We've moved this content over from an older government website. We'll align this page with the ontario.ca style guide in future updates.

Land Transfer Tax - Additional Information Collection

On April 24, 2017, the Province began collecting additional information from persons who purchase or acquire at least one and not more than six single family residences, or agricultural land, through the Prescribed Information for the Purposes of Section 5.0.1 Form (Form).

This report is based on the additional information data (referenced above) for properties registered in the Province. The annual tables below are based on registered property transfers reported to the Ministry between April 24, 2017 and December 31, 2024 and include a breakdown based on transactions in the Greater Golden Horseshoe Region (GGH), outside of the GGH, and Ontario as a whole.

Note: This analysis cannot be used to derive the amount of Non-Resident Speculation Tax (NRST) collected or transactions subject to the NRST, as some foreign transactions were subject to transitional relief or exempt from NRST. Please see Non-Resident Speculation Tax Collected.

Purchases by Foreign Entities – GGH and Non-GGH Regions, 2024

| Land Registry Office (LRO) | Total Transactions (A) | Foreign Transactions (B) | Foreign Transactions (%) (C = B / A) |

|---|---|---|---|

| GGH Total | 223,317 | 1,454 | 0.7 |

| Brant | 3,949 | 10 | 0.3 |

| Durham | 16,752 | 49 | 0.3 |

| Halton | 15,505 | 71 | 0.5 |

| Niagara North and South | 13,732 | 66 | 0.5 |

| Peel | 24,263 | 140 | 0.6 |

| Peterborough | 4,313 | 12 | 0.3 |

| Simcoe | 17,938 | 53 | 0.3 |

| Toronto | 58,465 | 695 | 1.2 |

| Victoria | 2,666 | 6 | 0.2 |

| Waterloo | 13,557 | 85 | 0.6 |

| Wellington | 6,997 | 11 | 0.2 |

| Wentworth | 11,530 | 46 | 0.4 |

| York Region | 27,068 | 197 | 0.7 |

| Other GGH Regions | 6,582 | 13 | 0.2 |

| Non-GGH Total | 127,361 | 791 | 0.6 |

| Algoma | 3,616 | 37 | 1.0 |

| Bruce | 2,716 | 11 | 0.4 |

| Cochrane | 2,372 | 14 | 0.6 |

| Elgin | 2,861 | 9 | 0.3 |

| Essex | 10,649 | 68 | 0.6 |

| Frontenac | 4,094 | 43 | 1.1 |

| Grey | 3,641 | 11 | 0.3 |

| Hastings | 4,222 | 15 | 0.4 |

| Huron | 1,841 | 8 | 0.4 |

| Kenora | 1,577 | 82 | 5.2 |

| Kent | 2,937 | 15 | 0.5 |

| Lambton | 3,369 | 15 | 0.4 |

| Lanark | 2,625 | 9 | 0.3 |

| Leeds | 2,235 | 33 | 1.5 |

| Manitoulin | 738 | 8 | 1.1 |

| Middlesex | 11,182 | 38 | 0.3 |

| Muskoka | 4,412 | 34 | 0.8 |

| Nipissing | 2,596 | 13 | 0.5 |

| Ottawa | 22,106 | 143 | 0.6 |

| Oxford | 3,318 | 9 | 0.3 |

| Parry Sound | 3,064 | 31 | 1.0 |

| Perth | 2,081 | 6 | 0.3 |

| Rainy River | 704 | 34 | 4.8 |

| Renfrew | 3,667 | 12 | 0.3 |

| Stormont | 1,975 | 7 | 0.4 |

| Sudbury | 4,831 | 22 | 0.5 |

| Thunder Bay | 4,184 | 27 | 0.6 |

| Timiskaming | 1,289 | 9 | 0.7 |

| Other Non-GGH Regions | 12,459 | 28 | 0.2 |

| Ontario Total | 350,678 | 2,245 | 0.6 |

| Agricultural Land (Ontario Total) | 578 | 8 | 1.4 |

Purchases by Foreign Entities – GGH and Non-GGH Regions, 2023

| Land Registry Office (LRO) | Total Transactions (A) | Foreign Transactions (B) | Foreign Transactions (%) (C = B / A) |

|---|---|---|---|

| GGH Total | 180,502 | 1,294 | 0.7 |

| Brant | 3,939 | 14 | 0.4 |

| Dufferin | 1,366 | 7 | 0.5 |

| Durham | 14,880 | 56 | 0.4 |

| Halton | 12,212 | 62 | 0.5 |

| Niagara North & South | 10,698 | 67 | 0.6 |

| Northumberland | 2,461 | 6 | 0.2 |

| Peel | 18,958 | 114 | 0.6 |

| Peterborough | 2,888 | 16 | 0.6 |

| Simcoe | 14,065 | 35 | 0.2 |

| Toronto | 44,361 | 569 | 1.3 |

| Victoria | 1,927 | 10 | 0.5 |

| Waterloo | 12,317 | 77 | 0.6 |

| Wellington | 4,646 | 13 | 0.3 |

| Wentworth | 10,966 | 34 | 0.3 |

| York | 23,491 | 209 | 0.9 |

| Other GGH Regions | 1,327 | 5 | 0.4 |

| Non-GGH Total | 90,121 | 656 | 0.7 |

| Algoma | 2,406 | 30 | 1.2 |

| Bruce | 1,823 | 26 | 1.4 |

| Elgin | 2,052 | 7 | 0.3 |

| Essex | 8,056 | 56 | 0.7 |

| Frontenac | 2,812 | 29 | 1.0 |

| Grey | 2,642 | 9 | 0.3 |

| Hastings | 2,814 | 9 | 0.3 |

| Huron | 1,320 | 7 | 0.5 |

| Kenora | 1,136 | 46 | 4.0 |

| Kent | 2,227 | 12 | 0.5 |

| Lambton | 2,515 | 13 | 0.5 |

| Lanark | 1,717 | 7 | 0.4 |

| Leeds | 1,393 | 24 | 1.7 |

| Manitoulin | 357 | 6 | 1.7 |

| Middlesex | 8,580 | 38 | 0.4 |

| Muskoka | 2,395 | 26 | 1.1 |

| Nipissing | 1,673 | 8 | 0.5 |

| Ottawa | 17,663 | 144 | 0.8 |

| Oxford | 2,690 | 8 | 0.3 |

| Parry Sound | 1,500 | 17 | 1.1 |

| Rainy River | 380 | 24 | 6.3 |

| Renfrew | 2,357 | 15 | 0.6 |

| Stormont | 1,249 | 6 | 0.5 |

| Sudbury | 3,385 | 27 | 0.8 |

| Thunder Bay | 2,935 | 28 | 1.0 |

| Other Non-GGH Regions | 12,044 | 34 | 0.3 |

| Ontario Total | 270,623 | 1,950 | 0.7 |

| Agricultural Land (Ontario Total) | 2,873 | 50 | 1.7 |

Note: Numbers in table above may not add due to rounding.

Purchases by Foreign Entities – GGH and Non-GGH Regions, 2022

| Land Registry Office (LRO) | Total Transactions (A) | Foreign Transactions (B) | Foreign Transactions (%) (C = B / A) |

|---|---|---|---|

| GGH Total | 236,881 | 2,345 | 1.0 |

| Brant | 4,788 | 24 | 0.5 |

| Durham | 19,328 | 61 | 0.3 |

| Haldimand | 1,825 | 7 | 0.4 |

| Halton | 14,485 | 108 | 0.7 |

| Niagara South & North | 14,110 | 116 | 0.8 |

| Northumberland | 3,294 | 13 | 0.4 |

| Peel | 27,936 | 160 | 0.6 |

| Peterborough | 4,021 | 25 | 0.6 |

| Simcoe | 16,840 | 61 | 0.4 |

| Toronto | 63,985 | 1,253 | 2.0 |

| Victoria | 2,337 | 8 | 0.3 |

| Waterloo | 15,690 | 103 | 0.7 |

| Wellington | 6,120 | 17 | 0.3 |

| Wentworth | 12,634 | 55 | 0.4 |

| York | 27,674 | 328 | 1.2 |

| Other GGH Regions | 1,814 | 6 | 0.3 |

| Non-GGH Total | 127,162 | 3,595 | 2.8 |

| Algoma | 3,355 | 53 | 1.6 |

| Bruce | 2,342 | 18 | 0.8 |

| Cochrane | 2,207 | 12 | 0.5 |

| Elgin | 2,919 | 14 | 0.5 |

| Essex | 11,195 | 146 | 1.3 |

| Frontenac | 4,194 | 56 | 1.3 |

| Grenville | 1,024 | 7 | 0.7 |

| Grey | 3,385 | 14 | 0.4 |

| Haliburton | 1,152 | 14 | 1.2 |

| Hastings | 3,616 | 19 | 0.5 |

| Huron | 1,795 | 16 | 0.9 |

| Kenora | 1,433 | 58 | 4.0 |

| Kent | 3,379 | 23 | 0.7 |

| Lambton | 3,308 | 22 | 0.7 |

| Lanark | 2,157 | 13 | 0.6 |

| Leeds | 1,959 | 52 | 2.7 |

| Lennox | 1,366 | 6 | 0.4 |

| Manitoulin | 451 | 15 | 3.3 |

| Middlesex | 15,538 | 2,309 | 14.9 |

| Muskoka | 3,010 | 32 | 1.1 |

| Nipissing | 2,540 | 27 | 1.1 |

| Norfolk | 2,011 | 8 | 0.4 |

| Ottawa | 24,760 | 425 | 1.7 |

| Oxford | 3,811 | 23 | 0.6 |

| Parry Sound | 1,937 | 34 | 1.8 |

| Perth | 2,104 | 19 | 0.9 |

| Prescott | 888 | 9 | 1.0 |

| Rainy River | 527 | 23 | 4.4 |

| Renfrew | 3,226 | 18 | 0.6 |

| Russell | 2,020 | 16 | 0.8 |

| Stormont | 1,787 | 12 | 0.7 |

| Sudbury | 4,796 | 46 | 1.0 |

| Thunder Bay | 3,574 | 26 | 0.7 |

| Other Non-GGH Regions | 3,396 | 10 | 0.3 |

| Ontario Total | 364,043 | 5,940 | 1.6 |

| Agricultural Land (Ontario Total) | 3,624 | 54 | 1.5 |

Note: Numbers in table above may not add due to rounding.

Purchases by Foreign Entities – GGH and Non-GGH Regions, 2021

| Land Registry Office (LRO) | Total Transactions (A) | Foreign Transactions (B) | Foreign Transactions (%) (C = B / A) |

|---|---|---|---|

| GGH Total | 269,316 | 3,173 | 1.2 |

| Brant | 4,697 | 17 | 0.4 |

| Dufferin | 2,047 | 9 | 0.4 |

| Durham | 20,654 | 79 | 0.4 |

| Halton | 18,087 | 141 | 0.8 |

| Niagara South & North | 16,079 | 136 | 0.8 |

| Northumberland | 3,484 | 8 | 0.2 |

| Peel | 35,399 | 244 | 0.7 |

| Peterborough | 4,454 | 21 | 0.5 |

| Simcoe | 20,019 | 70 | 0.3 |

| Toronto | 69,740 | 1,712 | 2.5 |

| Victoria | 2,635 | 9 | 0.3 |

| Waterloo | 16,423 | 132 | 0.8 |

| Wellington | 6,487 | 38 | 0.6 |

| Wentworth | 16,062 | 103 | 0.6 |

| York | 33,049 | 454 | 1.4 |

| Other GGH Regions | N/A | N/A | N/A |

| Non-GGH Total | 132,516 | 1,669 | 1.3 |

| Algoma | 3,626 | 40 | 1.1 |

| Bruce | 2,560 | 22 | 0.9 |

| Cochrane | 2,167 | 20 | 0.9 |

| Elgin | 699 | 5 | 0.7 |

| Dundas | 2,976 | 18 | 0.6 |

| Essex | 11,391 | 153 | 1.3 |

| Frontenac | 4,517 | 76 | 1.7 |

| Grey | 3,768 | 21 | 0.6 |

| Haliburton | 1,326 | 9 | 0.7 |

| Hastings | 4,196 | 27 | 0.6 |

| Huron | 1,866 | 6 | 0.3 |

| Kenora | 1,470 | 41 | 2.8 |

| Kent | 3,176 | 27 | 0.9 |

| Lambton | 3,683 | 32 | 0.9 |

| Lanark | 2,659 | 15 | 0.6 |

| Leeds | 2,069 | 31 | 1.5 |

| Lennox | 1,456 | 5 | 0.3 |

| Manitoulin | 486 | 7 | 1.4 |

| Middlesex | 14,763 | 290 | 2.0 |

| Muskoka | 3,600 | 32 | 0.9 |

| Nipissing | 2,522 | 20 | 0.8 |

| Ottawa | 26,065 | 519 | 2.0 |

| Oxford | 3,761 | 28 | 0.7 |

| Parry Sound | 2,142 | 38 | 1.8 |

| Perth | 2,228 | 12 | 0.5 |

| Prescott | 1,143 | 6 | 0.5 |

| Rainy River | 466 | 18 | 3.9 |

| Renfrew | 3,469 | 23 | 0.7 |

| Russell | 2,025 | 11 | 0.5 |

| Stormont | 1,843 | 10 | 0.5 |

| Sudbury | 4,941 | 49 | 1.0 |

| Thunder Bay | 3,370 | 41 | 1.2 |

| Timiskaming | 1,125 | 5 | 0.4 |

| Other Non-GGH Regions | 4,962 | 12 | 0.2 |

| Ontario Total | 401,832 | 4,842 | 1.2 |

| Agricultural Land (Ontario Total) | 4,134 | 51 | 1.2 |

Note: Numbers in table above may not add due to rounding.

Purchases by Foreign Entities – GGH and Non-GGH Regions, 2020

| Land Registry Office (LRO) | Total Transactions (A) | Foreign Transactions (B) | Foreign Transactions (%) (C = B / A) |

|---|---|---|---|

| GGH Total | 223,818 | 2,826 | 1.3 |

| Brant | 4,055 | 12 | 0.3 |

| Dufferin | 1,820 | 10 | 0.5 |

| Durham | 18,231 | 89 | 0.5 |

| Haldimand | 1,511 | 5 | 0.3 |

| Halton | 14,999 | 150 | 1.0 |

| Niagara South & North | 13,941 | 129 | 0.9 |

| Northumberland | 3,235 | 9 | 0.3 |

| Peel | 27,122 | 196 | 0.7 |

| Peterborough | 3,865 | 26 | 0.7 |

| Simcoe | 17,732 | 61 | 0.3 |

| Toronto | 55,570 | 1,384 | 2.5 |

| Victoria | 2,399 | 5 | 0.2 |

| Waterloo | 13,468 | 111 | 0.8 |

| Wellington | 5,886 | 31 | 0.5 |

| Wentworth | 13,760 | 91 | 0.7 |

| York | 26,224 | 517 | 2.0 |

| Non-GGH Total | 115,754 | 1,519 | 1.3 |

| Algoma | 2,777 | 41 | 1.5 |

| Bruce | 2,349 | 14 | 0.6 |

| Cochrane | 1,684 | 9 | 0.5 |

| Elgin | 2,681 | 12 | 0.4 |

| Essex | 10,205 | 136 | 1.3 |

| Frontenac | 4,086 | 67 | 1.6 |

| Grenville | 1,026 | 8 | 0.8 |

| Grey | 3,393 | 22 | 0.6 |

| Haliburton | 1,242 | 7 | 0.6 |

| Hastings | 3,713 | 19 | 0.5 |

| Huron | 1,576 | 12 | 0.8 |

| Kenora | 1,198 | 50 | 4.2 |

| Kent | 2,719 | 14 | 0.5 |

| Lambton | 3,357 | 23 | 0.7 |

| Lanark | 2,263 | 10 | 0.4 |

| Leeds | 1,858 | 35 | 1.9 |

| Lennox | 1,339 | 7 | 0.5 |

| Manitoulin | 417 | 7 | 1.7 |

| Middlesex | 12,079 | 237 | 2.0 |

| Muskoka | 3,159 | 41 | 1.3 |

| Nipissing | 2,087 | 18 | 0.9 |

| Norfolk | 1,979 | 9 | 0.5 |

| Ottawa | 24,472 | 526 | 2.1 |

| Oxford | 3,405 | 14 | 0.4 |

| Parry Sound | 2,109 | 36 | 1.7 |

| Perth | 1,943 | 8 | 0.4 |

| Prescott | 1,016 | 12 | 1.2 |

| Prince Edward | 944 | 6 | 0.6 |

| Rainy River | 439 | 29 | 6.6 |

| Renfrew | 3,132 | 16 | 0.5 |

| Russell | 1,931 | 7 | 0.4 |

| Stormont | 1,662 | 5 | 0.3 |

| Sudbury | 4,334 | 28 | 0.6 |

| Thunder Bay | 3,180 | 34 | 1.1 |

| Other Non-GGH Regions | N/A | N/A | N/A |

| Ontario Total | 339,572 | 4,345 | 1.3 |

| Agricultural Land (Ontario Total) | 3,452 | 34 | 1.0 |

Note: Numbers in table above may not add due to rounding.

Purchases by Foreign Entities – GGH and Non-GGH Regions, 2019

| Land Registry Office (LRO) | Total Transactions (A) | Foreign Transactions (B) | Foreign Transactions (%) (C = B / A) |

|---|---|---|---|

| GGH Total | 212,576 | 3,297 | 1.6 |

| Brant | 3,737 | 11 | 0.3 |

| Durham | 16,452 | 82 | 0.5 |

| Haldimand | 1,521 | 9 | 0.6 |

| Halton | 14,686 | 122 | 0.8 |

| Niagara South & North | 12,453 | 126 | 1.0 |

| Northumberland | 2,809 | 8 | 0.3 |

| Peel | 26,003 | 248 | 1.0 |

| Peterborough | 3,829 | 26 | 0.7 |

| Simcoe | 15,225 | 56 | 0.4 |

| Toronto | 56,671 | 1,869 | 3.3 |

| Victoria | 2,099 | 5 | 0.2 |

| Waterloo | 13,630 | 157 | 1.2 |

| Wellington | 5,385 | 22 | 0.4 |

| Wentworth | 13,210 | 67 | 0.5 |

| York | 24,866 | 489 | 2.0 |

| Other GGH Regions | N/A | N/A | N/A |

| Non-GGH Total | 113,804 | 1,754 | 1.5 |

| Algoma | 2,837 | 67 | 2.4 |

| Bruce | 2,413 | 17 | 0.7 |

| Dundas | 507 | 6 | 1.2 |

| Elgin | 2,565 | 15 | 0.6 |

| Essex | 10,449 | 193 | 1.8 |

| Frontenac | 4,117 | 69 | 1.7 |

| Grey | 2,969 | 19 | 0.6 |

| Haliburton | 1,102 | 8 | 0.7 |

| Hastings | 3,476 | 12 | 0.3 |

| Huron | 1,544 | 13 | 0.8 |

| Kenora | 1,215 | 91 | 7.5 |

| Kent | 2,807 | 26 | 0.9 |

| Lambton | 3,189 | 17 | 0.5 |

| Lanark | 2,175 | 22 | 1.0 |

| Leeds | 1,830 | 45 | 2.5 |

| Lennox | 1,242 | 6 | 0.5 |

| Manitoulin | 434 | 14 | 3.2 |

| Middlesex | 12,361 | 254 | 2.1 |

| Muskoka | 2,779 | 28 | 1.0 |

| Nipissing | 2,001 | 21 | 1.0 |

| Norfolk | 1,864 | 5 | 0.3 |

| Ottawa | 23,436 | 515 | 2.2 |

| Oxford | 3,345 | 18 | 0.5 |

| Parry Sound | 1,697 | 31 | 1.8 |

| Perth | 1,925 | 10 | 0.5 |

| Prescott | 931 | 5 | 0.5 |

| Prince Edward | 752 | 5 | 0.7 |

| Rainy River | 515 | 46 | 8.9 |

| Renfrew | 2,792 | 13 | 0.5 |

| Russell | 1,823 | 14 | 0.8 |

| Stormont | 1,613 | 70 | 4.3 |

| Sudbury | 3,967 | 34 | 0.9 |

| Thunder Bay | 831 | 8 | 1.0 |

| Timiskaming | 3,180 | 31 | 1.0 |

| Other Non-GGH Regions | 3,121 | 6 | 0.2 |

| Ontario Total | 326,380 | 5,051 | 1.5 |

| Agricultural Land (Ontario Total) | 3,685 | 126 | 0.7 |

Note: Numbers in table above may not add due to rounding.

Purchases by Foreign Entities – GGH and Non-GGH Regions, 2018

| Land Registry Office (LRO) | Total Transactions (A) | Foreign Transactions (B) | Foreign Transactions (%) (C = B / A) |

|---|---|---|---|

| GGH Total | 204,325 | 3,913 | 1.9 |

| Brant | 3,452 | 27 | 0.8 |

| Dufferin | 1,732 | 9 | 0.5 |

| Durham | 14,696 | 112 | 0.8 |

| Haldimand | 1,596 | 9 | 0.6 |

| Halton | 15,042 | 174 | 1.2 |

| Niagara South & North | 12,513 | 153 | 1.2 |

| Northumberland | 2,819 | 8 | 0.3 |

| Peel | 25,722 | 378 | 1.5 |

| Peterborough | 3,709 | 31 | 0.8 |

| Simcoe | 15,360 | 75 | 0.5 |

| Toronto | 52,020 | 1,923 | 3.7 |

| Victoria | 2,177 | 9 | 0.4 |

| Waterloo | 12,562 | 196 | 1.6 |

| Wellington | 5,542 | 33 | 0.6 |

| Wentworth | 11,661 | 104 | 0.9 |

| York | 23,722 | 672 | 2.8 |

| Non-GGH Total | 109,812 | 1,795 | 1.6 |

| Algoma | 2,543 | 58 | 2.3 |

| Bruce | 2,472 | 23 | 0.9 |

| Cochrane | 1,327 | 6 | 0.5 |

| Elgin | 2,392 | 11 | 0.5 |

| Essex | 10,286 | 209 | 2.0 |

| Frontenac | 3,982 | 65 | 1.6 |

| Glengarry | 575 | 5 | 0.9 |

| Grey | 2,952 | 18 | 0.6 |

| Haliburton | 1,069 | 14 | 1.3 |

| Hastings | 3,459 | 23 | 0.7 |

| Huron | 1,582 | 11 | 0.7 |

| Kenora | 1,252 | 92 | 7.3 |

| Kent | 2,639 | 25 | 0.9 |

| Lambton | 3,314 | 26 | 0.8 |

| Lanark | 2,180 | 17 | 0.8 |

| Leeds | 1,718 | 38 | 2.2 |

| Lennox | 1,184 | 7 | 0.6 |

| Manitoulin | 329 | 9 | 2.7 |

| Middlesex | 11,734 | 299 | 2.5 |

| Muskoka | 2,694 | 52 | 1.9 |

| Nipissing | 1,868 | 13 | 0.7 |

| Norfolk | 1,788 | 5 | 0.3 |

| Ottawa | 22,621 | 536 | 2.4 |

| Oxford | 3,158 | 17 | 0.5 |

| Parry Sound | 1,814 | 49 | 2.7 |

| Perth | 1,877 | 9 | 0.5 |

| Prescott | 925 | 7 | 0.8 |

| Prince Edward | 848 | 6 | 0.7 |

| Rainy River | 561 | 57 | 10.2 |

| Renfrew | 2,597 | 9 | 0.3 |

| Stormont | 1,477 | 12 | 0.8 |

| Sudbury | 3,761 | 31 | 0.8 |

| Thunder Bay | 3,136 | 27 | 0.9 |

| Other Non-GGH Regions | 3,698 | 9 | 0.2 |

| Ontario Total | 314,137 | 5,708 | 1.8 |

| Agricultural Land (Ontario Total) | 4,380 | 96 | 2.2 |

Note: Numbers in table above may not add due to rounding.

Purchases by Foreign Entities – GGH and Non-GGH Regions, 2017

| Land Registry Office (LRO) | Total Transactions (A) | Foreign Transactions (B) | Foreign Transactions (%) (C = B / A) |

|---|---|---|---|

| GGH Total | 166,502 | 4,517 | 2.7 |

| Brant | 2,644 | 7 | 0.3 |

| Dufferin | 1,709 | 11 | 0.6 |

| Durham | 12,101 | 139 | 1.1 |

| Haldimand | 1,291 | 5 | 0.4 |

| Halton | 11,293 | 258 | 2.3 |

| Niagara South & North | 9,973 | 191 | 1.9 |

| Northumberland | 2,484 | 10 | 0.4 |

| Peel | 21,658 | 392 | 1.8 |

| Peterborough | 3,273 | 18 | 0.5 |

| Simcoe | 13,425 | 107 | 0.8 |

| Toronto | 40,607 | 1,956 | 4.8 |

| Victoria | 1,926 | 8 | 0.4 |

| Waterloo | 11,305 | 187 | 1.7 |

| Wellington | 4,766 | 45 | 0.9 |

| Wentworth | 9,094 | 102 | 1.1 |

| York | 18,953 | 1,081 | 5.7 |

| Non-GGH Total | 88,803 | 1,430 | 1.6 |

| Algoma | 1,959 | 44 | 2.2 |

| Bruce | 2,130 | 26 | 1.2 |

| Cochrane | 1,093 | 8 | 0.7 |

| Elgin | 2,058 | 10 | 0.5 |

| Essex | 8,343 | 186 | 2.2 |

| Frontenac | 3,332 | 55 | 1.7 |

| Grey | 2,538 | 17 | 0.7 |

| Haliburton | 994 | 8 | 0.8 |

| Hastings | 2,993 | 16 | 0.5 |

| Huron | 1,249 | 10 | 0.8 |

| Kenora | 914 | 44 | 4.8 |

| Kent | 1,983 | 19 | 1.0 |

| Lambton | 2,629 | 23 | 0.9 |

| Lanark | 1,600 | 14 | 0.9 |

| Leeds | 1,378 | 36 | 2.6 |

| Lennox | 1,136 | 9 | 0.8 |

| Manitoulin | 313 | 8 | 2.6 |

| Middlesex | 10,065 | 269 | 2.7 |

| Muskoka | 2,466 | 28 | 1.1 |

| Nipissing | 1,511 | 10 | 0.7 |

| Norfolk | 1,535 | 5 | 0.3 |

| Ottawa | 17,353 | 410 | 2.4 |

| Oxford | 2,622 | 12 | 0.5 |

| Parry Sound | 1,697 | 31 | 1.8 |

| Perth | 1,484 | 9 | 0.6 |

| Prescott | 655 | 6 | 0.9 |

| Prince Edward | 660 | 6 | 0.9 |

| Rainy River | 414 | 26 | 6.3 |

| Renfrew | 1,990 | 6 | 0.3 |

| Russell | 1,089 | 6 | 0.6 |

| Stormont | 1,104 | 7 | 0.6 |

| Sudbury | 2,779 | 32 | 1.2 |

| Thunder Bay | 2,394 | 20 | 0.8 |

| Timiskaming | 664 | 5 | 0.8 |

| Other Non-GGH Regions | 1,679 | 9 | 0.5 |

| Ontario Total | 255,305 | 5,947 | 2.3 |

| Agricultural Land (Ontario Total) | 2,887 | 80 | 2.8 |

Notes:

Partial year data, April 24, 2017, to December 31, 2017.

Numbers in table above may not add due to rounding.

Glossary

| Term | Definition |

|---|---|

| Agricultural land | Refers to farm lands used for farm purposes by the owner or used for farm purposes by a tenant of the owner and buildings thereon used for farm purposes, including the residence of the owner or tenant and of the owner’s or tenant’s employees and their families on the farm land. |

| Controlled | In relation to the control of a corporation, means controlled, directly or indirectly in any manner whatever, within the meaning of section 256 of the Income Tax Act (Canada). |

| Foreign corporation | Means a corporation that is one of the following:

Note: For the purposes of the additional information, a corporation that is incorporated in Canada will not be considered a “foreign corporation” if its shares are listed on a stock exchange in Canada. |

| Foreign entity | Means a foreign corporation or a foreign national. |

| Foreign national | As defined in the Immigration and Refugee Protection Act (Canada), is an individual who is not a Canadian citizen or permanent resident of Canada and includes a stateless person. |

| Foreign transaction | Refers to a transaction which involved at least one foreign entity. |

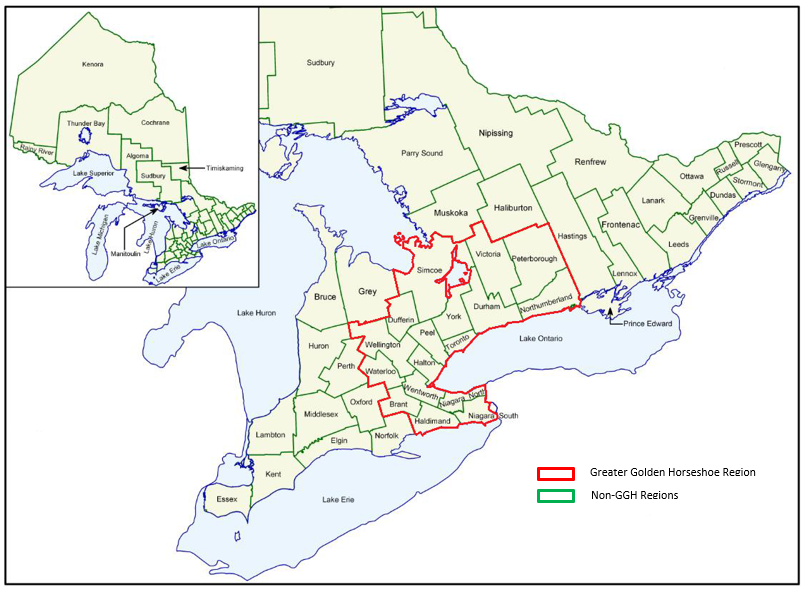

| Greater Golden Horseshoe Region (GGH) | Refers to the area of land comprised of the geographic areas of the following municipalities:

|

| Land Registry Office (LRO) | LROs are managed by the Ministry of Public and Business Service Delivery and Procurement and allow persons to register and search official private property records using Ontario’s land registration system. |

| Land Transfer Tax (LTT) | The LTT is a broad-based tax imposed on persons acquiring land, or a beneficial interest in land, in Ontario with few exceptions. LTT is payable to the Province when the transfer is registered under the Land Titles Act or the Registry Act, as applicable. If the acquisition of an interest in land is not registered, LTT is payable directly to the Province in respect of the unregistered disposition of a beneficial interest in land, within 30 days after the transaction closing date. |

| Non-GGH regions | Refers to the area of land in Ontario that is not within the GGH (see the GGH definition above). |

| Non-Resident Speculation Tax (NRST) | The NRST is a 25 per cent tax on the purchase or acquisition of an interest in residential property located in Ontario by foreign entities and taxable trustees. For more information, refer to the Non-Resident Speculation Tax. |

| Permanent resident of Canada | Means a person who has acquired permanent resident status and has not subsequently lost that status under section 46 of the Immigration and Refugee Protection Act (Canada). |

| Single family residence | Means a unit or proposed unit under the Condominium Act, 1998 or a structure or part of a structure that is designed for occupation as the residence of a family, including dependents or domestic employees of a member of the family, whether or not rent is paid to occupy any part of it and whether or not the land on which it is situated is zoned for residential use and,

For example: a detached and semi-detached house, duplex, freehold townhouse, condominium townhouse, condominium apartment, and cottage. |

Further Information

https://www.ontario.ca/document/land-transfer-tax/prescribed-information-purposes-section-501-form

Appendix A: Ontario – Land Registry Offices

Appendix B: NRST and Additional Information Collection – Comparison

| Item | NRST | Additional Information Collection |

|---|---|---|

| Date of Implementation | April 21, 2017 | April 24, 2017 |

| Transitional Provisions | Transitional relief provisions are available for eligible transactions regarding the general application of the NRST, as well as the applicable tax rate. Refer to the NRST webpage bulletin for more information. | N/A |

| Geographic Area | All of Ontario (applied only to the Greater Golden Horseshoe Region prior to March 30, 2022) | All of Ontario |

| Type of Property | Land that contains:

| Land that contains:

|

| Applicable Transferees (e.g., Purchasers) | The data will only show those who were subject to the tax (foreign entities, and taxable trustees);

| All persons who purchase or acquire the applicable land (see above) in Ontario.

|

| Transferees Excluded or Exempt |

|

|

Note: For exclusions relating to trustees of mutual fund trusts, REITs, and SIFT trusts, the trustee must exclusively hold title (or must hold title with similar trustees or other eligible persons).

Contact us

We are committed to providing accessible customer service. On request, we can arrange for accessible formats and communication supports. If you have questions, requests, or need help locating a document, please contact us.

Footnotes

- footnote[1] Back to paragraph LRO boundaries may not coincide with municipal, county or district boundaries.

- footnote[2] Back to paragraph Combined LROs due to low transaction counts.

- footnote[3] Back to paragraph These figures refer to transactions of agricultural land only and exclude transactions involving any other types of land (such as most residential, commercial or mixed-use property).

- footnote[4] Back to paragraph Unavailable due to low transaction counts.

- footnote[5] Back to paragraph In order to be eligible for an exemption from the NRST, the purchaser must meet all requirements (e.g., certification to occupy the land as a principal residence), and the land must be held exclusively by the transferee and their spouse (and potentially other eligible persons).