Ontario Community Infrastructure Fund

Learn about receiving formula-based grants from the Ontario Community Infrastructure Fund (OCIF).

How it works

We will be providing $400 million to 423 small, rural and northern communities across Ontario in 2026.

Communities don’t need to apply for the funding but will need to provide planning and reporting documents to us to receive the grants.

Under the formula-based component, eligible recipients:

- receive annual allocation notices specifying OCIF funding for the calendar year

- may accumulate annual formula-based grants for up to five years to address larger infrastructure projects

- are guaranteed to receive a minimum of $125,000 per year

Who is eligible

1. Ontario municipalities

The following Ontario municipalities are eligible:

- small municipalities (municipalities with populations less than 100,000)

- northern municipalities

- rural municipalities

The Ministry of Infrastructure (MOI) updates program eligibility to reflect the latest Census of Population data. 2021 census data was used to determine eligibility for 2026 grants.

2. Local Services Boards (LSBs)

Local Services Boards that own water and/or wastewater systems are eligible to receive the minimum grant of $125,000 per year.

A Local Services Board becomes ineligible for OCIF if it no longer owns water and/or wastewater systems. Effective at the beginning of the next allocation cycle, they will no longer receive OCIF funding.

Eligible and ineligible expenditures

Eligible capital expenditures

Capital expenditures on core infrastructure projects (such as roads, bridges, water and wastewater, including sanitary and stormwater facilities) that are part of an asset management plan are eligible, including:

- capital construction of new core infrastructure to be owned by the recipient that addresses an existing health or safety issue

- capital maintenance for the renewal, rehabilitation and replacement of core infrastructure owned by the recipient (this may include municipally owned infrastructure assets that are owned by a municipality’s municipal services corporation)

- debt-financing charges specifically associated with the capital construction and maintenance of core infrastructure

Coordinated infrastructure and land-use planning

Capital projects must be consistent with Ontario’s land-use planning framework. The provincial land-use planning framework promotes a comprehensive, integrated and long-term approach when planning for land use and infrastructure. This is achieved through policy direction derived from the Provincial Planning Statement (PPS) and applicable provincial land use plans such as the Greenbelt Plan.

An integrated approach to land use and infrastructure planning allows for the identification of benefits, such as cost savings and improved environmental protection, by ensuring development choices make the best use of existing infrastructure before consuming more land or resources.

When read together, the PPS and provincial plans require municipalities to consider, among other things:

- the coordination of infrastructure planning with growth management

- the full lifecycle costs of infrastructure, which may include asset management planning

- the planning and protection of infrastructure corridors and rights-of-way

- integration of environmental protection with infrastructure planning (for example, using watershed or watershed planning)

Eligible asset management planning expenditures

Eligible expenditures for the development, updating and improvement of asset management plans for any asset type(s), include:

- asset management software

- conferences and training for municipal staff that are 100% related to asset management planning, including reasonable related travel, meal and accommodation expenses

- third-party condition assessments

- third-party consultants whose responsibilities are limited to asset management planning

Collaboration on asset management

We encourage recipients to work together to develop and improve asset management plans. Smaller communities should consider hiring a shared resource to serve as their asset manager. By collaborating, communities can:

- share best practices

- learn from each other

- improve their asset management plans at a reduced cost

For example, four neighbouring communities with similar infrastructure systems could attract a full-time local expert dedicated to serving each municipality about one week per month.

In accordance with the Asset Management Planning for Municipal Infrastructure regulation (O. Reg. 588/17), municipalities are required to have an asset management plan for all of their infrastructure assets. These plans should identify proposed levels of service, activities required to meet proposed levels of service and a strategy to fund these activities by July 1, 2025 (phase 4). The 2025 requirement builds upon the 2024 requirements (phase 3).

Municipalities are required to post their updated and council approved asset management plans on their public facing website as per section 10 requirements of the Asset Management Planning for Municipal Infrastructure regulation (O. Reg 588/17).

Municipalities must inform the province that this requirement has been met by sending a link to their public-facing asset management plans to municipalassetmanagement@ontario.ca.

Additionally, municipalities are required to keep their asset management plans updated. As per section 7 of O. Reg 588/17, municipalities must update their asset management plan at least every five years upon the completion of the section 6 requirements.

Eligible optimization expenditures

Activities that improve the performance or increase the capacity of existing water and wastewater infrastructure under the Composite Correction Program are eligible, including:

- third-party comprehensive performance evaluations

- third-party comprehensive technical assistance

Innovative capital technologies

Ontario has become a world-class centre for developing new technologies that can help reduce, avoid or defer capital and lifecycle costs. Recipients may want to consider incorporating innovative technologies into their projects.

For example, the Ontario Water Consortium supports the development, demonstration and adoption of Ontario’s water technologies. Many of these technologies already support communities across Ontario, including projects funded through our Showcasing Water Innovation program and the consortium’s Advancing Water Technologies program.

Innovative approaches to community management of water include:

- trenchless technologies for lining watermains

- phosphorus removal from stormwater

- ammonia removal and partial denitrification from wastewater

Composite Correction Program

Municipalities can reduce or avoid life-cycle costs through non-capital solutions. The Composite Correction Program is a well-regarded, two-step protocol for optimizing water and wastewater systems.

The first step is a comprehensive performance evaluation to determine the factors that impact performance or capacity, including:

- operation

- design

- maintenance

- administration factors

The second step, comprehensive technical assistance, involves hands-on operator training and support to improve process control and operating procedures.

Eligible staff time expenditures (for municipalities only)

Municipalities may allocate up to 40% or $80,000 of their formula funding per year (whichever is less) to hours worked by municipal staff whose responsibilities include:

- asset management planning and/or

- Composite Correction Program implementation while receiving third-party comprehensive technical assistance

Ineligible expenditures include:

- infrastructure expansion projects to accommodate future employment or residential development on greenfield sites

- acquisition and/or leasing of land, buildings and other facilities

- legal fees

- rolling stock (for example, trucks, graders, etc.)

- movable/transitory assets (for example, portable generators, etc.)

- the costs of completing any application for a provincial funding program

- all taxes

- stand-alone street-light projects

- costs for recreational trails

A more detailed list of eligible expenditure categories is included in the transfer payment agreement.

What you need to submit to receive funding

Eligible municipalities must submit the following to the Ministry of Infrastructure periodically as requested by the ministry:

- Publicly-accessible link to a comprehensive asset management plan, covering all infrastructure assets and including all of the information and analysis described in the Asset Management Planning for Municipal Infrastructure regulation (O. Reg. 588/17).

- A link to an updated public-facing and council-approved plan that meets the requirements of the phase 4 timeline (July 1, 2025) of the regulation to municipalassetmanagement@ontario.ca.

- If your existing plan meets the regulatory requirements of the phase 3 timeline (July 1, 2024) and/or the phase 4 timeline (July 1, 2025) of the regulation, your municipality is required to re-submit the link to its plan to municipalassetmanagement@ontario.ca.

- A report called the Annual Financial Report (AFR) must be submitted twice per funding year via the Transfer Payment Ontario (TPON) system. The initial AFR outlines planned use of the allocation, while the final AFR details actual expenditures and includes additional program or project information as required by the ministry.

- Any other reporting requested.

Eligible LSBs must submit the following to the Ministry of Infrastructure periodically as requested by the ministry:

- An asset management plan that covers water/wastewater assets which are owned/operated by the LSB.

- A report called the Annual Financial Report (AFR) must be submitted twice per funding year via the Transfer Payment Ontario (TPON) system. The initial AFR outlines planned use of the allocation, while the final AFR details actual expenditures and includes additional program or project information as required by the ministry.

- Any other reporting requested.

Submit by email to ocif@ontario.ca or mail to:

Ontario Community Infrastructure Fund

c/o Infrastructure Program Delivery Branch

Ministry of Infrastructure

1 Stone Road West, 4th Floor Northwest

Guelph, ON

N1G 4Y2

In addition, eligible municipalities must submit their annual Financial Information Return (FIR), without critical errors, to the Ministry of Municipal Affairs and Housing via Smart FIR. For any related questions, please email fir.mah@ontario.ca.

Failure to provide this reporting may result in payments being withheld.

Banking funding

Eligible recipients may accumulate their formula-based grants for up to five years. For example, grant funding received in 2026 must be spent by December 31, 2030. Banked funds must be kept in an interest-bearing account.

Recipients must report on how and when banked funds will be used and the interest earned on the funds. Failure to use banked funds within five years will result in the funds having to be repaid to the Province, including interest earned.

Calculating the grant

The size of grants is determined by:

- estimated Current Replacement Values (CRVs) for core infrastructure owned by municipalities, including roads, bridges, water and wastewater

- the municipality’s economic conditions

The grant is designed to be responsive to local needs and economic conditions. In order to ensure that municipalities with greater requirements to replace core infrastructure and more challenging economic conditions receive proportionally larger grants, the amount of funding per $100,000 of total core infrastructure is calculated using an “infrastructure index".

Municipalities with a higher infrastructure index will receive a proportionally larger grant per $100,000 of core infrastructure.

The minimum grant size is $125,000. All eligible LSBs will receive the minimum amount.

Changes to the OCIF funding formula in 2026

Starting with the 2026 OCIF allocations, the minimum grant amount has increased from $100,000 to $125,000.

In addition, the smoothing percentage has changed from 15% to 10%. The smoothing mechanism, which limits year-over-year changes in funding, will generally limit changes for 2026 allocations to within ±10% of 2025 grants.

Starting with 2026 allocations, MOI is no longer using FIR-based estimates as an anchor to determine final CRV estimates for the OCIF funding formula.

FIR-based estimates were implemented following MOI’s redesign of OCIF and the introduction of CRVs to the funding formula.

In addition, MOI is no longer extracting CRVs from municipal asset management plans in order to update municipal CRVs used in the OCIF formula. CRVs are solely being updated through the annual CRV template data collection process, which allows municipalities to submit CRV estimates for their OCIF-eligible core infrastructure.

How the formula works

We use the following steps to calculate a municipality’s grant.

Step 1: Determine the amount of core infrastructure owned by the municipality

MOI collected and reviewed CRV information provided by municipalities through CRV template submissions and from municipal asset management plans:

- In cases where MOI received a CRV template submission, CRVs from the CRV template submissions were considered in the OCIF funding formula.

- In cases where MOI did not receive a CRV template submission, CRV information extracted from municipal asset management plans was used.

Note: All the CRV information is collected in alignment with the FIR core infrastructure categories historically used in the OCIF funding formula and represented in 2024 currency. Inflation rates are based on Non-Residential Building Construction Price Index (NRBCPI), provided by the Municipal Finance Officers' Association (MFOA) as part of their annual Deflator Tables release.

Step 2: Calculate the infrastructure index

The infrastructure index compares a municipality’s requirements to maintain its core infrastructure to its weighted property assessment and median household income.

The infrastructure index is composed of two indicators:

- the ratio of core infrastructure to weighted property assessment

- the ratio of core infrastructure per household to median household income

Note: Core infrastructure refers to estimated current replacement values of core infrastructure.

The two indicators are placed on comparable scales and then averaged to calculate a municipality’s infrastructure index.

Adjustments are made to core infrastructure values to make multi-tier municipalities comparable to single-tier municipalities when calculating the infrastructure index.

Step 3: Determine the funding to be calculated per $100,000 of core infrastructure

The amount of formula-based funding for every $100,000 of core infrastructure owned by the municipality depends on the municipality’s infrastructure index and how it relates to the median infrastructure index of all eligible municipalities.

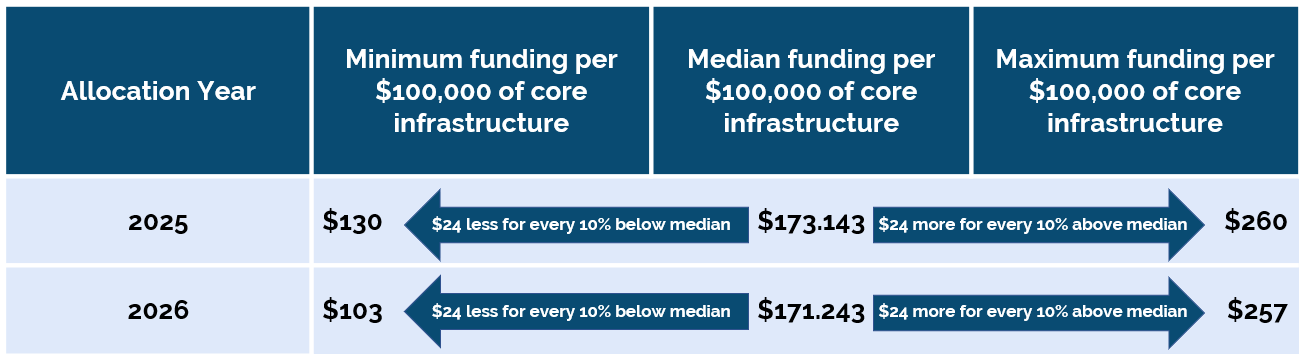

Allocations for municipalities with an infrastructure index at the median is calculated based on the median amount of funding per $100,000 of core infrastructure funding that is set at $171.243 in 2026. For 2025 OCIF, the median amount was $173.143.

In 2025:

- for every 10% that a municipality’s infrastructure index is below the median value, $24 less funding is calculated per $100,000 of core infrastructure, down to a minimum of $130.

- for every 10% that a municipality’s infrastructure index is above the median, $24 more funding is calculated per $100,000 of core infrastructure, up to a maximum amount of $260.

In 2026:

- for every 10% that a municipality’s infrastructure index is below the median value, $24 less funding is calculated per $100,000 of core infrastructure, down to a minimum of $103.

- for every 10% that a municipality’s infrastructure index is above the median, $24 more funding is calculated per $100,000 of core infrastructure, up to a maximum amount of $257.

The table below shows in graphic format the calculation described above:

Read the accessible description for the Table 1.

Step 4: Calculate the grant

Funding per $100,000 of core infrastructure will depend on a recipient’s infrastructure index (see step 3 above), relative to other recipients and within the limit of the annual funding envelope.

The amount calculated above will be subject to the minimum and maximum allocation parameters, resulting in no municipality receiving below $125,000 and the maximum grant not exceeding $10 million (2.5% of the annual funding envelope in 2026).

Next, a smoothing mechanism is applied to determine the final OCIF grant.

The smoothing mechanism

A smoothing mechanism has been implemented which generally limits changes in funding for 2026 to within ±10% of 2025 allocations. This allows for predictable and stable funding for municipalities.

If a municipality’s 2026 grant falls within 10% of its 2025 grant, the 2026 calculated amount would be used as the final grant.

If a municipality’s 2026 grant falls outside of 10% of its 2025 grant, the 2026 final grant amount would be adjusted to within 10% of the 2025 grant.

Financial matters and consultation with Indigenous groups

Payments

The size of the grant will determine the frequency of payments. Subject to meeting terms and conditions set out in the transfer payment agreement, recipients that receive larger grants are paid more frequently (payments can be made as frequently as monthly).

Consultations with Indigenous groups

The Government of Canada, the Government of Ontario and municipalities may have a duty to consult, where appropriate, with Indigenous Groups (First Nation, Inuit and Métis peoples) where an activity is contemplated that may adversely impact Aboriginal or treaty rights.

Consultation requirements will vary depending on the size and location of the project in question. Grant recipients should ensure duty-to-consult requirements are met prior to commencing construction of funded projects.

Contact us

If you have questions about the OCIF you can contact us by:

- Email: ocif@ontario.ca

- Website: Ministry of Infrastructure

Mailing address:

Ontario Community Infrastructure Fund

c/o Infrastructure Program Delivery Branch

Ministry of Infrastructure

1 Stone Road West, 4th Floor Northwest

Guelph, Ontario

N1G 4Y2

Chart descriptions

Table 1 — Funding based on the infrastructure index

In 2025:

- for every 10% that a municipality’s infrastructure index is below the median value, $24 less funding is calculated per $100,000 of core infrastructure, down to a minimum of $130.

- for every 10% that a municipality’s infrastructure index is above the median, $24 more funding is calculated per $100,000 of core infrastructure, up to a maximum amount of $260.

In 2026:

- for every 10% that a municipality’s infrastructure index is below the median value, $24 less funding is calculated per $100,000 of core infrastructure, down to a minimum of $103.

- for every 10% that a municipality’s infrastructure index is above the median, $24 more funding is calculated per $100,000 of core infrastructure, up to a maximum amount of $257.