Renewable energy on Crown land

Information on how to apply for the use of Crown land for a renewable energy project, including details on how this aligns with provincial energy procurement processes.

Renewable energy on Crown land

Renewable energy developments on Crown land (also known as public land) need to be consistent with provincial energy plans, programs and goals.

You may also be granted access to Crown land for a renewable energy project if it supports:

- provincial economic development priorities

- off-grid Aboriginal community use

- small-scale use for local resource management

In 2014, the ministry approved the Renewable Energy on Crown Land policy. It provides direction on where and how the ministry grants access for these projects.

If you are planning an activity on Crown land for waterpower or windpower pre-development, first review the Renewable Energy on Crown Land Predevelopment Document and email MNRFrenewableenergysupport@ontario.ca to:

- discuss your activity details

- determine if there are permitting requirements

- obtain a copy of the Crown land site report form

How to propose a grid-connected renewable energy project

The Crown land site access process for renewable energy projects is aligned with the Ontario Independent Electricity System Operator’s (IESO) energy procurement programs. The IESO’s procurement process determines which projects will be offered a contract to sell electricity onto the transmission grid.

Project specific renewable energy approval and permit requirements will need to be met. These requirements do not apply to a waterpower facility. These projects are subject to the Class Environmental Assessment for Waterpower Projects and other ministry permits and approvals.

If your renewable energy project is granted permits and approvals to conduct pre-development investigations, this does not guarantee:

- regulatory approvals to develop the proposed project

- any future occupational authority required for the project

You need to be familiar with the regulatory, approval, permitting and survey requirements (and applicable fees and rent) associated with your application, authorization and occupational authority.

Crown Land Site Report form

Use the CLSR to submit a bid to the IESO under the LT2 Request for Proposals (RFP) process if your energy project is located wholly or partially on Crown land under our ministry administration and control through the Public Lands Act. It is your responsibility as a proponent to ensure a project is on provincial Crown lands (in whole or in part).

The following Crown lands are not available for renewable energy development:

- an area regulated or recommended as a provincial park or conservation reserve, where the project would not qualify as an exception under the Provincial Parks and Conservation Reserves Act

- an area designated as a dedicated protected area in the Far North, where the project would qualify as an exception under community-based land use plans or the Far North Act

- greenfield waterpower development (including any reservoirs, impoundments and water control structures or weirs) on a naturally reproducing lake trout lake

- an area where existing authorizations or dispositions (such as lease) under the Public Lands Act, Aggregate Resources Act, Oil Gas and Salt Resources Act, or Mining Act would prohibit development

You must submit the Crown Land Site Report form to MNRFRenewableEnergySupport@ontario.ca at least 25 days before the deadline for submitting your project bid to the IESO.

Download the Crown Land Site Report form

If you require an alternative format of the Crown Land Site Report, please email MNRFRenewableEnergySupport@ontario.ca

Windpower projects

Windpower land use authorization

Once applicants complete the necessary requirements, we will issue or enter into the appropriate permits, instruments or agreements, referred to in Table 1: activity types, corresponding authorizations and related fees and rents. Permits or occupational authority documents issued, and associated fees, will comply with the appropriate ministry directives.

Occupational authority documents, such as easements for transmission lines associated with the lease letters patent for wind turbines, will run concurrent with (last as long as) the term of the lease letters patent.

Windpower survey requirements

We may direct the following survey options where:

- there are large distances between the turbines: individual turbine locations may be surveyed as separate parts on the survey plan for inclusion in the lease

- the turbines occupy a small area and/or are located in close proximity to each other: these areas may be surveyed as one part on the survey plan for inclusion in the lease

- there are clusters of turbines occupying small areas and/or they are located in close proximity to each other: these areas may be surveyed as separate parts for inclusion in the lease

Survey instructions

Survey instructions should consider public safety and/or potential encroachment onto adjacent lands. The areas surveyed should not be larger than needed to meet these needs.

For example an area under occupational authority should ensure that if a turbine were to collapse, no part of the turbine, including the blades, would encroach onto adjacent lands. The ministry district office will consult with the Office of the Surveyor General before issuing survey instructions.

Easements required for electrical collector lines between the turbines must be surveyed as separate parts on the survey plan.

Applicants must get an approved Crown land survey consistent with PL 2.06.01 Survey Plan Approval and the Instructions Governing Ontario Crown Land Surveys and Plans (November 2020).

Applicants are responsible for:

- the procurement and costs of a survey

- Crown land plan preparation and registration by an Ontario Land Surveyor

The ministry district office must issue survey instructions before any surveying of Crown land.

Windpower fees and rents

In addition to fees and rents established in our Crown land management policies, there are several rents and fees associated with windpower testing and windpower development.

Section 3.1 of the PL 6.01.02 Crown Land Rental Policy states that the policy does not apply to energy generation agreements. However, some fees and rents in Table 1 on this page mirror the fees and rents set out in the policy.

Windpower activities, authorizations, fees and rents

All fees and rents are subject to tax, if applicable.

Definition of windpower fees and rents

Base land rent

A base land rent will be applied to the area under the land use permit (if applicable) and under the subsequent lease letters patent.

This rent is payable annually at the beginning of the calendar year. It will be replaced by both the wind land rental charge and administrative land rent once the wind power project is operational.

Wind land rental charge

An annual rental charge applies on operational wind farms. It is paid in quarterly instalments, based on the total installed kilowatt capacity (the manufacturer’s rated power capacity) of all turbines in the project.

Find the calculation for the wind land rental charge under Chart 1

The wind land rental charge does not apply to off-grid communities.

Administrative land rent

Once the wind power project is operational, an annual administrative land rent for the Crown land occupied to facilitate the generation of windpower will apply. The rent that will replace the base land rent is in addition to the wind land rental charge.

Administrative land rent does not apply to off-grid communities.

Table 1 — Activity types, corresponding authorizations and related fees and rents

| Activity and improvement type | Authorization or Public Lands Act (PLA) authority | Details | Annual rents, fees and one-time fees associated with issuing authorizations |

|---|---|---|---|

| Construction activities associated with windpower testing facilities or a windpower development project | Work permit (O. Reg. 239/13: Activities on public lands and shore lands – Work permits and exemptions made under the PLA) |

| Not applicable |

| Construction activities associated with windpower testing facilities or a windpower development project | Letters of authority –(Subsection 27(1) of PLA) |

| Not applicable |

| Testing equipment (such as a meteorological testing tower) | Land use permit (O. Reg. 973 made under the PLA) | For the footprint of the meteorological testing tower | Initial (one-time) fee based on then public land administrative fee schedule and annual fees based on Policy PL 6.01.02 Crown Land Rental Policy |

| Wind turbines | Land use permit (O. Reg. 973 made under the PLA) |

| Initial (one-time) based on the public land administrative fee schedule and base land rent based on zonal values |

| Wind turbines | Land use permit (O. Reg. 973 made under the PLA) |

| Initial (one-time) based on the public land administrative fee schedule and base land rent based on zonal values |

| Wind turbines | Lease letters patent (section 16 of the PLA) |

|

|

| Electrical distribution and/or transmission lines | Land use permit (LUP) (O. Reg. 973 made under the PLA) |

|

|

| Electrical distribution and/or transmission lines | Grant of easement (Section 21 of PLA) |

|

|

| Roads | Road use management strategy and agreement (Crown land roads manual) |

| Not applicable |

| Roads | Land use permit (O. Reg. 973 made under the PLA) |

| Initial (one-time) and annual fee based on the public land administrative fee schedule |

| Roads | Grant of easement (Section 21 of PLA) |

| Initial (one-time) fee based on the public-land administrative fee schedule and annual rent based on Policy PL 4.11.04 Easements (Grants of) Policy |

| Transformer station | Letters patent (Section 16 of PLA) |

| Market value as per Policy PL 6.01.01 Public land sale price policy |

| Transformer station | Lease letters patent (Section 16 of PLA) |

| Refer to the fees and rents associated with the lease |

Other administrative fees-related transactions such as consent to transfer, assign, renew or extend, mortgage are based on Policy PL 6.02.01 Administrative Fees for Public Lands Transactions Policy.

Calculation of the base land rent for the occupational authority period, based on the total number of hectares authorized

Base land rent for the area occupied by wind turbines = land value (land locked zonal rate per hectare) × area × 100% (impact on fee simple) × 10% rate of return + CPI

Chart 1 – Windpower zonal values

| Zone | Land values |

|---|---|

| Northwest Zone | $454 per hectare ($184 per acre) |

| Northeast Zone | $294 per hectare ($119 per acre) |

| South Central Zone | $1,030 per hectare ($417 per acre) |

| Southeast Zone | $986 per hectare ($399 per acre) |

| Southwest Zone | $8,798 per hectare ($3,562 per acre) |

Note: The zonal values are subject to adjustment based on updated zonal value reports

Calculation of the wind land rental charge

Annual wind land rental charge = (total installed capacity in kilowatts × (8760 hours per year) × (30% capacity factor) × (3% rate of return) × (average price per kilowatt hour based on the price of electricity as detailed in the supply contract for the site).

Example for 1 megawatt (1,000 kW) of anticipated total installed capacity:

Annual wind land rental charge = (1,000 kW) × (8760 hours) × (0.30 capacity) × (0.03 rate of return) × ($0.09 per kWh) (example rate only — actual rate to be based on the price of electricity as set by the appropriate power purchase agreement at the time of lease issuance).

= $7095.60 per megawatt of total installed capacity annually.

Note: The wind land rental charge will not be applied as a portion of the rent for an off-grid community.

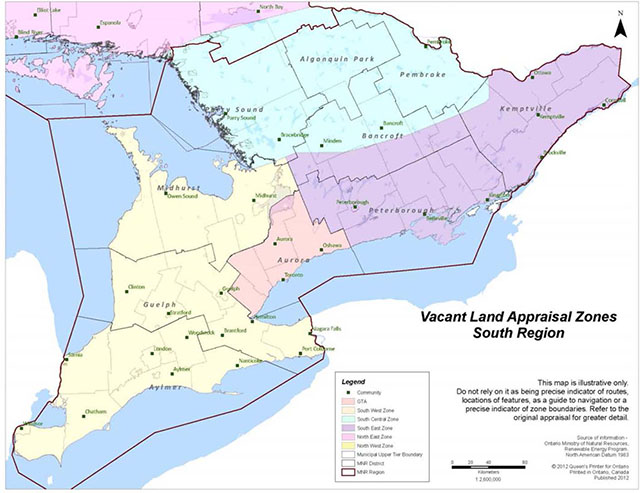

Wind zonal land value map — Southern Ontario

Enlarge Zonal Land Value Map - Southern Ontario

Wind zonal land value map — Northwestern Ontario

Enlarge Zonal Land Value Map- Northwestern Ontario

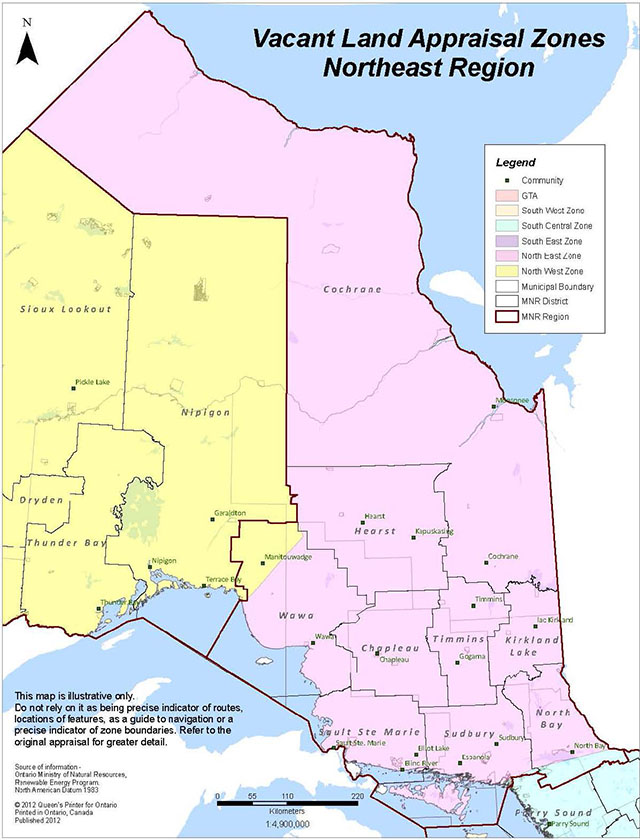

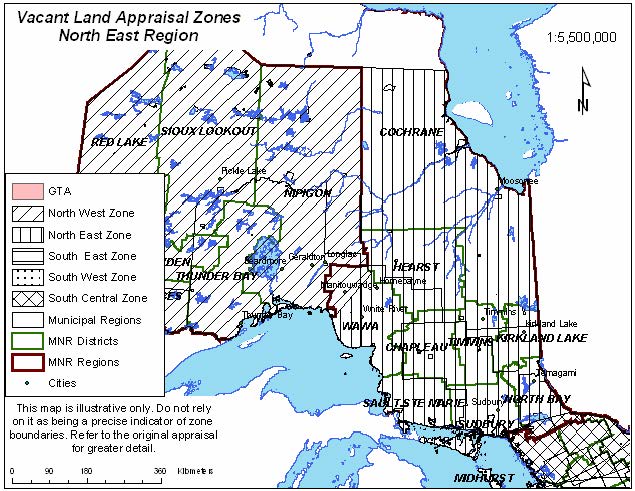

Wind zonal land value map — Northeastern Ontario

Enlarge Zonal Land Value Map- Northeastern Ontario

Waterpower projects

Predevelopment activities for waterpower projects

Waterpower project proponents may need access to Crown land for early pre-development activities to collect information:

- that can help assess potential waterpower development site feasibility

- about resource potential, site constraints and other data affecting potential project viability to inform next steps and decisions about the site

We may authorize activities and occupation of Crown land for these purposes in ways that reflect the scale, complexity and potential impacts of the activities.

Proponents are responsible for securing all other necessary municipal, provincial or federal approvals.

Desktop studies do not require consultation with us or our approval.

Duty to consult Indigenous communities

We have a duty to consult Indigenous communities if the Crown:

- has knowledge, real or constructive, of credibly asserted or established Aboriginal or treaty rights

- is contemplating actions that have the potential to adversely impact those rights

We assess the duty to consult and the depth of consultation required on a case-by-case basis.

We encourage waterpower proponents to engage with local Indigenous communities early in the pre-development stage where activities are being considered.

Table 2 — Examples of pre-development activities for waterpower projects and authorizations required for access to Crown land

The following table shows:

- examples of pre-development activities for waterpower projects

- the types of authorizations that are normally required to access Crown land under our regulations

The table does not provide all waterpower pre-development activities that could occur on Crown land. We may also need to consider other activities for potential impacts.

| Example of pre-development activity | Work permit required under the Public Lands Act, 1990 | Occupational authority (such as a land use permit) required under the Public Lands Act, 1990 | Other authorizations or requirements under the Public Lands Act, 1990 or other laws administered by the ministry |

|---|---|---|---|

| Site visits - observational activities | Not applicable | Not applicable | Not applicable |

| LiDAR (air based), aerial photography | Not applicable | Not applicable | Not applicable |

| Flagging (meaning use of flag tape) sites of interest | Not applicable | Not applicable | Not applicable |

| Installation of trail cameras or acoustic monitors | Not applicable | Not applicable | Consent to deposit authorization under the Public Lands Act, 1990 |

| Fish surveys (for example electrofishing, netting) | Not applicable | Not applicable | Licence to collect fish for scientific purposes under the Fish and Wildlife Conservation Act, 1997 |

| Installation of water flow and level gauges (may include tethering or anchoring but no dredging or filling) | No | Yes, if there is occupation of public land | If dredging or filling is required, an approval under the Lakes and Rivers Improvement Act, 1990 may be required |

| Minor brush clearing (no merchantable trees) | No | No | Not applicable |

| Overnight accommodation (including camping) | No | Yes | Campsite clearing may require an authorization under the Crown Forest Sustainability Act, 1994, if trees are removed |

| Tree clearing (meaning merchantable trees) | No | No | A forest resource licence or permit to remove Crown forest resources may be required under the Crown Forest Sustainability Act, 1994 |

| Privy or similarly sized structure | Yes | Yes | Not applicable |

| Trail, water crossing, road construction | Yes | Yes, unless otherwise permitted. Read Ontario Regulation 161/17 | If a water crossing holds back, forwards, or diverts water, an approval under the Lakes and Rivers Improvement Act, 1990 may be required |

| Surveying including installation of survey posts | Not applicable | Not applicable | The ministry issues survey instructions prior to survey |

| Geotechnical drilling | Contact us | Contact us | Contact us |

If your renewable energy project is granted permits and approvals as outlined above to conduct pre-development investigations, this does not guarantee regulatory approvals to develop the proposed project.

It also does not guarantee any future occupational authority required for the project.

You need to be familiar with the regulatory, approval, permitting and survey requirements (and applicable fees and rents) associated with your application, authorization and occupational authority.

New waterpower development – tenure

Tenure during construction

Sites with an energy capacity over 75kW

Sites on Crown land with an energy capacity of over 75kW will be authorized with a Crown lease during construction of the facility.

Once the Crown survey is complete, proponents can request a Crown lease to authorize the area that will encompass the footprint of the facility being constructed. Legal survey instructions are issued by the ministry district office.

A land use permit may be issued as interim tenure while survey requirements are being met.

For sites with an energy capacity over 75kW, a Crown lease will serve as an interim form of tenure. It will be replaced with a waterpower lease agreement once the facility is constructed. We developed a modified version of a Crown lease specifically for authorization of a waterpower site in these circumstances. Insurance and other financial sureties required during construction will be similar for both types of tenure documents.

Sites with an energy capacity of 75kW or less

For sites on Crown land with an energy capacity of 75kW or less, the site will be authorized with a land use permit during and after construction.

No survey is required.

Tenure for flooding

In general, Crown land required for flooding will be surveyed and authorized with an easement. Legal survey instructions are issued by the ministry district office.

If there is any flooding of private lands, appropriate documents demonstrating the proponent’s right to flood these lands must be provided to the ministry district office before an easement for the Crown land will be issued.

Other ancillary uses

Transmission lines, roads and land required for other approved uses will be authorized with the appropriate tenure or approval, such as a work permit or land use permit.

If the proponent requests it, an easement can generally be issued for transmission lines and roads. A Crown survey will be required. Legal survey instructions are issued by the ministry district office.

Tenure post construction — issuing a waterpower lease agreement

Once the facility is constructed, a waterpower lease agreement (WPLA) under the authority of Section 42 of the Public Lands Act, 1990 will be used to authorize the footprint of the facility occupying Crown land.

Waterpower survey requirements and forms

Once we decide to proceed with the necessary permits and approvals, the ministry district office will instruct proponents to submit an application for Crown land and a current corporate profile from the jurisdiction in which they were incorporated.

We will also provide survey instructions to the proponent.

Applicants will be required to obtain an approved Crown land survey in accordance with PL 2.06.01 Survey Plan Approval.

Waterpower lease agreement

The WPLA has a rolling term which can continue in perpetuity with ministry approval.

The WPLA is issued for an initial term that coincides with the applicants power purchase agreement, not to exceed a maximum term of 40 years.

For new (green-field) facilities, the initial term will be a minimum of 30 years or 20 years for an existing dam retrofit.

When no more than 10 years and no less than 48 months remain on the term, the lessee may apply for an extension of the term for a period of 10 years. This extension will be granted provided that:

- all terms and conditions in the lease agreement have been complied with

- the ministry has no objections or concerns after conducting a review of the current situation.

The leaseholder becomes eligible to request another 10 year extension when only 10 years remain on the term.

Waterpower fees and rents — taxes and charges on gross revenue and land rents

Gross revenue charge

The Electricity Act, 1998 sets out taxes and charges which owners of waterpower facilities must pay to the Ontario Government.

Each owner must pay a graduated property tax, calculated on each station’s gross revenue, derived from each station’s annual generation of electricity.

Each owner who is also the holder of a waterpower lease is also required to remit a water rental charge, which is calculated using the station’s gross revenue.

The taxes and charges together are known as the gross revenue charge (GRC). The GRC is remitted to the Ministry of Finance (MOF). Owners of waterpower facilities must register with MOF to report and remit the GRC.

Read Gross revenue charges for hydroelectric generating stations for more information about:

- GRC tax rates

- filing returns

- paying the tax

Gross revenue charge deduction

The Electricity Act, 1998 sets out taxes and charges which owners of waterpower facilities are liable to pay to the Ontario Government.

Each owner shall pay a graduated property tax, calculated on each station’s gross revenue, derived from each station’s annual generation of electricity. Each owner who also is the holder of a waterpower lease is also required to remit a water rental charge, which is calculated using the station’s gross revenue. The taxes and charges, which together are referred to as the Gross Revenue Charge (GRC), are remitted to the Ministry of Finance (MOF). From the date the operation commences, owners of waterpower facilities shall register with MOF for the purposes of reporting and remitting GRC.

For more information regarding GRC tax rates, filing return and paying the tax, please visit Gross revenue charges for hydroelectric generating stations.

As a financial incentive to encourage the construction of new waterpower facilities and to modify existing stations, the Act permits deductions to be made in determining the gross revenues of a waterpower facility based upon eligible capacity, for 120 months from the date when the eligible capacity came into service.

- Reg. 124/02 (Taxes and Charges on Hydro-electric Generating Stations) specifies that for a new or redeveloped station, all of a waterpower facility’s annual electricity generation is eligible for the tax and charges deduction. For an upgrade, the electricity generated by the facility attributable to the upgrade, is eligible for deduction. To be eligible, the upgrade must be projected to increase the average annual electricity generated by the station by at least 2%.

Persons proposing to develop waterpower facilities, or to redevelop or upgrade existing facilities, may apply to the ministry to obtain an “interim determination” of eligible capacity, as a basis for assessing the level of relief the project would provide from liability to pay the GRC. Once a project is constructed, is in service and has registered with the MOF as noted above, owners may apply to the ministry to obtain a final determination (Section 7 Statement) – a statement issued by the ministry which determines the project capacity eligible for relief from the liability to pay the GRC. This statement must be provided to the MOF to commence permitted deductions to the calculation of the waterpower facility’s gross revenues.

For more information on how to apply for the GRC deduction for new, redeveloped and upgraded waterpower facilities, read Procedure WR 3.02.01 New, redeveloped and upgraded hydro-electric generating stations – Ministry of Natural Resources statements issued for the purpose of claiming deductions to the Gross Revenue Charge under the Electricity Act, 1998.

Land rent

The holder of a waterpower lease agreement and other occupational authority documents (such as easements for flooding, land use permits for roads and transmission lines) is required to pay land rent. This is set out in the Public Lands Act, 1990.

For a full list of fees and rents for waterpower projects, read Table 3 — Waterpower fees and rents.

Table 3 waterpower fees and rents

| Occupational authority type | <75kw | Ministry water control structures - construction phase | Greenfield – construction phase | Facility footprint (include water control structure, parking and buildings in close proximity) | Building, not in close proximity to facility footprint | Flooding | |

|---|---|---|---|---|---|---|---|

| Land use permit | Crown Land Rental Policy - Table B |

|

| Not applicable | Crown Land Rental Policy | Not applicable | |

| Crown lease | $1,000/annually | $1,000/annually | Not applicable | Crown Land Rental Policy | Not applicable | ||

| Easement | Not applicable | Not applicable | Not applicable | Roads (Crown Land Rental Policy) Transmission Lines (annual rent based on Utility Corridor on public land Policy PL 4.10.03) |

| ||

| Existing WPLA or LO | Not applicable | Not applicable |

| Not applicable | *Flooding formula – no max.1 | ||

| New WPLA | Not applicable | Not applicable |

| Not applicable | Not applicable |

All fees and rents are subject to change without notice.

Chart 2 — Waterpower zonal values

| Zone | Land values |

|---|---|

| Northwestern Zone | $454 per hectare ($184 per acre) |

| Northeastern Zone | $294 per hectare ($119 per acre) |

| South Central Zone | $1,030 per hectare ($417 per acre) |

| Southeastern Zone | $986 per hectare ($399 per acre) |

| Southwestern Zone | $8,798 per hectare ($3,562 per acre) |

Note: The zonal values are subject to adjustment based on updated zonal value reports.

Notes:

- Property taxes are paid on all waterpower facilities (including private land) based on a percentage of gross revenue from generation defined under regulation of the Electricity Act, 1998.

- All fees and rents are subject to tax.

- The phase-in of large rent/fee increases is provided for in PL 6.01.02 Crown Land Rental Policy.

- Refer to PL 6.02.01 Administrative Fees for Public Land Transactions for applicable administrative fees.

- Cheques for application and rent fees are to be made payable to the Minister of Finance.

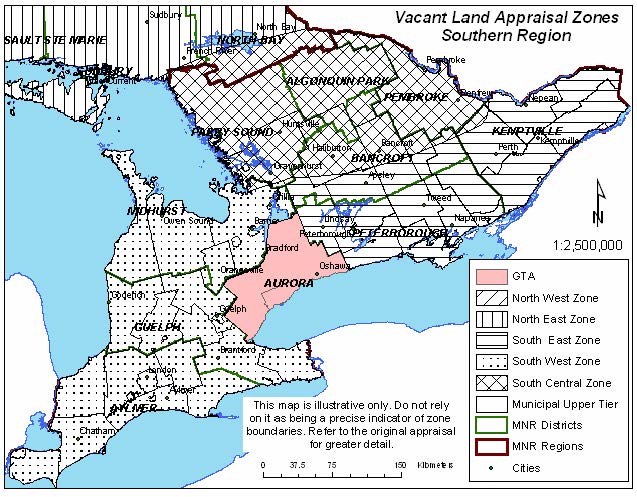

Waterpower zonal land value map— Southern Ontario

Enlarge Zonal Land Value Map-Southern Ontario

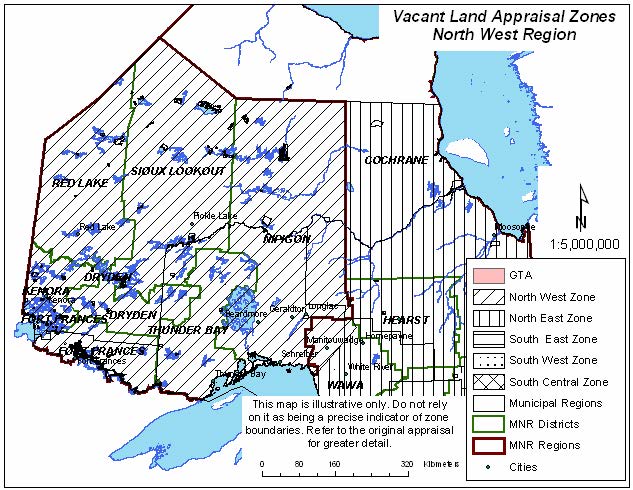

Waterpower zonal land value map — Northwestern Ontario

Enlarge Zonal Land Value Map – Northwestern Ontario

Waterpower zonal land value map — Northeastern Ontario

Enlarge Zonal Land Value Map -Northeastern Ontario

1 * Flooding formula to determine annual rent:

- waterpower zonal value × area × 25% (impact on fee simple) × 10% (rate of return)

- annual rent to be adjusted in each subsequent year by CPI (if occupational authority document permits annual adjustments)

- When the above formula results in a rental amount on a per document basis that is less than $200, a minimum rent of $200 will be charged