Public Accounts 2024–25: Annual report

The annual report is a high–level summary of the fiscal year’s results. It includes financial statements, analyzes the state of the Ontario government’s finances and outlines achievements for the fiscal year.

Foreword

I am pleased to present the 2024–25 Public Accounts for the Province of Ontario. The Public Accounts provide the people of Ontario with a clear and comprehensive view of the province’s finances.

The government recorded a $1.1 billion deficit for the fiscal year ending March 31, 2025, compared to a forecasted deficit of $9.8 billion in the 2024 Budget. This improvement is a result of higher-than-anticipated tax revenues from strong economic growth and increased revenues from the broader public sector.

This document highlights the efforts our government has taken to deliver on the commitments we set out in the 2024 Ontario Budget: Building a Better Ontario. Our government has a plan to protect Ontario and transform it into the most competitive place to invest, create jobs and do business in the G7, while investing even more in health care, education and other critical services. We are continuing to rebuild the province’s economy by attracting domestic and international manufacturing investments, expanding the province’s electricity capacity, supporting innovation and helping small businesses thrive.

The 2024–25 Public Accounts shows that our government is protecting Ontario’s economy, investing $212.1 billion across all programs. This represents an 8.7 per cent or $16.9 billion increase in program spending over the previous fiscal year. These investments are delivering on our government’s mission to build for future growth and keep workers on the job in the face of U.S. tariffs and economic uncertainty. We will continue our fiscally responsible approach, prudently managing provincial finances while maintaining our commitment and ability to provide critical financial supports that are required to protect Ontario’s economy and support jobs.

With total revenues of $226.2 billion, which is $17.2 billion or 8.2 per cent higher than the previous fiscal year, Ontario’s strong economic performances mean we are continuing a clear path back to balance. We are also continuing our prudent approach to managing debt, achieving the targets for all three of our debt sustainability measures. The interest and other debt servicing charges are $1.3 billion lower than the 2024 Budget forecast, and $100 million lower than the interim forecast due to lower overall borrowing costs. This concerted effort is also reflected in Ontario’s credit ratings, which were upgraded by both S&P and Morningstar DBRS in 2024. The upgrades help lower our province’s borrowing costs and support more investment in Ontario, creating more jobs and financing our historic infrastructure plan.

To protect Ontario’s health care system, we’re working to deliver even more connected and convenient care for people, when and where they need it. That is why we have made historic investments and increased spending in the health sector by $6.2 billion or 7.2 per cent to provide faster access to services and grow our health care workforce.

In order to build the infrastructure our province needs to support strong and safe communities, keep workers on the job and drive economic growth, infrastructure spending saw an increase of $5.6 billion or 23.9 per cent from the previous year, including investments in health infrastructure, public transit, schools, correctional facilities, broadband and housing.

This year marks the eighth year in a row that the Public Accounts has received a clean audit opinion from the province’s Auditor General.

The results in the 2024–25 Public Accounts are part of our government’s plan to build a more competitive, resilient and self-reliant economy while keeping costs down and protecting workers, businesses and jobs in the face of U.S. tariffs and economic uncertainty.

Original signed by:

The Honourable Caroline Mulroney

President of the Treasury Board

Introduction

The Annual Report is a key element of the Public Accounts of the Province of Ontario and is central to demonstrating the Province’s transparency and accountability in reporting its financial activities and position. Ontario’s Consolidated Financial Statements present the financial results for the 2024-25 fiscal year against the 2024 Budget released on March 26, 2024, and the financial position of the government as of March 31, 2025. As in previous years, the Annual Report also compares the current year’s results to the prior year’s results and provides a five-year trend analysis for many key financial ratios.

Producing the Public Accounts of Ontario requires the teamwork and collaboration of many stakeholders across Ontario’s public sector. The Office of the Auditor General plays a critical role in auditing and reporting on the Province’s Consolidated Financial Statements, and the Standing Committee on Public Accounts also plays an important role in providing legislative oversight and guidance. I would like to thank everyone for their contributions and collaboration.

We welcome your comments on the Public Accounts. Please share your thoughts by email to infoTBS@ontario.ca, or by writing to the Office of the Provincial Controller, Re: Annual Report, Treasury Board Secretariat, Second Floor, Frost Building South, 7 Queen’s Park Crescent, Toronto, Ontario M7A 1Y7.

Carlene Alexander, CPA, CGA, MBA

Deputy Minister and Secretary of the Treasury Board and Management Board of Cabinet

Treasury Board Secretariat

Statement of Responsibility

The Consolidated Financial Statements are prepared by the Government of Ontario in accordance with the accounting principles for governments issued by the Public Sector Accounting Board (PSAB).

The Consolidated Financial Statements are audited by the Auditor General of Ontario in accordance with the Auditor General Act, and with Canadian generally accepted assurance standards. The Auditor General expresses an independent audit opinion on these Consolidated Financial Statements. Her report, which appears on pages 45-51, provides her audit opinion and the basis for this opinion.

Management prepares the Consolidated Financial Statements in accordance with generally accepted accounting principles for the public sector. Management is also responsible for maintaining systems of financial management and internal controls to provide reasonable assurance that transactions recorded in the Consolidated Financial Statements are within statutory authority, assets are properly safeguarded, and reliable financial information is available for preparation of these Consolidated Financial Statements.

Original signed by:

Carlene Alexander, CPA, CGA, MBA

Deputy Minister,

Treasury Board Secretariat

August 29, 2025

Original signed by:

Jason Fitzsimmons

Deputy Minister,

Ministry of Finance

August 29, 2025

Original signed by:

Beili Wong, FCPA, FCA

Comptroller General,

Office of the Comptroller General

Treasury Board Secretariat

August 29, 2025

Original signed by:

Khalida Noor, CPA, CA

Assistant Deputy Minister and Provincial Controller,

Treasury Board Secretariat

August 29, 2025

The Government of Ontario is responsible for the Consolidated Financial Statements and accepts responsibility for the objectivity and integrity of these Consolidated Financial Statements and the Financial Statement Discussion and Analysis. Those charged with governance are responsible for overseeing the Government of Ontario’s financial reporting process.

Original signed by:

The Honourable Caroline Mulroney

President of the Treasury Board

August 29, 2025

Original signed by:

The Honourable Peter Bethlenfalvy

Minister of Finance

August 29, 2025

Financial Statement Discussion and Analysis

Highlights

2024-25 Financial Highlights ($ Billions) - Table 1

| Item | 2024 Budget | 2024-25 Actual | 2023-24 Restated Actual | Change from 2024 Budget | Change from 2023-24 Restated Actual |

|---|---|---|---|---|---|

| Total Revenue | 208.2 | 226.2 | 209.0 | 17.9 | 17.2 |

| Expense Programs | 200.6 | 212.1 | 195.2 | 11.5 | 16.9 |

| Interest and Other Debt Servicing Charges | 16.5 | 15.1 | 14.5 | (1.3) | 0.7 |

| Total Expense | 217.0 | 227.3 | 209.7 | 10.2 | 17.6 |

| Reserve | 1.0 | – | – | (1.0) | – |

| Annual Deficit | (9.8) | (1.1) | (0.7) | 8.7 | (0.4) |

| Item | 2024-25 Actual | 2023-24 Restated Actual | Change from 2023-24 Restated Actual |

|---|---|---|---|

| Financial Assets | 144.2 | 142.3 | 1.9 |

| Liabilities | 571.2 | 552.1 | 19.1 |

| Net Debt | (427.1) | (409.8) | (17.3) |

| Non-Financial Assets | 180.0 | 163.7 | 16.3 |

| Accumulated Deficit | (247.1) | (246.1) | (1.0) |

| Item | 2024-25 Actual | 2023-24 Restated Actual | Change from 2023-24 Restated Actual |

|---|---|---|---|

| Accumulated Operating Deficit | (249.2) | (248.5) | (0.7) |

| Accumulated Remeasurement Gains | 2.2 | 2.4 | (0.2) |

Note: Numbers may not add due to rounding.

Financial highlights

Change from 2023-24 Actuals

- The Ontario government recorded a $1.1 billion deficit for the fiscal year ended March 31, 2025, compared to the previous year’s restated deficit of $0.7 billion. The $0.4 billion increase in annual deficit is mainly due to higher program expenses and higher interest and other debt servicing charges, partially offset by higher revenues (see Table 1 above).

- Total revenues were $226.2 billion, which is $17.2 billion or 8.2 per cent higher than the previous year, largely due to increases in taxation revenues, transfers from the Government of Canada, revenues reported by ministries and the broader public sector, as well as one-time revenue from the tobacco legal settlement. See details on pages 9-10.

- Total program expenses were $212.1 billion, which is $16.9 billion or 8.7 per cent higher than the previous year. Expenses are higher in the:

- Health sector mainly to address growing demand for health care services, including for Ontario Health Insurance Plan and Ontario Public Drug Programs and operating costs for the delivery of health care;

- Education sector mainly due to creating more affordable child care spaces through the continued implementation of the Canada-wide Early Learning and Child Care Agreement, increased school board spending resulting from a rise in third-party revenue and funding to support commitments consistent with labour agreements;

- Postsecondary Education sector mainly due to higher college operating costs, higher uptake for student financial assistance, and to support investments in research and health human resources;

- Children’s and Social Services sector mainly due to an increase in demand for Ontario Works, primarily resulting from an increase in the number of asylum seekers arriving in Ontario, as well as funding to support annual inflationary increases to the Ontario Disability Support Program and the Assistance for Children with Severe Disabilities Program, and investments in the Ontario Autism Program; and

- Justice sector mainly due to initiatives to provide enhanced policing services across the province, including in First Nation communities, investments in correctional systems, public safety and transformation of court services delivery, as well as legal settlement costs

- Other sector mainly to support delivering a $200 taxpayer rebate for each eligible person, as well as higher spending across various programs such as broadband.

- Interest and other debt servicing charges were higher than the previous year by $0.7 billion, or 4.6 per cent, as a result of an increase in the total amount of debt outstanding. See details on page 21.

- Non-financial assets increased by $16.3 billion from the previous year, mainly due to an increase of $16.1 billion in the net book value of Ontario’s capital assets, such as buildings, and transportation infrastructure.

- Total infrastructure expenditure increased by $5.6 billion from the previous year. Increased investments include public transit, schools, correctional facilities, broadband and housing-enabling infrastructure. Ontario invested $24.5 billion in assets owned by the government and its consolidated entities, which reflect new capital investments and repairs to existing assets. The government also made $4.7 billion in transfers to non-consolidated partners and other infrastructure expenditures. See details on page 26.

- Total liabilities increased by $19.1 billion and total financial assets increased by $1.9 billion, resulting in an increase of $17.3 billion or 4.2 per cent in net debt from the previous year (see details on pages 29-30). The increase in liabilities is mainly due to an increase in debt. The increase in financial assets is mainly due to an increase in investments, investments in Government Business Enterprises (GBEs) and year-end derivative revaluations. The accumulated deficit increased by $1.0 billion, or 0.4 per cent, from the previous year, mainly as a result of the reported deficit of $1.1 billion and lower accumulated remeasurement gains of $2.2 billion.

Change from the 2024 Budget

- The Ontario government recorded a $1.1 billion deficit for the fiscal year ended March 31, 2025, compared to a forecasted deficit of $9.8 billion in the 2024 Budget , resulting from increases in taxation revenues and revenues reported by ministries and the broader public sector and lower interest and other debt servicing charges partially offset by increases in program expenses due to higher demands and distribution of programs and services. (See Table 1).

- Total revenues of $226.2 billion, were $17.9 billion or 8.6 per cent higher than planned in the 2024 Budget , primarily driven by stronger-than-expected revenues from ministries and consolidated government organizations, including the broader public sector; higher net income from GBEs; revenue from the court approved settlement between tobacco companies and their creditors, including Ontario; and increased taxation revenue based on updated tax assessment data for 2024 and prior years provided by the Canada Revenue Agency (CRA), which reflect stronger-than-expected economic growth in 2024. See details on page 11.

- Total program expenses of $212.1 billion, were $11.5 billion or 5.8 per cent higher than in the 2024 Budget . Program expenses were higher in the:

- Health sector mainly to address growing demand and costs for health services, including for the Ontario Health Insurance Plan, Ontario Public Drug Programs, hospitals and home and community care;

- Education sector mainly due to school board funding to support commitments consistent with labour agreements;

- Postsecondary Education sector mainly due to higher-than-forecasted college spending resulting from increased enrolment and associated operating costs, as well as higher-than-expected uptake for student financial assistance;

- Children’s and Social Services sector mainly due to higher-than-expected demand for Ontario Works, primarily resulting from an increase in the number of asylum seekers arriving in Ontario; and

- Justice sector mainly due to investments in policing, correctional systems, and public safety as well as legal settlement costs.

See details on pages 18.

- Interest and other debt servicing charges were lower than in the 2024 Budget by $1.3 billion, or 8.2 per cent, due to lower interest costs on debt outstanding, higher interest income from Ontario's own investments, and an increase in interest capitalization by consolidated entities. See details on page 21.

Analysis of 2024-25 Results

Revenue

| Revenue | 2024 Budget | 2024-25 Actual | 2023-24 Restated Actual | Change from 2024 Budget | Change from 2023-24 Restated Actual |

|---|---|---|---|---|---|

| Personal Income Tax | 51.9 | 55.7 | 50.8 | 3.8 | 4.9 |

| Sales Tax | 38.8 | 39.4 | 39.9 | 0.5 | (0.5) |

| Corporations Tax | 24.9 | 27.8 | 23.1 | 2.8 | 4.7 |

| Employer Health Tax | 8.7 | 9.1 | 8.6 | 0.3 | 0.5 |

| Education Property Tax | 5.8 | 5.9 | 5.8 | 0.1 | 0.1 |

| Ontario Health Premium | 5.0 | 5.2 | 5.0 | 0.2 | 0.2 |

| Gasoline and Fuel Tax | 2.6 | 2.2 | 2.1 | (0.3) | 0.1 |

| Other Taxes | 6.9 | 6.3 | 6.5 | (0.6) | (0.3) |

| Total Taxation Revenue | 144.7 | 151.5 | 141.8 | 6.8 | 9.7 |

| Transfers from Government of Canada | 36.3 | 36.6 | 34.3 | 0.4 | 2.3 |

| Fees, Donations and Other Revenues from Broader Public Sector Organizations | 10.2 | 14.7 | 13.1 | 4.5 | 1.6 |

| Income from Investment in Government Business Enterprises | 6.8 | 7.5 | 7.4 | 0.7 | 0.1 |

| Interest and Investment Income | 2.6 | 2.8 | 3.1 | 0.2 | (0.3) |

| Other Non-Tax Revenue | 7.7 | 13.1 | 9.2 | 5.3 | 3.8 |

| Total Revenue | 208.2 | 226.2 | 209.0 | 17.9 | 17.2 |

Note: Numbers may not add due to rounding.

Change from 2023-24 Actuals

Total revenues for 2024-25 increased by $17.2 billion or 8.2 per cent from the previous year.

- Taxation revenue increased by $9.7 billion or 6.8 per cent in 2024-25, supported by strong nominal Gross Domestic Product (GDP) growth of 5.3 per cent in 2024. The change in taxation revenue primarily reflects growth in reported Personal Income Tax (PIT) and Corporations Tax (CT).

- Transfers from Government of Canada increased by $2.3 billion or 6.7 per cent in 2024-25, mostly reflecting higher transfers from major federal funding programs, including Canada Health Transfer, Canada Social Transfer, Equalization, and support for Canada wide Early Learning and Child Care, Shared Health Priorities and Infrastructure Programs.

- Fees, donations and other revenues from broader public sector organizations (BPS) increased by $1.6 billion or 12.5 per cent in 2024-25, mainly due to higher third-party revenue from hospitals reflecting higher revenue from fees, ancillary services, donations, research grants, and other miscellaneous revenues.

- Income from Government Business Enterprises increased by 0.5 per cent in 2024–25. This performance was primarily driven by higher net income from Ontario Power Generation (OPG), Hydro One Ltd. (HOL), iGaming Ontario (iGO), and the Ontario Cannabis Retail Corporation (OCRC). These gains were largely offset by a decline in net income from the Liquor Control Board of Ontario (LCBO) and the Ontario Lottery and Gaming Corporation (OLG).

- Interest and investment income decreased by $0.3 billion or 9.7 per cent, mainly due to lower interest rates compared to last year.

- Other non-tax revenue increased by $3.8 billion or 41.2 per cent in 2024-25, mainly due to one-time revenue from the tobacco legal settlement and higher recoveries of prior-year expenditures.

Change from the 2024 Budget

Revenues for 2024-25 were $17.9 billion or 8.6 per cent higher than expected in the 2024 Budget .

- Taxation revenues were $6.8 billion or 4.7 per cent higher than forecasted in the 2024 Budget , mainly due to stronger-than-expected CT, PIT, and the Ontario Health Premium (OHP), based on updated tax assessment data for 2024 and prior years from the CRA. Also contributing to higher revenues was Sales Tax, reflecting upward revisions to official federal HST entitlement estimates.

- Transfers from the Government of Canada were $0.4 billion or 1.1 per cent higher, mainly due to higher transfers to the hospital sector and the signing of several new agreements, such as the National Strategy for Drugs for Rare Diseases. This was partially offset by the reprofiling of funding under the Canada wide Early Learning and Child Care Agreement.

- Fees, donations, and other revenues from BPS were $4.5 billion or 43.6 per cent higher, mainly due to higher-than-expected third-party revenue from BPS hospitals and colleges. For hospitals, the increase reflects stronger revenue from fees, ancillary services, donations, research grants, and other miscellaneous sources. Colleges reported higher third-party revenue largely due to higher-than-expected international student enrollment. This was supported by the federal government’s continued issuance of visas to existing cohorts of international students from prior years, enabling them to advance through their multi-year academic programs.

- Income from GBEs was $0.7 billion or 10.0 per cent higher, mainly reflecting higher-than-expected net income from OPG, iGO, HOL and the OCRC. This was partially offset by lower net income from the OLG and the LCBO.

- Interest and investment income increased by $0.2 billion or 9.2 per cent, mainly due to higher than forecast interest revenue reported by consolidated entities, particularly hospitals and colleges.

- Other non-tax revenues increased by $5.3 billion or 69.0 per cent mainly reflecting revenue reported in 2024-25 from the court approved settlement between tobacco companies and their creditors, including Ontario, higher recoveries of prior-year expenditures, and higher-than-expected revenue from fees, licences, permits, and other miscellaneous revenues reported by ministries and consolidated government organizations.

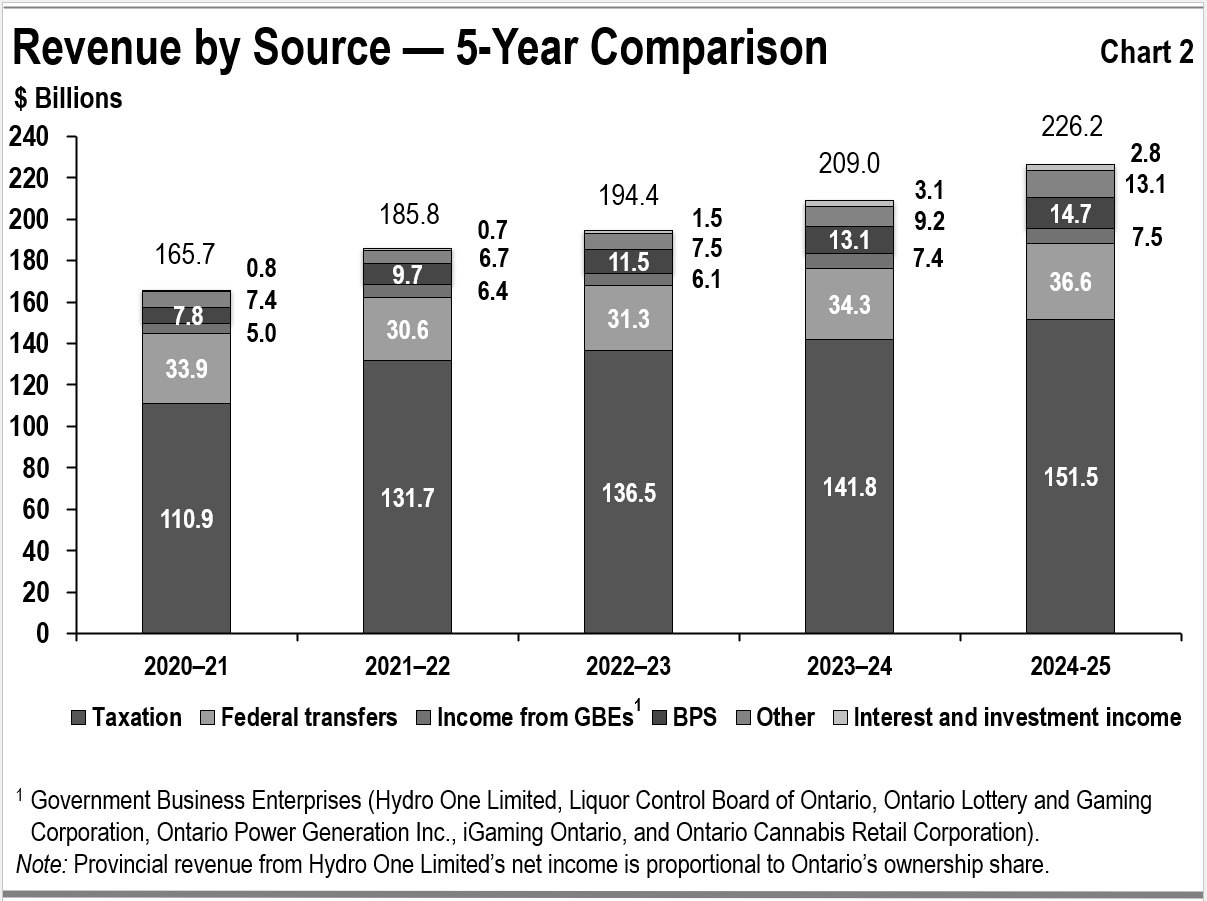

Revenue trend

Chart 2 shows the recent trends in revenue for Ontario’s major revenue sources.

Taxation revenue

Between 2020-21 and 2024-25 taxation revenue grew at an average annual rate of 8.1 per cent, higher than the average annual rate of nominal GDP growth of 7.7 per cent.

Although economic growth and taxation revenue growth are closely linked, the relationship is affected by several factors, including but not limited to:

- Growth in some revenue sources, such as Corporations Tax and Mining Tax, which can diverge significantly from economic growth in any given year due to the inherent volatility of business profits as well as the use of tax provisions, such as the option to carry losses forward or backward;

- The impact of housing completions and resales on HST and Land Transfer Tax revenue, which is proportionately greater than their contribution to GDP; and

- Changes in volume-based gasoline and fuel taxes which are more closely aligned to growth in real GDP as opposed to nominal GDP since these revenue sources are not directly influenced by price changes.

Federal government transfers

Between 2020-21 and 2024-25, Government of Canada transfers grew at an annual average rate of 1.9 per cent. This reflects existing federal-provincial funding arrangements and formulas. These include major federal transfers such as Canada Health Transfer, Canada Social Transfer and Equalization. There are also a number of federal transfers to the Province which are largely program-specific, such as Canada wide Early Learning and Child Care, Shared Health Priorities, Infrastructure and Labour Market Development. Some transfers are ongoing while others are time-limited.

Fees, donations and other revenues from BPS

Between 2020-21 and 2024-25 revenue from BPS increased at an average annual rate of 17.2 per cent. This increase mainly reflects lower third-party revenues in 2020-21 attributable to the impact of the COVID-19 pandemic.

Income from Investment in Government Business Enterprises

Income from GBEs includes OPG, HOL, LCBO, OLG, OCRC and iGO.

Between 2020-21 and 2024-25, income from GBEs increased at an annual average rate of 10.5 percent.

Interest and investment income

Interest and investment income refers to all interest and investment income earned from third parties.

Interest and investment income increased at an annual average rate of 38.1 per cent between 2020-21 and 2024-25.

Other non-tax revenues

Other non-tax revenues are generated from a variety of sources, including the sale and rental of goods and services; fees, licences, and permits; reimbursements for provincial expenditures related to specific service delivery; royalties from the use of Crown resources; and recoveries from power supply contracts.

- Other non-tax revenues increased at an annual average rate of 15.4 per cent between 2020-21 and 2024-25. This increase reflects revenue in 2024-25 from the court approved settlement between tobacco companies and their creditors, including Ontario, as well as lower revenues in 2020-21 attributable to the impact of the COVID-19 pandemic

Expense

| Expense | 2024 Budget | 2024-25 Actual | 2023–24 Restated Actual | Change from 2024 Budget | Change from 2023–24 Restated Actual |

|---|---|---|---|---|---|

| Health sector | 85.0 | 91.6 | 85.5 | 6.7 | 6.2 |

| Education sector | 37.6 | 38.4 | 37.2 | 0.8 | 1.2 |

| Postsecondary education sector | 12.2 | 14.1 | 13.2 | 2.0 | 0.9 |

| Children’s and social services sector | 19.9 | 20.7 | 19.4 | 0.8 | 1.3 |

| Justice sector | 5.9 | 7.2 | 6.0 | 1.3 | 1.2 |

| Other programs | 40.0 | 40.0 | 33.9 | - | 6.1 |

| Total Program Expense | 200.6 | 212.1 | 195.2 | 11.5 | 16.9 |

| Interest and Other Debt Servicing Charges | 16.5 | 15.1 | 14.5 | (1.3) | 0.7 |

| Total Expense | 217.0 | 227.3 | 209.7 | 10.2 | 17.6 |

| Reserve | 1.0 | – | – | (1.0) | – |

Note: Numbers may not add due to rounding.

Change from 2023-24 Actuals

Total program expenses for 2024-25 increased by $16.9 billion or 8.7 per cent, from $195.2 billion in the previous fiscal year to $212.1 billion.

- Health sector expense increased by $6.2 billion or 7.2 per cent over the previous fiscal year, mainly due to increased spending in base health sector programs to meet growing demand of Ontarians. Key health sector investments included:

- $2.8 billion in additional funding primarily to support increased utilization of health care services in response to Ontario’s growing population, including increased costs and spending on physician services;

- $1.0 billion in higher spending by hospitals driven by program growth, the expansion of service delivery capacity, and increased demand for services;

- $0.8 billion in additional funding for hospitals to respond to Ontario’s aging and growing population;

- $0.5 billion in additional funding primarily to support increased utilization of the Ontario Public Drug Programs, including expanding access to new drugs by introducing new drugs onto the drug formularies;

- $0.5 billion in additional funding for health sector programs including primary care teams, medical training and education, and supports to health human resources; and

- $0.7 billion in additional Long-Term Care Staffing Plan investments to improve average direct hours of care for long-term care residents and support training and education programs in the long-term care sector.

- Education sector expenses increased by $1.2 billion or 3.3 per cent over the previous fiscal year. This is mainly due to the continued implementation of the Canada-wide Early Learning and Child Care Agreement that reduces average out-of-pocket child care fees, increased school board spending resulting from a rise in third-party revenue from sources such as fundraising and community use of schools, and funding to support commitments consistent with labour agreements.

- Postsecondary education sector expenses increased by $0.9 billion or 6.9 per cent over the previous fiscal year. This is mainly due to higher college operating costs, the introduction of the new Postsecondary Education Sustainability Fund in 2024-25, to help sustain the sector, higher uptake for student financial assistance, and to support investments in research and health human resources.

- Children’s and social services sector expenses increased by $1.3 billion or 6.8 per cent over the previous fiscal year, primarily due to investments to improve access to services such as the Ontario Autism Program, as well as an increase in demand for Ontario Works, mainly resulting from an increase in the number of asylum seekers, and funding to support annual inflationary increases for the Ontario Disability Support Program and the Assistance for Children with Severe Disabilities Program.

- Justice sector expenses increased by $1.2 billion or 19.7 per cent over the previous fiscal year. This is mainly due to investments in essential service delivery and infrastructure for public safety, including First Nations policing, the Ontario Provincial Police, courts, corrections, fire protection services and police air support as well as legal settlement costs. .

- Other programs expenses increased by $6.1 billion or 18.0 per cent over the previous fiscal year, mostly reflecting:

- $3 billion increase to support a $200 taxpayer rebate to each eligible person;

- $0.8 billion increase due to legal settlement costs related to ongoing claims by Indigenous communities;

- $0.8 billion increase primarily due to investments in the Broadband and Cellular Infrastructure, and housing-enabling infrastructure;

- $0.5 billion increase in energy-related expenses, primarily due to higher costs to deliver the suite of electricity price mitigation programs; and

- $0.4 billion increase in support for strategic economic development investments.

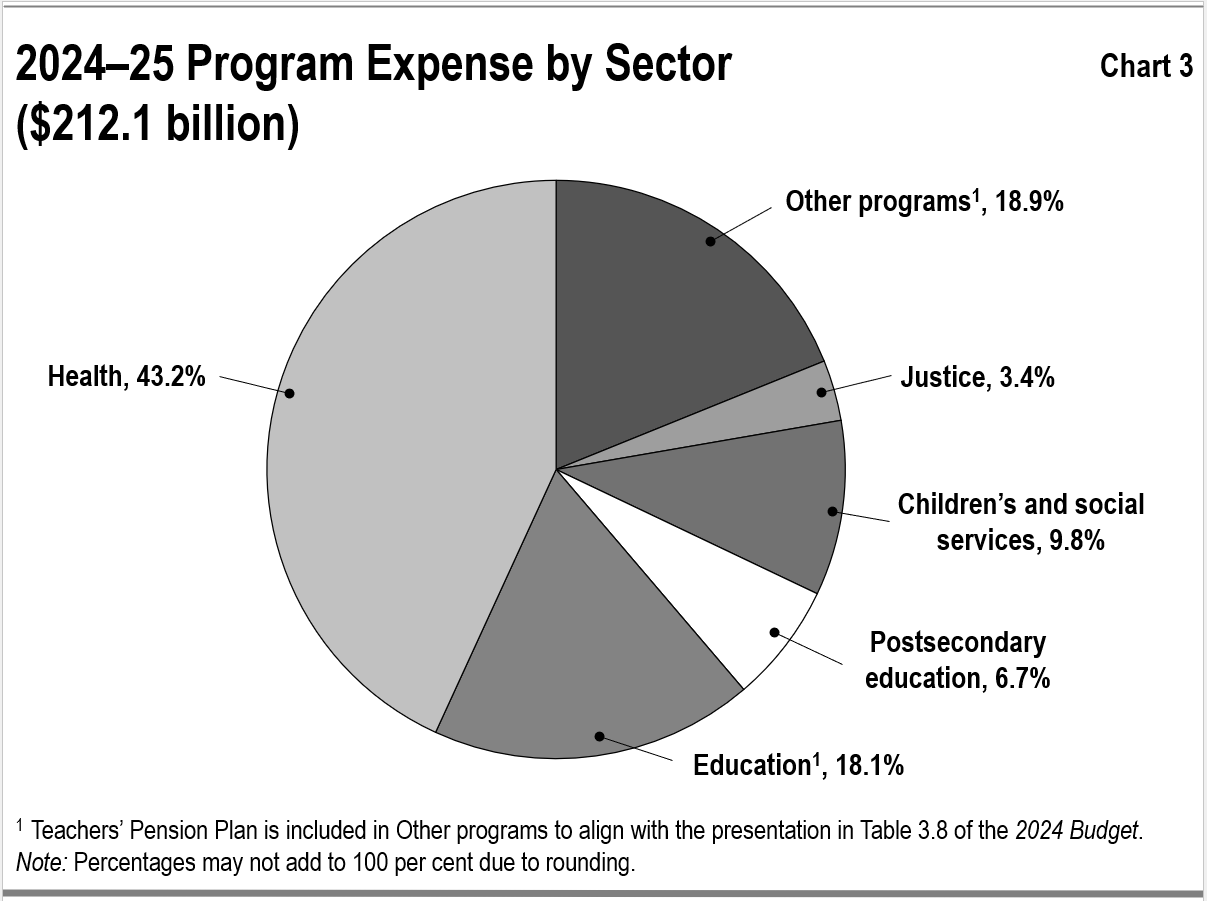

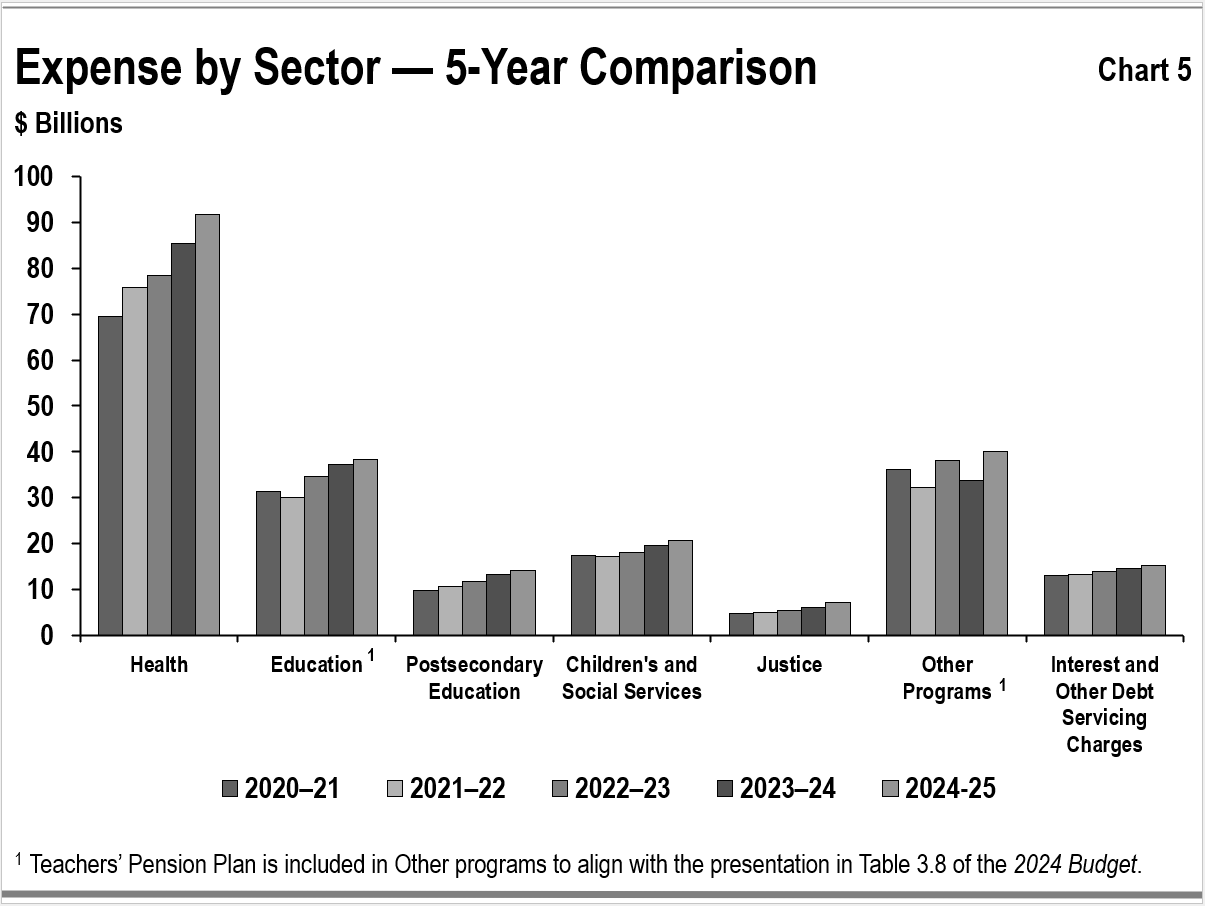

See Chart 3 for details of program expenses by sector.

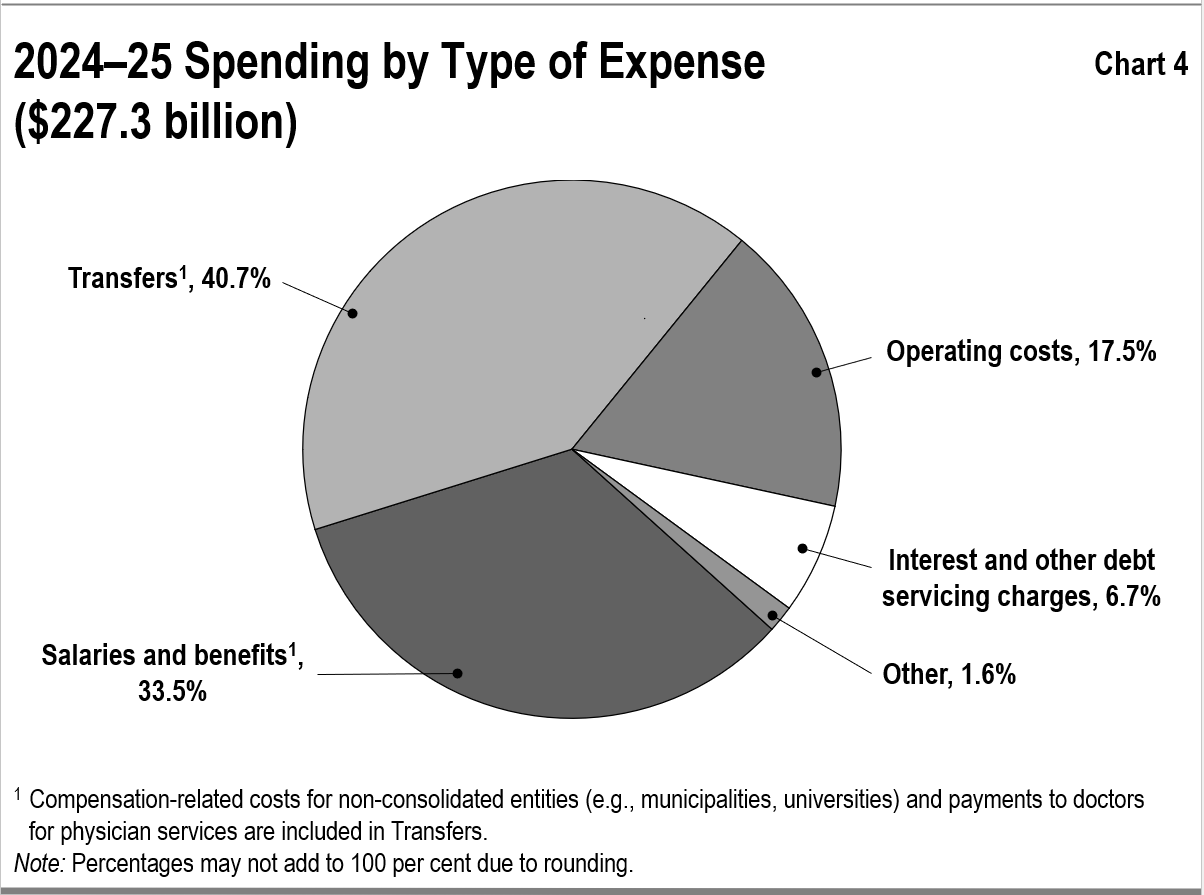

Chart 4 shows spending by type of expense. Government spending related to salaries and benefits includes those expenses for organizations consolidated as part of the government reporting entity, including hospitals, school boards, colleges and children’s aid societies, as well as the Ontario Public Service.

The expense labelled “Transfers” in Chart 4 reflects payments to a variety of service providers that support the delivery of public services. These third-party funding recipients consist of health care professionals including physicians, social service agencies, universities, child care providers and municipalities. As service providers, a large share of the spending of these third parties typically goes to salaries and benefits, i.e., compensation-related costs. Transfers do not include transfers to hospitals, school boards, colleges, and children’s aid societies — these are reflected in expense types such as operating costs and salaries and benefits, as reported by the organizations.

Change from the 2024 Budget

Total program spending for 2024–25 was $212.1 billion, which is $11.5 billion or 5.8 per cent higher than in the 2024 Budget . Changes in program spending were primarily attributed to the following factors:

- Health sector expense was $6.7 billion or 7.9 per cent above plan, mainly to address pressures related to compensation costs for the delivery of health care, and to address growing demand for other health services, such as utilization-driven programs like the Ontario Health Insurance Plan and the Ontario Drug Benefit Program. This also includes additional funding to support operating costs for hospitals and home and community care. This variance also reflects a decrease in Long-Term Care, primarily from lower than expected operational costs due to bed count changes, and reduced development spending due to updated timelines and construction schedules for development and redevelopment projects.

- Education sector expense was $0.8 billion or 2.0 per cent above plan, primarily due to funding to support commitments consistent with labour agreements.

- Postsecondary education sector expense was $2.0 billion or 16.1 per cent above plan, mainly due to higher-than-forecasted college spending resulting from increased enrolment and associated operating costs, as well as higher-than-expected uptake for student financial assistance.

- Children’s and social services sector expense was $0.8 billion or 4.1 per cent above plan, primarily because of higher-than-expected demand for Ontario Works, due to an increase in the number of asylum seekers arriving in Ontario, and increased funding to address operational costs for organizations that support vulnerable populations.

- Justice sector expense was $1.3 billion or 22.9 per cent above plan, primarily due to investments in essential service delivery including First Nations policing, the Ontario Provincial Police, courts, corrections, animal welfare services, coroner and forensic pathology services, and police air support, as well as legal settlement costs.

- Other programs expense was consistent with plan, mainly due to the following factors:

- $3 billion increase to support a $200 taxpayer rebate for each eligible person; and

- $0.8 billion increase due to legal settlement costs related to ongoing claims by Indigenous communities.

Partially offset by: - $1.5 billion decrease in contingency funds that were used during the fiscal year to fund program expenses in the various sectors for emerging needs and unforeseen events.

- $1.3 billion decrease, primarily due to updated construction schedules for programs such as the Broadband and Cellular Infrastructure Program and Transit-Oriented Communities; and

- $1 billion decrease in energy-related expenses, primarily due to lower than forecasted costs to sustain the suite of electricity price mitigation programs.

Expense trend

Chart 5 shows the recent trends in spending for major program areas.

- Health sector expense increased from $69.5 billion in 2020–21 to $91.6 billion in 2024–25, or on average by 7.2 per cent per year. The increase includes:

- Support for Ontario hospitals to scale up capacity and better meet patient needs to provide greater access to high-quality care;

- Investments to address growing demand for health services, including increased use of new drug therapies and higher demand for Ontario drug programs, as well as more physician visits;

- Additional funding to improve and transform home and community care services and improved access to mental health and addictions services;

- Funding for health human resources to strengthen the existing workforce and support the recruitment and retention of health care providers; and

- Support for long-term care homes through increased investments in the Long-Term Care Staffing Plan, operating funding and the Construction Funding Subsidy Top-Up to address sector waitlists and advance construction of new and redeveloped beds.

- Education sector expense increased from $31.3 billion in 2020–21 to $38.4 billion in 2024–25, or on average by 5.2 per cent per year. The increase is mainly due to:

- Implementing the Canada-wide Early Learning and Child Care system;

- Building, expanding and renewing schools to foster safe, healthy, accessible and supportive learning environments; and

- Providing funding to support enrolment growth and commitments consistent with labour agreements.

- Postsecondary education sector expense increased from $9.8 billion in 2020–21 to $ 14.1 billion in 2024–25, or on average by 9.5 per cent per year. This increase is primarily driven by higher college spending resulting from increased enrolment and associated operating costs. It also reflects greater investment in capital grants aimed at helping colleges and universities modernize their infrastructure through technology upgrades and essential repairs, higher uptake for student financial assistance and increased spending on research infrastructure. In addition, the new Postsecondary Education Sustainability Fund was introduced in 2024-25.

- Children’s and social services sector expense increased from $17.4 billion in 2020–21 to $20.7 billion in 2024–25, or on average by 4.5 per cent per year. This increase primarily reflects:

- Higher social assistance funding to address demand;

- Increases to the monthly core allowances for the Ontario Disability Support Program and the maximum monthly amount for the Assistance for Children with Severe Disabilities Program; and

- Investments to support client needs in the Ontario Autism Program and Developmental Services program.

- Justice sector expense increased from $4.8 billion in 2020–21 to $7.2 billion in 2024–25, or on average by 11.0 per cent per year. The increase is primarily due to investments in essential service delivery including First Nations policing, the Ontario Provincial Police, courts, corrections, fire protection services and police air support as well as legal settlement costs.

- Other programs expenses increased from $36.3 billion in 2020–21 to $40.0 billion in 2024–25, or on average by 2.5 per cent per year. The increase is primarily due to:

- Legal settlement costs related to ongoing claims by Indigenous communities; and

- Higher investments to support municipal community infrastructure and Broadband and Cellular Infrastructure.

Interest and Other Debt Servicing Charges

Interest and other debt servicing charges expense increased from $14.5 billion in 2023–24 to $15.1 billion in 2024–25 as a result of an increase in the total amount of debt outstanding.

Interest and other debt servicing charges expense was $1.3 billion below plan from the 2024 Budget in 2024–25, due to lower interest costs on general debt, higher interest income from Ontario's own investments, and an increase in interest capitalization by consolidated entities.

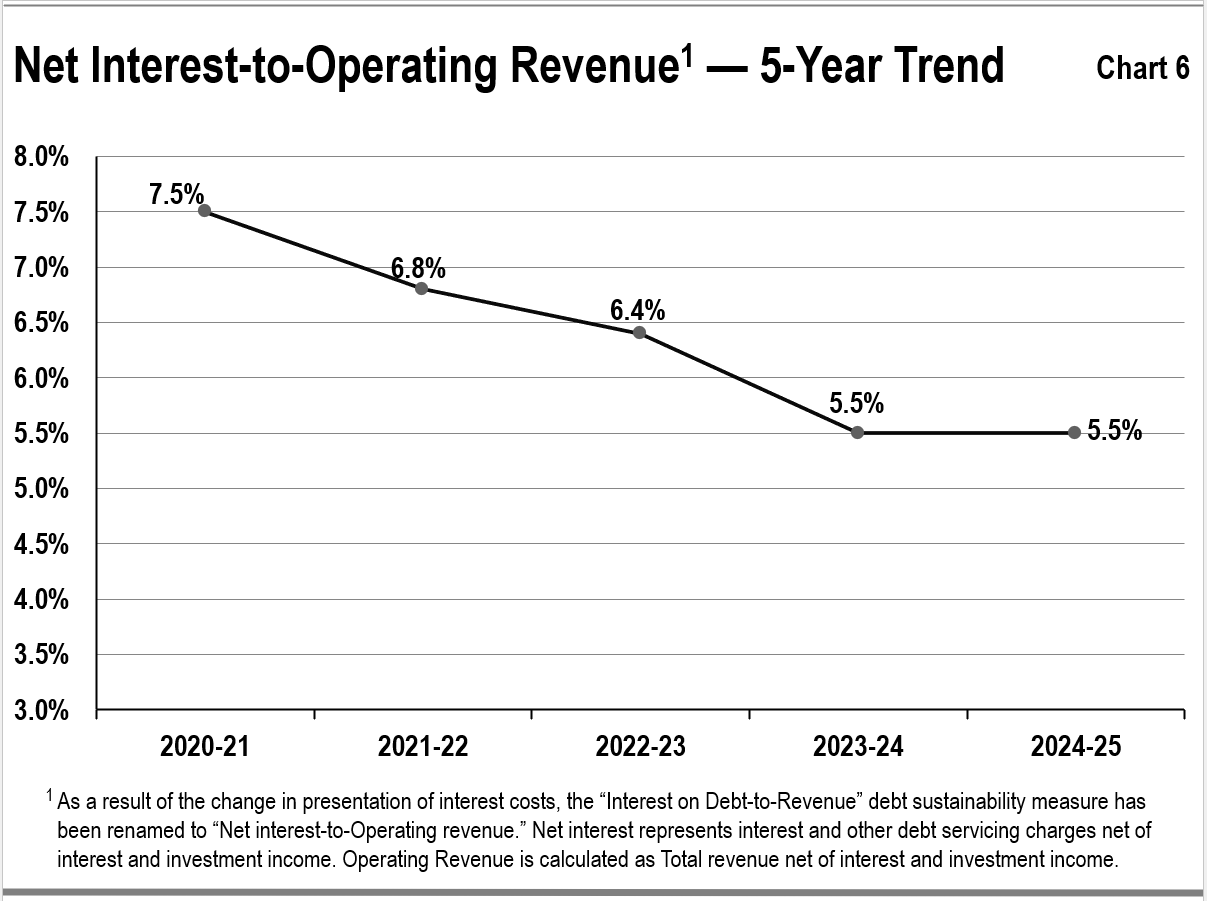

Chart 6 shows that the ratio of Net Interest-to-Operating Revenue has fallen for Ontario over the period between 2020–21 to 2024–25, from a high of 7.5 per cent in 2020–21 to the current level of 5.5 per cent.

Statement of financial position analysis

| Item | 2024–25 Actual | % of Total | 2023–24 Restated Actual | % of Total | Variance Increase (Decrease) |

|---|---|---|---|---|---|

| Cash and cash equivalents | 33.9 | 23.5% | 41.5 | 29.2% | (7.6) |

| Portfolio investments | 32.3 | 22.4% | 25.9 | 18.2% | 6.4 |

| Accounts receivable | 22.8 | 15.8% | 24.2 | 17.0% | (1.4) |

| Loans receivable | 12.1 | 8.4% | 11.9 | 8.4% | 0.2 |

| Derivative assets | 6.1 | 4.2% | 4.5 | 3.2% | 1.6 |

| Other assets | 1.0 | 0.7% | 1.1 | 0.8% | (0.1) |

| Investment in Government Business Enterprises | 36.0 | 25.0% | 33.2 | 23.3% | 2.8 |

| Total Financial Assets | 144.2 | 100% | 142.3 | 100% | 1.9 |

Note: Numbers may not add due to rounding.

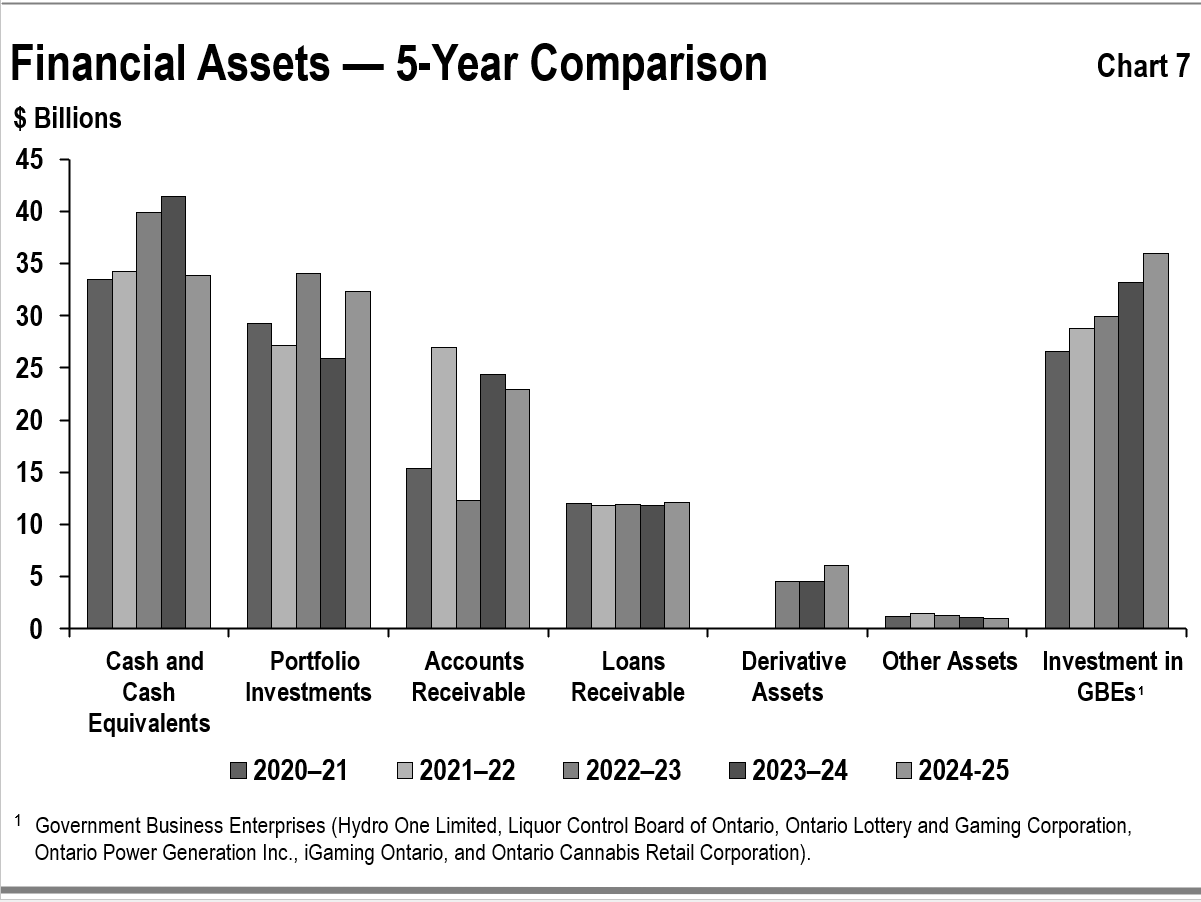

Financial assets consist of items that include cash and cash equivalents and portfolio investments that are available to the government to meet its expenditure needs; accounts and loans receivable, which are amounts it expects to receive from third parties; and other items including derivative assets and investment in GBEs.

Total financial assets increased by $1.9 billion in 2024–25 over the prior fiscal year. The increase was attributable to a (see Table 4):

- $6.4 billion increase in portfolio investments, mainly due to new investments by the Province and hospitals; and

- $2.8 billion increase in investment in GBEs, mainly due to the net income increase from Ontario Power Generation.

- $1.6 billion increase in derivative assets, mainly driven by the year-end revaluation of existing contracts.

These increases in 2024–25 are partially offset by:

- $7.6 billion lower in cash and cash equivalents primarily due to purchases of new portfolio investments and capital assets acquisitions by hospitals.

- $1.4 billion lower in Account Receivable primarily due to decrease in Harmonized Sales Tax and Personal Income Tax receivables, partially offset by the recognition of Tobacco claim payments.

Chart 7 shows the recent trends in financial assets for the government.

The level of financial assets, including cash, accounts receivable and portfolio investments tends to be more variable, since these assets year-over-year often reflect specific circumstances at the fiscal year-end such as pre-borrowing for the following period’s needs.

Total investment in GBEs has increased relatively steadily since 2020-21. The net increases were mainly due to the increases in net assets in GBEs, including Ontario Power Generation net income and investment earnings from the Ontario Nuclear Funds for nuclear waste management and decommissioning.

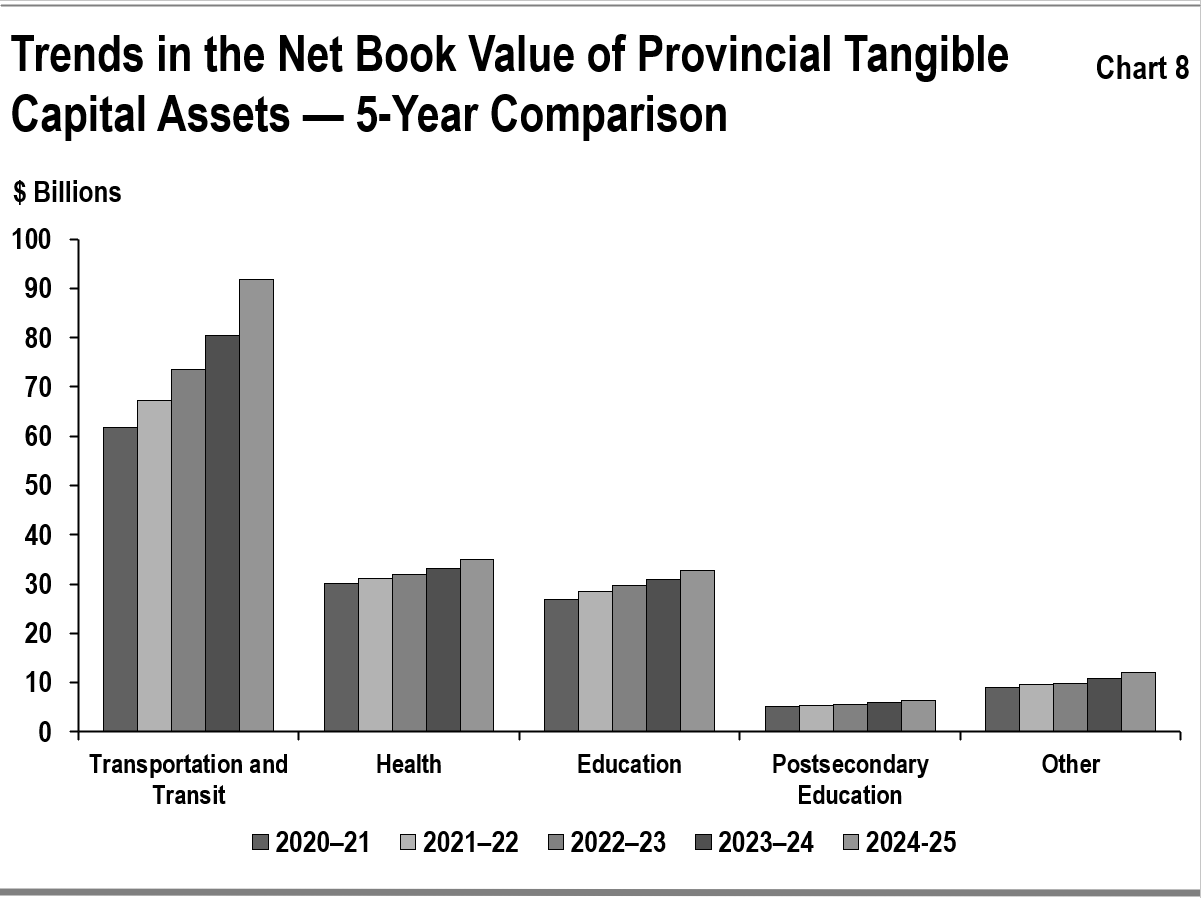

Tangible capital assets

The government is responsible for a large portfolio of non-financial assets, which is almost entirely made up of tangible capital assets.

Tangible capital assets owned by the government and its consolidated entities represent the largest component of Ontario’s infrastructure investments. These assets include those it owns directly, such as provincial highways, transit systems, as well as the assets of hospitals, school boards, colleges, children’s aid societies, and agencies that are consolidated in its financial statements. The assets of GBEs are reflected in Ontario’s statement of financial position as an investment in GBEs under financial assets.

The reported net book value of Ontario’s tangible capital assets was $177.8 billion in 2024–25, increasing by $16.1 billion, or 10.0 per cent over the prior fiscal year. Buildings, including hospitals, schools and college facilities, make up the single largest share at $78.2 billion in aggregate. The total on the balance sheet also includes assets under construction, some of which are being built using the public private partnership (P3) model, in which the private sector finances the assets during construction. The impacts of P3s on balance sheet liabilities are discussed in the Other Long Term Financing section.

Growth in the net book value of capital assets has averaged 7.6 per cent annually over the period between 2020–21 and 2024–25. Most of the growth has been in new and rehabilitated buildings within the province, transportation infrastructure including provincial highways and bridges, and the provincial transit network owned by Metrolinx, an agency of the government.

See Chart 8 for the recent trends in the net book value of provincial tangible capital assets by sector.

Infrastructure expenditures

Ontario’s infrastructure spending in 2024–25 was $29.2 billion (see Table 5). This includes $24.5 billion invested in assets owned by the government and its consolidated entities as discussed in the Tangible Capital Assets section, and $4.7 billion provided for capital investment to non-consolidated partners such as universities and municipalities as well as other infrastructure expenditures.

Total infrastructure spending in 2024–25 was $5.6 billion higher than the previous year, with increased expenditures across all sectors, excluding the Postsecondary Education sector. Increased investments include health infrastructure, public transit, schools, correctional facilities, broadband, and housing-enabling infrastructure, partially offset by decreased spending in the Postsecondary Education sector.

The 2024-25 total is in line with the $29.2 billion set out in the 2024 Budget , reflecting increases in the Transportation, Education, and Health sectors offset by decreases in the Postsecondary Education and Other sectors.

| Sector | Investment in Capital Assets | Transfers and Other Infrastructure Expenditures | Total Infrastructure Expenditures | 2024 Budget Total Infrastructure Expenditures |

|---|---|---|---|---|

| Transportation and transit | 14.3 | 1.2 | 15.5 | 14.8 |

| Health | 4.0 | 0.4 | 4.4 | 3.9 |

| Education | 3.7 | 0.2 | 3.9 | 3.4 |

| Postsecondary education | 0.7 | 0.2 | 0.9 | 1.0 |

| Other sectors | 1.8 | 2.8 | 4.6 | 6.2 |

| Totals | 24.5 | 4.7 | 29.2 | 29.2 |

Note: Numbers may not add due to rounding.

Liabilities

Ontario’s liabilities consist of debt and other financial obligations, including accounts payable and the estimated cost of future payments, including pensions and other employee future benefits liability. See Table 6.

| Item | 2024–25 Actual | % of Total | 2023–24 Actual | % of Total | Variance Increase (Decrease) |

|---|---|---|---|---|---|

| Accounts payable and accrued liabilities | 44.9 | 7.9% | 48.9 | 8.9% | (4.0) |

| Debt | 462.0 | 80.9% | 437.6 | 79.3% | 24.4 |

| Other long-term financing | 19.2 | 3.4% | 18.0 | 3.3% | 1.2 |

| Deferred revenue and capital contributions | 16.7 | 2.9% | 17.4 | 3.2% | (0.7) |

| Pensions and other employee future benefits liability | 13.7 | 2.4% | 13.8 | 2.5% | (0.1) |

| Derivative liabilities | 5.2 | 0.9% | 6.9 | 1.3% | (1.7) |

| Other liabilities | 9.4 | 1.6% | 9.4 | 1.7% | - |

| Total Liabilities | 571.2 | 100.0% | 552.0 | 100.0% | 19.1 |

Note: Numbers may not add due to rounding.

Debt

Debt makes up the largest share of liabilities. From 2023–24 to 2024–25, debt increased by $24.4 billion to $462.0 billion at fiscal year-end, primarily to finance the deficit which has increased to support investments in critical public services such as health care, education and infrastructure.

Table 7 summarizes the government’s financing in 2024–25.

| Item | Amount |

|---|---|

| Operating deficit and other transactions | (0.8) |

| Investment in capital assets owned by the government and its consolidated organizations, including hospitals, school boards, colleges and children’s aid societies | 23.1 |

| Decrease in the government’s cash and investments funded by cash holdings | (1.2) |

| Subtotal | 21.1 |

| Decrease in other long-term financing, Tangible Capital Assets financed by Public Private Partnership (P3) | 3.3 |

| Net new financing | 24.4 |

Note: Numbers may not add due to rounding.

The government completed an annual borrowing program of $49.5 billion in 2024–25, compared to the $42.6 billion borrowed in 2023–24.

Other long-term financing

This category includes obligations to finance construction of public assets including those procured through the P3 model and total debt of BPS. All assets that are owned by the Ontario government and its consolidated entities, and the associated financing liabilities, are reflected on Ontario’s balance sheet during construction and as the liabilities are incurred. For information on asset investments, see the Tangible Capital Assets section.

Other types of liabilities

Other types of liabilities include accounts payable, pensions and other employee future benefits, unspent transfers received from the federal government representing deferred revenues, derivative liabilities, and other liabilities.

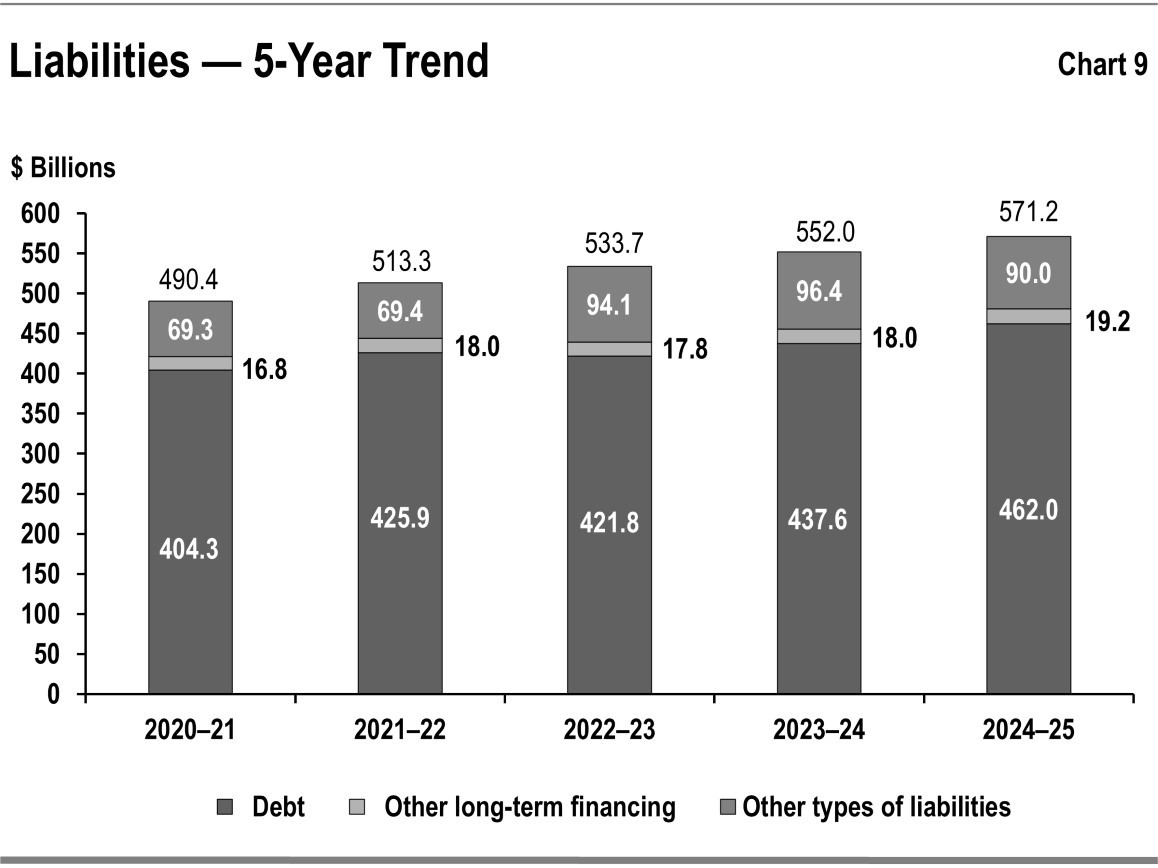

Chart 9 shows the recent trends in liabilities for Ontario. This trend over the period between 2020–21 and 2024–25 shows public debt rising, mainly to fund capital investments and the annual deficits. Other types of liabilities, including accounts payable and deferred revenue, tend to be more variable since they often reflect specific circumstances at the fiscal year-end, such as accrued liabilities for goods and services.

Risks and risk management

Ontario’s financial results and financial reporting are subject to various risks and uncertainties over which the Provincial government may have limited or no control.

A majority of Ontario’s taxation revenue is administered and collected by the federal government through various tax collection agreements. Actual tax assessments from the Canada Revenue Agency for the current tax year and prior years are provided to the Ontario Ministry of Finance well after the tax year has ended. In the absence of actual tax data from the federal government, the Ministry of Finance uses economic driven models to produce the forecasts for federally administered taxes. Ontario manages risks to the revenue forecast by consulting with private-sector economists to inform the government’s planning assumptions. For prudent fiscal planning, the Ontario Ministry of Finance’s GDP growth projections are typically set slightly below the average private-sector forecast. Ontario’s revenues rely heavily on the level and pace of economic activity in the province.

The ongoing monitoring of revenues allows the government to assess potential risks to its finances. Collaboration with the Canada Revenue Agency, which administers approximately 80 per cent of Ontario’s taxation revenues, is essential to achieving this. As well, Ontario continues to explore ways to enhance its tax revenue forecasting and monitoring.

There are also risks arising from other sources of revenue, such as federal transfers and income from GBEs. Since these represent a smaller share of total revenue compared to larger revenue sources such as tax revenue — the risks they present are relatively less material to the fiscal plan. In addition, these risks are difficult to predict and quantify; for example, federal transfers are subject to federal policy changes while GBE net incomes are subject to regulatory decisions and market conditions. Note 1 to the Consolidated Financial Statements provides additional details on measurement of uncertainty.

Additionally, given the current pace of change and the interconnected nature of the external and emerging risk environment, the Province needs to consider potential threats and opportunities as it sets priorities. Areas like artificial intelligence, geopolitical and economic stability (e.g., tariffs and trade), cybersecurity, infrastructure, supply chain management and the changing workforce create a dynamic environment that may introduce or amplify existing risks to government and require targeted responses and mitigation to support the government’s ability to achieve its priorities.

To address these challenges, critical investments and additional expenditures enabled the provision of services and the delivery of programs. This included the development of policies and changes to existing programs as well as a continued focus on modernizing government services to support economic development, enable digital transformation, and address key infrastructure needs.

Other risk management tools the government utilized include contingency funds to address risks that materialized. In the 2024 Budget , the government committed a total of $1.5 billion ($1.4 billion for operating and $0.1 billion for capital) for the standard contingency fund. After the release of the 2024 Budget , an additional top-up of $0.9 billion to the standard contingency fund was made to support the implementation of initiatives announced as part of the 2024 Ontario Economic Outlook and Fiscal Review. Funds from the standard contingency fund were used to support initiatives such as:

- Ontario Public Service compensation costs;

- The Beer Store, to support a stable transition to a more open and convenient alcohol beverage marketplace; and

- Social assistance, primarily to meet higher-than-expected demand for Ontario Works.

As required under the Fiscal Sustainability, Transparency and Accountability Act, 2019, a reserve is included in the projected surplus/deficit each year to guard against unforeseen revenue and expense changes that could have a negative impact on the government’s fiscal performance. The 2024 Budget included a $1.0 billion reserve for 2024–25. Excluding this reserve, the projected deficit for 2024–25 in the 2024 Budget was $8.8 billion.

Provisions for losses that are likely to occur as a result of contingent liabilities, such as ongoing litigation and land claims, and that can be reasonably estimated, are expensed and reported as liabilities. Note 1 to the Consolidated Financial Statements provides further details.

Note 3 to the Consolidated Financial Statements explains the government’s risk management strategies, which are intended to ensure that exposure to borrowing-related risk is managed in a prudent and cost-effective manner.

Changes in Canadian generally accepted accounting principles (GAAP) for the public sector issued by the Public Sector Accounting Board (PSAB) can have an impact on Ontario’s budgets, estimates and actual results. The Office of the Comptroller General, Treasury Board Secretariat actively monitors proposed changes and provides input to standard setters to support the development of standards that support sound public policy decision-making, transparency and accountability in reporting.

Key Financial Ratios

In this section of the Annual Report, the use of key measures of financial position will be used to assess Ontario’s financial position. The levels and trends of these measures indicate the impacts of economic and other events on the Ontario government’s finances. The ratio and level of each over the past five fiscal years are outlined in Table 8.

| Item | 2020–21 | 2021–22 | 2022–23 | 2023–24 | 2024–25 |

|---|---|---|---|---|---|

| Sustainability - Net Debt-to-GDP (%) | 42.6% | 39.5% | 37.7% | 36.6% | 36.2% |

| Sustainability - Net Debt-to-Operating Revenue (%) | 225.8% | 206.8% | 207.3% | 199.0% | 191.2% |

| Sustainability - Net Debt per Capita ($) | $25,234 | $25,794 | $26,405 | $26,228 | $26,485 |

| Flexibility - Net Interest-to-Operating Revenue (%) | 7.5% | 6.8% | 6.4% | 5.5% | 5.5% |

| Flexibility - Own-Source Operating Revenue to GDP (%) | 15.0% | 15.9% | 15.2% | 15.3% | 15.8% |

| Vulnerability - Federal Transfers to Total Operating Revenue (%) | 20.6% | 16.5% | 16.2% | 16.7% | 16.4% |

| Vulnerability - Foreign Currency Debt to Total Debt (%) | 15.8% | 16.1% | 14.0% | 12.9% | 14.5% |

| Vulnerability - Unhedged Foreign Currency Debt (%) | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% |

Notes:

- Beginning in 2020–21, Ontario is presenting public debt less of any investments in its own bonds and treasury bills.

- The forecasts of net debt and related ratios in the annual Budget are based on a calculation that includes the reserve.

- Sustainability Ratios for 2023–24 and 2024–25 have been presented to reflect an accounting policy change regarding the calculation of accrued Corporations Tax revenue, including the impact to Net Debt. See Note 17 to the Consolidated Financial Statements.

- To align ratio analysis related to the change in presentation of interest costs, Ontario’s ratio measures have been renamed. “Revenue” has been renamed to “Operating Revenue” to reflect changes in presentation. Net interest represents interest and other debt servicing charges net of interest and investment income. Operating Revenue is calculated as Total revenue net of interest and investment income.

Sources: Nominal GDP is based on Ontario Economic Accounts, First Quarter 2025, released by the Ontario Ministry of Finance. Population estimates are from Statistics Canada.

Measures of sustainability

Net debt provides a measure of the future government revenues that will be required to pay for the government’s past transactions. Net debt as a percentage of Ontario’s GDP shows the financial demands on the economy resulting from the government’s spending and taxation policies. A lower ratio of net debt-to-GDP generally indicates higher sustainability.

The government’s net debt-to-GDP ratio was 36.2 per cent at the end of fiscal year 2024–25, lower than the 39.2 per cent forecast in the 2024 Budget . As shown in Table 8, this ratio has decreased by 0.4 percentage points over the prior year, largely due to net debt increasing at a slower rate than GDP. The ratio of Net Debt-to-Operating Revenue is another key measure of sustainability, since net debt reflects the future revenue that is required to pay for past transactions and events. A lower net debt-to-operating revenue ratio generally indicates higher sustainability. This ratio was 191.2 per cent at the end of fiscal year 2024–25, lower than the 213.5 per cent forecast in the 2024 Budget . The ratio decreased by 7.8 percentage points from the prior year primarily due to higher operating revenues.

Measures of flexibility

The ratio of Net Interest-to-Operating Revenue shows the share of provincial revenue that is being used to pay interest and other debt servicing charges and therefore is not available for programs. Operating Revenue is calculated as total revenue net of interest and investment income. A lower ratio generally indicates that a government has more flexibility to direct its revenues to programs. The ratio has fallen for Ontario over the past five years, from a high of 7.5 per cent in 2020–21 to the current level of 5.5 per cent.

Own-source Operating Revenue as a share of Ontario’s GDP shows the extent to which the government is leveraging funds from the provincial economy collected through taxation, user fees and other revenue sources it controls. A high taxation burden may make a jurisdiction less competitive, therefore increases in this ratio may reduce future revenue flexibility.

Measures of vulnerability

Transfers from the federal government as a percentage of total operating revenue is an indicator of the degree to which Ontario relies on the federal government for revenue. A higher ratio may imply that a provincial government is more reliant on federal transfers. Provinces may have limited control over the value of these transfers, and changes in federal policies can result in shifts in federal revenues to provinces.

Ontario’s share of revenue from federal transfers, including direct transfers to the broader public sector (BPS) is 16.4 per cent in 2024–25. This is consistent with shares observed in recent years but lower than 2020–21 due to significant time-limited COVID-19 funding.

Foreign currency debt to total debt is a measure of vulnerability to changes in foreign currency exchange rates. Accessing borrowing opportunities in foreign currencies allows Ontario to diversify its investor and funding base. It also ensures that the government will continue to have adequate access to capital in the event that domestic market conditions become more challenging. Ontario manages foreign currency risk by hedging its exposure to foreign currencies through the use of financial instruments. Effective hedging has allowed the government to consistently limit its exposure to foreign currency fluctuations to 0.1 per cent of debt issued for provincial purposes in 2020–21, remaining unchanged from 2021–22 to 2024–25.

Fiscal Management

Use of taxpayer dollars

To support long-term economic growth and sustainable public finances, the government remains committed to ensuring taxpayer dollars are managed appropriately. This includes an emphasis on evidence-based decision-making and performance measurement to identify opportunities for modernization and to improve the effectiveness and efficiency of public programs and services.

To further support this approach, the government is advancing an outcomes management strategy to promote greater alignment between performance measurement and strategic objectives across the public sector. This work aims to strengthen accountability, inform decision-making, and support the delivery of effective and efficient programs and services while maintaining fiscal sustainability.

The Audit and Accountability Committee (AAC) plays an important role in supporting the government’s efforts to ensure the effectiveness and efficiency of operations, and sound stewardship of public funds through effective risk management, governance and internal control practices. The AAC supports enhanced governance by providing input and direction to ensure internal audit services continue to align with emerging risks and government priorities, based on independent strategic advice provided by the Ontario Internal Audit Committee (OIAC), an advisory audit committee of the AAC.

Non-Financial Activities

This section discusses key non-financial results of major sectors. The purpose is to provide highlights of Ontario government spending and the related activities in these sectors.

Health sector

Ontario’s health care system is connecting Ontarians to the care they need, when and where they need it during all stages of life. Ontario is building a patient-centred, equitable, results-driven, and sustainable public health care system in Ontario.

Results reported in 2024-25 include, but are not limited to:

- Launching the Primary Care Action Team, led by Dr. Jane Philpott, to implement a plan which will support the government’s goal of connecting everyone in the province to a family doctor or primary care team by 2029.

- Expanding the Ontario Breast Screening Program by lowering the age of self-referral for publicly funded mammograms to the age of 40, connecting more women to screening services to detect and treat breast cancer sooner.

- Adding new adult hospice beds across the province to expand access to community end-of-life care, with new pediatric hospice beds already added for Keaton’s House – Paul Paletta Children’s Hospice in Hamilton.

- Introducing the human papillomavirus (HPV) test in the Ontario Cervical Screening Program as the primary test in screening for cervical cancer.

- Publicly funding and administering a new treatment for advanced-stage prostate cancer – the first jurisdiction in Canada to do so.

- Completing the Mount Sinai Hospital redevelopment project to build a new and expanded emergency department, operating rooms, and intensive care unit, providing a more modern space to improve care for patients undergoing surgery, requiring emergency care, and for those with cancer.

- Increasing the availability of ambulances across the province and investing in the Dedicated Offload Nurses Program to support hospitals to hire more nurses and other health professionals dedicated to offloading ambulance patients in hospital emergency departments.

- Expanding the Respiratory Syncytial Virus (RSV) program to connect more infants, high-risk children and pregnant women to RSV vaccines that can help strengthen protection during the fall respiratory illness season.

- Increasing the annual income eligibility thresholds for the Ontario Seniors Dental Care Program and the Seniors Co-Payment Program for single Ontarians aged 65 and over to support seniors in accessing the dental and health care they need.

- Expanding the list of drugs that midwives can prescribe and administer for the first time since 2010.

- Finishing construction and opening new beds and upgrading beds in the long-term care sector between April 1, 2024, to March 31, 2025.

- Supporting the recruitment of over 3,300 personal support workers into the long-term care and home and community care sectors since November 2023 through new recruitment incentives.

- Continuing the Community Paramedicine for Long-Term Care program which supports Ontario’s certified land paramedic services to assist eligible seniors to stay in their own homes safely and for longer by providing access to non-emergency medical supports.

- Continuing investments in long-term care staffing to better meet long-term care system level average targets for four hours of care for Long-Term Care Homes.

- Launching the Integrated Technology Solutions program in 2024-25, which provides supplementary funding to help long term care homes acquire medication management technologies to prescribe and dispense medication and improve their access to tools and resources needed to make proper and accurate clinical decisions.

- Conducting 10,146 inspections to enforce compliance with legislative and regulatory requirements and launching a compliance assistance initiative helping long-term care homes achieve compliance.

Education sector

Ontario’s publicly funded early years and education system is focused on preparing Ontario’s children and students for success, and ensuring that young people develop in-demand skills that can be applied to the labour market for good, high-paying jobs. The government is committed to ensuring Ontario continues to have a leading education system, both in English and French, that focuses on important foundational skills like reading, writing and math.

Results reported in 2024–25 include:

- Continuing to modernize curriculum to ensure students have foundational skills in reading, writing and science, technology, engineering and math (STEM), to better prepare them for the jobs of tomorrow. This includes:

- Revising the Grade 10 Career Studies Course to include new mandatory learning on mental health literacy.

- Implementing a new de-streamed Grade 9 Exploring Canadian Geography course and new Grades 9 and 10 Business Studies and Technological Education courses.

- Launching a new Grade 9 English course for French-language schools.

- Requiring all high school students to earn a Grade 9 or 10 Technological Education credit as part of their Ontario Secondary School Diploma.

- Continuing investments to provide focused supports in the classroom and at home to help students build the math and literacy skills and knowledge they need to succeed.

- Announcing a new financial literacy graduation requirement to equip students with practical financial literacy skills, such as creating and managing a household budget, saving for a home, learning to invest wisely and protecting themselves from financial fraud.

- Continuing to implement policies and programs that support students in their education and career. This includes:

- Administering job skills programs such as Dual Credit and Specialist High Skills Major.

- Introducing the new Focused Apprenticeship Skills Training (FAST) pathway beginning in September 2025 allowing students in Grades 11 and 12 to participate in apprenticeship learning through additional co-operative education credits while completing high school.

- Implementing career coaching for Grade 9 and 10 students to explore new opportunities in STEM and the skilled trades.

- Introducing an updated provincial code of conduct to help reduce distractions in classrooms, improve student health and safety, and focus on learning, equipping students for life after graduation.

- Successfully negotiating labour agreements with education workers, averting strikes or the withdrawal of services. Agreements were also reached with principals and vice-principals.

- Improving access to child care, with 516,455 licenced child care spaces for children aged 0 to 12, an increase of 11,400 spaces since March 31, 2023.

Postsecondary education sector

Ontario’s postsecondary system prepares students and job seekers with the high-quality education, skills and opportunities needed to get good jobs and provides Ontario’s businesses with the skilled workforce and talent they need to thrive and prosper.

Results reported in 2024–25 include:

- Maintaining postsecondary education attainment rate in 2024–25 at approximately 75 per cent — consistent with 2023-24.

- Providing financial assistance through the Ontario Student Assistance Program to approximately 494,000 full-time students in the 2024–25 fiscal year.

- Supporting 7,200 students through the Ontario Learn and Stay Grant with over $57 million in grant funding issued in the 2024-25 academic year to date.

- Supporting 284 research projects for ground-breaking work at leading research institutes and organizations across the province, including at colleges, universities, and research hospitals, through the Ontario Research Fund and Early Researcher Awards.

- Supporting the training of more doctors with an expansion of 340 undergraduate seats and 551 postgraduate positions in medical schools over the next five years.

- Supporting the delivery of nursing education through the ongoing expansion of 3,000 additional enrolment spaces in Practical Nursing and Bachelor of Science in Nursing programs beginning in fall 2023.

- Supporting commercialization through Intellectual Property Ontario, which onboarded over 500 new small-medium enterprise clients in 2024-25, totalling more than 800 clients by the end of March 2025.

- Supporting about 6,500 high-quality research internships through Mitacs, an organization that builds research partnerships between postsecondary institutions and industry, with $32.4 million over three years.

Children’s and social services sector

The Ministry of Children, Community and Social Services funds, designs and delivers programs and services, working with community partners, to protect and support people in Ontario during times of need. The Ministry works to improve outcomes for children, youth, families and individuals who need support, and advance social and economic opportunities for women across Ontario.

Results reported in 2024–25 include:

- Helping people with disabilities keep up with the rising cost of living by increasing Ontario’s social assistance disability payments, including the Ontario Disability Support Program and the Assistance for Children with Severe Disabilities program, by almost 17 per cent since September 2022.

- Continuing to support children with autism and their families by enrolling thousands of children and youth into the Ontario Autism Program; this includes approximately 22,000 children in the Core Clinical Services program as of March 2025, an increase of approximately 14,000 since 2022.

- Opening the Grandview Kids Jerry Coughlan Building in Ajax, a fully accessible, state-of-the-art children’s treatment centre that will serve more than 6,000 children and youth with physical, communication and developmental needs in the Durham region annually.

- Continuing to help youth in the child welfare system prepare for and succeed after leaving care, by providing supports to pursue postsecondary education, training, and employment opportunities.

- Investing in 85 new community-based projects across the province to prevent gender-based violence through education and awareness, building safer, healthier communities and enhancing well-being and economic opportunities for people and families.

- Helping women gain the skills, training and knowledge needed to join the workforce and gain financial independence by investing in 25 local initiatives across the province through the Women’s Economic Security Program, which provides career training opportunities and additional supports to address barriers to employment.

- Supporting the construction of the new Anduhyaun Indigenous women’s shelter in Toronto, which will provide a safe space for Indigenous women and children fleeing violence.

- Helping veterans in need cover the rising cost of essentials like housing, health supports, assistive devices, and personal items by increasing the maximum support through the Soldier’s Aid Commission to $3,000 per year, up from $2,000.

Justice sector

The justice sector supports the administration and delivery of justice services, including the administration of courts, prosecution of offences, provision of legal services and supports to victims and vulnerable persons, as well as administering the public safety, policing and correctional systems to ensure that Ontario’s diverse communities are supported and protected.

Results reported in 2024–25 include:

- Continuing the largest transformation of the justice sector in Ontario’s history, designed to bring more services online across Ontario, including rural, Northern and First Nation communities. This includes:

- Extending availability of video and audio court hearings across the province, enabling 147 courtrooms across Ontario to support hybrid hearings, an increase of 23 courtrooms compared to 2023-24.

- Expanding electronic filing service to include more than 900 types of civil, family, bankruptcy, Divisional Court and Small Claims Court documents;

- Increasing capacity of a single online platform to ensure the public can access basic court information in select civil and active criminal matters.

- Helping the courts keep pace with a growing number of complex cases by increasing the capacity to hear cases. This includes appointing 16 new judges to prosecute more cases and hiring 190 new court services staff members to support the administration of the courts and the judiciary while supporting victims and witnesses through the court process.

- Investing in air operations focused on addressing violent carjackings, auto theft, street racing and impaired driving, with dedicated resources to support Ottawa, Toronto, Durham, Halton, and Peel Regional Police Services, to improve response time and increase public safety on highways and roadways.

- Launching the Provincial Bail Compliance Dashboard, to consolidate and share critical information, particularly for individuals charged with firearms-related offences to help police monitor high-risk offenders on bail.

- Continuing work to support the Nishnawbe Aski Police Service Board as it joins Ontario’s policing framework under the Community Safety and Policing Act, including doubling the number of officers serving 34 First Nation communities and ensure culturally appropriate policing with legislated service standards.

- Protecting firefighters through the Fire Protection Grant, which is helping 374 municipal fire departments purchase equipment and upgrade infrastructure to reduce exposure to cancer-causing chemicals.

- Modernizing police governance with the implementation of the Community Safety and Policing Act and establishment of Canada’s first Inspectorate General of Policing to provide independent oversight, drive performance improvements, and enhance public trust in policing through inspections, data analysis, and collaboration with police services and boards.

- Expanding mental health supports for public safety personnel, including police, firefighters, correctional workers and paramedics, alongside initiatives such as the Ontario Immediate Family Wellness Program that offers bereavement counselling to families of first responders who die in the line of duty or by suicide.

- Building more capacity in provincial jails and modernizing adult correctional services across Ontario. The London Intermittent Centre at Elgin-Middlesex Detention Centre has been repurposed and reopened as of March 2025. Work is also underway on major correctional infrastructure projects such as the Brockville Correctional Complex and Quinte Detention Centre expansion.

- Supporting Ontario’s regulated iGaming market, which generated almost $3.2 billion in total gaming revenue, which is a 32 per cent increase from the previous year.

Condition and capacity of provincial tangible capital assets

Infrastructure investments should be made using an evidence-based approach. This includes a focus on asset management to ensure the delivery of high-quality public services, while efficiently managing the costs.

- The Province compiled its first infrastructure asset inventory in 2016 as a key step in managing provincial assets more effectively. The infrastructure asset inventory is now updated annually and currently contains information such as the location, age, condition and value of over 15,000 tangible capital assets, including buildings and Ontario’s entire road and bridge network. This covers the majority of the infrastructure assets owned or consolidated (i.e., certain BPS organizations) by the Ontario government, as well as some other assets that are funded in part, but not owned or consolidated, by the government.

- The Province uses the infrastructure asset inventory to track, monitor and report on the physical condition of assets. For example, the infrastructure asset inventory contains indicators such as Facility Condition Indexes (FCIs), Bridge Condition Indexes (BCIs) and Pavement Condition Indexes (PCIs), which help to inform the state of infrastructure assets.

- Ontario has expanded its infrastructure asset data to include other relevant data and analysis, such as the current and projected capacity and utilization of assets. This integrated data provides a base to support evidence-based infrastructure planning decisions which help ensure that infrastructure investments provide value for money and are made at the right time and the right place.

Transparency and Accountability

Ontario continues to take steps that enhance government transparency and fiscal accountability in its financial reporting. Throughout the fiscal year, the government provides regular updates on Ontario’s finances. The Annual Report and Consolidated Financial Statements, along with supplementary information, are central to demonstrating the government’s transparency and accountability in reporting its financial activities and its position at the end of the fiscal year.

Recent developments in public sector accounting standards

The Ontario government’s financial reports are prepared in accordance with the accounting standards for governments set by the Public Sector Accounting Board (PSAB) and contained in the Chartered Professional Accountants of Canada (CPA Canada) Public Sector Accounting Handbook.

As described in Note 1 to the Consolidated Financial Statements, future changes in both public-sector and private-sector accounting standards may affect how assets, liabilities, revenues and expenses are reported in Ontario’s consolidated financial reports. Other current projects that are being closely monitored by Ontario include accounting for intangible assets, employee benefits, government not-for-profit strategy, and annual improvement projects.

The C.D. Howe Institute Fiscal Accountability Report

Annually, the C.D. Howe Institute issues its commentary on the fiscal reporting transparency of senior Canadian governments, with a focus on the relevance, accessibility, timeliness and reliability of these government financial reports, including the Public Accounts. Each government is assigned a letter grade based on the quality of the numbers presented in these reports, access and user friendliness, and the ability to use them for various decision-making purposes.

In the 2024 report, Ontario had maintained its grade.

At the time of the Auditor General opinion date for the 2024–25 Public Accounts , the 2025 Fiscal Accountability Report covering the Public Accounts of Ontario 2023–2024 had not been issued.

Chart Descriptions

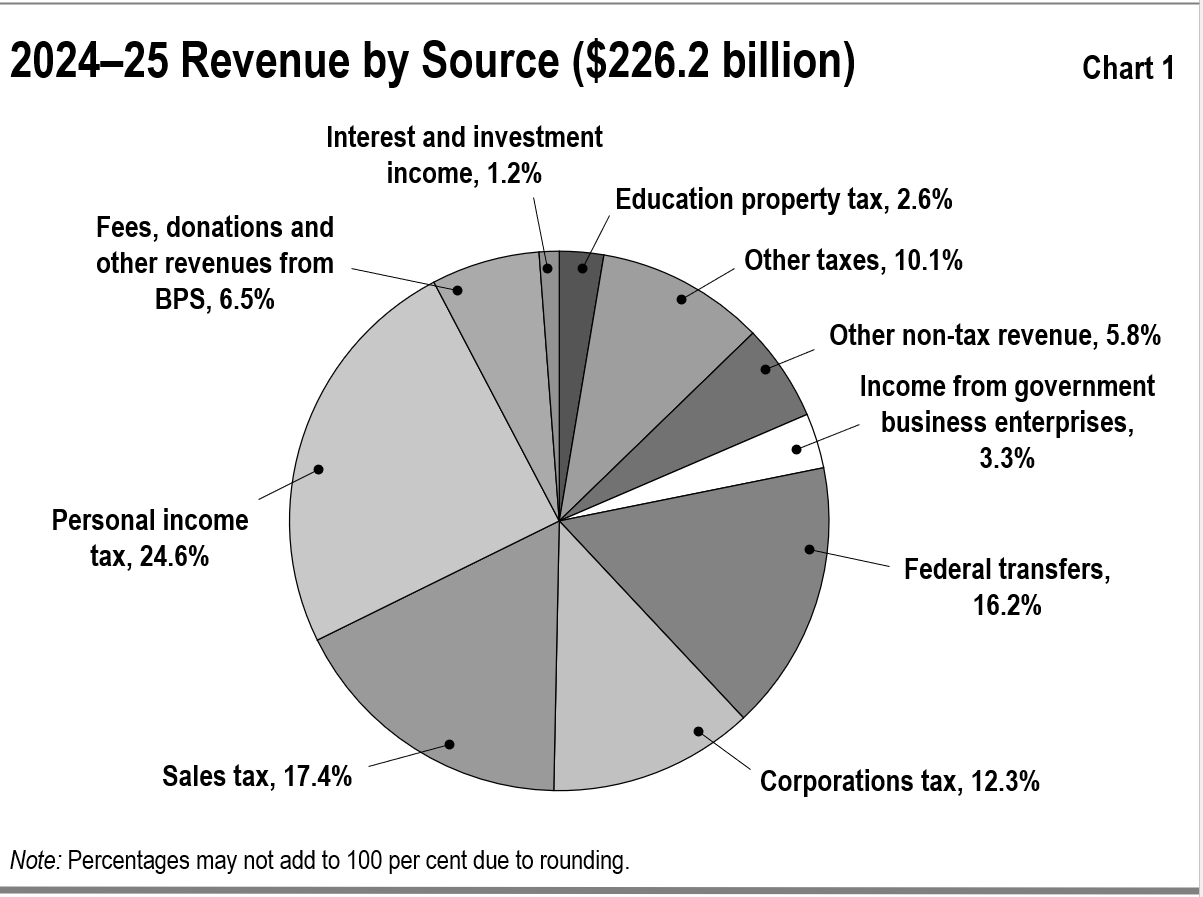

Chart 1: 2024–25 Revenue by Source

This chart shows the percentage composition of Ontario’s Total Revenues in 2024–25 by source. Total revenue is $226.2 billion.

Personal Income Tax accounts for 24.6 per cent. Sales Tax accounts for 17.4 per cent. Corporations Tax accounts for 12.3 per cent. Education Property Tax accounts for 2.6 per cent . Other taxes account for 10.1 per cent . Federal Transfers account for 16.2 per cent. Income from Investment in Government Business Enterprises accounts for 3.3 per cent. Fees, donations and other revenues from BPS account for 6.5 per cent. Other non-tax revenue accounts for 5.8 per cent.. Interest and investment income accounts for 1.2 per cent.