with any business endeavour.

Single trip permit

A permit that allows conditional travel in a jurisdiction. Single trip permits may be purchased from authorized single trip permit agencies on a trip‑by‑trip basis. Single trip permits may include fees for registration, weight distance tax, fuels tax, other elements, or a combination of these. A trip permit expires when you leave a jurisdiction or at the end of a specified time period.

Appendix A

IFTA member jurisdictions

Canadian Provinces

- AB - Alberta

- BC - British Columbia

- MB - Manitoba

- NB - New Brunswick

- NL - Newfoundland

- NS - Nova Scotia

- ON - Ontario

- PE - Prince Edward Island

- QC - Quebec

- SK - Saskatchewan

United States

- AL - Alabama

- AR - Arkansas

- AZ - Arizona

- CA - California

- CO - Colorado

- CT - Connecticut

- DE - Delaware

- FL - Florida

- GA - Georgia

- IA - Iowa

- ID - Idaho

- IL - Illinois

- IN - Indiana

- KS - Kansas

- KY - Kentucky

- LA - Louisiana

- ME - Maine

- MD - Maryland

- MA - Massachusetts

- MI - Michigan

- MN - Minnesota

- MS - Mississippi

- MO - Missouri

- MT - Montana

- NE - Nebraska

- NV - Nevada

- NH - New Hampshire

- NJ - New Jersey

- NM - New Mexico

- NY - New York

- NC - North Carolina

- ND - North Dakota

- OH - Ohio

- OK - Oklahoma

- OR - Oregon

- PA - Pennsylvania

- RI - Rhode Island

- SC - South Carolina

- SD - South Dakota

- TN - Tennessee

- TX - Texas

- UT - Utah

- VT - Vermont

- VA - Virginia

- WA - Washington

- WI - Wisconsin

- WV - West Virginia

- WY - Wyoming

Appendix B

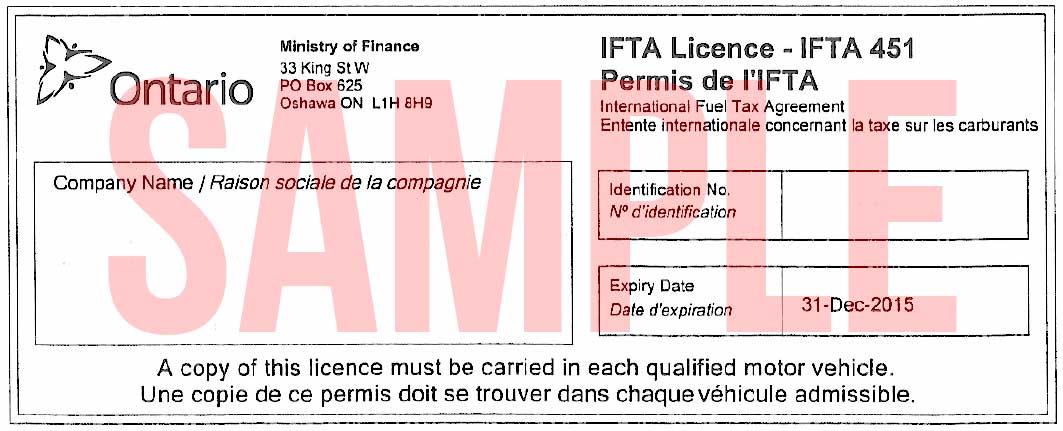

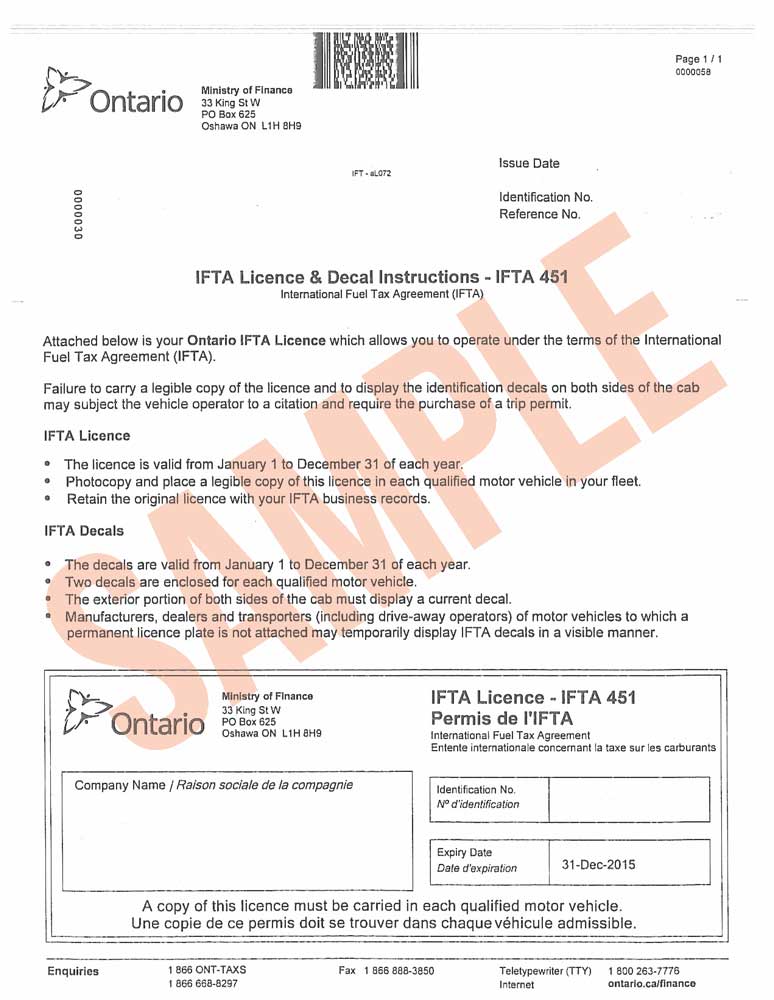

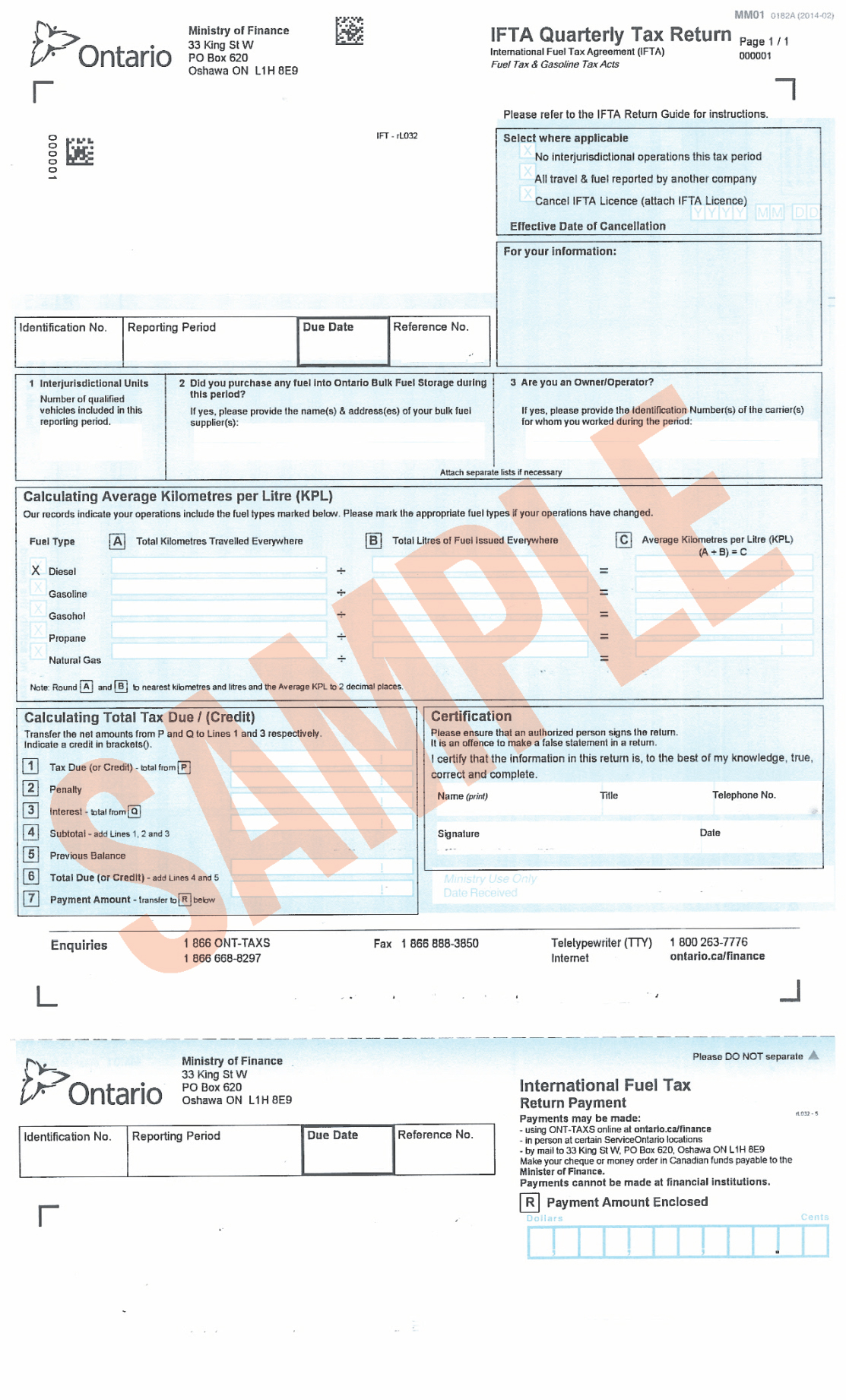

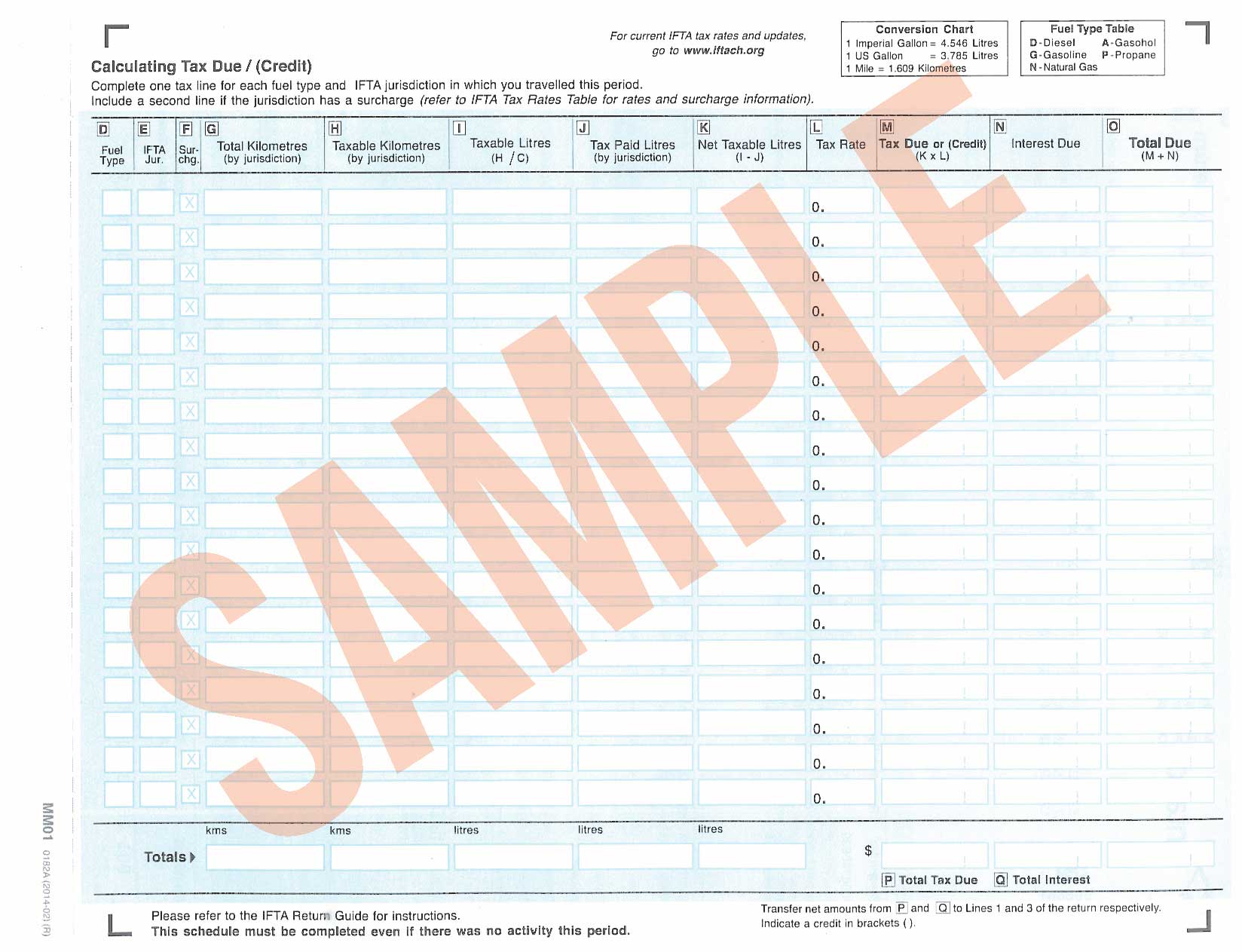

Samples of IFTA forms, schedules and tax returns for Ontario

IFTA Licence and Decal Instructions

Request for Additional Decals - IFTA

Application for IFTA Registration - IFTA

IFTA Quarterly Tax Return

Annual Request for Decals Renewal

Contact information

Phone numbers

- 1 866 ONT-TAXS (1 866 668-8297)

- Teletypewriter (TTY): 1 800 263-7776

- Fax: 905 433-5680

Ministry of Finance website

General IFTA inquiries

email: financecommunications.fin@ontario.ca

Addresses

Tax information centre (walk in registration and payments)

Ministry of Finance

33 King Street West

PO Box 620

Oshawa ON L1H 8H5

Opening hours: Monday - Friday, 8:30 a.m. to 4:00 p.m.

Tax and decal fee payments

Ministry of Finance

33 King Street West

PO Box 620

Oshawa ON L1H 8H5

Objections to an assessment

Ministry of Finance

Advisory, Objections, Appeals and Services Branch

33 King Street West

PO Box 699

Station A

Oshawa ON L1H 8S6

For more information

Ministry of Finance

IFTA Program

33 King Street West

PO Box 625

Oshawa ON L1H 8H9